Market Overview

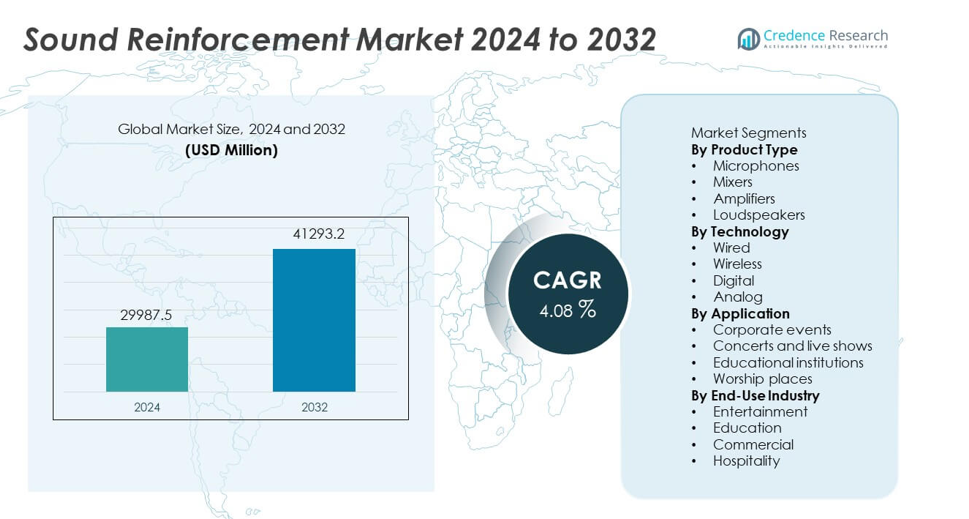

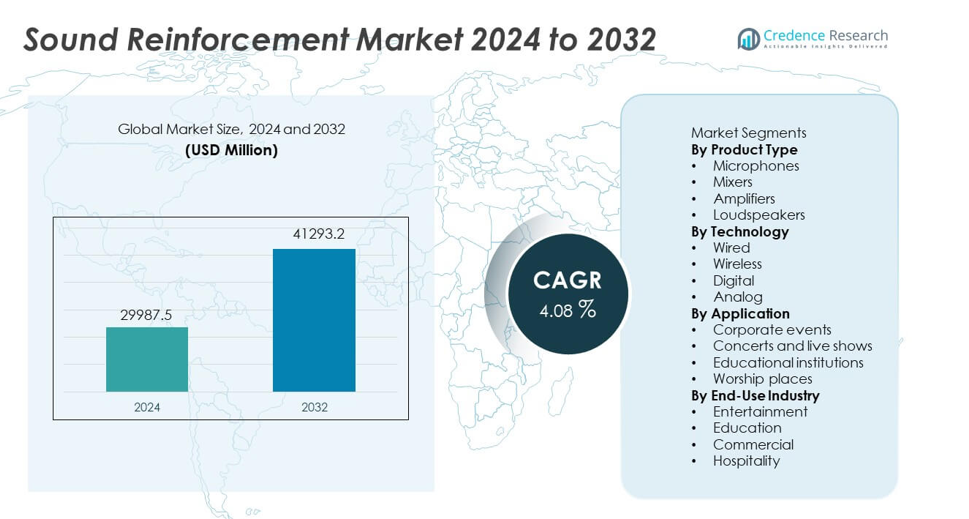

Sound Reinforcement market size was valued at USD 29,987.5 million in 2024 and is projected to reach USD 41,293.2 million by 2032, registering a CAGR of 4.08% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sound Reinforcement market Size 2024 |

USD 29,987.5 million |

| Sound Reinforcement market, CAGR |

4.08% |

| Sound Reinforcement market Size 2032 |

USD 41,293.2 million |

The top players in the Sound Reinforcement market include Shure Incorporated, Yamaha Corporation, Bose Corporation, Harman International, Sennheiser Electronic GmbH & Co. KG, QSC LLC, Audio-Technica Corporation, Meyer Sound Laboratories, RCF S.p.A, and Loud Technologies Inc. These companies lead through strong product portfolios, continuous R&D investment, and advanced digital and wireless technologies that improve sound quality and system efficiency. North America stands as the leading region with a 34% market share, driven by high adoption of professional audio systems in concerts, sports arenas, corporate events, and educational institutions. Europe and Asia Pacific follow with strong demand from entertainment and infrastructure development projects.

Market Insights

- The Sound Reinforcement market reached USD 29,987.5 million in 2024 and will grow at a CAGR of 4.08 percent through 2032.

- Demand rises as live events expand, and microphones lead the product segment with a 34 percent share driven by increased use in concerts and corporate setups.

- Wireless technology gains strong traction, holding a 41 percent share as venues shift toward flexible, low-clutter audio systems with advanced digital control features.

- Competition intensifies as major players enhance portfolios with lightweight speakers, energy-efficient amplifiers, and AI-supported tuning solutions to strengthen performance in large venues.

- North America leads with a 34 percent share, followed by Europe at 28 percent and Asia Pacific at 29 percent, supported by strong entertainment activity, infrastructure upgrades, and rising adoption in education and corporate environments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Microphones lead this segment with a 34% share, supported by strong demand from live concerts, corporate events, and broadcast studios. Growth in smart microphone technology and rising adoption of noise-cancellation features strengthen this category. Mixers and amplifiers gain traction as event organizers prefer advanced control systems for large venues. Loudspeakers also expand due to multizone audio setups in arenas and stadiums. Rising investments in event production and improvements in acoustic performance support overall segment growth.

- For instance, Shure introduced the Axient Digital platform with a 184 MHz tuning range and AES-256 encryption. The system supports up to 47 compatible channels in one frequency band.

By Technology

Wireless systems dominate the technology segment with a 41% share, driven by demand for flexible setups in concerts, conferences, and worship centers. Wireless platforms reduce cable clutter, improve mobility, and support fast installation across events. Digital solutions also gain momentum as audio engineers prefer enhanced signal processing and remote control. Analog systems continue to serve small venues that prioritize affordability. Advancements in frequency management and low-latency transmission drive higher adoption of modern wireless systems.

- For instance, Sennheiser’s Digital 6000 wireless system operates with very low latency. The platform supports a wide switching bandwidth for complex environments.

By Application

Concerts and live shows hold the largest share at 38%, as large venues require high-power reinforcement systems to deliver clear and consistent sound. Corporate events grow due to rising conferences, product launches, and hybrid meeting formats. Educational institutions adopt reinforcement systems for lecture halls and auditoriums. Worship places expand their use of loudspeakers, amplifiers, and microphones to improve clarity during services. Rising event frequency and investment in high-quality audio systems strengthen this segment.

Key Growth Drivers

Growing Demand for Large-Scale Live Events

Rising global interest in concerts, festivals, and sports events drives strong adoption of advanced sound reinforcement systems. Event organizers invest in high-capacity loudspeakers, digital mixers, and wireless microphones to deliver clear audio across large venues. Growth in arena upgrades and outdoor event infrastructure improves system penetration. Advancements in acoustic engineering help reduce distortion and enhance audience experience. Increased spending on entertainment boosts long-term demand for professional sound solutions.

- For instance, Meyer Sound’s LEO line array delivers a peak sound pressure level of 140 dB for stadium events. The system supports long-throw coverage beyond 300 meters with uniform sound dispersion.

Rapid Adoption of Digital and Wireless Technologies

Digital processing platforms and wireless transmission systems reshape modern event setups. Users prefer wireless microphones and speakers due to flexible placement, reduced clutter, and faster installation. Digital audio networks enable real-time monitoring, remote control, and advanced tuning across different zones. Integration with IP-based systems enhances scalability in corporate and institutional applications. These capabilities raise efficiency and support greater use of high-performance reinforcement equipment across diverse venues.

- For instance, Sennheiser’s Digital 6000 system offers a switching bandwidth of 244 MHz for complex RF environments. QSC’s Q-SYS platform manages over 250 networked audio endpoints through a single control core.

Expansion of Corporate and Educational Applications

Corporate events, training programs, and hybrid meetings increase demand for reliable sound systems in conference halls and studios. Educational institutions also adopt reinforcement setups for lecture theatres, auditoriums, and e-learning environments. Growth in corporate communication tools supports deployment of professional-grade microphones and digital mixers. Universities invest in upgraded AV infrastructure to enhance student engagement. These factors broaden market reach beyond entertainment, adding steady demand from formal and structured environments.

Key Trends & Opportunities

Integration of Smart and Networked Audio Systems

Manufacturers introduce smart sound systems with networked control, AI-based optimization, and remote configuration. These innovations allow engineers to adjust audio parameters in real time and coordinate multiple devices from a single interface. Networked audio supports large venue synchronization and reduces manual intervention. AI-driven tuning features enhance clarity and reduce background noise. This shift creates strong opportunities for cloud-connected reinforcement systems across arenas, corporate centers, and modern educational campuses.

- For instance, QSC’s Q-SYS platform supports many networked audio endpoints on a single Core processor. The system processes audio with centralized control and monitoring.

Increasing Use of Lightweight and Energy-Efficient Equipment

Demand grows for compact, lightweight speakers and amplifiers that simplify transport and reduce installation time. Manufacturers adopt advanced materials and efficient power modules to improve durability and lower energy use. These systems support mobile event companies that require quick setup and dismantling. Reduced power consumption also appeals to sustainability-focused venues. This trend opens opportunities for eco-friendly product lines that support long-term operational savings.

- For instance, RCF’s HDL 6-A line array weighs a specific amount and uses a powerful digital amplifier module. Powersoft’s X4 amplifier delivers substantial power across multiple channels in a single rack space form factor with active power factor correction.

Key Challenges

High Installation and Maintenance Costs

Professional sound reinforcement setups require significant investment in amplifiers, mixers, signal processors, and cabling. Large venues often face higher installation costs due to complex zoning and system calibration. Maintenance demands also rise with continuous usage in concerts and corporate events. These expenses limit adoption in small and mid-sized facilities. Budget constraints in schools and community centers further slow replacement cycles, affecting market expansion.

Interference and Signal Reliability Issues in Wireless Systems

Growing reliance on wireless microphones and speakers increases the risk of signal interference, especially in crowded frequency environments. Congested urban areas, overlapping frequencies, and equipment incompatibility can affect audio stability during live events. Engineers must manage frequency planning, shielding, and device coordination to maintain consistent performance. These challenges raise operational complexity and may result in disruptions during critical event moments, impacting user confidence.

Regional Analysis

North America

North America holds a 34% share due to its strong entertainment industry and high investment in advanced audio infrastructure. Growing demand for concerts, sports events, and corporate functions supports widespread adoption of digital and wireless systems. Venues upgrade reinforcement equipment to enhance audience experience and meet modern acoustic standards. Educational institutions and worship centers also drive consistent system replacement cycles. Strong presence of leading manufacturers further supports market expansion across the region.

Europe

Europe accounts for a 28% share, driven by a mature live event ecosystem and steady growth in cultural festivals and professional conferences. Countries upgrade sound infrastructure in stadiums, opera houses, and public venues to meet evolving acoustic requirements. Corporate events and broadcast studios add steady demand for high-performance microphones and digital mixers. Strict regulations on audio quality and noise control ensure wider adoption of modern reinforcement systems. Advancements in wireless technology also support long-term market growth.

Asia Pacific

Asia Pacific leads in growth momentum with a 29% share, supported by rising investments in entertainment venues, expanding corporate sectors, and rapid urban development. Concerts, exhibitions, and large public gatherings fuel strong demand for high-capacity reinforcement systems. Educational institutions and places of worship adopt advanced audio solutions to enhance communication and engagement. Expanding media production and e-sports industries add new opportunities. Government infrastructure projects also boost installations in stadiums and convention centers across major economies.

Latin America

Latin America captures an 5% share, driven by increasing adoption of audio systems in concerts, sports events, and community festivals. Urban centers invest in upgraded reinforcement setups to support large-scale gatherings and cultural programs. Corporate events and educational institutions contribute to steady demand for microphones, amplifiers, and digital mixers. Growth remains moderate due to budget constraints, yet rising entertainment activity and modernization of public venues support long-term expansion.

Middle East & Africa

The Middle East & Africa region holds a 4% share, supported by growing investments in hospitality, religious gatherings, and large event venues. Countries in the Gulf prioritize advanced audio systems for conferences, tourism spaces, and high-profile events. Expanding construction of stadiums and cultural centers stimulates demand for professional reinforcement systems. Adoption increases in educational institutions and corporate facilities. Market growth remains gradual in Africa, but rising urbanization and public infrastructure upgrades provide emerging opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Product Type

- Microphones

- Mixers

- Amplifiers

- Loudspeakers

By Technology

- Wired

- Wireless

- Digital

- Analog

By Application

- Corporate events

- Concerts and live shows

- Educational institutions

- Worship places

By End-Use Industry

- Entertainment

- Education

- Commercial

- Hospitality

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the market is shaped by leading companies such as Shure Incorporated, Yamaha Corporation, Bose Corporation, Harman International, Sennheiser Electronic GmbH & Co. KG, QSC LLC, Audio-Technica Corporation, Meyer Sound Laboratories, RCF S.p.A, and Loud Technologies Inc. These players compete through continuous innovation in digital processing, wireless technologies, and networked audio systems. Many firms enhance product durability, sound clarity, and system integration to meet growing demand across concerts, corporate events, and educational venues. Strategic partnerships with event organizers and AV integrators help expand market reach. Companies also focus on lightweight, energy-efficient designs that support fast deployment and reduce operational load. Ongoing R&D investment strengthens their ability to deliver high-performance solutions that suit large and complex venue requirements.

Key Player Analysis

Recent Developments

- In 2025, Yamaha Music India hosted the Yamaha Audio Engineers Forum in Mumbai, focusing on live sound and pro audio trends.

- In June 2025, Yamaha Corporation opened a new Experience Center in Bengaluru featuring integrated pro audio solutions for sound reinforcement.

- In January 2025, Shure Incorporated unveiled new professional audio gear at NAMM 2025, including Nexadyne instrument microphones and SLX-D quad-channel receivers.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Technology, Application, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for advanced digital mixers will rise as venues upgrade event infrastructure.

- Wireless audio systems will expand due to faster setup needs and flexible stage layouts.

- Smart and networked sound systems will gain adoption in large multi-zone venues.

- Lightweight loudspeaker designs will support growth in mobile event production.

- AI-based tuning and real-time monitoring will improve sound accuracy across applications.

- Corporate and educational sectors will invest more in modern reinforcement systems.

- Stadiums and entertainment arenas will drive demand for high-capacity audio setups.

- Energy-efficient amplifiers and eco-focused designs will influence new product development.

- Integration with cloud-based control platforms will enhance remote management.

- Expanding events and tourism activities in emerging markets will support long-term growth.