Market Overview

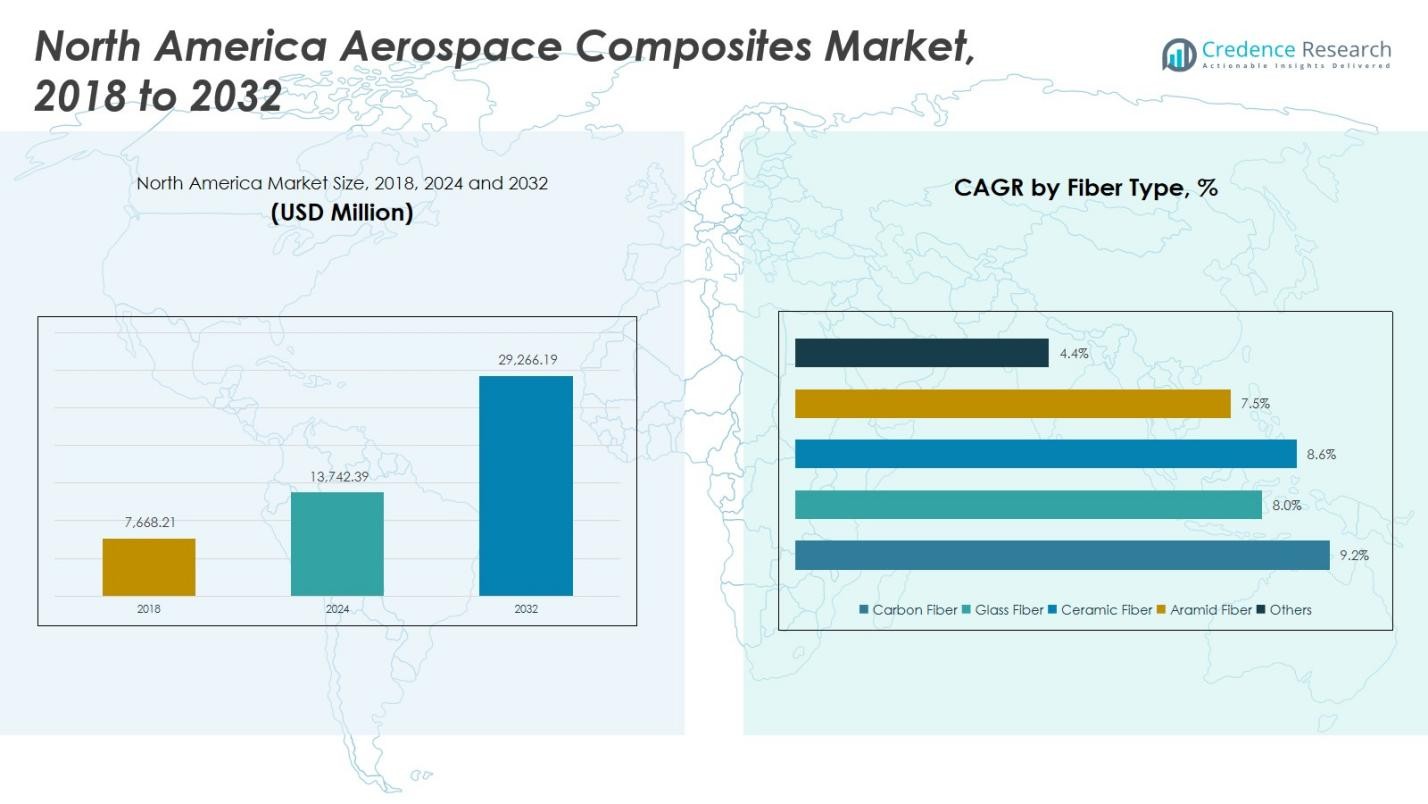

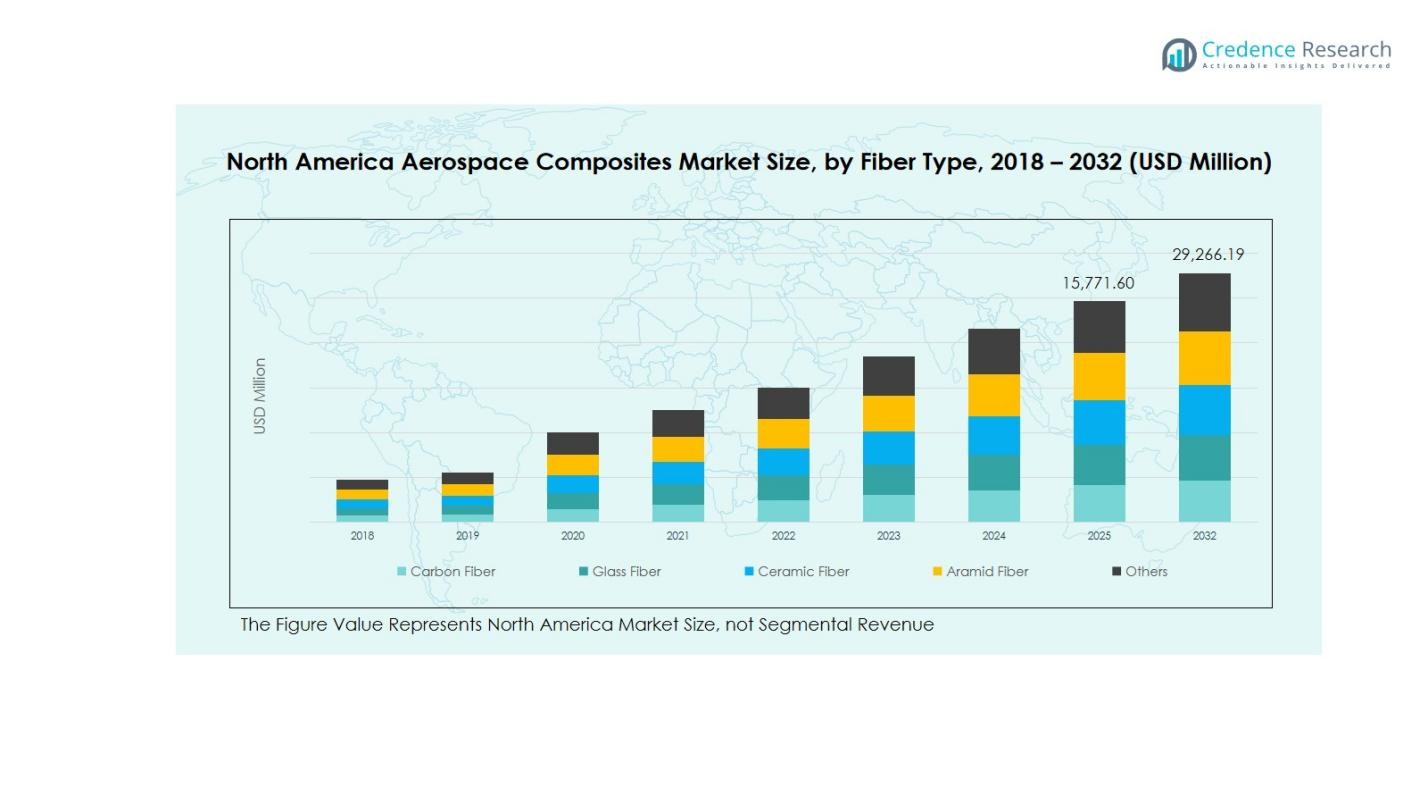

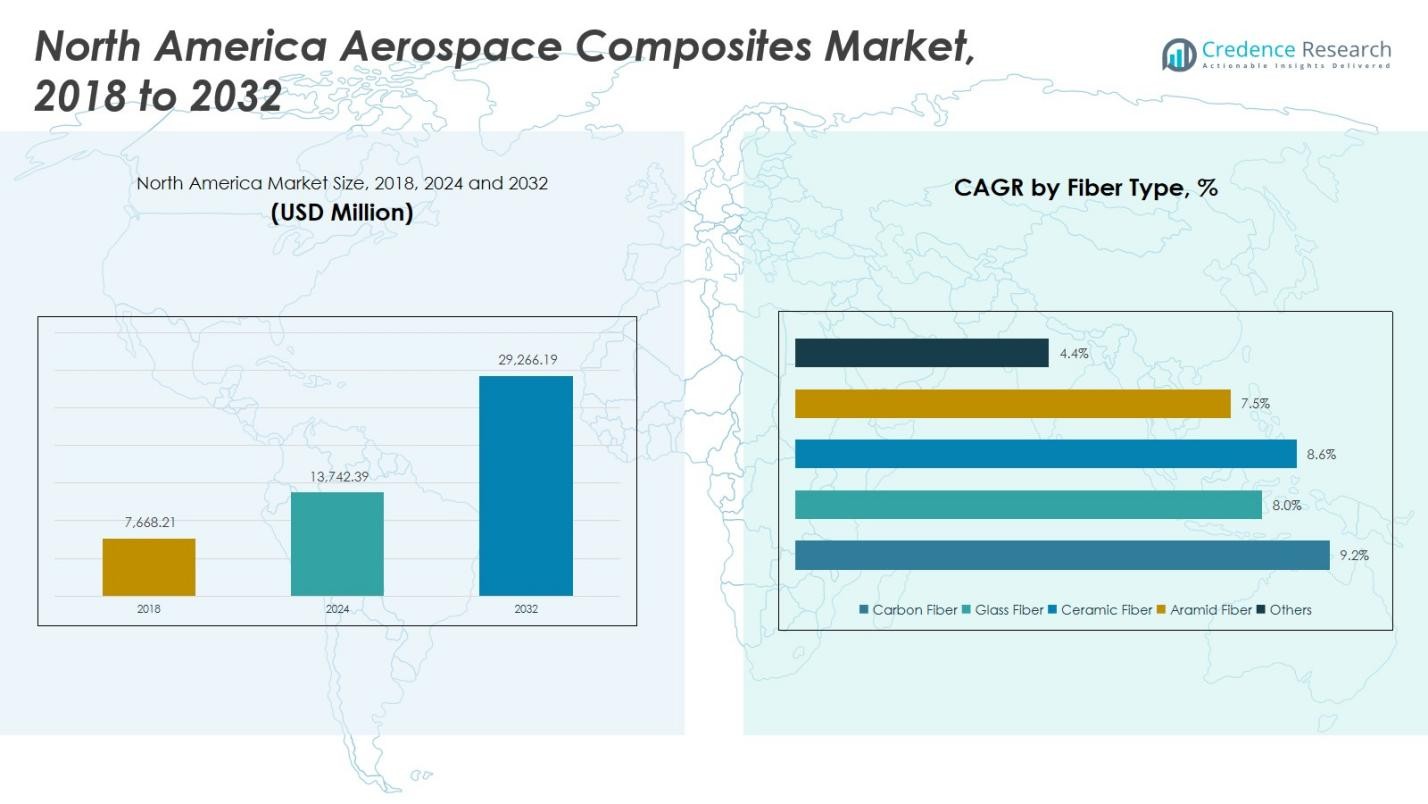

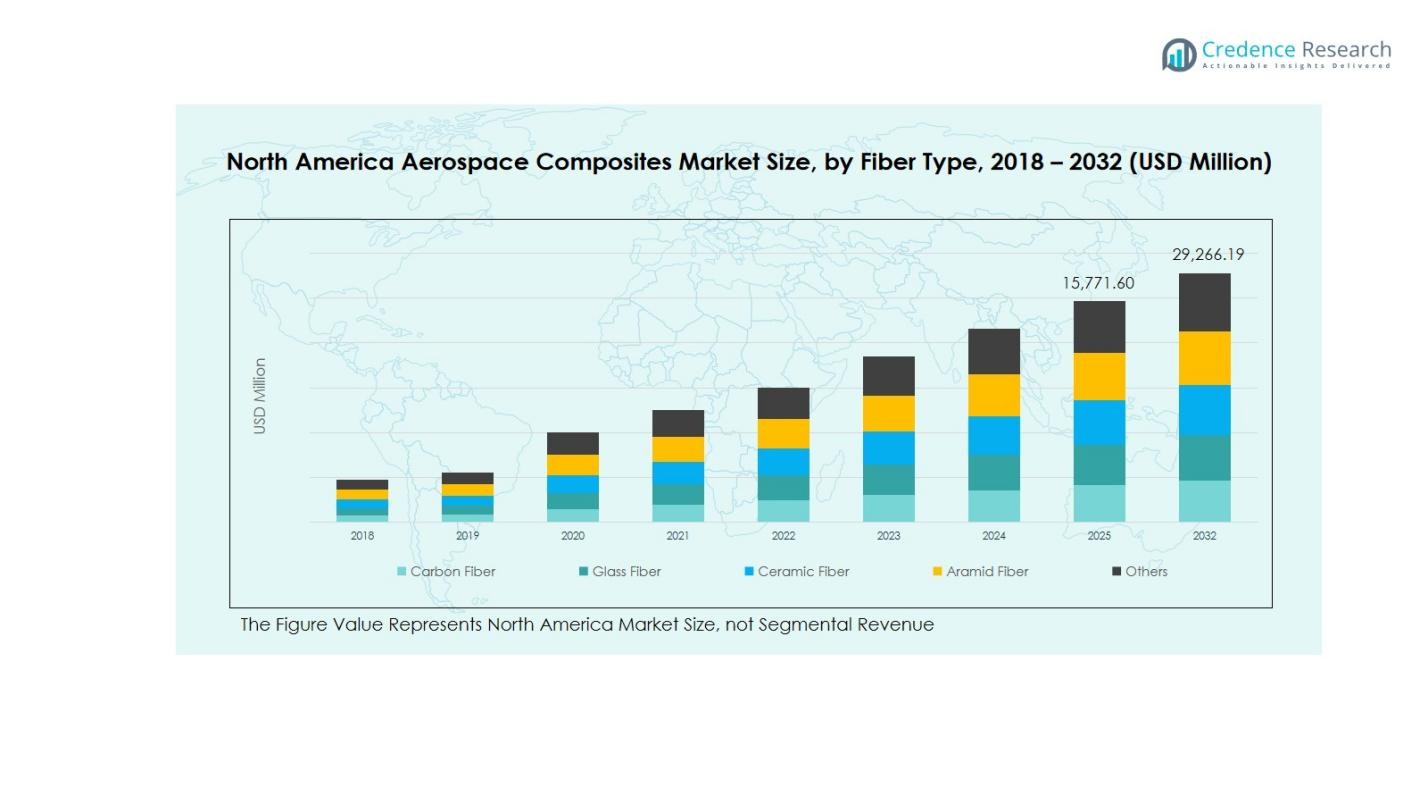

North America Aerospace Composites Market size was valued at USD 7,668.21 Million in 2018, increasing to USD 13,742.39 Million in 2024, and is anticipated to reach USD 29,266.19 Million by 2032, growing at a CAGR of 9.23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Aerospace Composites Market Size 2024 |

USD 13,742.39 Million |

| North America Aerospace Composites Market, CAGR |

9.23% |

| North America Aerospace Composites Market Size 2032 |

USD 29,266.19 Million |

The North America Aerospace Composites Market is dominated by key players including Hexcel Corporation, Toray Industries, Teijin Limited, Solvay S.A., and Mitsubishi Chemical Corporation. These companies leverage advanced