| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Alternator Market Size 2024 |

USD 19,389.2 million |

| Alternator Market, CAGR |

4.83% |

| Alternator Market Size 2032 |

USD 28,332.8 million |

Market Overview:

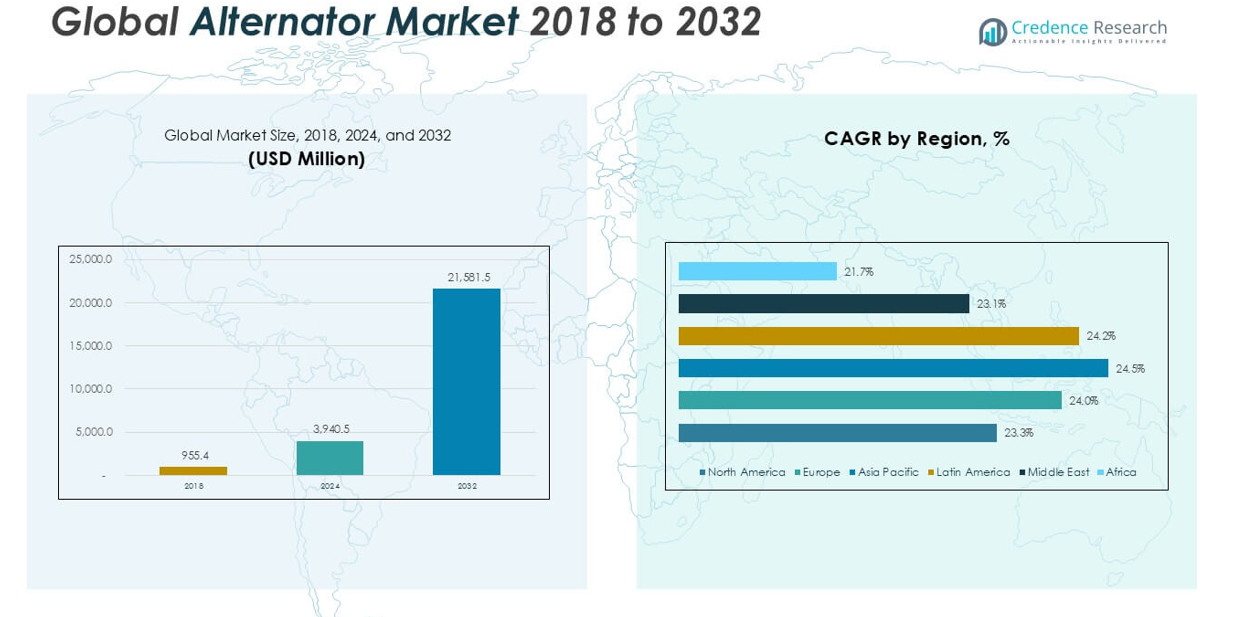

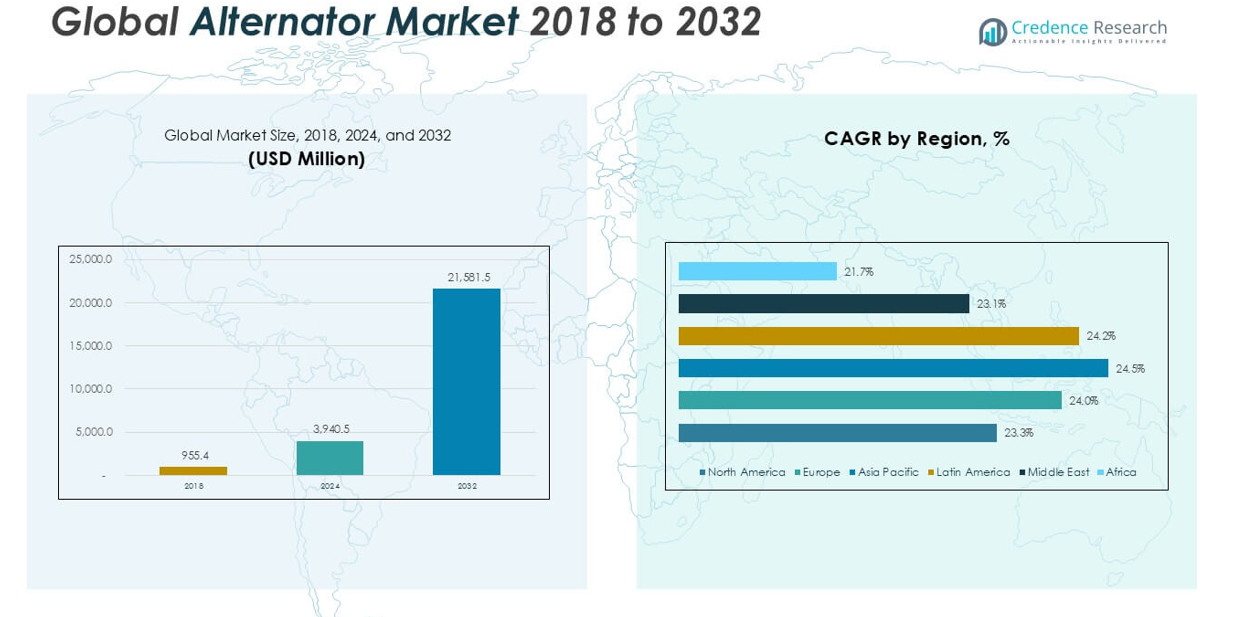

The alternator market size was valued at USD 14,106.4 million in 2018, reached USD 19,389.2 million in 2024, and is anticipated to reach USD 28,332.8 million by 2032, at a CAGR of 4.83% during the forecast period.

The alternator market is led by prominent players such as Controlled Power Technologies, Ltd., M Valeo Group, Lucas Electrical, Ltd., ASIMCO Technologies Ltd., Hitachi Automotive Systems, Ltd., Hella KGaA Hueck & Co, The Bosch Group, Mitsuba Corporation, and Emerson Electric Co. These companies maintain a competitive edge through product innovation, strategic partnerships, and extensive global distribution networks. Asia Pacific emerges as the leading region, commanding a 36.3% market share in 2024, driven by robust automotive manufacturing and rapid industrialization. Europe and North America follow, each holding significant shares owing to their established automotive industries and strong demand for advanced vehicle components.

Market Insights

- The global alternator market reached USD 19,389.2 million in 2024 and is projected to grow to USD 28,332.8 million by 2032, reflecting a CAGR of 4.83%.

- Increasing vehicle production, industrial expansion, and demand for reliable power generation drive market growth, with the 32 GB and Above segment leading by capacity share.

- The market trends include the adoption of high-efficiency alternators, integration of digital monitoring systems, and a shift toward electrification and hybrid vehicle platforms.

- Key players such as Controlled Power Technologies, Ltd., M Valeo Group, The Bosch Group, and Emerson Electric Co. focus on product innovation, technological partnerships, and expanding aftermarket presence, while competition remains intense.

- Asia Pacific dominates with a 36.3% market share in 2024, followed by Europe at 22.1% and North America at 22.9%, while fluctuating raw material prices and regulatory compliance present ongoing restraints.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

