Market Overview

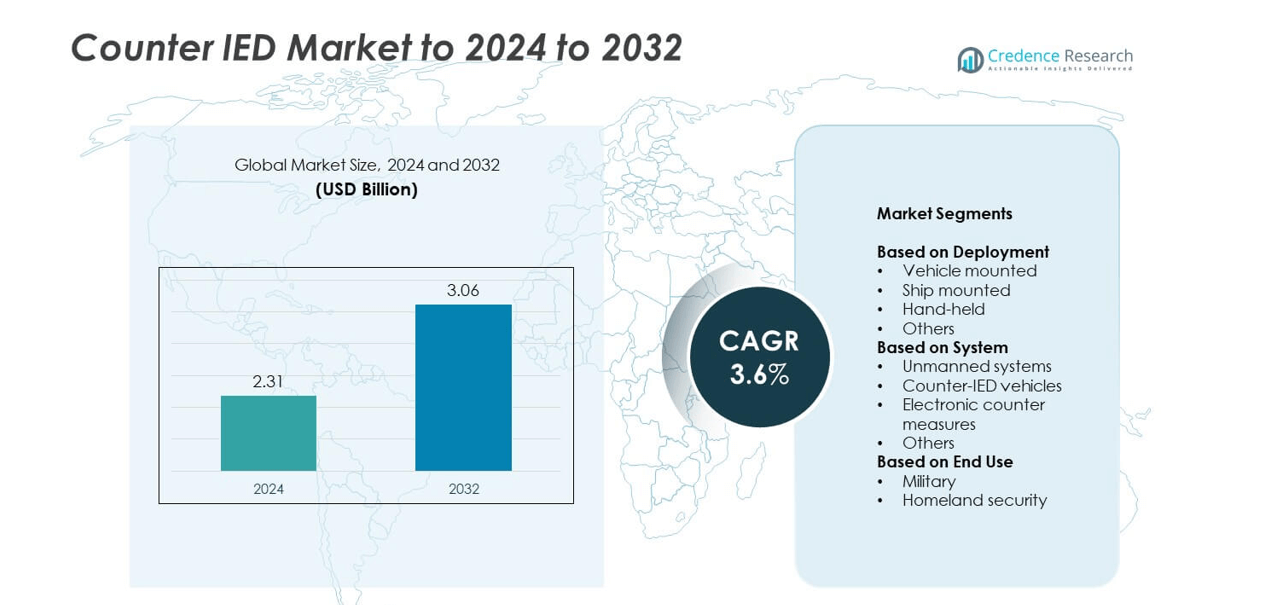

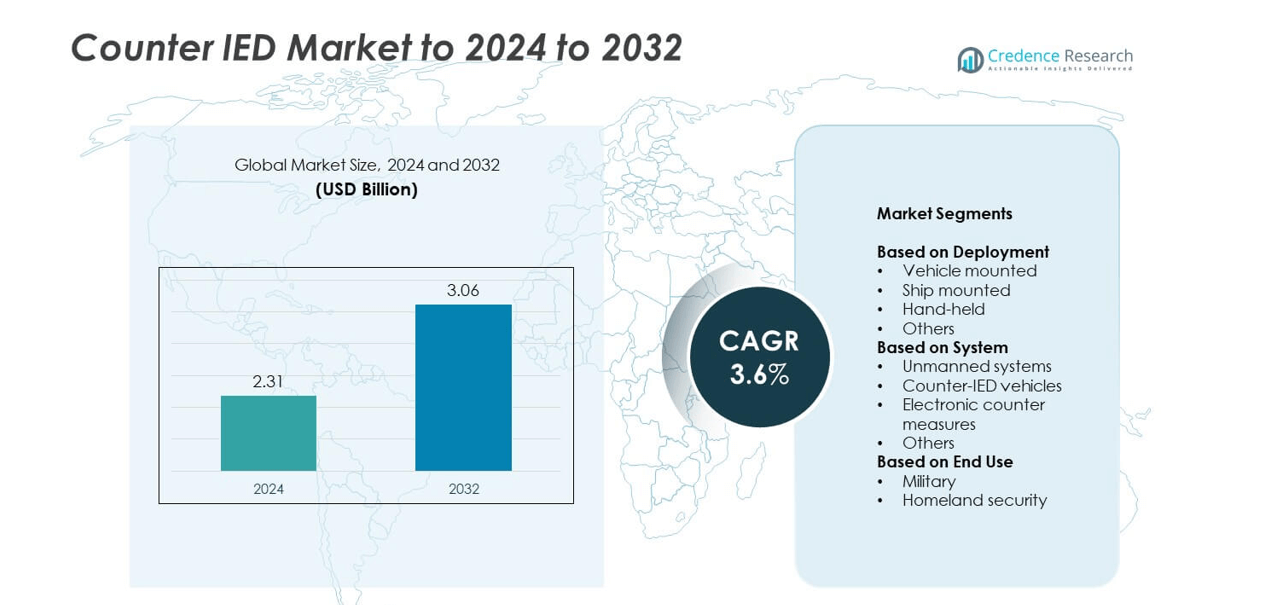

Counter IED market size was valued at USD 2.31 billion in 2024 and is anticipated to reach USD 3.06 billion by 2032, at a CAGR of 3.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Counter IED Market Size 2024 |

USD 2.31 billion |

| Counter IED Market, CAGR |

3.6% |

| Counter IED Market Size 2032 |

USD 3.06 billion |

The counter-IED market is dominated by leading defense contractors such as BAE Systems, Thales Group, Lockheed Martin Corporation, Rheinmetall Aktiengesellschaft, Elbit Systems Ltd., Raytheon Technologies, and Northrop Grumman Corporation. These companies focus on developing advanced jamming systems, autonomous vehicles, and AI-enabled detection technologies to enhance operational safety and threat response. Strategic partnerships with military organizations and defense agencies strengthen their global market position. North America led the market with a 37% share in 2024, supported by high defense spending and early adoption of electronic countermeasure systems, followed by Europe and Asia Pacific with strong modernization initiatives.

Market Insights

- The counter-IED market was valued at USD 2.31 billion in 2024 and is projected to reach USD 3.06 billion by 2032, growing at a CAGR of 3.6%.

- Rising terrorism threats, cross-border conflicts, and defense modernization programs are driving increased adoption of advanced detection and jamming systems worldwide.

- The market is witnessing a strong shift toward AI-based electronic countermeasures and unmanned systems, enhancing real-time detection and reducing personnel risk.

- Leading companies are focusing on partnerships, R&D investment, and modular system development, with the electronic countermeasure segment accounting for about 48% share in 2024.

- North America led the global market with a 37% share, followed by Europe at 28% and Asia Pacific at 22%, driven by continuous investments in defense technology, border security, and threat intelligence programs across major economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Deployment

Vehicle-mounted systems dominated the counter-IED market in 2024 with over 42% share, driven by their extensive use in convoy protection and route clearance missions. These systems offer enhanced mobility, integrated jamming devices, and real-time surveillance, making them critical for defense forces operating in high-threat zones. Ship-mounted and hand-held systems followed, supported by rising naval defense modernization and border security needs. The growing demand for vehicle-mounted solutions stems from their ability to combine protection, communication, and detection technologies for rapid threat response across both urban and battlefield environments.

