| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe EV Fleet Management System Market Size 2024 |

USD 4,401.53 Million |

| Europe EV Fleet Management System Market, CAGR |

4.14% |

| Europe EV Fleet Management System Market Size 2032 |

USD 6,281.53 Million |

Market Overview

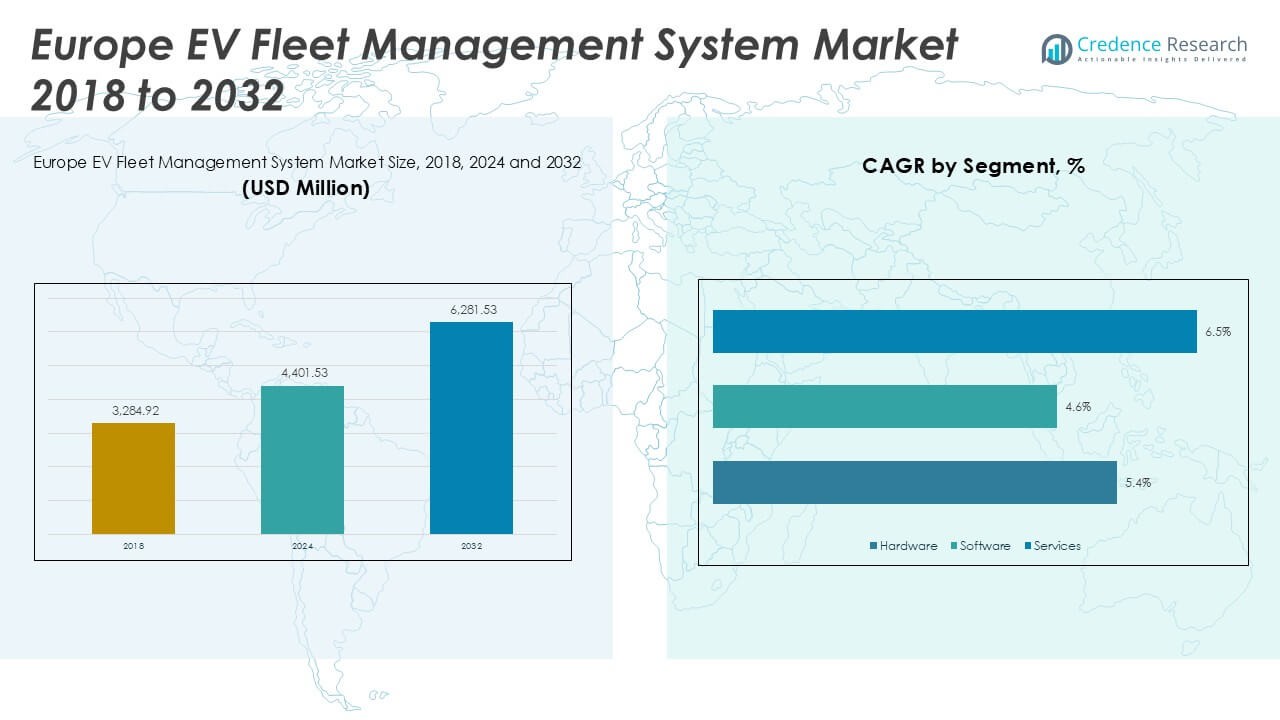

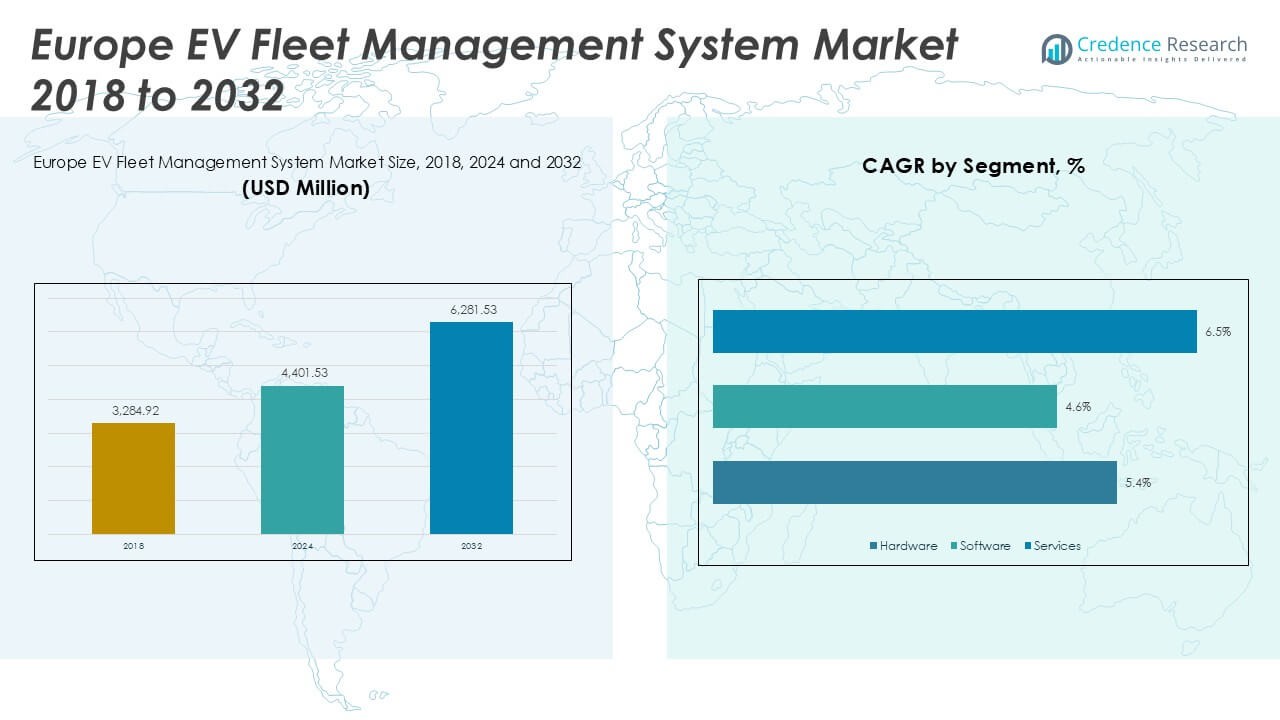

The Europe EV Fleet Management System Market size was valued at USD 3,284.92 million in 2018, reached USD 4,401.53 million in 2024, and is anticipated to reach USD 6,281.53 million by 2032, at a CAGR of 4.14% during the forecast period.

The Europe EV Fleet Management System Market is experiencing steady growth, driven by increasing adoption of electric vehicles across commercial fleets and stringent government regulations promoting zero-emission transportation. Fleet operators are investing in advanced management systems to optimize operational efficiency, reduce total cost of ownership, and meet evolving sustainability targets. Growing emphasis on real-time data analytics, predictive maintenance, and route optimization enhances fleet performance and lowers downtime. Integration of telematics, IoT, and cloud-based platforms is transforming traditional fleet management, enabling seamless monitoring and remote control of EV fleets. The rising focus on carbon footprint reduction, availability of government incentives, and ongoing advancements in battery technology are further supporting market expansion. However, challenges such as high initial investment and integration complexities remain. Overall, the market is set to benefit from continued technological innovation and the region’s strong commitment to green mobility.

Geographical analysis of the Europe EV Fleet Management System Market highlights the strong presence of advanced fleet solutions across Western and Northern Europe, with countries like Germany, the UK, and France leading adoption due to robust infrastructure, supportive regulations, and mature automotive sectors. Southern and Eastern Europe are witnessing accelerated growth, fueled by urban mobility initiatives, government support, and expanding public charging networks. Major cities are investing in digital fleet management to meet sustainability targets and optimize operations. Key players shaping the market include EO Charging, Octo Telematics, and Einride, all of which provide innovative platforms and tailored solutions for diverse fleet needs. These companies are driving the evolution of the sector through continuous technological advancements, partnerships, and a focus on enhancing operational efficiency and sustainability for fleet operators across Europe.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe EV Fleet Management System Market reached USD 4,401.53 million in 2024 and is projected to grow to USD 6,281.53 million by 2032, reflecting a CAGR of 4.14%.

- Rising demand for electric vehicles in commercial fleets, driven by government incentives and sustainability regulations, is accelerating the adoption of advanced fleet management solutions.

- Integration of telematics, IoT, and AI-powered analytics is transforming fleet operations, enabling real-time monitoring, predictive maintenance, and route optimization for greater efficiency.

