Market Overview:

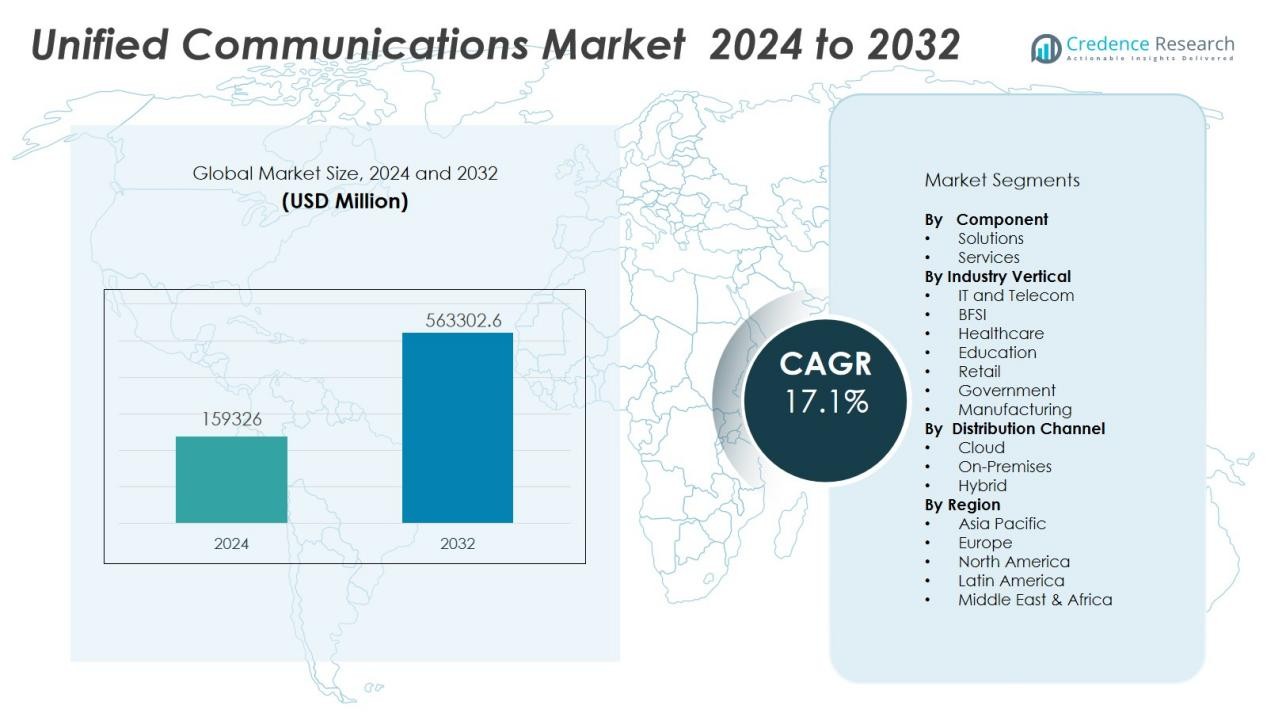

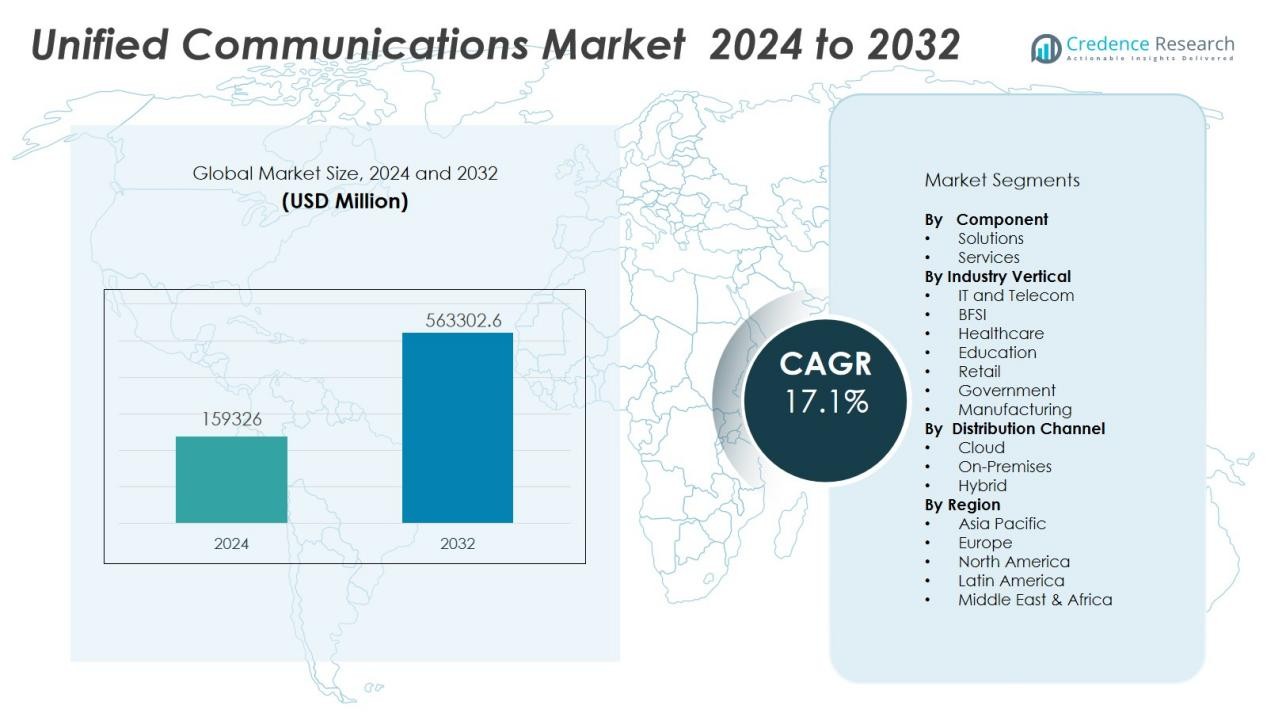

The Unified communications market size was valued at USD 159326 million in 2024 and is anticipated to reach USD 563302.6 million by 2032, at a CAGR of 17.1 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Unified Communications Market Size 2024 |

USD 159326 Million |

| Unified Communications Market, CAGR |

17.1 % |

| Unified Communications Market Size 2032 |

USD 563302.6 Million |

Key drivers include the surge in remote and hybrid work models, increasing reliance on cloud-based services, and growing adoption of video conferencing, VoIP, and team messaging platforms. Enterprises across sectors prioritize solutions that enable secure, real-time communication and collaboration, fueling innovation in AI-powered features, enhanced mobility, and device interoperability. The need for scalable, flexible communication infrastructure also prompts organizations to invest in unified communications as a service (UCaaS) to support dynamic business environments.

Regionally, North America dominates the unified communications market, driven by early technology adoption, strong enterprise IT investment, and widespread cloud infrastructure. Europe follows, supported by stringent data protection regulations and the push for digital workplace modernization. The Asia-Pacific region exhibits the fastest growth, with expanding digital ecosystems, increasing mobile penetration, and rapid enterprise adoption in countries such as China, India, and Japan.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Unified communications market reached USD 159,326 million in 2024 and is set to surpass USD 563,302.6 million by 2032.

- Rising remote and hybrid work trends drive enterprise demand for secure, real-time communication and collaboration tools.

- Cloud-based platforms gain momentum for their scalability, flexibility, and cost efficiency across global organizations.

- AI-powered features such as transcription, smart scheduling, and real-time translation fuel platform innovation.

- Security, compliance, and data privacy remain critical as enterprises navigate regulatory challenges and cyber threats.

- North America leads with 38% share, followed by Europe at 31% and Asia-Pacific at 22%, each with unique adoption drivers.

- Integration complexities and legacy system constraints present ongoing challenges to seamless unified communications deployment.

Market Drivers:

Rising Demand for Remote and Hybrid Work Solutions Across Industries:

The Unified communications market experiences significant growth due to the global shift toward remote and hybrid work models. Organizations in sectors such as IT, finance, healthcare, and education require seamless communication platforms to connect distributed teams and support flexible work arrangements. Unified communications solutions integrate messaging, voice, video, and collaboration tools, enabling real-time interaction regardless of location. Businesses prioritize these platforms to maintain operational efficiency and employee engagement in dynamic workplace environments.

