Market Overviews

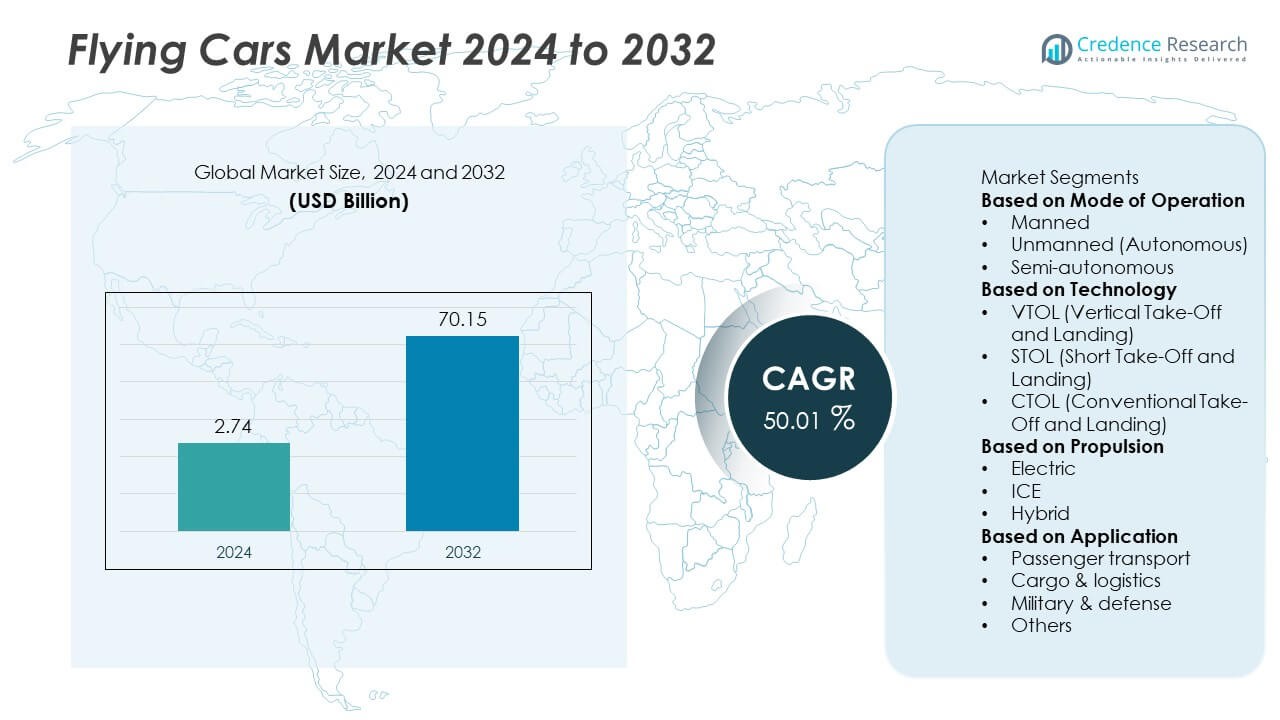

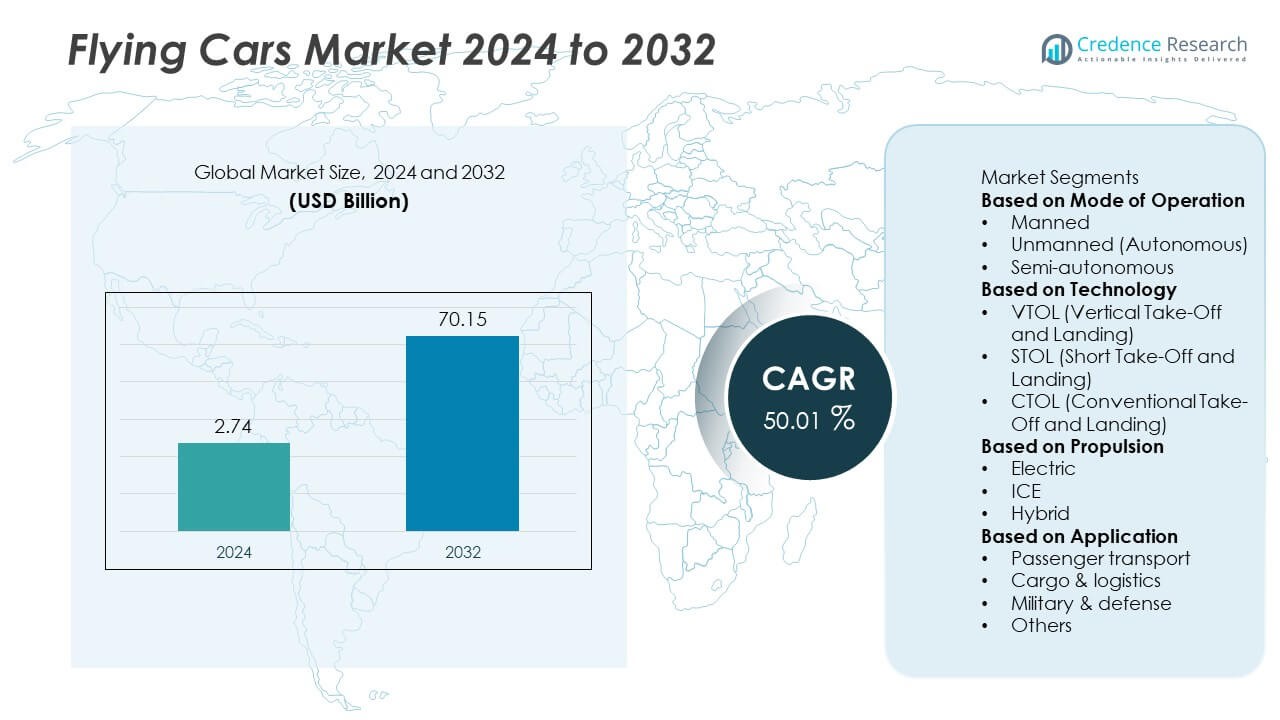

The Flying Cars Market was valued at USD 2.74 billion in 2024 and is projected to reach USD 70.15 billion by 2032, growing at an impressive CAGR of 50.01% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flying Cars Market Size 2024 |

USD 2.74 Billion |

| Flying Cars Market, CAGR |

50.01% |

| Flying Cars Market Size 2032 |

USD 70.15 Billion |

The flying cars market is led by major companies including PAL-V International, Archer Aviation, Airbus, SkyDrive, UBER, Terrafugia, Moller, AeroMobil, Joby Aviation, and Boeing. These companies are driving innovation through electric propulsion systems, autonomous flight technology, and hybrid air mobility designs. North America emerged as the leading region with a 41% market share in 2024, driven by advanced R&D initiatives, strong regulatory support, and large-scale pilot programs. Europe followed with a 29% share, supported by sustainability-driven policies and technological collaborations, while Asia-Pacific accounted for 23%, fueled by rapid urbanization, government investments in smart city infrastructure, and growing public-private partnerships in next-generation air mobility solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The flying cars market was valued at USD 2.74 billion in 2024 and is projected to reach USD 70.15 billion by 2032, registering a CAGR of 50.01% during the forecast period.

- Growing urban congestion, advancements in electric propulsion, and strong investments in air mobility infrastructure are driving rapid market growth worldwide.

- The market is witnessing strong trends in autonomous flight systems, AI-based navigation, and sustainable eVTOL technologies enhancing safety and performance.

- Key players such as PAL-V International, Airbus, Joby Aviation, and Archer Aviation are focusing on partnerships, prototype launches, and certification to strengthen global presence.

- North America held a 41% market share in 2024, followed by Europe with 29% and Asia-Pacific with 23%; by technology, the VTOL segment led with a 58% share, highlighting growing preference for vertical take-off designs suited for dense urban environments.

