| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| N-Phenyl-N-(Phenylmethyl)-Glycine Methyl Ester market Size 2024 |

USD 1,504.78 Million |

| N-Phenyl-N-(Phenylmethyl)-Glycine Methyl Ester market, CAGR |

4.74% |

| N-Phenyl-N-(Phenylmethyl)-Glycine Methyl Ester market Size 2032 |

USD 2,238.42 Million |

Market Overview

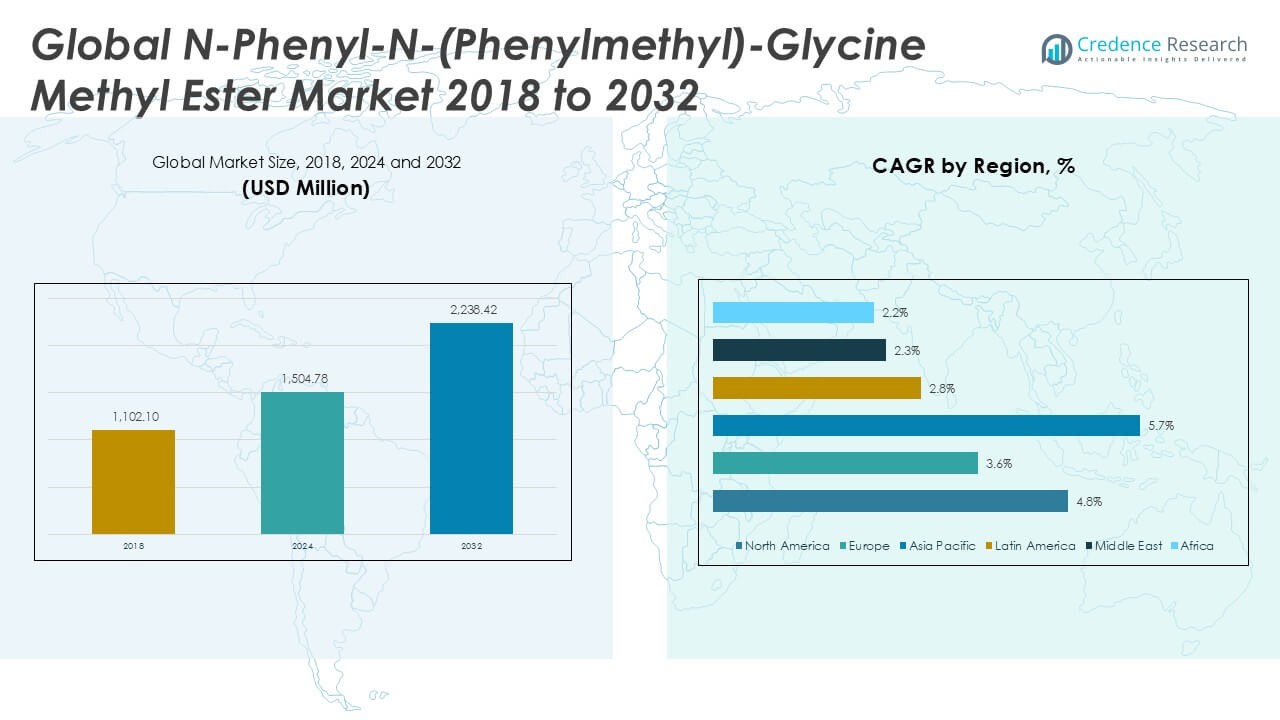

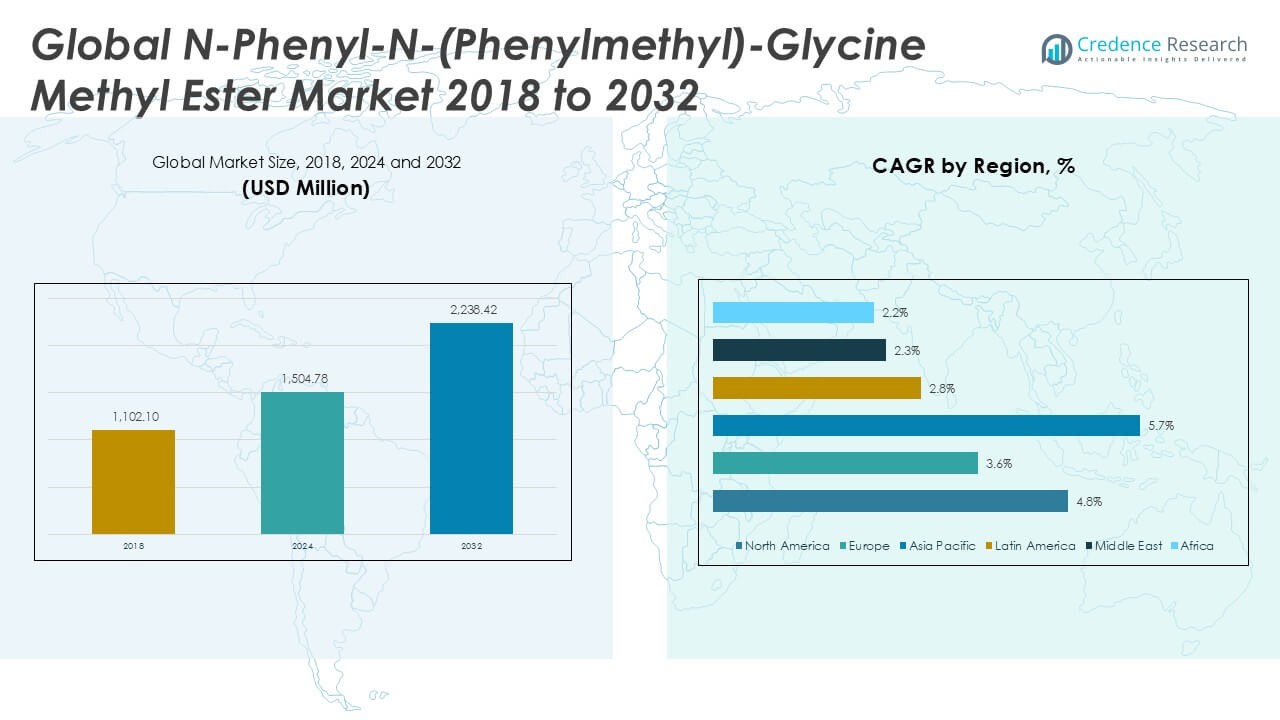

The N-Phenyl-N-(Phenylmethyl)-Glycine Methyl Ester market was valued at USD 1,102.10 million in 2018, reached USD 1,504.78 million in 2024, and is anticipated to reach USD 2,238.42 million by 2032, reflecting a compound annual growth rate (CAGR) of 4.74% during the forecast period.

The N-Phenyl-N-(Phenylmethyl)-Glycine Methyl Ester market is driven by rising demand from the pharmaceutical and agrochemical sectors, where this compound serves as a key intermediate in the synthesis of specialty chemicals and active pharmaceutical ingredients. Stringent regulations encouraging the use of high-purity intermediates and ongoing innovation in drug development further support market expansion. Manufacturers increasingly invest in advanced production processes to enhance yield and cost efficiency, responding to growing application diversity. The market also benefits from expanding research in fine chemicals and new applications in material science. On the trends front, there is a noticeable shift toward sustainable manufacturing practices and adoption of green chemistry to minimize environmental