Market Overview

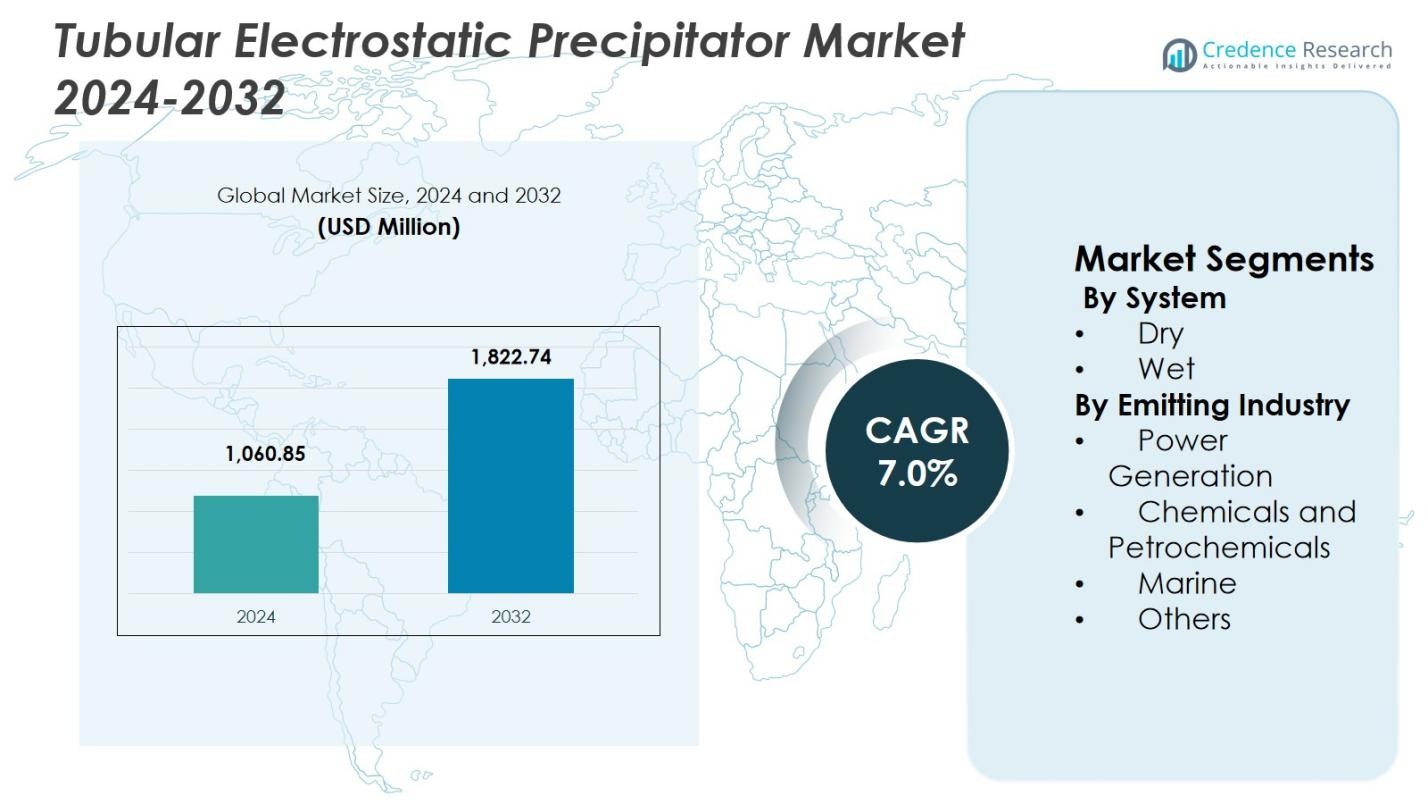

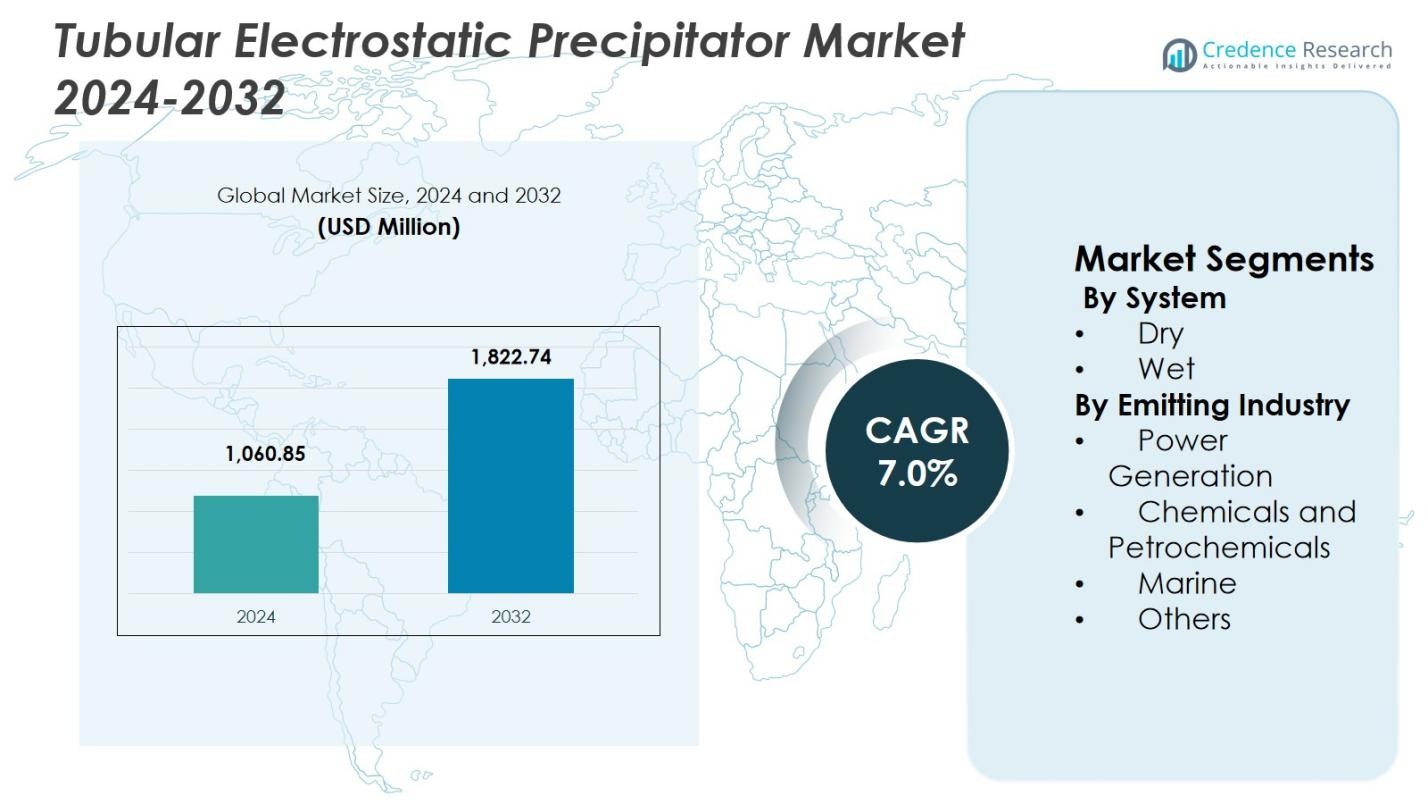

Tubular Electrostatic Precipitator Market size was valued at USD 1,060.85 million in 2024 and is anticipated to reach USD 1,822.74 million by 2032, at a CAGR of 7.0% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tubular Electrostatic Precipitator Market Size 2024 |

USD 1,060.85 Million |

| Tubular Electrostatic Precipitator Market, CAGR |

7.0% |

| Tubular Electrostatic Precipitator Market Size 2032 |

USD 1,822.74 Million |

Tubular Electrostatic Precipitator Market is supported by the presence of established global and regional manufacturers such as GEA Group, Thermax, Babcock & Wilcox Enterprises, Hamon Research-Cottrell, Nederman MikroPul, Scheuch, Isgec Heavy Engineering, Beltran Technologies, AirPol, and Operational Group. These companies focus on delivering high-efficiency particulate control systems tailored for power generation, chemical processing, marine, and other heavy industrial applications. Their strategies emphasize system customization, compliance with stringent emission regulations, and long-term service capabilities including retrofitting and maintenance. Regionally, Asia-Pacific leads the Tubular Electrostatic Precipitator Market with 34.9% market share in 2024, driven by rapid industrialization, large-scale thermal power capacity, and tightening air quality regulations in countries such as China and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Tubular Electrostatic Precipitator Market was valued at USD 1,060.85 million in 2024 and is projected to grow at a CAGR of 7.0% through 2032, supported by rising demand for advanced particulate emission control systems across industrial sectors.