manufacturing technologies, strategic partnerships, and capacity expansion to maintain leadership in the region. Hexcel Corporation and Toray Industries are particularly strong in carbon fiber and thermoset composites, catering to both commercial and military aircraft segments. The United States emerges as the leading region, commanding a market share of 75% in 2024, driven by robust commercial aircraft production, extensive military programs, and widespread adoption of high-performance composites. Canada and Mexico contribute to regional growth through regional aircraft manufacturing, UAV production, and specialized component assembly, but the U.S. remains the primary hub for R&D, technological advancement, and high-value aerospace composite applications, reinforcing its dominance in North America.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North America Aerospace Composites Market was valued at USD 13,742.39 Million in 2024 and is projected to reach USD 29,266.19 Million by 2032, growing at a CAGR of 9.23%. Carbon fiber dominates the fiber type segment with over 55% share, while thermoset composites account for around 65% of the resin type segment.

- Market growth is driven by increasing demand for lightweight and fuel-efficient aircraft, expansion of commercial fleets, and rising investments in military and defense aviation programs.

- Key trends include the adoption of advanced manufacturing technologies such as automated fiber placement and resin transfer molding, and growing opportunities from hybrid-electric and electric propulsion systems.

- The market remains highly competitive with leading players like Hexcel Corporation, Toray Industries, Teijin Limited, Solvay S.A., and Mitsubishi Chemical Corporation focusing on innovation, strategic partnerships, and capacity expansion.

- The United States leads the region with a 75% market share, followed by Canada at 15% and Mexico at 10%, reflecting strong aerospace manufacturing and UAV production hubs.

Market Segmentation Analysis:

By Fiber Type:

In the North America aerospace composites market, carbon fiber dominates the fiber type segment, accounting for over 55% of the market share in 2024. Its high strength-to-weight ratio and excellent fatigue resistance make it ideal for structural components in commercial and military aircraft. The growing demand for lightweight, fuel-efficient aircraft is driving carbon fiber adoption, while glass fiber and aramid fiber also hold notable shares due to cost-effectiveness and specific applications in interiors and radomes. Ceramic fibers are used in high-temperature components, though their share remains limited.

