Market Overview

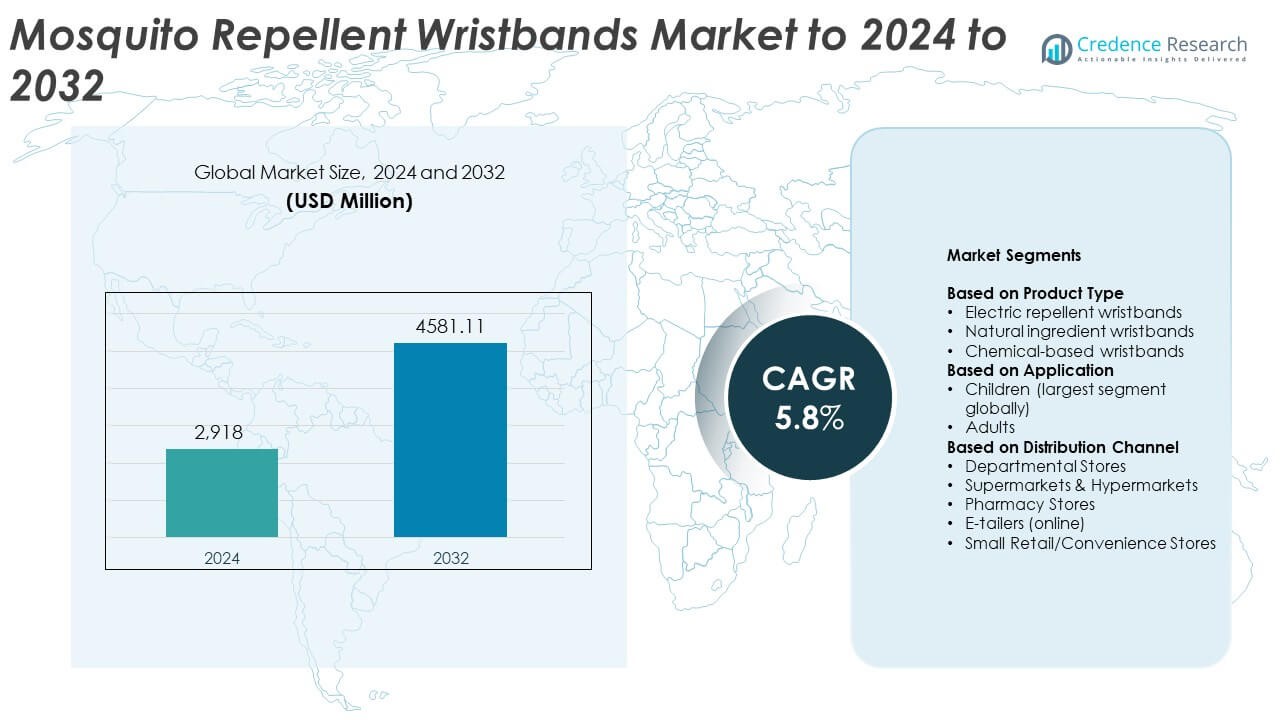

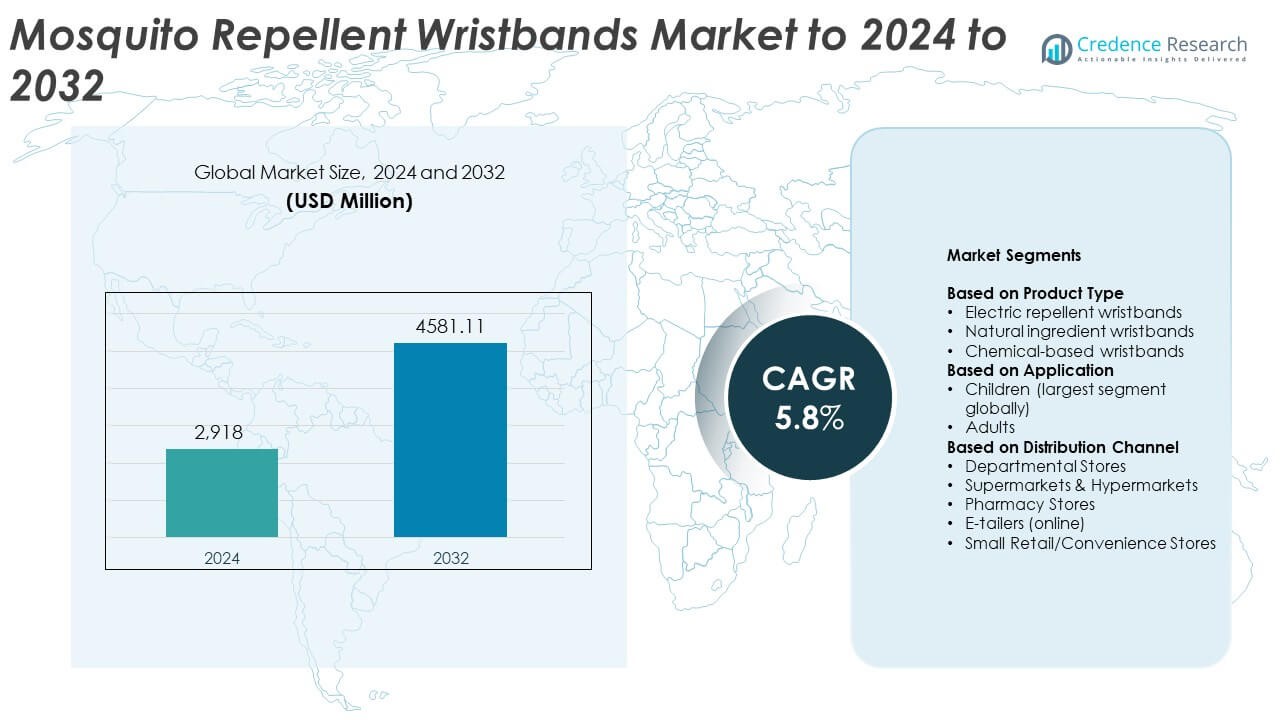

Mosquito Repellent Wristbands Market size was valued at USD 2,918 million in 2024 and is anticipated to reach USD 4,581.11 million by 2032, at a CAGR of 5.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mosquito Repellent Wristbands Market Size 2024 |

USD 2,918 Million |

| Mosquito Repellent Wristbands Market, CAGR |

5.8% |

| Mosquito Repellent Wristbands Market Size 2032 |

USD 4,581.11 Million |

The mosquito repellent wristbands market features active participation from key players such as Cliganic, AYOUYA, Thermacell Repellents, Bugslock, Dabur, Duck Baby, Aspectek, and Auberge, each competing through natural formulations, improved durability, and wider retail presence. Companies focus on child-safe and eco-friendly designs to meet rising consumer preferences for skin-safe protection. Asia Pacific leads the global market with 34% share due to high mosquito density and large population exposure, while North America follows with 32% driven by strong outdoor activity levels and higher awareness. Europe maintains a solid position with 26% share supported by strong demand for natural and regulatory-compliant solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The mosquito repellent wristbands market was valued at USD 2,918 million in 2024 and is projected to reach USD 4,581.11 million by 2032, growing at a CAGR of 5.8%.

- Rising cases of dengue, malaria, chikungunya, and Zika drive strong product demand, with children accounting for the largest application segment at 57% due to higher vulnerability and parental preference for skin-safe protection.

Natural ingredient wristbands and eco-friendly designs continue to trend as consumers shift away from synthetic chemicals, while smart wearable wristbands gain traction in urban markets.

- Competition strengthens as brands focus on long-lasting formulations, child-safe materials, and expanded distribution through supermarkets, pharmacies, and fast-growing online channels, supported by improved regulatory compliance.

- Asia Pacific leads the global market with 34% share due to high mosquito density, followed by North America at 32% and Europe at 26%, while electric wristbands dominate product type with 44% share driven by enhanced protection and usage convenience.