- Stringent emission regulations for power generation, cement, metals, and chemical industries act as a key driver, accelerating adoption of tubular electrostatic precipitators due to their high efficiency in capturing fine and corrosive particulates.

- Market trends highlight strong dominance of the Dry system segment with a 61.8% share, while wet tubular ESPs are gaining traction in corrosive and high-moisture applications, supported by technological upgrades and digital monitoring integration.

- The market structure reflects the presence of established global and regional players focusing on system customization, retrofitting projects, and long-term service contracts for power and heavy industrial users.

- Asia-Pacific leads with a 34.9% regional share, followed by North America at 26.8% and Europe at 24.3%, while power generation remains the leading emitting industry segment with a 47.6% share.

Market Segmentation Analysis:

By System:

The Tubular Electrostatic Precipitator Market by system is led by the Dry segment, which accounted for 61.8% market share in 2024. Dry tubular electrostatic precipitators dominate due to their widespread adoption in high-temperature and dry gas applications, particularly in power plants and heavy industrial facilities. Their robust design, lower water dependency, and suitability for continuous operations support strong demand. Easier maintenance, proven long-term reliability, and lower operational complexity compared to wet systems further reinforce dominance. Growing investments in thermal power generation and industrial emission control upgrades continue to drive sustained adoption of dry tubular systems.

- For instance, Mitsubishi Power supplies dry ESPs for boilers in thermal power plants, achieving dust emissions as low as ≤10 mg/Nm³ through features like moving electrode types and pulse energization for reliable continuous operation.

By Emitting Industry:

By emitting industry, Power Generation emerged as the dominant sub-segment, holding 47.6% market share in 2024. This leadership is driven by strict emission regulations for particulate matter from coal- and biomass-based power plants. Tubular electrostatic precipitators are preferred for their high collection efficiency, ability to handle large flue gas volumes, and stable performance under high temperatures. Ongoing modernization of aging power infrastructure, retrofitting of emission control equipment, and continued reliance on thermal power in developing economies significantly contribute to the segment’s strong position.

- For instance, Thermax installed an electrostatic precipitator for a biomass-fired boiler at a sugar plant in Ecuador, treating high flue gas volumes from the combustion process to meet emission norms.

Key Growth Drivers

Stringent Industrial Emission Regulations

Rising enforcement of air pollution control regulations across power generation, cement, metals, and chemical industries strongly drives the Tubular Electrostatic Precipitator Market. Governments are mandating stricter particulate matter and hazardous emission limits to address environmental and public health concerns. Tubular electrostatic precipitators offer high collection efficiency for fine and corrosive particulates, making them well suited for regulatory compliance. Increasing penalties for non-compliance and mandatory retrofitting of emission control systems in existing plants are accelerating adoption, particularly in regions with expanding industrial activity and tightening environmental standards.

- For instance, FLSmidth has installed electrostatic precipitators in over 3,000 industrial plants globally, including cement and power generation facilities, achieving dust emission levels as low as 5mg/Nm³, which complies with some of the strictest global standards.

Expansion of Thermal Power and Heavy Industries

Continued expansion of thermal power plants and heavy industrial operations significantly supports demand for tubular electrostatic precipitators. Coal-fired power generation, waste-to-energy facilities, and large-scale process industries generate high particulate emissions that require reliable, high-capacity control solutions. Tubular designs are favored for their ability to handle large flue gas volumes and maintain performance under high temperatures and corrosive conditions. Ongoing capacity additions, life extension of aging power plants, and increased industrial output in emerging economies further reinforce market growth.

