Market Overview

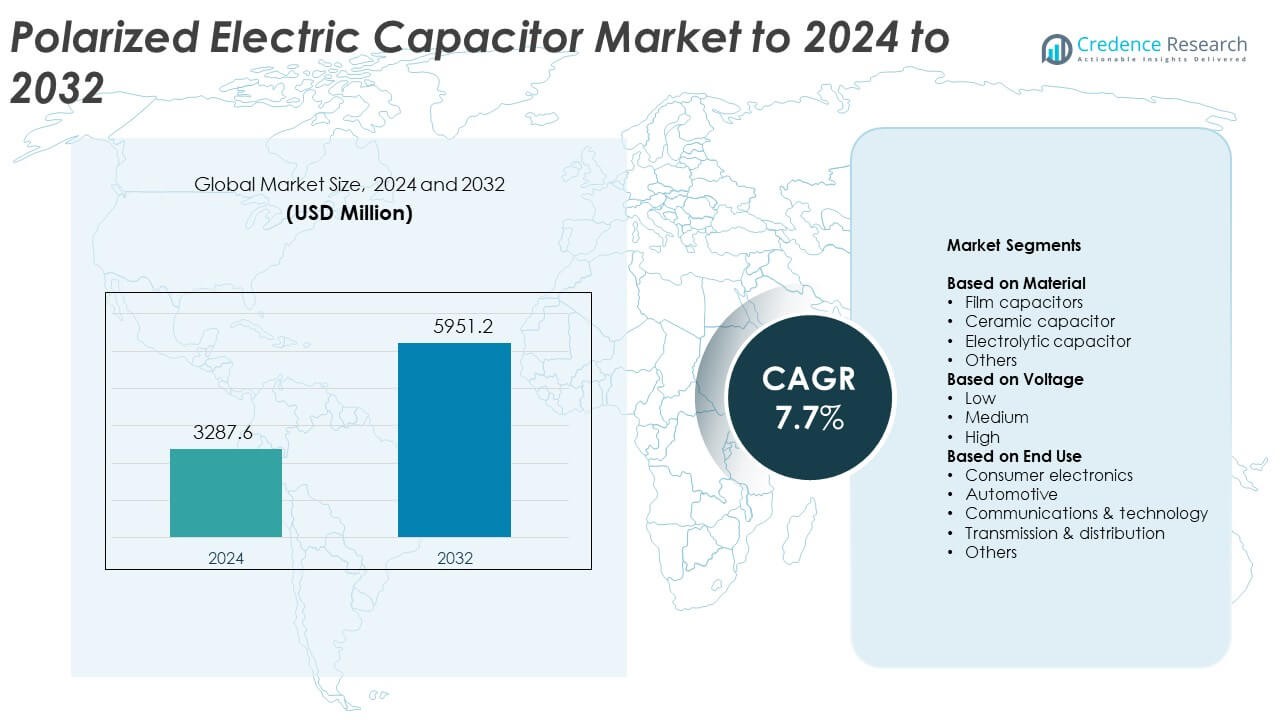

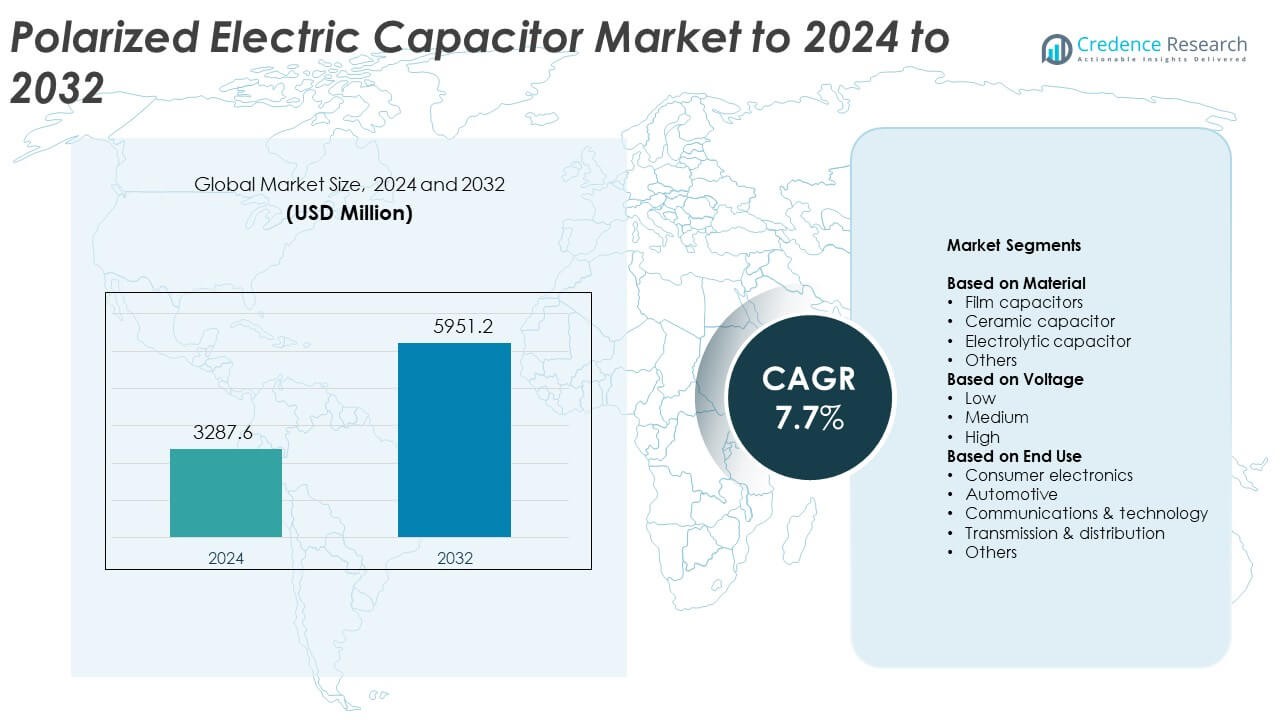

Polarized Electric Capacitor Market size was valued USD 3287.6 million in 2024 and is anticipated to reach USD 5951.2 million by 2032, at a CAGR of 7.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polarized Electric Capacitor Market Size 2024 |

USD 3287.6 Million |

| Polarized Electric Capacitor Market, CAGR |

7.7% |

| Polarized Electric Capacitor Market Size 2032 |

USD 5951.2 Million |

The polarized electric capacitor market includes major players such as Panasonic Corporation, KYOCERA AVX, Havells, Schneider Electric, SAMSUNG ELECTRO-MECHANICS, Murata Manufacturing, ABB, Cornell Dubilier, KEMET Corporation, and ELNA, all contributing to strong global competition through innovation in high-density, long-life, and heat-resistant capacitor technologies. Asia Pacific leads the market with about 38% share, driven by large-scale electronics manufacturing, strong EV adoption, and extensive telecom infrastructure growth. North America follows with roughly 28% share, supported by advanced industrial systems and rising demand in automotive and consumer electronics. Europe holds close to 24% share, anchored by electric mobility, renewable energy expansion, and industrial automation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The polarized electric capacitor market reached USD 3287.6 million in 2024 and is projected to reach USD 5951.2 million by 2032, expanding at a CAGR of 7.7%.

- Demand grows as consumer electronics, EV systems, and telecom equipment require stable power regulation and higher capacitance density.

- Miniaturization trends, renewable energy expansion, and rising use of advanced automotive electronics shape purchasing patterns across major industries.

- The market remains competitive as global players focus on long-life capacitors, improved materials, and expanded production to meet rising application needs.

- Asia Pacific leads with about 38% share, followed by North America at roughly 28% and Europe at about 24%, while electrolytic capacitors dominate with nearly 46% share across applications.

Market Segmentation Analysis:

By Material