For instance, Boeing’s 787 Dreamliner incorporates around 32,000 kg of carbon fiber reinforced plastic, constituting nearly 50% of the fuselage structure, which helps reduce the overall weight by about 20% compared to traditional aluminum designs

By Aircraft Type:

Commercial aircraft represent the largest sub-segment in North America, capturing approximately 60% of the market share in 2024. The expansion of passenger fleets and the emphasis on fuel efficiency are key growth drivers. Military aircraft and helicopters are significant contributors, leveraging composites for weight reduction and durability in challenging conditions. The “Others” category, including private jets and UAVs, holds a smaller share but is gradually growing with the rise of regional aviation and specialized aircraft applications.

By Resin Type:

Within the resin type segment, thermoset composites dominate, accounting for around 65% of the market share in 2024. Their superior mechanical properties, thermal stability, and ease of manufacturing make them suitable for primary aerostructures and engine components. Thermoplastic composites, though currently holding a smaller share, are witnessing growth due to faster processing times, recyclability, and increasing use in secondary structures. Rising investments in lightweight and high-performance materials across aerospace applications continue to drive overall resin adoption.

For instance, Boeing’s 777X program extensively uses carbon fiber-reinforced epoxy thermosetting composites in wing structures to enhance aerodynamic performance and reduce fuel burn.

Key Growth Drivers

Increasing Demand for Lightweight Aircraft

The North America aerospace composites market is driven by the growing demand for lightweight aircraft, particularly in commercial and military aviation. Reducing aircraft weight enhances fuel efficiency, lowers operational costs, and aligns with stringent environmental regulations. Manufacturers are increasingly adopting carbon fiber and advanced thermoset composites in primary structures, aerostructures, and engine components. The shift toward fuel-efficient aircraft designs and next-generation aerospace programs continues to create strong demand for high-performance composite materials across the region.

For instance, Atlas Fibre supplies thermoset composites known for their corrosion resistance and thermal stability, stocking millions worth of materials specifically tailored to the aviation industry, supporting manufacturing of parts that increase aircraft efficiency and durability.

Technological Advancements in Composites Manufacturing

Advanced manufacturing technologies, including automated fiber placement, 3D printing, and resin transfer molding, are fueling growth in the North America aerospace composites market. These innovations enhance precision, reduce production time, and lower material waste while enabling the production of complex shapes for modern aircraft. Companies leverage such technologies to improve mechanical performance and achieve cost-effective large-scale production. As aerospace manufacturers prioritize efficiency and quality, the adoption of cutting-edge composite processing techniques remains a major growth driver.

For instance, Automated Fiber Placement (AFP) technology is utilized by major aerospace companies like Airbus for manufacturing fuselage components of the A350 and Boeing for the 787, enabling the creation of large, complex structures with high precision and reduced weight.

Rising Investments in Military and Defense Aviation

Increasing defense budgets and the modernization of military fleets are driving aerospace composites demand in North America. Lightweight, high-strength materials are essential for aircraft used in defense applications, including fighter jets, helicopters, and unmanned aerial vehicles (UAVs). Investments in next-generation military aircraft programs boost adoption of carbon fiber and thermoplastic composites, while regulatory compliance ensures high safety and durability standards. Domestic initiatives to develop advanced aerospace materials further support consistent market growth.

Key Trends & Opportunities

Trend Toward Electrification and Hybrid Propulsion

Electrification and hybrid propulsion systems are creating new opportunities in aerospace composites. These systems require lightweight, high-performance materials to optimize battery efficiency and reduce structural weight. The growing focus on eco-friendly aviation and emission reduction drives the integration of thermoplastic composites and carbon fiber in propulsion components and aircraft structures. Companies investing in research and development for hybrid-electric aircraft benefit from the increasing demand for sustainable aerospace solutions in North America.

For instance, Heart Aerospace’s ES-30 regional hybrid-electric airplane, which uses advanced composite materials in its propulsion components to provide a fully electric zero-emission range of 200 kilometers, aligning with sustainability goals in North America.

Expansion of Regional Aircraft and UAV Markets

The regional aircraft and UAV segments present significant growth opportunities for aerospace composites. Lightweight composites enhance endurance, payload capacity, and overall performance, making them ideal for regional and specialized aircraft. UAV adoption across defense, logistics, and commercial sectors continues to rise, driving demand for carbon fiber, glass fiber, and thermoplastic materials. Increasing investments in these segments offer companies avenues to develop innovative, high-performance composite solutions for emerging aviation applications.

