Market Overview

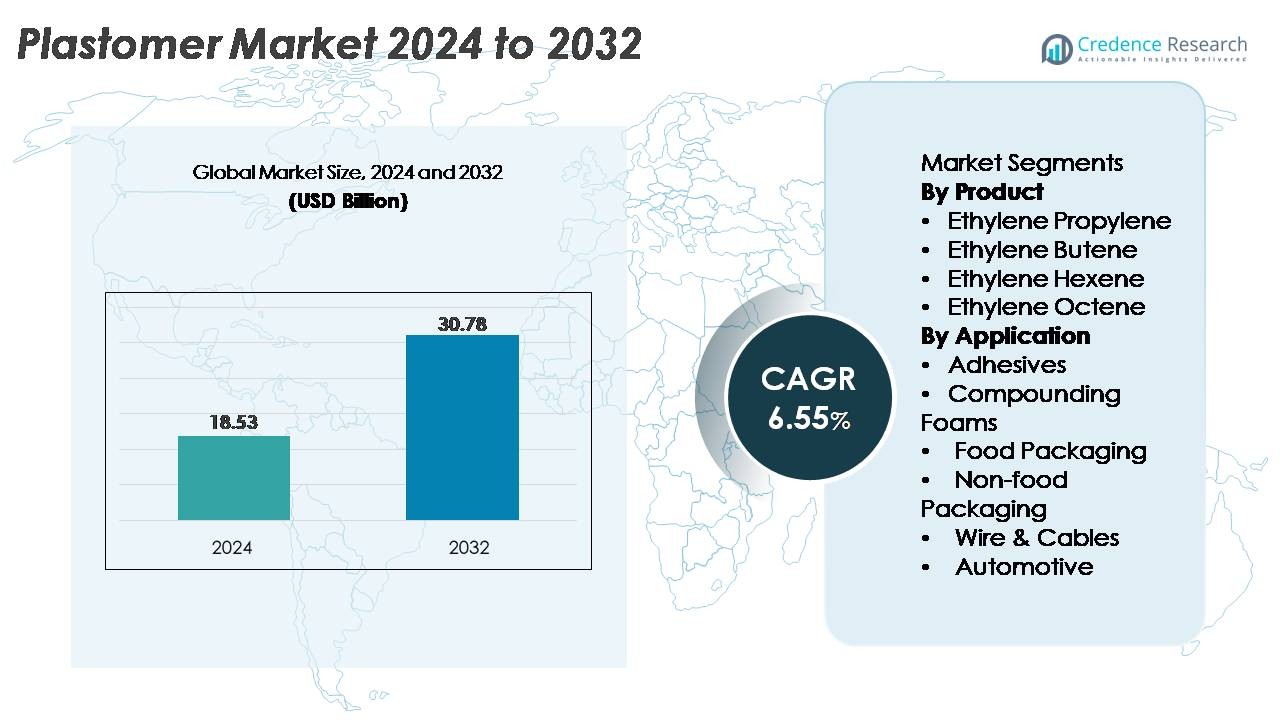

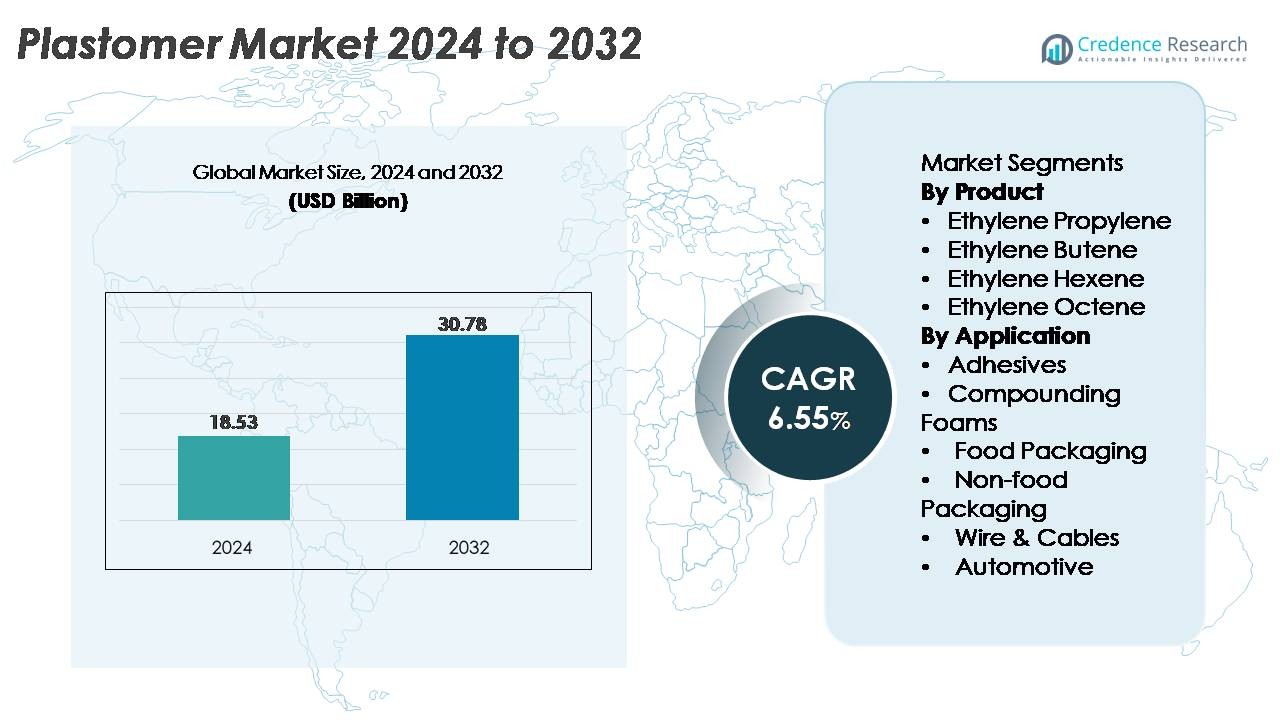

The global Plastomer Market was valued at USD 18.53 billion in 2024 and is projected to reach USD 30.78 billion by 2032, expanding at a CAGR of 6.55% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plastomer Market Size 2024 |

USD 18.53 Billion |

| Plastomer Market, CAGR |

6.55% |

| Plastomer Market Size 2032 |

USD 30.78 Billion |

The plastomer market is dominated by major global polyolefin producers including Chevron Phillips Chemical Company, LyondellBasell, Royal Dutch Shell, Dow Chemical Company, Westlake Chemical Corporation, ExxonMobil, Saudi Basic Industries Corporation (SABIC), and Borealis. These companies maintain strong leadership through integrated feedstock operations, advanced metallocene catalyst technologies, and extensive product portfolios serving high-performance packaging, adhesives, foams, and wire & cable applications. Regionally, Asia-Pacific leads the global market with a 38% share, driven by large-scale converting capacity, rapid industrialization, and expanding food and hygiene packaging demand. North America and Europe follow, supported by strong sustainability-driven adoption of recyclable PE-based film structures.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The global plastomer market was valued at USD 18.53 billion in 2024 and is projected to reach USD 30.78 billion by 2032, expanding at a CAGR of 6.55% during the forecast period.

- Demand is driven by the rapid adoption of plastomer-enhanced flexible packaging, hygiene films, and adhesive formulations, with ethylene octene emerging as the dominant product sub-segment due to its superior elasticity and sealing performance.

- Key trends include accelerated investments in recyclable mono-material PE packaging, metallocene catalyst-based resin advancement, and increased use of plastomers in wire & cable insulation, automotive components, and specialty foams.

- The competitive landscape remains consolidated, with leading players such as ExxonMobil, SABIC, Dow, LyondellBasell, and Borealis leveraging integrated feedstock capacities and high-performance PE portfolios, though volatility in ethylene and alpha-olefin pricing continues to restrain smaller converters.

