Market Overview

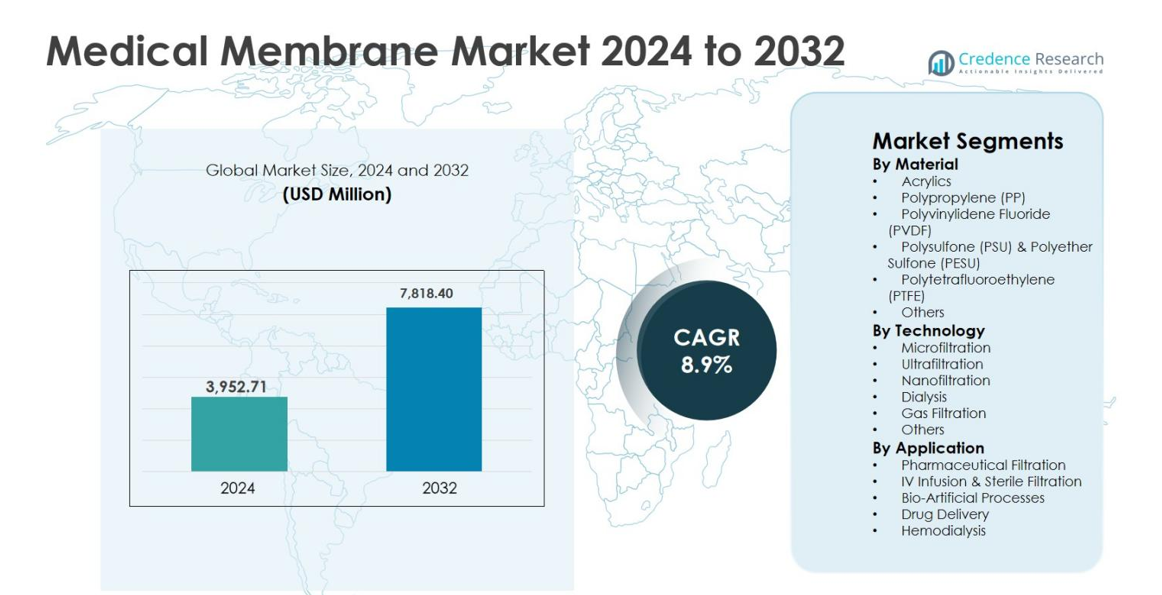

Medical membrane market size was valued at USD 3,952.71 million in 2024 and is anticipated to reach USD 7,818.40 million by 2032, growing at a CAGR of 8.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medical Membrane Market Size 2024 |

USD 3,952.71 million |

| Medical Membrane Market, CAGR |

8.9% |

| Medical Membrane Market Size 2032 |

USD 7,818.40 million |

Medical membrane market is characterized by the strong presence of established global players such as Amniox Medical, Asahi Kasei, Danaher Corporation, Koch Membrane Systems, Merck Group, Mann Hummel, Sartorius AG, W. L. Gore & Associates, 3M Company, and Hangzhou Cobetter Filtration Equipment, which collectively drive innovation and technological advancement across dialysis, pharmaceutical filtration, and sterile medical applications. These companies focus on advanced membrane materials, high filtration efficiency, and regulatory compliance to strengthen their market positions. Regionally, North America leads the Medical membrane market with an exact 38.6% share, supported by advanced healthcare infrastructure and high dialysis adoption, followed by Europe with 27.4% and Asia Pacific with 24.1%, reflecting expanding healthcare access and pharmaceutical manufacturing growth.

Market Insights

- Medical membrane market size was valued at USD 3,952.71 million in 2024 and is projected to reach USD 7,818.40 million by 2032, expanding at a CAGR of 8.9% during the forecast period, supported by rising demand across dialysis, pharmaceutical filtration, and sterile medical applications.

- Market growth is primarily driven by the increasing prevalence of chronic kidney disease, rising dialysis procedures, and expanding pharmaceutical and biopharmaceutical manufacturing, which significantly boost demand for high-performance filtration and separation membranes.

