Market Overview

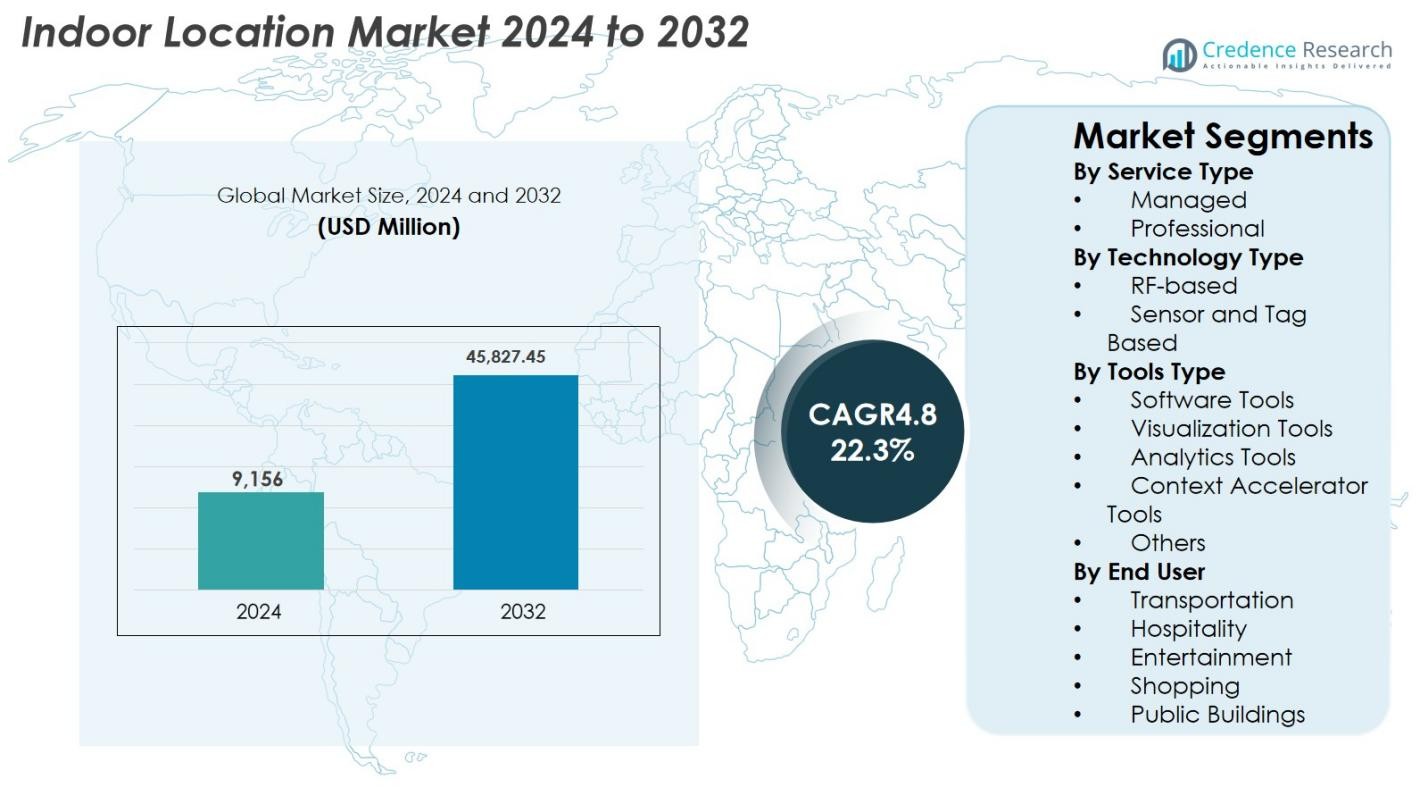

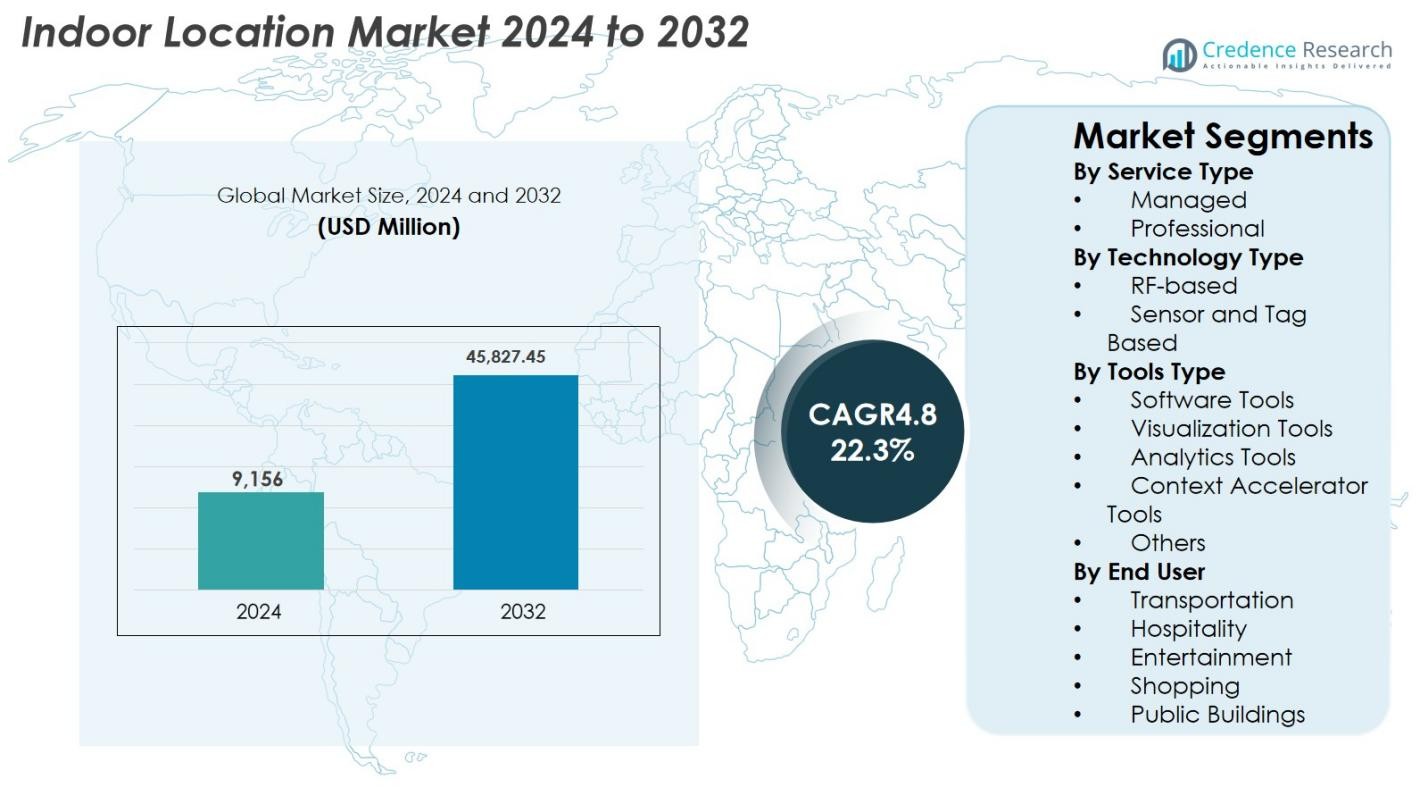

Indoor Location market size was valued at USD 9,156 Million in 2024 and is anticipated to reach USD 45,827.45 Million by 2032, at a CAGR of 22.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Indoor Location Market Size 2024 |

