Market Overview

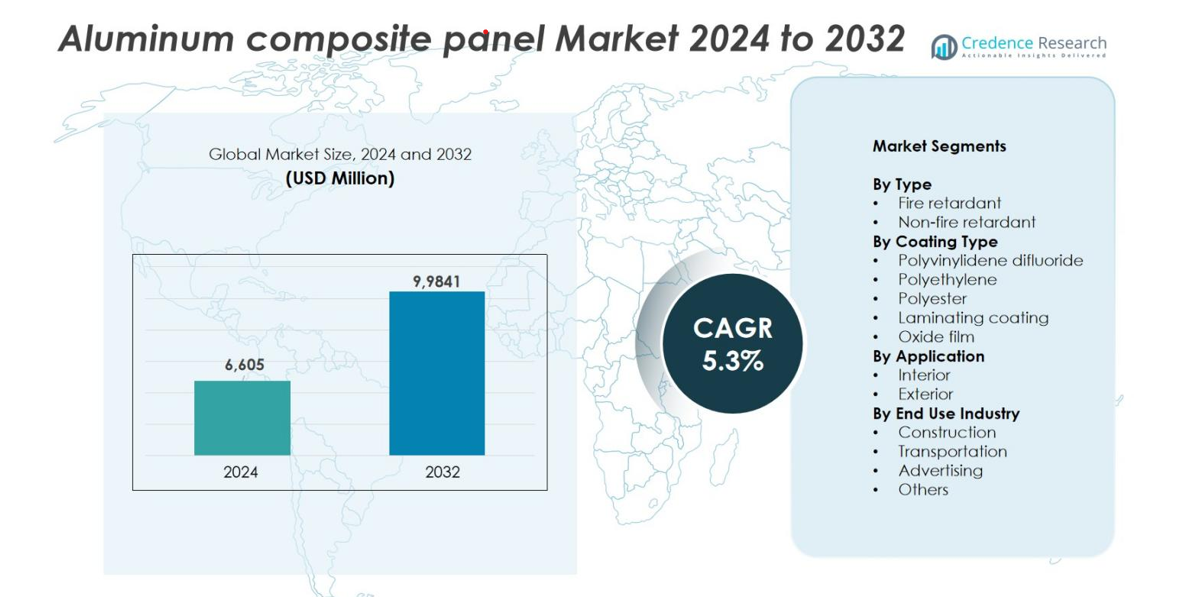

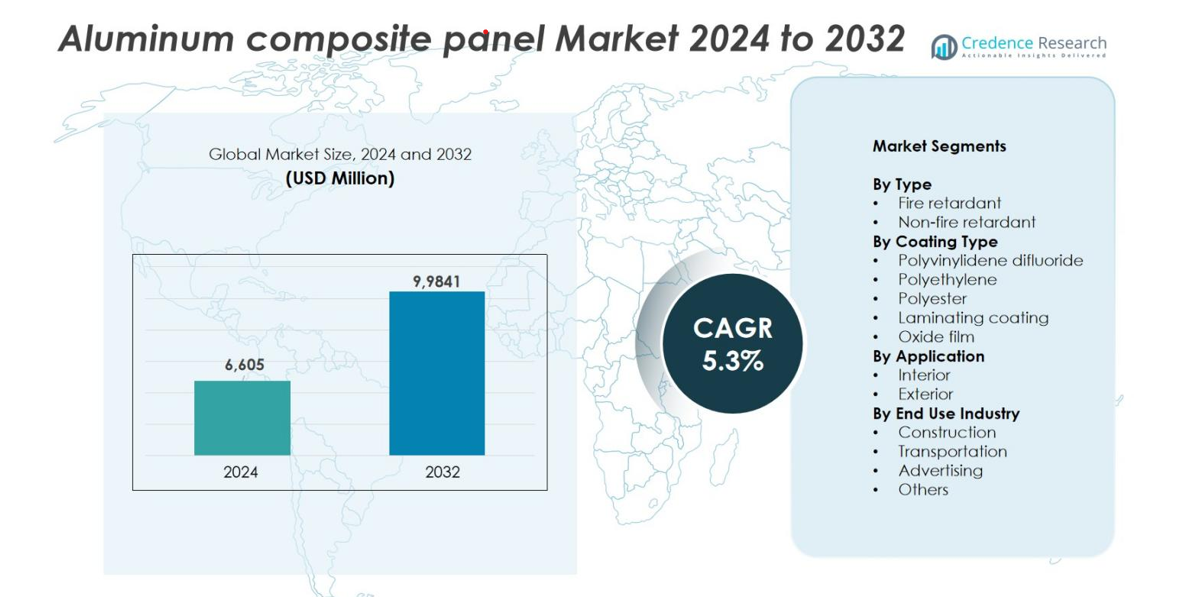

The Aluminum Composite Panel Market size was valued at USD 6,605 million in 2024 and is anticipated to reach USD 9,984 million by 2032, growing at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aluminum Composite Panel Market Size 2024 |

USD 6,605 million |

| Aluminum Composite Panel Market, CAGR |

5.3% |

| Aluminum Composite Panel Market Size 2032 |

USD 9,984 million |

The aluminum composite panel market is led by diversified global and regional specialists.

