Market Overview

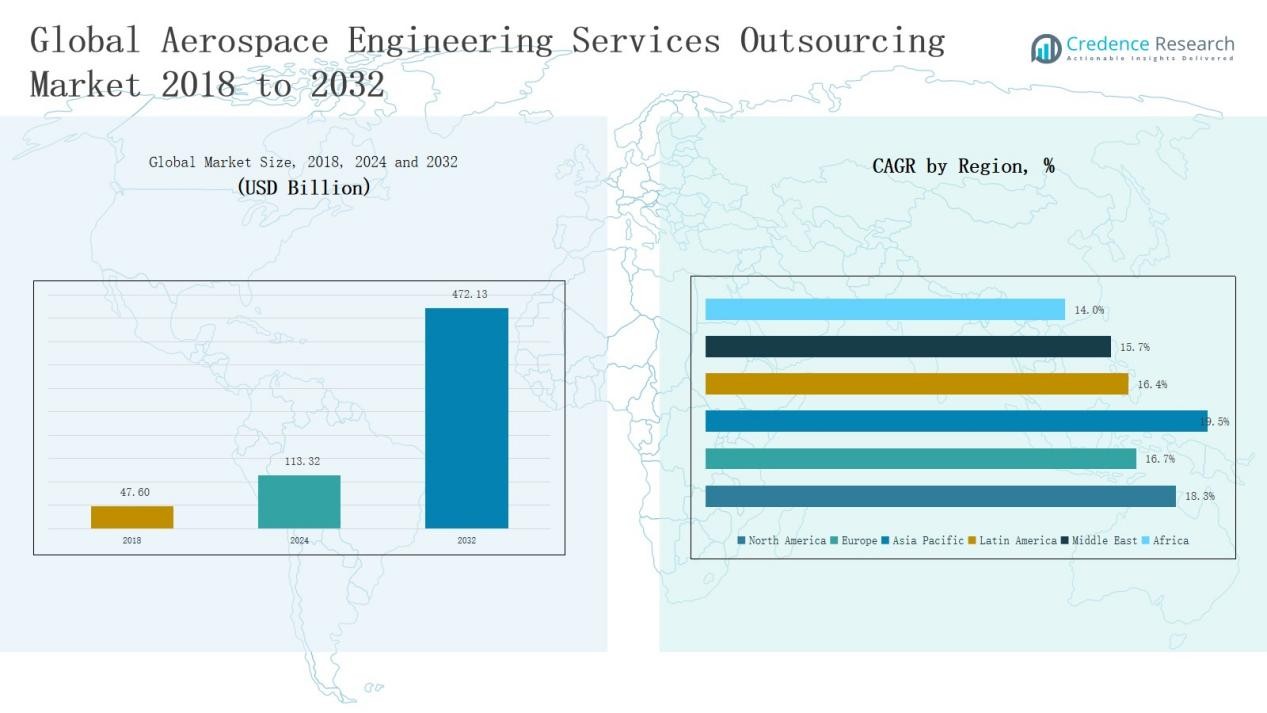

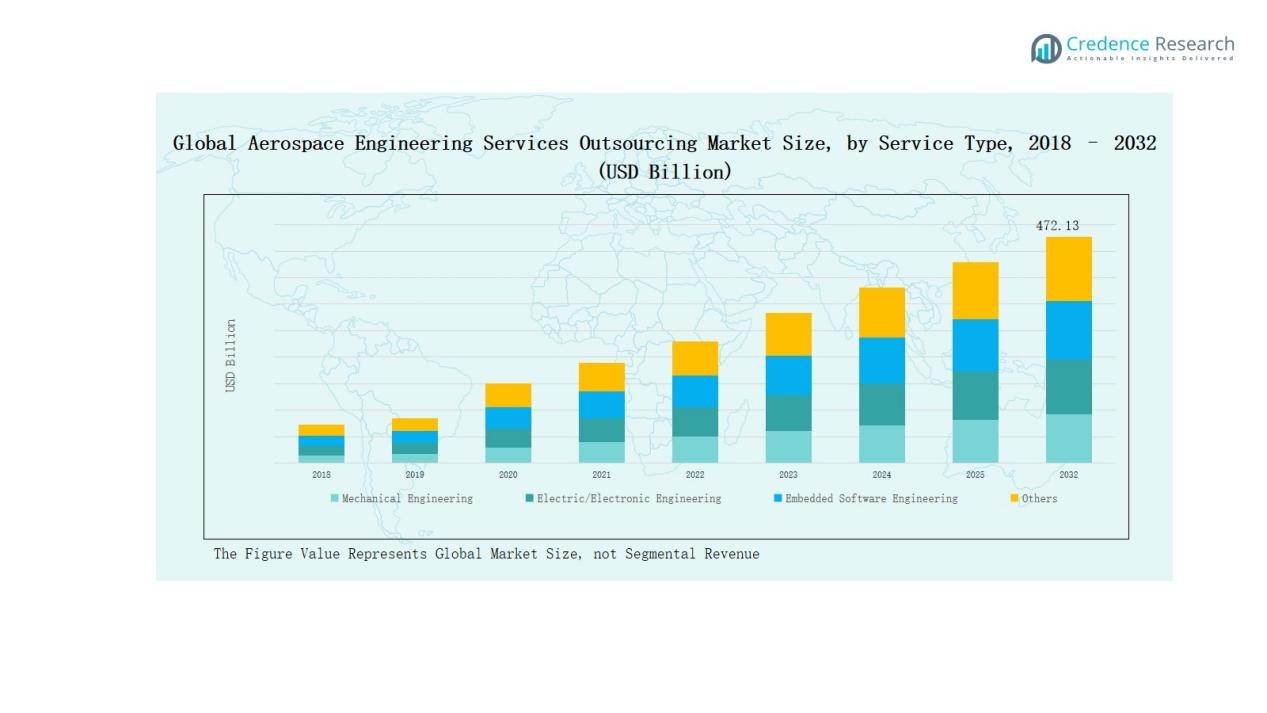

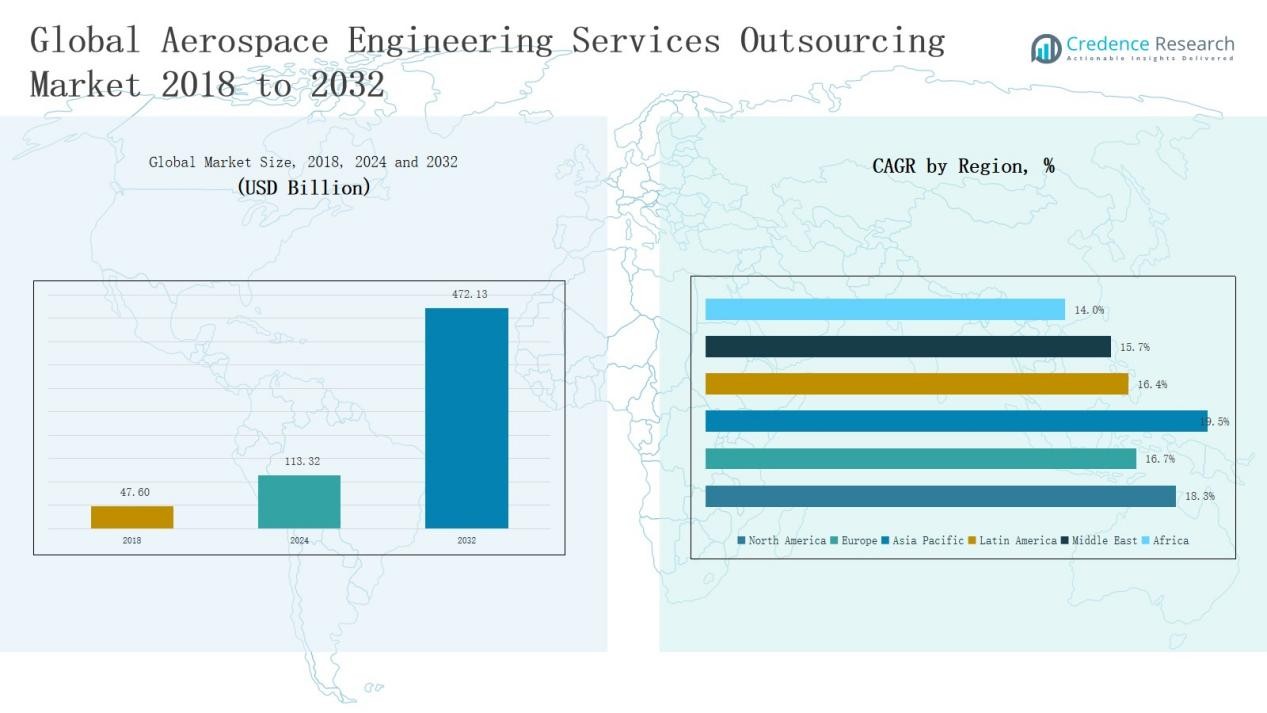

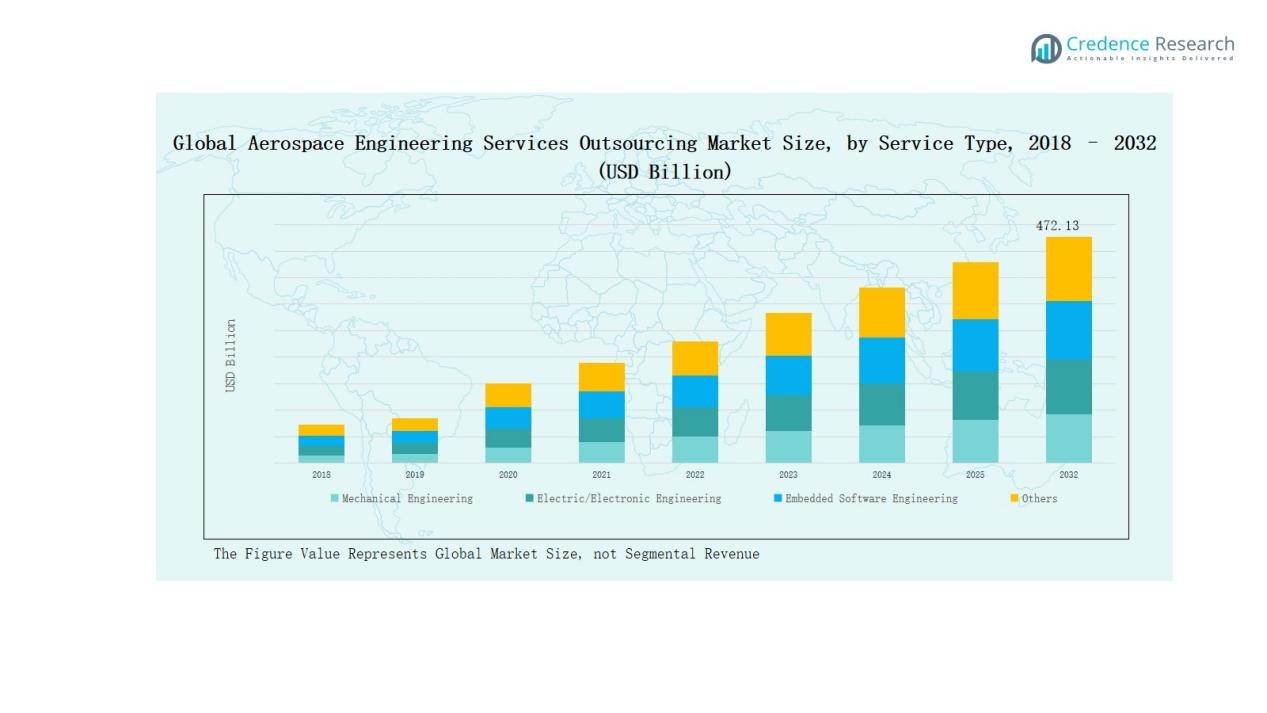

The Aerospace Engineering Services Outsourcing Market was valued at USD 47.60 billion in 2018, grew to USD 113.32 billion in 2024, and is anticipated to reach USD 472.13 billion by 2032, expanding at a CAGR of 18.21% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aerospace Engineering Services Outsourcing Market Size 2024 |