USD 9,156 Million |

| Indoor Location Market, CAGR |

22.3% |

| Indoor Location Market Size 2032 |

USD 45,827.45 Million |

Indoor Location market is driven by key players including Apple Inc., Broadcom Corporation, Cisco Systems Inc., Ericsson, Google Inc., Microsoft Corporation, Motorola Solutions, Nokia Corporation, STMicroelectronics N.V., Qualcomm, and Zebra Technologies, who are actively innovating and expanding their global presence. North America leads the market with a 32.6% share in 2024, supported by widespread adoption of advanced technologies, strong IoT infrastructure, and early deployment of UWB, BLE, and RF-based systems. Europe follows with a 27.4% share, benefiting from smart city initiatives, Industry 4.0 adoption, and stringent regulatory compliance. Asia-Pacific holds a 25.1% share, driven by rapid urbanization, IoT integration, and growing retail and industrial adoption. Emerging regions such as Latin America and Middle East & Africa contribute 8.2% and 6.7% respectively, fueled by infrastructure development, smart building projects, and increasing awareness of real-time tracking and indoor navigation solutions.

Market Insights

- Indoor Location market was valued at USD 9,156 Million in 2024 and is projected to reach USD 45,827.45 Million by 2032, growing at a CAGR of 22.3% during the forecast period.

- Growth is driven by rising demand for real-time indoor navigation, asset tracking, and IoT-enabled smart infrastructure across retail, healthcare, and industrial sectors. Professional services dominate the service type segment with 62.4% share, while RF-based technology leads with 54.7% share, and Software Tools account for 41.3% of the tools segment.

- Major trends include integration of AI, analytics, and digital twin platforms, and increasing adoption of UWB, 5G, and multi-sensor fusion technologies for precise positioning and enhanced operational efficiency.

- Key players include Apple Inc., Broadcom Corporation, Cisco Systems Inc., Ericsson, Google Inc., Microsoft Corporation, Motorola Solutions, Nokia Corporation, STMicroelectronics N.V., Qualcomm, and Zebra Technologies, who focus on innovation, collaborations, and global expansion.

- North America leads with 32.6% share, Europe follows with 27.4%, Asia-Pacific holds 25.1%, Latin America accounts for 8.2%, and Middle East & Africa contributes 6.7% to the market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Service Type

The Indoor Location market by service type is led by Professional Services, accounting for 62.4% share in 2024, driven by the increasing need for system integration, consulting, deployment, and optimization support as enterprises expand indoor positioning infrastructures. Organizations rely on professional service providers to tailor solutions for complex environments such as retail stores, warehouses, airports, and hospitals. Managed Services, although smaller in share, are growing rapidly due to rising demand for continuous system monitoring, maintenance, and real-time performance management, especially among businesses adopting location-based analytics and automation at scale.

- For instance, Pointr enables indoor positioning in large buildings -such as airports, retail spaces, and hospitals using its “Deep Location®” solution.

By Technology Type

Within technology type, RF-based systems dominated the Indoor Location market with a 54.7% share in 2024, supported by their wide applicability, cost-effectiveness, and compatibility with Wi-Fi, Bluetooth Low Energy (BLE), and UWB technologies. These systems offer high accuracy and seamless integration with existing wireless infrastructure, making them preferred across retail, logistics, and industrial facilities. Sensor and Tag-Based technologies are expanding due to increasing deployment of IoT sensors, RFID tags, and beacon networks that enhance real-time asset tracking, safety monitoring, and workflow automation in manufacturing units, hospitals, and large commercial complexes.

- For instance, many indoor positioning implementations today rely on BLE beacons for proximity sensing: systems based on BLE have been used successfully for indoor navigation and asset tracking in retail stores and warehouses because of their low‑power, cost-efficient deployment and compatibility with existing devices.

By Tools Type

In the tools segment, Software Tools held the dominant position with a 41.3% share in 2024, driven by the rising need for indoor mapping, positioning algorithms, device management, and real-time navigation capabilities. These tools enable enterprises to create digital twins, manage location workflows, and optimize space utilization. Visualization Tools and Analytics Tools are witnessing strong adoption as businesses leverage heatmaps, occupancy insights, and predictive analytics for operational decision-making. Context Accelerator Tools and others continue to grow as companies integrate AI-driven contextual data processing to support personalized user experiences, security management, and data-driven automation routines.

