Market Overview

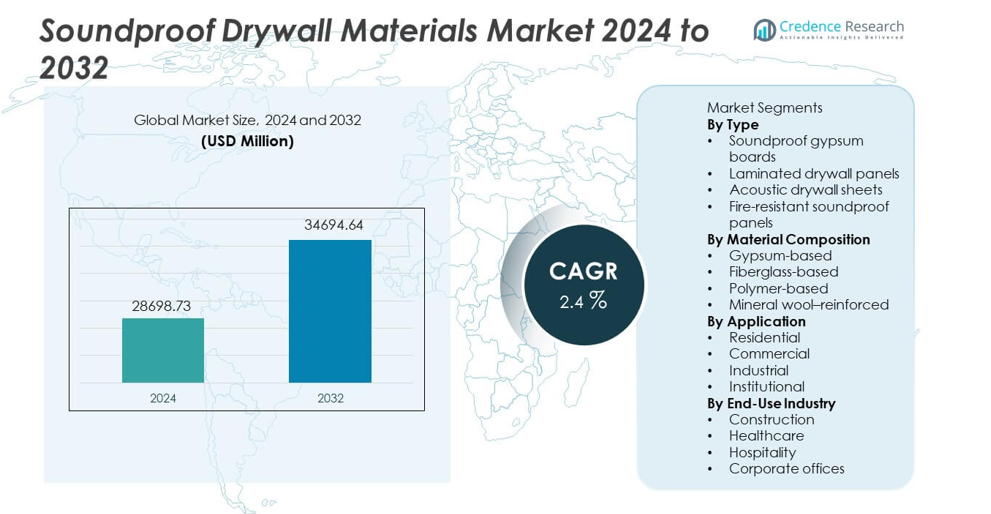

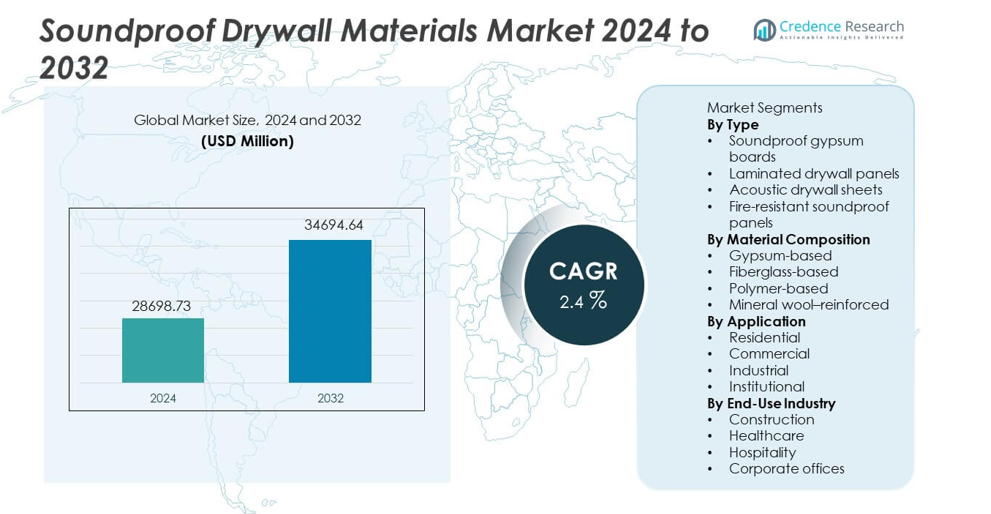

The Soundproof Drywall Materials Market was valued at USD 28,698.73 million in 2024 and is projected to reach USD 34,694.64 million by 2032, registering a CAGR of 2.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Soundproof Drywall Materials Market Size 2024 |

USD 28,698.73 million |

| Soundproof Drywall Materials Market, CAGR |

2.4% |

| Soundproof Drywall Materials Market Size 2032 |

USD 34,694.64 million |

The top players in the Soundproof Drywall Materials market include Saint-Gobain, USG Corporation, Knauf Gips KG, CertainTeed, National Gypsum Company, Georgia-Pacific, PABCO Gypsum, QuietRock, Continental Building Products, and Armstrong World Industries, all of which strengthen the market through advanced acoustic drywall technologies and high-performance material innovations. These companies expand portfolios to meet rising demand in residential, commercial, and institutional projects. North America leads the market with a 34% share driven by strict noise insulation standards and strong construction activity, followed by Europe with 28% supported by sustainable building practices. Asia Pacific holds a 30% share due to rapid urbanization and growing investment in modern infrastructure.