- For instance, Lockheed Martin has delivered over 4,700 Symphony C-IED vehicle‐mounted systems globally since 2006, used in convoy protection missions.

By System

Electronic countermeasures accounted for the largest share of around 48% in 2024, fueled by advancements in signal jamming and radio frequency detection technologies. These systems are widely deployed to neutralize remote-controlled explosive devices, offering superior protection for troops and assets. Unmanned systems are gaining traction due to their capability for remote operation and reduced soldier risk during bomb disposal. Continuous innovations in software-defined jammers and sensor integration are driving the dominance of electronic countermeasure systems in modern defense operations.

- For instance, SRC, Inc.’s AN/VLQ-12 CREW Duke is one of the most widely deployed vehicle-mounted electronic warfare systems, protecting thousands of vehicles in combat zones.

By End Use

The military segment held the leading position with about 67% market share in 2024, supported by increased defense budgets and cross-border threat mitigation efforts. Military agencies are investing in advanced detection vehicles, autonomous robots, and jamming systems to enhance field safety and mission efficiency. Homeland security applications are expanding due to rising urban terrorism risks and critical infrastructure protection initiatives. The continued focus on modernizing armed forces and integrating electronic warfare technologies sustains the dominance of the military segment in the counter-IED market.

Key Growth Drivers

Rising Global Terrorism and Asymmetric Warfare

The growing threat of terrorism and asymmetric warfare continues to drive the demand for counter-IED technologies worldwide. Governments are increasing defense budgets to strengthen protective and detection capabilities in conflict-prone regions. Continuous insurgent activity in the Middle East, Africa, and parts of Asia has led to large-scale procurement of vehicle-mounted and electronic countermeasure systems. Defense agencies are also prioritizing intelligence-driven countermeasures, integrating advanced sensors and jamming systems to detect and neutralize improvised explosive devices before detonation.