Key Growth Drivers

Rising Demand for Real-Time Indoor Navigation and Asset Tracking

The Indoor Location market experiences strong momentum as enterprises across retail, healthcare, logistics, and manufacturing prioritize real-time navigation and asset tracking to improve operational efficiency. Growing deployment of BLE beacons, Wi-Fi triangulation systems, and UWB technology supports precise indoor positioning critical for inventory control, workforce monitoring, and resource optimization. Hospitals increasingly adopt indoor location solutions to track medical equipment, patient movement, and emergency response workflows, reducing delays and enhancing care delivery. In retail, indoor navigation enhances customer experience, enables targeted promotions, and supports frictionless shopping models. Additionally, industrial environments leverage indoor positioning for safety compliance, predictive maintenance, and automated material handling. As digital transformation accelerates and enterprises embrace location-aware operations, demand for high-accuracy and low-latency indoor tracking technologies continues to expand.

- For instance, in retail, Lowe’s has deployed indoor navigation systems in select stores to guide customers to products via a mobile app, supporting personalized promotions and a frictionless shopping experience.

Expansion of IoT, Smart Infrastructure, and Connected Workflows

Growth in IoT ecosystems and smart infrastructure significantly drives adoption of indoor location technologies as enterprises integrate sensors, connected devices, and automation platforms into their workflows. Smart buildings require intelligent space management, occupancy monitoring, and energy optimization, all supported by precise indoor positioning and analytics systems. Warehouses and factories deploy IoT-enabled beacons, RFID networks, and sensor grids to streamline logistics operations, reduce downtime, and achieve real-time visibility of assets and personnel. The rise of Industry 4.0 further accelerates adoption as indoor location solutions become essential for robotics pathing, AGV navigation, and worker safety monitoring. Integration with cloud platforms and AI enhances data processing, enabling predictive insights and contextual decision-making. As enterprises scale connected environments, indoor location services become foundational components of digital infrastructure, ensuring seamless automation and improved workplace productivity.

- For instance, DHL has deployed RFID and BLE beacon networks across its warehouses to enable real-time asset tracking and streamline logistics operations, reducing downtime and improving workflow visibility.

Increasing Adoption of Customer Experience and Personalization Solutions

Indoor Location technologies witness rapid adoption in consumer-facing sectors such as retail, hospitality, and entertainment, where personalized customer engagement and seamless experience delivery are strategic priorities. Retailers utilize indoor mapping, heatmap analytics, and proximity marketing tools to understand customer behavior, optimize store layouts, and deliver targeted promotions. Shopping malls, airports, and event venues enhance visitor satisfaction through indoor navigation, queue management, and contextual notifications. Hospitality operators deploy indoor location tracking to offer contactless services, personalized room experiences, and efficient housekeeping management. As data-driven personalization becomes a competitive differentiator, indoor location systems enable precise behavioral insights and micro-level movement analysis. Rising expectations for frictionless, hyper-personalized engagement, coupled with expanding adoption of mobile applications and digital interaction models, substantially increases demand for robust indoor positioning solutions.

Key Trends & Opportunities

Integration of AI, Analytics, and Digital Twin Platforms

A major trend shaping the Indoor Location market is the convergence of AI-driven analytics, digital twins, and advanced visualization tools that transform raw location data into actionable insights. Organizations increasingly adopt AI-enabled positioning engines, anomaly detection models, and movement pattern analytics to enhance predictive decision-making. Digital twin technology enables facility managers to create virtual replicas of buildings, optimize space utilization, and simulate footfall scenarios. These advancements open new opportunities across retail planning, smart facility management, and industrial workflow optimization. As enterprises pursue automation-first strategies, the integration of indoor positioning data with AI platforms and digital twin environments becomes central to achieving operational intelligence and performance improvements.

- For instance, Siemens Smart Infrastructure uses digital twin environments combined with AI-enabled indoor positioning data to predict footfall, monitor occupancy patterns, and support proactive maintenance in large commercial complexes.