- For instance, Cisco Webex Calling now facilitates over 8 billion cloud-based business calls monthly and is trusted by more than 39 million end-users globally, underscoring its extensive adoption for hybrid work solutions in organizations such as T-Mobile, Office Depot, and Cigna Health.

Accelerating Adoption of Cloud-Based Communication Platforms:

Cloud-based unified communications solutions have gained strong traction among enterprises seeking scalability, flexibility, and simplified management. These platforms eliminate the need for complex on-premise infrastructure, reducing costs and enabling rapid deployment. Organizations leverage the cloud to support business continuity and facilitate secure access to communication tools from any device. The Unified communications market benefits from the trend toward digital transformation and the growing reliance on cloud services across all business functions.

- For instance, Microsoft Teams reached 320 million monthly active users in early 2024, making it the most widely adopted business communication service globally and highlighting its integral role in digital transformation initiatives for enterprises.

Integration of Artificial Intelligence and Advanced Analytics:

The integration of artificial intelligence (AI) and advanced analytics into unified communications platforms drives innovation and enhances user experience. AI-powered features such as automated transcription, intelligent meeting scheduling, and real-time language translation optimize productivity and collaboration. Organizations deploy analytics to gain insights into communication patterns and user engagement, supporting data-driven decision-making. It helps businesses tailor communication strategies and improve service delivery.

Heightened Focus on Security, Compliance, and Data Privacy:

Regulatory requirements and the need to protect sensitive information drive investments in secure unified communications solutions. Enterprises seek platforms that offer robust encryption, multi-factor authentication, and advanced threat detection to address rising cybersecurity risks. Compliance with data protection standards such as GDPR and HIPAA remains a top priority for organizations in regulated industries. The Unified communications market responds with solutions that ensure secure collaboration while meeting evolving legal and industry standards.

Market Trends:

Growing Integration of Collaboration Tools and Expansion of Unified Communications as a Service (UCaaS):

Unified communications market participants are rapidly enhancing their platforms by integrating advanced collaboration tools, including project management, document sharing, and workflow automation features. Organizations demand solutions that support unified messaging, voice, video, and content sharing within a single interface. It enables streamlined communication, boosts team productivity, and reduces the complexity associated with multiple standalone applications. The expansion of Unified Communications as a Service (UCaaS) fuels market growth, offering businesses subscription-based models that lower upfront costs and simplify IT management. Enterprises prefer UCaaS for its scalability, automatic updates, and seamless integration with existing business applications. Market leaders continually invest in improving cloud performance and user experience to maintain a competitive edge.

- For instance, Microsoft launched a new version of its Teams platform engineered for enhanced performance, which allows the application to launch and join meetings up to 2 times faster, improving user productivity.

Emphasis on Mobility, Device Interoperability, and Artificial Intelligence-Powered Enhancements:

The Unified communications market witnesses strong momentum for solutions that support mobility and device interoperability, responding to the needs of a remote and mobile workforce. Vendors prioritize the development of applications compatible across smartphones, tablets, laptops, and desktops, ensuring consistent communication experiences regardless of device. Artificial intelligence features such as real-time transcription, automated meeting summaries, and virtual assistants are reshaping user expectations. Enterprises use AI-driven analytics to monitor usage patterns, optimize workflows, and personalize user interfaces. Sustainability and energy efficiency also emerge as trends, with vendors focusing on green data centers and low-power hardware solutions. Continuous innovation and the adoption of next-generation technologies reinforce the market’s evolution, positioning unified communications as a core pillar in digital business transformation.

- For instance, RingCentral showcases deep platform integration by providing an App Gallery with over 300 pre-built applications, enabling seamless connection with leading business software.

Market Challenges Analysis:

Integration Complexities and Legacy System Constraints Slow Adoption:

The Unified communications market faces significant challenges due to integration complexities with legacy IT systems and diverse communication platforms. Many organizations encounter operational disruptions when upgrading from older infrastructure to unified communication solutions. It demands significant investments in interoperability tools, customization, and technical support, which can delay deployment timelines. Variability in communication protocols and inconsistent device compatibility add to the complexity, making seamless integration difficult. Organizations often struggle to standardize workflows and maintain business continuity during transitions. These integration issues hinder the ability of enterprises to fully capitalize on the benefits of unified communications.

