Market Overview

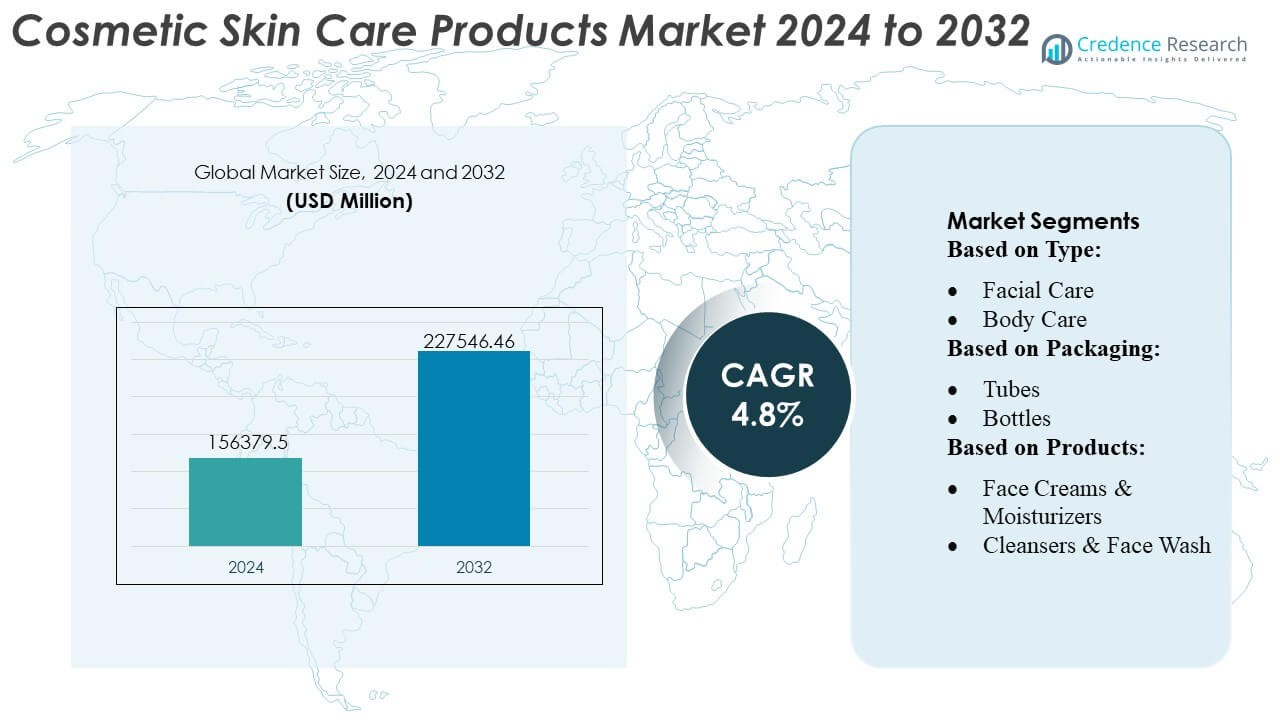

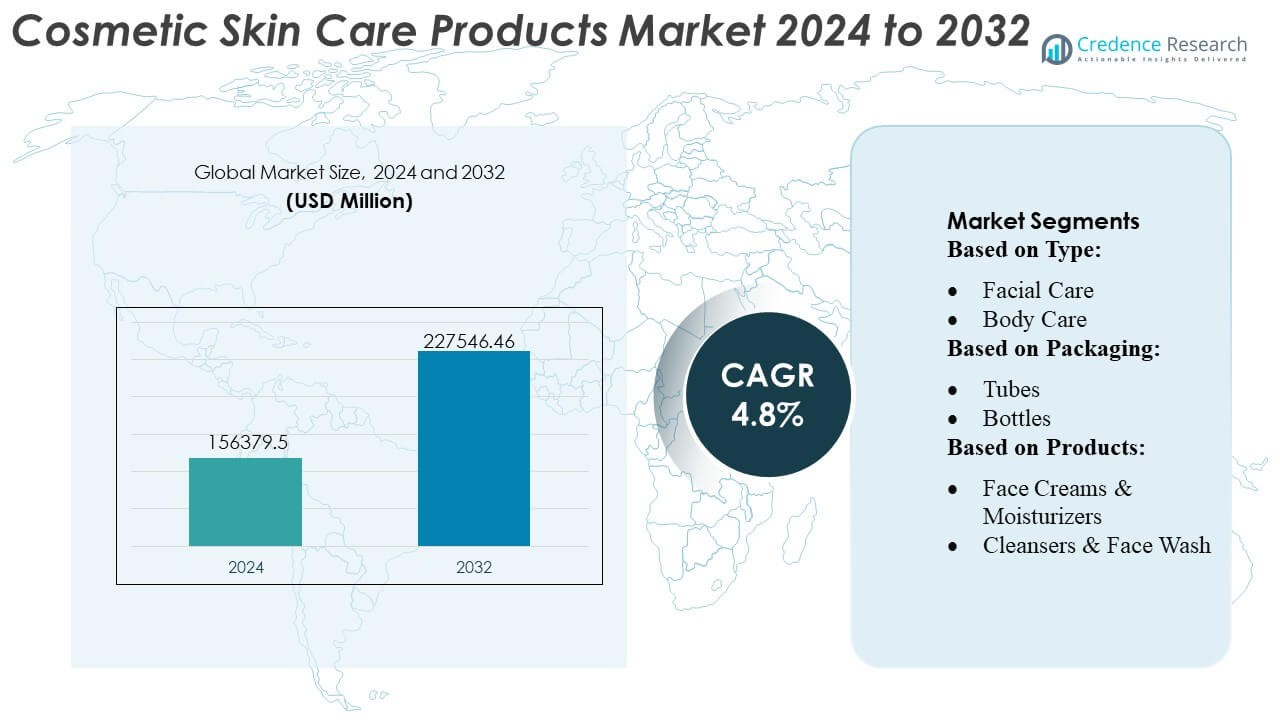

Cosmetic Skin Care Products Market size was valued USD 156379.5 million in 2024 and is anticipated to reach USD 227546.46 million by 2032, at a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cosmetic Skin Care Products Market Size 2024 |

USD 156379.5 Million |

| Cosmetic Skin Care Products Market, CAGR |

4.8% |

| Cosmetic Skin Care Products Market Size 2032 |

USD 227546.46 Million |

The Cosmetic Skin Care Products Market is shaped by a mix of global beauty conglomerates and fast-growing derma-cosmetic innovators that compete through advanced formulations, strong brand portfolios, and expanding omnichannel strategies. Leading players reinforce market presence with clinically validated actives, premium skincare lines, and sustainability-driven packaging innovations, while emerging brands gain traction through ingredient transparency and personalized solutions. Asia-Pacific remains the dominant regional market with an exact 40% share, supported by robust beauty culture, rapid product innovation, and strong consumer adoption of multi-step skincare routines, making it the primary growth engine for global industry expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market stood at USD 156379.5 million in 2024 and will reach USD 227546.46 million by 2032 at a 4.8% CAGR, reflecting steady long-term expansion.

- Growth is driven by rising demand for anti-aging, brightening, and barrier-repair products, supported by high adoption of clinically validated formulations and premium skincare routines.