impact. Strategic collaborations between producers and end-user industries, along with a focus on capacity expansion in emerging economies, are reshaping the competitive landscape. These factors collectively sustain steady market growth while positioning the industry for continued innovation and global reach.

The N-Phenyl-N-(Phenylmethyl)-Glycine Methyl Ester market demonstrates strong geographical diversity, with significant growth anchored in North America, Europe, and Asia Pacific. North America leads with advanced pharmaceutical and chemical manufacturing capabilities, supported by extensive R&D infrastructure in the United States and Canada. Europe follows closely, driven by stringent regulatory standards and a robust presence of specialty chemical producers in Germany and the United Kingdom. Asia Pacific experiences rapid expansion, underpinned by rising pharmaceutical output and agrochemical demand in China, India, and Japan. Key players shaping the competitive landscape include TCI Chemicals (Tokyo Chemical Industry Co., Ltd.), BASF SE, and Merck KGaA. These companies drive innovation and maintain supply chain resilience, contributing to the market’s global reach and ongoing advancement across core applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The N-Phenyl-N-(Phenylmethyl)-Glycine Methyl Ester market was valued at USD 1,102.10 million in 2018, reached USD 1,504.78 million in 2024, and is projected to reach USD 2,238.42 million by 2032, reflecting a CAGR of 4.74%.

