Market Overview

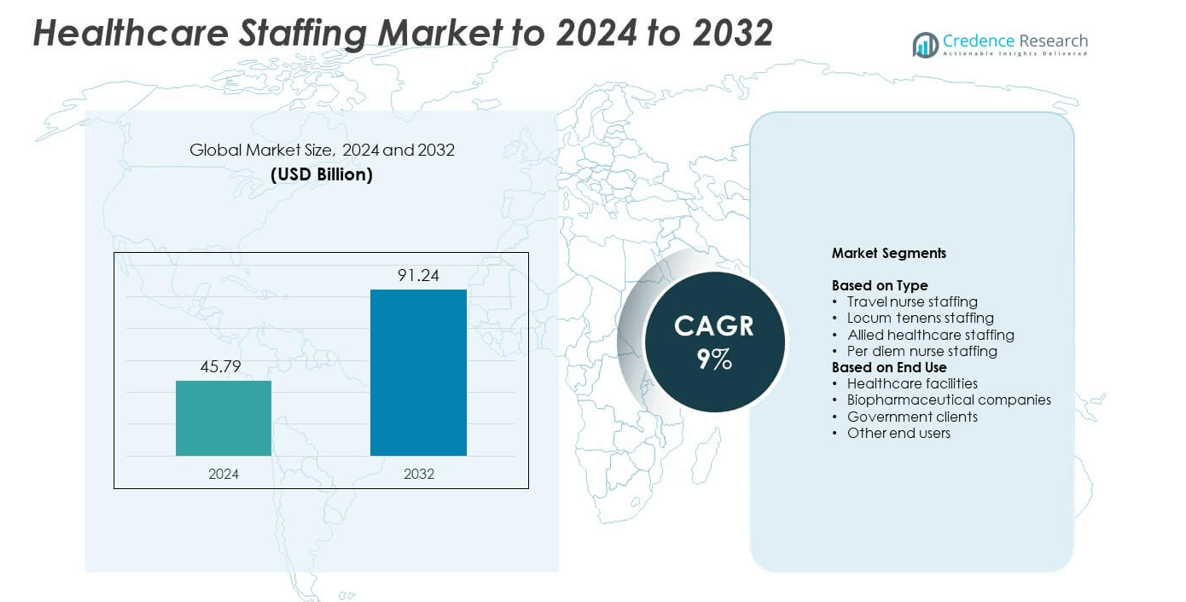

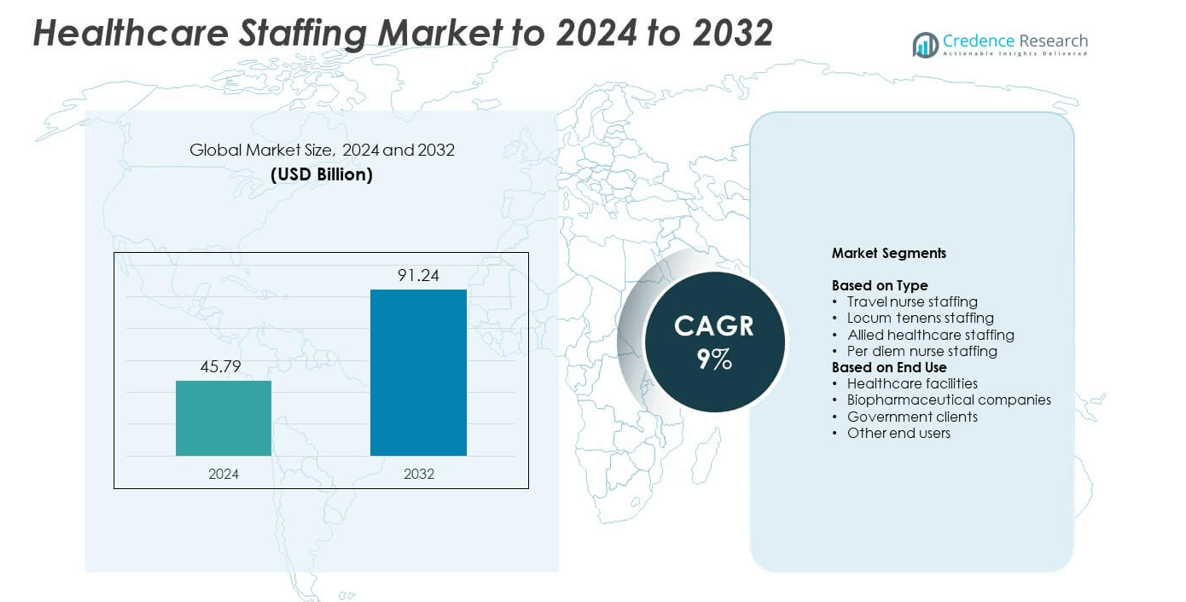

The Healthcare Staffing Market size was valued at USD 45.79 billion in 2024 and is anticipated to reach USD 91.24 billion by 2032, at a CAGR of 9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Healthcare Staffing Market Size 2024 |