For instance, Facebook’s now-transitioned Aquila drone project that leveraged carbon fiber composites to build a lightweight drone with over a 110-foot wingspan, designed for extended flight durations at high altitudes for internet provision.

Key Challenges

High Production Costs of Advanced Composites

The high cost of advanced aerospace composites, particularly carbon fiber and thermoset materials, remains a major challenge. Expensive raw materials, complex manufacturing processes, and specialized equipment increase overall production costs. This limits adoption among smaller manufacturers and in cost-sensitive applications. While technological advancements are gradually reducing costs, achieving cost-effective mass production continues to be a key obstacle for broader penetration in North America’s aerospace market.

Stringent Regulatory and Certification Requirements

Aerospace composites face strict regulatory and certification requirements to ensure safety, performance, and durability. Compliance with standards from agencies such as the FAA and ASTM can be time-consuming and costly. Any delays in certification can affect product launches and project timelines. Manufacturers must invest heavily in testing, quality assurance, and documentation to meet these regulations, posing a barrier to market entry and slowing the adoption of innovative composite materials.

Regional Analysis

United States

The United States leads the North America aerospace composites market, holding a market share of 75% in 2024. Strong commercial aircraft production, significant military aviation programs, and high adoption of carbon fiber and thermoset composites drive market growth. Key manufacturers invest in advanced manufacturing technologies, including automated fiber placement and resin transfer molding, to meet demand for lightweight and fuel-efficient aircraft. Increasing defense budgets, the expansion of UAVs, and the modernization of military fleets further support market adoption. The U.S. remains the primary hub for R&D in high-performance aerospace materials, strengthening its dominance in the regional market.

Canada

Canada accounts for a market share of 15% in the North America aerospace composites market in 2024. Growth is driven by regional aircraft manufacturing, maintenance, repair, and overhaul (MRO) activities, and increasing use of carbon and glass fiber composites in aerostructures and interiors. Investment in aerospace innovation, government support for green aviation initiatives, and partnerships with global aircraft manufacturers further enhance market adoption. Canadian aerospace companies increasingly leverage thermoplastic composites for efficiency and recyclability, while domestic UAV production provides emerging opportunities. Rising focus on fuel-efficient and lightweight aircraft continues to drive the regional composites market.

Mexico

Mexico holds a market share of 10% in the North America aerospace composites market in 2024. The market is fueled by the growth of aerospace manufacturing clusters and increasing exports of commercial and regional aircraft components. Companies in Mexico focus on assembling lightweight aerostructures, interiors, and engine components using carbon and glass fiber composites. Cost advantages, skilled labor availability, and strategic partnerships with U.S. and Canadian manufacturers strengthen Mexico’s position in the aerospace supply chain. The rise of regional aircraft programs and the growing UAV sector further contribute to market growth, making Mexico an important emerging hub for aerospace composites in North America.

