Market Overview

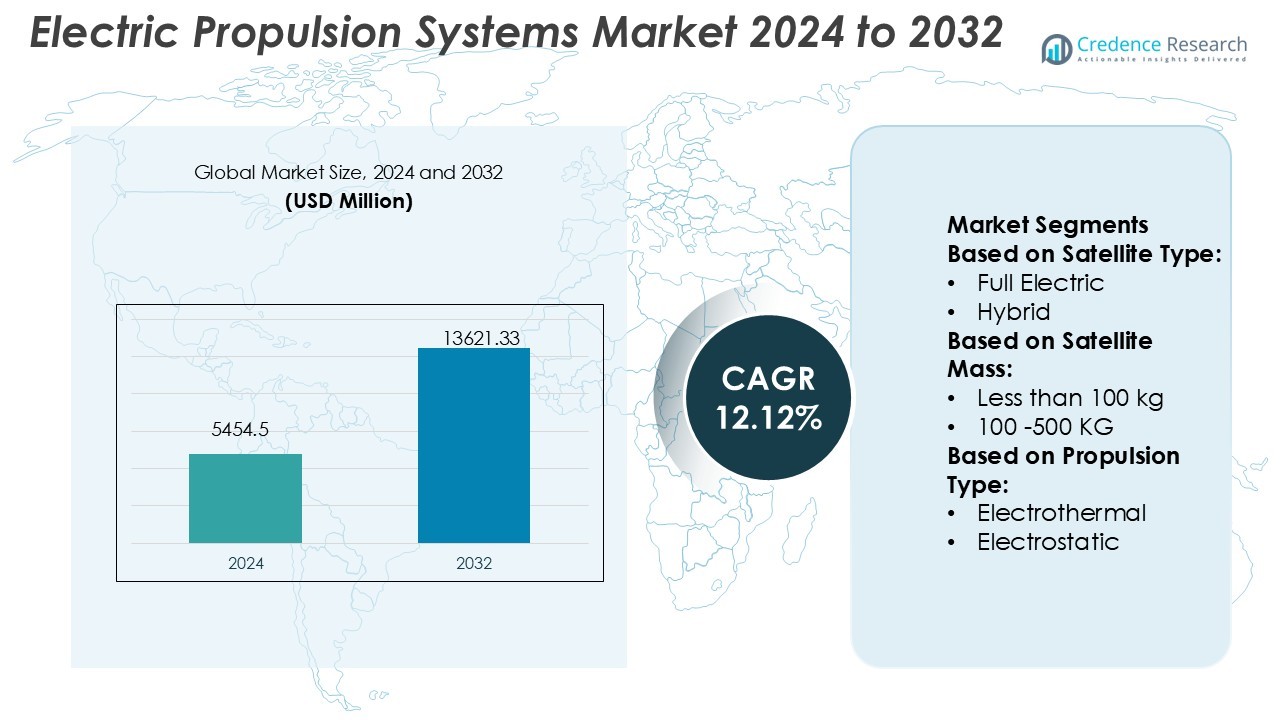

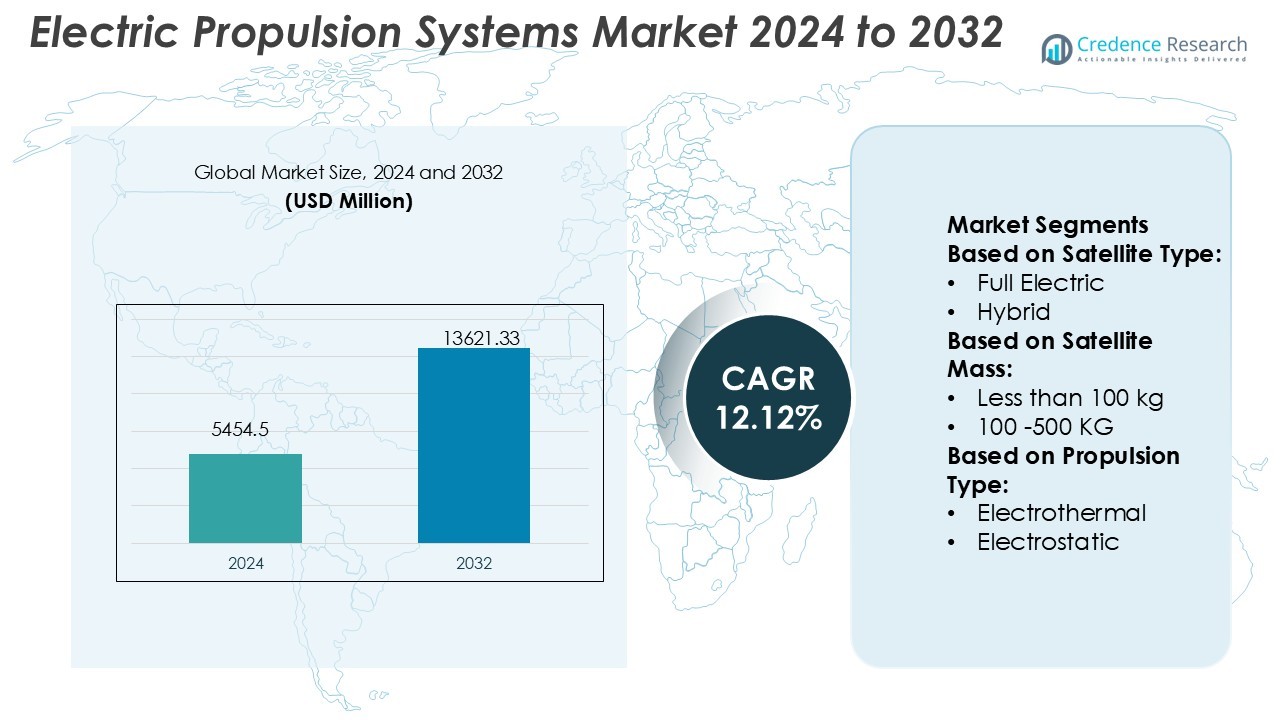

Electric Propulsion Systems Market size was valued USD 5454.5 million in 2024 and is anticipated to reach USD 13621.33 million by 2032, at a CAGR of 12.12% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Propulsion Systems Market Size 2024 |

USD 5454.5 Million |

| Electric Propulsion Systems Market, CAGR |

12.12% |

| Electric Propulsion Systems Market Size 2032 |

USD 13621.33 Million |

The Electric Propulsion Systems Market is driven by major players such as ArianeGroup, Boeing, Bellatrix Aerospace, L3Harris Technologies, Accion Systems, Airbus, Ad Astra Rocket, Lockheed Martin, Busek, and Aerojet Rocketdyne. These companies focus on advancing propulsion technologies for satellites, spacecraft, and deep-space missions through strategic partnerships and R&D investments. Their efforts center on enhancing efficiency, reducing fuel consumption, and extending operational lifespans. North America leads the global market with a 33% share, supported by strong government funding, commercial satellite expansion, and technological leadership in electric and hybrid propulsion systems. Continuous innovation and regional collaboration strengthen its dominance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Electric Propulsion Systems Market was valued at USD 5454.5 million in 2024 and is projected to reach USD 13621.33 million by 2032, growing at a CAGR of 12.12%.

- Market growth is driven by increasing satellite constellations, demand for fuel efficiency, and expansion in deep-space exploration programs.

- Advancements in ion and Hall-effect thrusters, hybrid propulsion adoption, and miniaturized systems for CubeSats represent key trends shaping future development.

- The competitive landscape includes leading players investing in R&D to enhance performance, efficiency, and sustainability across defense and commercial applications.

