Market Overview:

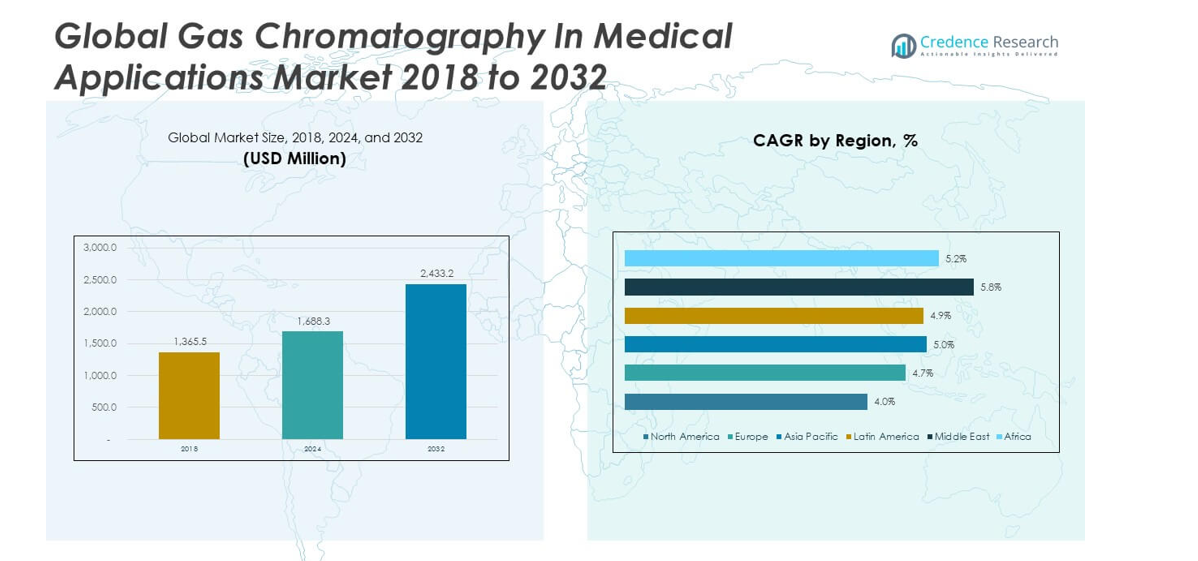

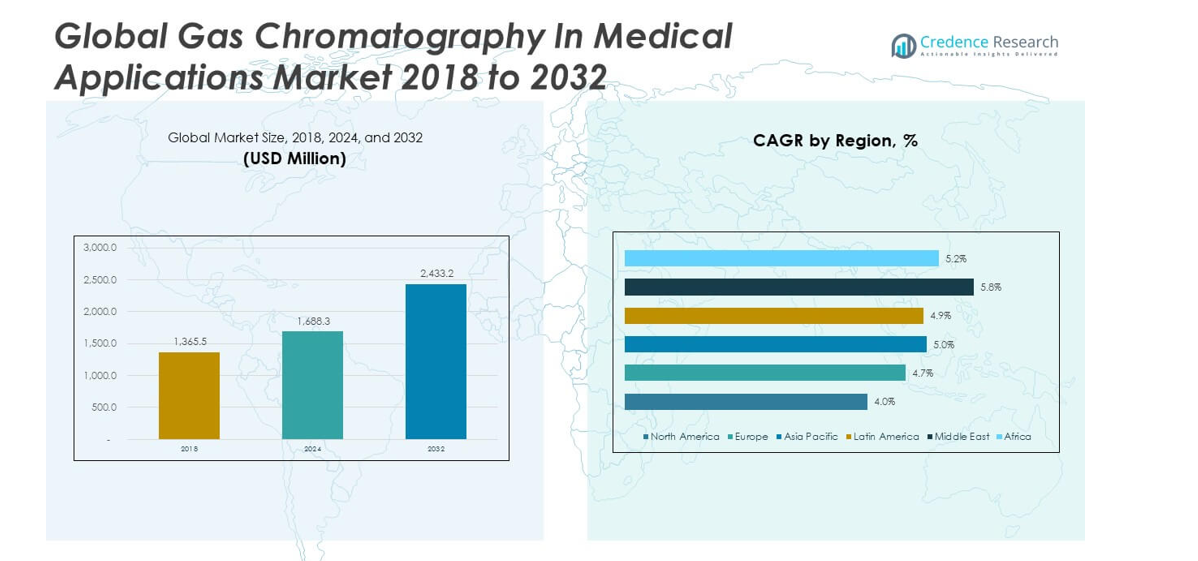

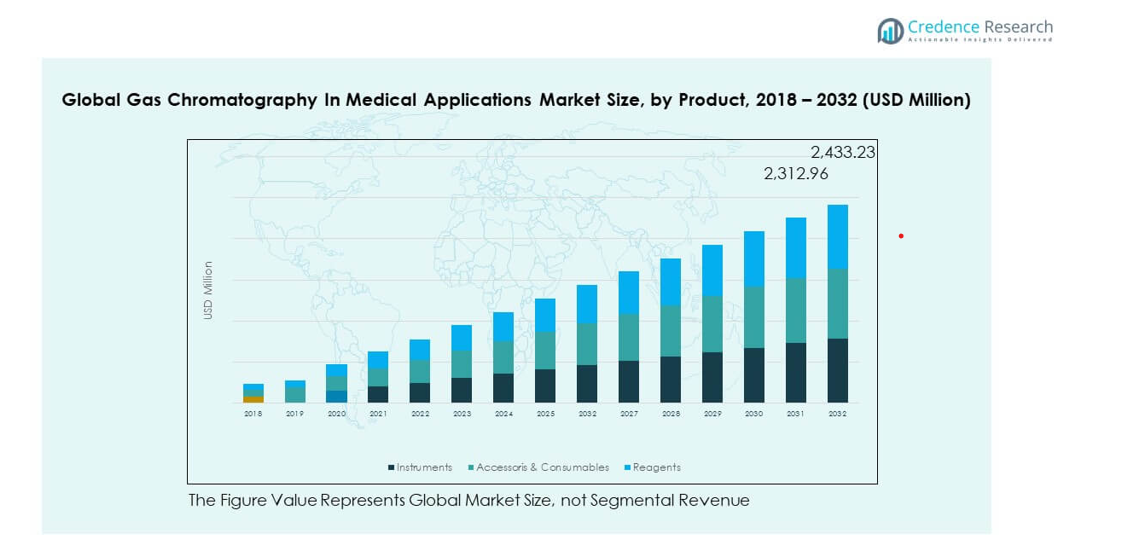

The Global Gas Chromatography in Medical Applications Market size was valued at USD 1,365.5 million in 2018, to USD 1,688.3 million in 2024, and is anticipated to reach USD 2,433.2 million by 2032, at a CAGR of 4.75% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gas Chromatography in Medical Applications Market Size 2024 |

USD 1,688.3 million |

| Gas Chromatography in Medical Applications Market, CAGR |

4.75% |

| Gas Chromatography in Medical Applications Market Size 2032 |

USD 2,433.2 million |

The growth of the Global Gas Chromatography in Medical Applications Market is driven by increased demand for precise medical diagnostics and advancements in healthcare. The ability of gas chromatography to provide detailed and accurate analysis of biological samples, such as blood and urine, fuels its widespread adoption in hospitals, clinical labs, and pharmaceutical companies. The growing focus on personalized medicine, quality control in drug development, and regulatory compliance also contributes to market growth, making gas chromatography essential for modern medical applications.

Regionally, North America dominates the Global Gas Chromatography in Medical Applications Market due to its advanced healthcare infrastructure and high adoption of innovative diagnostic technologies. Europe follows closely, with significant contributions from countries like Germany and the UK, which have strong medical research sectors. Emerging markets in Asia Pacific, particularly China and India, are experiencing rapid growth, driven by rising healthcare investments and a shift towards modern diagnostic practices. These regions are expected to see increasing demand as healthcare systems continue to expand and evolve.

Market Insights:

- The Global Gas Chromatography in Medical Applications Market size was valued at USD 1,365.5 million in 2018, USD 1,688.3 million in 2024, and is projected to reach USD 2,433.2 million by 2032, growing at a CAGR of 4.75% during the forecast period.