Market Segmentation Analysis:

By Mode of Operation

The segment dominated the flying cars market in 2024, holding a 46% share. This segment’s leadership is driven by advancements in AI-based navigation, autonomous flight control, and collision avoidance systems. Autonomous flying cars offer enhanced safety, efficiency, and reduced pilot dependency, making them ideal for urban air mobility. Growing investment by tech and aerospace companies in autonomous aerial platforms further supports demand. The increasing acceptance of driverless technologies across transportation industries is accelerating commercialization and regulatory approval for fully autonomous air mobility systems.

- For instance, Joby Aviation has demonstrated autonomous flight technology through partnerships with the U.S. military and has conducted flight testing in collaboration with NASA. The company acquired the autonomy division of Xwing, which developed the “Superpilot” autonomous flight system.

By Technology

The VTOL (Vertical Take-Off and Landing) segment led the market in 2024 with a 58% share, attributed to its flexibility and suitability for congested urban environments. VTOL vehicles eliminate the need for runways, allowing vertical lift and landing from compact areas, making them ideal for intra-city transport. Manufacturers are heavily investing in electric VTOL prototypes powered by distributed propulsion systems to enhance stability and efficiency. The rise of air taxi services and infrastructure development for vertiports across major cities are major factors driving the widespread adoption of VTOL technology.

- For instance, Archer Aviation’s Midnight eVTOL features twelve independent electric propellers, achieved a piloted flight covering approximately 55 miles at speeds exceeding 203 kilometers per hour at its California test facility, and has completed its first transition flight.

By Propulsion

The electric propulsion segment accounted for a 54% share of the global flying cars market in 2024, fueled by growing emphasis on sustainability and reduced emissions. Electric flying cars offer quieter operations, lower maintenance costs, and improved energy efficiency compared to internal combustion engines. Government incentives for electric mobility and advancements in high-density battery technology are accelerating adoption. Leading companies are developing next-generation electric powertrains and fast-charging systems to extend range and performance. The global shift toward zero-emission aviation continues to position electric propulsion as the future standard for flying cars.

Key Growth Drivers

Advancements in Electric and Hybrid Propulsion Systems

Rapid improvements in battery energy density and electric propulsion technology are driving the flying cars market forward. Electric and hybrid powertrains reduce emissions, lower maintenance costs, and enhance efficiency. Manufacturers are investing heavily in lightweight materials and high-performance batteries to extend flight range and reduce operational costs. These innovations align with global sustainability goals and urban air mobility initiatives. The transition toward clean energy aviation is accelerating development, positioning electric flying cars as the future of short-distance transportation.

- For instance, Airbus has conducted flight tests of its all-electric CityAirbus NextGen prototype at its Donauwörth facility. The aircraft, which has eight electric propellers and a cruise speed of 120 km/h, is designed to have an operational range of 80 km.

Growing Urbanization and Traffic Congestion Solutions

Increasing urban congestion and limited ground infrastructure are key factors fueling the adoption of flying cars. Urban air mobility offers faster, more efficient travel options, reducing commute times in major metropolitan areas. Governments and private companies are collaborating to develop aerial corridors and vertiport networks to enable safe operations. The rising need for smart, space-efficient transportation systems is prompting investment in flying car projects, particularly in regions such as North America, Europe, and Asia-Pacific where urban populations are expanding rapidly.

- For instance, SkyDrive partnered with Japan’s Ministry of Land, Infrastructure, Transport and Tourism to obtain certification for its SD-05 eVTOL aircraft and conduct demonstration flights at the Osaka Expo in 2025.

Rising Investments and Strategic Partnerships

Massive funding from automotive, aerospace, and technology firms is accelerating product development and commercialization. Collaborations between companies such as Hyundai, Joby Aviation, and Airbus are helping advance design, safety standards, and mass production capabilities. Governments are also supporting prototype testing and certification programs for electric vertical take-off and landing (eVTOL) vehicles. These partnerships are not only boosting innovation but also ensuring faster integration of flying cars into existing mobility ecosystems, paving the way for commercial launches within the decade.