- North America leads with a 33% market share, followed by Europe and Asia Pacific, while the full-electric segment dominates propulsion type with the largest share due to high efficiency and reduced launch mass advantages.

Market Segmentation Analysis:

By Satellite Type

The full electric satellite segment dominated the Electric Propulsion Systems Market with a 63% share in 2024. Full electric satellites are preferred for their reduced launch mass and lower operational costs. They offer efficient thrust performance suitable for geostationary and low Earth orbit missions. Demand is driven by satellite operators aiming for higher payload capacity and longer mission life. Technological innovations in ion and Hall-effect thrusters further support this dominance, enabling enhanced propulsion efficiency and minimizing fuel consumption during orbit transfers and station-keeping operations.

- For instance, Boeing’s 702SP all-electric platform uses four 25-cm Xenon Ion Propulsion System (XIPS) thrusters, each having passed a 16,250-hour life test with 14,134 on–off cycles and a total xenon throughput of ~170 kg.

By Satellite Mass

Satellites weighing above 1,000 kg accounted for a 48% market share in 2024. These heavy satellites primarily use electric propulsion for orbit raising, station-keeping, and deep-space missions. The segment’s growth is fueled by increasing deployment of high-capacity communication and Earth observation satellites. Electric propulsion allows significant mass savings compared to chemical systems, improving overall payload efficiency. Growing investments in high-throughput satellites by commercial operators and government agencies are further boosting adoption across geostationary and interplanetary missions.

- For instance, NOVELSAT’s NS3000 professional modem supports data rates ranging from 100 Kbps to 850 Mbps, integrates DVB-S2X technology with efficiency gains of up to 40% in satellite spectrum use, and features built-in AES-256 encryption for secure transmissions.