- Asia Pacific leads with 36% share, supported by strong pharmaceutical expansion, healthcare infrastructure, and investments in diagnostics. Europe follows with 27%, driven by advanced research and strict quality regulations, while North America accounts for 21%, supported by robust healthcare infrastructure and adoption of new technologies.

- The Middle East is the fastest-growing region with a CAGR of 5.8%, fueled by heavy healthcare investments, rapid modernization of diagnostic facilities, and rising demand for advanced technologies in countries like Saudi Arabia, UAE, and Qatar.

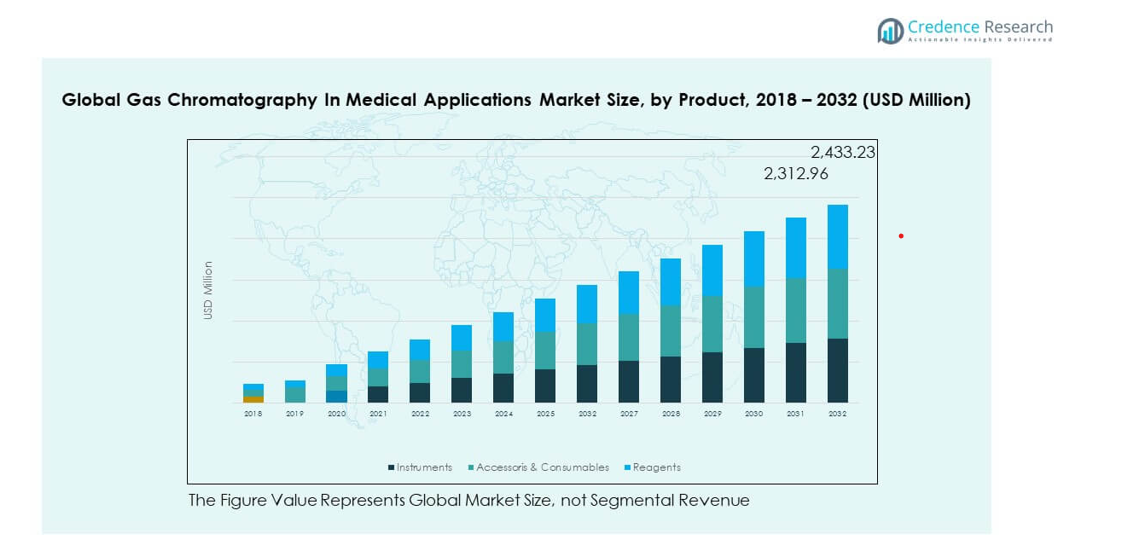

- By product segmentation, instruments dominate with 47% of the market, followed by accessories & consumables at 35%, while reagents contribute 18%. This reflects the critical role of instruments in delivering reliable and precise diagnostic outcomes.

- Accessories & consumables, with 35% share, highlight steady demand for essential components like tubing, fittings, and auto-sampler parts, while reagents at 18% continue to support advanced testing and research applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Advancements in Medical Research and Diagnostics

The Global Gas Chromatography in Medical Applications Market is witnessing growth due to continuous advancements in medical research. Gas chromatography is pivotal for precise analysis of biological samples, enabling early disease detection and accurate diagnostics. It helps in testing drug formulations, identifying biomarkers, and analyzing the presence of harmful substances in biological fluids. These capabilities make it indispensable in medical applications, fostering the demand for gas chromatography systems.

Rising Demand for Personalized Medicine

With the increasing shift towards personalized medicine, the demand for tailored treatments has grown. Gas chromatography plays a crucial role in identifying individual patient profiles by analyzing metabolic and genetic information. The ability to precisely measure biomarkers enhances the efficacy of personalized therapies. This trend is driving the adoption of gas chromatography systems in the medical industry, as healthcare providers seek accurate and individualized solutions for patients.

