Market Overview

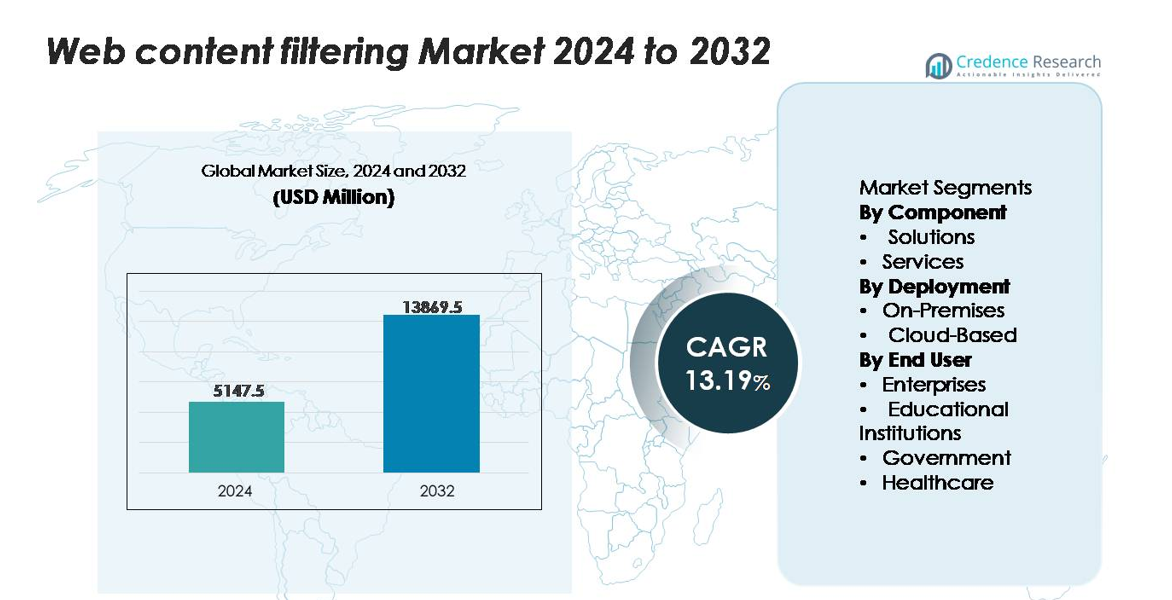

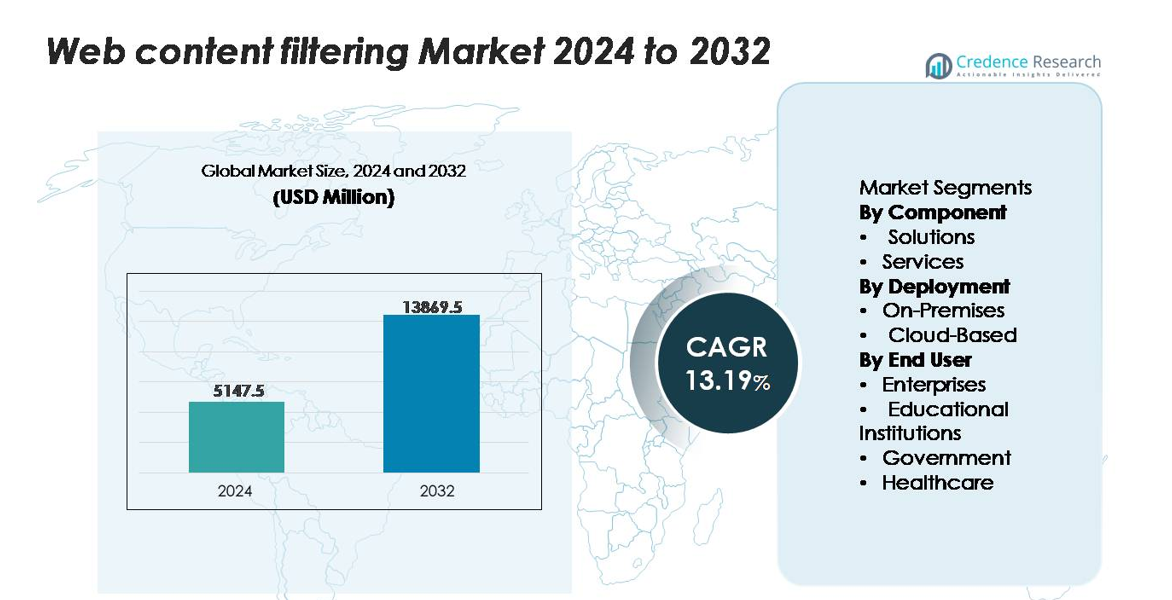

The Web Content Filtering Market was valued at USD 5,147.5 million in 2024 and is projected to reach USD 13,869.5 million by 2032, expanding at a CAGR of 13.19% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Web Content Filtering Market Size 2024 |