- Growing demand for pharmaceutical intermediates and specialty chemicals serves as a primary market driver, supported by expanding applications in drug synthesis and agrochemicals.

- The market trends show increasing adoption of advanced manufacturing technologies, with a focus on automation and process optimization to improve efficiency and product quality.

- Sustainability initiatives and regulatory compliance shape production practices, prompting companies to invest in green chemistry and eco-friendly processes.

- The competitive landscape includes major players such as TCI Chemicals (Tokyo Chemical Industry Co., Ltd.), BASF SE, and Merck KGaA, each leveraging innovation, global supply networks, and strong R&D capabilities.

- Market restraints include stringent regulatory requirements and volatility in raw material prices, which increase operational complexity and challenge profit margins for manufacturers.

- Regional analysis reveals robust growth in North America and Asia Pacific, driven by advanced pharmaceutical manufacturing in the United States and expanding chemical industries in China and India, while Europe, Latin America, the Middle East, and Africa show steady but moderate development.

Market Drivers

Rising Demand from Pharmaceutical Industry Fuels Market Expansion

The pharmaceutical sector’s increasing requirement for advanced intermediates stands as a primary driver of the N-Phenyl-N-(Phenylmethyl)-Glycine Methyl Ester Market. Companies utilize this compound in the synthesis of active pharmaceutical ingredients and specialty drugs, which require high-purity materials to ensure product safety and efficacy. Regulatory authorities emphasize stringent quality control, encouraging the adoption of reliable intermediates in drug manufacturing. Pharmaceutical R&D activities continue to expand, driving consumption and market growth. It responds to market needs by supporting the scale-up of production capacities and establishing supply chain resilience. The demand for cost-effective yet high-quality intermediates remains strong, anchoring market development and sustained investment. The pharmaceutical sector’s focus on innovation and precision further amplifies the need for this compound.

- For instance, Merck KGaA invested EUR 440 million in its Darmstadt site expansion in 2023, adding 32,000 square meters of new lab and production space to boost advanced pharmaceutical ingredient output.

Expansion of Agrochemical Applications Drives Market Growth

The use of N-Phenyl-N-(Phenylmethyl)-Glycine Methyl Ester as a critical intermediate in agrochemical synthesis boosts its demand in the agricultural sector. Crop protection product manufacturers value its functional versatility and chemical stability, allowing for efficient formulation of advanced herbicides and pesticides. Regulatory shifts toward safer and more effective crop protection solutions accelerate the integration of such intermediates into product lines. Agrochemical companies invest in research to optimize yield and reduce production costs, further strengthening the compound’s market position. It helps agricultural stakeholders meet growing food security needs and address pest resistance challenges. The drive for enhanced productivity and sustainability in farming creates a robust market outlook. These factors collectively underpin a strong upward trajectory in the agrochemical segment.

- For instance, BASF SE registered over 2,100 new patents for agricultural solutions in 2023 and spent EUR 944 million on crop protection R&D globally.

Innovation in Fine Chemicals and Material Science Broadens Market Scope

Continuous advancements in fine chemical synthesis and material science research open new avenues for N-Phenyl-N-(Phenylmethyl)-Glycine Methyl Ester. Researchers leverage its unique properties to develop high-performance polymers, specialty coatings, and advanced materials for diverse industrial applications. It benefits from increasing investment in R&D and pilot-scale projects, especially in emerging economies. Collaborative efforts between chemical manufacturers and research institutions accelerate the commercialization of innovative applications. The trend toward multi-functionality and value-added chemical solutions sustains market interest. Companies position themselves to capture growth opportunities by expanding product portfolios. Innovation remains at the core of market expansion and diversification.