Stringent Regulatory Requirements for Drug Testing

Government agencies worldwide are imposing stringent regulations for drug testing and safety. Gas chromatography is a vital tool in ensuring drugs meet these regulatory standards. By providing accurate testing for impurities and confirming the quality and safety of pharmaceutical products, gas chromatography supports the compliance needs of the medical and pharmaceutical sectors. This growing emphasis on regulation further accelerates the demand for advanced chromatography systems.

- For instance, Phenomenex launched the Zebron ZB-Dioxin GC column in 2021, offering a single-column solution for regulated dioxins (2,3,7,8-TCDD and TCDF) and reducing instrument downtime by 50% versus multi-column methods, while cutting runtime for dioxin analyses by about 25%.

Expanding Healthcare Infrastructure in Emerging Markets

The healthcare sector in emerging markets is expanding rapidly, creating new opportunities for gas chromatography systems. Countries in Asia-Pacific, Latin America, and the Middle East are investing heavily in healthcare infrastructure and medical research. This growth in healthcare facilities, coupled with the rising need for efficient diagnostic tools, is driving the demand for gas chromatography in these regions. The Global Gas Chromatography in Medical Applications Market stands to benefit from these emerging market developments.

- For instance, PerkinElmer’s Clarus GC systems combined with TurboMatrix Headspace Samplers have been adopted in clinical and toxicology labs, where automated headspace sampling reduces manual workload and improves sample throughput while ensuring reproducible results for complex biological matrices.

Market Trends:

Integration with Automation and Digital Technologies

The integration of gas chromatography with automation and digital technologies is one of the key trends shaping the market. Automated gas chromatography systems allow for faster, more reliable results, minimizing human error. Additionally, advancements in digital technologies, including cloud-based data storage and AI-driven analytics, enable real-time analysis and remote monitoring. These innovations improve the efficiency and accessibility of medical diagnostics, making gas chromatography systems more versatile and user-friendly.

- For instance, in November 2024, TetraScience launched Chromatography Insights, a universal dashboard designed to integrate data from multiple chromatography data systems in the biopharmaceutical sector, enabling harmonized reporting and improved enterprise-scale analytics.

Shift Towards Non-Invasive Diagnostic Methods

The trend toward non-invasive diagnostic methods is becoming increasingly prominent in the medical field. Gas chromatography is being adapted for use in non-invasive procedures, such as breath analysis and skin sampling. These applications provide faster and more comfortable alternatives to traditional blood and urine tests. With the growing focus on patient comfort and reducing medical risks, this trend is driving the development of new gas chromatography applications in medical diagnostics.

Focus on Environmental and Sustainable Practices

There is a growing trend toward environmentally sustainable practices in medical diagnostics. Gas chromatography equipment manufacturers are increasingly focusing on reducing their environmental footprint by designing energy-efficient systems. These systems not only reduce power consumption but also minimize the use of harmful solvents in the analytical process. The shift toward greener technology aligns with global environmental goals and drives innovation in the gas chromatography market for medical applications.

- For instance, Shimadzu launched the Brevis GC-2050 series in January 2025, featuring an ECO Idling Function that reduces power consumption by approximately 61% and gas usage by about 92% during standby periods, while visualizing cumulative CO₂ reduction to help optimize sustainability in laboratory operations.

Expansion in Proteomics and Metabolomics

Proteomics and metabolomics are emerging fields in medical diagnostics, with gas chromatography playing a significant role in these areas. Gas chromatography is essential for analyzing the complex mixtures found in biological samples, particularly in proteomic and metabolic studies. The demand for these specialized services is increasing as researchers explore disease mechanisms at a molecular level. This trend is expected to expand the role of gas chromatography in advanced medical applications.

Market Challenges Analysis:

High Equipment and Operational Costs

The high cost of gas chromatography systems remains a significant challenge for the Global Gas Chromatography in Medical Applications Market. The initial investment in purchasing, maintaining, and upgrading these systems can be prohibitive, particularly for small healthcare facilities in emerging markets. The operational costs, including the need for trained personnel and regular maintenance, further add to the financial burden. Despite these challenges, the increasing demand for precise diagnostic tools continues to drive investment in this technology.

