Market Overview:

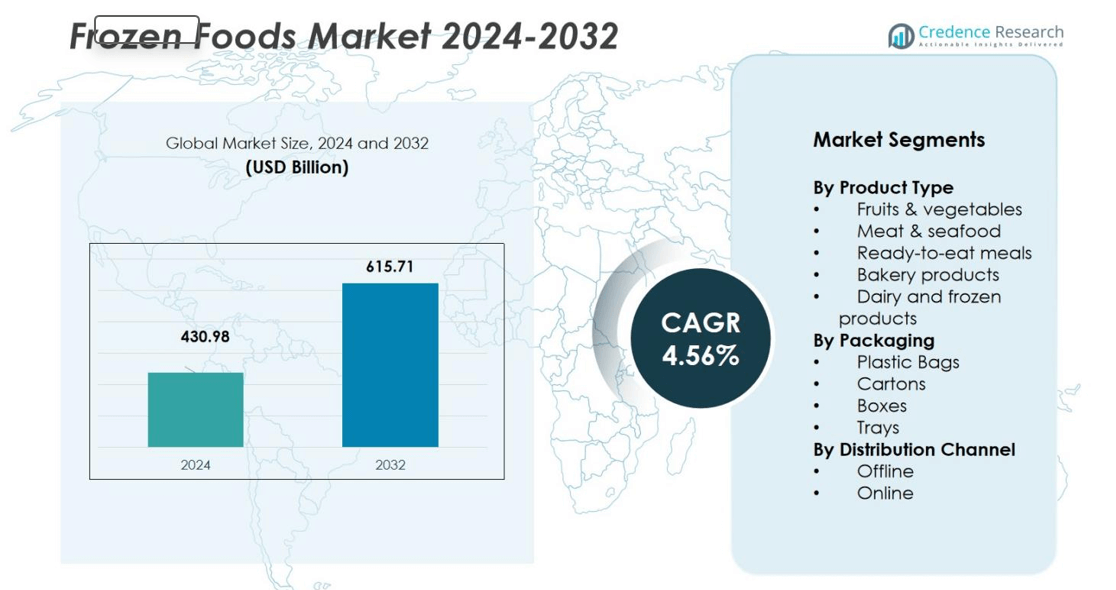

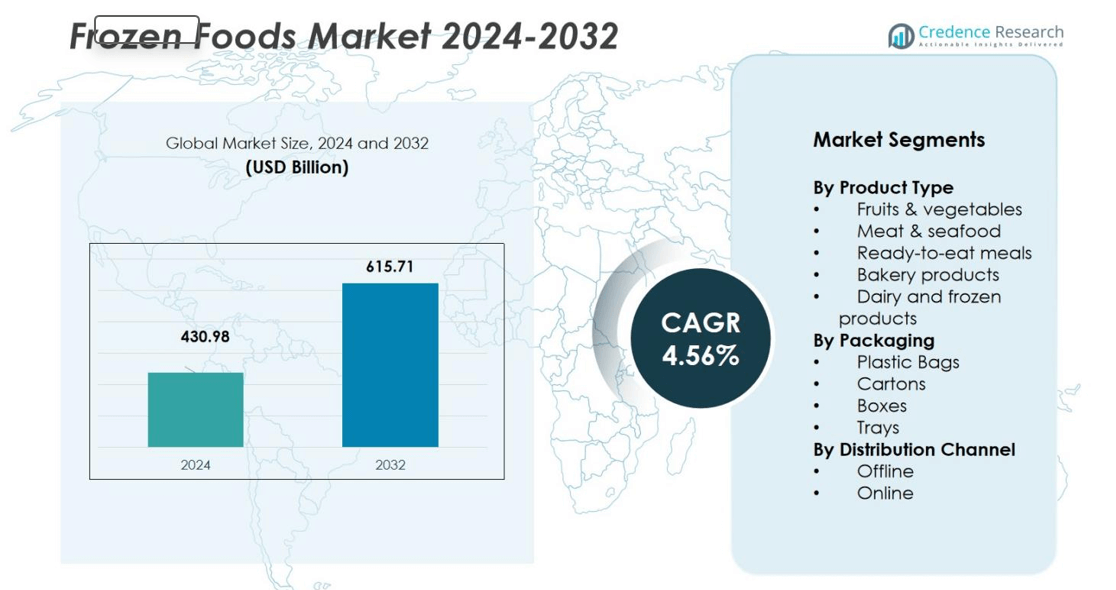

The Frozen Foods Market size was valued at USD 430.98 billion in 2024 and is anticipated to reach USD 615.71 billion by 2032, growing at a CAGR of 4.56% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Frozen Foods Market Size 2024 |

