Market Overview

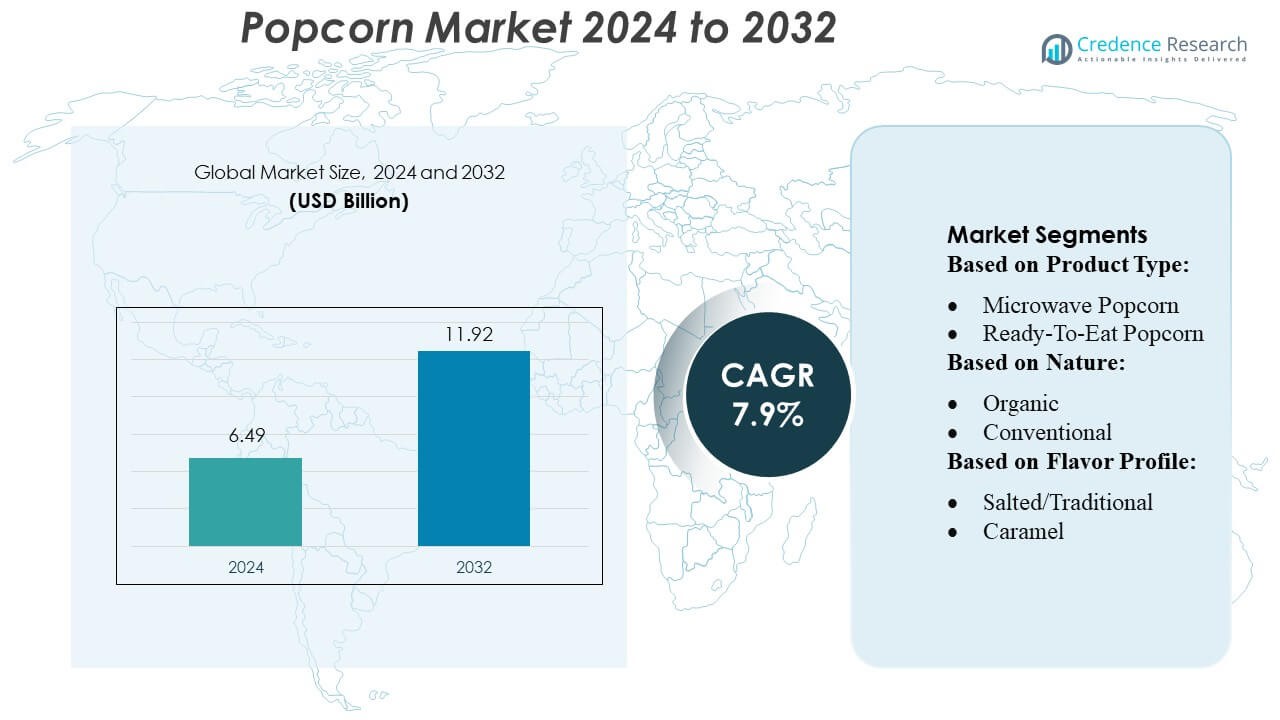

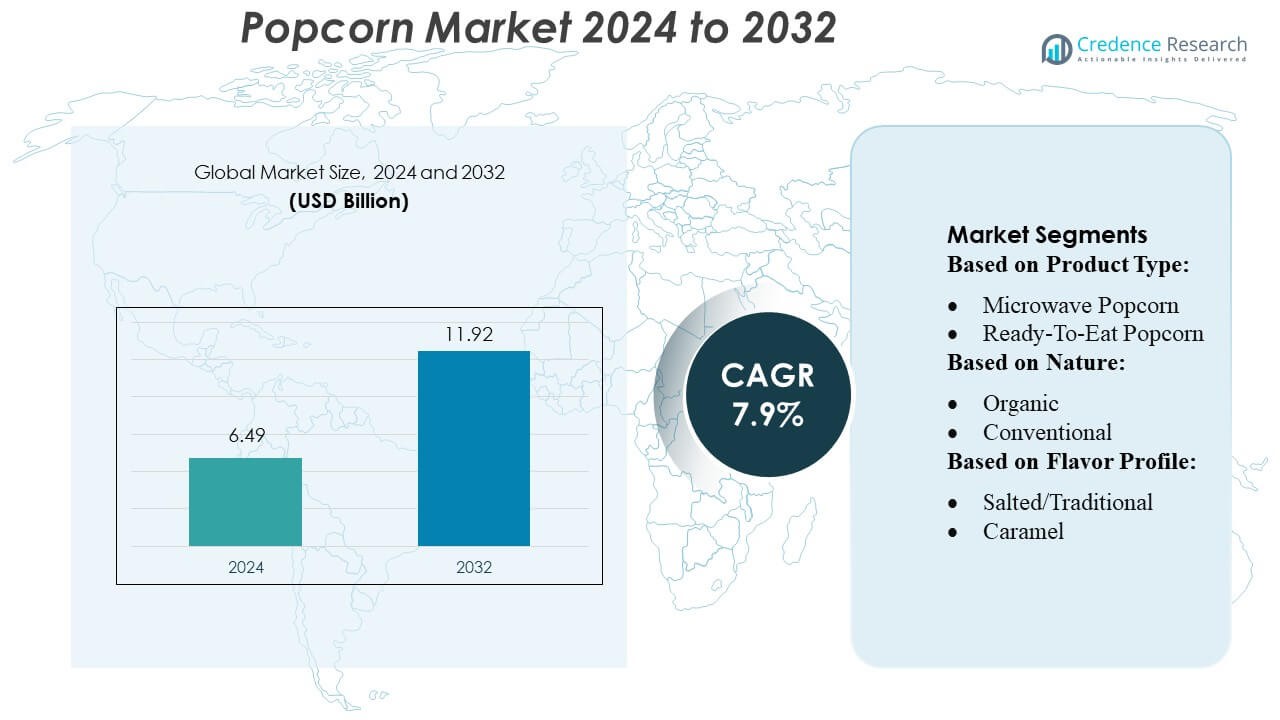

Popcorn Market size was valued USD 6.49 billion in 2024 and is anticipated to reach USD 11.92 billion by 2032, at a CAGR of 7.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Popcorn Market Size 2024 |

USD 6.49 Billion |

| Popcorn Market, CAGR |

7.9% |

| Popcorn Market Size 2032 |

USD 11.92 Billion |

The popcorn market features a competitive landscape defined by a mix of large food conglomerates and specialized snack producers that actively innovate and expand their offerings. These players invest in flavor variety, clean-label ingredients, and premium ready-to-eat formats to stand out in a saturated market. Their strong manufacturing capabilities and broad distribution networks—across modern retail, cinema chains, and e-commerce—bolster market reach. Strategic product reformulations and sustainable packaging reinforce their ability to respond to evolving consumer preferences. Meanwhile, operational efficiency and marketing investments help reinforce their market positioning against smaller niche brands. North America leads globally, holding around 48.3% of the market.

Market Insights

- The popcorn market reached USD 6.49 billion in 2024 and is projected to hit USD 11.92 billion by 2032, supported by a 7.9% CAGR, driven by rising demand for convenient, healthier, and flavor-rich snack options.

- Growth is supported by strong consumer interest in ready-to-eat formats, clean-label ingredients, and innovative gourmet flavors, which continue to reshape product development and expand premium segment adoption.

- Competition intensifies as global and specialty brands strengthen distribution across retail, cinemas, and e-commerce while investing in sustainable packaging, efficient production, and targeted marketing to maintain visibility.

- Market restraints emerge from volatile raw material costs and increasing pressure to meet clean-label and sustainability standards, which challenge smaller manufacturers and raise operational complexities.

- Regionally, North America holds 48.3% of the market, while the ready-to-eat segment leads overall sales, supported by expanding retail penetration, rising online consumption, and growing preference for on-the-go snacking.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

In the popcorn market, the Ready-to-Eat (RTE) popcorn segment dominates, accounting for over 55% of total market share, driven by rising demand for convenient, on-the-go snacking and continuous product innovation. Consumers prefer RTE options due to their portability, flavor variety, and clean-label positioning, which aligns with healthier snacking trends. Microwave popcorn follows, supported by affordable pricing and widespread household adoption, but RTE leads growth as brands introduce premium, air-popped, and gourmet variants that attract health-conscious and indulgence-seeking buyers alike.