- Key market trends include growing adoption of advanced polymer-based membranes such as polysulfone and polyether sulfone, which held a dominant material segment share of 34.8% in 2024, along with increasing preference for ultrafiltration technology accounting for 29.6% share.

- The market is moderately consolidated, with leading players such as Asahi Kasei, Danaher Corporation, Merck Group, Sartorius AG, W. L. Gore & Associates, and 3M Company focusing on innovation, capacity expansion, and regulatory-compliant solutions.

- Regionally, North America led the market with a 38.6% share in 2024, followed by Europe at 27.4% and Asia Pacific at 24.1%, while cost pressures and regulatory complexity remain key restraints in emerging regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

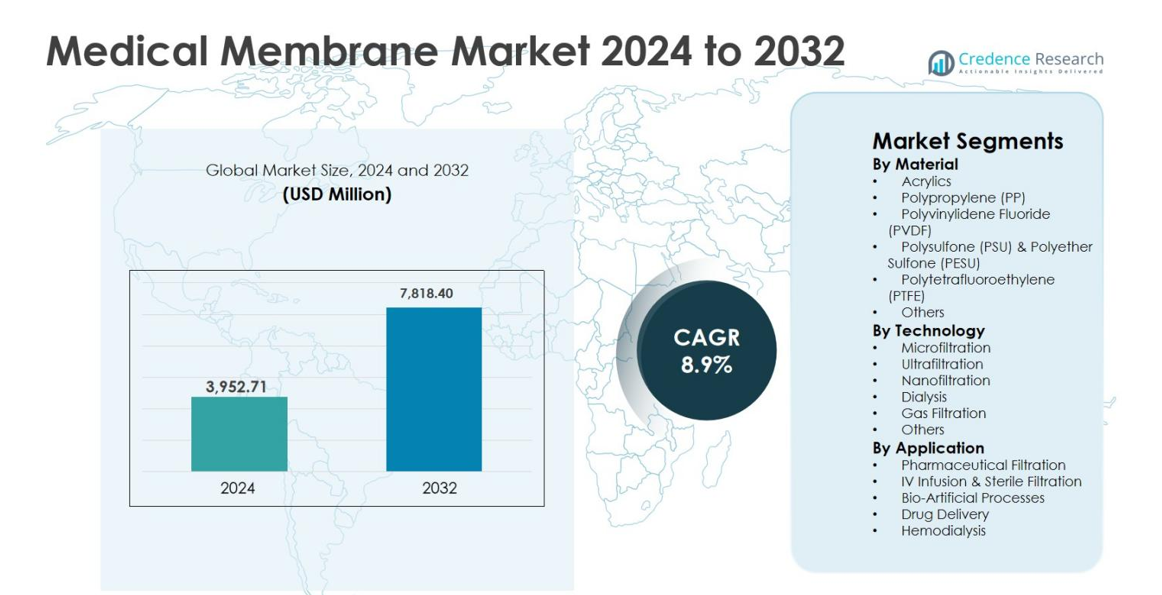

By Material

The Medical membrane market by material shows strong dominance of Polysulfone (PSU) & Polyether Sulfone (PESU), which accounted for 34.8% market share in 2024, driven by their excellent thermal stability, chemical resistance, and high biocompatibility. These materials are widely adopted in hemodialysis, ultrafiltration, and pharmaceutical filtration applications due to their superior permeability and mechanical strength. Polypropylene (PP) and PVDF membranes follow, supported by cost efficiency and chemical durability. Rising demand for long-lasting, high-performance membranes in critical medical applications continues to reinforce PSU & PESU leadership.