Shift Toward Sustainable and Compliant Manufacturing Enhances Market Prospects

Manufacturers face mounting pressure to comply with environmental standards and implement sustainable practices in chemical production. The N-Phenyl-N-(Phenylmethyl)-Glycine Methyl Ester Market witnesses a shift toward green chemistry and adoption of cleaner technologies, aimed at reducing emissions and waste. Regulatory frameworks incentivize the use of environmentally responsible processes, prompting manufacturers to invest in modernization and process optimization. It creates competitive advantage for companies prioritizing eco-friendly operations and resource efficiency. Supply chain partners increasingly demand sustainability credentials, influencing procurement strategies. The alignment of production practices with global sustainability goals shapes industry dynamics. Compliance and environmental stewardship become critical factors driving long-term market value.

Market Trends

Integration of Advanced Production Technologies Reshapes Manufacturing

The adoption of advanced production technologies represents a defining trend in the N-Phenyl-N-(Phenylmethyl)-Glycine Methyl Ester Market. Manufacturers deploy automated synthesis systems, real-time process monitoring, and precision reaction controls to boost product quality and operational efficiency. It benefits from digitalization, which enables greater traceability and consistency throughout production cycles. Technology adoption helps reduce downtime and waste, supporting a leaner manufacturing environment. Companies that invest in continuous process improvement maintain a competitive edge and ensure compliance with rigorous quality standards. Strategic deployment of new equipment and software strengthens production capabilities. Technological innovation stands at the forefront of market evolution.

- For instance, Tokyo Chemical Industry Co., Ltd. (TCI) completed a digital upgrade in 2023, automating 17 production lines, which increased batch throughput by 28% and reduced error rates by 21%.

Strategic Collaborations and Partnerships Accelerate Market Growth

Collaborations and partnerships between raw material suppliers, manufacturers, and end-user industries emerge as key trends shaping the N-Phenyl-N-(Phenylmethyl)-Glycine Methyl Ester Market. Industry players form alliances to secure stable supply chains and leverage complementary expertise for product innovation. Joint ventures often focus on expanding production capacities and accelerating product development cycles. It enables market participants to address fluctuating demand and capitalize on new application areas. Strategic relationships also help companies share risk and respond swiftly to regulatory changes or market disruptions. The trend toward partnership-driven growth highlights the importance of collaboration for long-term success.

- For instance, Santa Cruz Biotechnology, Inc. collaborated with 12 global pharmaceutical companies and research universities in 2023, facilitating the development and launch of 75 new chemical intermediates.

Emphasis on Sustainability and Regulatory Compliance Drives Transformation

A pronounced emphasis on sustainability and regulatory compliance marks a significant shift in the market landscape. Manufacturers respond to heightened environmental scrutiny by implementing green chemistry principles and eco-friendly process improvements. Regulatory agencies enforce stricter controls over chemical production, encouraging the development of low-emission and low-waste manufacturing practices. It positions companies with strong compliance records as preferred partners for global customers. Transparency and accountability in operations become critical, prompting detailed reporting and third-party audits. The transition toward sustainable operations underpins both market reputation and growth prospects.

Geographic Diversification and Expansion into Emerging Economies Boost Market Opportunities

Geographic diversification and targeted expansion into emerging economies create new growth avenues for the N-Phenyl-N-(Phenylmethyl)-Glycine Methyl Ester Market. Companies invest in local production facilities and distribution networks to better serve high-potential regions in Asia-Pacific, Latin America, and the Middle East. It allows manufacturers to respond to regional demand fluctuations and mitigate supply chain risks. Tailored product offerings cater to local industry requirements, improving customer satisfaction and market penetration. Regional expansion strategies support job creation and foster technology transfer. Geographic diversification remains vital for companies seeking to build resilience and capture untapped opportunities.