Market Segmentation Analysis:

By Product Type

Electric repellent wristbands led this segment in 2024 with about 44% share, driven by rising demand for stronger and longer-lasting protection in high-risk zones. Households preferred electric variants because these models release controlled repellent vapors and support extended outdoor use. Natural ingredient wristbands grew at a steady pace as parents sought plant-based options with lower irritation risk. Chemical-based wristbands held a moderate share due to their low cost and easy availability, yet their adoption remained slower in regions with higher preference for non-synthetic formulations.

- For instance, SC Johnson has helped over 4.7 million people through recent charitable contributions, including donating more than 1.4 million units of product like repellents to help communities facing outbreaks of insect-borne disease and cleaners to assist areas recovering from natural disasters.

By Application

Children accounted for the largest application segment in 2024 with nearly 57% share, supported by strong use in schools, parks, and residential outdoor areas. Parents selected wristbands for children because they avoid direct skin application, reduce chemical exposure, and provide continuous mosquito protection during play hours. Adult users showed stable growth as outdoor recreation, travel, and evening activity levels increased, but children remained the key demand driver due to higher vulnerability to mosquito-borne infections.

- For instance, Godrej Consumer Products Ltd. generates approximately ₹14,096 crorein annual consolidated revenue from its consumer products portfolio (as of FY 2024), which includes household names like Goodknight and Cinthol.

By Distribution Channel

Supermarkets and hypermarkets dominated this segment in 2024 with around 36% share, driven by wider product visibility, bulk purchase options, and frequent seasonal promotions. Pharmacy stores held a strong position as consumers trusted pharmacist-recommended mosquito protection products for young children. E-tailers expanded rapidly with rising online shopping and doorstep delivery convenience. Departmental stores and small retail outlets maintained a steady presence, serving walk-in buyers in suburban and rural areas, but large retail chains continued to lead due to broader assortment and stronger brand penetration.

Key Growth Drivers

Rising Mosquito-Borne Disease Cases

Growing outbreaks of dengue, malaria, chikungunya, and Zika continue to push families toward preventive solutions, strengthening demand for wristbands in high-risk regions. Many tropical and subtropical countries now face extended mosquito seasons due to warmer climates, which increases the need for continuous protection throughout the year. Parents prefer wearable wristbands because these products avoid direct chemical contact and offer a more comfortable option for children. This rising health concern has driven strong adoption across schools, households, and outdoor environments, making disease prevalence one of the most powerful growth drivers.

- For instance, the World Health Organization reported 249 million malaria cases worldwide in 2022, marking one of the highest recorded global burdens, which increased demand for preventive consumer mosquito-control products.

Preference for Skin-Safe and Child-Friendly Products

Parents increasingly rely on wristbands because they avoid messy sprays, reduce chemical exposure, and provide mild formulations suitable for sensitive skin. These factors make wristbands a preferred choice for young children who spend long hours outdoors in parks, playgrounds, and school spaces. Natural ingredient wristbands, made from citronella and other plant oils, gained traction as buyers shifted toward gentler repellents with fewer side effects. This shift in consumer behavior toward safer and more comfortable formats continues to support market penetration in urban and suburban regions worldwide.

- For instance, Kao Corporation’s Health and Beauty Care Business generated 392.9 billion yen in sales in 2023, which includes brands in skin care and personal health categories, such as the global strategy brand Bioré UV care line and sensitive skin brands like Curél.

Growth of Outdoor Activities and Travel Mobility

A steady rise in outdoor leisure activities, adventure tourism, weekend travel, and evening recreation has increased exposure to mosquito-prone environments, boosting the use of wristbands. Travelers prefer these products because they are compact, lightweight, and easy to carry during treks, camping trips, or local tourism. Growing disposable incomes also support purchases of premium models designed for extended use. The trend toward active lifestyles, combined with higher awareness of mosquito-borne risks, makes outdoor activity growth a major contributor to long-term market expansion.