- For instance, Fresenius Medical Care uses polysulfone-based Helixone membranes in its FX-class hemodialyzers to deliver high-flux performance and efficient uremic toxin removal

By Technology

Based on technology, Ultrafiltration emerged as the dominant sub-segment, capturing 29.6% of the Medical membrane market share in 2024, supported by its extensive use in dialysis, protein separation, and pharmaceutical purification. Ultrafiltration offers precise molecular separation, high flux rates, and consistent performance, making it ideal for clinical and bioprocessing environments. Microfiltration and dialysis technologies also contribute significantly, driven by growing chronic kidney disease prevalence. Increasing investments in advanced filtration technologies and expanding biopharmaceutical manufacturing facilities are key drivers strengthening ultrafiltration adoption globally.

- For instance, Fresenius Medical Care uses high-flux polysulfone ultrafiltration membranes in its FX-class hemodialyzers to enhance removal of middle-molecule uremic toxins in chronic dialysis.

By Application

By application, Hemodialysis led the Medical membrane market with a 31.2% share in 2024, driven by the rising incidence of renal disorders, aging populations, and expanding dialysis infrastructure worldwide. Medical membranes play a critical role in efficient toxin removal and blood purification during dialysis procedures. Pharmaceutical filtration and IV infusion & sterile filtration also show strong growth due to strict regulatory standards and increasing injectable drug production. Continuous advancements in membrane efficiency, biocompatibility, and patient safety remain key drivers sustaining hemodialysis dominance.

Key Growth Drivers

Rising Prevalence of Chronic and Lifestyle-Related Diseases

The Medical membrane market is significantly driven by the rising prevalence of chronic and lifestyle-related diseases, particularly chronic kidney disease, cardiovascular disorders, and diabetes. The growing global burden of renal failure has led to a steady increase in hemodialysis procedures, where medical membranes play a critical role in blood purification and toxin removal. Aging populations across developed and emerging economies further intensify demand, as elderly patients require long-term dialysis and advanced medical treatments. Additionally, the increasing incidence of hospital-acquired infections has accelerated the use of sterile filtration membranes in IV infusion, drug delivery, and pharmaceutical processing, strengthening overall market growth.

- For instance, Baxter’s portfolio of dialyzers and blood‑line sets, used in chronic and acute dialysis, incorporates synthetic membranes specifically engineered for efficient uremic toxin clearance and biocompatibility in long‑term treatment settings.

Expansion of Pharmaceutical and Biopharmaceutical Manufacturing

Rapid expansion of pharmaceutical and biopharmaceutical manufacturing is a major growth driver for the Medical membrane market. Stringent regulatory requirements for drug purity, sterility, and contamination control have increased the adoption of advanced filtration membranes in drug production and injectable formulation processes. Medical membranes are widely used in pharmaceutical filtration, protein separation, and vaccine manufacturing due to their high precision and reliability. The growing pipeline of biologics, biosimilars, and personalized medicines further supports demand, as these products require highly efficient filtration technologies to ensure safety and efficacy throughout the manufacturing lifecycle.

- For instance, Merck’s Millipore Express and Durapore sterilizing-grade membrane filters are routinely used for sterile filtration of injectable biologics and vaccines to ensure removal of bacteria and particulates before final filling

Technological Advancements in Membrane Materials and Performance

Continuous technological advancements in membrane materials and performance are fueling growth in the Medical membrane market. Innovations in polymer science have led to the development of membranes with enhanced biocompatibility, higher permeability, improved chemical resistance, and longer operational life. Advanced materials such as polysulfone, polyether sulfone, and PVDF are increasingly replacing conventional membranes in critical medical applications. These improvements enhance treatment efficiency, reduce downtime, and lower long-term operational costs for healthcare providers, encouraging widespread adoption across hospitals, dialysis centers, and pharmaceutical facilities.

Key Trends & Opportunities

Growing Adoption of Home-Based and Portable Dialysis Solutions

A key trend shaping the Medical membrane market is the growing adoption of home-based and portable dialysis solutions. Healthcare systems are increasingly shifting toward decentralized care models to reduce hospital burden and improve patient quality of life. This shift is creating opportunities for compact, high-efficiency membranes that offer consistent performance in smaller dialysis systems. Manufacturers are focusing on lightweight, durable membranes with improved filtration accuracy to support home dialysis devices. This trend is particularly strong in developed regions, supported by favorable reimbursement policies and rising patient awareness.