Cybersecurity Threats and Data Privacy Concerns Impact Market Confidence:

Cybersecurity risks and data privacy concerns present persistent challenges for the Unified communications market. Enterprises handle sensitive business information across multiple platforms, increasing the risk of data breaches and cyberattacks. It requires robust security protocols and regular vulnerability assessments to mitigate these risks, driving up operational costs. Compliance with evolving data protection regulations such as GDPR and CCPA places additional burdens on providers and users. Concerns about unauthorized access and potential regulatory penalties influence procurement decisions and restrict widespread adoption. Heightened security requirements demand constant innovation, placing pressure on vendors to deliver advanced, resilient solutions.

Market Opportunities:

Growing Demand for Hybrid Work Solutions Expands Market Reach:

The Unified communications market offers strong opportunities with the global shift toward hybrid and remote work models. Enterprises seek advanced collaboration tools that enable seamless connectivity and productivity across distributed teams. It supports this trend by providing integrated voice, video, and messaging platforms compatible with multiple devices. Organizations prioritize investments in scalable solutions that adapt to evolving workplace requirements. Demand for features such as cloud-based management, AI-driven analytics, and workflow automation continues to grow. These capabilities position unified communications as a strategic enabler of flexible, future-ready business operations.

Emergence of Industry-Specific Solutions Drives New Revenue Streams:

Industry-specific applications present untapped opportunities in the Unified communications market. Sectors such as healthcare, education, financial services, and retail require customized platforms that address regulatory, workflow, and security needs. It enables providers to develop targeted solutions that improve user experiences and operational efficiency within specialized environments. Growth in digital transformation initiatives across emerging markets accelerates the adoption of tailored communication platforms. Providers that deliver sector-focused features and compliance support can capture new customer segments. This trend supports the expansion of unified communications beyond traditional enterprise users, unlocking long-term growth prospects.

Market Segmentation Analysis:

By Component:

The Unified communications market segments by component into solutions and services. Solutions include voice, video, messaging, conferencing, and collaboration tools, which form the backbone of unified communication ecosystems. Services such as consulting, integration, support, and managed services enable seamless deployment and ongoing performance optimization. Enterprises prioritize scalable, feature-rich solutions, driving innovation in multi-modal communication platforms. Service providers focus on technical support and managed services to maximize uptime and enhance user experiences.

- For instance, Cisco’s Room Bar Pro supports dual 96MP cameras and delivers up to 4 simultaneous 1080p video streams with a total decoded resolution of 4K pixels at 60 frames per second, enhancing meeting clarity in mid-sized rooms.

By Deployment Mode:

Deployment modes in the Unified communications market include on-premises, cloud, and hybrid models. Cloud deployment leads market growth due to its scalability, cost efficiency, and ease of integration with modern IT environments. Hybrid models attract organizations requiring flexibility and control, allowing them to combine legacy systems with advanced cloud features. On-premises solutions remain relevant for enterprises prioritizing data control and regulatory compliance, though their share continues to decline.

- For instance, Microsoft Azure Communication Services supports over 60 global cloud regions, enabling organizations to deploy enterprise-grade communication apps at scale.

By Industry Vertical:

Industry verticals adopting unified communications include IT and telecom, BFSI, healthcare, education, retail, government, and manufacturing. The IT and telecom sector leads in adoption, driven by rapid digitalization and high collaboration needs. Healthcare and education sectors leverage unified communications to enable telemedicine and remote learning. BFSI emphasizes secure, compliant communication platforms. Retail and manufacturing sectors use unified communications to improve operational efficiency and customer engagement, supporting diverse business models and global operations.

Segmentations:

By Component:

By Deployment Mode:

By Industry Vertical:

- IT and Telecom

- BFSI

- Healthcare

- Education

- Retail

- Government

- Manufacturing

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America :

North America leads the Unified communications market with a 38% share, supported by high enterprise IT spending and rapid adoption of digital solutions. The region’s mature technology infrastructure enables seamless deployment of unified communication platforms across large and mid-sized organizations. Strong emphasis on cloud-based services and security compliance drives continuous investment in advanced collaboration tools. Regulatory focus on data privacy and remote work policies fuels ongoing upgrades and integration projects. Key players in the market leverage the region’s robust demand to pilot innovative features and subscription models. The competitive landscape remains intense, with providers prioritizing scalability and cross-platform compatibility.