Key Trends & Opportunities

Shift Toward Natural and Eco-Friendly Wristbands

Consumers are increasingly seeking plant-based and eco-friendly wristbands as awareness of chemical side effects and environmental concerns rises. Brands are responding by developing products using natural oils such as lemongrass, citronella, eucalyptus, and peppermint, reducing dependency on synthetic repellents. This trend creates opportunities for innovation in biodegradable materials, hypoallergenic designs, and reusable wristband formats. The growing demand for green products has opened new avenues for both premium and mass-market brands targeting health-conscious buyers.

- For instance, NOW Foods’ total sales were expected to exceed $800 million in 2023. In the broader industry, global essential oil production is estimated at more than 300,000 tonnes annually, with orange, eucalyptus, mint, and lemon being among the top four essential oils produced by volume.

Adoption of Smart and Wearable Technologies

Technology-driven wristbands powered by adjustable repellent emission systems, rechargeable batteries, and integrated sensors are gaining traction among urban consumers. These models offer stronger, programmable protection that appeals to users living in high-risk mosquito zones or frequently traveling. Smart features also support product differentiation, helping brands enter the premium wearable segment. As interest in connected devices increases, this trend unlocks opportunities in urban markets where consumers seek enhanced personal safety and convenience.

- For instance, Thermacell devices have been in the market for over 25 years, with tens of millions of devices being sold across more than 30 countries worldwide.

Expansion Through E-Commerce and Subscription Models

Online retail platforms have expanded market reach by offering easy product comparisons, wider brand choices, and faster delivery. Many companies now offer subscription-based packs that provide monthly refills or seasonal bundles, creating steady and predictable sales cycles. E-commerce platforms and direct-to-consumer websites help manufacturers reach buyers in remote areas where physical retail availability is limited. This shift toward digital purchasing presents major long-term opportunities for sustaining growth across global and regional markets.

Key Challenges

Limited Long-Lasting Protection and Performance Variability

Many wristbands struggle to deliver strong and consistent protection for long durations, especially in dense mosquito environments. Factors such as rapid evaporation of repellent oils, inconsistent diffusion rates, and quality variations across manufacturers affect reliability. These limitations often lead consumers to question the effectiveness of certain products, reducing repeat purchases. Enhancing longevity, standardizing formulations, and improving quality control remain essential to build stronger customer confidence.

Regulatory Restrictions and Quality Control Issues

Several countries enforce strict rules governing insect repellents, requiring safety tests, ingredient approvals, and labeling compliance. Low-cost, unregulated products entering the market often fail to meet these standards, leading to recalls and damaging overall consumer trust. Manufacturers face rising operational costs as they invest in certifications, testing, and compliance processes to meet regional requirements. These regulatory hurdles slow market expansion and create significant barriers for new entrants.

Regional Analysis

North America

North America held around 32% share in 2024, supported by high awareness of mosquito-borne diseases and rising outdoor recreational activities. Consumers in the United States and Canada preferred wristbands as they offer portable protection during camping, hiking, and sports. Strong retail presence across supermarkets, pharmacies, and online platforms contributed to wider adoption. The region also saw increasing demand for natural and DEET-free wristbands due to growing skin-sensitivity concerns. Product innovation in smart wristbands and premium wearable repellents further boosted market expansion. The presence of strong distribution networks helped maintain steady demand.

Europe

Europe accounted for nearly 26% share in 2024, driven by strong health awareness and stricter safety preferences for child-safe mosquito protection products. Countries such as Germany, France, and the United Kingdom saw growing adoption of natural ingredient wristbands that align with eco-conscious consumer behavior. Seasonal mosquito spikes during warmer months supported sales across retail and pharmacy channels. Expanding use of wristbands during outdoor travel, sports, and leisure activities contributed to rising demand. Regulatory focus on ingredient transparency encouraged manufacturers to introduce cleaner formulations and compliant product lines, supporting steady regional growth.