Growing Use of UWB, 5G, and Multi-Sensor Fusion Technologies

Emerging technologies such as ultra-wideband (UWB), 5G, and multi-sensor fusion offer higher positioning accuracy, lower latency, and enhanced scalability, unlocking new opportunities in mission-critical indoor applications. 5G networks enable centimeter-level precision and support large device densities, making them suitable for smart factories, healthcare facilities, and high-traffic commercial environments. Multi-sensor fusion—combining RF signals, inertial sensors, cameras, and environmental data—enhances reliability in complex indoor spaces where traditional RF-based systems face interference. These technological advancements open opportunities for innovative applications such as autonomous indoor robotics, immersive AR/VR navigation, and precise safety monitoring. As organizations modernize digital infrastructure, adoption of these advanced technologies continues to accelerate.

- For instance, in manufacturing, Ericsson has partnered with KTH Royal Institute of Technology to deploy 5G-based indoor positioning in smart factories, enabling real-time monitoring of equipment and autonomous guided vehicles (AGVs) with low-latency, high-density device support.

Key Challenges

High Deployment Costs and Complexity in Large-Scale Environments

Despite strong growth potential, high deployment costs remain a major challenge for large facilities such as airports, hospitals, shopping complexes, and industrial plants. Implementing indoor positioning requires extensive hardware installation, calibration, software integration, and ongoing maintenance, which increases overall operational expenditures. Large and multi-floor environments add complexity due to signal interference, structural variations, and the need for continuous accuracy tuning. Integrating indoor location systems with legacy IT infrastructure and enterprise applications also demands specialized technical expertise. As organizations face budget constraints and resource limitations, initial investment costs and integration complexity act as barriers to large-scale adoption.

Privacy Concerns and Stringent Regulatory Requirements

Privacy and data protection challenges significantly impact the Indoor Location market, particularly in sectors that track customer movement, employee activity, or patient behavior. Regulations such as GDPR, HIPAA, and regional data governance laws impose strict obligations on how indoor positioning data is collected, stored, and processed. Unauthorized or unclear tracking practices can lead to compliance violations, reputational risks, and customer distrust. Companies must establish transparent consent mechanisms, implement data anonymization, and ensure robust cybersecurity measures to protect sensitive location information. As indoor tracking technologies become more sophisticated, addressing privacy concerns and meeting regulatory standards becomes essential for market expansion and user adoption.

Regional Analysis

North America

North America dominated the Indoor Location market in 2024 with a 32.6% share, driven by high adoption of advanced technologies, extensive deployment in retail, healthcare, and industrial sectors, and the presence of leading technology vendors such as Apple, Cisco, and Microsoft. The region benefits from well-established IoT infrastructure, strong investment in smart building initiatives, and growing interest in real-time asset tracking and indoor navigation solutions. Rapid digital transformation in warehouses, hospitals, and airports, coupled with increasing demand for personalized customer experiences and analytics-driven insights, further strengthens market growth. Continuous innovation and early adoption of UWB and 5G technologies ensure North America remains a key revenue contributor.

Europe

Europe accounted for 27.4% share of the Indoor Location market in 2024, supported by increasing smart city projects, modern retail transformations, and government initiatives promoting digital infrastructure and Industry 4.0 adoption. Key markets include Germany, the UK, and France, where enterprises implement indoor positioning for navigation, workforce management, and asset tracking. The region’s regulatory frameworks emphasize data privacy and security, encouraging deployment of compliant, high-accuracy systems. Rising investments in smart airports, healthcare facilities, and industrial automation, along with the integration of analytics and visualization tools, continue to drive market expansion, positioning Europe as a significant growth region for indoor location solutions.

Asia-Pacific

Asia-Pacific held a 25.1% share in the Indoor Location market in 2024, fueled by rapid urbanization, smart city developments, and rising adoption of IoT-enabled indoor positioning systems in retail, manufacturing, and logistics sectors. Countries such as China, Japan, South Korea, and India lead adoption with investments in UWB, BLE, and sensor-based technologies. Growing demand for customer experience personalization, real-time tracking, and operational efficiency drives the deployment of advanced indoor location solutions. Expansion of modern retail chains, industrial automation, and digital infrastructure projects, along with increasing awareness of analytics and visualization tools, further strengthens the region’s market position and growth potential.