USD 5,147.5 million |

| Web Content Filtering Market, CAGR |

13.19% |

| Web Content Filtering Market Size 2032 |

USD 13,869.5 million |

The Web Content Filtering market is dominated by leading cybersecurity providers such as Cisco, Fortinet, Broadcom (Symantec), Trend Micro, Barracuda Networks, Forcepoint, and Webroot, alongside cloud-native security leaders including Zscaler and Akamai. These companies compete through advanced DNS-layer protection, AI-driven URL categorization, SSL/TLS inspection, and integration with SASE and zero-trust frameworks. North America remains the most influential region, holding an exact 38% market share, supported by mature cybersecurity infrastructure, strict compliance mandates, and high enterprise adoption of cloud-delivered filtering. Europe follows with 28%, while Asia-Pacific captures 24%, reflecting rapid digital expansion and rising threat exposure across the region.

Market Insights

- The Web Content Filtering market reached USD 5,147.5 million in 2024 and is projected to hit USD 13,869.5 million by 2032, expanding at a 13.19% CAGR, driven by escalating cyberthreats and increased demand for secure digital environments.

- Market growth is propelled by rising malware, phishing, and ransomware incidents, along with stricter compliance mandates that push enterprises toward advanced URL filtering, DNS protection, and encrypted traffic inspection tools.

- Key trends include rapid adoption of AI-enabled categorization engines, cloud-delivered filtering aligned with SASE architectures, and enhanced behavioral analytics for detecting previously unseen threats.

- Competitive intensity remains high among Cisco, Fortinet, Broadcom (Symantec), Trend Micro, Zscaler, and Akamai, with cloud-based deployments leading the segment at over 60% share due to scalability and remote-work compatibility.

- Regionally, North America holds 38%, followed by Europe at 28% and Asia-Pacific at 24%, while enterprises remain the dominant end-user segment due to large-scale network traffic and compliance-driven security needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

Solutions represent the dominant sub-segment in the Web Content Filtering market, holding the largest share due to widespread adoption of URL filtering, DNS filtering, malware blocking, and policy-based access controls integrated into unified threat management ecosystems. Enterprises increasingly deploy advanced solution suites to enforce centralized governance, reduce exposure to malicious domains, and ensure compliance across distributed workforces. Services continue to grow as organizations rely on managed security providers for configuration, policy tuning, and threat analytics support. However, the scale, automation depth, and real-time detection capabilities of solution platforms keep this sub-segment in the leading position.

- For instance, Palo Alto Networks’ Advanced URL Filtering service uses an AI-driven categorization engine to detect and prevent new and evasive web-based threats in real time. The system processes massive amounts of data, with its platforms analyzing over 7.35 billion new unique objects and preventing over 11.3 billion attacks inline in real-time as of November 2025 across global deployments.

By Deployment

Cloud-based deployment remains the dominant sub-segment, driven by rapid adoption of scalable, latency-optimized filtering architectures that protect remote users, mobile endpoints, and hybrid networks. Cloud platforms enable dynamic threat intelligence updates, automated policy enforcement, and seamless integration with SASE and zero-trust frameworks, making them preferred by enterprises modernizing their security stack. On-premises models retain relevance in regulated environments requiring strict data residency and internal traffic inspection, but the agility, multi-location coverage, and reduced maintenance requirements of cloud deployments continue to solidify their leadership in overall market share.

- For instance, Zscaler’s cloud security platform processes more than 300 billion web and application transactions per day, enabling real-time inspection and URL filtering at global scale across its distributed cloud architecture.

By End User

Enterprises form the dominant end-user sub-segment, holding the largest market share as organizations intensify efforts to secure distributed teams, cloud workloads, and high-volume network traffic. Enterprise demand is driven by rising phishing attempts, insider risks, compliance mandates, and the need to manage user access across diverse digital environments. Educational institutions rely heavily on filtering to block inappropriate content and safeguard student networks, while government agencies prioritize threat blocking and data protection. Healthcare organizations emphasize compliance with privacy regulations, but enterprises remain the primary growth engine due to scale and continuous digital transformation.