Electrolytic capacitors held the dominant share in 2024 with about 46% of the polarized electric capacitor market. These components remained essential for power smoothing, energy storage, and high-capacitance needs in consumer electronics and industrial systems. Strong demand came from power supplies, inverters, and compact electronic devices that require stable performance under varying load conditions. Film capacitors and ceramic capacitors grew in precision and high-frequency circuits, but their lower capacitance density kept their share smaller. Rising production of compact devices and power electronics helped electrolytic capacitors maintain a strong lead.

- For instance, TDK’s CeraLink capacitor B58035U7105M062 offers a typical capacitance of 1 microfarad at a rated voltage of 700 volts with a nominal operating current of 12 amperes at 100 kilohertz and 85 degrees Celsius, as specified in its product datasheet.

By Voltage

Low-voltage capacitors led this segment in 2024 with nearly 52% share. These components saw high use in smartphones, laptops, home appliances, and low-power industrial equipment. Manufacturers favored low-voltage units due to their compact size, stable tolerance, and suitability for portable device power regulation. Medium- and high-voltage capacitors expanded in electric vehicles, renewable systems, and grid equipment, but adoption remained smaller because of higher design complexity and limited application scope. Growth in consumer electronics and small power systems kept low-voltage capacitors at the forefront.

- For instance, Samsung Electro-Mechanics’ CL10A226MP8NUNE multilayer ceramic capacitor in the CL10 series provides 22 microfarads at a rated voltage of 10 volts in a 0603 surface-mount package, according to distributor specifications.

By End Use

Consumer electronics dominated this segment in 2024 with around 41% share. Rising production of smartphones, wearables, smart appliances, and entertainment devices raised demand for polarized capacitors that support power regulation and signal stability. Rapid upgrades in personal electronics and strong global shipment volumes boosted the segment’s scale. Automotive and communications technology followed as emerging areas due to rising electronics content in vehicles and network equipment. However, the broad and recurring demand from everyday consumer devices ensured the leading position for the consumer electronics segment.