Latin America

Latin America accounted for 8.2% share of the Indoor Location market in 2024, with growth supported by increasing adoption of indoor navigation systems in retail, airports, and healthcare facilities. Countries such as Brazil and Mexico lead the market due to expanding commercial infrastructure and investments in IoT-enabled smart buildings. Rising demand for asset tracking, customer engagement, and space optimization drives deployment of BLE and RF-based systems. Although challenges such as limited technology penetration and budget constraints exist, growing awareness of real-time analytics, predictive monitoring, and context-aware solutions is enabling broader adoption, positioning Latin America as an emerging market with moderate but steady growth opportunities.

Middle East & Africa

Middle East & Africa contributed 6.7% share to the Indoor Location market in 2024, driven by smart city initiatives, modern retail infrastructure, and airport expansion projects in the UAE, Saudi Arabia, and South Africa. Adoption of indoor positioning systems is supported by demand for navigation, asset tracking, and security management in commercial and healthcare sectors. Investments in UWB, RF, and sensor-based technologies, along with growing digital transformation initiatives, enable enterprises to enhance operational efficiency and customer experience. Despite challenges such as limited technical expertise and infrastructure gaps in some countries, strategic deployments in urban hubs and industrial complexes continue to fuel market growth in the region.

Market Segmentations

By Service Type

By Technology Type

- RF-based

- Sensor and Tag Based

By Tools Type

- Software Tools

- Visualization Tools

- Analytics Tools

- Context Accelerator Tools

- Others

By End User

- Transportation

- Hospitality

- Entertainment

- Shopping

- Public Buildings

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Indoor Location market is highly dynamic, with leading players actively driving innovation, expanding global footprints, and forming strategic partnerships to strengthen their market position. Key players include Apple Inc., Broadcom Corporation, Cisco Systems Inc., Ericsson, Google Inc., Microsoft Corporation, Motorola Solutions, Nokia Corporation, STMicroelectronics N.V., Qualcomm, and Zebra Technologies. These companies focus on developing advanced solutions such as UWB, BLE, RF-based systems, and multi-sensor fusion technologies, while integrating analytics, visualization, and AI-driven tools to enhance real-time tracking and navigation capabilities. Strategic initiatives like mergers, acquisitions, product launches, and collaborations are common, enabling vendors to expand service offerings and penetrate new verticals including retail, healthcare, industrial, and smart buildings. Continuous investment in R&D, digital twin integration, and context-aware solutions supports competitive differentiation. The presence of regional players further intensifies competition, compelling global vendors to enhance accuracy, reduce deployment costs, and improve user experience, fostering sustained market growth and innovation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, Airtel Business partnered with Swift Navigation to launch India’s first next‑gen spatial precision solution offering centimetre‑level location accuracy.

- In June 2025, IndoorAtlas released SDK version 3.7.1 for both iOS and Android, bringing improvements to AR wayfinding, cart‑mode performance, and magnetic‑only positioning

- In April 2025, IndoorAtlas and Corussoft launched a collaboration to deliver indoor‑positioning event apps in Germany (for event venues).

Report Coverage

The research report offers an in-depth analysis based on Service Type, Technology Type, Tools Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of ultra-wideband and multi-sensor fusion technologies will increase for higher accuracy and reliability.

- Integration with AI and analytics platforms will enable predictive insights and real-time decision-making.

- Expansion of smart building and Industry 4.0 initiatives will drive market demand across commercial and industrial sectors.

- Growing use in retail and hospitality will enhance personalized customer experiences and location-based services.

- Cloud-based indoor location solutions will gain traction due to scalability and ease of deployment.

- Healthcare facilities will increasingly implement indoor tracking for equipment, patient, and staff management.

- Integration with digital twin platforms will support space optimization and workflow simulation.

- Emerging regions will witness steady growth due to urbanization and infrastructure development.

- Strategic collaborations, partnerships, and product innovations will intensify market competition.

- Continuous improvement in software tools, visualization, and context-aware solutions will boost adoption across industries.