Market Challenges Analysis

Stringent Regulatory Requirements and Compliance Costs Hinder Market Progress

The N-Phenyl-N-(Phenylmethyl)-Glycine Methyl Ester Market faces significant challenges from evolving regulatory frameworks and rising compliance costs. Regulatory bodies in major economies enforce strict controls on chemical manufacturing, usage, and waste disposal to protect environmental and public health. It requires companies to invest in advanced testing, monitoring, and documentation systems, which increase operational expenses and lengthen product development timelines. Non-compliance risks costly delays or market access restrictions, particularly in regions with aggressive enforcement. Navigating complex international regulations demands technical expertise and continuous updates to standard operating procedures. High compliance costs can deter small and mid-sized companies from entering or expanding in the market. These barriers necessitate a proactive and well-resourced approach to regulatory management.

Volatility in Raw Material Prices and Supply Chain Disruptions Limit Growth

Fluctuating prices and unpredictable supply of critical raw materials present persistent challenges for the N-Phenyl-N-(Phenylmethyl)-Glycine Methyl Ester Market. It depends on stable supplies of specialty chemicals, which are often subject to geopolitical risks, trade restrictions, and natural disasters. Price volatility erodes profit margins and complicates long-term planning for manufacturers. Supply chain disruptions, such as transportation bottlenecks or shortages of key inputs, can halt production and impact customer delivery schedules. Companies must diversify supplier bases and invest in inventory management solutions to minimize disruptions. The complexity of sourcing high-quality raw materials underscores the need for resilient supply chain strategies to sustain growth and customer satisfaction.

Market Opportunities

Expansion into High-Growth End-Use Sectors Presents Significant Opportunities

The N-Phenyl-N-(Phenylmethyl)-Glycine Methyl Ester Market benefits from expanding applications in pharmaceuticals, agrochemicals, and advanced materials. Pharmaceutical companies continue to pursue new drug formulations that require high-purity intermediates, increasing demand for this compound. Agrochemical manufacturers explore innovative crop protection products that leverage its chemical stability and functional versatility. Growth in specialty materials and polymers creates new avenues for product development and market penetration. It stands to gain from collaborations with end-use industries to co-develop customized solutions that meet evolving technical requirements. A proactive approach to R&D enables companies to unlock value in high-growth sectors and strengthen competitive positioning.

Adoption of Sustainable and Green Manufacturing Methods Creates Value

The shift toward environmentally responsible production processes opens new opportunities for the N-Phenyl-N-(Phenylmethyl)-Glycine Methyl Ester Market. Manufacturers who invest in green chemistry, energy-efficient technologies, and low-waste operations can differentiate themselves and access new customer segments. Regulatory incentives and increasing customer preference for sustainable products reinforce the case for eco-friendly manufacturing. It enables companies to improve brand reputation and meet stringent buyer requirements in global markets. Collaboration with research organizations and technology providers accelerates the adoption of next-generation manufacturing methods. The market can leverage these advancements to deliver both economic and environmental value for stakeholders.

Market Segmentation Analysis:

By Application:

The N-Phenyl-N-(Phenylmethyl)-Glycine Methyl Ester Market features a diverse application landscape, with pharmaceutical intermediates representing the leading segment. It serves as a crucial building block in the synthesis of active pharmaceutical ingredients and specialty drugs. Regulatory focus on high-purity intermediates in drug manufacturing continues to propel demand in this segment, with pharmaceutical companies seeking reliable and efficient raw materials. Chemical research forms another significant segment, benefiting from the versatility and reactivity of N-Phenyl-N-(Phenylmethyl)-Glycine Methyl Ester. Research institutions and specialty chemical producers use it for the development of novel compounds and advanced materials. Its ability to facilitate complex organic syntheses makes it valuable in both academic and industrial research settings. Agricultural chemicals constitute a growing segment within the N-Phenyl-N-(Phenylmethyl)-Glycine Methyl Ester Market. Manufacturers of crop protection products incorporate the compound as an intermediate for formulating advanced herbicides and pesticides.

- For instance, Alfa Aesar expanded its catalog in 2023 to over 45,000 chemical products, supplying more than 500 new compounds for chemical research worldwide.

By End-User:

From an end-user perspective, pharmaceutical companies dominate the market due to stringent quality requirements and robust research activities. Chemical manufacturers also represent a key end-user group, leveraging the compound for diverse synthesis processes and specialty product development. The agricultural sector emerges as a strategic end user, integrating the compound into new-generation crop protection solutions. It responds to the specific needs of each end-user segment by offering tailored product specifications, ensuring consistent supply, and supporting collaborative innovation initiatives. This segmentation underscores the compound’s broad utility and potential for growth across several high-value industries.