By Propulsion Type

Electrostatic propulsion led the market with a 52% share in 2024, driven by its superior specific impulse and proven in-orbit performance. It includes ion and Hall-effect thrusters widely used in communication and navigation satellites. The system’s high fuel efficiency and reliability make it ideal for long-duration missions. Advancements in gridless ion technology and plasma acceleration systems continue to improve thrust efficiency. Growing demand for cost-effective satellite operations and reduced propellant mass strongly supports the adoption of electrostatic propulsion systems in both commercial and defense applications.

Key Growth Drivers

Expanding Satellite Constellations

The rising deployment of small and medium satellite constellations drives the adoption of electric propulsion systems. These systems enable precise orbital control, lower launch costs, and extended satellite life. Increasing demand for high-throughput communication, Earth observation, and navigation satellites further supports this trend. Leading firms like SpaceX, OneWeb, and Amazon’s Project Kuiper increasingly integrate electric propulsion for efficiency in low Earth orbit missions, fueling sustained market growth.

- For instance, ORBCOMM’s ST 6100 satellite modem is engineered for industrial IoT and maritime connectivity, providing reliable, two-way messaging for tracking and monitoring fixed and mobile assets in remote areas.

Focus on Fuel Efficiency and Sustainability

Electric propulsion systems reduce fuel mass and emissions compared to chemical propulsion. The shift toward environmentally sustainable satellite operations encourages adoption of electric thrusters. Governments and private operators favor green propulsion alternatives to meet emission norms and mission cost efficiency. Continuous R&D in ion and Hall-effect thrusters enhances performance-to-mass ratios, supporting both commercial and scientific applications.

- For instance, Hughes Network Systems’ JUPITER System hardware upgrades enabling throughputs exceeding 300 Mbps on the latest terminals, designed to meet the demands of enterprise, mobility, and cellular backhaul applications.

Government and Private Sector Investments

Growing funding from national space agencies and private aerospace firms strengthens market development. NASA, ESA, and ISRO support programs focused on advanced electric propulsion for deep-space exploration. At the same time, commercial ventures invest in scalable satellite networks requiring cost-efficient propulsion. This combined investment environment accelerates innovation and deployment across defense, telecom, and research missions.

Key Trends & Opportunities

Rising Adoption of CubeSats and Small Satellites

Miniaturization in satellite design and reduced launch costs boost electric propulsion adoption in CubeSats. Lightweight systems like electrostatic or electrothermal thrusters offer high precision with minimal power. Universities and startups increasingly deploy such propulsion for low Earth orbit missions. The trend supports growing R&D partnerships and launch collaborations among global space agencies.

- For instance, Datum Systems’ M7LT modem is a configurable satellite modem that supports data rates up to 350 Mbps using DVB-S2X technology. It is designed to operate with low processing latency and offers a variety of configurations for applications requiring high spectral efficiency.

Advancements in Hybrid Propulsion Technologies

Hybrid systems combining chemical and electric propulsion enhance operational flexibility and mission range. These systems allow rapid orbital transfers with low fuel consumption. Integration of hybrid technology in geostationary and interplanetary missions opens new commercial and scientific applications. Companies are investing in hybrid-ready platforms to capture future demand in deep-space missions.

- For instance, SatixFy’s SX-3000 modem chip supports high throughput rates and is capable of dynamic beam hopping, enabling efficient resource allocation in High-Throughput Satellite (HTS) systems.

Increasing Commercialization of Space Activities

Commercial satellite operators expand services for broadband, Earth imaging, and defense communications. This commercialization encourages cost-effective propulsion solutions with improved efficiency and reusability. Growth in private launches and satellite constellations creates significant opportunities for electric propulsion manufacturers and component suppliers worldwide.

Key Challenges

High Initial Development and Integration Costs

Electric propulsion systems require complex materials and precise engineering, increasing upfront investment. Developing high-performance thrusters, power electronics, and propellant systems raises overall mission costs. Smaller satellite developers face financial barriers to adoption. These costs slow wider implementation despite long-term operational benefits.

Technical Complexity and Power Limitations

Electric propulsion demands substantial onboard power and advanced thermal management. Limited power generation in small satellites constrains thrust performance and mission scope. Challenges in system miniaturization and compatibility with varied spacecraft platforms persist. Overcoming these technical barriers remains critical for large-scale deployment.

Regional Analysis

North America

North America holds a 33% share of the Electric Propulsion Systems Market in 2024. The region benefits from strong investments by NASA, SpaceX, and Northrop Grumman in satellite and deep-space programs. Growing commercial space launches and defense satellite modernization drive adoption of advanced propulsion systems. The U.S. leads regional demand with increased deployment of electric thrusters in geostationary and low Earth orbit missions. Technological innovations, coupled with robust private-public partnerships, enhance market competitiveness and support long-term growth across the aerospace and defense sectors.