Limited Availability of Skilled Technicians

Another challenge faced by the market is the limited availability of skilled technicians who can operate and maintain complex gas chromatography systems. The need for specialized training and expertise creates a bottleneck in the widespread adoption of these systems, particularly in less developed regions. Addressing this skills gap is crucial for enhancing the efficiency and reach of gas chromatography in medical applications.

Market Opportunities:

Growing Adoption in Emerging Economies

The rapid expansion of healthcare infrastructure in emerging economies presents a significant opportunity for the Global Gas Chromatography in Medical Applications Market. As healthcare systems in regions like Asia-Pacific and Africa continue to develop, there is a growing need for advanced diagnostic tools. Gas chromatography systems can provide the high-quality, precise results necessary for improving patient outcomes. This trend opens up new market opportunities in these regions, where healthcare spending is on the rise.

Advancements in Targeted Therapeutics

With the increasing focus on targeted therapeutics and precision medicine, gas chromatography is gaining traction in research and development. The ability to identify specific biomarkers and monitor treatment efficacy is becoming increasingly important in personalized healthcare. This trend presents a significant opportunity for the Global Gas Chromatography in Medical Applications Market to expand its presence in the growing field of targeted drug development and treatment monitoring.

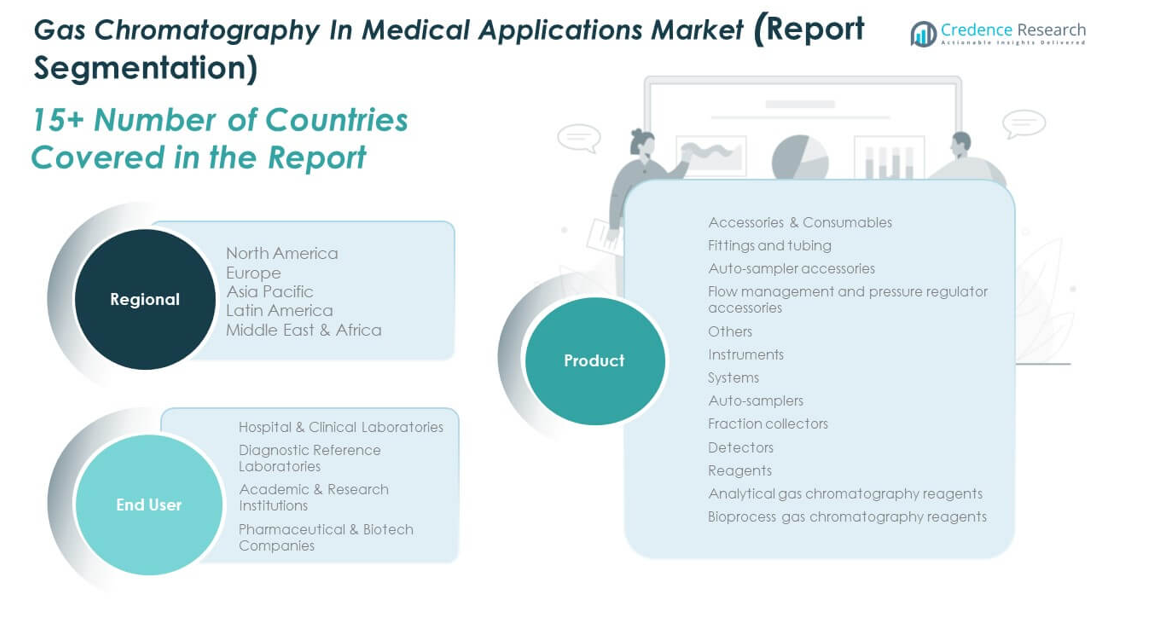

Market Segmentation Analysis:

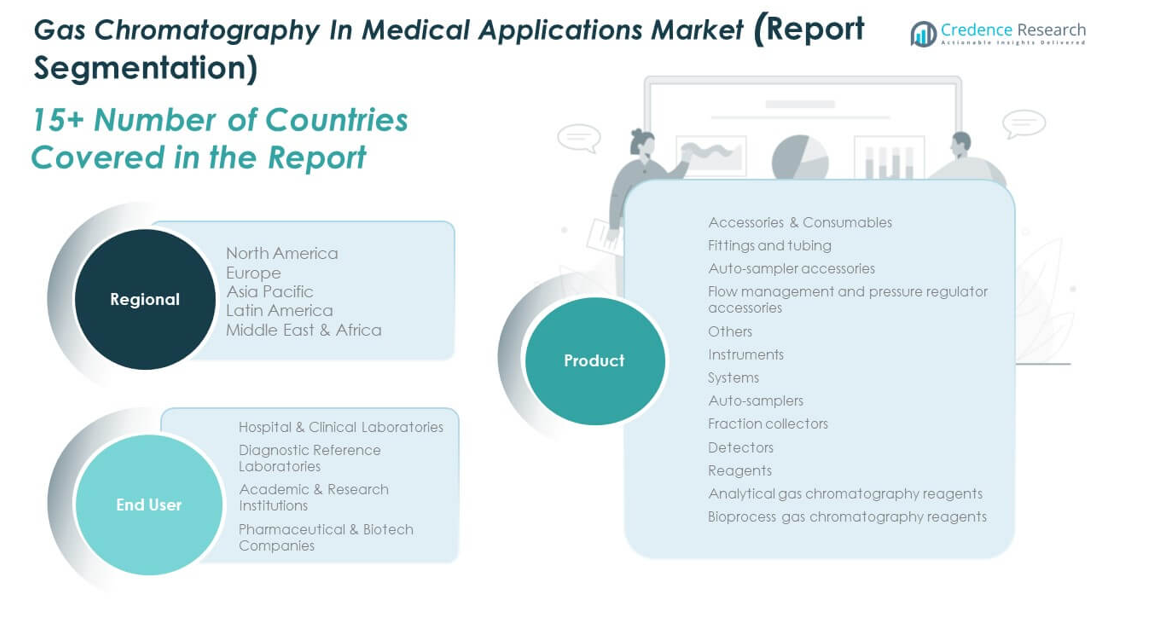

The Global Gas Chromatography in Medical Applications Market is divided into several product and end-user segments, each contributing to its growth.

By product segment includes Accessories & Consumables, Instruments, Reagents, and Others. Accessories & Consumables, such as fittings, auto-sampler accessories, and flow management tools, form a vital part of gas chromatography systems. The Instruments segment, including systems, auto-samplers, fraction collectors, and detectors, plays a crucial role in ensuring precision and reliability in medical diagnostics. Reagents, both analytical and bioprocess, are essential for the effective operation of gas chromatography systems, particularly in medical testing and pharmaceutical applications.

- For instance, Agilent’s Intuvo 9000 GC System features “click-and-run” connections that allow columns to be changed in less than one minute, and its Guard Chip protects downstream components from contamination, reducing downtime for maintenance in high-throughput laboratories.

By end-user segment encompasses Hospital & Clinical Laboratories, Diagnostic Reference Laboratories, Academic & Research Institutions, and Pharmaceutical & Biotech Companies. Hospital & Clinical Laboratories are significant contributors to the market due to their increasing need for accurate diagnostic tools. Diagnostic Reference Laboratories rely on gas chromatography for high-precision testing of biological samples. Academic & Research Institutions focus on advancing medical research, using gas chromatography for various studies, while Pharmaceutical & Biotech Companies utilize it for drug development, quality control, and clinical testing. The demand from these sectors is expected to grow steadily as healthcare and pharmaceutical industries continue to innovate and expand.

- For instance, Labcorp applies confirmation testing by GC/MS, identifying and quantifying specific metabolites with high reliability for toxicology screens and reporting results with industry-accepted sensitivity according to current best practices.