- For instance, Baxter’s HomeChoice CLARIA automated peritoneal dialysis system is designed for home use and relies on durable, biocompatible membrane-based PD solutions to safely perform multiple overnight exchanges with precise ultrafiltration control.

Rising Demand for Single-Use and Disposable Medical Filtration Products

The increasing demand for single-use and disposable medical filtration products presents a significant opportunity for the Medical membrane market. Hospitals and pharmaceutical manufacturers are prioritizing disposable membranes to minimize cross-contamination risks and comply with strict infection control standards. Single-use membranes reduce cleaning requirements and operational downtime while enhancing patient safety. This trend is gaining momentum in sterile filtration, IV infusion, and bioprocessing applications, creating opportunities for membrane manufacturers to develop cost-effective, high-performance disposable solutions.

- For instance, Merck’s Millipore Express single-use sterilizing-grade filters are widely used in biopharmaceutical manufacturing to perform final sterile filtration of drug products without the need for cleaning or reuse.

Key Challenges

High Manufacturing Costs and Complex Production Processes

High manufacturing costs and complex production processes pose a key challenge to the Medical membrane market. The production of high-quality medical membranes requires advanced materials, precision engineering, and stringent quality control, which significantly increase operational costs. Maintaining consistency, biocompatibility, and regulatory compliance adds further complexity, particularly for membranes used in critical applications such as dialysis and pharmaceutical filtration. These factors can limit market entry for new players and increase pricing pressures, especially in cost-sensitive healthcare markets.

Stringent Regulatory Requirements and Approval Delays

Stringent regulatory requirements and lengthy approval processes present another major challenge for the Medical membrane market. Medical membranes must comply with rigorous safety, performance, and biocompatibility standards set by global regulatory authorities. The need for extensive testing, clinical validation, and documentation can delay product launches and increase development costs. Regulatory variations across regions further complicate market expansion strategies for manufacturers, making compliance management a critical challenge, particularly for companies operating on a global scale.

Regional Analysis

North America

North America dominated the Medical membrane market with a 38.6% share in 2024, supported by advanced healthcare infrastructure, high adoption of dialysis treatments, and strong pharmaceutical and biopharmaceutical manufacturing activity. The region benefits from a high prevalence of chronic kidney disease and cardiovascular disorders, driving consistent demand for hemodialysis and sterile filtration membranes. The presence of leading membrane manufacturers, strong R&D investments, and strict regulatory standards further support market leadership. Increasing use of advanced filtration membranes in injectable drug production and hospital-based infection control continues to strengthen regional growth.

Europe

Europe accounted for 27.4% of the Medical membrane market share in 2024, driven by well-established healthcare systems and rising demand for high-quality medical filtration solutions. The region shows strong adoption of medical membranes in dialysis centers, pharmaceutical filtration, and bio-artificial processes. Growing aging populations and increasing incidence of renal disorders support steady demand for dialysis membranes. Additionally, stringent regulatory frameworks related to drug safety and sterility encourage the use of advanced membrane technologies. Continuous investments in biopharmaceutical manufacturing and medical device innovation further contribute to regional market expansion.

Asia Pacific

Asia Pacific held a 24.1% share of the Medical membrane market in 2024 and is witnessing the fastest growth due to expanding healthcare infrastructure and rising patient populations. Increasing prevalence of chronic diseases, rapid urbanization, and improving access to dialysis treatments are major growth drivers. Countries such as China, India, and Japan are experiencing rising demand for cost-effective medical membranes in dialysis and pharmaceutical filtration. Government initiatives to expand healthcare coverage and growing investments in pharmaceutical manufacturing facilities further enhance market growth across the region.