USD 430.98 billion |

| Frozen Foods Market, CAGR |

4.56% |

| Frozen Foods Market Size 2032 |

USD 615.71 billion |

The Frozen Foods Market is highly competitive, with major players such as Ajinomoto Co., Inc., Cargill, Incorporated, Dr. Oetker, General Mills, Inc., Kellanova, Nestlé, Nomad Foods, Pinnacle Foods Co, Tyson Foods, Inc., and Omar International Pvt. Ltd. leading the industry. These companies maintain strong market positions through innovation, diversified product offerings, and strategic expansion into emerging markets. The companies are investing heavily in product development, focusing on plant-based, ready-to-eat meals, and healthier frozen food options to meet evolving consumer preferences. North America holds the largest market share, accounting for 37.6%, driven by high demand for convenience foods and a large working population that seeks quick, easy meal solutions. Europe follows closely with a 38% market share, supported by strong demand for premium frozen products and clean-label formulations. Asia Pacific is also witnessing rapid growth, driven by urbanization and increasing disposable incomes in emerging economies like China and India.

Market Insights

- The Frozen Foods Market size stood at USD 430.98 billion in 2024 and is projected to reach USD 615.71 billion by 2032, registering a CAGR of 4.56% during the forecast period.

- Drivers include busy lifestyles and rising demand for convenience meals, with the ready-to-eat segment holding a dominant 30% share of the market.

- Trends show an expansion of online grocery channels and increasing demand for plant-based and clean-label frozen food options as consumers seek healthier alternatives.

- Competitive analysis highlights major players like Ajinomoto Co., Inc., Cargill, Incorporated, Dr. Oetker, Nestlé, Tyson Foods, Inc., and Nomad Foods, who leverage innovation and global distribution to maintain market leadership.

- Restraints and regional analysis indicate that regions like North America and Europe lead with shares of 37.6% and 38% respectively, while cold‑chain infrastructure issues and high energy costs limit growth in regions such as Latin America and Middle East & Africa.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The Frozen Foods Market is segmented into fruits & vegetables, meat & seafood, ready-to-eat meals, bakery products, and dairy & frozen products. Among these, ready-to-eat meals dominate the market, holding the largest share of 30%. The convenience of these meals, which require minimal preparation time, makes them increasingly popular among busy consumers. Additionally, the rising demand for healthier and nutritious frozen meal options, along with advancements in packaging that enhance shelf life, is driving the growth of this segment.

- For instance, Conagra Brands launched over 50 new frozen ready meal and side dish products in the U.S., including plant-based and protein-rich options, responding to consumers’ demand for convenient nutrition and broader meal variety.

By Packaging

In terms of packaging, the plastic bags segment leads the Frozen Foods Market, accounting for a significant share of 40%. Plastic bags are favored for their ability to preserve the quality and freshness of frozen foods while being lightweight and cost-effective. Their versatility in packaging various types of frozen products and their ease of use in both retail and consumer settings contribute to their dominance. As environmental concerns grow, however, there is an increasing shift towards more sustainable packaging solutions, which may impact future market dynamics.

- For instance, Coldwater Prawns of Norway uses sustainable frozen food pouches made with around 60% ocean-bound recycled plastic developed with SABIC and Estiko Packaging Solutions, showcasing a strong commitment to sustainability while maintaining product quality.

By Distribution Channel

The offline distribution channel holds the largest market share in the Frozen Foods Market, with an estimated share of 70%. This is driven by the widespread presence of supermarkets, hypermarkets, and retail stores, which offer consumers the convenience of physically inspecting and purchasing frozen food products. Despite the strong performance of offline channels, the online segment is gaining traction due to the growing preference for e-commerce shopping, particularly among tech-savvy consumers who value home delivery and the convenience of browsing a wide range of products.

Key Growth Drivers

Convenience and Time-Saving Benefits

One of the major growth drivers in the Frozen Foods Market is the increasing demand for convenience and time-saving food options. As busy lifestyles become more common, consumers are turning to frozen foods that require minimal preparation and cooking time. Ready-to-eat meals, in particular, are gaining popularity for their ease of use, which allows individuals to enjoy nutritious meals without the hassle of meal prep. This trend is further accelerated by the growing preference for convenience among younger consumers and working professionals.

