Market Overview

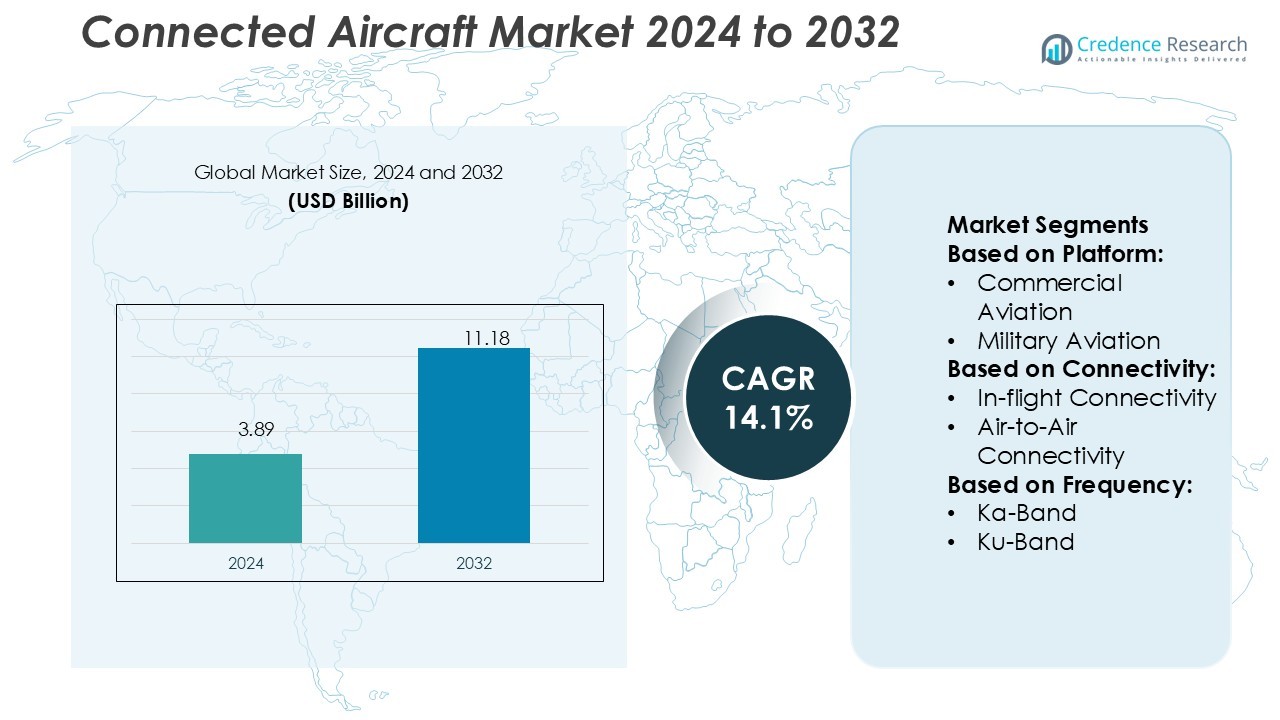

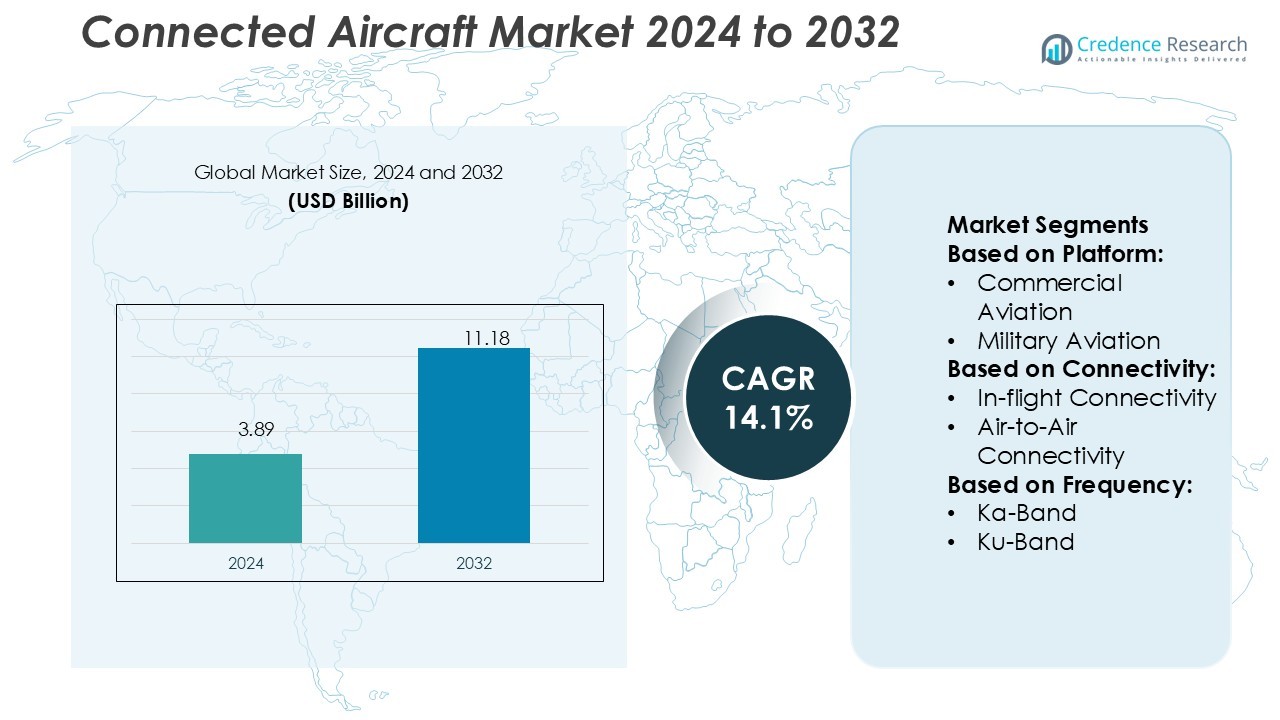

Connected Aircraft Market size was valued USD 3.89 billion in 2024 and is anticipated to reach USD 11.18 billion by 2032, at a CAGR of 14.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Connected Aircraft Market Size 2024 |

USD 3.89 Billion |

| Connected Aircraft Market, CAGR |

14.1% |

| Connected Aircraft Market Size 2032 |

USD 11.18 Billion |

The Connected Aircraft Market is driven by major players including Panasonic Avionics Corporation, Thales Group, Gogo, Burrana Inc., Zodiac Aerospace, Global Eagle Entertainment, BAE Systems PLC, Inmarsat, and Honeywell. These companies focus on advanced in-flight connectivity, real-time communication systems, and secure data solutions to strengthen their global market position. They invest heavily in satellite networks, IoT integration, and software-driven platforms to enhance operational performance and passenger experience. Strategic partnerships with airlines and OEMs help expand their service capabilities. North America leads the global market with a 34% share, supported by strong technological infrastructure, high adoption rates of advanced connectivity systems, and the presence of key aviation technology providers. This leadership is reinforced by ongoing investments in modern air traffic systems and secure communication solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Connected Aircraft Market size was valued at USD 3.89 billion in 2024 and is expected to reach USD 11.18 billion by 2032, growing at a CAGR of 14.1%.

- Growing demand for real-time communication, advanced in-flight connectivity, and enhanced passenger experience is driving strong market expansion.

- Key players focus on IoT integration, satellite networks, and software platforms to boost operational efficiency and global service coverage.

- Limited infrastructure in emerging regions and high integration costs remain key restraints, slowing adoption in some markets.

- North America leads with a 34% market share, supported by strong infrastructure and early technology adoption, while commercial aviation represents the dominant segment, accounting for the largest share due to fleet modernization and rising connectivity investments.