Segmentation:

By Product Segment:

- Accessories & Consumables

- Fittings and tubing

- Auto-sampler accessories

- Flow management and pressure regulator accessories

- Others

- Instruments

- Systems

- Auto-samplers

- Fraction collectors

- Detectors

- Reagents

- Analytical gas chromatography reagents

- Bioprocess gas chromatography reagents

- Others

By End-User Segment:

- Hospital & Clinical Laboratories

- Diagnostic Reference Laboratories

- Academic & Research Institutions

- Pharmaceutical & Biotech Companies

By Region Segment:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America Regional Analysis

The North America Global Gas Chromatography in Medical Applications Market size was valued at USD 301.79 million in 2018 to USD 358.72 million in 2024 and is anticipated to reach USD 489.32 million by 2032, at a CAGR of 4.0% during the forecast period. North America holds the largest market share of 21%, driven by its advanced healthcare systems and early adoption of cutting-edge diagnostic technologies. The United States dominates due to significant investments in medical research and strong regulatory frameworks supporting accurate testing methods. Hospitals and laboratories in the region heavily rely on gas chromatography for precision diagnostics, toxicology, and pharmaceutical testing. Canada contributes with its growing healthcare research sector, while Mexico is expanding through government-led healthcare initiatives. The presence of leading global companies also strengthens market performance. It continues to expand with technological upgrades and strong research collaborations across healthcare institutions.

Europe Regional Analysis

The Europe Global Gas Chromatography in Medical Applications Market size was valued at USD 371.84 million in 2018 to USD 457.27 million in 2024 and is anticipated to reach USD 654.30 million by 2032, at a CAGR of 4.7% during the forecast period. Europe accounts for 27% of the global share, with Germany, the UK, and France leading the region’s growth. Strong pharmaceutical industries, advanced healthcare systems, and a focus on quality control in drug development drive adoption. Gas chromatography is widely used in academic and clinical research centers across the region. Europe benefits from strict regulatory environments that emphasize accurate testing standards, creating demand for advanced systems. Expanding research in metabolomics and proteomics adds further growth opportunities. Southern and Eastern Europe are emerging as promising contributors with increasing healthcare investments. It continues to strengthen due to innovation-driven healthcare strategies and high demand for non-invasive diagnostics.

Asia Pacific Regional Analysis

The Asia Pacific Global Gas Chromatography in Medical Applications Market size was valued at USD 479.31 million in 2018 to USD 601.58 million in 2024 and is anticipated to reach USD 884.24 million by 2032, at a CAGR of 5.0% during the forecast period. Asia Pacific commands the largest share globally at 36%, making it the dominant region. China, Japan, and India drive demand with expanding healthcare infrastructure and rising investments in biotechnology and diagnostics. The region’s pharmaceutical sector continues to grow rapidly, adopting gas chromatography for drug development and quality assurance. Government initiatives to modernize healthcare services further accelerate market expansion. Universities and research institutes are strengthening their focus on advanced diagnostics, fueling adoption in academic settings. Southeast Asia also presents growth potential with increasing healthcare spending. It is the fastest-growing region, supported by innovation, cost-effective healthcare models, and a rising patient base requiring accurate diagnostics.

Latin America Regional Analysis

The Latin America Global Gas Chromatography in Medical Applications Market size was valued at USD 107.74 million in 2018 to USD 134.73 million in 2024 and is anticipated to reach USD 197.09 million by 2032, at a CAGR of 4.9% during the forecast period. Latin America represents 8% of the global market share, with Brazil and Mexico as primary contributors. The region is experiencing growth due to expanding healthcare infrastructure and a rising demand for advanced diagnostic technologies. Pharmaceutical companies in the region increasingly adopt gas chromatography for testing and research. Hospitals and laboratories are upgrading capabilities to improve accuracy in clinical diagnostics. Government healthcare initiatives are improving accessibility to advanced medical tools across urban and semi-urban areas. Argentina and other countries are gradually emerging as contributors to research-focused demand. It continues to expand with increasing pharmaceutical R&D and strengthening diagnostic standards across the region.

Middle East Regional Analysis

The Middle East Global Gas Chromatography in Medical Applications Market size was valued at USD 59.26 million in 2018 to USD 78.12 million in 2024 and is anticipated to reach USD 121.91 million by 2032, at a CAGR of 5.8% during the forecast period. The region holds 5% of the global share, with Saudi Arabia, UAE, and Qatar emerging as major hubs. Significant government investments in healthcare modernization fuel demand for gas chromatography systems. Hospitals and diagnostic centers in the Gulf Cooperation Council countries are adopting advanced tools to improve accuracy and efficiency. Research collaborations with global institutions also enhance adoption. Israel adds momentum with strong research and innovation in biotechnology. Turkey demonstrates steady growth with investments in medical infrastructure. It benefits from the rising prevalence of chronic diseases and the focus on advanced diagnostic technologies.