- For instance, Conagra Brands’ Healthy Choice line includes numerous convenient, health-oriented, and specifically-labeled gluten-free frozen meals such as the Beef Merlot Café Steamers and various Power Bowls, which meet consumer preferences for healthier options

Advancements in Freezing Technology

Technological innovations in freezing methods are driving the growth of the Frozen Foods Market. Advances such as flash freezing, cryogenic freezing, and improved packaging technologies are enhancing the quality and shelf life of frozen foods. These innovations help preserve the nutritional value, texture, and taste of products, ensuring that they remain as fresh as possible over extended periods. As a result, consumers are more confident in purchasing frozen items, contributing to the overall market expansion.

- For instance, the adoption of Individual Quick Freezing (IQF) technology by companies like Advanced IQF Systems allows rapid freezing that preserves the original flavor, color, and texture more effectively than traditional methods, supporting better freshness upon thawing.

Rising Demand for Healthy Frozen Food Options

As health-conscious eating becomes a growing trend, consumers are seeking healthier alternatives in the frozen food category. This shift has led to an increase in demand for frozen fruits, vegetables, low-calorie meals, and plant-based frozen products. The availability of frozen foods with clean labels, organic certifications, and fewer preservatives is fueling market growth. Consumers are increasingly drawn to frozen foods that align with their dietary preferences, such as gluten-free, low-carb, or high-protein options, further enhancing the appeal of the frozen food sector.

Key Trends & Opportunities

Growth of Plant-Based Frozen Foods

A prominent trend in the Frozen Foods Market is the rise of plant-based frozen food options. With the growing popularity of veganism and vegetarianism, consumers are increasingly seeking plant-based alternatives to traditional frozen meats and dairy products. The expansion of plant-based frozen meals, snacks, and desserts presents significant opportunities for manufacturers to cater to this evolving demand. Companies that innovate in plant-based frozen foods have the potential to tap into a rapidly growing consumer base that prioritizes sustainability and health-conscious eating.

- For instance, Tesco has introduced vegan frozen mains such as the Plant Chef Seasonal Seeded Roasts with Port Gravy and the Plant Chef No Turkey Crown with Sage and Onion Stuffing, tapping into holiday season demand for plant-based convenience meals in retail aisles.

E-commerce and Online Distribution

The expansion of online grocery shopping presents a significant opportunity for the Frozen Foods Market. E-commerce platforms provide consumers with the convenience of purchasing frozen food products from the comfort of their homes, often with faster delivery times. This trend is especially strong among tech-savvy younger generations who prioritize convenience and variety. Retailers are increasingly investing in their online presence, offering promotional discounts and delivery services to attract customers, thereby driving the growth of the online distribution segment in the frozen food sector.

- For instance, BigBasket launched its exclusive frozen foods brand Precia in collaboration with chef Sanjeev Kapoor, making a diverse range of frozen vegetables, snacks, and sweets widely available through its online platform to meet the rising demand for convenient meal solutions.

Key Challenges

Supply Chain and Storage Constraints

A key challenge in the Frozen Foods Market is the complexity of managing the cold chain and logistics associated with frozen products. Maintaining consistent cold temperatures throughout the supply chain—from production to retail—can be challenging and costly. Any disruption in the cold chain can lead to product spoilage, impacting product quality and safety. Moreover, fluctuations in energy prices and transportation costs add to the logistical hurdles, posing challenges for companies that aim to maintain cost-efficiency while ensuring product quality.

Environmental Concerns and Sustainability

Sustainability concerns related to packaging and the environmental impact of frozen food production are also challenges facing the market. With increasing consumer awareness about plastic waste and carbon footprints, there is pressure on companies to adopt more eco-friendly packaging solutions and reduce energy consumption during production and storage. Regulatory pressures and the demand for sustainable practices are pushing manufacturers to innovate, but this transition may require significant investments in research, technology, and supply chain adjustments, adding complexity to market growth.

Regional Analysis

North America

The North America region holds a market share of 37.6% in the global frozen foods sector. This dominance is driven by established retail channels, widespread adoption of convenience foods, and strong brand presence. Urbanized consumers and a large working‑population in countries such as the U.S. embrace frozen ready‑to‑eat meals and snacks, supporting the segment’s growth. The region’s advanced cold‑chain infrastructure and high disposable income levels further reinforce sustained demand for frozen food items. Manufacturers continue investing in product innovation and online distribution to maintain market leadership.

Europe

Europe accounts for 38% of the global frozen foods market share in 2024. The region benefits from mature consumer habits, high retail penetration, and awareness around branded frozen products. Countries like Germany, the United Kingdom, and France offer strong demand for ready meals and premium frozen items as lifestyles become busier. Further, Europe’s robust infrastructure and emphasis on product quality bolster market stability. Manufacturers in this region focus on clean‑label formulations and sustainability in packaging to meet evolving regulatory and consumer expectations.