Market Segmentation Analysis:

By Platform

Commercial aviation dominates the connected aircraft market with the largest market share. Airlines adopt connected solutions to improve operational efficiency, passenger experience, and flight safety. High passenger traffic drives strong demand for in-flight entertainment, real-time monitoring, and predictive maintenance. For instance, major airlines deploy advanced connectivity systems to support real-time data exchange between aircraft and ground stations. Business and general aviation, military aviation, UAVs, and advanced air mobility are growing segments. Their growth is supported by increased fleet modernization and rising defense budgets.

- For instance, SES and ThinKom, a Gulfstream G-III equipped with Thales’ FlytLIVE logged sustained throughputs exceeding 265 Mbps while switching between GEO and MEO beams mid-flight.

By Connectivity

In-flight connectivity holds the dominant share in the market. Airlines prioritize strong in-flight Wi-Fi and entertainment systems to meet passenger expectations for continuous connectivity. These solutions enhance customer satisfaction and open new revenue streams through premium services. For instance, leading carriers use high-speed satellite communication for seamless streaming and messaging. Air-to-air and air-to-ground connectivity segments are expanding as demand for data sharing and networked flight operations increases. These advancements support predictive maintenance and optimized flight operations.

- For instance, Gogo does offer its AVANCE systems for business aviation, and the number of installations is growing. As of March 31, 2025, total AVANCE aircraft online grew to 4,716, and AVANCE units comprised approximately 68% of total ATG aircraft online.

By Frequency

Ku-band dominates the market with the largest share due to its wide coverage and stable performance. This frequency band supports reliable broadband connections essential for passenger and crew communication. For instance, several airlines use Ku-band satellite networks to offer high-speed Wi-Fi on international routes. Ka-band is growing quickly, offering higher bandwidth for advanced applications. L-band is widely used for safety-critical communications due to its strong signal reliability, especially in challenging weather conditions and remote airspace.

Key Growth Drivers

Rising Demand for High-Speed In-Flight Connectivity

Airlines are investing in advanced connectivity to enhance passenger experience. High-speed Wi-Fi and real-time entertainment services are now core offerings for major carriers. Growing adoption of satellite-based communication networks enables low-latency and uninterrupted service. For instance, Panasonic Avionics has equipped over 3,000 aircraft globally with its broadband systems, ensuring stable in-flight internet. Increasing passenger expectations and business travel demand are driving operators to upgrade legacy systems. This shift strengthens the competitive edge of airlines and accelerates adoption of connected aircraft technologies.

- For instance, Zodiac RAVE™ Centric IFSC became a line-fit option on the Airbus A350 XWB as enabling embedded modular seat-centric systems with independent seat failures (i.e., one seat failure does not impact others).

Expansion of Real-Time Aircraft Data Monitoring

Airlines are leveraging connected systems to monitor aircraft performance in real time. Advanced sensors and IoT solutions collect engine health, flight path, and maintenance data. This data enables predictive maintenance and operational cost reduction. For example, Honeywell’s Connected Aircraft solutions can reduce unscheduled maintenance events by 35%. These insights allow airlines to prevent downtime and enhance safety standards. Growing emphasis on operational efficiency and regulatory compliance is pushing airlines to invest in robust monitoring and analytics solutions.

- For instance, Global Eagle’s Airconnect Global Antenna integrates a three-axis precision pointing mechanism with steerable beams to maintain link continuity even during banking maneuvers, tested across latitudes from –30° to +60° in real flights.

Growth in Unmanned and Advanced Air Mobility Platforms

The rise of unmanned aerial vehicles (UAVs) and electric vertical take-off and landing (eVTOL) aircraft is fueling demand for connected solutions. These platforms rely on constant, secure communication for navigation and traffic management. For instance, Airbus’ Vahana program demonstrated automated flight with real-time ground control through 4G networks. Rapid urbanization and smart city development are supporting this growth. Advanced connectivity enables efficient airspace integration and regulatory compliance, driving wider adoption of connected aircraft technologies across both commercial and defense sectors.

Key Trends & Opportunities

Integration of Satellite and 5G Networks

The convergence of satellite and 5G networks is transforming aircraft connectivity. Hybrid systems enable low-latency, high-speed data transfer for both cockpit and cabin operations. Companies like Viasat and Inmarsat are expanding satellite constellations to improve coverage. This integration supports seamless streaming, predictive analytics, and advanced operational applications. It creates opportunities for airlines to offer premium services and optimize route management, making connected aircraft a strategic asset.