Key Trends and Opportunities

Integration of AI and Autonomous Flight Technology

The adoption of artificial intelligence and machine learning is transforming the capabilities of flying cars. AI enables precise navigation, route optimization, and obstacle detection, improving safety and reliability. Autonomous flight systems are reducing human error, paving the way for fully automated air taxis. Companies are developing advanced air traffic management solutions to handle autonomous vehicle coordination. This integration presents significant opportunities for urban mobility platforms and investors in smart aviation infrastructure.

- For instance, Joby Aviation leveraged its Superpilot autonomy software to conduct over 7,000 miles of uncrewed flights across 40 hours during a U.S. Department of Defense exercise, validating gate-to-gate autonomous flight in complex airspace.

Development of Urban Air Mobility Infrastructure

The expansion of vertiports, charging stations, and digital air traffic systems is creating new opportunities in the flying car ecosystem. Governments and private firms are collaborating to establish infrastructure that supports regular flying car operations. Integration with smart cities and digital communication networks enhances safety and efficiency. As pilot programs and urban mobility trials progress, infrastructure development will remain critical in shaping the long-term commercial viability of flying cars.

- For instance, Uber Elevate has designed a modular Skyport concept able to support vertical takeoff and landing traffic of up to 1,000 aircraft per hour, using retrofitted parking decks or helipad rooftops as infrastructure nodes.

Sustainability and Zero-Emission Initiatives

Environmental concerns are pushing manufacturers to design eco-friendly flying vehicles. Companies are focusing on electric and hydrogen-powered models to minimize carbon footprints. These developments align with international emission reduction goals and promote long-term sustainability. The shift toward zero-emission air mobility creates opportunities for green technology providers, material innovators, and investors focused on sustainable aviation solutions.

Key Challenges

High Development and Operational Costs

The high cost of research, development, and certification remains a major obstacle to widespread adoption. Flying cars require advanced propulsion systems, robust materials, and regulatory compliance testing, all of which increase production expenses. Additionally, building supporting infrastructure like vertiports and charging networks demands significant investment. These factors make flying cars less accessible for the mass market. Achieving cost efficiency through economies of scale and technological advancement is essential for commercial success.

Regulatory and Safety Concerns

Strict aviation regulations and safety certifications present major challenges to market growth. Governments are still developing frameworks for air traffic management, pilot licensing, and autonomous flight approval. Concerns around mid-air collisions, noise pollution, and urban flight paths delay commercialization. Manufacturers must meet stringent safety standards while ensuring cost-effective production. Collaboration between aviation authorities and industry players is crucial to establish globally accepted regulations for safe and efficient urban air operations.

Regional Analysis

North America

North America dominated the flying cars market in 2024 with a 41% share, driven by strong technological innovation, robust funding, and supportive government policies for urban air mobility. The United States leads the region with active projects from companies like Joby Aviation, Archer Aviation, and Boeing. High adoption potential for electric vertical take-off and landing (eVTOL) vehicles and extensive testing of autonomous air systems further strengthen the region’s position. Favorable regulatory initiatives by the Federal Aviation Administration (FAA) and growing partnerships between automotive and aerospace firms continue to accelerate commercialization across key U.S. cities.

Europe

Europe accounted for a 29% share of the global flying cars market in 2024, supported by progressive regulatory frameworks and increasing investments in air mobility infrastructure. Countries such as Germany, the United Kingdom, and France are leading innovation through collaborations among aviation startups and automotive giants. The European Union Aviation Safety Agency (EASA) is developing certification standards for eVTOL vehicles, boosting industry confidence. Sustainable transportation goals and pilot programs for urban air taxis are expanding across major cities, positioning Europe as a frontrunner in green air transport adoption.

Asia-Pacific

Asia-Pacific captured a 23% market share in 2024, emerging as a rapidly expanding region due to strong government initiatives and growing urban populations. Countries like Japan, China, and South Korea are investing heavily in flying car development and smart city integration. Japan’s national roadmap for air mobility and China’s progress with companies like XPeng AeroHT highlight the region’s commitment to commercialization. Rising disposable incomes, dense urbanization, and technological readiness support demand. Regional governments are also encouraging local manufacturing and public-private partnerships to enhance air traffic safety and operational scalability.

