Market Overview

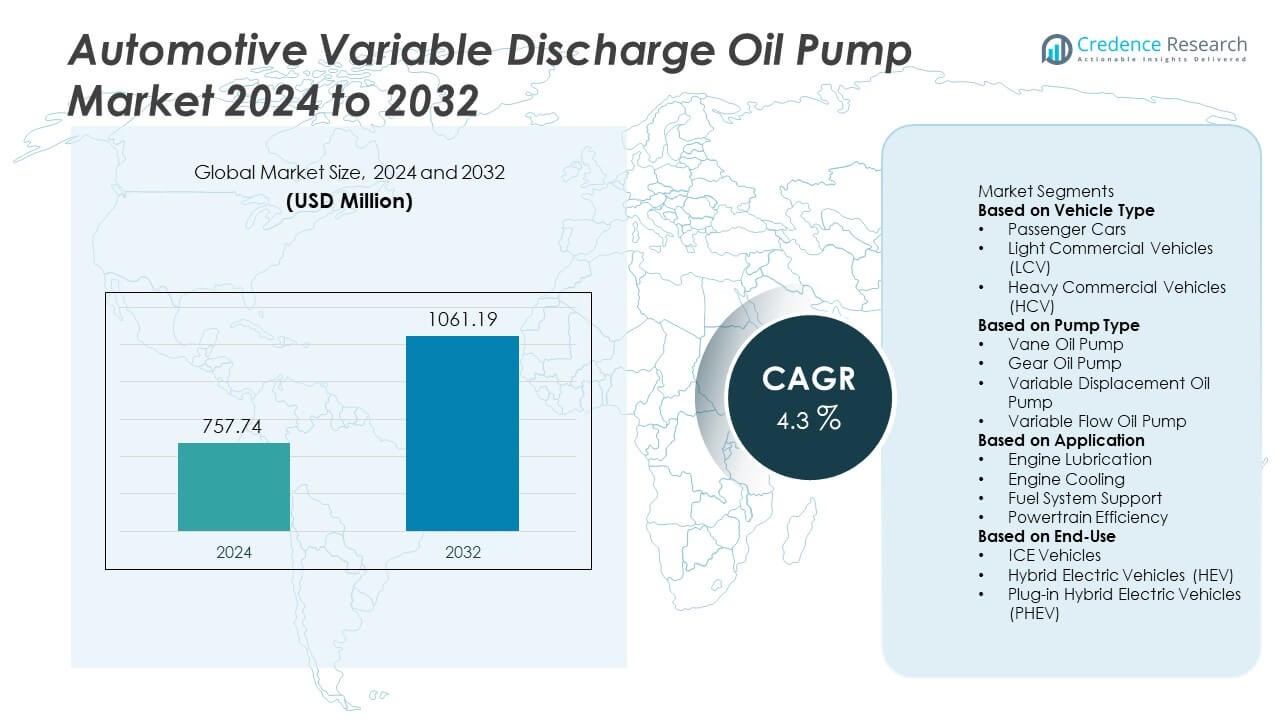

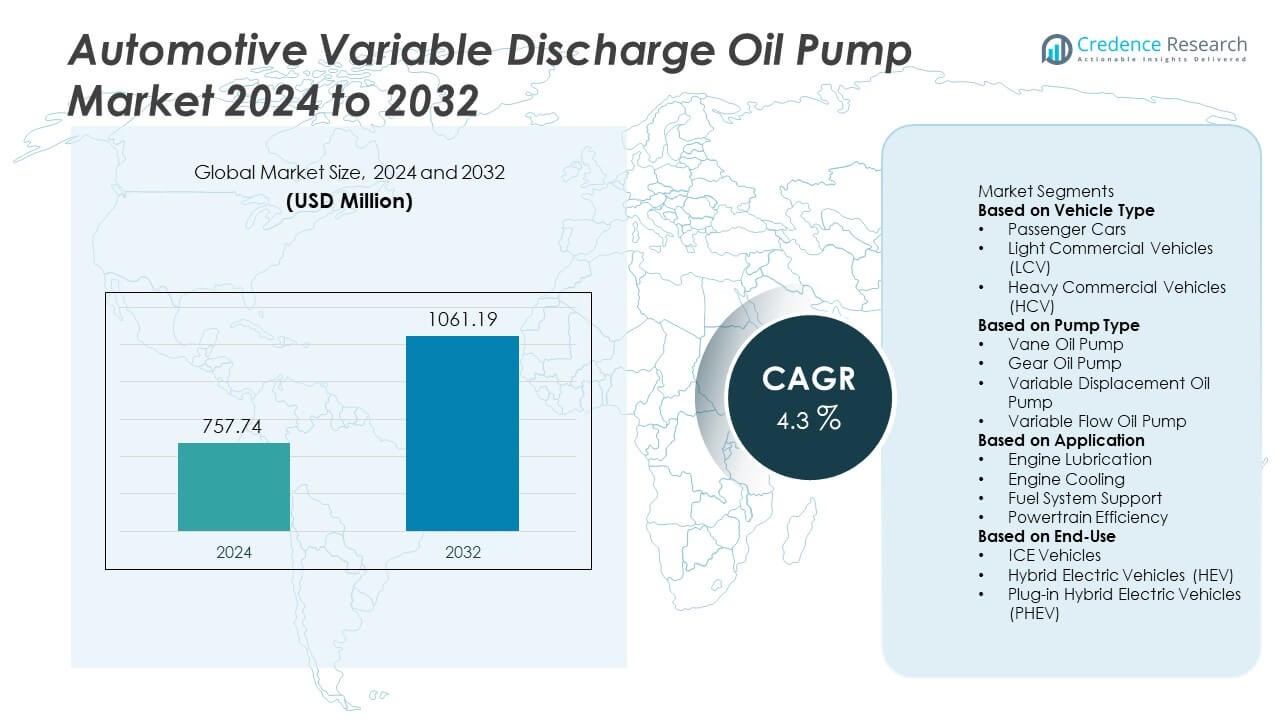

The Automotive Variable Discharge Oil Pump Market reached USD 757.74 million in 2024. The market is projected to increase to USD 1,061.19 million by 2032, reflecting a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Variable Discharge Oil Pump Market Size 2024 |

USD 757.74 Million |

| Automotive Variable Discharge Oil Pump Market, CAGR |

4.3% |

| Automotive Variable Discharge Oil Pump Market Size 2032 |

USD 1,061.19 Million |

The top players in the Automotive Variable Discharge Oil Pump market include Bosch, Denso Corporation, Delphi Technologies, Magna International Inc., Hitachi Astemo, Johnson Electric, MAHLE GmbH, Rheinmetall Automotive, STACKPOLE International, and SHW AG, each focusing on advanced lubrication solutions to improve engine efficiency and emission performance. Asia Pacific leads the market with a 34% share, supported by strong vehicle production in China, Japan, and South Korea. North America follows with 27%, driven by high adoption of hybrid and fuel-efficient engines, while Europe holds 24%, supported by stringent emission standards and rapid powertrain electrification.

Market Insights

- The Automotive Variable Discharge Oil Pump market reached USD 757.74 million in 2024 and is projected to reach USD 1,061.19 million by 2032, registering a CAGR of 4.3% during the forecast period.

- Rising demand for fuel-efficient and hybrid engines drives market growth, with variable displacement pumps holding the largest 46% segment share due to strong adoption in passenger car platforms focused on emission reduction and improved powertrain performance.

- Key trends include increasing integration of electronic control units and sensor-based lubrication, along with growing aftermarket opportunities as vehicle ownership durations rise and maintenance awareness strengthens across fleet operators.

- Bosch, Denso, Delphi Technologies, Magna, Hitachi Astemo, Johnson Electric, MAHLE, Rheinmetall Automotive, STACKPOLE International, and SHW AG remain key competitors, competing on innovation, OEM partnerships, and smarter oil flow management technologies.

- Asia Pacific leads regional demand with a 34% share, followed by North America at 27% and Europe at 24%, supported by strong vehicle production, turbocharged engine penetration, and hybrid powertrain expansion across major markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Vehicle Type

Passenger cars hold the dominant share of 58% in the Automotive Variable Discharge Oil Pump market. Higher production volumes, rising fuel-efficiency standards, and wider adoption of advanced engine technologies drive strong demand. Light commercial vehicles follow due to growth in last-mile delivery fleets and urban logistics. Heavy commercial vehicles show steady growth, supported by long-haul transportation and powertrain durability needs. Automakers increase integration of variable oil pumps to enhance thermal control and reduce friction losses. Growing adoption of hybrid passenger cars further strengthens the leading position of this segment.