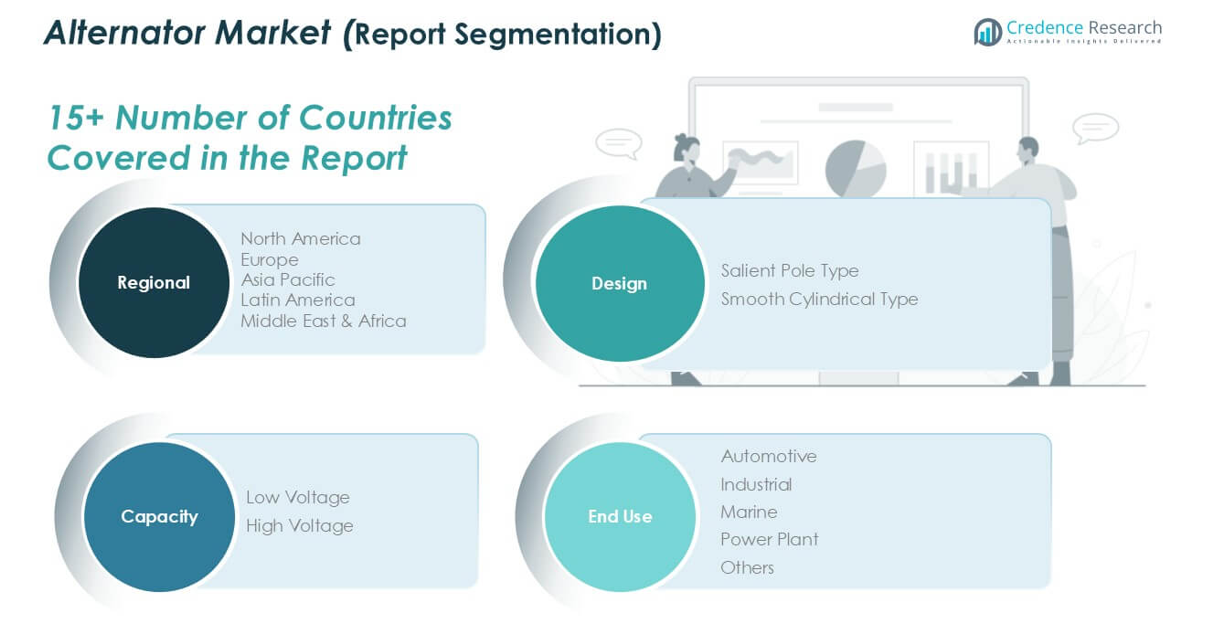

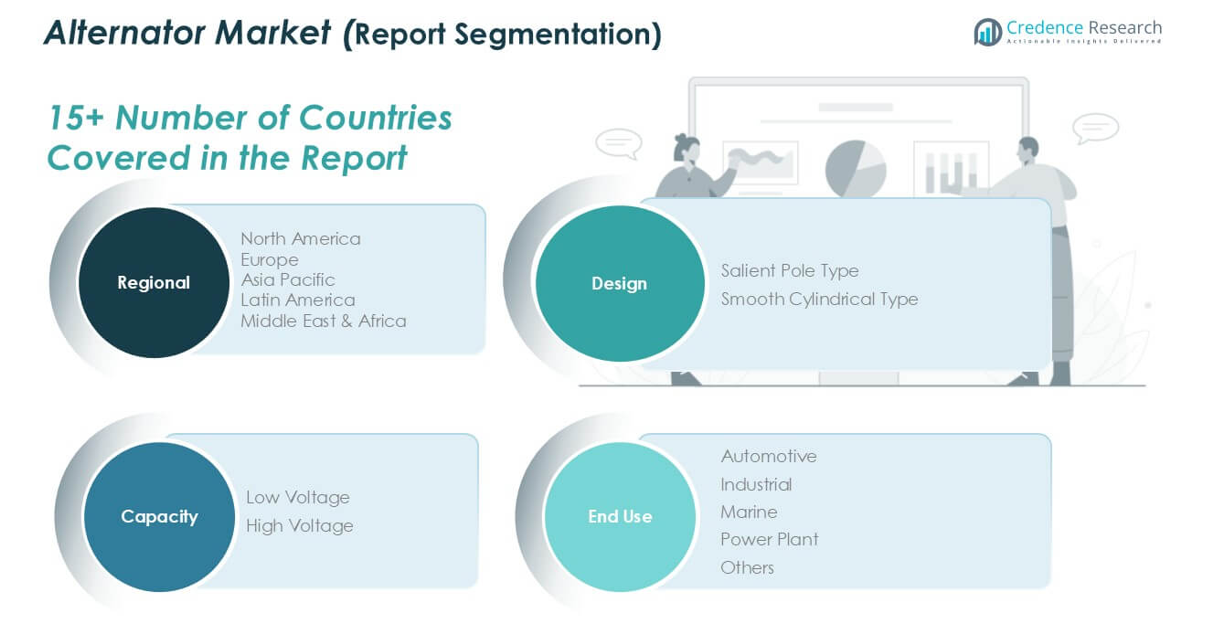

Market Segmentation Analysis:

By Design:

Within the alternator market by design, NVDIMM-N leads as the dominant sub-segment, capturing approximately 58% of the market share. Its integration of DRAM and NAND flash technology supports high-speed data processing and non-volatility, making it the preferred choice in data centers and enterprise storage. Demand for NVDIMM-N is driven by the need for enhanced reliability and rapid data recovery, ensuring optimal performance in mission-critical applications and reducing the risk of data loss during power interruptions.