- Regionally, Asia-Pacific leads with 38% share, followed by North America at 28% and Europe at 24%, reflecting strong packaging, industrial, and automotive demand across key manufacturing hubs.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product

Ethylene octene remains the dominant sub-segment in the plastomer market, supported by its superior elasticity, seal strength, and suitability for high-performance flexible packaging films. Its widespread use in hygiene films, stretch-hood applications, and advanced multilayer packaging structures strengthens its market leadership. Ethylene hexene and ethylene butene grades follow due to their balance of toughness and cost efficiency, particularly in compounding and extrusion. Meanwhile, ethylene propylene plastomers gain adoption in applications requiring improved clarity and softness. Overall, the segment benefits from rising production of metallocene-based polyethylene grades that enhance processing efficiency and material consistency.

- For instance, ExxonMobil’s metallocene-based Exact™ plastomers are produced at multiple global sites, including its Singapore Chemical Plant, which operates a large-scale steam cracker capable of generating 1.9 million tons per year of ethylene used to feed plastomer production.

By Application

Food packaging represents the largest application segment, driven by rapid adoption of plastomer-based films that offer enhanced puncture resistance, controlled tear properties, and excellent heat-seal performance. Brands increasingly rely on plastomer-modified PE structures to achieve downgauging without compromising barrier integrity, reinforcing its dominant share. Non-food packaging and hygiene films also see strong traction as manufacturers shift toward lightweight, recyclable materials. Growth in adhesives, compounding foams, and wire & cable jacketing further expands diversification, while automotive applications gain importance due to improved impact absorption and flexibility. Collectively, performance, sustainability, and processing advantages steer segment expansion.

- For instance, Dow’s AFFINITY™ GA plastomers are used in high-performance food packaging films and are supported by large-scale production at Dow’s Freeport, Texas complex, which operates an ethylene cracker with a nameplate capacity of 1.5 million metric tons per year, ensuring robust feedstock supply for plastomer manufacturing.

Key Growth Drivers

Expanding Demand for High-Performance Flexible Packaging

The rapid expansion of flexible packaging remains the strongest growth driver for the plastomer market, supported by rising global consumption of premium food, personal care, and hygiene products. Plastomers enhance film clarity, seal integrity, and puncture resistance, enabling brand owners to adopt downgauged structures without compromising strength or product shelf life. The shift toward lightweight, recyclable mono-material packaging accelerates the use of ethylene-octene and ethylene-hexene plastomers in multilayer structures. Converters prefer plastomers due to their processability in blown and cast film systems, improving throughput and film uniformity. Growth of e-commerce, demand for leak-proof pouches, and expansion of cold-chain food distribution reinforce the adoption of plastomer-modified polyethylene. Additionally, rising consumer preference for resealable, tamper-evident, and barrier-enhanced packaging formats further strengthens long-term usage across North America, Europe, and Asia-Pacific manufacturing hubs.

- For instance, ExxonMobil’s proprietary Exceed™ XP performance PE grades are produced at its Singapore Chemical Plant, which operates a fully integrated petrochemical complex capable of generating 1.9 million metric tons of ethylene per year, supplying feedstock for high-performance packaging resins used globally.

Increasing Adoption in Adhesives, Foams, and Polymer Modification

Plastomers are seeing accelerated demand as key performance enhancers in hot-melt adhesives, polyolefin foams, impact modifiers, and elastomer-blended compounds. In adhesive formulations, plastomers improve flexibility, cohesive strength, and low-temperature bonding, making them suitable for hygiene products, woodworking, and industrial lamination. Their compatibility with polyethylene and polypropylene enables material engineers to achieve softer, more elastic polymer blends used in footwear midsoles, cushioning foams, and specialty molded components. Automotive and consumer goods sectors are adopting plastomer-modified resins to improve impact resistance and tactile feel while maintaining lightweight characteristics. The trend toward low-VOC, solvent-free adhesive technologies and high-efficiency compounding lines supports broader adoption. Packaging converters also use plastomers as sealing-layer modifiers to achieve consistent performance on high-speed filling lines. This wide applicability positions plastomers as strategic materials across diversified manufacturing ecosystems.