- Leading players such as EO Charging, Octo Telematics, and Einride are shaping the competitive landscape through continuous innovation, strategic partnerships, and tailored service offerings for various fleet sizes and industries.

- High initial investment costs, system integration challenges with legacy infrastructure, and concerns about data security and regulatory compliance are significant restraints for widespread market adoption.

- Western and Northern Europe remain the key growth hubs due to established infrastructure, proactive government policies, and early technological adoption, while Southern and Eastern Europe are quickly catching up, supported by new investments and expanding charging networks.

- The market is witnessing a shift toward cloud-based, scalable platforms that offer flexibility, remote management, and seamless integration, catering to both large and small fleet operators aiming for improved operational performance and lower emissions.

Market Drivers

Government Policies and Regulatory Push Accelerate Market Growth

Strong government initiatives and regulatory frameworks support the expansion of the Europe EV Fleet Management System Market. Authorities across Europe implement stringent emission reduction targets and offer financial incentives for fleet electrification, including subsidies, tax exemptions, and low-emission zones. These measures encourage commercial operators to accelerate EV adoption and seek advanced fleet management solutions to remain compliant. The policy environment fosters innovation by compelling service providers to develop solutions tailored to regulatory needs. EV-specific infrastructure investments, such as charging networks, further reinforce the shift to electric fleets. The regulatory landscape remains a primary driver, shaping procurement decisions and investment in modern management systems.

- For instance, EO Charging secured a contract to provide charging infrastructure and software to more than 4,000 electric vehicles for the UK’s NHS fleet, supporting one of the largest public sector EV transitions in Europe.

Growing Pressure to Achieve Corporate Sustainability Goals

Corporate sustainability and environmental, social, and governance (ESG) commitments are driving commercial fleet operators to prioritize electric vehicle adoption. Organizations set ambitious decarbonization targets and report progress to stakeholders, increasing demand for reliable EV fleet management platforms that monitor emissions, energy consumption, and utilization metrics. Businesses value management systems that help optimize routes, minimize energy usage, and automate sustainability reporting. The Europe EV Fleet Management System Market meets these needs by delivering tools that support transparent performance tracking and compliance with corporate standards. Enhanced data-driven insights enable continuous improvement in fleet operations and sustainability outcomes.

- For instance, Einride’s freight mobility platform enabled DB Schenker to operate more than 200 electric trucks in their European logistics fleet, resulting in tracked emission savings of over 13,000 metric tons of CO₂ annually.

Technological Innovation Enhances Operational Efficiency

Rapid advancements in digital technologies, such as IoT, telematics, and AI-powered analytics, are transforming traditional fleet management practices. Integration of real-time vehicle data and predictive maintenance capabilities allows operators to streamline operations and reduce downtime. Intelligent platforms support route optimization, energy management, and automated scheduling, contributing to lower operational costs and higher asset utilization. The Europe EV Fleet Management System Market benefits from continuous software and hardware upgrades, which make adoption attractive to both large enterprises and small fleets. These innovations drive a shift towards smarter, more efficient management of electric vehicle fleets.

Expanding EV Ecosystem and Improved Charging Infrastructure

A robust and rapidly growing EV ecosystem underpins market growth. Expansion of public and private charging infrastructure reduces range anxiety and enables efficient scheduling and deployment of EVs across urban and long-haul routes. Partnerships between fleet operators, technology providers, and charging network companies facilitate seamless integration of management systems with charging solutions. The Europe EV Fleet Management System Market leverages these ecosystem improvements to offer comprehensive solutions for energy monitoring, charge planning, and cost optimization. This evolving infrastructure landscape supports increased EV adoption, further fueling demand for advanced management systems.

Market Trends

Integration of Advanced Telematics and Real-Time Data Analytics

The adoption of sophisticated telematics and real-time data analytics is transforming fleet management operations across Europe. Fleet operators leverage integrated platforms to monitor vehicle location, battery health, charging status, and driver behavior in real time. These tools enable more accurate decision-making, predictive maintenance scheduling, and optimal route planning. The Europe EV Fleet Management System Market benefits from a growing demand for solutions that improve fleet transparency and performance metrics. Enhanced connectivity between vehicles and back-end systems leads to more proactive management and a reduction in unplanned downtime. Real-time insights empower fleet managers to optimize utilization and respond swiftly to operational challenges.