- For instance, BMW AG integrated a variable discharge oil pump in its B48 2.0-liter engine, improving mechanical efficiency and supporting higher power density. The pump delivers a controlled oil flow based on load. This reduced internal friction and enabled improved real-world fuel performance across BMW 3 Series and X3 models.

By Pump Type

Variable displacement oil pumps account for the largest market share of 46%. This dominance is linked to the ability to regulate oil flow based on engine load and speed, improving efficiency and lowering emissions. Gear oil pumps remain relevant in low-cost engine platforms, while vane oil pumps serve mid-performance applications. Variable flow pumps gain traction in hybrid and start-stop engines to maintain lubrication stability. Increasing regulatory pressure on CO₂ reduction encourages OEMs to shift toward advanced variable displacement systems, sustaining strong growth within this leading sub-segment.

- For instance, Denso Corporation developed a variable displacement oil pump used in Toyota Dynamic Force 2.5-liter engines with a pressure control range of 0.1 to 1.0 MPa. The design reduces parasitic losses and ensures stable lubrication during rapid engine stop-start events. Denso reported internal testing showing lower mechanical drag compared to fixed-flow designs.

By Application

Engine lubrication represents the leading application, capturing a 52% share of the market. Reliable lubrication supports friction reduction, component protection, and extended engine life, making it critical for modern powertrains. Engine cooling follows, driven by thermal management needs in turbocharged and hybrid systems. Fuel system support and powertrain efficiency applications continue to expand as automakers push higher combustion efficiency and lower emissions. Variable discharge oil pumps optimize lubrication flow, helping enhance fuel economy and reduce mechanical losses, strengthening demand in the dominant engine lubrication segment across both ICE and hybrid platforms.

Key Growth Drivers

Growing Adoption of Fuel-Efficient Engine Technologies

Automakers increase the use of fuel-efficient and low-emission powertrains, driving demand for variable discharge oil pumps. These pumps optimize lubrication by adjusting oil flow based on engine load, reducing friction and energy consumption. Stricter global emission norms accelerate the shift from fixed-displacement pumps toward advanced variable flow systems. The expansion of hybrid vehicle production further supports adoption, as efficient lubrication remains essential in start-stop and electric-assist engines. This driver strengthens the role of variable discharge oil pumps as a core component in next-generation engine platforms focused on performance and efficiency.

- For instance, MAHLE GmbH developed a variable oil pump for Volkswagen’s EA888 2.0-liter TSI engine with an adjustable delivery rate between 2 and 70 liters per minute. This design reduced mechanical drive losses and contributed to better combustion efficiency while supporting thermal balance under high boost pressure.

Expansion of Hybrid and Electrified Powertrains

The rapid electrification of vehicle fleets increases the need for precise thermal and lubrication control. Hybrid engines operate under dynamic load cycles, making controlled oil flow vital for seamless transitions between electric and combustion modes. Variable discharge oil pumps ensure stable lubrication, enhance component durability, and support longer service intervals. Government incentives for hybrid and plug-in hybrid vehicles continue to boost installation rates. Tier-I suppliers invest in electronically controlled pump technologies, reinforcing growth as electrified powertrains evolve.

- For instance, Hitachi Astemo supplies an electronically controlled variable displacement oil pump for engine lubrication to improve fuel efficiency in vehicles.

Rising Demand for Lightweight and High-Performance Engines

Downsized turbocharged engines gain market traction, driving higher requirements for advanced oil management. Variable discharge oil pumps reduce parasitic losses while supporting elevated operating pressures needed for modern combustion systems. Lightweight engine blocks and friction-optimized components benefit from controlled lubrication, improving thermal stability and engine longevity. Manufacturers integrate smart pump systems to support high-speed performance and demanding towing conditions. This driver contributes to strong adoption as engines advance toward higher power density and reduced maintenance demands.