- For instance, BAE also maintains over 1,000 flight computers on more than 300 satellites, which cumulatively have logged more than 10,000 years of in-orbit flight time.

Shift Toward Predictive Maintenance Models

Predictive maintenance is gaining traction as airlines seek to minimize downtime. Connected sensors continuously monitor aircraft systems, identifying issues before they escalate. Boeing’s AnalytX platform, for example, analyzes over 100 million flight data points daily. This proactive approach reduces maintenance costs and enhances fleet availability. As regulatory frameworks evolve, predictive solutions offer airlines a competitive advantage through cost savings, safety improvements, and operational resilience.

- For instance, Panasonic’s Converix™ platform can access over 10,000 datapoints across an aircraft and analyze multiple terabytes of structured and unstructured data to generate daily reports to airlines.

Advancements in Cybersecurity Solutions

As connectivity expands, cybersecurity remains a top priority. Aircraft systems are adopting advanced encryption and real-time threat detection to safeguard operations. Companies like Collins Aerospace are developing intrusion detection systems tailored for aviation. Strengthening cybersecurity builds passenger trust and ensures regulatory compliance. The demand for secure digital ecosystems presents opportunities for new product offerings and strategic partnerships within the connected aircraft ecosystem.

Key Challenges

High Implementation and Operational Costs

The deployment of connected aircraft technologies requires significant investment. Upgrading existing fleets with satellite antennas, routers, and cybersecurity solutions can be costly. Smaller carriers face budget constraints, slowing adoption. Additionally, ongoing maintenance and bandwidth fees add to operational costs. This creates a market divide between large airlines and regional operators, impacting overall connectivity penetration rates.

Complex Regulatory and Airspace Integration Issues

Integration of connected aircraft systems must comply with strict aviation safety and communication standards. Varying international regulations create operational complexity for global carriers. Coordinating between aviation authorities, satellite operators, and telecom providers can delay implementation. Moreover, managing airspace for UAVs and eVTOLs adds further challenges. This regulatory complexity can hinder large-scale deployment and slow market growth.

Regional Analysis

North America

North America leads the Connected Aircraft Market with a 34% market share. The region benefits from strong investment in aerospace connectivity, advanced air traffic infrastructure, and early adoption of IoT technologies. Airlines focus on improving operational efficiency and passenger experience through high-speed in-flight connectivity. The U.S. dominates due to major OEMs like Boeing and leading communication providers driving innovation. Government initiatives to modernize air traffic control also strengthen market growth. The increasing demand for real-time flight data and seamless communication makes North America a critical hub for connected aircraft advancements.

Europe

Europe holds a 27% market share in the Connected Aircraft Market, supported by robust aviation regulations and technology integration programs. Countries such as the U.K., Germany, and France are key contributors, with airlines adopting advanced satellite communication systems. The European Union’s Single European Sky initiative boosts real-time aircraft monitoring and interoperability. Airbus plays a major role in driving connectivity solutions across fleets. The region also invests in cybersecurity measures to protect digital flight operations. Strategic collaborations between airlines, equipment suppliers, and telecom firms continue to accelerate market growth.

Asia-Pacific

Asia-Pacific accounts for a 25% market share, making it one of the fastest-growing regions in the Connected Aircraft Market. Rapid expansion of commercial aviation and rising passenger traffic drive strong demand for connectivity solutions. Countries like China, Japan, and India are increasing investments in in-flight connectivity and real-time operational monitoring. Regional airlines focus on improving flight safety, efficiency, and customer experience. Major OEMs and telecom operators are partnering to expand satellite and 5G infrastructure. Low-cost carriers are also integrating connected aircraft systems to stay competitive and enhance service quality.