Latin America

Latin America captured 6.2% of the Medical membrane market share in 2024, supported by gradual improvements in healthcare infrastructure and rising awareness of chronic disease management. Increasing cases of diabetes and kidney disorders are driving demand for dialysis membranes, particularly in Brazil and Mexico. The region is also witnessing growing adoption of medical membranes in pharmaceutical filtration as local drug manufacturing expands. Although cost constraints and limited access to advanced healthcare facilities pose challenges, increasing public and private healthcare investments are steadily supporting market growth.

Middle East & Africa

The Middle East & Africa region accounted for 3.7% of the Medical membrane market share in 2024, driven by expanding healthcare investments and rising demand for advanced medical treatments. Growth is supported by increasing prevalence of lifestyle-related diseases and improving access to dialysis services, particularly in Gulf Cooperation Council countries. Governments are investing in hospital infrastructure and medical device procurement, boosting demand for medical membranes. However, limited healthcare access in parts of Africa restrains growth, though ongoing healthcare modernization initiatives continue to create long-term opportunities.

Market Segmentations:

By Material

- Acrylics

- Polypropylene (PP)

- Polyvinylidene Fluoride (PVDF)

- Polysulfone (PSU) & Polyether Sulfone (PESU)

- Polytetrafluoroethylene (PTFE)

- Others

By Technology

- Microfiltration

- Ultrafiltration

- Nanofiltration

- Dialysis

- Gas Filtration

- Others

By Application

- Pharmaceutical Filtration

- IV Infusion & Sterile Filtration

- Bio-Artificial Processes

- Drug Delivery

- Hemodialysis

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Medical membrane market features a well-established competitive landscape characterized by the presence of global medical device leaders, specialized membrane manufacturers, and filtration technology providers. Key players such as Amniox Medical, Asahi Kasei, Danaher Corporation, Koch Membrane Systems, Merck Group, Mann Hummel, Sartorius AG, W. L. Gore & Associates, 3M Company, and Hangzhou Cobetter Filtration Equipment actively compete through product innovation, material advancements, and expansion of application portfolios. These companies focus on developing high-performance membranes with improved biocompatibility, permeability, and durability to meet stringent regulatory standards. Strategic initiatives including capacity expansions, partnerships with pharmaceutical and dialysis service providers, and investments in research and development strengthen their market positions. The competitive environment is further shaped by continuous technological upgrades and growing demand from dialysis, pharmaceutical filtration, and sterile medical applications, encouraging sustained innovation and differentiation across the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, Medtronic Cardiac Surgery launched its VitalFlow™ Extracorporeal Membrane Oxygenation (ECMO) system in Europe, introducing a next-generation, all-in-one ECMO solution designed for intensive care and transport support for critically ill patients.

- In September 2025, Integration Health acquired ECMO Advantage, a specialized provider of extracorporeal membrane oxygenation (ECMO) services, expanding nationwide access to life-saving ECMO services and training.

- In August 2025, VIVOLTA and Fibrothelium announced a long-term manufacturing partnership to scale production of the SimplySilk® membrane for guided bone regeneration in dental and maxillofacial applications

Report Coverage

The research report offers an in-depth analysis based on Material, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Medical membrane market is expected to witness sustained growth driven by rising demand for dialysis and blood purification treatments worldwide.

- Increasing prevalence of chronic kidney disease and aging populations will continue to support long-term demand for high-performance medical membranes.

- Advancements in polymer science will enable the development of membranes with improved biocompatibility, permeability, and durability.

- Adoption of ultrafiltration and nanofiltration technologies will expand due to their efficiency in pharmaceutical and bioprocessing applications.

- Growth in biopharmaceutical production will increase the use of medical membranes in sterile filtration and drug manufacturing.

- Expansion of home-based and portable dialysis solutions will create demand for compact and efficient membrane designs.

- Rising focus on infection control will boost adoption of single-use and disposable medical membrane products.

- Emerging markets will see increased penetration as healthcare infrastructure and access to dialysis services improve.

- Strategic collaborations and capacity expansions by key players will strengthen supply chains and global reach.

- Ongoing regulatory compliance and quality improvements will remain critical to maintaining market competitiveness.