Key Trends and Opportunities

Key Trends and Opportunities

Increasing Integration of Smart and Connected Pump Systems

Automobile manufacturers enhance oil pump systems with sensors, electronic controls, and predictive diagnostics. Smart variable discharge pumps adjust lubrication in real time, minimizing wear and reducing fuel consumption. Fleet operators gain improved reliability and reduced maintenance downtime through remote monitoring capabilities. Advancements in data analytics and thermal insight enable proactive servicing and component protection. This trend opens opportunities for collaborations among pump manufacturers, automotive software providers, and powertrain technology companies.

- For instance, Rheinmetall Automotive (Pierburg) introduced an electronically controlled oil pump with an integrated sensor package capable of monitoring oil pressure up to 3.0 bar and temperature up to 100°C.

Growing Opportunities in Aftermarket Demand

Aging vehicle fleets and extended ownership cycles support strong aftermarket sales for variable discharge oil pumps. Replacement demand increases particularly for turbocharged and hybrid engines that rely on precise lubrication performance. Service networks and workshops expand inventory for advanced pump systems, including retrofit-compatible variants. Manufacturers focus on modular product designs that align with older engine platforms and widely used vehicle models. This opportunity strengthens long-term revenue streams outside OEM supply contracts.

- For instance, General Motors (GM) utilizes variable displacement oil pumps in some of its engines, such as the 2.0-liter turbocharged Ecotec, to improve efficiency and provide optimal lubrication based on engine operating conditions.

Key Challenges

High System Integration and Production Costs

Advanced variable discharge oil pumps require precision components, electronic controllers, and durable materials, raising manufacturing costs. Automakers in price-sensitive markets may delay adoption and continue using fixed-displacement designs. Integration into hybrid powertrains increases engineering and calibration expenses, impacting product affordability. Higher repair and replacement costs can also influence aftermarket acceptance in cost-conscious regions. These pressures may slow technology deployment across entry-level and mid-range vehicles.

Complex Calibration and Reliability Requirements

Variable discharge oil pumps must perform effectively under diverse driving conditions, increasing validation complexity. Inadequate flow control can cause overheating, lubrication failure, or severe engine damage, making reliability critical. Automakers spend significant time testing compatibility with turbocharged, start-stop, and hybrid systems, extending development cycles. Electronic sensors and control units add failure risks and require skilled servicing. Continuous improvements in pump control algorithms, diagnostics, and materials remain necessary to overcome these challenges.

Regional Analysis

North America

North America holds a market share of 27%. Strong adoption of fuel-efficient and hybrid engine platforms drives demand for variable discharge oil pumps across the United States and Canada. Automakers focus on reducing CO₂ emissions, boosting integration of electronically controlled lubrication systems in passenger and commercial vehicles. Growth in light truck and SUV production further supports pump installation, particularly for advanced turbocharged engines. The presence of major Tier-I suppliers and ongoing investments in powertrain innovation strengthen regional competitiveness. Expanding electric and hybrid fleets, supported by government incentives and charging infrastructure development, ensures steady market growth during the forecast period.

Europe

Europe accounts for a market share of 24%. Strict emission regulations under Euro standards and rapid expansion of hybrid and plug-in hybrid vehicles accelerate adoption of variable discharge oil pumps. Countries such as Germany, France, and the United Kingdom lead in engine efficiency upgrades and powertrain electrification. Automotive OEMs enhance lubrication technologies to improve thermal management and reduce friction losses in downsized engines. Investments in autonomous and connected vehicle engineering contribute to smarter pump control integration. Rising commercial fleet modernization and growth in aftermarket replacement demand further reinforce the market outlook across the region.

Asia Pacific

Asia Pacific commands the largest market share of 34%. High production volumes of passenger and commercial vehicles in China, Japan, South Korea, and India drive significant pump demand. Rapid adoption of turbocharged gasoline engines and expansion of hybrid mobility solutions strengthen regional growth. Local suppliers collaborate with global OEMs to introduce efficient oil pump systems tailored for diverse driving conditions. Urbanization, e-commerce logistics expansion, and rising middle-income vehicle ownership support higher vehicle output. Government policies encouraging reduced fuel consumption and cleaner engine technologies further elevate market penetration in both OEM and aftermarket segments across the region.