- For instance, Meryer (Shanghai) Chemical Technology Co., Ltd. served 2,800 institutional clients in 2023, supplying custom intermediates for over 350 specialty projects in pharmaceutical, agrochemical, and research sectors.

Segments:

Based on Application:

- Pharmaceutical Intermediates

- Chemical Research

- Agricultural Chemicals

Based on End-User:

- Pharmaceutical Companies

- Chemical Manufacturers

- Agricultural Sector

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America N-Phenyl-N-(Phenylmethyl)-Glycine Methyl Ester Market

North America N-Phenyl-N-(Phenylmethyl)-Glycine Methyl Ester Market grew from USD 427.13 million in 2018 to USD 576.37 million in 2024 and is projected to reach USD 860.06 million by 2032, reflecting a compound annual growth rate (CAGR) of 4.8%. North America is holding a 38% market share. The United States and Canada drive regional demand through robust pharmaceutical production, extensive research activity, and a strong presence of chemical manufacturing companies. Investments in R&D and advanced production infrastructure support market leadership. Regulatory compliance and an established supply chain ecosystem give North America a competitive advantage. The market benefits from partnerships between major pharmaceutical and chemical companies. Growth prospects remain strong, particularly in the U.S. market.

Europe N-Phenyl-N-(Phenylmethyl)-Glycine Methyl Ester Market

Europe N-Phenyl-N-(Phenylmethyl)-Glycine Methyl Ester Market grew from USD 217.73 million in 2018 to USD 281.89 million in 2024 and is set to reach USD 383.51 million by 2032, with a CAGR of 3.6%. Europe accounts for 17% of the global market share. Germany, France, and the United Kingdom represent key markets, supported by advanced chemical industries and strict regulatory standards. Focus on innovation and sustainable practices shapes the competitive landscape. The presence of multinational pharmaceutical firms fosters demand for high-purity intermediates. It maintains momentum through technological advancements and collaboration with research organizations. Supply chain resilience remains a top priority in the region.

Asia Pacific N-Phenyl-N-(Phenylmethyl)-Glycine Methyl Ester Market

Asia Pacific N-Phenyl-N-(Phenylmethyl)-Glycine Methyl Ester Market grew from USD 365.17 million in 2018 to USD 522.87 million in 2024 and is projected to reach USD 839.66 million by 2032, at a CAGR of 5.7%. Asia Pacific holds a 38% market share. China, India, and Japan are the primary contributors, driven by expanding pharmaceutical manufacturing and a rapidly growing agrochemical sector. Competitive production costs and increasing foreign investment accelerate market expansion. The region attracts significant interest from global manufacturers seeking to leverage local expertise and growing demand. Government initiatives supporting innovation and compliance further reinforce Asia Pacific’s position. It remains a pivotal region for both supply and demand.

Latin America N-Phenyl-N-(Phenylmethyl)-Glycine Methyl Ester Market

Latin America N-Phenyl-N-(Phenylmethyl)-Glycine Methyl Ester Market grew from USD 43.48 million in 2018 to USD 58.48 million in 2024 and is expected to reach USD 74.99 million by 2032, posting a CAGR of 2.8%. Latin America holds a 3% market share. Brazil and Mexico are the leading countries, supported by the development of the agricultural chemicals sector. Economic reforms and the expansion of pharmaceutical manufacturing are enhancing market dynamics. Companies invest in local production facilities to reduce supply chain disruptions. Market players pursue strategic collaborations with international firms. It responds to regional needs by customizing product offerings and distribution.

Middle East N-Phenyl-N-(Phenylmethyl)-Glycine Methyl Ester Market

Middle East N-Phenyl-N-(Phenylmethyl)-Glycine Methyl Ester Market grew from USD 28.91 million in 2018 to USD 35.85 million in 2024 and will likely reach USD 44.37 million by 2032, with a CAGR of 2.3%. The Middle East holds a 2% market share. Saudi Arabia and the United Arab Emirates are central to market activity due to investments in chemical manufacturing and logistics infrastructure. Regulatory improvements and economic diversification support demand for high-quality intermediates. Companies establish regional partnerships to strengthen market reach. The sector benefits from integration with local petrochemical and pharmaceutical supply chains. It faces challenges related to feedstock costs and evolving standards.