USD 45.79 billion |

| Healthcare Staffing Market, CAGR |

9% |

| Healthcare Staffing Market Size 2032 |

USD 91.24 billion |

AMN Healthcare, Cross Country Healthcare, Maxim Healthcare, Aya Healthcare, TeamHealth, Adecco Group, Jackson Healthcare, Healthtrust Workforce Solutions, CHG Management, Medical Solutions, Trustaff, Envision Healthcare, LocumTenens, Medicus Healthcare Solutions, Aurus Medical, and IMN Enterprises are key players driving the Healthcare Staffing Market. These companies focus on offering travel nurse, locum tenens, allied health, and per diem staffing solutions, leveraging digital recruitment platforms and AI-enabled workforce management tools. Strategic partnerships with hospitals, clinics, and government health programs strengthen their market presence. North America leads the market with a 40% share, supported by well-established healthcare infrastructure and persistent workforce shortages. Europe and Asia Pacific follow with 28% and 22% shares, respectively, benefiting from healthcare reforms, digital staffing adoption, and growing demand for specialized medical professionals. Latin America and the Middle East & Africa account for 6% and 4%, reflecting expanding healthcare facilities and workforce mobilization efforts.

Market Insights

- The Healthcare Staffing Market was valued at USD 45.79 billion in 2024 and is projected to reach USD 91.24 billion by 2032, growing at a CAGR of 9%.

- Rising shortages of healthcare professionals, increasing chronic disease prevalence, and aging populations are driving demand for flexible staffing solutions.

- Growing adoption of digital staffing platforms, AI-enabled workforce management, and telehealth-ready professionals are shaping market trends across hospitals and clinics.

- The market is highly competitive, led by AMN Healthcare, Cross Country Healthcare, Maxim Healthcare, Aya Healthcare, and TeamHealth, focusing on service diversification, partnerships, and technology integration.

- North America leads with a 40% market share, followed by Europe at 28%, Asia Pacific at 22%, Latin America at 6%, and the Middle East & Africa at 4%, reflecting regional healthcare infrastructure, workforce availability, and reliance on contract-based staffing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Travel nurse staffing dominated the Healthcare Staffing Market in 2024 with a 42% share. The segment leads due to high demand for flexible nursing professionals to address staffing shortages and seasonal surges in hospitals. Increasing patient volumes and the need for specialized nurses in intensive care, surgery, and emergency units support segment growth. Digital staffing platforms that match nurses with short-term assignments are enhancing deployment efficiency. The continued expansion of healthcare networks and post-pandemic recovery efforts further strengthen the demand for travel nurse staffing across major healthcare systems.

- For instance, Aya Healthcare helped a health system hire 965 nurses in nine months. Time-to-fill fell from 210 days to 15.5 days.

By End Use

Healthcare facilities held the largest share of 61% in 2024, making them the primary end users of healthcare staffing services. Hospitals, clinics, and long-term care centers rely on staffing agencies to manage workforce gaps caused by rising patient admissions and staff turnover. Growing healthcare expenditure and the expansion of private hospital networks drive demand for skilled professionals. Biopharmaceutical companies and government health departments are also adopting staffing services for research and public health programs. The push toward operational efficiency and quality care continues to boost adoption among healthcare facilities.

- For instance, TeamHealth supports over 2,500 acute care hospitals and post-acute facilities with its network of more than 19,000 affiliated clinicians.

Key Growth Drivers

Rising Healthcare Workforce Shortages

Growing global shortages of healthcare professionals remain a major growth driver for the healthcare staffing market. Aging populations and increasing patient admissions have intensified demand for nurses, physicians, and allied health workers. Hospitals and clinics face challenges maintaining adequate staff levels, especially in rural and specialized care areas. Staffing agencies bridge this gap by providing skilled professionals on flexible contracts. The trend toward contract-based healthcare employment is expected to strengthen as medical facilities continue addressing persistent workforce imbalances.

- For instance, CHG Healthcare estimates that about 52,000 physicians work locum tenens assignments in the U.S. each year, reporting that its brands place a significant percentage of those providers and that it facilitates care for over 25 million patients annually.