- For instance, Octo Telematics processes data from over 6.5 million connected vehicles worldwide, providing actionable analytics for more than 100 fleet customers in Europe to reduce accidents and improve fleet utilization.

Cloud-Based Solutions Enable Greater Flexibility and Scalability

The migration toward cloud-based fleet management platforms continues to gain momentum. Cloud architecture allows businesses to access data from multiple locations, manage large-scale fleets, and integrate seamlessly with other enterprise systems. Scalability and remote accessibility drive adoption among organizations seeking flexibility as their EV fleets expand. The Europe EV Fleet Management System Market capitalizes on this shift, offering platforms that facilitate easy updates, custom reporting, and centralized control of dispersed assets. Cloud deployment reduces IT overhead, supports remote diagnostics, and provides secure storage for critical operational data. Organizations prioritize cloud-enabled platforms to future-proof their fleet operations.

- For instance, TRONITY’s platform enables fleet customers to remotely monitor over 25,000 electric vehicles across 12 European countries, centralizing data for seamless multi-location management.

Emphasis on Smart Charging and Energy Optimization

Intelligent charging management has emerged as a central trend in the EV fleet sector. Solutions now focus on optimizing charging schedules, reducing peak energy costs, and supporting integration with renewable energy sources. The Europe EV Fleet Management System Market incorporates smart charging modules that coordinate charging across multiple vehicles and locations, preventing grid overload and lowering operational expenses. Platforms feature automated alerts, real-time tracking, and analytics that help operators maximize vehicle uptime and manage charging infrastructure efficiently. Companies value tools that enable them to balance operational demands with sustainability objectives.

Focus on User Experience and Customization for Diverse Fleet Needs

Fleet management solutions are evolving to provide intuitive user interfaces and greater customization options. Vendors tailor platforms to suit the unique operational requirements of different industries and fleet sizes. The Europe EV Fleet Management System Market responds to this trend by offering modular solutions, personalized dashboards, and configurable workflows. Enhanced user experience leads to quicker onboarding, improved compliance, and greater user satisfaction. The focus on customization ensures that platforms remain relevant as fleet needs shift with advances in EV technology and evolving regulatory requirements.

Market Challenges Analysis

High Initial Investment and Integration Complexities Hinder Adoption

One of the primary challenges facing the Europe EV Fleet Management System Market is the substantial initial investment required for system deployment and integration. Fleet operators must allocate significant capital to procure compatible hardware, software, and infrastructure upgrades to support EV operations. Legacy systems may not integrate easily with advanced fleet management platforms, creating additional barriers for organizations transitioning from conventional vehicles. Training staff to effectively use new digital tools adds another layer of complexity and potential resistance. Budget constraints among small and medium enterprises often slow the pace of adoption. These factors contribute to longer return on investment timelines and create hesitation among prospective buyers.

Data Security Concerns and Evolving Regulatory Requirements

Increasing reliance on cloud-based and connected systems raises concerns about data privacy and cybersecurity within the Europe EV Fleet Management System Market. Fleet operators must ensure that sensitive operational and driver data remain secure against unauthorized access and cyber threats. Compliance with evolving data protection regulations across different European countries introduces further complexity for multinational operators. Ensuring continuous compliance with GDPR and industry-specific standards requires ongoing monitoring and updates to data management practices. Disparate regulatory frameworks across regions make it challenging to implement standardized solutions. These security and compliance challenges create ongoing operational and financial pressures for fleet operators and solution providers.

Market Opportunities

Expansion of Smart Cities and Green Transportation Initiatives Creates New Avenues

The rapid development of smart cities and large-scale green transportation projects provides significant growth opportunities for the Europe EV Fleet Management System Market. Governments and municipalities invest in digital infrastructure to support integrated, sustainable urban mobility solutions. Fleet management systems aligned with smart city objectives can enable efficient, data-driven deployment of EV fleets for public transport, last-mile delivery, and shared mobility services. These initiatives promote the adoption of connected and intelligent fleet management platforms that optimize traffic flows and reduce environmental impact. Collaborations between public and private sectors create a favorable environment for the adoption of advanced fleet management solutions. The alignment with urban sustainability goals opens doors for customized and scalable EV fleet management offerings.

