Market overview

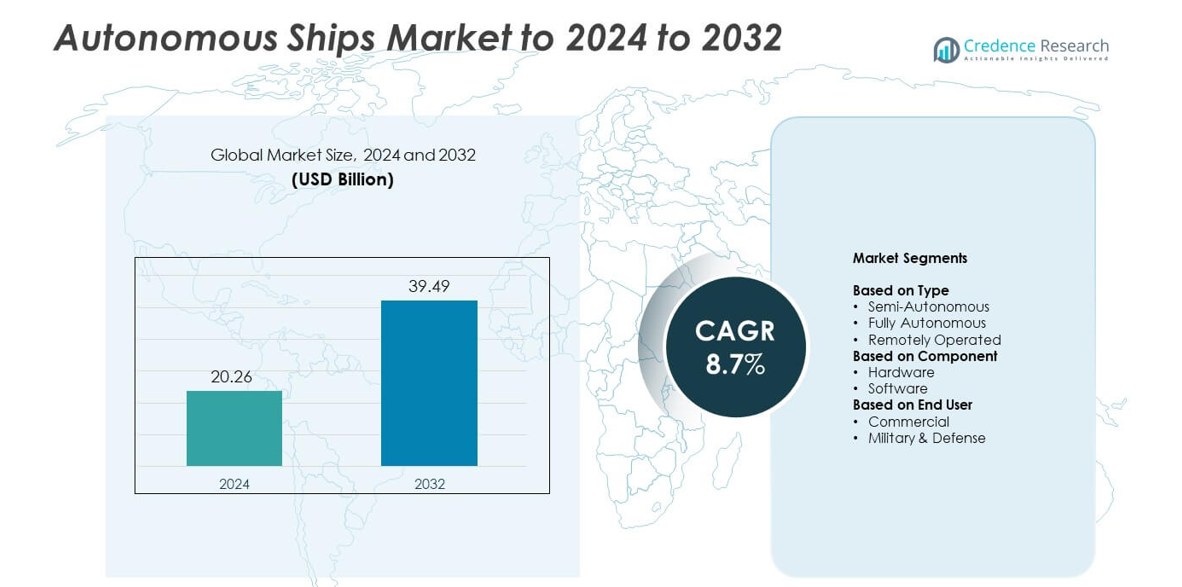

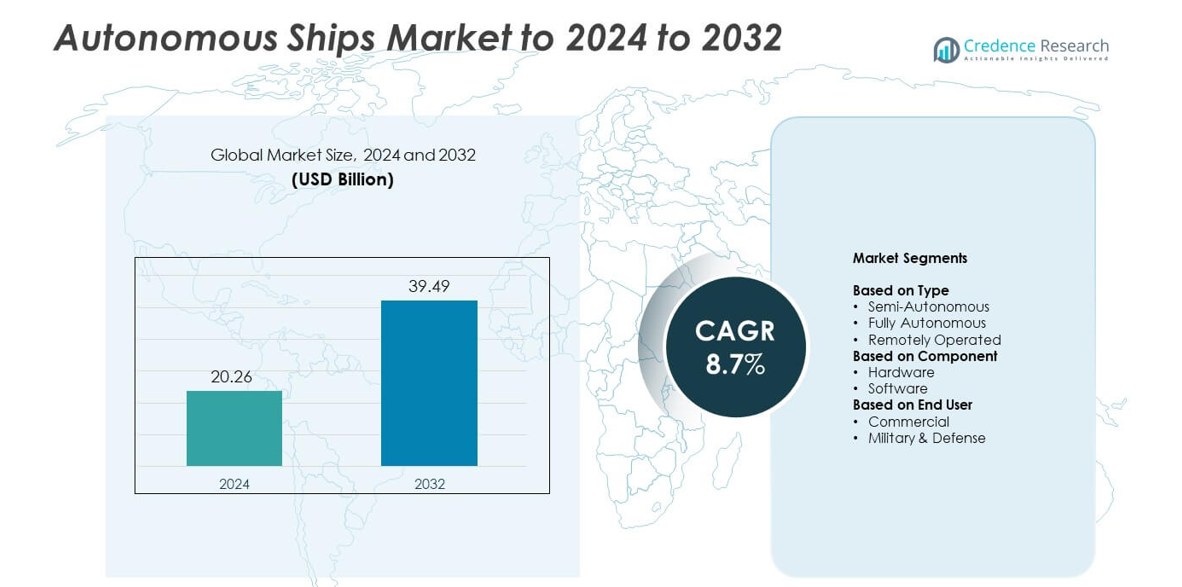

Autonomous Ships Market size was valued at USD 20.26 billion in 2024 and is anticipated to reach USD 39.49 billion by 2032, at a CAGR of 8.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Autonomous Ships Market Size 2024 |