- For instance, Ecomak retrofitted an underperforming electrostatic precipitator at a sinter plant in Karnataka, India, achieving emissions below 50 mg/Nm³ continuously, surpassing the 100 mg/Nm³ guarantee. Completion occurred within 30 days from order receipt.

Growing Focus on High-Efficiency Particulate Control

Industries increasingly prioritize high-efficiency particulate removal to improve environmental performance and operational reliability. Tubular electrostatic precipitators provide superior dust collection efficiency compared to conventional filtration systems, especially for fine and sticky particles. Their ability to maintain stable performance with lower pressure drops reduces energy consumption and operating costs. As industries seek long-term, cost-effective emission control solutions, demand for advanced tubular ESP systems with enhanced electrical and mechanical designs continues to rise.

Key Trends & Opportunities

Shift Toward Wet Tubular ESPs for Corrosive Applications

A notable trend in the Tubular Electrostatic Precipitator Market is the growing adoption of wet tubular ESPs for handling sticky, corrosive, and submicron particles. Industries such as chemicals, petrochemicals, and marine exhaust treatment increasingly favor wet systems due to their ability to prevent re-entrainment and manage high-moisture gas streams. This shift creates opportunities for manufacturers to develop corrosion-resistant materials, advanced water management systems, and compact designs tailored to complex industrial environments.

- For instance, Babcock & Wilcox applies wet tubular ESPs in chemical plants for regeneration of spent acids, capturing particulates and sulfuric acid mist effectively through up-flow tubular configurations that handle corrosive conditions.

Integration of Digital Monitoring and Automation

The integration of digital monitoring and automation technologies presents strong growth opportunities in the market. Advanced sensors, real-time performance monitoring, and automated voltage control systems improve operational efficiency and reduce maintenance downtime. Predictive maintenance capabilities help plant operators optimize performance and extend equipment lifespan. Increasing adoption of Industry 4.0 practices across industrial facilities is driving demand for smart tubular electrostatic precipitators with data-driven control and remote monitoring features.

- For instance, Babcock & Wilcox’s SQ-300i Hybrid Automatic Voltage Control provides on-board waveform analysis and V-I curve generation for power quality monitoring. It automates tuning of setback and spark rates to increase power delivery to ESP fields.

Key Challenges

High Capital and Installation Costs

High initial capital investment remains a key challenge for the Tubular Electrostatic Precipitator Market. Tubular ESP systems require significant upfront costs related to equipment, structural integration, and electrical infrastructure. Installation complexity, especially in retrofit projects with limited space, further increases expenses. Small and mid-sized industrial operators often face budget constraints, which can delay adoption or push them toward lower-cost emission control alternatives despite the long-term efficiency benefits of tubular systems.

Operational Complexity and Maintenance Requirements

Operational complexity and maintenance demands pose ongoing challenges for market growth. Tubular electrostatic precipitators require precise electrical control, regular cleaning, and skilled personnel to ensure optimal performance. Issues such as electrode fouling, corrosion in wet systems, and voltage instability can impact efficiency if not properly managed. Limited availability of trained technicians in developing regions and higher maintenance requirements compared to simpler filtration technologies can restrain wider adoption.

Regional Analysis

North America

North America accounted for 26.8% market share in 2024 in the Tubular Electrostatic Precipitator Market, supported by strict environmental regulations and strong enforcement of emission standards across power generation and industrial facilities. The United States leads regional demand due to large-scale thermal power plants, chemical processing units, and waste-to-energy facilities requiring advanced particulate control systems. Ongoing retrofitting of aging industrial infrastructure, combined with investments in emission reduction technologies, sustains demand. Technological adoption, higher compliance spending, and the presence of established equipment manufacturers further strengthen North America’s position in the global market.

Europe

Europe held 24.3% market share in 2024, driven by stringent emission norms under EU environmental directives and aggressive decarbonization targets. Countries such as Germany, France, and the United Kingdom emphasize advanced air pollution control technologies across power generation, cement, metals, and chemical industries. The region shows strong adoption of both dry and wet tubular electrostatic precipitators to manage fine and corrosive particulates. Ongoing upgrades of industrial plants, increased focus on industrial sustainability, and regulatory pressure to reduce particulate emissions continue to support stable market growth across Europe.