Growth Potential Through Integration of AI, IoT, and Predictive Analytics

Rapid advancements in artificial intelligence, IoT, and predictive analytics unlock new possibilities for operational excellence in the Europe EV Fleet Management System Market. Solution providers can develop platforms that deliver real-time diagnostics, automate maintenance scheduling, and forecast fleet performance with high accuracy. These innovations help fleet operators reduce operational costs, maximize asset utilization, and improve customer service levels. The integration of machine learning algorithms supports dynamic route optimization and efficient energy management. By leveraging these emerging technologies, the market can offer differentiated solutions tailored to the evolving needs of diverse fleet operators. The ability to provide value-added services drives long-term customer engagement and market expansion.

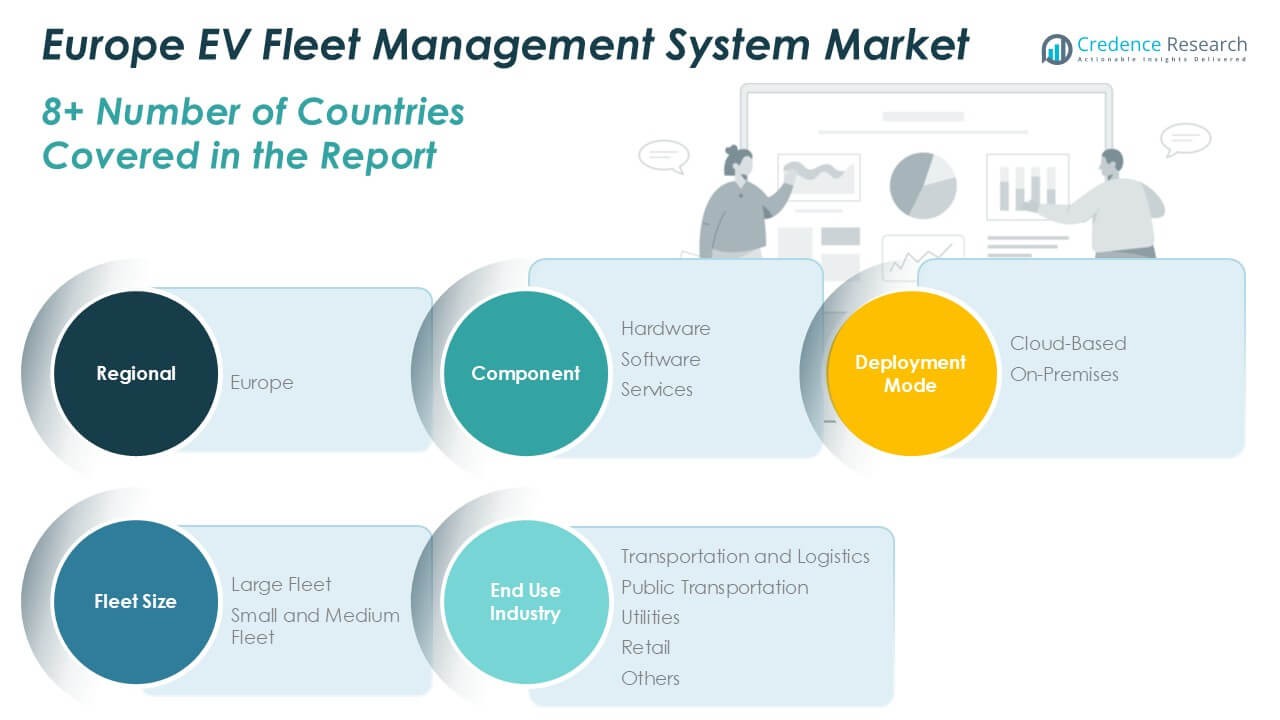

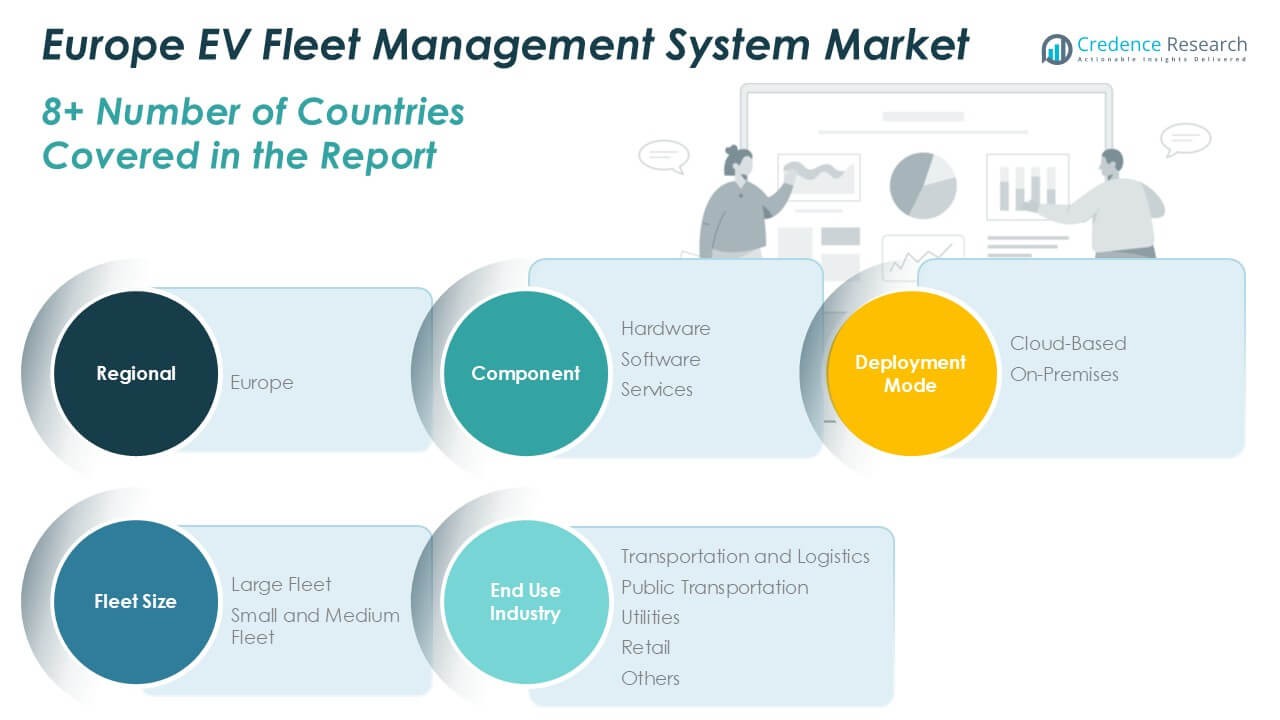

Market Segmentation Analysis:

By Component:

The Europe EV Fleet Management System Market consists of three key components: hardware, software, and services. Hardware forms the backbone of fleet management by providing essential devices such as GPS trackers, telematics units, sensors, and in-vehicle communication systems. These physical components collect and transmit real-time operational data, supporting critical monitoring and analytics functions. Software plays a pivotal role in data interpretation, fleet tracking, predictive maintenance, and decision-making, often powered by AI and cloud technologies. Advanced software solutions allow operators to optimize routes, monitor battery status, and manage energy consumption effectively. Services encompass installation, system integration, technical support, and maintenance, ensuring smooth operation and rapid issue resolution. The demand for comprehensive service packages grows as fleets become more reliant on digital management and continuous system uptime.