Expanding Geriatric Population and Chronic Diseases

The expanding elderly population and the growing prevalence of chronic diseases are fueling healthcare service demand. Aging individuals require frequent medical attention, rehabilitation, and long-term care, creating consistent demand for nurses and caregivers. Rising cases of cardiovascular disorders, diabetes, and respiratory illnesses also drive staffing needs across hospitals and homecare settings. Healthcare providers increasingly depend on external staffing solutions to ensure uninterrupted patient services, strengthening the role of specialized staffing agencies in chronic and elder care management.

- For instance, Teladoc Health reported 93.8 million U.S. Integrated Care members at 2024 year-end.

Adoption of Digital Staffing Platforms

The rapid adoption of digital staffing platforms is transforming workforce management in healthcare. AI-driven tools and cloud-based recruitment systems streamline candidate matching, credential verification, and scheduling processes. These platforms enhance operational efficiency while reducing recruitment time for healthcare providers. Virtual hiring systems also enable agencies to connect talent across regions, addressing geographical skill shortages. As hospitals and clinics accelerate digital transformation, the integration of automated staffing solutions is becoming a key driver supporting market scalability and workforce flexibility.

Key Trends and Opportunities

Growing Demand for Allied Health Professionals

The demand for allied healthcare professionals such as therapists, laboratory technicians, and diagnostic experts is rising sharply. This growth stems from increased investment in diagnostic and preventive healthcare services. Technological progress in imaging, pathology, and rehabilitation has expanded opportunities for specialized roles. Staffing agencies are diversifying service portfolios to include allied roles beyond traditional nursing. As healthcare systems prioritize early diagnosis and personalized treatment, demand for allied professionals will continue to create new placement opportunities in both hospitals and outpatient facilities.

- For instance, Jackson Healthcare engages more than 20,000 clinician providers serving over 20 million patients each year.

Integration of Telehealth and Remote Care Staffing

The integration of telehealth and remote care models presents major opportunities for healthcare staffing. Virtual consultations and digital monitoring require licensed practitioners available for online platforms. Staffing firms are now offering telemedicine-ready professionals to meet this growing demand. This model expands access to healthcare services in underserved regions while improving cost efficiency for hospitals. As telemedicine regulations stabilize and technology adoption widens, remote staffing services are expected to gain stronger traction across both public and private healthcare sectors.

- For instance, Amwell Medical Group provides about 2,300 active providers and covers 80 million members.

Key Challenges

High Turnover and Burnout Among Healthcare Staff

High turnover rates and burnout remain critical challenges for the healthcare staffing industry. Prolonged working hours, emotional stress, and exposure to high-risk environments contribute to workforce fatigue. Hospitals face constant cycles of recruitment and replacement, raising operational costs. Agencies must address these issues through wellness programs and structured support initiatives to retain skilled staff. Without adequate retention measures, healthcare institutions may struggle to maintain service continuity and quality, particularly in critical care and emergency departments.

Regulatory Compliance and Licensing Barriers

Stringent regulatory requirements and varying licensing standards across regions hinder cross-border staffing operations. Healthcare professionals must meet country-specific or state-specific credentialing, which delays placement timelines. Agencies spend significant resources on verification and compliance processes, affecting scalability. Frequent policy changes in healthcare employment laws further complicate workforce mobility. To sustain growth, staffing providers need to invest in compliance management systems and establish partnerships with regulatory authorities to streamline credential approvals and reduce administrative bottlenecks.

Regional Analysis

North America

North America led the Healthcare Staffing Market in 2024 with a 40% share. The region’s dominance is supported by the strong presence of established staffing agencies, advanced healthcare infrastructure, and persistent nurse shortages. The United States experiences a high demand for travel nurses and locum tenens professionals to address hospital staffing gaps. Government initiatives to expand healthcare access further drive market growth. Canada’s aging population and growing reliance on contract-based healthcare workers also contribute to rising demand, strengthening North America’s leadership in healthcare staffing services.

Europe

Europe accounted for 28% of the Healthcare Staffing Market in 2024, driven by expanding healthcare coverage and workforce mobility across member states. The United Kingdom, Germany, and France are major markets due to hospital modernization and increasing demand for specialized medical professionals. The region’s aging workforce and healthcare reforms are encouraging hospitals to use temporary and contract-based staff. Digital staffing platforms and international recruitment from Eastern Europe further support market expansion. Europe’s emphasis on quality care standards continues to stimulate steady growth in healthcare staffing across public and private sectors.