Asia Pacific

The Asia Pacific region is rapidly growing and currently holds 19.1% of the frozen foods market share. Rapid urbanization, rising disposable incomes, and shifting dietary habits drive increased consumption of frozen meals and vegetables in countries such as China and India. Improvements in cold‑chain logistics and expanding modern retail formats enhance product accessibility. The region offers a high growth opportunity as younger consumers adopt convenient frozen food options. Companies entering this market prioritise localisation of flavours and tailored packaging to succeed.

Latin America

Latin America contributes 6.8% to the global frozen foods market share. Growth in this region stems from increasing urbanization, rising working‑class households, and expanding modern retail and e‑commerce channels. However, challenges such as inconsistent cold‐chain infrastructure and economic volatility temper growth rates compared with mature markets. Still, manufacturers targeting Latin America benefit from untapped demand for frozen snacks, vegetables, and ready meals. Strategic investment in regional supply‑chain development and targeted product launches can drive further expansion.

Middle East & Africa

The Middle East & Africa region holds 3.7% of the global frozen foods market share. This modest share reflects lower market maturity, but the region shows growing potential thanks to increasing urban populations, rising incomes, and lifestyle shifts favouring convenience foods. Challenges such as limited refrigeration infrastructure and strong fresh‑food traditions persist. Brands focusing on affordable frozen meat, seafood and ready meals, combined with improved distribution networks, stand to capture emerging demand and establish early mover advantages in these markets.

Market Segmentations:

By Product Type

- Fruits & vegetables

- Meat & seafood

- Ready-to-eat meals

- Bakery products

- Dairy and frozen products

By Packaging

- Plastic Bags

- Cartons

- Boxes

- Trays

By Distribution Channel

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

In the global frozen foods market, major key players such as Ajinomoto Co., Inc., Cargill, Incorporated, Dr. Oetker, General Mills, Inc., Kellanova, Nestlé, Nomad Foods, Pinnacle Foods Co, Tyson Foods, Inc., and Omar International Pvt. Ltd. dominate the competitive landscape. These companies employ a range of strategies including product diversification, technological innovation, and geographical expansion to strengthen their market position. They are investing heavily in research and development to introduce healthier, plant-based, and convenience-focused frozen food options, which cater to shifting consumer preferences. Moreover, these players are focusing on expanding their presence in emerging markets through enhanced distribution networks and partnerships. Smaller regional players and private-label brands also contribute to market dynamics by offering competitively priced alternatives. As the market is characterized by moderate concentration, the key players must continually optimize their supply chains, enhance product quality, and improve sustainability to maintain leadership and drive long-term growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, Conagra Brands, Inc. expanded its product portfolio by introducing a range of multi-serve meal options, including side vegetables, gluten-free selections, and plant-based dishes, aligning with the rising demand for diverse and health-focused frozen meal choices.

- In February 2025, ITC Ltd. announced the acquisition of Prasuma, a well-established brand in India’s frozen, chilled, and ready-to-eat foods category. The acquisition aims to strengthen ITC’s manufacturing network and improve logistics efficiency within its growing food division.

- In April 2023, Nestlé formed a joint venture with PAI Partners, a private equity firm, to focus on its frozen pizza business in Europe. The partnership seeks to create a specialized entity in this competitive segment, with both parties sharing equal voting rights and Nestlé holding a minority stake.

- In March 2023, McCain Foods unveiled a $438.4 million investment to expand its potato processing facility in Coaldale, Alberta. The expansion will double the plant’s capacity, boosting production efficiency and strengthening supply for key regional and export markets.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Packaging, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The global frozen foods market will expand as consumer preference for convenience rises with busier lifestyles.

- Urbanisation and rising disposable incomes in emerging regions will drive demand for frozen meals and snacks.

- Innovations in freezing and packaging technologies will enable longer shelf‑life and better product quality, thereby fueling market growth.

- Demand for health‑focused frozen options—such as plant‑based meals, organic vegetables, and low‑calorie meals—will grow strongly.

- Online grocery platforms will boost frozen foods sales by offering home delivery and wider variety to consumers.

- Retailers and manufacturers will expand into emerging markets, capturing untapped potential and diversifying geographic revenue streams.

- Customized, single‑serve and value‑pack frozen items will gain traction among time‑pressed and smaller households.

- Sustainability initiatives such as eco‑friendly packaging and efficient cold‑chain logistics will become key differentiators in the market.

- Price volatility in raw materials and energy costs will force companies to optimise supply chains and production efficiency.

- Cold‑chain infrastructure limitations in certain regions will challenge expansion, necessitating investment and partnership strategies.