- For instance, Radius Limited has deployed more than 500,000 telematics devices in commercial vehicles across Europe, supporting customers with hardware, software, and integrated maintenance services.

By Deployment Mode:

The market offers cloud-based and on-premises deployment options, each catering to different operational needs. Cloud-based solutions are gaining prominence due to their scalability, remote accessibility, and lower upfront infrastructure costs. These platforms enable fleet managers to monitor vehicles from any location, automate updates, and integrate easily with third-party applications. On-premises deployment appeals to organizations with strict data security requirements or those operating in regions with limited internet connectivity. This mode allows full control over system customization and data management, though it typically involves higher setup and maintenance expenses. The growing shift towards digital transformation and centralized fleet operations has accelerated cloud adoption among both large and small fleet operators.

- For instance, WeFlex’s cloud-based EV fleet management system has enabled over 2,000 ride-hailing vehicles in London to achieve full operational visibility and remote support, reducing on-site service calls.

By Fleet Size:

Fleet size segmentation covers large fleets and small and medium fleets. Large fleet operators prioritize sophisticated management systems capable of handling extensive vehicle networks and complex logistics operations. These operators benefit from economies of scale and require robust integration between vehicles, charging infrastructure, and business systems. The market supports their needs by offering advanced analytics, automated scheduling, and centralized control. Small and medium fleets seek cost-effective, user-friendly solutions that can streamline day-to-day management without extensive IT investment. The Europe EV Fleet Management System Market addresses both segments by delivering scalable and customizable platforms, ensuring broad market relevance and adoption across diverse business sizes.