Asia Pacific

Asia Pacific dominated the global market with about 34% share in 2024, driven by high mosquito density, humid climates, and frequent outbreaks of dengue and malaria. Countries including India, China, Indonesia, and Vietnam saw strong demand for affordable wristbands used by children and adults. Growing urbanization, large population bases, and increased outdoor activities supported rapid adoption. Expansion of e-commerce platforms allowed brands to penetrate rural and semi-urban areas. Rising preference for natural and low-irritation wristbands among families further boosted growth. The region’s high exposure risk continues to make Asia Pacific the fastest-growing market.

Latin America

Latin America held close to 5% share in 2024, supported by widespread concerns over dengue and Zika outbreaks across Brazil, Colombia, and Mexico. Families increasingly used wristbands as a portable preventive measure during outdoor and school activities. Local retail chains and pharmacies expanded their product ranges, improving accessibility. Rising interest in natural ingredient wristbands contributed to growth among health-conscious consumers. E-commerce availability also supported penetration into regions with limited physical retail options. Continued focus on affordable mosquito protection solutions helped maintain demand across urban and peri-urban areas.

Middle East & Africa

Middle East and Africa accounted for roughly 3% share in 2024, driven by rising mosquito-borne disease risks in tropical African countries and growing health awareness. Adoption increased in regions with warm climates where outdoor and evening activities are common. Expanding retail networks and improving access to pharmacy channels supported market growth. Natural wristbands gained traction due to concerns over chemical repellents, especially for children. However, limited product availability in rural areas restricted faster expansion. Increased government health campaigns and rising disposable incomes are expected to support steady future demand.

Market Segmentations:

By Product Type

- Electric repellent wristbands

- Natural ingredient wristbands

- Chemical-based wristbands

By Application

- Children (largest segment globally)

- Adults

By Distribution Channel

- Departmental Stores

- Supermarkets & Hypermarkets

- Pharmacy Stores

- E-tailers (online)

- Small Retail/Convenience Stores

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the mosquito repellent wristbands market includes key players such as Cliganic, AYOUYA, Thermacell Repellents, Bugslock, Dabur, Duck Baby, Aspectek, and Auberge. Companies in this space focus on improving product effectiveness through enhanced repellent release mechanisms, longer-lasting formulations, and safer natural ingredients to attract health-conscious buyers. Many brands invest in child-friendly, hypoallergenic, and eco-focused designs to meet rising demand for skin-safe solutions. Innovation in smart wearable repellents, including battery-powered and adjustable emission wristbands, strengthens premium positioning. Firms also expand through omnichannel strategies, leveraging supermarkets, pharmacies, and fast-growing online platforms to increase visibility. Strong regulatory compliance and quality certification remain essential for gaining customer trust and entering global markets.

Key Player Analysis

- Cliganic

- AYOUYA

- Thermacell Repellents

- Bugslock

- Dabur

- Duck Baby

- Aspectek

- Auberge

Recent Developments

- In 2024, Dabur entered the mosquito liquid vaporizer market with the launch of Odomos Universal Mosquito Liquid Vaporizer.

- In 2023, Aspectek offers a waterproof, portable mosquito zapper device designed for outdoor and indoor use.

- In 2023, Thermacell Repellents introduced the EL55, which combined the rechargeable repeller with a dimmable light feature.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow as mosquito-borne infections continue to rise across tropical and subtropical regions.

- Demand for natural ingredient wristbands will increase as consumers shift toward plant-based and skin-safe repellents.

- Smart wearable wristbands with adjustable emission technology will gain traction among urban and tech-focused buyers.

- Subscription-based refill and multi-pack models will strengthen repeat purchases and brand loyalty.

- E-commerce expansion will support wider product reach in rural and semi-urban markets.

- Manufacturers will invest in longer-lasting formulations to improve repellent stability and user confidence.

- Child-friendly and hypoallergenic wristbands will remain priority choices for families worldwide.

- Partnerships with retail chains and pharmacy networks will enhance product visibility and distribution.

- Regulatory compliance and quality certification will shape product innovation and global market entry.

- Emerging markets in Asia Pacific, Africa, and Latin America will drive long-term volume growth.