USD 20.26 billion |

| Autonomous Ships Market, CAGR |

8.7% |

| Autonomous Ships Market Size 2032 |

USD 39.49 billion |

The Autonomous Ships Market is shaped by leading companies that advance AI navigation, remote-operation systems, and integrated sensor technologies to support higher autonomy levels across global fleets. These players focus on enhancing safety, improving route efficiency, and reducing crew dependence, which strengthens adoption in both commercial and defense applications. North America emerged as the leading region in 2024 with about 34% share, supported by strong digital port infrastructure and significant investment in unmanned surface vessel programs. Europe followed with roughly 30% share, driven by extensive autonomous ship trials and advanced maritime innovation hubs.

Market Insights

- The Autonomous Ships Market reached USD 20.26 billion in 2024 and is projected to hit USD 39.49 billion by 2032 at a CAGR of 8.7%.

- Market growth is driven by rising demand for reduced-crew operations, improved voyage safety, and wider adoption of AI-based navigation across commercial and defense fleets.

- Key trends include expansion of remote fleet management, deployment of predictive tools, and increasing interest in sustainable and fuel-efficient autonomous vessel designs across major shipping routes.

- Competition intensifies as technology providers upgrade sensors, control systems, and communication platforms, while shipyards integrate advanced autonomy packages to strengthen market positioning.

- North America led the market with about 34% share, followed by Europe at nearly 30% and Asia Pacific at around 27%, while semi-autonomous vessels dominated the type segment with about 46% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The semi-autonomous category led the Autonomous Ships Market in 2024 with about 46% share. Shipowners favored this type because semi-autonomous vessels balance automation and human oversight, reducing operational errors while keeping costs manageable. The format gained traction in cargo transport and offshore operations due to improved navigation accuracy and lower crew requirements. Fully autonomous vessels grew steadily as AI-based control systems improved, while remotely operated ships advanced in surveillance and short-route applications. Rising demand for safer maritime operations helped strengthen adoption across key shipping fleets.

- For instance, Rolls‑Royce logged close to 400 hours of sea trials of autonomous ferry operations in Finland.

By Component

Hardware dominated the component segment in 2024 with nearly 58% share. Growing installation of sensors, radar units, GPS modules, propulsion control systems, and advanced communication devices supported strong demand. Hardware platforms remained essential for real-time obstacle detection, route optimization, and remote monitoring across complex sea conditions. Software solutions expanded at a faster pace as operators adopted AI navigation, predictive maintenance, and autonomous decision-support tools. Increasing investment in integrated control ecosystems drove long-term growth for software upgrades across commercial and defense fleets.

- For instance, the Furuno FAR-1513 series radar has a transmitter power of 12 kW, while the Furuno FAR-1523 series radar has a transmitter power of 25 kW.

By End User

The commercial segment held the leading position in 2024 with about 62% share due to rapid automation in cargo shipping, container handling, and offshore logistics. Companies adopted autonomous technologies to cut operational costs, increase route efficiency, and improve safety during long voyages. Military and defense applications grew as navies deployed unmanned surface vessels for surveillance, mine-countermeasure missions, and reconnaissance. Rising focus on reduced-crew and crewless maritime operations supported wider adoption across global defense programs.

Key Growth Drivers

Rising Demand for Reduced-Crew and Crewless Operations

Growing pressure to cut operating costs and improve voyage safety pushed shipping companies to adopt reduced-crew and crewless vessel formats. Autonomous navigation systems lowered human error, improved route accuracy, and enabled long-distance operations with fewer personnel. Rising labor shortages across global maritime fleets further strengthened adoption. Freight operators also used autonomous functions to boost fuel efficiency and maintain consistent performance under harsh sea conditions. These factors made reduced-crew capability a major growth driver for the Autonomous Ships Market.

- For instance, Mitsui O.S.K. Lines conducted sea-trials for unmanned or semi-autonomous navigation of commercial vessels over about 750 km in one route.