Segments:

Based on Component:

- Hardware

- Software

- Services

Based on Deployment Mode:

Based on Fleet Size:

- Large Fleet

- Small and Medium Fleet

Based on End Use Industry:

- Transportation and Logistics

- Public Transportation

- Utilities

- Retail

- Others

Based on the Geography:

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis

Western Europe

Western Europe dominates the Europe EV Fleet Management System Market, accounting for approximately 46% of the regional market share. Countries such as Germany, France, the Netherlands, and the United Kingdom lead the adoption of electric vehicles and advanced fleet management technologies. Western Europe’s strong regulatory environment, robust investment in charging infrastructure, and active government incentives have accelerated fleet electrification and digital transformation. The region benefits from mature automotive and technology sectors, which foster rapid integration of telematics, IoT, and cloud-based platforms. Businesses and municipalities are increasingly shifting their fleets to electric models to meet stringent emissions targets and align with sustainability mandates. Leading automotive OEMs and technology providers are headquartered here, further supporting market development through innovation and pilot projects. The well-established supply chain, coupled with a high concentration of large commercial fleets, ensures steady demand for scalable and integrated fleet management systems. Western Europe’s proactive stance on environmental policies continues to drive investments, making it the most influential region in the European market landscape.

Northern Europe

Northern Europe holds a market share of approximately 22% in the Europe EV Fleet Management System Market. The region, encompassing Sweden, Norway, Denmark, and Finland, is recognized for its ambitious climate goals, advanced digital infrastructure, and high EV penetration rates. Norway, in particular, stands out as a global leader in electric vehicle adoption due to generous government incentives, strong consumer awareness, and expansive charging networks. Businesses and public sector organizations in Northern Europe implement advanced fleet management solutions to optimize operational efficiency, reduce costs, and ensure regulatory compliance. The presence of highly skilled technology providers and a collaborative ecosystem between public and private stakeholders accelerates digital transformation across fleets of all sizes. Northern Europe’s commitment to achieving carbon neutrality has stimulated early adoption of cloud-based and AI-driven management platforms. This progressive environment positions the region as a trendsetter, encouraging other parts of Europe to follow its lead in sustainable fleet operations.

Southern Europe

Southern Europe accounts for roughly 16% of the Europe EV Fleet Management System Market. Key countries include Italy, Spain, Portugal, and Greece, where urban mobility projects and a thriving tourism industry are major growth catalysts. Governments in these countries are investing in modernizing public transportation and implementing low-emission zones in cities, stimulating demand for electric vehicle fleets and management systems. The region’s warm climate and dense urban populations favor last-mile delivery services and shared mobility platforms, both of which increasingly rely on EV fleet management solutions to ensure efficiency and reliability. While Southern Europe is still catching up with Western and Northern Europe in terms of infrastructure maturity, the pace of investment and adoption is accelerating. Market growth is supported by EU funding, cross-border collaboration, and a growing presence of both local and international technology vendors. The flexibility and scalability of modern fleet management systems appeal to a diverse range of operators, including municipal transit authorities, logistics providers, and hospitality groups.

Eastern Europe

Eastern Europe holds a market share of approximately 9% in the Europe EV Fleet Management System Market. Countries such as Poland, Czech Republic, Hungary, and Romania are in the early stages of transitioning to electric vehicle fleets but show high growth potential due to improving economic conditions and increasing urbanization. The region is witnessing gradual infrastructure upgrades, expanding charging station networks, and growing governmental interest in clean mobility solutions. Cost-sensitive fleet operators are starting to explore EV fleet management systems to achieve greater efficiency and cost savings. International technology providers are entering the market through partnerships and pilot programs, introducing advanced platforms tailored to local needs. Although adoption is at a nascent stage, the rising awareness of sustainability, coupled with EU directives and funding, is expected to accelerate future growth. Eastern Europe’s emerging market status presents opportunities for solution providers to establish a strong presence by offering accessible, scalable, and locally relevant platforms tailored to varying fleet sizes and operational requirements.