Market Insights

- The market reached USD 28,698.73 million in 2024 and will grow at a CAGR of 2.4% through 2032.

- Rising construction activity and stricter noise control standards drive strong demand for soundproof drywall materials, with soundproof gypsum boards holding a 42% share.

- Sustainable and high-performance acoustic materials gain traction as builders prioritize eco-friendly solutions and improved sound insulation for residential, commercial, and institutional projects.

- Competitive activity increases as major companies enhance product durability, fire resistance, and installation efficiency while addressing restraints such as higher material and labor costs.

- North America leads with a 34% share, followed by Europe at 28% and Asia Pacific at 30%, while the residential application segment dominates with a 55% share supported by urban housing expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Soundproof gypsum boards, laminated drywall panels, acoustic drywall sheets, and fire-resistant soundproof panels form the core product landscape, with soundproof gypsum boards holding the largest share at 42%. Their dominance comes from widespread use in residential and commercial buildings due to strong noise reduction, cost efficiency, and easy installation. The rise in urban housing projects and stricter noise control standards increases demand for high-density gypsum panels. Acoustic drywall sheets gain traction in studios and offices needing enhanced sound absorption, while fire-resistant soundproof panels find growing adoption in safety-sensitive environments. Expanding construction activities continue to reinforce segment growth.

- For instance, USG Corporation’s Sheetrock Brand UltraLITE panels reduced board weight per pallet while maintaining a single-stud wall sound rating comparable to a standard wall.

By Material Composition

Gypsum-based, fiberglass-based, polymer-based, and mineral wool–reinforced materials shape the material composition segment, with gypsum-based products leading at 47%. Gypsum materials remain preferred due to strong acoustic resistance, high durability, and compatibility with standard building systems. Growing investments in sustainable building materials further support their use in green construction projects. Fiberglass-based panels gain attention for higher sound absorption in commercial spaces, while polymer-based solutions appeal to lightweight construction needs. Mineral wool–reinforced materials expand usage in industrial facilities where thermal and acoustic performance is essential. Continuous material innovation drives adoption across diverse project requirements.

- For instance, Knauf introduced gypsum boards using a significant amount of recycled content, including industrial byproducts and post-consumer waste, while meeting the relevant requirements of the EN 520 standard.

By Application

Residential, commercial, industrial, and institutional sectors drive application demand, with the residential segment holding the highest share at 55%. Rising urban development, apartment constructions, and home renovation activities increase the need for effective noise isolation solutions. Homeowners prefer soundproof drywall to reduce noise from traffic, neighbors, and indoor appliances. Commercial projects such as hotels, offices, and educational facilities also increase use due to mandated noise control standards. Industrial facilities adopt high-density panels to meet safety and productivity guidelines. Institutional spaces like hospitals and clinics rely on soundproof drywall to maintain quiet environments. Strong demand across housing markets reinforces segment leadership.

Key Growth Drivers

Rising Demand for Noise Control in Urban Development

Rapid urbanization increases noise levels in residential and commercial environments, driving strong demand for soundproof drywall materials. Builders adopt advanced acoustic panels to meet rising expectations for quieter indoor spaces, especially in high-density housing projects. Government regulations on noise insulation also support wider use across new constructions and renovation activities. Growth in apartment living and mixed-use developments strengthens demand for panels that reduce sound transmission. This shift toward improved acoustic comfort positions noise control requirements as a major driver of market expansion.

- For instance, Saint-Gobain validated Gyproc SoundBloc boards as a component within specific high-performance wall systems designed for noise reduction in multi-story housing.

Growth in Commercial Infrastructure and Office Modernization

Expanding commercial infrastructure fuels significant adoption of soundproof drywall materials as businesses prioritize improved acoustic performance. Offices, conference rooms, and hospitality venues invest in high-performance drywall to enhance occupant comfort and productivity. Modern open-office layouts require stronger acoustic separation to minimize disruption. Hotels and educational institutions also implement soundproof solutions to meet regulatory standards and improve user experience. Rising redevelopment and interior remodeling projects across global markets further support steady demand. These factors position commercial modernization as a key growth driver.