- For instance, Epirus delivered prototype Leonidas high-power microwave systems (4 units) to the U.S. Army under IFPC-HPM contracts for integration on mobile platforms.

Defense Modernization and Technological Integration

Military modernization programs across major economies are fueling investments in automated and AI-based counter-IED platforms. Defense forces are adopting unmanned ground vehicles and autonomous drones for reconnaissance and bomb disposal operations. The integration of artificial intelligence, data analytics, and real-time communication enhances situational awareness and precision in threat detection. Continuous R&D in compact sensors, adaptive jamming systems, and signal analysis tools further supports the deployment of advanced electronic countermeasure systems across modern defense operations.

- For instance, Alaris COJOT provides antennas covering 20 MHz to 8 GHz, with power up to 400 W, for vehicle-mounted and hand-held jamming systems in border security tasks.

Increasing Border Security and Homeland Defense Initiatives

Rising concerns over cross-border smuggling, terrorism, and internal security threats are boosting adoption of counter-IED systems by homeland security agencies. Governments are strengthening border surveillance and investing in portable detection devices and mobile jamming platforms. The deployment of vehicle-mounted and handheld systems helps improve rapid response capabilities during security missions. Growing collaboration between defense and homeland security sectors further accelerates the implementation of integrated counter-IED frameworks for national protection and civilian safety.

Key Trends & Opportunities

Adoption of Unmanned and Autonomous Counter-IED Platforms

Unmanned systems are transforming IED detection and disposal by minimizing human exposure to risk. The shift toward autonomous ground and aerial vehicles enables precise, remote-controlled operations in hazardous areas. These platforms integrate imaging sensors, robotic arms, and AI-driven analytics for accurate target identification. Ongoing military modernization programs are creating opportunities for manufacturers to develop multi-mission unmanned platforms combining surveillance, jamming, and threat neutralization capabilities across defense and homeland applications.

- For instance, QinetiQ’s TALON EOD robots have over 4,000 units deployed by the U.S. and allies, completing 80,000+ counter-IED missions.

Integration of AI and Data Analytics in Threat Detection

Artificial intelligence and predictive analytics are being integrated to enhance counter-IED effectiveness. AI-driven algorithms process real-time data from sensors and surveillance systems to identify threat patterns faster. Machine learning models also improve detection accuracy by recognizing new explosive signatures and remote activation methods. This data-centric approach is allowing defense forces to make faster operational decisions, reduce false alarms, and improve resource allocation during counter-IED missions in both field and urban environments.

- For instance, SeeByte’s SeeTrack autonomy/ATR software is in operational use with over 25 navies, supporting multi-sensor fusion and target recognition in EOD/mine-countermeasure missions.

Key Challenges

High Development and Operational Costs

The high cost of advanced detection sensors, jamming equipment, and unmanned systems poses a major barrier to widespread adoption. Smaller nations with limited defense budgets face difficulties in maintaining and upgrading counter-IED systems. Additionally, high operational expenses for training, system calibration, and maintenance impact long-term deployment sustainability. The challenge lies in balancing affordability with technological advancement while ensuring consistent system performance under diverse combat and environmental conditions.

Evolving Threat Techniques and Electronic Warfare Complexity

Insurgents and terror groups continuously develop sophisticated IED designs and detonation methods, challenging existing defense mechanisms. The emergence of radio-frequency controlled and concealed IEDs makes detection and neutralization increasingly difficult. Rapid advancements in electronic warfare technologies demand continuous system upgrades to stay effective. This evolving threat landscape forces defense agencies to invest heavily in adaptive jamming and data analysis tools to ensure readiness against unpredictable and complex explosive threats.

Regional Analysis

North America

North America held the largest share of around 37% in 2024, supported by strong defense investments from the United States and Canada. The region benefits from advanced R&D programs and a well-established defense infrastructure focusing on IED detection, jamming, and disposal systems. U.S. defense agencies continuously upgrade electronic countermeasures and unmanned vehicles to improve troop protection in overseas operations. Collaborative programs between private defense contractors and federal agencies are accelerating innovation in AI-based and autonomous counter-IED technologies across both military and homeland security applications.

Europe

Europe accounted for nearly 28% share in 2024, driven by ongoing military modernization and cross-border security initiatives. Countries such as the United Kingdom, France, and Germany are enhancing their defense readiness by deploying vehicle-mounted and electronic countermeasure systems. NATO-led operations and rising concerns about urban terrorism continue to fuel demand for advanced detection and jamming solutions. Strategic partnerships with domestic defense manufacturers and the integration of AI-based threat analytics support Europe’s strong position in the counter-IED technology landscape.