Asia-Pacific

Asia-Pacific dominated the Tubular Electrostatic Precipitator Market with 34.9% market share in 2024, supported by rapid industrialization and expanding power generation capacity. China and India are key contributors due to large coal-based power plants, growing chemical and petrochemical industries, and tightening emission regulations. Rising investments in industrial infrastructure and increased enforcement of air quality standards drive strong demand for high-capacity particulate control systems. The region also benefits from cost-effective manufacturing and large-scale retrofit projects, positioning Asia-Pacific as the primary growth engine for the global market.

Latin America

Latin America captured 8.1% market share in 2024, driven by gradual industrial expansion and increasing environmental awareness. Countries such as Brazil, Mexico, and Chile are strengthening emission regulations for power plants, cement facilities, and mining operations. Growing investments in energy infrastructure and modernization of industrial facilities support adoption of tubular electrostatic precipitators. While market penetration remains lower than in developed regions, rising regulatory enforcement and government initiatives to improve air quality are creating steady demand for advanced particulate emission control solutions across the region.

Middle East & Africa

The Middle East & Africa accounted for 5.9% market share in 2024, supported by industrial development and expansion of power generation, oil refining, and petrochemical sectors. Countries including Saudi Arabia, the UAE, and South Africa are increasingly adopting emission control technologies to comply with evolving environmental regulations. Tubular electrostatic precipitators are gaining traction in high-temperature and corrosive applications common in the region. Ongoing infrastructure investments, coupled with growing focus on environmental compliance in industrial projects, continue to drive moderate but steady market growth.

Market Segmentations:

By System

By Emitting Industry

- Power Generation

- Chemicals and Petrochemicals

- Marine

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Tubular Electrostatic Precipitator Market includes GEA Group, Thermax, Babcock & Wilcox Enterprises, Hamon Research-Cottrell, Nederman MikroPul, Scheuch, Isgec Heavy Engineering, Beltran Technologies, AirPol, and Operational Group. The market is characterized by the presence of established global manufacturers and strong regional players focusing on advanced emission control solutions for power generation and heavy industries. Companies emphasize high-efficiency particulate removal, system customization, and compliance with stringent environmental regulations. Strategic initiatives include technology upgrades, project-based contracts, and expansion of service offerings such as retrofitting and maintenance. Manufacturers increasingly invest in corrosion-resistant materials and digital monitoring capabilities to enhance operational reliability. Competitive positioning is influenced by engineering expertise, global project execution capabilities, and long-term client relationships, particularly with power utilities and large industrial operators.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Scheuch

- AirPol

- Thermax

- Operational Group

- GEA Group

- Isgec Heavy Engineering

- Nederman MikroPul

- Beltran Technologies

- Hamon Research-Cottrell

- Babcock & Wilcox Enterprises

Recent Developments

- In April 2025, Siempelkamp Energy & Drying Solutions GmbH secured its first wet electrostatic precipitator (WESP) order for the mineral-wool industry, marking its entry into a new industrial segment with a complete installation and commissioning project planned for 2026.

- In 2025, Thermax successfully commissioned an electrostatic precipitator (ESP) for a leading palm oil producer in Thailand, enhancing particulate emission control at the facility.

Report Coverage

The research report offers an in-depth analysis based on System, Emitting Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Tubular Electrostatic Precipitator Market is expected to benefit from tightening global emission regulations across power generation and heavy industries.

- Increasing retrofitting of aging industrial plants will continue to support demand for advanced particulate control systems.

- Growth in thermal power, waste-to-energy, and industrial combustion processes will sustain long-term market expansion.

- Adoption of wet tubular electrostatic precipitators will rise in applications handling corrosive and fine particulates.

- Technological advancements will focus on improving collection efficiency and operational stability under extreme conditions.

- Integration of digital monitoring and automation will enhance system performance and reduce unplanned downtime.

- Emerging economies will remain key growth contributors due to industrial expansion and regulatory enforcement.

- Manufacturers will increasingly offer customized and application-specific solutions to strengthen customer retention.

- Service-based offerings such as maintenance, upgrades, and retrofits will gain strategic importance.

- Sustainability-driven investments will position tubular electrostatic precipitators as a core solution for long-term air quality management.