Key players include Mitsubishi Chemical Corporation (ALPOLIC), Alpolic Materials, Alcoa, Alstrong, Alucopanel, Alfrex, Alumax Industrial, Alutec, Alumaze, and Alumanate.

Vendors compete on certified fire-retardant grades, PVDF weatherability, recyclability, and design customization. Asia-Pacific leads the market with 37% share, supported by rapid urbanization and large infrastructure pipelines.

Market Insights

- The Aluminum Composite Panel Market was valued at USD 6,605 million in 2024 and is expected to reach USD 9,984 million by 2032, growing at a CAGR of 5.3% during the forecast period.

- Rising demand for modern, fire-retardant facades in commercial and residential construction is a major market driver, supported by strict building safety regulations and sustainable architecture trends.

- Technological advancements in PVDF coatings, digital printing, and recyclable composite materials enhance performance and design versatility, shaping evolving market trends.

- The competitive landscape features companies such as Mitsubishi Chemical Corporation, Alpolic Materials, Alcoa, Alstrong, and Alucopanel focusing on innovation, lightweight structures, and global distribution expansion.

- Asia-Pacific leads with 37% share, followed by Europe with 27%, while the fire-retardant segment dominates the market, driven by strong construction growth and regulatory compliance in high-rise and public infrastructure projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The fire-retardant segment dominates the aluminum composite panel market with the largest market share. Its widespread use in commercial buildings, airports, and high-rise constructions is driven by rising safety standards and strict fire regulations. These panels provide superior thermal resistance and limit flame spread, making them ideal for exterior cladding applications. Governments and building authorities increasingly mandate fire-safe materials, accelerating adoption. The non-fire-retardant segment continues to serve low-risk and interior applications where cost efficiency and easy installation remain key priorities.

- For instance, Viva ACP produces fire-retardant panels with cores comprising 70-90% mineral content like Magnesium Hydroxide and Aluminium Trihydroxide, offering superior fire resistance for both residential and commercial structures.

By Coating Type

The polyvinylidene difluoride (PVDF) coating segment holds the dominant share in the market, supported by its excellent weather resistance, color stability, and UV protection. PVDF-coated panels are widely preferred for outdoor structures such as facades and signage due to their long-term durability and resistance to corrosion. The growing use of PVDF coatings in sustainable and energy-efficient building designs further enhances their market position. Meanwhile, polyester and polyethylene coatings cater to cost-sensitive indoor projects that demand aesthetic appeal and smooth finishes.

- For instance, PVDF-coated aluminum panels are extensively used in building facades for their resistance to coastal environmental conditions, ensuring long-term durability.

By Oxide Film and Laminating Coating

Within the advanced surface treatments, the oxide film segment is gaining steady growth owing to its superior hardness, scratch resistance, and enhanced adhesion properties. Oxide film coatings improve the panel’s resistance to wear and environmental damage, extending lifespan in industrial and architectural settings. Laminating coatings also contribute to design flexibility by offering varied textures and finishes suitable for premium interiors. The demand for durable, visually appealing materials in modern infrastructure projects continues to boost adoption across both oxide film and laminating-coated aluminum composite panels.

Key Growth Drivers

Rising Demand for Modern Building Facades

The growing adoption of aluminum composite panels (ACPs) in modern architecture is a key growth driver. Architects and builders increasingly prefer ACPs for their light weight, design flexibility, and sleek appearance. The panels enhance building aesthetics while ensuring structural integrity, making them ideal for both commercial and residential projects. Rapid urbanization, infrastructure modernization, and smart city projects in Asia-Pacific and the Middle East further stimulate demand. Fire-retardant and weather-resistant ACPs are now widely used in skyscrapers, airports, and corporate offices to meet safety and sustainability standards, accelerating global market expansion.

- For instance, 3A Composites manufactures ALUCORE®, a next-generation composite material widely used in India and exported globally, including Asia-Pacific and the Middle East, known for its fire safety, durability, and sustainable features.

Expansion in Industrial and Transportation Applications

The application of aluminum composite panels extends beyond construction to transportation and industrial sectors. Manufacturers are integrating ACPs in vehicle bodies, rail interiors, and marine structures due to their corrosion resistance, acoustic insulation, and lightweight properties. This reduces fuel consumption and enhances durability, aligning with green mobility initiatives. Industrial facilities also adopt ACPs for wall cladding and insulation, contributing to energy-efficient infrastructure. Continuous innovation in coatings and composite technologies further enhances panel performance, driving broader cross-sector adoption across global industries.