Latin America

Latin America holds a 5% market share in the Connected Aircraft Market. Regional airlines are adopting connectivity solutions to improve operational performance and passenger experience. Brazil and Mexico lead the regional adoption due to rising air traffic and modernized fleet operations. Infrastructure upgrades and partnerships with satellite communication providers are expanding coverage and reliability. Although market penetration remains lower than in other regions, strong aviation growth and supportive regulatory efforts are expected to accelerate adoption. The region presents emerging opportunities for connected aircraft technology providers.

Middle East & Africa

The Middle East & Africa region captures a 9% market share in the Connected Aircraft Market. The region’s growth is driven by major airlines like Emirates, Qatar Airways, and Etihad, which prioritize premium connectivity for passengers. Investments in airport modernization and satellite coverage expansion support this demand. Gulf countries lead in adopting real-time aircraft tracking and advanced communication solutions. Africa is gradually upgrading aviation infrastructure, enabling new opportunities. Government support for smart aviation initiatives further enhances connectivity adoption, particularly in major aviation hubs across the Middle East.

Market Segmentations:

By Platform:

- Commercial Aviation

- Military Aviation

By Connectivity:

- In-flight Connectivity

- Air-to-Air Connectivity

By Frequency:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Connected Aircraft Market features prominent players such as Panasonic Avionics Corporation, Thales Group, Gogo, Burrana Inc., Zodiac Aerospace, Global Eagle Entertainment, BAE Systems PLC, Panasonic Avionics, Inmarsat, and Honeywell. The competitive landscape of the Connected Aircraft Market is characterized by strong technological innovation and strategic collaborations. Companies focus on developing advanced in-flight connectivity, real-time data exchange, and secure communication systems to enhance operational efficiency. Growing investment in satellite networks, IoT integration, and cybersecurity strengthens market positioning and service reliability. Many players emphasize product diversification through hardware-software integration, enabling better passenger experiences and improved airline performance. Strategic alliances with OEMs and MRO providers expand global reach and ensure system compatibility. This competitive environment encourages continuous innovation, price competitiveness, and market consolidation, reinforcing connected aircraft technologies as a core element of modern aviation infrastructure.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Panasonic Avionics Corporation

- Thales Group

- Gogo

- Burrana Inc.

- Zodiac Aerospace

- Global Eagle Entertainment

- BAE Systems PLC

- Panasonic Avionics

- Inmarsat

- Honeywell

Recent Developments

- In June 2025, Qatar Airways selected Panasonic Avionics’ Converix platform for 60 B777X aircraft, adding AI-powered virtual cabin crew and integrated data management.

- In May 2025, China National Aero-Technology Import & Export Corporation (CATIC) showcased its standalone weapon fire control system (SWFCS) at the 2025 Langkawi International Maritime and Aerospace (LIMA) Exhibition, which was held from May 19 to May 24 in Malaysia.

- In April 2025, Dynamatic Technologies Limited, an Indian aerostructure manufacturer, and Deutsche Aircraft, a German regional aircraft OEM for sustainable aviation, jointly inaugurated the rear fuselage assembly line for the 40-seater D328eco turboprop aircraft at Dynamatic’s advanced aerospace facility located outside Bangalore.

- In October 2024, Prime Minister Narendra Modi inaugurated the TATA Aircraft Complex to produce C-295 aircraft with his Spanish counterpart, Pedro Sanchez, in Vadodara, Gujarat.

Report Coverage

The research report offers an in-depth analysis based on Platform, Connectivity, Frequency and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rapid expansion with growing demand for real-time data exchange.

- Airlines will increasingly adopt advanced in-flight connectivity solutions to enhance passenger experience.

- Integration of 5G technology will enable faster and more reliable communication networks.

- Satellite-based systems will play a key role in expanding global coverage for connected aircraft.

- Cybersecurity solutions will gain more focus to protect critical aviation data.

- Partnerships between airlines, telecom operators, and OEMs will accelerate technology deployment.

- IoT-enabled aircraft operations will improve flight safety and operational efficiency.

- AI and analytics will support predictive maintenance and better fleet management.

- Regulatory frameworks will evolve to support seamless and secure aviation connectivity.

- Market competition will intensify as more players invest in digital aviation technologies.