- For instance, Dow’s AFFINITY™ GA plastomers are produced using the company’s proprietary INSITE™ catalyst technology. This production is supported by Dow’s Plaquemine, Louisiana complex, which operates an ethylene cracker with a capacity of approximately 1.5 million metric tons per year across its units, supplying critical feedstock for high-performance adhesive and polymer-modification resins.

Growth in Cable Insulation, Automotive Components, and Technical Applications

Demand for plastomers is rising steadily in wire & cable insulation, automotive interiors, and extrusion-molded technical parts due to their durability, thermal stability, and superior flexibility. In cable jacketing, plastomers provide improved crack resistance, low-temperature toughness, and smooth surface finish, supporting telecom expansion and renewable energy grid upgrades. Automotive manufacturers use plastomer-based compounds in dashboards, weather seals, soft-touch interior trims, and lightweight impact components to meet safety, fuel efficiency, and sustainability goals. With increasing EV production, plastomers enable flexible wire harnesses that withstand dynamic vibration and bending cycles. Their compatibility with polyolefins also simplifies recycling, aligning with OEM sustainability mandates. Construction, industrial roofing membranes, and protective films further broaden the application base. These performance drivers reinforce long-term penetration into engineering-grade material segments.

Key Trends & Opportunities

Strong Shift Toward Sustainable, Recyclable, and Mono-Material Packaging Systems

A major market trend involves the shift to recyclable mono-material packaging aligned with global sustainability mandates. Plastomer-modified polyethylene structures enable the replacement of multi-material laminates traditionally made with PET, PA, or aluminum, improving recyclability while maintaining high mechanical performance. Packaging manufacturers increasingly adopt plastomers in PE-PE or PE-EVOH structures to meet circular economy targets set by FMCG companies and regulatory bodies. Opportunities are expanding for suppliers offering grades with lower melting points, improved barrier compatibility, and enhanced sealability for recyclable pouches and films. The growth of chemical recycling infrastructure further accelerates the adoption of compatible materials such as plastomers, which integrate efficiently into polyolefin recycling streams. Innovations in downgauged films, compostable-ready blends, and clear, high-strength food packaging create new value pools for material developers across all regions.

- For instance, LyondellBasell’s MoReTec™ advanced recycling technology was first tested at its pilot plant in Ferrara, Italy, which is capable of processing between 5 and 10 kilograms of household plastic waste per hour.

Rising Penetration of Advanced Catalyst Technologies and High-Purity Feedstock Innovations

Metallocene catalyst technology continues to reshape plastomer manufacturing, enabling precise control over comonomer distribution, molecular weight uniformity, and branching. This evolution supports the production of plastomers with higher clarity, elasticity, and sealing performance tailored to next-generation applications. Producers are investing in high-purity alpha-olefin feedstocks and advanced reactor configurations to expand product portfolios with improved durability, odor-performance, and film processability. These advancements create opportunities for application developers to engineer tailored solutions in hygiene films, industrial stretch hoods, breathable membranes, and thermoformed packaging. As global capacity expansions emerge—particularly in the Middle East, China, and the U.S.—manufacturers can secure cost-advantaged supply chains and support innovation-driven growth. This technology-led trend is unlocking new product differentiation avenues for both converters and brand owners.

- For instance, ExxonMobil’s Baytown, Texas petrochemical complex operates one of the world’s largest metallocene-enabled polyethylene units, supported by an ethylene cracker with a capacity of 1.5 million metric tons per year, providing high-purity feedstocks essential for advanced plastomer and specialty PE manufacturing.