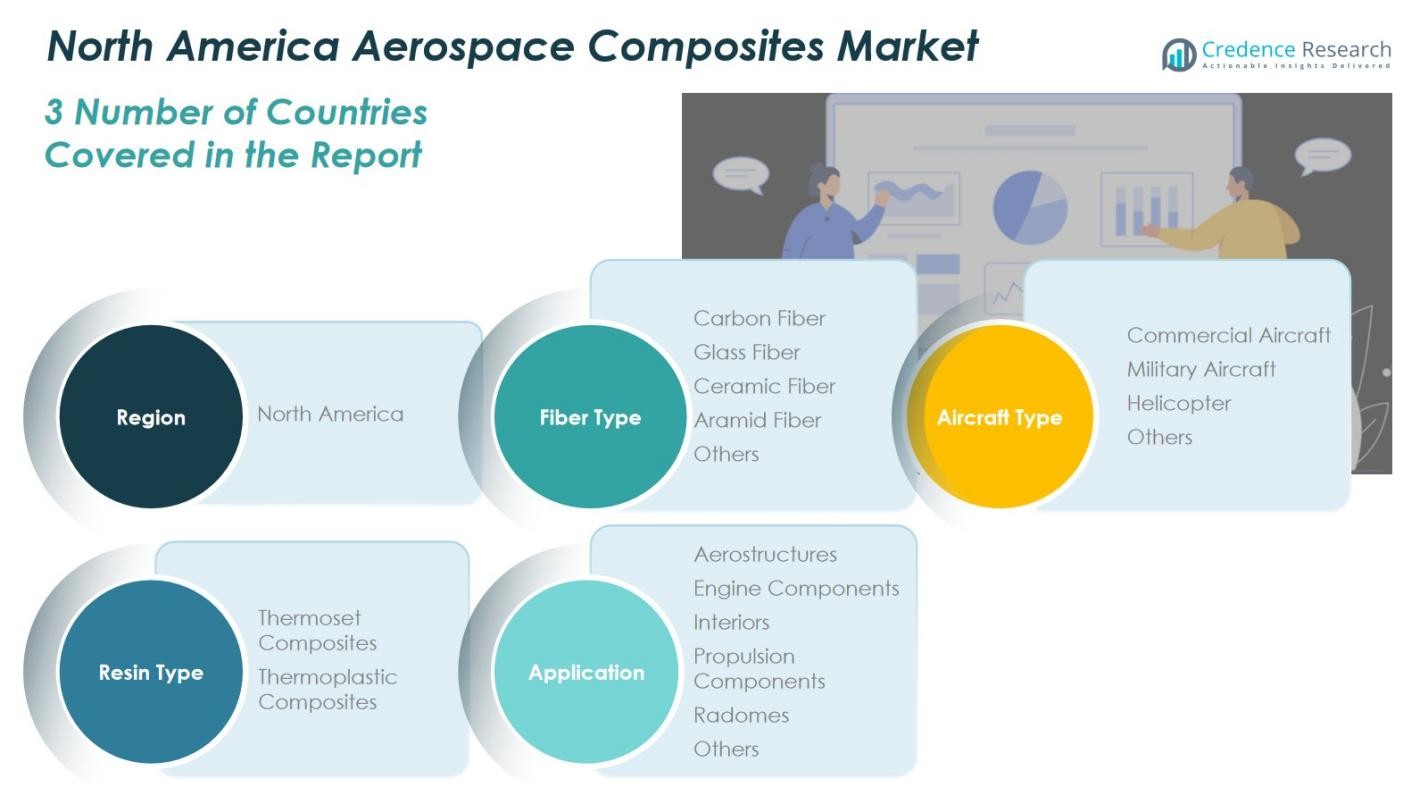

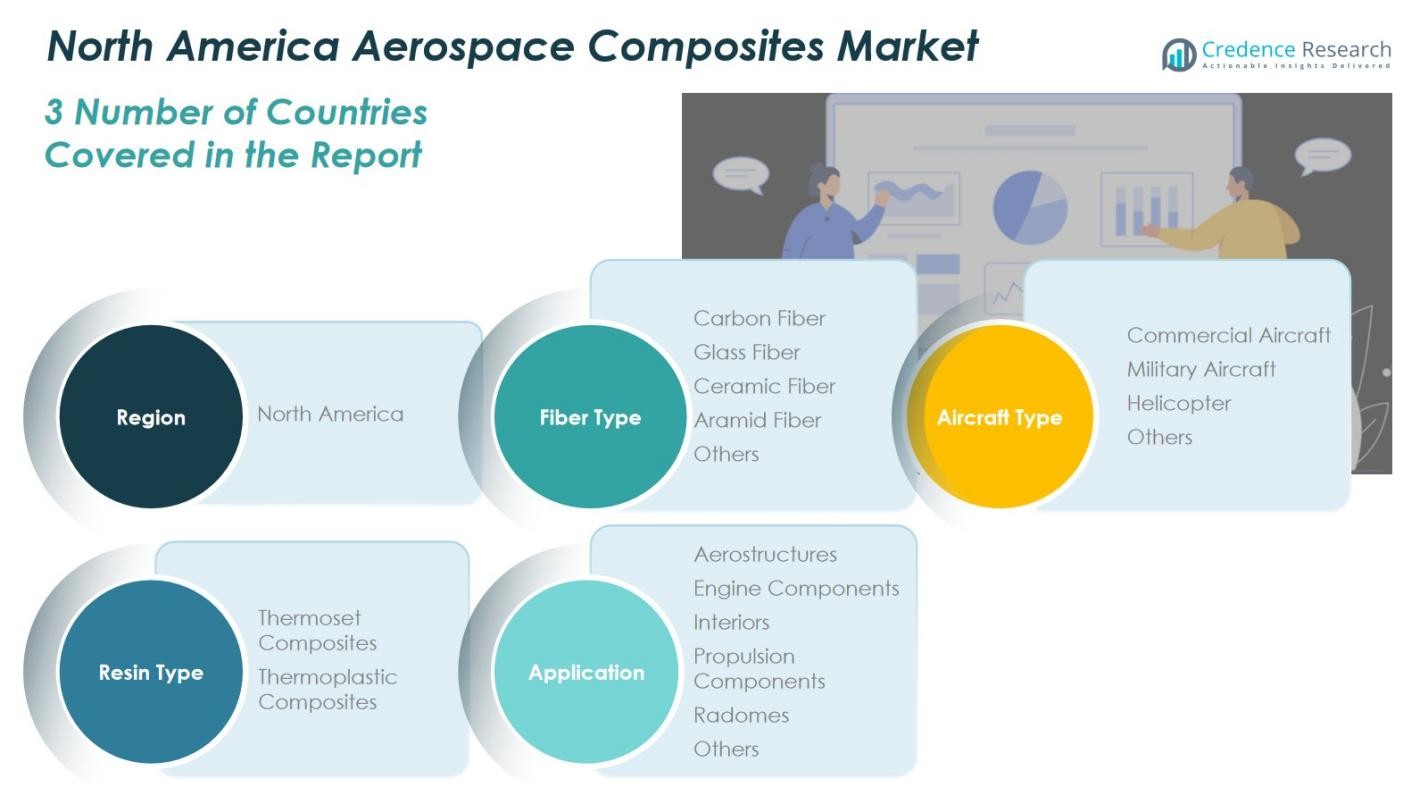

Market Segmentations:

By Fiber Type:

- Carbon Fiber

- Glass Fiber

- Ceramic Fiber

- Aramid Fiber

- Others

By Aircraft Type:

- Commercial Aircraft

- Military Aircraft

- Helicopter

- Others

By Resin Type

- Thermoset Composites

- Thermoplastic Composites

By Application:

- Aerostructures

- Engine Components

- Interiors

- Propulsion Components

- Radomes

- Others

By Region

- Unites States

- Canada

- Mexico

Competitive Landscape

The competitive landscape of the North America aerospace composites market is dominated by key players including Hexcel Corporation, Toray Industries, Teijin Limited, Solvay S.A., and Mitsubishi Chemical Corporation. These companies focus on innovation, strategic partnerships, and capacity expansion to strengthen their market positions. They invest heavily in advanced manufacturing technologies such as automated fiber placement, resin transfer molding, and thermoplastic composites processing to meet the growing demand for lightweight and high-performance aircraft components. Additionally, collaborations with aircraft manufacturers and defense organizations enable faster adoption of next-generation materials. Smaller regional players differentiate through niche applications, including UAVs, interiors, and radomes. The market remains highly competitive, driven by the need for cost efficiency, regulatory compliance, and the development of eco-friendly composites. Strategic acquisitions and R&D initiatives continue to shape market dynamics and maintain technological leadership in North America.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 14, 2025, Boeing secured European Union antitrust approval for its $4.7 billion acquisition of Spirit AeroSystems. To mitigate competition concerns, Boeing agreed to divest Spirit’s Airbus-related operations and sell its Malaysian facility to Composites Technology Research Malaysia Sdn Bhd. The deal is awaiting U.S. regulatory approval and is projected to close within the current quarter.