Advancements in Sensors, AI, and Control Systems

Improved sensor accuracy, machine-learning algorithms, and advanced control units accelerated autonomous vessel development. Modern radar, LiDAR, GPS, and onboard analytics enhanced real-time detection and decision-making during complex marine operations. These technologies supported reliable navigation across congested routes and low-visibility environments. Maritime companies invested heavily in integrated AI platforms to boost vessel autonomy levels. This technological progress established advanced sensor and AI ecosystems as a key growth driver for the Autonomous Ships Market.

- For instance, ABB’s “Ability Marine Pilot Vision” system offers full 360-degree visibility and sensor fusion for real-time situational awareness on vessels.

Expansion of Smart Ports and Digital Maritime Infrastructure

Growth in smart port infrastructure strengthened adoption of autonomous vessels by enabling seamless data exchange between ships and coastal systems. Digital tracking, automated berthing, and high-bandwidth communication networks improved traffic management and reduced docking delays. Shipping companies adopted these capabilities to cut turnaround time and enhance cargo handling efficiency. Governments invested in port modernization to support future autonomous fleet deployment. This broad digital expansion acted as a key growth driver within the Autonomous Ships Market.

Key Trends and Opportunities

Growth of Remote Fleet Management and Predictive Operations

Maritime operators expanded remote-control centers to manage vessel fleets from land-based hubs. This trend improved operational visibility, reduced onboard staffing needs, and enabled continuous monitoring across global routes. Predictive analytics created new opportunities by reducing maintenance disruptions and improving fuel use. Companies used data-driven insights to optimize shipping schedules and avoid risk zones. Remote and predictive capabilities positioned the market for long-term digital transformation.

- For instance, The autonomous and fully electric container vessel Yara Birkeland was a collaboration between the chemical company Yara International (owner) and the maritime technology company Kongsberg, and built by the Norwegian shipbuilder Vard. The vessel is 80 meters (262 feet) long with a beam (width) of approximately 15 meters (49 feet).

Increased Deployment of Autonomous Systems in Defense Operations

Navies adopted autonomous surface vessels for surveillance, reconnaissance, and mine-countermeasure missions. These platforms offered low-risk operation in high-threat environments and supported real-time intelligence gathering. Defense agencies invested in high-end navigation, communication encryption, and multi-vessel coordination systems. Growing military interest opened new opportunities for manufacturers to supply purpose-built unmanned vessels. This defense-focused adoption shaped one of the strongest trends and opportunities in the Autonomous Ships Market.

- For instance, Elbit Systems’ “Seagull USV” can operate continuously for more than 4 days at sea and is designed for unmanned surface missions.

Rising Interest in Sustainable and Fuel-Efficient Autonomous Vessels

Shipping companies sought autonomous designs that reduce emissions and improve fuel savings. AI-based routing optimized engine loads and selected low-consumption pathways for long voyages. Electric and hybrid propulsion systems gained traction as operators pursued greener operations. Governments supported this shift with emission targets and carbon-reduction mandates. The push toward sustainability created strong opportunities for next-generation autonomous vessel development.

Key Challenges

High Integration Costs and Limited Return for Small Operators

Autonomous vessels require significant investment in sensors, communication units, AI software, and navigation hardware. Many small and mid-size shipping companies found these upfront costs difficult to justify without immediate financial return. Integration became more complex for older fleets where retrofitting required major structural updates. These cost pressures slowed adoption and formed a key challenge for the Autonomous Ships Market.

Regulatory Gaps and Safety Compliance Issues

Global maritime regulations for autonomous vessels remain incomplete, creating uncertainty for commercial deployment. Differences in national rules complicate cross-border routes and slow large-scale adoption. Safety certification, liability rules, and collision-avoidance guidelines continue to evolve, causing delays for manufacturers and operators. Ensuring compliance across diverse shipping regions remains a key challenge affecting market expansion.

Regional Analysis

North America

North America led the Autonomous Ships Market in 2024 with about 34% share due to strong adoption of advanced navigation systems, high defense spending, and early deployment of semi-autonomous commercial vessels. The U.S. invested in unmanned surface vessels for surveillance and logistics, while Canada supported upgrades in maritime safety technologies. Strong digital port infrastructure and active technology partnerships between shipbuilders and AI firms improved operational readiness. Growing interest in reduced-crew shipping and robust regulatory frameworks further strengthened the region’s leadership.