- For instance, Armstrong World Industries deployed acoustic fiberglass ceiling-wall systems achieving high sound absorption performance in ASTM C423 chamber tests for office interiors.

Strict Building Regulations and Safety Standards

Government regulations enforcing acoustic insulation and fire safety create strong momentum for advanced drywall materials. Builders choose high-density gypsum boards and fire-resistant acoustical panels to comply with updated building codes. These standards drive adoption across residential, commercial, and institutional structures. Growing awareness of health impacts linked to prolonged noise exposure also supports regulatory tightening. Manufacturers respond with certified, performance-tested materials to meet compliance needs. The alignment of evolving regulations with construction practices continues to boost market uptake.

Key Trends & Opportunities

Rising Adoption of Sustainable and High-Performance Materials

Sustainability trends drive interest in eco-friendly soundproof drywall made from recycled content and low-emission compounds. Builders favor materials with stronger acoustic ratings and reduced environmental impact. Demand grows for lightweight, high-density panels that support faster installation and better energy efficiency. Manufacturers explore advanced composites to improve sound absorption and fire resistance. Green building certifications expand opportunities for acoustic drywall in large commercial and institutional projects. This shift toward high-performance and sustainable solutions opens new growth avenues.

- For instance, Knauf developed high-performance boards with an increased surface mass, improving airborne sound insulation in partition walls. These solutions feature a special high-density core, which is denser than standard plasterboard, to effectively block the transmission of sound energy and meet acoustic performance requirements.

Integration of Acoustic Drywall in Smart and Modern Buildings

Smart building designs emphasize comfort, efficiency, and advanced sound control, which creates new opportunities for soundproof drywall materials. Modern architectural layouts with open spaces require improved noise isolation across rooms and floors. The rise of home offices and multimedia rooms increases demand for acoustic paneling in residential spaces. Commercial buildings adopt specialized drywall to support hybrid work environments and digital communication spaces. This alignment between smart building needs and advanced drywall performance accelerates long-term market adoption.

- For instance, QuietRock engineered multilayer drywall assemblies tested to achieve a high sound isolation rating (STC) in single-stud smart office walls, with performance ratings far exceeding standard construction.

Key Challenges

High Installation and Material Costs

Premium soundproof drywall materials cost more than standard options, creating barriers for cost-sensitive projects. Installation often requires skilled labor and additional structural support, which increases overall expenses. Small builders and homeowners may choose cheaper alternatives, slowing adoption in certain regions. Budget constraints in developing markets further limit use in large-scale residential projects. These cost pressures challenge widespread market penetration despite strong acoustic benefits.

Limited Awareness and Technical Expertise

A lack of awareness about advanced drywall capabilities restricts adoption in many construction markets. Builders and consumers often underestimate the performance differences between standard and soundproof panels. Incorrect installation can reduce acoustic performance, making technical expertise essential. In regions with limited training and specification knowledge, contractors may avoid complex acoustic materials. These gaps in awareness and technical skill remain key challenges for scaling the market globally.

Regional Analysis

North America

North America holds a 34% share driven by strong adoption of advanced building materials and strict noise insulation standards in residential and commercial projects. High urban density increases demand for soundproof drywall in apartments, offices, and mixed-use buildings. Renovation activities also support growth as property owners upgrade acoustic performance to enhance comfort. The presence of established manufacturers and widespread use of fire-resistant panels contribute to steady regional expansion. Rising construction of educational and healthcare facilities further boosts demand. Strong regulatory enforcement and higher spending capacity reinforce North America’s leading market position.

Europe

Europe accounts for a 28% share supported by long-standing emphasis on sustainable construction and acoustic comfort requirements. Countries with dense urban environments increase adoption of soundproof drywall materials to meet noise control regulations. Green building certifications enhance demand for gypsum-based and eco-friendly acoustic panels. Commercial infrastructure upgrades, including hotels, offices, and public buildings, strengthen regional momentum. Renovation activities in older structures also contribute to segment expansion. Growth in industrial and institutional projects enhances market stability. Europe’s strong regulatory framework continues to drive consistent demand across major economies.