- For instance, Alumaze’s ACP sheets are widely used in bus bodies due to their lightweight properties that enhance fuel efficiency and corrosion resistance, supporting greener mobility initiatives.

Technological Advancements and Material Innovation

Advancements in coating technologies and material engineering are fueling ACP market growth. New formulations such as PVDF, nano-PVDF, and fluoropolymer coatings offer enhanced UV protection, self-cleaning properties, and extended color durability. Manufacturers are also developing recyclable and eco-friendly ACP variants to comply with environmental regulations and green building certifications like LEED and BREEAM. Automation in panel fabrication and precision lamination processes improves consistency and reduces production costs. These innovations strengthen product competitiveness, making ACPs more appealing to developers seeking high-performance, low-maintenance facade materials.

Key Trends & Opportunities

Growing Focus on Sustainable and Energy-Efficient Construction

Sustainability is reshaping market dynamics, with a strong shift toward energy-efficient and eco-friendly ACPs. Companies are producing recyclable panels and low-emission coatings to support green building initiatives. Reflective and insulated ACPs contribute to lower energy consumption in buildings by maintaining interior temperature stability. Government incentives for sustainable construction, along with consumer demand for environmentally responsible materials, drive further adoption. The trend aligns with the global push toward net-zero emissions and is expected to redefine product innovation in the ACP market over the coming decade.

- For instance, in Ahmedabad, India, ACP sheets coated with PVDF and Nano-PVDF reflect solar radiation and provide thermal insulation, significantly reducing the need for air conditioning and leading to substantial energy savings during hot summers.

Expanding Use in Renovation and Refurbishment Projects

The renovation of aging infrastructure across developed economies presents a major opportunity for ACP manufacturers. Retrofitting projects increasingly use ACPs to enhance building aesthetics, insulation, and durability without heavy structural changes. Lightweight and customizable ACPs allow faster installation and minimal disruption during renovation. Public buildings, shopping centers, and educational institutions are adopting these materials to meet updated safety and design standards. With governments emphasizing urban renewal, the demand for fire-safe and eco-friendly ACPs in refurbishment continues to rise globally.

Integration of Digital Printing and Custom Design Solutions

Technological innovation in digital printing and design customization is creating new growth avenues. Advanced surface printing techniques allow manufacturers to deliver panels in diverse textures and finishes such as wood, metallic, or stone patterns. These customizable options meet architectural and branding needs across retail and corporate sectors. The rising preference for visually distinct facades in modern construction enhances demand for digitally printed ACPs. This trend enables companies to differentiate products and cater to premium market segments focused on aesthetics and personalization.

Key Challenges

Fluctuating Raw Material Prices

Volatility in aluminum and polymer resin prices poses a major challenge to ACP manufacturers. Global supply chain disruptions, trade restrictions, and fluctuating energy costs impact raw material availability and pricing. Since aluminum accounts for a significant portion of production cost, even minor price increases can compress profit margins. Manufacturers are adopting long-term supply agreements and recycling initiatives to mitigate price risks. However, sustained volatility continues to pressure small and mid-sized producers, affecting market stability and long-term competitiveness.

Stringent Environmental and Fire Safety Regulations

Compliance with evolving fire safety and environmental standards remains a critical challenge. Governments worldwide are imposing stricter norms for facade materials following incidents involving non-compliant panels. Manufacturers must invest heavily in research and testing to develop panels that meet Class A fire ratings and low-VOC standards. The certification process increases production costs and extends time-to-market. Companies that fail to adapt risk losing certifications or facing restricted market access. Ensuring consistent regulatory compliance while maintaining profitability remains a complex balance for industry players.

Regional Analysis

North America

North America holds a market share of 22% in the aluminum composite panel market, driven by the strong adoption of advanced facade systems in commercial and institutional buildings. The United States leads the regional growth, supported by modernization projects and sustainability-focused construction. Fire-retardant ACPs are gaining traction due to strict safety standards and energy-efficient building mandates. The growing renovation of public infrastructure, coupled with the popularity of lightweight, low-maintenance materials, continues to boost demand. Technological innovation and product customization by regional manufacturers further enhance market competitiveness and adoption rates.

Europe

Europe accounts for 27% of the global aluminum composite panel market, driven by the increasing use of eco-friendly materials in green building projects. Countries like Germany, France, and the U.K. emphasize sustainable construction practices, supported by stringent EU energy efficiency directives. The market benefits from advanced architectural designs and refurbishment of aging infrastructure across urban areas. Fire-rated and recyclable ACPs are gaining preference in compliance with EN standards. Manufacturers in the region focus on product durability and design flexibility to meet evolving regulatory and aesthetic requirements in the construction sector.