- For instance, PROPER Snacks recently expanded its savoury popcorn range to include Tangy Chilli, Smoky & Sweet Paprika, and Cracked Black Pepper & Salt, with each flavor’s serving designed to be under 100 kcal, as confirmed in a company release.

By Nature

The Conventional popcorn segment remains dominant with around 80% market share, supported by extensive retail availability, lower price points, and consistent consumer preference for everyday snacking. Conventional variants benefit from large-scale production and broad distribution across supermarkets, convenience stores, and online channels, enabling strong penetration in both developed and emerging markets. Organic popcorn is expanding steadily, fueled by rising awareness of chemical-free, non-GMO ingredients, but its higher cost and limited availability keep it secondary to the well-established conventional category.

- For instance, Conagra has adopted regenerative agriculture practices with its popcorn growers, working with approximately 130 contract farmers across the Midwestern United States.

By Flavor Profile

Within the flavor profile segment, Salted/Traditional popcorn leads with approximately 45% market share, driven by its timeless appeal, lower calorie content, and widespread preference among consumers seeking simple, familiar tastes. This segment gains traction due to its suitability for everyday snacking and its strong presence across both RTE and microwave formats. Caramel and other specialty flavors are growing rapidly—supported by premiumization, festive demand, and gourmet offerings—but Salted/Traditional maintains dominance due to its affordability, versatility, and broad acceptance across diverse consumer groups.

Key Growth Drivers

Rising Demand for Healthy and Low-Calorie Snacks

Consumers increasingly prefer healthier snacking options, and popcorn benefits from its naturally low-calorie, whole-grain profile. Brands continue to innovate with air-popped, non-GMO, and low-fat formulations that appeal to health-conscious buyers. The rising adoption of clean-label ingredients and reduced artificial additives further accelerates demand. Growing awareness of dietary benefits such as fiber content and satiety value enhances popcorn’s positioning in the better-for-you snacks category. This shift in consumer preference strongly strengthens market penetration across supermarkets, online channels, and specialty health stores.

- For instance, JOLLY TIME’s Healthy Pop Butter & Sea Salt microwave popcorn delivers just 2 g of fat per serving and 5 g of dietary fiber, as confirmed on the company’s nutrition information.

Rapid Expansion of Ready-to-Eat (RTE) Snack Consumption

The convenience of ready-to-eat popcorn significantly drives market growth as consumers prioritize time-saving food formats. RTE variants offer portability, longer shelf life, and flavor diversity, making them suitable for on-the-go snacking and household consumption. Manufacturers are expanding product lines with gourmet and artisanal flavors to attract premium buyers. Strong distribution through retail chains and e-commerce platforms boosts accessibility. This segment also benefits from attractive packaging innovations and portion-controlled packs that support frequent snacking behavior across diverse demographics.

- For instance, PopCorners brand sources its non-GMO corn from North American family farms, utilizing a proprietary air-popping production process to create the snack. This modern industrial process operates at a much higher, proprietary capacity than the figure of 5,000 chips per hour.

Growth of Entertainment and Out-of-Home Consumption Channels

Popcorn demand continues to rise in cinemas, amusement venues, events, and quick-service outlets. Despite increasing home entertainment, theaters remain major contributors to volume consumption. The expansion of multiplex infrastructures in emerging markets further widens commercial demand. Additionally, partnerships between popcorn brands and entertainment chains enhance product visibility and consistency. Seasonal events, sports screenings, and festivals support recurring spikes in sales. This sustained linkage between popcorn and entertainment culture significantly reinforces market growth across both developed and developing regions.

Key Trends & Opportunities

Premiumization and Flavor Innovation

The market sees strong traction toward gourmet popcorn offerings, including unique savory, sweet, and fusion flavors. Consumers increasingly seek differentiated taste experiences, prompting brands to introduce exotic options such as truffle, chili-lime, dark chocolate drizzle, and cheese blends. Premium products often feature high-quality kernels, artisanal preparation methods, and aesthetically appealing packaging. This trend opens opportunities for niche players and craft snack brands to capture higher margins. As flavor experimentation becomes mainstream, premium segments position popcorn as an indulgent yet accessible snack choice.