Asia Pacific

Asia Pacific held a 22% share of the Healthcare Staffing Market in 2024, showing the fastest growth potential. Rising healthcare infrastructure investment, expanding medical tourism, and the growing shortage of skilled healthcare workers are key drivers. Countries like India, Japan, and Australia are investing heavily in training and digital workforce management. The demand for nurses, technicians, and allied professionals is rising in both urban and rural healthcare systems. Increased collaboration between hospitals and staffing firms enhances workforce availability, positioning Asia Pacific as a key emerging market in healthcare staffing.

Latin America

Latin America captured an 6% share of the Healthcare Staffing Market in 2024. The region’s market growth is supported by healthcare system modernization and public-private partnerships in countries such as Brazil, Mexico, and Argentina. Rising government investment in hospital infrastructure and growing demand for skilled nurses and specialists are driving staffing needs. Limited local talent availability has prompted healthcare facilities to rely on contract and international staffing agencies. The adoption of digital recruitment tools is gradually improving efficiency, fostering moderate but consistent expansion across Latin America’s healthcare staffing sector.

Middle East and Africa

The Middle East and Africa accounted for a 4% share of the Healthcare Staffing Market in 2024. The market is expanding with the rapid development of healthcare infrastructure in GCC countries and South Africa. Government-funded hospital projects and increasing foreign patient inflows are creating strong demand for skilled professionals. However, workforce shortages and regional licensing restrictions pose operational challenges. The reliance on expatriate healthcare professionals remains high, especially in specialized fields. Continuous investment in healthcare training programs and cross-border staffing partnerships supports gradual growth across the region.

Market Segmentations:

By Type

- Travel nurse staffing

- Locum tenens staffing

- Allied healthcare staffing

- Per diem nurse staffing

By End Use

- Healthcare facilities

- Biopharmaceutical companies

- Government clients

- Other end users

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

AMN Healthcare, Cross Country Healthcare, Maxim Healthcare, Aya Healthcare, TeamHealth, Adecco Group, Jackson Healthcare, Healthtrust Workforce Solutions, CHG Management, Medical Solutions, Trustaff, Envision Healthcare, LocumTenens, Medicus Healthcare Solutions, Aurus Medical, and IMN Enterprises are leading the competitive landscape in the Healthcare Staffing Market. These companies are focusing on expanding their service portfolios to include travel nurses, locum tenens, allied health professionals, and per diem staff. They are investing in digital recruitment platforms, AI-enabled workforce management, and credential verification systems to enhance operational efficiency. Strategic partnerships with hospitals, clinics, and government healthcare programs strengthen their market presence. Continuous innovation in staffing solutions, including remote and telehealth-ready professionals, enables rapid deployment across regions. The emphasis on workforce retention, training programs, and regulatory compliance further drives differentiation. Rising demand for flexible staffing and specialized clinical expertise continues to fuel competition, encouraging service quality improvements and adoption of advanced technology across the sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- AMN Healthcare

- Cross Country Healthcare

- Maxim Healthcare

- Aya Healthcare

- TeamHealth

- Adecco Group

- Jackson Healthcare

- Healthtrust Workforce Solutions

- CHG Management

- Medical Solutions

- Trustaff

- Envision Healthcare

- LocumTenens

- Medicus Healthcare Solutions

- Aurus Medical

- IMN Enterprises

Recent Developments

- In 2023, IMN Enterprises launches MedAdventures, a customized workforce and staffing solutions provider for healthcare and medical facilities.

- In 2023, Jackson Healthcare completed the acquisition of LRS Healthcare, a medical staffing firm specializing in nursing and allied health. This expanded its portfolio of staffing brands.

- In 2022, Maxim Healthcare Group announced it would separate its two business units into independently operated companies: Maxim Healthcare Services and Maxim Healthcare Staffing

Report Coverage

The research report offers an in-depth analysis based on Type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing adoption of AI-driven staffing platforms will streamline recruitment and workforce management processes.

- Demand for travel nurses and locum tenens professionals will continue to rise due to staffing shortages.

- Expansion of telehealth and virtual care models will create new opportunities for remote healthcare staffing.

- Increased investment in training programs will help reduce the global shortage of skilled medical professionals.

- Healthcare facilities will increasingly prefer flexible and contract-based staffing to manage cost efficiency.

- Rising aging population and chronic disease prevalence will sustain long-term demand for healthcare workers.

- Global collaborations between staffing agencies and healthcare providers will enhance cross-border workforce mobility.

- Automation and predictive analytics will optimize scheduling and improve staff utilization rates.

- Growing focus on employee well-being will drive retention and reduce burnout among healthcare professionals.

- Emerging markets in Asia Pacific and the Middle East will present strong expansion opportunities for staffing firms.