USD 113.32 Billion |

| Aerospace Engineering Services Outsourcing Market, CAGR |

18.21% |

| Aerospace Engineering Services Outsourcing Market Size 2032 |

USD 472.13 Billion |

The Aerospace Engineering Services Outsourcing Market features strong competition among global leaders such as Altair Engineering Inc., Alten Group, Capgemini, Bertrandt AG, Honeywell International Inc., ITK Engineering GmbH, Tech Mahindra Limited, HCL Technologies Limited, Tata Consultancy Services Limited (TCS), and L&T Technology Services. These companies drive growth through advanced design, simulation, and digital engineering capabilities, offering end-to-end solutions to major OEMs and Tier 1 suppliers. Strategic collaborations, AI integration, and sustainable design development strengthen their market positions. North America emerged as the leading region in 2024 with a 44% share, supported by robust aerospace infrastructure, extensive R&D activities, and long-standing outsourcing partnerships with global manufacturers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Aerospace Engineering Services Outsourcing Market grew from USD 47.60 billion in 2018 to USD 113.32 billion in 2024 and is projected to reach USD 472.13 billion by 2032, expanding at a CAGR of 18.21%.

- North America led the market with a 44% share in 2024, driven by high R&D investments, OEM presence, and digital engineering adoption across the U.S. aerospace industry.

- Mechanical Engineering dominated by service type with a 38% share, fueled by rising demand for component testing, system integration, and adoption of 3D modeling and digital twin technologies.

- Design held the largest function share at 41%, supported by lightweight component innovation and reduced development cycles through simulation and digital validation tools.

- Offshore outsourcing captured 64% of the market, supported by cost-effective engineering talent in India, the Philippines, and Eastern Europe, enhancing large-scale aerospace project efficiency.

Market Segment Insights

By Service Type

Mechanical Engineering dominated the Aerospace Engineering Services Outsourcing Market in 2024 with a 38% share. The segment benefits from strong demand for structural design, component testing, and system integration in aircraft manufacturing. Growing adoption of advanced materials, 3D modeling, and digital twin technologies has further expanded outsourcing needs. Electric/Electronic Engineering and Embedded Software Engineering are gaining traction due to avionics modernization, autonomous flight systems, and the shift toward electric and hybrid propulsion platforms.

By Function

Design accounted for the largest share of 41% in 2024, driven by continuous innovation in aircraft structures, aerodynamics, and lightweight component development. OEMs and Tier 1 suppliers increasingly outsource design functions to reduce costs and shorten development cycles. Simulation & Digital Validation is also expanding rapidly, supported by advanced computational tools that help enhance performance, reliability, and safety standards while minimizing physical prototyping costs for aerospace manufacturers.

- For instance, Boeing expanded its use of Siemens’ digital validation tools to conduct virtual certification of aircraft systems, which significantly reduced physical prototype requirements and accelerated performance testing.

By Location

Offshore services held the leading position with a 64% market share in 2024. The growth is fueled by the availability of skilled engineers, lower operational costs, and expanding aerospace clusters in India, the Philippines, and Eastern Europe. Many global aerospace OEMs rely on offshore partners for high-volume design, analysis, and digital validation projects. Onshore outsourcing continues to grow steadily in regions requiring strict data security and compliance with aerospace regulatory frameworks.

- For instance, India’s Infosys reported expanding its aerospace engineering delivery by setting up a new facility in Bengaluru to support digital aero-structure validation projects for leading OEMs.

Key Growth Drivers

Rising Aircraft Production and Fleet Modernization

The continuous rise in global aircraft production and modernization programs drives the Aerospace Engineering Services Outsourcing Market. Airlines are upgrading fleets to meet stricter fuel efficiency and emission standards. OEMs and Tier 1 suppliers outsource engineering functions to reduce turnaround time and improve innovation. Outsourced service providers deliver design, testing, and validation expertise, supporting faster development of next-generation aircraft and sustainable aviation technologies.