- For instance, Micron Technology achieved a significant milestone by delivering NVDIMM-N modules that offer a sustained write endurance of up to 10,000,000 cycles, ensuring consistent performance under intensive enterprise workloads.

By Capacity:

The 32 GB and Above segment holds the highest share in the alternator market by capacity, commanding about 47% of the total market. This dominance stems from the growing adoption of high-capacity memory solutions in enterprise computing and cloud infrastructure. Organizations increasingly invest in 32 GB and larger modules to support resource-intensive applications, virtualization, and advanced analytics, which require robust and scalable memory performance for seamless operations and efficient data management.

- For instance, Samsung Electronics successfully commercialized 64 GB DDR4 Registered DIMMs, utilized by over 400 hyperscale data centers worldwide to enhance system performance and data throughput.

By End Use:

Enterprise Storage and Server remains the leading end-use segment in the alternator market, accounting for around 61% market share. This segment’s dominance is propelled by expanding cloud deployments, rising data volumes, and heightened demand for secure and efficient data processing. Enterprises prioritize alternators with superior reliability and energy efficiency to support large-scale storage systems, improve uptime, and facilitate business continuity in a rapidly evolving digital environment.

Market Overview

Expansion of Automotive Production

Rising global automotive production acts as a critical driver for the alternator market, with manufacturers focusing on both passenger and commercial vehicles. Continuous technological upgrades in vehicle electronics and electrification, coupled with increasing consumer demand for fuel-efficient and reliable vehicles, stimulate the adoption of advanced alternator systems. As leading automotive markets in Asia Pacific and North America expand, the requirement for high-performance alternators in new vehicle assemblies continues to rise, fueling consistent market growth.

- For instance, Denso Corporation supplied more than 35 million high-efficiency alternators to original equipment manufacturers in 2023, supporting major automotive assembly plants in Japan and the United States.

Industrialization and Infrastructure Development

Rapid industrialization and infrastructure expansion in emerging economies significantly bolster alternator demand. Construction of new manufacturing plants, power generation facilities, and transportation networks require robust and reliable power generation equipment. Alternators are increasingly deployed in industrial generators, backup systems, and machinery, ensuring operational continuity and energy efficiency. As governments invest in infrastructure modernization, particularly in Asia Pacific, Latin America, and Africa, the market for industrial-grade alternators continues to grow steadily.

- For instance, Cummins Inc. commissioned over 6,500 industrial alternators for backup power systems in new manufacturing facilities across India between 2022 and 2024.

Growth in Renewable Energy Installations

The increasing adoption of renewable energy sources, such as wind and hydropower, fuels the need for alternators that efficiently convert mechanical energy into electrical energy. Expansion of off-grid and distributed energy systems in rural and remote areas further drives demand for advanced alternators with high efficiency and reliability. Technological innovations that improve energy conversion rates and reduce maintenance requirements position alternators as a vital component in the renewable energy ecosystem.

Key Trends & Opportunities

Shift Toward Electrification and Hybrid Vehicles

A major trend reshaping the alternator market is the transition toward electric and hybrid vehicles. Automotive OEMs are integrating high-efficiency alternators into new vehicle architectures to optimize energy management, support regenerative braking, and enhance battery charging. This shift opens opportunities for manufacturers to develop next-generation alternators with higher output, improved durability, and smart integration with vehicle electronics.

- For instance, Valeo introduced a 48V belt starter generator that delivers 12 kW of continuous power, now featured in hybrid models produced by major European automakers.

Adoption of Digital Monitoring and Smart Alternators

The adoption of digital monitoring technologies and smart alternators represents a key opportunity in both automotive and industrial sectors. Advanced alternators now feature sensors and real-time diagnostics that enable predictive maintenance and operational efficiency. Companies investing in digitalized power management systems gain a competitive edge, as end users increasingly demand equipment that delivers both reliability and actionable performance data.

- For instance, ABB integrated IoT-enabled sensors into its alternator lineup, facilitating real-time diagnostics and reducing unplanned downtime by up to 27% for industrial customers in 2024.