Africa Regional Analysis

The Africa Global Gas Chromatography in Medical Applications Market size was valued at USD 45.61 million in 2018 to USD 57.91 million in 2024 and is anticipated to reach USD 86.38 million by 2032, at a CAGR of 5.2% during the forecast period. Africa accounts for 3% of the global share, with South Africa and Egypt leading the regional market. Growing healthcare investments and rising demand for reliable diagnostic tools fuel adoption. Hospitals and laboratories are integrating gas chromatography to strengthen testing capabilities. The need to tackle communicable and non-communicable diseases drives demand for advanced diagnostics. Governments are focusing on improving access to modern healthcare technology, especially in urban centers. Research institutions in South Africa contribute through academic studies and pharmaceutical projects. It continues to expand as diagnostic awareness increases and international collaborations enhance access to advanced systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- GE Healthcare

- Shimadzu Corporation

- Thermo Fisher Scientific, Inc.

- Agilent Technologies

- Bio-Rad Laboratories, Inc.

- PerkinElmer, Inc.

- Restek Corporation

- Waters Corporation

- Other Key Players

Competitive Analysis:

The Global Gas Chromatography in Medical Applications Market is highly competitive, with several key players driving technological advancements and market growth. Companies like GE Healthcare, Shimadzu Corporation, Thermo Fisher Scientific, and Agilent Technologies are major contributors, offering a range of gas chromatography instruments and consumables. These players focus on enhancing product performance through innovations in automation, sensitivity, and integration with digital technologies. Strategic developments such as mergers, acquisitions, and new product launches are commonly used to expand market share and improve technological capabilities. Key market players are also exploring regional expansion to capitalize on emerging healthcare markets, particularly in Asia Pacific and Latin America. The competition is intensified by continuous efforts to develop more efficient and cost-effective solutions tailored to the specific needs of the medical sector. Players that offer advanced systems with improved efficiency and precision are likely to maintain a strong position in the market.

Recent Developments:

- In May 2025, Agilent Technologies announced the enhanced 8850 Gas Chromatograph, now compatible with both single and triple quadrupole mass spectrometry systems. This benchtop instrument is one of the fastest and smallest GC/MS systems available, designed for high-throughput labs requiring precision and space-saving solutions.

- In March 2025, Shimadzu Corporation debuted a full new lineup of compact gas chromatography systems at Pittcon 2025. The expanded Brevis GC-2050 model now includes a newly developed thermal conductivity detector, offering high-sensitivity analysis for inorganic gases and hydrocarbons, and the GI-30 Auto Gas Selector for automated sample handling.

- In January 2025, Shimadzu Corporation launched seven new Brevis GC-2050 systems targeted at green transformation and medical analysis fields. These systems integrate thermal conductivity and pretreatment devices, offering efficient solutions for laboratories focused on environmental, clinical, and pharmaceutical applications.

Report Coverage:

The research report offers an in-depth analysis based on product and end-user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Gas Chromatography in Medical Applications Market will continue to expand as medical diagnostics demand precision and efficiency.

- Increasing healthcare investments across emerging economies will drive regional growth, particularly in Asia Pacific and Latin America.

- Technological advancements, such as automation and integration with AI, will enhance system performance and reliability.

- Rising focus on personalized medicine will further fuel the demand for gas chromatography in medical applications.

- Non-invasive diagnostic methods using gas chromatography will gain momentum, improving patient comfort and diagnostic accuracy.

- The growing emphasis on compliance with regulatory standards will increase the adoption of advanced chromatographic systems.

- Market players will prioritize research and development to create cost-effective solutions tailored to diverse healthcare needs.

- The rising prevalence of chronic diseases will increase the need for reliable diagnostic systems like gas chromatography.

- Regional players in emerging markets will drive competition, providing affordable and efficient solutions for local needs.

- The market will see continued collaboration between healthcare providers and technology companies to develop next-generation diagnostic tools.