Key Growth Drivers

Rising demand for consumer electronics

Global production of smartphones, laptops, wearables, and smart appliances continues to rise, which boosts the use of polarized electric capacitors. These components support power stability, energy storage, and signal conditioning in compact devices. Manufacturers push for higher performance and miniaturization, which increases the need for capacitors with improved efficiency and durability. Strong growth in personal electronics and connected devices keeps this driver central to market expansion.

- For instance, Apple delivered 231.8 million iPhones in 2023, as documented by shipment statistics, each handset integrating multiple polarized capacitors for power management and radio circuits.

Expansion of automotive electronics

Automotive systems now use more electronic parts for safety, infotainment, power management, and electric drivetrain control. Polarized capacitors remain vital for voltage regulation and energy buffering in EV chargers, onboard inverters, and advanced driver systems. Rising EV adoption accelerates the use of components that support higher temperature tolerance and longer life cycles. The shift toward smarter and more electric vehicles strengthens this growth pillar.

- For instance, BYD recorded sales of 3,024,417 vehicles in 2023, the majority being new energy vehicles with dense electronic and power-conversion content that uses large numbers of polarized capacitors in inverters and battery-management units.

Growth in power and renewable infrastructure

Transmission grids, solar inverters, and wind power systems require capacitors that manage voltage fluctuations and supply steady power quality. Expanding renewable installations increases the need for high-capacitance and long-life polarized capacitors. Grid modernization programs further raise demand for reliable components that handle continuous load variations. This driver remains important as countries invest in cleaner and more efficient energy systems.

Key Trends & Opportunities

Miniaturization and high-density capacitor development

Manufacturers are shifting toward smaller capacitor designs with higher capacitance density to support compact electronics, EV control units, and wearable devices. Advances in materials and improved electrolyte formulations help achieve better thermal stability and longer operating life. This trend opens opportunities for premium capacitor variants used in fast-growing device categories. Companies investing in thin, high-capacity formats benefit from rising adoption across multiple industries.

- For instance, KEMET’s AO-CAP aluminum organic polymer series specifies a minimum equivalent series resistance of 3 milliohms with a voltage range from 2 to 35 volts, illustrating high-density, low-loss capacitor technology for compact electronics.

Integration of capacitors in advanced automotive systems

Automotive electronics continue to expand with features like ADAS, battery management, regenerative braking, and infotainment systems. These functions require durable capacitors that handle rapid charge-discharge cycles and temperature stress. The need for reliable polarized capacitors rises as automakers build more electronics-heavy vehicle platforms. This trend presents opportunities for suppliers offering automotive-grade components with enhanced lifespan and safety features.

- For instance, Continental’s autonomous mobility manufacturing plant in Texas produced more than 3.5 million advanced driver-assistance system units in its first year of operation, each module incorporating multiple polarized capacitors for stable power and sensor conditioning.

Growth of 5G and communication equipment

Communication networks demand stable power filtering and noise suppression in radio units, base stations, and broadband devices. Polarized capacitors play a key role in meeting these requirements. Expansion of 5G rollout increases production of RF systems and associated power modules. This creates openings for suppliers offering capacitors optimized for higher frequencies and energy efficiency.

Key Challenges

Volatility in raw material availability

Electrolytic capacitors rely on aluminum, electrolytes, and specific dielectric materials, all of which face supply fluctuations. Price instability affects manufacturing costs and reduces profit margins for producers. Global disruptions in metal refining or chemical production can delay component supply and impact customer lead times. Managing steady material flows remains a persistent challenge for capacitor makers.

Performance limitations under extreme conditions

Polarized capacitors may degrade under high temperature, high ripple current, or continuous stress. These limitations restrict their use in harsh automotive, aerospace, and industrial environments. Manufacturers must improve reliability to meet rising expectations for long-life and high-stability components. Performance constraints continue to challenge deployment in demanding applications that require strong durability.

Regional Analysis

North America

North America held about 28% share of the polarized electric capacitor market in 2024, driven by strong demand across consumer electronics, automotive electronics, and industrial power systems. The region benefits from steady growth in electric vehicles, data centers, and communication equipment that rely on stable power regulation. Expanding 5G infrastructure and rising use of advanced driver systems support higher adoption of polarized capacitors. The presence of major technology manufacturers and ongoing investment in renewable energy further strengthen regional consumption. The market also grows as companies upgrade power systems for better efficiency and reliability.