- Trends highlight strong momentum in clean beauty, hybrid multifunctional products, and AI-enabled personalization, strengthening brand differentiation across all price segments.

- Competitive intensity increases as global and derma-cosmetic brands innovate through active-rich formulations, sustainable packaging, and stronger e-commerce engagement, while mass-market players gain share through affordability-led strategies.

- Asia-Pacific leads with an exact 40% regional share, while facial care maintains the dominant 58–60% segment share, supported by strong consumer interest in serums, moisturizers, and sunscreens across both premium and mass-market channels.

Market Segmentation Analysis:

By Type

Facial care remains the dominant segment, accounting for an estimated 58–60% share, driven by rising demand for anti-aging, hydrating, and skin-brightening formulations supported by dermatology-backed ingredients such as retinol, ceramides, niacinamide, and peptides. Consumers increasingly adopt multi-step routines, boosting sales of serums and moisturizers designed for targeted concerns including pigmentation, acne, and sensitivity. Body care and lip care grow steadily as brands expand exfoliating, nourishing, and repairing products, yet facial care leads due to higher product usage frequency, premiumization trends, and strong penetration across both mass and luxury retail channels.

- For instance, Fermenta Biotech offers a range of enzymes for various applications, including lipases (e.g., CALB) used for the synthesis of specialty lipids and Penicillin G Amidase (e.g., Fermase PS 250) used for the manufacture of beta-lactam antibiotics.