- For instance, Kernels are sourced using regenerative agriculture techniques, and they are now packaged in a 28-oz pouch made from 35% post-consumer recycled (PCR) material, reducing the product’s lifecycle greenhouse-gas emissions by roughly 60%, as confirmed by brands utilizing these practices like Quinn Snacks.

Growing Penetration of Online Retail and Subscription Models

E-commerce expansion offers significant opportunity for popcorn brands to increase reach through direct-to-consumer channels. Online platforms support bulk purchasing, limited-edition flavors, and gift packs, catering to diverse customer preferences. Subscription snack boxes and curated gourmet popcorn bundles further elevate brand loyalty. Digital marketing, influencer-led campaigns, and algorithm-driven product recommendations strengthen visibility and repeat sales. This shift toward online retail empowers smaller producers to compete effectively while enabling established brands to scale faster with targeted distribution.

- For instance, Campbell Soup Company revealed at its September 2024 Investor Day event that it has over 1 billion worth of innovation projects in its pipeline across its Snacks and Meals & Beverages divisions, representing future growth catalysts for the company.

Rising Adoption of Organic and Clean-Label Variants

Consumers show expanding interest in organic, non-GMO, gluten-free, and minimally processed popcorn. This trend reflects their preference for natural ingredients and transparent sourcing. Manufacturers respond by integrating organic kernels, plant-based flavor enhancers, and sustainably sourced oils. Clean-label certification and environmentally responsible packaging strengthen consumer trust. As organic snacks gain shelf prominence in specialty and premium retail channels, popcorn producers find growth opportunities in both developed and emerging health-focused markets.

Key Challenges

Volatility in Raw Material Prices

Fluctuations in corn prices pose a significant challenge to popcorn manufacturers, directly affecting production costs and profit margins. Weather disruptions, inconsistent crop yields, and increasing competition for corn supply from other industries contribute to these price instabilities. Smaller players face greater difficulty in absorbing these cost variations, often leading to reduced product variety or higher retail prices. Managing long-term supply contracts and optimizing procurement strategies becomes essential to mitigate the financial impact of raw material uncertainties.

Intensifying Competition and Brand Differentiation Issues

The market faces saturation with numerous regional and global brands offering similar product formats and flavors. High competition pressures companies to invest heavily in product innovation, marketing, and packaging enhancements to maintain consumer attention. Price-sensitive buyers often switch easily between brands, challenging long-term loyalty. New entrants, coupled with private-label offerings from retail chains, further compound competitive intensity. Establishing unique value propositions becomes critical to differentiate in a crowded marketplace dominated by both mass-market and premium players.

Regional Analysis

North America

North America holds the largest share of the global popcorn market, accounting for about 40–45%. The region benefits from strong snacking habits, widespread use of microwave popcorn, and high demand for ready-to-eat varieties. The U.S. leads consumption due to established cinema culture and continuous flavor innovation. Major brands operate extensive retail and online distribution networks, supporting high product availability. Growing interest in healthier, organic, and non-GMO snacks also strengthens market performance, ensuring North America maintains its dominant position.

Europe

Europe represents around 25–30% of the global popcorn market, supported by rising demand for better-for-you snacks and expanding interest in gourmet flavors. Consumers in the UK, Germany, and France show strong preference for premium and artisanal popcorn options. The region benefits from broad supermarket penetration and increasing online snack purchases. Higher health awareness encourages the shift toward air-popped and clean-label variants. Steady cinema attendance and growing convenience-store formats further support regional sales, keeping Europe a significant contributor to global market growth.

Asia-Pacific

Asia-Pacific accounts for approximately 20–25% of the global popcorn market and is among the fastest-growing regions. Rising urbanization, westernized snacking habits, and the rapid expansion of multiplex cinemas drive demand. China, India, and Japan are key consumers, with growing preference for ready-to-eat popcorn and region-specific flavors. Increasing disposable incomes and improved retail infrastructure strengthen market penetration. E-commerce growth makes premium and imported popcorn brands more accessible, supporting the region’s upward trajectory.