Asia-Pacific

Asia-Pacific dominates the global market with a 37% share, fueled by rapid urbanization, industrial expansion, and government-led infrastructure projects. China, India, and Japan are major contributors, with large-scale investments in smart cities and commercial complexes. Affordable labor, strong manufacturing capabilities, and rising demand for high-performance construction materials drive growth. The region also benefits from expanding transportation and industrial applications of ACPs. Continuous technological advancements in coating and lamination processes strengthen local production capacity, positioning Asia-Pacific as the global hub for aluminum composite panel manufacturing and export.

Latin America

Latin America represents 8% of the aluminum composite panel market, supported by growing construction activity in Brazil, Mexico, and Chile. Rapid urban development, renovation of public spaces, and expanding retail infrastructure boost ACP adoption. Local manufacturers focus on cost-effective, weather-resistant panels to meet regional climate conditions. Government programs promoting energy-efficient and aesthetic building materials also contribute to demand. While price sensitivity limits premium product penetration, increasing awareness of fire safety and durability standards presents new opportunities for market growth across the region’s developing economies.

Middle East & Africa

The Middle East & Africa region accounts for 6% of the global market, driven by extensive infrastructure projects and tourism-related developments. Countries such as the UAE, Saudi Arabia, and South Africa lead regional demand with investments in smart cities and commercial real estate. High resistance to extreme temperatures and modern design appeal make ACPs ideal for architectural facades. The region’s growing focus on sustainable and fire-resistant materials further accelerates market expansion. Strategic partnerships with global manufacturers and large-scale construction initiatives continue to strengthen regional adoption and market share.

Market Segmentations:

By Type

- Fire retardant

- Non-fire retardant

By Coating Type

- Polyvinylidene difluoride

- Polyethylene

- Polyester

- Laminating coating

- Oxide film

By Application

By End Use Industry

- Construction

- Transportation

- Advertising

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The aluminum composite panel market features a competitive landscape with global and regional players focusing on innovation, product diversification, and sustainability. Leading companies such as Mitsubishi Chemical Corporation, Alpolic Materials, Alcoa, Alstrong, Alutec, Alucopanel, Alfrex, Alumax Industrial, Alumaze, and Alumanate emphasize advanced coating technologies and fire-retardant panel development to meet global safety and environmental standards. Strategic initiatives, including mergers, joint ventures, and geographic expansion, strengthen their market presence. Firms invest in R&D to produce lightweight, weather-resistant, and recyclable panels for modern architectural applications. Manufacturers are also integrating digital printing and nano-coating technologies to enhance aesthetics and durability. Partnerships with construction firms and distributors help expand product reach, while competitive pricing and customization options attract diverse end-users. The growing demand for sustainable materials continues to push manufacturers toward eco-friendly innovations and circular production models, intensifying competition within the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Alutec

- Alpolic Materials

- Alstrong

- Alumax Industrial

- Alcoa

- Mitsubishi Chemical Corporation

- Alucopanel

- Alfrex

- Alumaze

- Alumanate

Recent Developments

- In January 2025, Viva launched Solid X India’s first pre-coated, ready-to-install solid aluminum panels. This game-changing product marks a new era in architectural design, combining outstanding strength, versatility, and sustainability to revolutionize modern facades and interiors.

- In November 2024, Alucobond introduced “Alucodual,” a new advanced addition to its range of premium aluminum composite materials. Created to expand the company’s portfolio of technology-driven cladding solutions, Alucodual is specifically designed for use in architectural applications where enhanced design and functionality are paramount.

- In 2024, Viva introduced its latest collection, Pure Aura. This new line of anodized aluminum panels personifies purity, combining ageless natural beauty with contemporary workmanship. With Pure Aura, Viva makes a big leap in the revolution of architectural design, offering a practical, top-quality solution that responds to aesthetics and green building principles

Report Coverage

The research report offers an in-depth analysis based on Type, Coating, Application, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness steady expansion driven by urban infrastructure and commercial construction growth.

- Increasing adoption of fire-retardant and sustainable ACPs will boost product innovation.

- Technological advances in nano-coatings and digital printing will enhance design flexibility.

- Manufacturers will focus on recyclable and low-emission materials to meet green building standards.

- Asia-Pacific will remain the leading regional hub due to large-scale infrastructure projects.

- Demand from transportation and industrial sectors will rise for lightweight, durable materials.

- Renovation and refurbishment projects in developed regions will sustain long-term demand.

- Stringent fire safety regulations will push manufacturers toward certified high-performance panels.

- Strategic mergers and partnerships will strengthen global distribution and production networks.

- The integration of smart materials and advanced coatings will define the next growth phase.