Europe :

Europe holds a 31% share in the Unified communications market, propelled by widespread digital transformation efforts and evolving workplace dynamics. Enterprises in the region invest in unified communication solutions to enhance productivity, comply with regulatory standards, and support flexible work arrangements. It benefits from strong government incentives for digitalization and increasing adoption across public sector organizations. Multilingual support and interoperability with existing IT systems remain critical purchasing criteria for European buyers. Security and GDPR compliance requirements shape product development and vendor selection. The region attracts global vendors seeking to expand their presence and localize offerings for diverse markets.

Asia-Pacific :

Asia-Pacific accounts for a 22% share in the Unified communications market, demonstrating the fastest growth rate globally. It gains momentum from rising enterprise digitalization, robust economic expansion, and rapid adoption of hybrid work models in countries such as China, India, and Japan. Expanding small and medium-sized enterprises drive demand for cost-effective, scalable communication platforms. Local providers focus on integrating regional language support and mobile-first features to capture diverse user segments. Government-led digital initiatives and increasing investment in IT infrastructure accelerate deployment across industries. The region’s dynamic growth environment positions Asia-Pacific as a key focus for future market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Alcatel-Lucent Enterprise

- Cisco Systems Inc.

- NEC Corporation

- Poly Inc.

- Microsoft Corporation

- Mitel Network Corporation

- Avaya Inc.

- Tata Communications

- IBM Corporation

- Unify

- Verizon Communications Inc.

Competitive Analysis:

The Unified communications market features intense competition among global technology leaders and specialized vendors. Key players include Alcatel-Lucent Enterprise, Cisco Systems Inc., NEC Corporation, Poly Inc., Microsoft Corporation, Mitel Network Corporation, Avaya Inc., and Tata Communications. These companies differentiate through comprehensive product portfolios, strong R&D capabilities, and global service networks. It drives innovation in unified communication platforms by integrating AI, advanced security, and seamless device compatibility. Strategic partnerships, cloud-based offerings, and regular feature enhancements support customer retention and expansion. Competitors target diverse industry verticals and prioritize solutions that address evolving enterprise needs, focusing on scalability, interoperability, and user experience. The competitive landscape remains dynamic, shaped by continuous advancements and growing demand for integrated communication solutions.

Recent Developments:

- In July 2025, ALE launched the Aries AD5x DECT Headsets series, designed for clear audio and flexible business communications.

- In February 2025, Forerunner Technologies completed its acquisition of NEC’s on-premise Unified Communications (UC) business in the Americas, ensuring continued development and support of these products.

- In October 2023, Mitel Networks completed its acquisition of Unify, formerly the UCC services business of Atos Group, thereby expanding its unified communications presence globally.

Market Concentration & Characteristics:

The Unified communications market exhibits moderate concentration, with several global and regional players competing for market share. Leading vendors such as Microsoft, Cisco, Zoom, and RingCentral hold significant positions, driven by continuous innovation and strong brand recognition. It features high barriers to entry due to complex integration requirements, evolving security standards, and the need for scalable solutions. The market favors providers offering unified platforms that combine voice, video, messaging, and collaboration tools with strong interoperability. Intense competition drives frequent product enhancements and partnerships, while customers prioritize reliability, ease of use, and seamless integration with existing IT ecosystems.

Report Coverage:

The research report offers an in-depth analysis based on Component, Deployment Mode, Industry Vertical and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Providers will integrate advanced AI capabilities for real‑time transcription, voice recognition, and smart conversation analytics.

- It will expand adoption of immersive collaboration tools, including augmented and virtual reality environments.

- Enterprises will demand enhanced security measures, such as zero‑trust models and end‑to‑end encryption across communication channels.

- Cloud‑native deployment options will become standard, supporting rapid scalability and simplified management.

- Unified communications will integrate more deeply with CRM, ERP, and project management platforms to streamline workflows.

- Mobile‑first strategies will rise, enabling seamless collaboration on smartphones and tablets.

- Vendors will offer pay‑as‑you‑go pricing and modular feature bundles to match evolving enterprise budgets.

- Hybrid work environments will push providers to support low‑latency global connectivity and distributed team collaboration.

- Industry‑specific customization—covering sectors like healthcare, finance, education—will drive tailored feature development.

- Providers will prioritize sustainability and reduced energy consumption in both software and infrastructure design.