Asia Pacific

Asia Pacific captures a 30% share fueled by rapid urbanization, expanding residential construction, and rising investment in commercial infrastructure. High-rise buildings and compact living spaces increase the need for effective noise insulation. Growing awareness of acoustic comfort drives adoption in urban housing developments. Government-backed smart city programs and rising disposable income support demand for advanced drywall materials. Commercial growth in hospitality, retail, and corporate offices strengthens regional uptake. Both local and global manufacturers expand production capacities to meet rising demand. Asia Pacific’s strong construction activity positions it as a key growth engine.

Latin America

Latin America holds a 5% share driven by gradual growth in residential and commercial construction. Urban centers increase adoption of soundproof drywall as noise levels rise and building quality standards improve. The hospitality sector invests in acoustic materials to enhance guest experience, while office spaces incorporate drywall solutions to support modern work environments. Economic fluctuations impact large-scale investments, but renovation projects maintain steady demand. Increasing influence of international building standards encourages greater use of fire-resistant and acoustic panels. Retail expansion and growing awareness of noise control support regional market development.

Middle East & Africa

The Middle East & Africa region accounts for a 3% share supported by expanding infrastructure projects and rising investment in premium residential developments. High-end housing, hotels, and commercial complexes incorporate soundproof drywall to improve acoustic comfort and meet modern building standards. Gulf countries drive demand with strong construction pipelines and a focus on luxury real estate. In Africa, adoption grows gradually as urbanization accelerates and awareness of advanced acoustic materials increases. Institutional projects such as hospitals and educational facilities contribute to segment growth. The region shows steady potential as construction activities continue to expand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Type

- Soundproof gypsum boards

- Laminated drywall panels

- Acoustic drywall sheets

- Fire-resistant soundproof panels

By Material Composition

- Gypsum-based

- Fiberglass-based

- Polymer-based

- Mineral wool–reinforced

By Application

- Residential

- Commercial

- Industrial

- Institutional

By End-Use Industry

- Construction

- Healthcare

- Hospitality

- Corporate offices

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the market is shaped by leading companies such as Saint-Gobain, USG Corporation, Knauf Gips KG, CertainTeed, National Gypsum Company, Georgia-Pacific, PABCO Gypsum, QuietRock, Continental Building Products, and Armstrong World Industries, which focus on advancing acoustic and fire-resistant drywall technologies. These players invest in high-density gypsum formulations, laminated multi-layer panels, and mineral-enhanced composites to deliver stronger soundproofing performance for residential, commercial, and institutional projects. Manufacturers expand production capacity and regional distribution to meet rising construction demand across diverse markets. Emphasis on sustainability drives development of low-emission, recyclable, and energy-efficient drywall materials. Companies also strengthen R&D to meet evolving building codes and performance certifications. Competitive intensity increases as brands enhance product durability, reduce installation time, and introduce integrated acoustic systems tailored for modern building designs.

Key Player Analysis

- Saint-Gobain

- USG Corporation

- Knauf Gips KG

- CertainTeed

- National Gypsum Company

- Georgia-Pacific

- PABCO Gypsum

- QuietRock (Serious Energy)

- Continental Building Products

- Armstrong World Industries

Recent Developments

- In October 2025, Saint-Gobain completed a major expansion at its CertainTeed gypsum wallboard plant in Palatka, Florida, doubling capacity to meet rising drywall demand. This expansion made the facility the largest gypsum wallboard plant in the world.

- In October 2025, CertainTeed’s expanded Palatka plant increased output of gypsum and acoustic drywall products.

- In May 2024, Knauf ran a campaign highlighting its existing range of sound-resistant plasterboards, including the Knauf Soundshield Plus product, which is designed for enhanced acoustic performance in high-sound environments.

Report Coverage

The research report offers an in-depth analysis based on Type, Material Composition, Application, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow as urban construction projects require stronger noise control solutions.

- Sustainable and low-emission drywall materials will gain wider adoption across major markets.

- Advanced composite panels with higher acoustic ratings will strengthen premium product demand.

- Residential renovations will expand use of soundproof drywall in high-density living spaces.

- Commercial buildings will adopt enhanced acoustic systems to improve workplace productivity.

- Hospitals and educational institutions will drive demand for high-performance, fire-rated drywall.

- Manufacturers will invest in lightweight and easy-install panels to reduce labor costs.

- Digital design tools will support precise acoustic planning and increase material adoption.

- Regional building regulations will continue tightening, driving use of certified acoustic materials.

- Global players will expand production networks to meet growing demand in emerging markets.