Key Player Analysis

- EO Charging

- TRONITY

- Octo Telematics

- Einride

- Radius Limited

- LIZY

- WeFlex

- Erinion

- Dynamon

- Zeti

Competitive Analysis

The competitive landscape of the Europe EV Fleet Management System Market is shaped by a mix of established technology providers and innovative new entrants, with leading players including EO Charging, Octo Telematics, Einride, Radius Limited, and TRONITY. These companies are driving industry transformation by offering comprehensive platforms that integrate real-time data analytics, smart charging solutions, and predictive maintenance tools. Companies compete by developing advanced platforms that integrate real-time telematics, smart charging, predictive maintenance, and data analytics to help fleet operators optimize costs and reduce emissions. Market leaders invest heavily in research and development to deliver differentiated features, such as automated scheduling, energy management, and seamless integration with charging infrastructure. Partnerships with automotive OEMs, energy companies, and municipalities strengthen market positions and enable wider adoption of EV fleet solutions across both public and private sectors. Vendors prioritize user-friendly interfaces, cloud-based scalability, and customizable modules to address the diverse requirements of large enterprises and small to mid-sized fleets. Competitive dynamics drive continuous technological advancements and the rollout of value-added services, ensuring operators gain tangible benefits in efficiency, compliance, and sustainability from their fleet management investments.

Recent Developments

- In January 2024, MoveEV, an AI-powered EV transition platform, partnered with Geotab. The collaboration integrates MoveEV’s flagship product, ReimburseEV, into the Geotab Marketplace, marking a significant step in advancing sustainable fleet management. In September 2023, Trimble partnered with transportation solution provider Next Generation Logistics to make its Engage Lane solution available to their base of shippers through the Transportation Cloud.

- In December 2023, Komatsu completed the acquisition of iVolve Holdings through its wholly-owned subsidiary in Australia. With this acquisition, the company expects to cater to iVolve’s customers in North America and Australia and target mid-tier operations.

- In December 2023, Traxall International, a sister company of Fleet Operations, completed the acquisition of Fleet Logistics Group. This acquisition was done to develop one of the largest independent mobility and fleet management providers with over 400,000 contracts under management in Europe.

- In June 2023, ZEVX, an EV systems provider, introduced OpenZEVX, a SaaS fleet management software dedicated to e-mobility solutions and battery-electric powertrains. The new launch is expected to enable fleet managers to enhance EV powertrains and charging systems to optimize EV range, performance, and driver safety.

- In June 2023, Webfleet, Bridgestone‘s fleet management software, introduced a trailer management solution, named Webfleet Trailer. The new solution is dedicated to supporting transport and logistics firms with trailer fleets operating long haul.

Market Concentration & Characteristics

The Europe EV Fleet Management System Market exhibits moderate to high market concentration, with a handful of established players commanding significant influence through technological innovation and broad service portfolios. It is characterized by strong integration of telematics, IoT, and data analytics, allowing fleet operators to achieve high operational efficiency and compliance with sustainability standards. Companies differentiate their offerings by delivering scalable cloud-based solutions, seamless connectivity, and comprehensive data-driven insights tailored for fleets of varying sizes. The market values user-centric design and customizable modules to support a range of applications across logistics, public transportation, and utilities. Evolving regulatory frameworks and ongoing investments in charging infrastructure foster an environment where innovation and adaptability are essential. The competitive landscape supports continuous improvement, with new entrants and established providers competing to address evolving fleet management challenges across Europe.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment Mode, Fleet Size, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Europe EV fleet management system market is expected to grow steadily due to rising adoption of electric vehicles across commercial and public sectors.

- Increasing government regulations and incentives for zero-emission fleets will support market expansion.

- Fleet operators are investing more in real-time monitoring and predictive maintenance to enhance EV performance and reduce downtime.

- Integration of telematics and cloud-based analytics is becoming essential for efficient EV fleet operations.

- Demand for route optimization and energy management solutions is increasing to minimize operational costs.

- The shift toward Mobility-as-a-Service (MaaS) is encouraging widespread deployment of EV fleet management platforms.

- Collaboration between OEMs and software providers is driving innovation in advanced fleet tracking and charging infrastructure management.

- Adoption of AI and machine learning in fleet software is enhancing decision-making and sustainability.

- Growth in last-mile delivery services is pushing logistics companies to upgrade to EV fleets with smart management systems.

- Expansion of charging infrastructure and standardization of protocols will play a key role in future market growth.