Key Growth Drivers

Rising Frequency of Web-Based Threats and Advanced Cyberattacks

The escalating volume and sophistication of cyberattacks—ranging from phishing and ransomware to malicious domains and zero-day exploits—significantly drive the demand for advanced web content filtering solutions. Organizations face continuous exposure as employees access cloud applications, external websites, and distributed digital resources, making automated filtering critical for preventing infiltration attempts. Modern threat actors increasingly use evasive tactics such as polymorphic malware, encrypted payloads, and domain-generation algorithms, necessitating real-time inspection and behavioral analysis capabilities. As enterprises expand remote and hybrid operations, exposure points multiply, accelerating the need for centralized, policy-driven filtering mechanisms. This rise in threat complexity compels businesses across industries to strengthen perimeter and endpoint protection, establishing web content filtering as an essential cybersecurity layer. The continuous evolution of attack patterns ensures sustained investment in adaptive filtering technologies capable of processing high-volume traffic and identifying anomalous browsing activity before damage occurs.

- For instance, Zscaler reported blocking more than 9 billion web-based threats per day across its cloud security platform, including 8 billion malicious HTTPS transactions, highlighting the scale of encrypted attack vectors

Stringent Compliance Mandates and Data Protection Regulations

Increasingly strict global and regional regulatory frameworks act as a major driver for web content filtering adoption. Standards such as GDPR, HIPAA, CIPA, PCI DSS, and national cybersecurity directives require organizations to enforce content access controls, prevent data leakage, and maintain secure digital environments. These regulations mandate monitoring of outbound and inbound traffic, creating urgency for solutions that can block unauthorized content, restrict access to risky domains, and maintain audit-ready logs. Enterprises, educational institutions, healthcare systems, and government organizations all face penalties for non-compliance, making automated filtering an operational necessity. Additionally, data localization and cross-border data transfer rules drive organizations to implement policy-based filtering aligned with regional requirements. As regulatory scrutiny intensifies, firms prioritize technologies that offer real-time visibility, classification accuracy, and governance continuity across cloud, on-premises, and hybrid infrastructures. This regulatory environment continues to sustain strong, long-term market momentum.

- For instance, Cisco Umbrella processes more than 620 billion DNS requests per day across its global security network, enabling organizations to meet regulatory logging and access-control requirements with high-volume, real-time visibility.

Expansion of Remote Work, BYOD, and Distributed Workforce Models

The acceleration of remote and hybrid work models has significantly increased reliance on cloud services, mobile devices, and decentralized access points, creating new vulnerabilities that web content filtering solutions are uniquely positioned to mitigate. Organizations must secure traffic originating from unmanaged devices, home networks, and public Wi-Fi environments where traditional perimeter controls are ineffective. Web content filtering delivers consistent enforcement of browsing policies, threat blocking, and user-specific controls regardless of location, enabling security teams to maintain visibility across distributed endpoints. Bring-your-own-device (BYOD) policies further drive adoption as enterprises seek lightweight, agent-based, or cloud-delivered filtering systems to safeguard employee-owned devices. The demand for secure access to SaaS platforms, collaboration tools, and remote desktops amplifies the requirement for real-time URL categorization, DNS-layer filtering, and encrypted traffic inspection. As decentralized work environments become permanent, organizations increasingly invest in scalable filtering technologies that support flexible deployment and unified policy management.

Key Trends & Opportunities

Integration of AI, Machine Learning, and Behavioral Analytics

A major trend shaping the market is the adoption of AI-driven filtering models capable of detecting anomalous browsing behavior, newly registered domains, and previously unseen threats. Machine learning engines analyze large datasets to categorize URLs, identify malicious intent, and predict emerging threat vectors before they propagate. Behavioral analytics adds contextual intelligence, enabling systems to differentiate between normal user actions and suspicious access patterns. These capabilities enhance detection accuracy and significantly reduce false positives, improving productivity and user experience. Vendors are increasingly embedding AI modules into DNS filtering, proxy gateways, cloud-based filtering engines, and secure web gateways. This evolution creates opportunities for offering adaptive, autonomous security controls aligned with zero-trust principles. As organizations prioritize proactive, predictive security postures, AI-enhanced content filtering emerges as a core competitive differentiator, fueling next-generation solution development and long-term adoption.

- For instance, Webroot’s BrightCloud® Threat Intelligence platform uses AI models that classify more than 95 million URLs per day and analyze over 5 billion web requests daily, supplying real-time threat scores to filtering systems.