- In September 26, 2024, Toray Advanced Composites introduced the Toray Cetex® TC1130 PESU thermoplastic composite, a high-performance material engineered to meet rising demand for lightweight, durable components in aerospace applications.

- In June 2025, Fiber Dynamics formed a partnership with Austrian firm Fill GmbH to enhance U.S. aerospace composites manufacturing capabilities. This collaboration supports automated production for commercial aerospace and defense sectors, strengthening the domestic supply chain.

Report Coverage

The research report offers an in-depth analysis based on Fiber Type, Aircraft Type, Resin Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow with rising demand for lightweight and fuel-efficient aircraft.

- Carbon fiber will maintain dominance due to its superior strength-to-weight ratio.

- Thermoset composites will remain widely used, while thermoplastic adoption will increase for secondary structures.

- Commercial aircraft will drive the largest share of demand, supported by fleet expansions.

- Military aircraft and UAV programs will create consistent growth opportunities.

- Advanced manufacturing technologies will accelerate production efficiency and material performance.

- Investments in hybrid-electric and electric propulsion systems will boost composites adoption.

- Regional aircraft and specialized aviation applications will present emerging growth segments.

- Strategic partnerships, acquisitions, and R&D initiatives will shape competitive dynamics.

- Environmental regulations and sustainability goals will encourage the use of recyclable and eco-friendly composites.