- For instance, TAP Air Portugal implemented IATA FuelIS, an advanced analytics solution, enabling the airline to optimize fleet fuel consumption and benchmark environmental performance against global peers using verified data from over 220 contributing airlines.

Increasing Adoption of Digital Engineering Solutions

The growing use of digital tools such as simulation, digital twin, and 3D modeling fuels outsourcing demand. Aerospace companies are adopting advanced software platforms for faster prototyping and cost-efficient product validation. Service providers specializing in digital engineering enable real-time collaboration and optimization across the supply chain. This adoption enhances operational flexibility and helps manufacturers manage complex design cycles and compliance standards in modern aircraft programs.

- For instance, Rolls-Royce advanced its use of digital twin technology for aero-engine performance monitoring through the IntelligentEngine program, enabling predictive maintenance and faster validation.

Cost Efficiency and Access to Skilled Workforce

Cost optimization and access to a global talent pool remain key outsourcing drivers. Aerospace OEMs prefer engineering hubs in Asia-Pacific and Eastern Europe to leverage skilled engineers at lower costs. Outsourcing firms offer multidisciplinary expertise in mechanical, software, and electronic systems, reducing internal R&D overhead. This approach allows OEMs to focus on core innovation while external partners handle complex design, analysis, and digital integration processes efficiently.

Key Trends & Opportunities

Shift Toward Sustainable and Electric Aviation

The market is witnessing a growing focus on sustainability and electrification. Engineering service providers are increasingly involved in developing electric propulsion systems, lightweight materials, and energy-efficient designs. Collaborations with OEMs on green aviation programs create strong growth opportunities. This trend aligns with global carbon reduction targets and accelerates the adoption of innovative, eco-friendly aircraft systems through specialized outsourced design and simulation support.

- For instance, the Electra EL-2 Goldfinch, an electric short takeoff and landing (eSTOL) demonstrator, uses distributed electric propulsion and completed its first crewed flight on November 20, 2023, showcasing advancements in hybrid-electric aviation technology.

Expansion of Aerospace Digitalization and AI Integration

The integration of artificial intelligence, automation, and cloud-based platforms is transforming aerospace engineering services. Companies are using AI for predictive maintenance, structural analysis, and design optimization. Outsourcing partners offering AI-driven solutions gain competitive advantage by improving accuracy and reducing engineering timelines. The demand for digital collaboration platforms and data analytics tools presents major opportunities for technology-driven service providers in the global aerospace ecosystem.

- For instance, Air France-KLM partnered with Google Cloud in December 2024 to implement generative AI for predictive maintenance, cutting data analysis time from hours to minutes and enhancing operational efficiency.

Key Challenges

Data Security and Intellectual Property Concerns

Outsourcing complex aerospace engineering tasks raises significant data security and IP protection challenges. Sensitive design data shared across borders increases risks of cyberattacks and information leaks. Regulatory compliance and export control laws demand strict security frameworks. Companies must ensure that outsourcing partners maintain certified systems and secure networks to protect proprietary technologies and classified information in global collaboration environments.

Regulatory and Quality Compliance Complexity

The aerospace industry operates under strict international standards such as AS9100, DO-178C, and FAA/EASA regulations. Ensuring consistent compliance across outsourced operations remains difficult. Service providers must maintain high-quality documentation, testing validation, and process traceability. Failure to meet compliance standards can delay certification or lead to financial penalties. Continuous audits and alignment with OEM quality systems are essential for sustaining outsourcing partnerships.

Talent Retention and Skill Shortage

The market faces growing challenges in retaining skilled aerospace engineers, particularly in digital systems and embedded software. High turnover rates and talent migration affect project continuity. Outsourcing firms must invest in upskilling and workforce development to meet evolving technical requirements. Competition for expertise in emerging fields like AI-driven design and avionics integration further pressures service providers to maintain strong retention and training programs.