Growth of Cloud Security Architectures, SASE, and Zero-Trust Adoption

The shift toward cloud-native security frameworks—especially Secure Access Service Edge (SASE) and zero-trust network architectures—creates strong opportunities for integrated, cloud-delivered web content filtering. Modern enterprises demand unified platforms that combine access control, threat protection, and visibility across distributed environments. Cloud-based filtering aligns seamlessly with SASE, providing scalable, globally distributed inspection capabilities without relying on on-premises appliances. As organizations move away from traditional VPN architectures, filtering becomes essential for securing direct-to-cloud traffic and protecting mobile and remote endpoints. Zero-trust adoption further accelerates demand for granular identity-based filtering, continuous verification, and least-privilege enforcement. Vendors offering cloud-native filtering engines, API-driven integrations, and real-time threat telemetry gain strategic advantage. With enterprises modernizing digital infrastructure, cloud-centric filtering remains a major opportunity for innovation and expansion.

- For instance, Zscaler operates more than 160 cloud data centers worldwide and processes over 500 billion transactions per day, enabling real-time policy enforcement for remote and mobile endpoints.

Increasing Use of Encrypted Traffic Inspection and SSL/TLS Visibility Tools

As more than 90% of web traffic is now encrypted, organizations face growing challenges in monitoring and filtering harmful content hidden within HTTPS streams. This trend creates significant opportunity for vendors developing advanced SSL/TLS inspection technologies that can decrypt, analyze, and re-encrypt traffic without degrading network performance. Enterprises demand solutions capable of handling high throughput, distributed users, and latency-sensitive applications while maintaining privacy compliance. The rise of encrypted malware campaigns—where attackers intentionally exploit SSL encryption to bypass defenses—further increases the relevance of deep packet inspection and certificate validation tools. Vendors investing in high-speed decryption engines, hardware acceleration, and intelligent bypass controls position themselves strongly within the market. As the encrypted threat landscape expands, inspection capabilities become a critical differentiator and expansion opportunity for web content filtering providers.

Key Challenges

Privacy Concerns, Data Handling Issues, and Regulatory Constraints

Despite growing adoption, privacy concerns related to traffic inspection, data logging, and user behavior monitoring present a significant challenge. SSL/TLS decryption—although essential for detecting threats—can introduce regulatory risks if not implemented with strict governance controls. Some regions impose stringent limitations on user monitoring, which forces organizations to balance security needs with privacy obligations. Educational institutions and government entities face heightened scrutiny around data retention and identity tracking. Failure to manage encrypted traffic responsibly can expose institutions to legal complications and compliance violations. Vendors must therefore integrate privacy-by-design principles, anonymization capabilities, and policy-based controls to ensure lawful processing. These limitations often slow deployment timelines and complexity, particularly in multinational organizations navigating diverse regulations. As data protection laws tighten globally, resolving the tension between visibility and privacy remains a central market challenge.

Performance Overheads and Complexity in High-Traffic Environments

Deploying web content filtering, particularly in environments with large user bases and high volumes of encrypted traffic, introduces performance overheads that can impact user experience. Deep inspection, SSL/TLS decryption, and real-time categorization require substantial computational resources, often leading to increased latency, bandwidth consumption, and system load. Organizations operating latency-sensitive applications or distributed architectures may struggle to maintain optimal performance without heavy investment in scalable infrastructure. Implementation complexity also rises as security teams must configure granular policies, manage bypass rules, and ensure compatibility with cloud services, remote endpoints, and mobile devices. Enterprises with legacy systems encounter integration hurdles, which delay full-scale deployment. This balance between comprehensive filtering and operational efficiency remains a major challenge, driving demand for more optimized, cloud-based, and hardware-accelerated filtering technologies.

Regional Analysis

North America

North America holds the largest share of the Web Content Filtering market, accounting for about 38%, supported by strong cybersecurity spending, rapid adoption of cloud-delivered security platforms, and stringent regulatory frameworks such as CIPA, HIPAA, and state-level data protection mandates. Enterprises across technology, BFSI, and healthcare drive high-volume deployment of AI-enhanced filtering, DNS-layer protection, and encrypted traffic inspection. The expansion of remote work and the dominance of leading cybersecurity vendors further strengthen adoption. Educational institutions also remain major contributors as districts enforce safe browsing policies across student networks, reinforcing the region’s continued leadership.

Europe

Europe represents around 28% of the global market, driven by strict compliance obligations under GDPR, the NIS2 Directive, and digital sovereignty initiatives. Organizations across the EU prioritize privacy-centric filtering solutions that support secure browsing, sensitive data governance, and controlled access to high-risk content categories. Strong enterprise digitization, growth in cloud migration, and rising adoption of zero-trust frameworks accelerate demand. Sectors such as government, education, and BFSI maintain high deployment volumes, particularly for DNS filtering and SSL inspection. Europe’s multi-country cybersecurity harmonization efforts and increased investments in threat intelligence further reinforce its significant market share.