Asia Pacific

Asia Pacific captured about 22% share in 2024, supported by rising defense budgets and regional security challenges in countries such as India, China, and South Korea. Governments are heavily investing in border protection and counter-terrorism programs, adopting modern surveillance and detection systems. The expansion of defense industrial capabilities in Japan and India enhances regional self-reliance in counter-IED technologies. The growing presence of local manufacturers, along with joint ventures with international defense firms, is strengthening the region’s ability to deploy advanced unmanned and electronic countermeasure solutions.

Middle East & Africa

The Middle East & Africa region represented nearly 9% of the global market in 2024, primarily driven by persistent insurgency threats and cross-border conflicts. Countries such as Saudi Arabia, Israel, and South Africa are increasing investments in vehicle-mounted detection systems and portable jammers. The presence of high-risk zones across parts of the Middle East encourages continuous procurement of counter-IED technologies. Regional collaboration with Western defense contractors and growing demand for mobile and ruggedized systems are expected to support sustained market growth through 2032.

Latin America

Latin America accounted for approximately 4% share in 2024, supported by growing homeland security spending and anti-smuggling operations. Nations such as Brazil and Mexico are adopting portable detection and communication systems to counter urban security threats. The expansion of regional defense cooperation programs is helping strengthen technological adoption and personnel training. Although investment levels remain moderate compared to other regions, rising security awareness and modernization of defense forces are expected to enhance Latin America’s role in the global counter-IED market over the forecast period.

Market Segmentations:

By Deployment

- Vehicle mounted

- Ship mounted

- Hand-held

- Others

By System

- Unmanned systems

- Counter-IED vehicles

- Electronic counter measures

- Others

By End Use

- Military

- Homeland security

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Key players such as BAE Systems Land & Armaments Inc., Thales Group, Lockheed Martin Corporation, Rheinmetall Aktiengesellschaft, Elbit Systems Ltd., Raytheon Technologies (United Technologies Corporation), Allen-Vanguard Corporation, L3 Technologies Inc., Chemring Group Plc, Sierra Nevada Corporation, and Northrop Grumman Corporation collectively dominate the counter-IED market through strong technological portfolios and global defense partnerships. These companies focus on developing advanced jamming systems, autonomous detection platforms, and AI-driven threat analysis tools. Continuous investments in R&D and integration of sensor-based technologies enhance their competitiveness in both military and homeland security applications. Strategic collaborations with defense agencies and cross-border governments enable the introduction of modular and rapidly deployable systems suited for varied terrains. The market remains highly consolidated, with large enterprises securing major defense contracts, while smaller firms contribute through specialized electronic countermeasure solutions and software-driven threat response technologies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BAE Systems Land & Armaments Inc.

- Thales Group

- Lockheed Martin Corporation

- Rheinmetall Aktiengesellschaft

- Elbit Systems Ltd.

- Raytheon Technologies (United Technologies Corporation)

- Allen-Vanguard Corporation

- L3 Technologies Inc.

- Chemring Group Plc

- Sierra Nevada Corporation

- Northrop Grumman Corporation

Recent Developments

- In 2025, Allen-Vanguard Corporation highlighted its TURMOIL RF Decoy system at the DSEI event in September.

- In 2024, L3Harris Technologies Announced a strategic partnership with Palantir Technologies in October 2024 to accelerate its digital transformation and develop advanced defense technologies.

- In 2024, BAE Systems acquired Kirintec, a UK-based company specializing in C-IED, Counter-Uncrewed Air System (C-UAS), and electronic warfare technologies. The acquisition strengthens BAE’s CEMA (Cyber and Electromagnetic Activities) capabilities.

Report Coverage

The research report offers an in-depth analysis based on Deployment, System, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The counter-IED market will expand steadily with ongoing global defense modernization programs.

- Demand for electronic countermeasure systems will grow due to advanced threat detection needs.

- Integration of AI and machine learning will enhance real-time decision-making in field operations.

- Unmanned and autonomous systems will gain wider adoption for safe explosive disposal missions.

- Defense collaborations and joint development programs will strengthen innovation in counter-IED technologies.

- Miniaturized and portable counter-IED devices will see increased use in homeland security operations.

- Governments will emphasize domestic production to reduce dependency on foreign defense suppliers.

- Cloud-based data platforms will improve coordination and predictive threat analysis in military missions.

- Increased training and simulation programs will improve operational readiness for counter-IED forces.

- Continuous evolution of threat tactics will drive ongoing investment in adaptive and modular defense systems.