Regional Analysis

North America

North America dominated the Aerospace Engineering Services Outsourcing Market in 2024 with a 44% share. The market grew from USD 21.11 billion in 2018 to USD 49.74 billion in 2024 and is projected to reach USD 207.79 billion by 2032, expanding at a CAGR of 18.3%. Growth is driven by high R&D investments, strong OEM presence, and increased demand for digital engineering in aircraft production. The U.S. leads regional outsourcing due to advanced aerospace infrastructure and partnerships between OEMs and specialized engineering service providers.

Europe

Europe held a 17% market share in 2024, valued at USD 18.71 billion, up from USD 8.35 billion in 2018, and is expected to reach USD 70.40 billion by 2032, growing at a CAGR of 16.7%. The region benefits from the presence of Airbus, Rolls-Royce, and Safran, which increasingly outsource engineering activities for cost efficiency. Rising adoption of sustainable aviation technologies and electric propulsion design supports steady outsourcing growth, particularly across France, Germany, and the UK.

Asia Pacific

Asia Pacific ranked second globally with a 27% share in 2024, increasing from USD 13.97 billion in 2018 to USD 35.08 billion in 2024, and projected to reach USD 159.22 billion by 2032, at the fastest CAGR of 19.5%. The region’s growth is fueled by expanding aerospace clusters in India, China, and Japan, offering cost-effective and skilled engineering talent. Favorable government policies, digitalization, and increased participation of outsourcing firms in aircraft design and simulation strengthen Asia Pacific’s leadership potential.

Latin America

Latin America accounted for a 6% market share in 2024, rising from USD 2.25 billion in 2018 to USD 5.29 billion in 2024, and expected to reach USD 19.49 billion by 2032, growing at a CAGR of 16.4%. The region’s growth is supported by Brazil’s aerospace industry and increasing collaborations with international OEMs. Outsourcing in manufacturing design and simulation services is expanding, driven by local engineering capabilities and investment in technology-based partnerships.

Middle East

The Middle East represented a 4% market share in 2024, valued at USD 2.93 billion, up from USD 1.34 billion in 2018, and projected to reach USD 10.31 billion by 2032, registering a CAGR of 15.7%. The region’s growth is propelled by aviation infrastructure expansion in GCC countries and aerospace diversification initiatives. Increased government spending on MRO and engineering hubs strengthens outsourcing opportunities.

Africa

Africa captured a 2% market share in 2024, growing from USD 0.58 billion in 2018 to USD 1.57 billion in 2024, and projected to reach USD 4.92 billion by 2032, expanding at a CAGR of 14.0%. The market is emerging with growing MRO facilities and localized aerospace training programs. Partnerships with global aerospace companies are gradually supporting technology transfer and engineering service expansion across key nations such as South Africa and Egypt.