Asia-Pacific

Asia-Pacific accounts for approximately 24% of the market and is the fastest-growing region due to expanding internet penetration, rising cyberattacks, and increasing adoption of cloud-first architectures. Countries such as China, India, Japan, and South Korea are witnessing strong enterprise demand for scalable filtering solutions as digital transformation accelerates across manufacturing, IT services, education, and financial sectors. Government-driven cybersecurity frameworks, large remote workforces, and rapid growth in online learning environments further boost deployment. The shift toward mobile-first enterprise operations and high-volume data traffic drives adoption of cloud-based filtering, positioning Asia-Pacific as a core future growth engine.

Latin America

Latin America holds about 6% of the global market, with adoption accelerating as enterprises strengthen threat defense strategies and governments introduce national cybersecurity regulations. Countries such as Brazil, Mexico, Colombia, and Chile are increasingly deploying DNS filtering, web gateway solutions, and cloud-based inspection to address rising ransomware and phishing incidents. The region’s expanding SME sector fuels demand for cost-effective, cloud-native filtering tools, while educational institutions adopt filtering to protect digital learning platforms. Limited cybersecurity budgets remain a restraint, but growing digital infrastructure investments steadily increase the region’s overall market contribution.

Middle East & Africa

The Middle East & Africa region accounts for approximately 4% of the market, supported by increasing cybersecurity modernization across government, oil & gas, banking, and telecom sectors. GCC countries lead adoption through national cyber resilience programs that prioritize secure web access, encrypted traffic visibility, and policy-driven browsing controls. Rapid cloud adoption, rising threat exposure, and expanding digital government services further stimulate demand. In Africa, heightened internet penetration and emerging data protection laws are driving initial deployments, particularly in education and public-sector institutions. Despite infrastructural disparities, the region’s adoption rate continues to rise steadily.

Market Segmentations:

By Component

By Deployment

By End User

- Enterprises

- Educational Institutions

- Government

- Healthcare

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Web Content Filtering market is characterized by a mix of global cybersecurity leaders, specialized filtering vendors, and cloud-native security service providers competing on accuracy, scalability, and advanced threat intelligence capabilities. Key players focus on expanding AI-driven URL categorization, DNS-layer protection, encrypted traffic inspection, and real-time behavioral analytics to counter increasingly sophisticated web-based threats. Vendors continuously strengthen their portfolios through integrations with SASE, zero-trust architectures, and cloud security ecosystems, addressing the needs of remote workforces and distributed networks. Strategic partnerships, acquisitions, and R&D investments remain central to enhancing detection speed, reducing false positives, and improving cloud-based policy orchestration. Companies also differentiate through privacy-centric designs and compliance-ready features aligned with regional data governance laws. As enterprises accelerate cloud migration and adopt unified security platforms, competition intensifies around delivering lightweight, high-performance, and seamlessly integrated filtering solutions that support diverse endpoints and high-volume traffic environments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, the company introduced new AI-powered sub-categories to its Advanced URL Filtering solution, offering enhanced granular control and visibility.

- In January 2025, Barracuda unveiled enhancements to its Email Protection suite (not strictly Web Content Filtering but relevant to web/email security), focusing on flexible deployment and proactive account-takeover prevention.

- In October 2024, DrayTek issued security updates to address 14 vulnerabilities (including a CVSS 10.0 remote code execution flaw) impacting over 700,000 exposed routers, ensuring web-interface and content-filtering modules are patched

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly shift toward cloud-native filtering platforms as enterprises expand hybrid and remote work environments.

- AI- and machine learning–driven threat detection will become standard, enabling faster identification of emerging malicious domains.

- Encrypted traffic inspection will gain priority as attackers increasingly hide payloads within SSL/TLS traffic.

- Adoption of SASE and zero-trust frameworks will accelerate integration of web filtering into unified security architectures.

- DNS-layer protection will expand as organizations prioritize lightweight, scalable filtering across distributed endpoints.

- Enterprises will demand greater privacy controls to balance deep inspection with regulatory compliance.

- Education, healthcare, and government sectors will increase deployment to address growing digital safety requirements.

- Advanced behavioral analytics will enhance contextual filtering and reduce false positives across complex networks.

- Vendors will focus on high-performance filtering that minimizes latency while managing high-volume traffic.

- Partnerships between cybersecurity vendors and cloud service providers will strengthen multi-layered content filtering ecosystems.