By Packaging

Tubes represent the dominant packaging format with around 45–47% share, supported by convenience, hygiene, controlled dosing, and compatibility with diverse formulations such as creams, gels, scrubs, and sunscreens. Their lightweight structure, recyclability improvements, and suitability for travel-size products further strengthen adoption across personal and professional skincare settings. Bottles and jars maintain meaningful demand for premium serums, lotions, and masks, while emerging airless dispensers enhance stability for active-rich formulations. However, tubes lead as brands prioritize portability and cost-efficient packaging aligned with e-commerce distribution and sustainability-driven redesign initiatives.

- For instance, Merck scaled up a SAFC synthetic cholesterol product, we have increased our capacity by 50 times, helping biomanufacturers bring lifesaving therapies to patients faster.

By Products

Face creams and moisturizers lead the product category with a dominant 42–44% share, driven by continuous innovations in hydration technologies, barrier-repair formulations, and anti-aging solutions tailored to specific skin types and climatic conditions. Their universal applicability and daily-use nature make them the highest-volume contributors across retail channels. Cleansers, sunscreens, and face masks witness strong traction as consumers adopt preventive skincare habits and ingredient-focused routines, while shaving lotions and body moisturizers expand through gender-inclusive and dermatologically tested offerings. Still, moisturizers remain the core revenue driver due to consistent global replenishment cycles and premium line extensions.

Key Growth Drivers

1. Rising Demand for Advanced Anti-Aging and Skin-Repair Solutions

Demand strengthens as consumers increasingly prioritize products that address wrinkles, hyperpigmentation, and barrier damage. Brands accelerate formulation innovation using retinoids, peptides, hyaluronic acid complexes, and microbiome-balancing ingredients that deliver clinically validated results. The shift toward preventive skincare among younger demographics further expands adoption across moisturizers, serums, and targeted treatments. This driver gains additional momentum from premiumization trends, where high-efficacy products command higher price points and reinforce brand loyalty across both online and offline channels.

- For instance, Conagen jointly announced the commercialization of Rosavel™ (rosmarinic acid), a natural preservative solution that achieves 98% purity and minimizes the color and flavor intensity typically associated with standard rosemary extracts.

2. Growth of E-Commerce and Digital Consumer Engagement

Digital retail adoption rises sharply as consumers favor convenience, personalized product recommendations, and wider assortment accessibility. AI-driven skin diagnostics, virtual try-on tools, influencer marketing, and subscription-based replenishment models enhance purchasing confidence and repeat sales. Major brands integrate omnichannel strategies and data-driven targeting to strengthen acquisition and retention. The rapid expansion of cross-border e-commerce also supports the global penetration of Korean, Japanese, European, and clean-beauty brands, thereby widening consumer exposure and accelerating category growth.

- For instance, Amyris produces a fermentation-derived squalane with specific “up to 97 %” purity figure was removed. While 97% is pure, commercial specifications for Amyris’s product are typically cited as over 98% purity, making the original statement potentially misleading or outdated.

3. Increased Preference for Natural, Clean, and Dermatology-Backed Formulations

Consumers increasingly opt for products free from parabens, sulfates, mineral oils, and synthetic fragrances, reinforcing demand for plant-based, microbiome-friendly, and clinically tested formulations. Regulatory pressure and sustainability awareness drive transparent labeling and ingredient safety validation. Brands leverage science-backed actives, eco-certified components, and biodegradable formulations to position themselves within the premium and mass segments. This transition supports high adoption among environmentally conscious consumers and enhances trust through dermatologist endorsements and safety-led product narratives.

Key Trends & Opportunities

1. Expansion of Personalized and AI-Enhanced Skincare Solutions

Personalization emerges as a major opportunity as AI platforms analyze skin tone, texture, hydration levels, and lifestyle factors to recommend precise formulations. Customized serums, mix-in boosters, and subscription kits gain traction for their tailored performance benefits. Genomic skincare, microbiome mapping, and precision-dose devices unlock new product development pathways. Brands increasingly deploy AI chatbots and virtual skin assessments to improve consumer guidance, minimize trial-and-error, and elevate user experience, creating strong differentiation in a competitive market.