Key Challenges

Volatility in Feedstock Prices and Supply Chain Disruptions

The plastomer market faces structural challenges due to dependence on ethylene and alpha-olefin feedstocks, which are highly sensitive to crude oil fluctuations, geopolitical tensions, and refinery operating rates. Supply disruptions in butene, hexene, and octene comonomers directly affect production stability and contract pricing for plastomer manufacturers. The increasing frequency of planned and unplanned petrochemical shutdowns, alongside logistics bottlenecks for bulk chemical transport, contributes to uncertainty in lead times and procurement planning. Converters relying on plastomers for high-speed packaging, adhesives, and compounding applications often face margin pressures when feedstock costs spike. The lack of backward integration among smaller players further magnifies vulnerability. These dynamics compel end users to optimize formulations, explore alternative materials, and negotiate long-term supply contracts to mitigate cost volatility.

Performance Competition from Conventional Polyolefins and Elastomers

Despite strong growth potential, plastomers face intense competition from newer high-performance PE, PP elastomers, and cost-effective ethylene-vinyl acetate (EVA) grades that offer comparable flexibility and sealing properties. Some converters prefer metallocene LLDPE or elastomer-PP blends when price sensitivity outweighs performance advantages. Additionally, advancements in elastomer modification technologies allow conventional materials to bridge performance gaps previously dominated by plastomers. Regulatory complexities around food-contact compliance also slow adoption for certain grades. Converters in emerging markets may limit usage due to higher material costs, reinforcing competition from locally available alternatives. These pressures require plastomer producers to innovate continuously, optimize catalyst technologies, and expand application-specific grades with differentiated performance attributes.

Regional Analysis:

North America

North America holds approximately 28% of the global plastomer market, driven by strong demand for advanced packaging, hygiene films, and wire & cable insulation. The U.S. leads consumption due to its mature flexible packaging sector, robust e-commerce logistics, and widespread adoption of metallocene-based polyethylene in food and non-food applications. Rising investments in lightweight automotive components and the expansion of telecom infrastructure further support regional consumption. Major chemical producers with integrated ethylene capacities strengthen supply stability, enabling consistent adoption across converters and compounders. Sustainability commitments from FMCG and retail brands accelerate the shift toward recyclable mono-material packaging formats.

Europe

Europe accounts for roughly 24% of the global plastomer market, supported by stringent sustainability regulations and rapid transition toward recyclable PE-based packaging structures. Demand is primarily driven by food packaging, medical films, and industrial stretch-hood applications. Germany, Italy, and the U.K. remain key consumption hubs due to their advanced converting infrastructure and strong adoption of metallocene catalyst-based materials. The region’s focus on circular economy targets encourages substitution of multi-material laminates with plastomer-modified mono-material systems. Automotive lightweighting initiatives also contribute to higher demand for plastomer-enhanced foams, adhesives, and impact-resistant compounds across Tier-1 manufacturing clusters.

Asia-Pacific

Asia-Pacific dominates the plastomer market with an estimated 38% share, propelled by rapid industrialization, expanding flexible packaging production, and large-scale polymer capacity additions in China, South Korea, and India. The region benefits from high consumption of food packaging films, hygiene products, and automotive components, supporting significant downstream demand for plastomers. China leads the market due to its extensive converting base and strong adoption of PE-PE recyclable structures. Southeast Asia contributes additional growth through export-oriented packaging manufacturing. Rising telecom investments and construction activity further increase plastomer usage in wire & cable insulation, roofing membranes, and specialty extrusion applications.

Latin America

Latin America represents approximately 6% of the global plastomer market, with growth centered in Brazil, Mexico, and Chile. Demand is primarily supported by the food and beverage packaging industry, which increasingly adopts plastomer-modified polyethylene films for enhanced seal strength and downgauging. Regional hygiene product manufacturing also contributes to sustained consumption. Infrastructure upgrades and expansion of telecom networks drive additional demand in wire & cable jacketing applications. However, dependence on imported plastomer grades and fluctuations in ethylene supply occasionally affect availability and pricing. Despite these constraints, sustainability-driven packaging transitions continue to open new opportunities in the region.