Africa N-Phenyl-N-(Phenylmethyl)-Glycine Methyl Ester Market

Africa N-Phenyl-N-(Phenylmethyl)-Glycine Methyl Ester Market grew from USD 19.68 million in 2018 to USD 29.31 million in 2024 and is projected to reach USD 35.82 million by 2032, reflecting a CAGR of 2.2%. Africa is holding a 2% market share. South Africa, Egypt, and Nigeria represent key countries, driven by growing demand for agricultural chemicals and pharmaceutical ingredients. Investments in industrial capacity and regulatory improvements stimulate regional growth. Companies focus on enhancing distribution networks to reach new customers. Market expansion is supported by partnerships with local distributors and public sector initiatives. It faces headwinds from infrastructural limitations and supply chain challenges.

Key Player Analysis

- TCI Chemicals (Tokyo Chemical Industry Co., Ltd.)

- Boc Sciences

- Chem-Impex International, Inc.

- AdooQ BioScience

- Meryer (Shanghai) Chemical Technology Co., Ltd.

- Alfa Aesar (A Johnson Matthey Company)

- Santa Cruz Biotechnology, Inc.

- BASF SE

- Merck KGaA

Competitive Analysis

The competitive landscape of the N-Phenyl-N-(Phenylmethyl)-Glycine Methyl Ester market features several prominent players, including TCI Chemicals (Tokyo Chemical Industry Co., Ltd.), BASF SE, Merck KGaA, Alfa Aesar (A Johnson Matthey Company), and Santa Cruz Biotechnology, Inc. These companies maintain a strong presence through global distribution networks, comprehensive product portfolios, and consistent investment in research and development. Strategic initiatives such as product innovation, process optimization, and expansion into emerging markets define the approach of leading players. Partnerships with research institutions and end-user industries allow for rapid adoption of new applications and improved customer support. Companies differentiate themselves by prioritizing compliance with international regulatory standards and focusing on sustainable manufacturing practices. The market’s competitive dynamics remain intense, with frequent new product launches and continuous improvement in supply chain efficiency. Established players hold their positions by offering technical expertise, responsive customer service, and a strong commitment to quality, ensuring their leadership in the evolving global market.

Market Concentration & Characteristics

The N-Phenyl-N-(Phenylmethyl)-Glycine Methyl Ester Market displays moderate to high market concentration, with a limited number of global and regional players dominating supply. It is characterized by the presence of established chemical manufacturers with advanced production capabilities and strong distribution networks. Leading companies invest in R&D to support innovation, maintain high product quality, and respond quickly to changing industry requirements. The market caters primarily to specialized applications in pharmaceuticals, agrochemicals, and advanced materials, where purity and regulatory compliance are critical. Barriers to entry remain high due to strict quality standards, regulatory demands, and the need for technical expertise in synthesis and formulation. It features long-term relationships between suppliers and end-users, with an emphasis on customized solutions and reliable delivery. Overall, the market’s competitive environment encourages continual improvement in technology, supply chain management, and customer service to sustain leadership and address evolving needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to witness steady growth driven by increasing demand for pharmaceutical intermediates.

- Rising investments in drug development and contract manufacturing will fuel market expansion.

- Growing applications in organic synthesis and research laboratories will support long-term demand.

- The market will benefit from the expanding generic drug sector across emerging economies.

- Improved production technologies will enhance efficiency and reduce manufacturing costs.

- Strategic collaborations among manufacturers and chemical suppliers will strengthen global supply chains.

- Regulatory approvals for new drug formulations containing the compound will create new growth avenues.

- Increased focus on R&D activities in the chemical and pharmaceutical industries will boost product adoption.

- Asia Pacific is expected to emerge as a key market due to rising industrial activity and favorable government policies.

- Market players will likely focus on quality standardization and sustainability practices to maintain competitiveness.