- For instance, Titan Biotech operates GMP-facilitated manufacturing facilities in Bhiwadi, Rajasthan (approximately 60 km from Delhi), and holds ISO 13485 and ISO 9001 certifications.

2. Rapid Growth of Hybrid and Multifunctional Products

Multifunctional skincare—including tinted moisturizers, SPF-infused serums, and anti-pollution moisturizers—grows rapidly as consumers seek simplified routines without compromising performance. Busy lifestyles and rising skincare minimalism drive demand for 2-in-1 and 3-in-1 solutions that combine hydration, protection, and treatment. Brands respond with hybrid formulations incorporating antioxidants, peptides, and UV filters to deliver cumulative benefits. This opportunity expands further through dermatology-driven hybrids designed to address emerging concerns such as blue-light protection and environmental stress damage.

- For instance, Chemical manufacturers have implemented process modifications and purification steps, such as vacuum stripping, to reduce 1,4-dioxane levels in ethoxylated surfactants. This is in response to regulatory pressure and consumer demand for cleaner products.

3. Sustainability-Led Innovation and Eco-Optimized Packaging

Sustainability becomes a defining opportunity as consumers prioritize refillable formats, recyclable materials, waterless formulations, and reduced carbon footprints. Brands invest in bio-based packaging, PCR plastics, aluminum alternatives, and minimalistic designs that lower environmental impact. Solid cleansers, concentrated serums, and powder-to-liquid formats help reduce water usage and shipping weight. Companies integrating LCA-based sustainability claims and third-party certifications enhance credibility and strengthen premium positioning in mature markets.

Key Challenges

1. Regulatory Complexity and Rising Compliance Costs

Stringent regulations across the U.S., EU, and Asia require continuous reformulation, safety validation, and documentation, increasing operational costs and time-to-market constraints. Ingredient bans, evolving labeling rules, and tightening claims substantiation standards challenge product development cycles. Smaller brands face higher compliance burdens, limiting their competitive flexibility. Global companies must harmonize formulations to satisfy multiple markets while ensuring product stability, efficacy, and consumer safety.

2. Intensifying Competitive Pressure and Price Sensitivity

The market faces strong competition from global beauty houses, indie brands, derma-cosmetic specialists, and private-label products. Frequent product launches and aggressive discounting create price pressure, especially in mass and mid-range categories. Consumers increasingly compare value propositions across channels, reducing loyalty and raising customer acquisition costs. Brands must differentiate through innovation, clinical validation, and superior sensory profiles while balancing affordability in a saturated landscape.

Regional Analysis

North America

North America holds an estimated 28–30% market share, supported by strong consumer spending on premium skincare, widespread adoption of anti-aging products, and high dermatology consultation rates. The region benefits from advanced R&D capabilities, clean beauty acceleration, and strong retail integration across specialty stores, pharmacies, and e-commerce platforms. U.S. consumers continue to prioritize ingredient transparency, barrier-repair formulations, and multifunctional products, driving growth in serums, moisturizers, and sunscreens. The expanding presence of clinical-grade brands and subscription-based skincare models further reinforces sustained market expansion across both mature and emerging consumer groups.

Europe

Europe accounts for 24–26% of the global market, driven by strong regulatory standards, high adoption of natural and organic formulations, and robust growth in dermo-cosmetic brands. Consumers favor science-backed skincare with proven efficacy, supporting demand for anti-aging serums, moisturizers, and sensitive-skin formulations. The region also benefits from strong retail penetration across pharmacies, beauty chains, and prestige outlets. Sustainability-focused packaging innovations and clean-label requirements shape brand strategies, while rising consumer preference for vegan and eco-certified products strengthens market traction in Germany, France, the U.K., Italy, and the Nordics.

Asia-Pacific

Asia-Pacific leads the global market with a dominant 38–40% share, driven by high population density, expanding middle-class income, strong beauty culture, and rapid innovation in Korean and Japanese skincare ecosystems. Consumers actively adopt multi-step routines, accelerating demand for moisturizers, sunscreens, essences, and masks. Growing urbanization, rising concerns regarding pollution-induced skin damage, and increasing preference for whitening and brightening formulations support category expansion. E-commerce growth and cross-border beauty exports further boost regional performance. China, South Korea, Japan, and India remain pivotal growth engines due to strong brand diversification and rising premiumization trends.

Latin America

Latin America captures 7–8% of the market, influenced by increasing awareness of skincare routines, rising urban lifestyles, and growing demand for hydrating, brightening, and sun-protection products. Brazil and Mexico demonstrate strong traction for affordable yet dermatologically tested formulations, supported by expanding retail distribution and influencer-driven marketing. Economic variability encourages value-focused purchasing, boosting sales of multipurpose and mass-market skincare solutions. Rising interest in natural ingredients, botanical extracts, and sensitive-skin products further shapes product innovation. Local brands gain momentum by offering climate-specific formulations suited to high humidity and sun exposure.

Middle East & Africa (MEA)

The Middle East & Africa region holds 5–6% market share, supported by rising disposable incomes, increasing demand for luxury skincare, and growing awareness of preventive routines. High sun exposure elevates the need for moisturizers, brightening serums, and high-SPF sunscreens, particularly in GCC markets. International brands expand premium offerings through specialty retail and e-commerce partnerships, while local brands leverage traditional ingredients such as argan oil and botanical extracts. Although price sensitivity persists in parts of Africa, urban markets show growing acceptance of dermatology-led formulations and products tailored for hyperpigmentation and uneven skin tone.

Market Segmentations:

By Type:

By Packaging:

By Products:

- Face Creams & Moisturizers

- Cleansers & Face Wash

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Cosmetic Skin Care Products Market players such as Colgate-Palmolive Company, Shiseido Co., Ltd., Revlon, Beiersdorf AG, Coty Inc., L’Oréal S.A., Johnson & Johnson, Inc., Unilever, Procter & Gamble (P&G), and Avon Products, Inc. the Cosmetic Skin Care Products Market remains highly dynamic, shaped by continuous innovation, strong branding strategies, and rapid adoption of digital engagement models. Companies compete by expanding dermatology-backed product lines, enhancing active-ingredient efficacy, and strengthening premium and mass-market offerings to meet diverse consumer needs. E-commerce acceleration, AI-driven skin diagnostics, and personalized skincare systems create new avenues for differentiation, while sustainability commitments push brands toward recyclable packaging, cleaner formulations, and transparent labeling. Competitive intensity continues to rise as both global corporations and emerging niche brands invest in research, influencer partnerships, and omnichannel distribution to capture evolving consumer preferences across regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In January 2025, Albéa Matamoros (Albéa Cosmetics & Fragrance’s plant in Mexico) and Drunk Elephant partnered to launch three new sustainable skincare products D-Bronzi, O-Bloos, and B-Goldi in the U.S., utilizing Albéa’s eco-friendly packaging (PP caps, HDPE/MDPE bottles) to blend Drunk Elephant’s clean formulas with responsible supply chain practices.

- In January 2025, L’Oréal partnered with IBM to develop sustainable cosmetic formulations using generative artificial intelligence (AI). The company utilized IBM’s GenAI technology to analyze cosmetic formulation data, enabling the incorporation of sustainable raw materials while reducing energy consumption and material waste.

- In January 2025, Tatcha, a transformative Japanese skincare brand, is excited to announce its expansion into the nation’s largest beauty retailer, Ulta Beauty. Tatcha increased its market presence in the United States through distribution in more than 1,400 Ulta Beauty retail locations and their e-commerce platform, with primary emphasis on their Dewy Skin Cream product.

Report Coverage

The research report offers an in-depth analysis based on Type, Packaging, Products and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will advance through stronger adoption of dermatology-backed formulations targeting aging, pigmentation, and barrier-repair concerns.

- Brands will increasingly integrate AI-driven skin analysis tools to support personalized product recommendations.

- Sustainability will influence product development, driving demand for refillable packaging, waterless formats, and eco-certified ingredients.

- E-commerce and social commerce channels will expand, strengthening direct-to-consumer engagement and subscription-based models.

- Hybrid multifunctional products combining treatment, hydration, and sun protection will gain wider acceptance.

- Premium skincare will grow as consumers prioritize clinically proven results and high-performance actives.

- Growth in men’s grooming and gender-neutral skincare will broaden target demographics.

- Regional beauty trends, especially in Asia-Pacific, will inspire global product innovation and ingredient adoption.

- Regulatory tightening will push brands to enhance formulation transparency and claims substantiation.

- Emerging biotech innovations, including microbiome-based and peptide-rich formulations, will create new competitive advantages.