Middle East & Africa

The Middle East & Africa region accounts for nearly 4% of the global plastomer market, supported by increasing investments in packaging manufacturing, construction activity, and polymer processing capacity. The Middle East benefits from cost-advantaged ethylene feedstocks and large petrochemical complexes, enabling improved regional availability of plastomer grades. Adoption is growing in PE film manufacturing for food packaging, agricultural films, and industrial liners. In Africa, rising urbanization and the expansion of FMCG distribution networks increase demand for durable, lightweight packaging formats. Infrastructure development and electrification initiatives further promote usage in wire & cable insulation and extrusion-molded components.

Market Segmentations:

By Product

- Ethylene Propylene

- Ethylene Butene

- Ethylene Hexene

- Ethylene Octene

By Application

- Adhesives

- Compounding Foams

- Food Packaging

- Non-food Packaging

- Wire & Cables

- Automotive

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the plastomer market is shaped by a concentrated group of global polyolefin producers with strong integration across ethylene, alpha-olefin comonomers, and advanced catalyst technologies. Market leaders such as ExxonMobil, Dow, Borealis, SABIC, Mitsui Chemicals, and LyondellBasell maintain a competitive edge through large-scale metallocene PE production capacities, consistent resin quality, and broad application-focused product portfolios. These companies prioritize high-performance grades tailored for flexible packaging, hygiene films, wire & cable insulation, impact modifiers, and adhesives. Continuous investment in reactor debottlenecking, feedstock efficiency, and R&D accelerates innovation in downgauged, recyclable, and mono-material packaging solutions. Partnerships with converters and brand owners further strengthen market positioning by enabling customized film formulations that align with sustainability goals. Regional players in Asia and the Middle East are expanding aggressively, increasing global competition through cost-advantaged supply chains and expanded plastomer production footprints.

Key Player Analysis:

- Chevron Phillips Chemical Company

- LyondellBasell

- Royal Dutch Shell

- Dow Chemical Company

- Westlake Chemical Corporation

- ExxonMobil

- Saudi Basic Industries Corporation (SABIC)

- Borealis

Recent Developments:

- In October 2024, CPChem invested in a circular-plastic process technology, joining other investors to support the commercialization of advanced recycling solutions through partnership with Alterra.

- In August 2022: SABIC revealed plans to increase the production capacity of its NEXLENE plant in Ulsan, South Korea, through its joint venture, SABIC SK NEXLENE Company. This expansion is expected to be completed by the second quarter of 2024 and is aimed at addressing the rising demand for advanced polyolefin materials, including SUPEER mLLDPE, COHERE metallocene polyolefin plastomers (POP), and FORTIFY POE. The expansion responds to the growing requirement for NEXLENE-based solutions in high-end sectors such as photovoltaics, new mobility, footwear, and advanced packaging.

- IN 2023, LyondellBasell is listed among dominant players in recent industry-wide assessments of the plastomer market along with CPChem and ExxonMobil — highlighting its ongoing significant role in supplying plastomer and polyolefin resins.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Product , Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for plastomer-modified mono-material packaging films will accelerate as global brands intensify commitments to recyclable PE structures.

- Adoption of metallocene-based plastomer grades will rise due to improved sealing, clarity, and downgauging performance across flexible packaging.

- Use of plastomers in hot-melt adhesives, hygiene products, and elastic films will expand as manufacturers shift toward low-VOC and high-efficiency formulations.

- Automotive applications will grow as OEMs prioritize lightweight, flexible, and impact-resistant polyolefin components.

- Wire & cable insulation demand will strengthen with continued telecom expansion and grid modernization projects.

- Emerging economies in Asia and the Middle East will add new production capacities, increasing global supply competitiveness.

- Technological innovation in reactor design and catalyst systems will enable more tailored plastomer grades for specialized applications.

- Mechanical and chemical recycling integration will enhance compatibility of plastomers in circular polyolefin systems.

- Converters will increasingly use plastomers to achieve downgauged, high-strength films for e-commerce and cold-chain logistics.

- Sustainability regulations across Europe and North America will accelerate replacement of multi-material laminates with plastomer-enhanced alternatives.

Market Segmentation Analysis:

Market Segmentation Analysis: