Market Overview

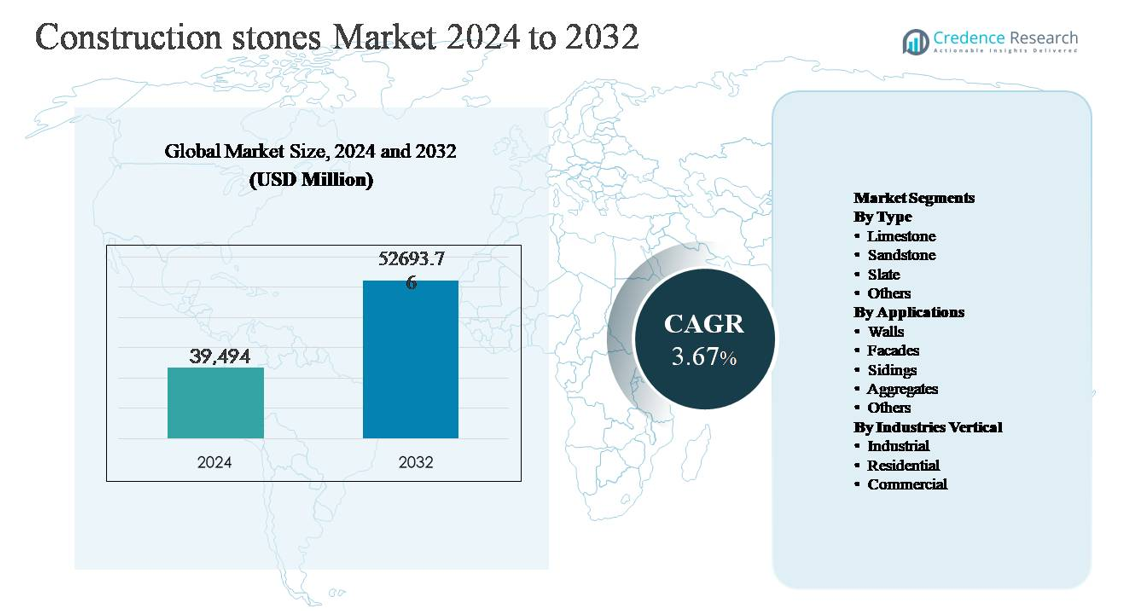

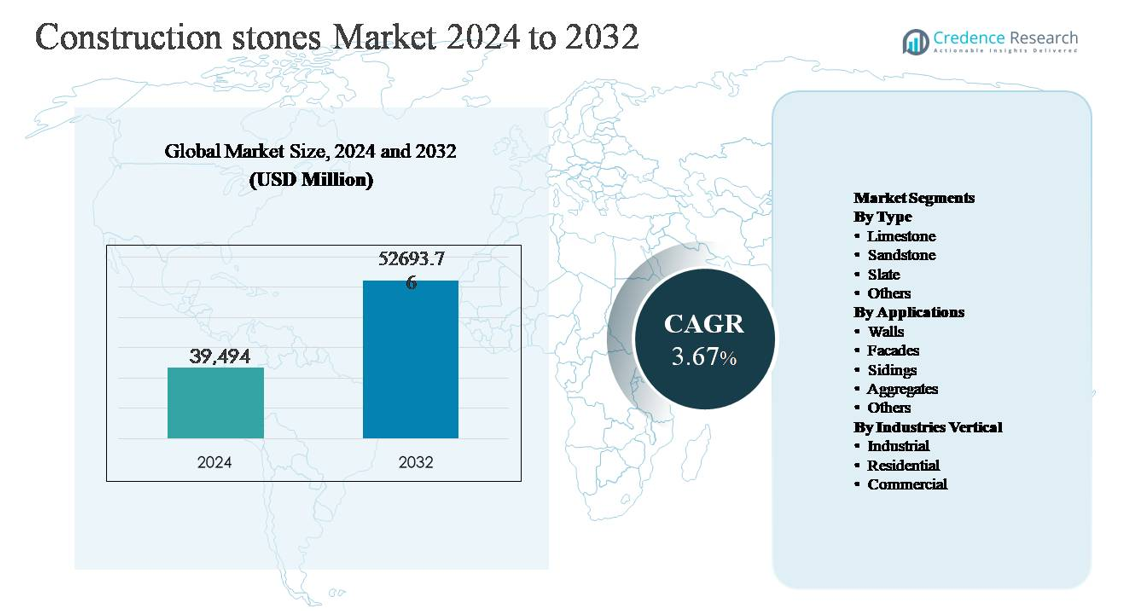

The construction stones market was valued at USD 39,494 million in 2024 and is projected to reach USD 52,693.76 million by 2032, expanding at a compound annual growth rate (CAGR) of 3.67% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Construction Stones Market Size 2024 |

USD 39,494 million |

| Construction Stones Market, CAGR |

3.67% |

| Construction Stones Market Size 2032 |

USD 52,693.76 million |

The construction stones market is led by a mix of global manufacturers and regionally strong producers focusing on quarrying, processing, and value-added stone solutions. Key players such as Cosentino Group, Caesarstone, Dal-Tile, Marazzi Group, Granite Canada Exports, Sunrise Quartzite, RockSolid Granit USA, Dakota Granite, US Stoneworks, Precision Countertops, Duracite, AbleGroup, Vangura, LSR Group, Benchmark Building Supplies, and Silkar Mining Joint-Stock compete through diversified stone portfolios, processing capabilities, and strong distribution networks. Asia-Pacific is the leading region, holding approximately 43% of the global market share, driven by large-scale infrastructure development, urban housing growth, and abundant natural stone reserves. North America and Europe follow, supported by renovation activity, commercial construction, and demand for premium architectural stone products.

Market Insights

- The construction stones market was valued at USD 39,494 million in 2024 and is projected to reach USD 52,693.76 million by 2032, expanding at a CAGR of 3.67% during the forecast period, supported by steady demand from infrastructure, residential, and commercial construction activities.

- Market growth is primarily driven by large-scale infrastructure development, urban housing expansion, and rising investments in transportation networks, with aggregates accounting for nearly 45-50% of total demand due to their extensive use in roads, concrete, and civil works.

- Key market trends include growing preference for natural and sustainable building materials, increased use of decorative stones in façades and interiors, and adoption of advanced quarrying and processing technologies to improve efficiency and product customization.

- The competitive landscape remains fragmented, with global players and regional suppliers competing through quarry ownership, value-added stone processing, design-driven portfolios, and strengthened distribution networks for large projects.

- Regionally, Asia-Pacific dominates with around 40-45% market share, followed by North America at 22-25% and Europe at 18-20%, while industrial construction remains the leading end-use segment with approximately 40-45% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type:

By type, limestone represents the dominant sub-segment in the construction stones market, accounting for an estimated 38-42% market share. Its leadership is driven by widespread availability, cost efficiency, ease of cutting, and strong suitability for structural, cladding, and aggregate applications. Limestone is extensively used in cement production, road base layers, and building blocks, reinforcing its demand across infrastructure and housing projects. Sandstone follows due to its aesthetic appeal and weather resistance in architectural uses, while slate maintains niche demand for roofing and premium flooring. Other stones cater to specialized decorative and industrial requirements.

- For instance, CUPA Group’s Spanish slate operations extract roofing slates tested to withstand over 100 freeze thaw cycles, supporting durability in harsh climates. Other stones serve specialized decorative and industrial requirements, typically produced in smaller, application-specific volumes.

By Applications:

By application, aggregates form the dominant sub-segment, contributing approximately 45-50% of total demand, supported by large-scale infrastructure, road construction, and concrete production activities. Aggregates are essential inputs for highways, bridges, railways, and urban development projects, making them volume-driven and price-sensitive. Walls and facades represent the next significant share, driven by residential and commercial construction aesthetics and durability needs. Sidings and other applications, including landscaping and paving, grow steadily, supported by urban beautification initiatives and increased use of natural stone for long-lasting exterior finishes.

- For instance, Holcim operates dedicated aggregates facilities integrated with its cement operations, such as the Texas Materials sites in the U.S., where individual quarries are equipped with crushing and screening lines capable of processing up to 800 tonnes per hour, supporting continuous supply for ready-mix concrete and asphalt plants.

By Industries Vertical:

By industry vertical, the industrial segment dominates with an estimated 40-45% market share, driven by sustained investments in infrastructure, manufacturing facilities, energy projects, and transportation networks. High consumption of aggregates and structural stones in industrial construction underpins this dominance. The residential segment follows closely, supported by urban housing demand, renovation activities, and preference for durable natural materials. The commercial segment, including offices, retail spaces, and hospitality projects, shows steady growth, driven by façade aesthetics, premium flooring, and long lifecycle performance requirements of natural construction stones.

Key Growth Drivers

Expansion of Infrastructure and Urban Development

Large-scale infrastructure development remains a primary growth driver for the construction stones market. Governments across emerging and developed economies continue to prioritize investments in highways, rail corridors, ports, airports, and urban transit systems, all of which require significant volumes of aggregates, limestone, and other construction stones. Rapid urbanization further accelerates demand for residential housing, utilities, and public buildings, reinforcing consistent stone consumption. Stone-based materials are favored for their structural strength, load-bearing capacity, and long service life, making them indispensable in foundational and civil works. Public–private partnerships and long-term infrastructure pipelines provide demand visibility, while renovation and rehabilitation of aging infrastructure in mature markets add incremental volume growth.

- For instance, Network Rail in the United Kingdom procures granite and limestone ballast graded at 5-50 mm, with annual ballast renewal volumes exceeding 2 million tonnes to maintain track stability.

Growth in Residential and Commercial Construction Activity

Rising population density, migration toward urban centers, and increasing household formation are driving sustained residential construction activity. Construction stones are widely used in walls, flooring, roofing, and exterior applications due to their durability, thermal performance, and visual appeal. In parallel, commercial construction including office buildings, retail complexes, hospitality projects, and mixed-use developments supports demand for premium stone finishes such as sandstone and slate. Developers increasingly favor natural stone for façades and interiors to enhance aesthetics and asset value. Growing investments in real estate development, especially in Asia-Pacific and the Middle East, continue to strengthen demand across both volume-driven and value-added stone segments.

- For instance, Levantina Group has supplied large-format sandstone and limestone façade panels measuring up to 2 meters in length, processed using multi-wire cutting technology to achieve consistent surface flatness for high-rise commercial buildings..”

Durability and Cost Efficiency of Natural Stone Materials

The inherent durability and long lifecycle of natural construction stones act as a strong market driver. Compared to engineered alternatives, natural stones offer superior resistance to weathering, mechanical stress, and fire, reducing long-term maintenance and replacement costs. Limestone and aggregates, in particular, provide cost-efficient solutions for structural and infrastructure applications due to their widespread availability and ease of processing. As construction stakeholders increasingly evaluate materials based on total lifecycle costs rather than upfront pricing, stone-based materials gain preference. This advantage is especially relevant in large public infrastructure and industrial projects, where longevity and structural reliability are critical decision-making factors.

Key Trends & Opportunities

Rising Preference for Sustainable and Natural Building Materials

Sustainability considerations are shaping material selection across the construction sector, creating opportunities for the construction stones market. Natural stones are perceived as environmentally favorable due to minimal chemical processing, recyclability, and long service life. Builders and architects increasingly specify locally sourced stone to reduce transportation emissions and align with green building standards. This trend supports demand for limestone, sandstone, and slate in both structural and decorative applications. Opportunities also emerge in certified quarrying practices and responsible sourcing initiatives, enabling producers to differentiate offerings and access environmentally conscious projects.

- For instance, Polycor operates dimension stone quarries certified under the ANSI/NSC 373 Sustainable Production of Natural Dimension Stone standard, with audited operations covering more than 14 active quarries across North America, ensuring traceable and responsibly extracted limestone and granite.

Technological Advancements in Quarrying and Stone Processing

Advancements in quarrying equipment, cutting technologies, and digital modeling tools are improving operational efficiency and product consistency. Automated cutting, precision shaping, and advanced surface finishing allow manufacturers to produce customized stone products with reduced waste. These innovations support higher-margin applications such as façades, sidings, and architectural elements. Digital design integration also enables closer collaboration with architects and contractors, opening opportunities in premium construction projects. Improved logistics and material handling further enhance supply chain reliability, strengthening the competitiveness of organized stone producers.

- For instance, Caterpillar-equipped quarry fleets now operate haul trucks with payload capacities exceeding 90 tonnes, improving material movement efficiency and reinforcing the competitiveness of organized stone producers.

Growth in Decorative and Architectural Applications

Demand for aesthetically appealing construction materials continues to rise, particularly in commercial and high-end residential projects. Natural stones are increasingly used for façades, feature walls, landscaping, and interior design elements. This trend creates opportunities for value-added stone products with specialized textures, colors, and finishes. Urban redevelopment and smart city initiatives further support architectural stone demand, especially in public spaces and landmark developments.

Key Challenges

Environmental Regulations and Quarrying Restrictions

Stringent environmental regulations present a significant challenge for the construction stones market. Quarrying activities face increasing scrutiny related to land degradation, dust emissions, water usage, and biodiversity impact. Regulatory approvals, mining permits, and compliance costs can delay project timelines and restrict supply in certain regions. Local opposition to quarry operations also creates operational uncertainty. These constraints can lead to supply imbalances, increased production costs, and limited access to high-quality stone reserves, particularly near urban centers where demand is strongest.

High Transportation Costs and Supply Chain Constraints

Construction stones are heavy, low-value-per-unit-weight materials, making transportation costs a critical challenge. Rising fuel prices, limited availability of bulk transport infrastructure, and long haul distances from quarries to construction sites significantly affect pricing and margins. Supply chain disruptions can further impact timely delivery, especially for large infrastructure projects with strict schedules. Smaller producers face difficulties competing beyond regional markets, while large-scale projects increasingly favor suppliers with integrated logistics capabilities. This cost sensitivity limits market flexibility and constrains cross-border trade of construction stones.

Regional Analysis

North America

North America accounts for an estimated 22-25% of the global construction stones market, supported by steady infrastructure renewal and residential construction activity. Demand is driven by highway rehabilitation, commercial real estate redevelopment, and public infrastructure programs across the U.S. and Canada. Aggregates dominate consumption, particularly for roads, bridges, and concrete-intensive projects, while limestone remains widely used in cement and building applications. Renovation of aging infrastructure and stable housing starts sustain consistent demand. Additionally, preference for durable, locally sourced materials supports regional quarry operations, while environmental compliance increasingly shapes production practices.

Europe

Europe represents approximately 18-20% of the global market, driven by renovation-led construction, transportation upgrades, and energy infrastructure investments. The region shows strong demand for limestone and sandstone in both structural and architectural applications, particularly for façades and heritage restoration. Western Europe leads consumption due to mature construction markets, while Eastern Europe contributes growth through infrastructure expansion. Strict environmental regulations influence quarrying activity, encouraging efficiency and recycling of stone materials. The focus on sustainable construction and long-life materials further supports the use of natural stones across residential, commercial, and public-sector projects.

Asia-Pacific

Asia-Pacific dominates the construction stones market with an estimated 40-45% market share, reflecting rapid urbanization, large-scale infrastructure development, and high residential construction volumes. Countries such as China, India, and Southeast Asian nations drive aggregate and limestone demand for roads, railways, ports, and housing projects. Government-led infrastructure programs and expanding industrial zones significantly boost stone consumption. The region benefits from abundant natural reserves and cost-effective quarrying, supporting high-volume production. Growing commercial construction and urban redevelopment further increase demand for decorative stones, reinforcing Asia-Pacific’s leadership position.

Latin America

Latin America holds around 7-9% of the global market, supported by infrastructure modernization, urban housing demand, and mining-related construction. Brazil and Mexico are key contributors, with aggregates and limestone widely used in transportation and public works projects. Economic recovery initiatives and private investment in commercial and residential developments drive gradual demand growth. However, market performance varies by country due to economic volatility and regulatory differences. Local quarrying supports regional supply, while limited large-scale infrastructure pipelines compared to Asia-Pacific constrain faster expansion.

Middle East & Africa

The Middle East & Africa region accounts for approximately 6-8% of global market share, driven by large infrastructure and commercial construction projects, particularly in the Gulf countries. Aggregates and limestone are heavily used in mega projects, urban expansion, and industrial facilities. In Africa, demand is supported by road construction, housing shortages, and urbanization. Availability of natural stone resources supports local production, while investment-led construction cycles influence demand volatility. High dependence on public spending and project-based activity shapes regional consumption patterns.

Market Segmentations:

By Type

- Limestone

- Sandstone

- Slate

- Others

By Applications

- Walls

- Facades

- Sidings

- Aggregates

- Others

By Industries Vertical

- Industrial

- Residential

- Commercial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The construction stones market features a fragmented yet competitive landscape characterized by the presence of large multinational suppliers, regional quarry operators, and specialized value-added processors. Leading companies compete through extensive quarry ownership, diversified stone portfolios, and integrated processing capabilities covering cutting, finishing, and distribution. Strategic focus areas include securing long-term access to high-quality reserves, expanding value-added offerings such as engineered and precision-cut stone products, and strengthening distribution networks to serve large infrastructure and commercial projects efficiently. Players increasingly invest in advanced processing technologies to improve consistency, reduce waste, and meet customized architectural requirements. Sustainability initiatives, including responsible quarrying and compliance with environmental standards, are gaining importance as differentiators. Regional players maintain competitiveness through proximity to end markets and cost advantages, while larger firms leverage branding, scale, and design-driven product innovation to capture premium segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cosentino Group

- Caesarstone

- Dal-Tile

- Marazzi Group

- Silkar Mining Joint-Stock

- Granite Canada Exports

- RockSolid Granit USA

- Sunrise Quartzite

- Dakota Granite

- Precision Countertops

Recent Developments

- In July 23, 2025, New Cosentino City showrooms unveiled Cosentino announced the opening of new design-forward Cosentino City showroom locations in Dallas, Honolulu, and Richmond, strengthening its global retail and specification presence.

- In March 27, 2025, Cosentino releases 2025-2026 Global Trend Report Cosentino published its first ever Global Trend Report – Shaping Tomorrow: Future Design & Architecture, offering forward-looking insights into design innovation.

Report Coverage

The research report offers an in-depth analysis based on Type, Applications, Industries vertical and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Infrastructure modernization and urban expansion will continue to sustain long-term demand for construction stones across major economies.

- Aggregates will remain the largest consumption segment, supported by ongoing road, rail, and concrete-intensive construction projects.

- Asia-Pacific will maintain its leadership position, driven by urbanization, industrial growth, and large public infrastructure pipelines.

- Demand for natural stones in residential construction will rise due to durability, aesthetic appeal, and lifecycle performance advantages.

- Commercial and mixed-use developments will increasingly adopt premium stone finishes for façades and interior applications.

- Sustainability considerations will encourage responsible quarrying practices and greater use of locally sourced stone materials.

- Technological advancements in quarrying and processing will improve productivity, reduce waste, and enhance product customization.

- Value-added stone products will gain traction as architects and developers seek differentiated architectural designs.

- Consolidation among regional suppliers may increase as companies pursue scale, reserve security, and distribution efficiency.

- Transportation efficiency and logistics integration will remain critical factors influencing competitiveness and project execution.