Latin America

Latin America held a 4% share of the global flying cars market in 2024. Growth in this region is fueled by expanding urbanization and increasing interest in sustainable mobility. Countries like Brazil and Mexico are investing in aviation infrastructure and exploring aerial transportation to address congested cities. Regional collaborations with global players are enabling early-stage testing and prototype development. Although regulatory and cost barriers remain, improving economic conditions and government-led innovation initiatives are expected to create new opportunities for air mobility adoption in the coming years.

Middle East & Africa

The Middle East & Africa region accounted for a 3% share of the global flying cars market in 2024, with rising interest in advanced transportation solutions and tourism-driven aerial mobility. The UAE leads the region with Dubai’s smart city initiatives and partnerships with eVTOL developers for urban flight operations. Saudi Arabia is investing in futuristic transport infrastructure under Vision 2030. Africa shows potential through early-stage pilot projects focused on logistics and passenger transport. Despite limited infrastructure, growing investments and government support signal a gradual move toward commercial flying car adoption.

Market Segmentations:

By Mode of Operation

- Manned

- Unmanned (Autonomous)

- Semi-autonomous

By Technology

- VTOL (Vertical Take-Off and Landing)

- STOL (Short Take-Off and Landing)

- CTOL (Conventional Take-Off and Landing)

By Propulsion

By Application

- Passenger transport

- Cargo & logistics

- Military & defense

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the flying cars market features major players such as PAL-V International, Archer Aviation, Airbus, SkyDrive, UBER, Terrafugia, Moller, AeroMobil, Joby Aviation, and Boeing. These companies are leading innovation through advancements in electric vertical take-off and landing (eVTOL) technologies, autonomous flight systems, and hybrid propulsion designs. Strategic partnerships and heavy investments are accelerating prototype development, testing, and commercialization across urban air mobility networks. Manufacturers are focusing on reducing production costs, improving safety systems, and achieving regulatory certifications for large-scale deployment. Collaborations between aerospace firms and automotive manufacturers are also expanding the ecosystem, integrating AI-driven navigation and smart infrastructure. Government approvals, air traffic management frameworks, and infrastructure readiness remain key competitive factors. As global demand for sustainable and efficient urban transport rises, established aviation leaders and emerging startups are intensifying their efforts to capture early market leadership in this transformative mobility segment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, Joby Aviation and Archer Aviation performed public flight demonstrations of their eVTOL aircraft at the Monterey County Airshow, showcasing quiet electric flight over ~10 minutes.

- In September 2025, Archer Aviation announced plans to participate in the White House’s eVTOL pilot program with U.S. airlines and cities for air taxi trials.

- In December 2024, PAL-V collaborated with Netherlands Aerospace Center (NLR) to develop rotor blades for the Liberty, with new blades weighing 78 pounds per set and spanning nearly 36 feet.

- In September 2024, PAL-V Liberty passed its first Periodic Technical Inspection (PTI/APK), four years after its road certification.

Report Coverage

The research report offers an in-depth analysis based on Mode of Operation, Technology, Propulsion, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increasing government support will accelerate regulatory approvals and commercial adoption of flying cars.

- Advancements in battery and propulsion technology will extend flight range and reduce energy costs.

- Integration of autonomous flight systems will enhance safety and operational efficiency in urban air mobility.

- Development of vertiports and air traffic infrastructure will enable large-scale deployment in major cities.

- Strategic partnerships between aviation and automotive firms will speed up prototype testing and production.

- Growing demand for zero-emission transport will push manufacturers toward fully electric flying vehicles.

- Rising investments from venture capital and tech firms will strengthen innovation and commercialization efforts.

- Expansion of air taxi services will create new opportunities in passenger and logistics applications.

- Emerging markets in Asia-Pacific and the Middle East will experience rapid adoption through smart city projects.

- Continuous improvements in safety standards and certification processes will enhance consumer confidence and market maturity.