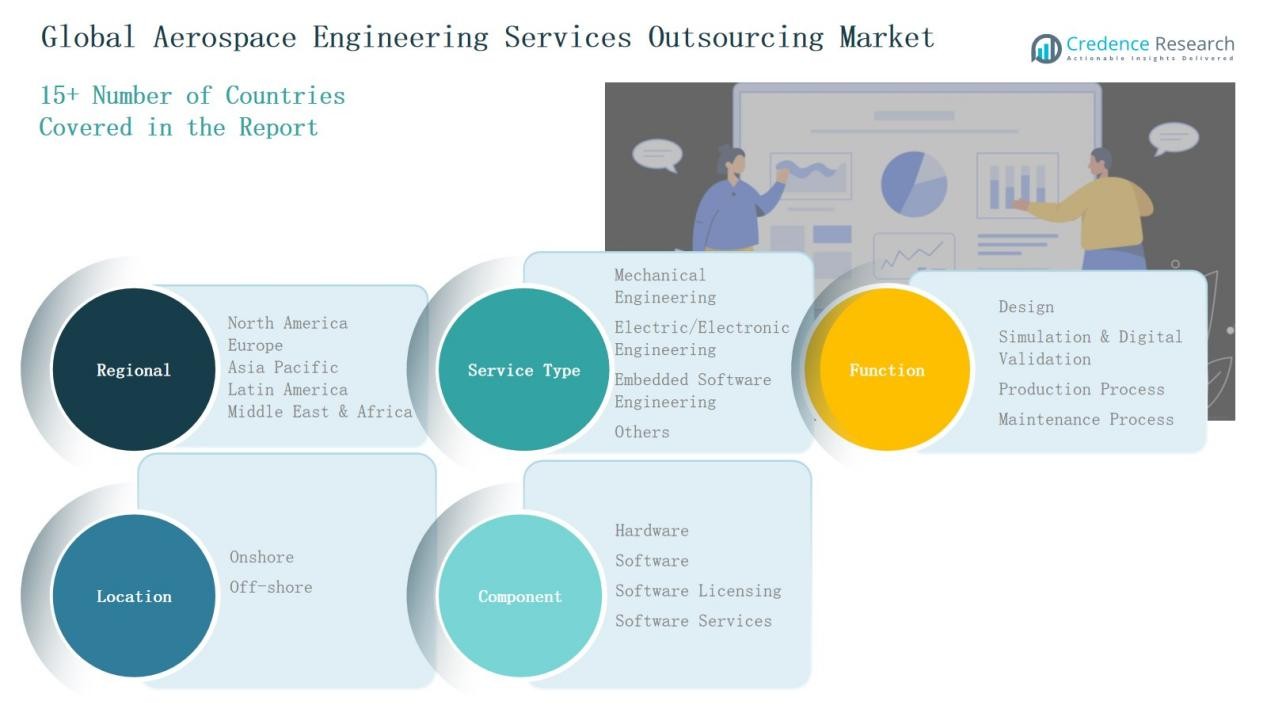

Market Segmentations:

By Service Type

- Mechanical Engineering

- Electric/Electronic Engineering

- Embedded Software Engineering

- Others

By Function

- Design

- Simulation & Digital Validation

- Production Process

- Maintenance Process

By Location

By Component

- Hardware

- Software

- Software Licensing

- Software Services

By Region

North America

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The Aerospace Engineering Services Outsourcing Market is highly competitive, with global and regional players offering specialized engineering, design, and digital solutions to major OEMs and Tier 1 suppliers. Key companies such as Altair Engineering Inc., Alten Group, Capgemini, Bertrandt AG, Honeywell International Inc. and ITK Engineering GmbH dominate through diversified service portfolios and long-term partnerships with aircraft manufacturers. Firms compete on innovation, technical expertise, and digital transformation capabilities, including simulation, digital twin, and AI-driven analytics. Strategic alliances, mergers, and acquisitions are common as companies expand global delivery centers and strengthen aerospace-specific offerings. Asia Pacific-based service providers increasingly gain prominence due to cost advantages and engineering talent availability. Continuous investment in advanced technologies, cybersecurity, and compliance standards defines the competitive differentiation across this rapidly expanding global outsourcing landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In October 2025, Expleo entered a strategic agreement with Deutsche Aircraft to provide advanced aerospace engineering services aimed at enhancing next-generation aircraft development.

- In September 2025, Accenture completed the acquisition of SIPAL’s Integrated Product Support (IPS) business in Italy, expanding its aerospace and defense engineering capabilities.

- In July 2025, Chorus Aviation agreed to acquire Elisen & Associates Inc., a firm in aerospace engineering and certification services.

- In September 2025, Accenture announced intent to acquire Orlade Group (France), which offers advisory and project management for aerospace, defense, and capital projects.

Report Coverage

The research report offers an in-depth analysis based on Service Type, Function, Location, Component and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for outsourced aerospace engineering services will grow with rising aircraft production.

- Digital engineering adoption will expand through AI, simulation, and digital twin technologies.

- OEMs will increasingly partner with offshore service providers for cost optimization.

- Sustainability goals will boost demand for lightweight materials and electric propulsion design.

- Integrated design-to-manufacturing solutions will drive collaboration between OEMs and service firms.

- Asia Pacific will continue to emerge as a global outsourcing hub for aerospace development.

- Increased focus on cybersecurity and data protection will shape vendor selection criteria.

- Cloud-based engineering platforms will enhance remote collaboration and design validation.

- Skilled workforce shortages will encourage automation and training investments in outsourcing centers.

- Strategic mergers and partnerships will accelerate innovation and expand global engineering capacity.