Europe

Europe accounted for nearly 24% share in 2024, supported by strong production of automotive electronics, industrial machines, and energy systems. The region’s push toward electric mobility increases demand for capacitors used in battery management, onboard chargers, and power converters. Growth in renewable power projects and smart grid upgrades enhances adoption in high-performance power units. Consumer electronics manufacturing remains steady, although more concentrated in specific countries. Tight environmental rules also encourage development of longer-life components, boosting adoption of advanced polarized capacitors. Demand from automation and communication sectors further strengthens the regional market.

Asia Pacific

Asia Pacific dominated the market in 2024 with about 38% share, making it the leading regional contributor. High electronics manufacturing in China, Japan, South Korea, and Taiwan drives strong consumption of polarized capacitors across smartphones, appliances, and computing devices. Rapid expansion of electric vehicles, telecom networks, and industrial automation further boosts demand. The region benefits from large-scale capacitor production and material availability that lower manufacturing costs. Growing infrastructure and renewable energy investments also increase need for capacitors in power systems. Rising consumer demand for compact and connected devices keeps Asia Pacific ahead of other regions.

Latin America

Latin America held close to 6% market share in 2024, supported by growing uptake of consumer electronics, automotive components, and industrial equipment. Expanding telecom networks and steady investment in power distribution drive moderate demand for polarized capacitors. Countries in the region are gradually adopting renewable power and electric mobility, which increases interest in energy-efficient components. Local manufacturing remains limited, so the market depends on imports from Asia and North America. Rising household electronics use and industrial automation help sustain steady growth, although economic fluctuations continue to influence procurement cycles.

Middle East and Africa

Middle East and Africa accounted for around 4% share in 2024, reflecting early but steady adoption of polarized capacitors across power infrastructure, communication systems, and consumer electronics. Investments in renewable projects, including solar installations in Gulf countries, increase demand for capacitors used in inverters and grid systems. Expanding telecom upgrades and digitalization efforts also drive usage in network equipment. Industrial development across select economies supports adoption in machinery and power control units. Although manufacturing presence is low, rising import availability and infrastructure spending are helping the region experience gradual and consistent growth.

Market Segmentations:

By Material

- Film capacitors

- Ceramic capacitor

- Electrolytic capacitor

- Others

By Voltage

By End Use

- Consumer electronics

- Automotive

- Communications & technology

- Transmission & distribution

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The polarized electric capacitor market features leading companies such as Panasonic Corporation, KYOCERA AVX, Havells, Schneider Electric, SAMSUNG ELECTRO-MECHANICS, Murata Manufacturing, ABB, Cornell Dubilier, KEMET Corporation, and ELNA at the forefront of global competition. The industry continues to advance as manufacturers invest in improved dielectric materials, higher capacitance density, and components that withstand wider temperature ranges to meet rising performance standards. Market participants focus on miniaturization to support compact consumer devices and automotive electronics. Strategic priorities include expanding production capacity, enhancing quality control, and developing application-specific capacitor lines for electric vehicles, power inverters, industrial automation, and 5G infrastructure. Companies also strengthen their supply chains to reduce material risks and improve delivery timelines. Growing demand for long-life, high-reliability components pushes firms to upgrade testing capabilities and adopt advanced manufacturing processes. The competitive environment remains dynamic, shaped by technology innovation, global expansion, and continuous product refinement.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Panasonic Corporation

- KYOCERA AVX

- Havells

- Schneider Electric

- SAMSUNG ELECTRO-MECHANICS

- Murata Manufacturing

- ABB

- Cornell Dubilier

- KEMET Corporation

- ELNA

Recent Developments

- In 2024, KYOCERA AVX launched the RES series of aluminum electrolytic capacitors, designed to save board space in high-density PCB layouts for communications, industrial, and consumer devices, and broadening its polarized capacitor portfolio.

- In 2024, ELNA Co., Ltd., a wholly-owned subsidiary of TAIYO YUDEN, acquired a factory building from Tenma Corporation in Hirosaki, Aomori Prefecture, Japan.

- In 2023, Cornell Dubilier introduced the MLPS flatpack aluminum electrolytic capacitors, a low-profile, 10,000-hour at 105 °C series that offers high capacitance density for space-constrained power electronics and energy-storage applications.

Report Coverage

The research report offers an in-depth analysis based on Material, Voltage, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow as demand rises in consumer electronics and compact devices.

- Electric vehicle adoption will boost the need for high-temperature and long-life capacitors.

- Telecom expansion and 5G rollout will increase use in network power systems.

- Renewable energy projects will drive higher consumption in inverters and grid equipment.

- Miniaturization will push manufacturers to develop higher-density capacitor designs.

- Automotive electronics will require more durable and safety-certified capacitor solutions.

- Industrial automation growth will support wider adoption in control and power units.

- Material innovation will improve performance, lifespan, and thermal stability.

- Supply chain optimization will become a priority to reduce raw material risks.

- Technology upgrades will support new applications in robotics, aerospace, and smart devices.