Key Challenges

Volatility in Raw Material Prices

One of the main challenges facing the alternator market is the volatility of raw material prices, particularly for metals like copper and aluminum used in windings and casings. Fluctuating commodity costs impact production expenses and profit margins for manufacturers. Sustained price increases may necessitate cost optimization strategies or lead to higher end-user prices, potentially affecting overall market competitiveness.

Increasing Penetration of Battery-Driven Systems

The rising penetration of battery-driven and fully electric vehicle systems poses a challenge for traditional alternator demand. As automakers pivot toward battery electric vehicles (BEVs), which do not require conventional alternators, there is potential for market contraction in the automotive segment. Manufacturers must diversify their offerings and adapt to new power management technologies to mitigate this impact.

Stringent Environmental Regulations

Stringent global regulations targeting emissions, noise, and efficiency standards create compliance challenges for alternator manufacturers. Meeting evolving regulatory requirements requires continuous investment in R&D and advanced engineering solutions. Failure to comply can limit market access and disrupt supply chains, making regulatory adaptation a crucial area for ongoing business resilience.

Regional Analysis

North America

North America accounts for a significant portion of the alternator market, representing a 22.9% market share in 2024 with a value of USD 4,450.64 million, up from USD 3,338.99 million in 2018. The market is projected to reach USD 6,233.21 million by 2032, registering a CAGR of 4.3%. This region benefits from strong automotive manufacturing, robust demand in industrial applications, and ongoing investment in advanced vehicle electrification and infrastructure. A mature ecosystem of OEMs and Tier 1 suppliers sustains steady market growth, ensuring North America remains a prominent contributor to the global alternator sector.

Europe

Europe captures 22.1% of the global alternator market in 2024, reaching USD 4,293.04 million from USD 3,090.72 million in 2018. The region’s market size is expected to rise to USD 6,360.70 million by 2032, achieving a CAGR of 5.0%. This growth is supported by strong regulatory focus on vehicle efficiency, the presence of leading automotive OEMs, and the transition toward hybrid and electric vehicle platforms. Continuous technological advancements and a shift toward sustainable manufacturing practices bolster Europe’s market position, making it a key region in global alternator adoption.

Asia Pacific

Asia Pacific leads the alternator market, holding a dominant 36.3% market share in 2024 with a market value of USD 7,038.82 million, up from USD 5,047.28 million in 2018. The market is set to reach USD 10,483.12 million by 2032, the highest CAGR among regions at 5.1%. Rapid industrialization, expanding automotive production, and significant investments in transportation infrastructure drive growth. Key economies such as China, Japan, and India play central roles, while a large manufacturing base and expanding export opportunities cement Asia Pacific’s leadership in the global alternator industry.

Latin America

Latin America comprises 8.3% of the alternator market in 2024, with market value rising from USD 1,145.44 million in 2018 to USD 1,605.98 million in 2024. By 2032, the market is forecasted to reach USD 2,408.28 million at a CAGR of 5.2%. The region benefits from increasing automotive assembly, demand for aftermarket parts, and gradual industrial modernization. Growing investments in commercial vehicle fleets and improvements in transportation infrastructure further support alternator adoption, positioning Latin America as an emerging growth region with expanding market opportunities.

Middle East

The Middle East represents 6.0% of the alternator market in 2024, with a market value of USD 1,154.76 million, up from USD 870.37 million in 2018. The market is projected to reach USD 1,606.47 million by 2032, recording a CAGR of 4.2%. Market growth is supported by ongoing investments in construction, infrastructure, and commercial vehicles. Industrial sector expansion, coupled with the adoption of advanced power generation equipment, fuels steady demand for alternators. Economic diversification efforts in several Gulf countries further drive new opportunities within the region.

Africa

Africa holds a 4.4% share of the global alternator market in 2024, valued at USD 845.92 million from USD 613.63 million in 2018. The market is expected to grow to USD 1,240.97 million by 2032, at a CAGR of 4.9%. Growth is fueled by urbanization, rising automotive ownership, and infrastructural development projects across the continent. As governments prioritize energy access and transportation modernization, the demand for alternators in both industrial and vehicle applications is set to increase, positioning Africa as a region with strong potential for future expansion.