Latin America

Latin America contributes about 5–7% to the global popcorn market, with gradual growth driven by expanding retail channels and urban consumption. Brazil and Mexico lead regional demand due to rising cinema attendance and increased availability of packaged snacks. Ready-to-eat popcorn is gaining preference, supported by affordable pricing and convenient pack sizes. Flavor innovation tailored to local tastes also helps brands improve visibility. Although smaller in share, Latin America shows steady progress as distribution networks strengthen and consumer interest in modern snacks increases.

Middle East & Africa

The Middle East & Africa region holds roughly 4–6% of the global popcorn market. Growth is supported by expanding cinema chains, modern retail development, and a young population with growing snack consumption. Countries such as Saudi Arabia, the UAE, and South Africa show the strongest demand. Ready-to-eat popcorn is the leading category, helped by rising interest in convenient and lighter snacks. Increasing online sales and the entry of global brands strengthen product availability. Although still developing, the region shows consistent potential for long-term market expansion.

Market Segmentations:

By Product Type:

- Microwave Popcorn

- Ready-To-Eat Popcorn

By Nature:

By Flavor Profile:

- Salted/Traditional

- Caramel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the popcorn market features a diverse mix of global and specialized players, including Eagle Family Foods Group LLC, PROPER Snacks, Conagra Brands, Inc., JOLLY TIME, The Hershey Company, PepsiCo Inc., Quinn Foods LLC, Weaver Popcorn, Inc., Intersnack Group GmbH & Co. KG., and Campbell Soup Company. The popcorn market is characterized by a mix of large multinational food companies, regional manufacturers, and emerging niche brands that compete through innovation, pricing, and distribution strength. Companies focus heavily on flavor diversification, clean-label formulations, and premium ready-to-eat formats to differentiate in an increasingly crowded marketplace. Strong retail placement across supermarkets, convenience stores, and online platforms remains a core competitive advantage. Many producers are expanding organic and non-GMO product lines to meet growing health-conscious demand, while others invest in sustainable packaging and supply-chain efficiency. Intensifying competition encourages continuous product renovation, marketing investments, and strategic collaborations to sustain market share and brand visibility.

Key Player Analysis

- Eagle Family Foods Group LLC

- PROPER Snacks

- Conagra Brands, Inc.

- JOLLY TIME

- The Hershey Company

- PepsiCo Inc.

- Quinn Foods LLC

- Weaver Popcorn, Inc.

- Intersnack Group GmbH & Co. KG.

- Campbell Soup Company

Recent Developments

- In November 2025, Pop Secret’s ready-to-eat (RTE) popcorn is currently available at a variety of nationwide retailers, including Kroger, Five Below, Big Y, and Spartan Nash. Initially, the flavors had specific retail limits, but distribution has since expanded to approximately 2,300 locations nationwide for all three varieties.

- In May 2025, Conagra Brands Brings Diverse Collection of Snacks to 2025 Sweets & Snacks Expo | Conagra Brands. Mango Habanero caters to the sweet and heat trend by combining tropical fruit with spicy seasonings on a sweet and salty kettle base.

- In September 2024, snacking brand 4700BC partnered with Netflix to launch new popcorn variants in India. The featured flavors were Sweet & Salty and Cheese & Caramel, designed to complement consumers’ viewing experiences.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Nature, Flavor Profile and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow as consumers increasingly prefer convenient and healthier snacking options.

- Ready-to-eat popcorn will expand further due to strong demand for on-the-go, flavorful snack formats.

- Premium and gourmet popcorn varieties will gain traction as brands introduce innovative and exotic flavors.

- Clean-label, organic, and non-GMO popcorn products will see rising adoption among health-conscious buyers.

- E-commerce and direct-to-consumer channels will play a larger role in product distribution and brand visibility.

- Sustainable packaging solutions will become a priority as companies aim to reduce environmental impact.

- Flavored popcorn segments will grow rapidly as consumers seek differentiated and indulgent snack experiences.

- Emerging markets will offer new growth opportunities due to increasing urbanization and expanding retail networks.

- Partnerships with cinemas, events, and entertainment venues will continue to support commercial popcorn demand.

- Innovation in production efficiency and ingredient sourcing will strengthen competitiveness across the industry.