Europe

Europe held roughly 30% share in 2024, supported by strong maritime innovation programs and active government initiatives promoting autonomous vessel trials. Norway, Finland, and the U.K. led development with purpose-built test zones, zero-emission vessel research, and remote-operation centers. Commercial operators adopted autonomous solutions to improve safety across busy shipping lanes and cut emissions under strict environmental mandates. Integration of smart port systems across Western Europe supported smoother data exchange, making the region a major hub for autonomous maritime advancements.

Asia Pacific

Asia Pacific accounted for about 27% share in 2024, driven by rapid expansion in commercial shipping, strong investment in digital port infrastructure, and rising defense modernization programs. China, Japan, and South Korea advanced domestic autonomous shipbuilding projects and strengthened AI-based navigation research. Large fleet sizes and high cargo traffic supported strong adoption across commercial routes. Regional governments encouraged smart maritime corridors to improve logistics flow. Demand for reduced-crew vessels in coastal and intra-Asia trade boosted long-term growth potential.

Latin America

Latin America captured close to 5% share in 2024, supported by gradual adoption of digital maritime systems and rising investments in port modernization. Brazil and Mexico led regional activity with increased interest in autonomous technologies for offshore energy, coastal surveillance, and cargo handling. Limited funding and slower regulatory development kept adoption moderate, yet pilot projects expanded across major ports. Growth potential improved as shipping companies explored reduced-crew formats to lower operational costs and enhance route efficiency.

Middle East and Africa

Middle East and Africa held about 4% share in 2024, driven by selective adoption across high-value maritime hubs such as the UAE, Saudi Arabia, and South Africa. Governments invested in smart port development to strengthen trade efficiency and support future autonomous vessel operations. Defense agencies explored unmanned surface platforms for surveillance in strategic waters. Although overall adoption remained early-stage due to cost and capability gaps, strong port-centric growth and rising digitalization supported steady progress.

Market Segmentations:

By Type

- Semi-Autonomous

- Fully Autonomous

- Remotely Operated

By Component

By End User

- Commercial

- Military & Defense

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Autonomous Ships Market features major players such as Marine Technologies LLC, ABB Ltd., Ulstein Group ASA, Northrop Grumman, Kongsberg Gruppen, Honeywell International, L3 ASV, Mitsui OSK. Lines, and Rolls-Royce. These companies strengthen market competition through advanced navigation platforms, AI-based control systems, and integrated sensor architectures designed for safer and more efficient maritime operations. Vendors focus on upgrading remote-operation capabilities, enhancing collision-avoidance performance, and expanding autonomous solutions for commercial and defense vessels. Investment in digital twins, predictive maintenance systems, and real-time monitoring tools supports long-term value creation. Strong partnerships with shipyards, port authorities, and technology firms accelerate system deployment across global fleets. Continuous innovation in propulsion control, communication networks, and smart routing drives the market toward higher autonomy levels.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Honeywell and Near Earth Autonomy completed the first autonomous test flight of a Leonardo AW139 helicopter as part of the U.S. Marine Corps Aerial Logistics Connector program

- In 2024, L3Harris (formerly L3 ASV) and Seasats successfully tested an advanced autonomous surface vessel (ASV) by completing a 2,500-mile journey from San Diego to Pearl Harbor, Hawaii.

- In 2024, Northrop Grumman showcased autonomous naval warfare capabilities through its Helix and Scion systems, which integrate autonomous surface vehicles (USVs) with electronic warfare payloads

Report Coverage

The research report offers an in-depth analysis based on Type, Component, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will shift toward higher autonomy levels across commercial and defense fleets.

- Remote fleet management centers will expand as operators rely more on land-based control.

- AI-driven navigation and decision systems will become standard in new vessel designs.

- Smart port integration will improve data flow and support smoother autonomous operations.

- Demand for reduced-crew ships will rise due to labor shortages and safety needs.

- Defense agencies will increase deployment of unmanned surface vessels for key missions.

- Sustainable and fuel-efficient autonomous vessels will gain stronger adoption.

- Regulatory frameworks will mature, enabling safer global deployment.

- Retrofitting older fleets with autonomous systems will become more common.

- Collaboration between shipbuilders and tech firms will accelerate innovation in autonomy.