Market Segmentations:

By Design:

- NVDIMM-N

- NVDIMM-F

- NVDIMM-P

By Capacity:

- 8 GB

- 16 GB

- 32 GB and Above

By End Use:

- Enterprise Storage and Server

- High-End Workstation

- Others

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the alternator market is characterized by the presence of several global and regional players that focus on technological innovation, product differentiation, and strategic partnerships to maintain and enhance market position. Key companies such as Controlled Power Technologies, Ltd., M Valeo Group, Lucas Electrical, Ltd., ASIMCO Technologies Ltd., Hitachi Automotive Systems, Ltd., Hella KGaA Hueck & Co, The Bosch Group, Mitsuba Corporation, and Emerson Electric Co. drive industry dynamics through continuous investment in research and development and expansion of their product portfolios. These companies emphasize high efficiency, durability, and integration with modern vehicle electronics to address evolving customer requirements. Strategic collaborations with automotive OEMs, expansion into emerging markets, and robust aftermarket support further strengthen their market presence. Competitive intensity remains high, with firms vying for larger shares by leveraging advanced manufacturing technologies, scaling production capacities, and aligning with global trends in electrification and sustainability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Controlled Power Technologies, Ltd.

- M Valeo Group

- Lucas Electrical, Ltd.

- ASIMCO Technologies Ltd.

- Hitachi Automotive Systems, Ltd.

- Hella KGaA Hueck & Co

- The Bosch Group

- Mitsuba Corporation

- Emerson Electric Co.

Recent Developments

- In July 2024, Valeo launched a 12V alternators SKUs for EVs, leveraging its extensive expertise in the field. The latest generation of these alternators is designed with high-quality components to enhance reliability, comfort, and efficiency, thereby extending their lifespan. The newly introduced 12V EG efficiency alternator employs synchronous rectification using MOSFET technology, which nearly eliminates voltage drop during electric current rectification. It has mass production capabilities range from 60 Amps to 300 Amps and features 6 phases to reduce magnetic noise.

- In November 2023, Bosch expanded its range of starters and alternators to include an all-makes program, significantly increasing market coverage for workshops. This new offer allows workshops to replace defective original equipment (OE) starters and alternators from various manufacturers, enhancing product accessibility for diverse vehicles. The expanded range caters to both passenger cars and commercial vehicles across multiple European and Asian brands. By bundling part numbers, Bosch aims to streamline inventory management and improve product availability. The complete all-makes range is accessible to workshops worldwide through established distribution channels

Market Concentration & Characteristics

The alternator market demonstrates a moderately concentrated structure, with several major multinational companies controlling a significant share of global revenues. Leading players include The Bosch Group, Controlled Power Technologies, Ltd., M Valeo Group, Hitachi Automotive Systems, Ltd., Hella KGaA Hueck & Co, Lucas Electrical, Ltd., Mitsuba Corporation, ASIMCO Technologies Ltd., and Emerson Electric Co. These companies maintain their dominance through advanced product development, strategic alliances, and robust distribution networks. The market features high entry barriers due to technological requirements and strong brand reputations. Product differentiation remains a key characteristic, driven by ongoing innovation in efficiency, integration with digital diagnostics, and compliance with strict regulatory standards. Intense competition encourages investment in research and development and adoption of sustainable manufacturing processes. It exhibits global reach, with regional concentration strongest in Asia Pacific, Europe, and North America, where automotive manufacturing and industrial growth support robust demand for advanced alternator solutions.

Report Coverage

The research report offers an in-depth analysis based on Design, Capacity, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Manufacturers will expand product portfolios to address rising demand for smart and high-efficiency alternator solutions.

- Companies will shift toward digital integration, embedding real-time diagnostics in alternator systems.

- Vehicle electrification efforts will create opportunities for idling-stop alternators and hybrid-compatible designs.

- Industrial infrastructure upgrades will drive demand for heavy-duty alternators in power generation applications.

- OEMs will increase collaboration with technology providers to develop next-gen alternator modules.

- Regulatory emphasis on emissions and energy efficiency will influence development of low-loss alternator technologies.

- Emerging markets will draw investment, stimulating regional manufacturing of alternator components.

- Material supply constraints will push firms to explore alternative metals and recycling initiatives.

- Aftermarket services will grow as maintenance needs expand across aging vehicle fleets.

- Innovation in smart grids and renewable integration will drive demand for alternators in distributed energy systems.