Europe

Europe accounts for 29% of the Electric Propulsion Systems Market share in 2024. The region’s growth is supported by ESA’s large-scale electric propulsion initiatives and national programs in France, Germany, and the U.K. Companies such as Airbus Defence and Space and Thales Alenia Space lead advancements in Hall-effect and ion thrusters for telecommunication and exploration satellites. The European focus on fuel efficiency, sustainability, and reusable space systems further promotes adoption. Government incentives and increasing collaborations with private aerospace firms strengthen Europe’s leadership in high-precision propulsion technologies.

Asia Pacific

Asia Pacific captures 25% of the Electric Propulsion Systems Market in 2024, driven by rising investments from China, Japan, and India. The region experiences rapid expansion in commercial and defense satellite launches. China’s DFH Satellite Co. and Japan’s JAXA accelerate adoption of electric propulsion for communication and navigation missions. India’s ISRO also invests in indigenous thruster development for small satellite constellations. Growing participation of private companies and regional space startups fosters innovation. Expanding low Earth orbit projects and favorable government policies continue to enhance Asia Pacific’s market influence.

Latin America

Latin America holds a 7% share of the Electric Propulsion Systems Market in 2024. The region’s growth stems from emerging satellite and space technology programs in Brazil, Argentina, and Mexico. Investments in Earth observation, telecommunications, and environmental monitoring satellites are increasing. Brazil’s National Institute for Space Research (INPE) plays a central role in regional propulsion development. Collaboration with international aerospace companies enhances technology transfer and local manufacturing. Though adoption remains at an early stage, government interest in space capability expansion supports steady regional growth.

Middle East & Africa

The Middle East & Africa region accounts for 6% of the Electric Propulsion Systems Market in 2024. The UAE, Israel, and South Africa lead regional adoption through satellite launch and communication initiatives. The UAE Space Agency’s ongoing Mars and lunar exploration projects highlight growing investments in electric propulsion. Israel Aerospace Industries advances small satellite propulsion innovations, expanding defense and commercial applications. Increasing focus on regional space autonomy and knowledge partnerships with global players strengthens the sector’s foundation. Despite smaller market size, future growth prospects remain promising.

Market Segmentations:

By Satellite Type:

By Satellite Mass:

- Less than 100 kg

- 100 -500 KG

By Propulsion Type:

- Electrothermal

- Electrostatic

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Electric Propulsion Systems Market is highly competitive, with key players including ArianeGroup, Boeing, Bellatrix Aerospace, L3Harris Technologies, Accion Systems, Airbus, Ad Astra Rocket, Lockheed Martin, Busek, and Aerojet Rocketdyne. The Electric Propulsion Systems Market features intense competition driven by rapid innovation and technological advancement. Companies emphasize the development of efficient, lightweight, and high-thrust propulsion systems suited for satellites, spacecraft, and deep-space missions. Manufacturers focus on enhancing power efficiency, mission flexibility, and durability while reducing operational costs and fuel dependency. Growing collaboration between space agencies, research institutions, and private aerospace firms accelerates product development and commercialization. Continuous investment in electric thrusters, hybrid propulsion, and next-generation ion engines is reshaping market dynamics. The competition centers on reliability, performance, and sustainability to meet rising demand across commercial, defense, and scientific space missions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, Wärtsilä announced it will provide the electric propulsion system for the first battery-powered, zero-emission high-speed passenger ferries in the United States.

- In February 2025, ZeroAvia secured its first commercial agreement for a standalone electric propulsion system, with Jetcruzer International purchasing the company’s 600kW system. The propulsion system will support Jetcruzer International’s ongoing electric aircraft development program.

- In April 2023, Exotrail unveiled a new contract with the satellite manufacturer Satrec Initiative to embark on a spaceware electric propulsion system for a Korean governmental mission. The Satrec Initiative is the global leader in Earth observation solutions, and it operates from Korea.

- In February 2023, Thales Alenia Space awarded a contract by the Korea Aerospace Research Institute (KARI) to supply electric propulsion systems for the GEO-KOMSAT-3 multi-band communication satellite equipped with Satellite-based Augmentation System (SBAS), scheduled to launch by 2027.

Report Coverage

The research report offers an in-depth analysis based on Satellite Type, Satellite Mass, Propulsion Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for electric propulsion will rise with increasing satellite constellation launches.

- Miniaturized propulsion systems will gain traction for CubeSats and small satellites.

- Hybrid propulsion combining electric and chemical systems will expand for flexible missions.

- Advancements in ion and Hall-effect thrusters will improve efficiency and lifespan.

- Government and private investments will accelerate deep-space mission capabilities.

- Commercial satellite operators will adopt electric propulsion to reduce fuel and maintenance costs.

- Regional manufacturing collaborations will strengthen technology transfer and supply chains.

- Sustainability goals will drive the shift toward cleaner and energy-efficient propulsion technologies.

- Integration of AI and data analytics will enhance real-time propulsion performance monitoring.

- Growing participation of emerging space nations will diversify global market competition.