Latin America

Latin America holds a market share of 8%. Moderate vehicle production and growing demand for cost-efficient engine technologies support market development across Brazil, Mexico, and Argentina. Light commercial vehicles used in logistics and agriculture drive interest in improved lubrication solutions. OEMs gradually integrate variable discharge oil pumps to support better fuel economy and engine durability in challenging operating environments. Economic recovery and expansion of fleet maintenance services strengthen aftermarket potential. Although adoption remains lower than in developed markets, increasing emission regulations and modernization of transport fleets are expected to enhance long-term adoption of advanced variable lubrication systems.

Middle East and Africa

Middle East and Africa represent a market share of 7%. Demand grows steadily due to expansion in commercial transportation, construction, and mining activity, where reliable lubrication systems are essential for engine protection. Countries including the United Arab Emirates, Saudi Arabia, and South Africa show rising interest in variable discharge oil pumps for both light and heavy vehicle segments. Extreme temperature conditions increase the need for effective oil flow control and thermal stability. Improving vehicle servicing infrastructure and gradual shifts toward cleaner automotive technologies support market progression. Partnerships between global suppliers and regional distributors enhance product availability and long-term adoption.

Market Segmentations:

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

By Pump Type

- Vane Oil Pump

- Gear Oil Pump

- Variable Displacement Oil Pump

- Variable Flow Oil Pump

By Application

- Engine Lubrication

- Engine Cooling

- Fuel System Support

- Powertrain Efficiency

By End-Use

- ICE Vehicles

- Hybrid Electric Vehicles (HEV)

- Plug-in Hybrid Electric Vehicles (PHEV)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Bosch, Denso Corporation, Delphi Technologies, Magna International Inc., Hitachi Astemo, Johnson Electric, MAHLE GmbH, Rheinmetall Automotive, STACKPOLE International, and SHW AG lead the competitive landscape of the Automotive Variable Discharge Oil Pump market. The market features strong competition driven by technology upgrades, product efficiency improvements, and expanding integration across hybrid and turbocharged engine platforms. Key players focus on designing electronically controlled pumps that optimize lubrication and reduce mechanical losses. Partnerships with automotive OEMs strengthen supply programs and ensure alignment with evolving powertrain standards and emission regulations. Several companies invest in lightweight materials, advanced sealing systems, and predictive maintenance capabilities through sensor-based pump architectures. Mergers, capacity expansions, and R&D investments support long-term positioning, particularly in Asia Pacific and Europe. Competition also intensifies in the aftermarket segment as service networks adopt variable discharge pump replacements for aging vehicle fleets, creating multi-channel revenue growth opportunities for global and regional manufacturers.

Key Player Analysis

- Bosch

- Denso Corporation

- Delphi Technologies

- Magna International Inc.

- Hitachi Astemo

- Johnson Electric

- MAHLE GmbH

- Rheinmetall Automotive

- STACKPOLE International

- SHW AG

Recent Developments

- In August 2025, Delphi, a brand of PHINIA Inc., announced its largest product launch of the year in North America, introducing over 50 first-to-market parts across various categories.

- In April 2025, Johnson Electric showcased a range of innovative motion solutions, including for the powertrain, at Auto Shanghai 2025, with a focus on efficient oil flow control for hybrid and electric vehicle platforms using compact, lightweight designs.

- In 2025, Astemo, Ltd. (formerly Hitachi Astemo, as of April 1, 2025) continued to innovate within the automotive oil pump market, supporting electrification trends by developing variable displacement and intelligent pump solutions tailored for hybrid and next-generation vehicle platforms.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Pump Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow as automakers increase the use of hybrid and fuel-efficient engines.

- Adoption of electronically controlled oil pumps will expand across new vehicle platforms.

- Variable displacement technology will remain preferred for reducing friction and improving engine efficiency.

- Integration of sensors and predictive maintenance functions will support smart powertrain systems.

- Aftermarket sales will rise due to longer vehicle ownership and higher engine servicing needs.

- Lightweight pump designs will gain traction to support engine downsizing and emission targets.

- Partnerships between pump manufacturers and OEMs will strengthen product development and testing.

- Fleets will adopt advanced lubrication systems to reduce fuel consumption and extend engine life.

- Asia Pacific will remain a major growth hub supported by strong automotive production capacity.

- Regulatory pressure on emission reduction will accelerate technology upgrades across all vehicle segments.

Key Trends and Opportunities

Key Trends and Opportunities