Market Overview

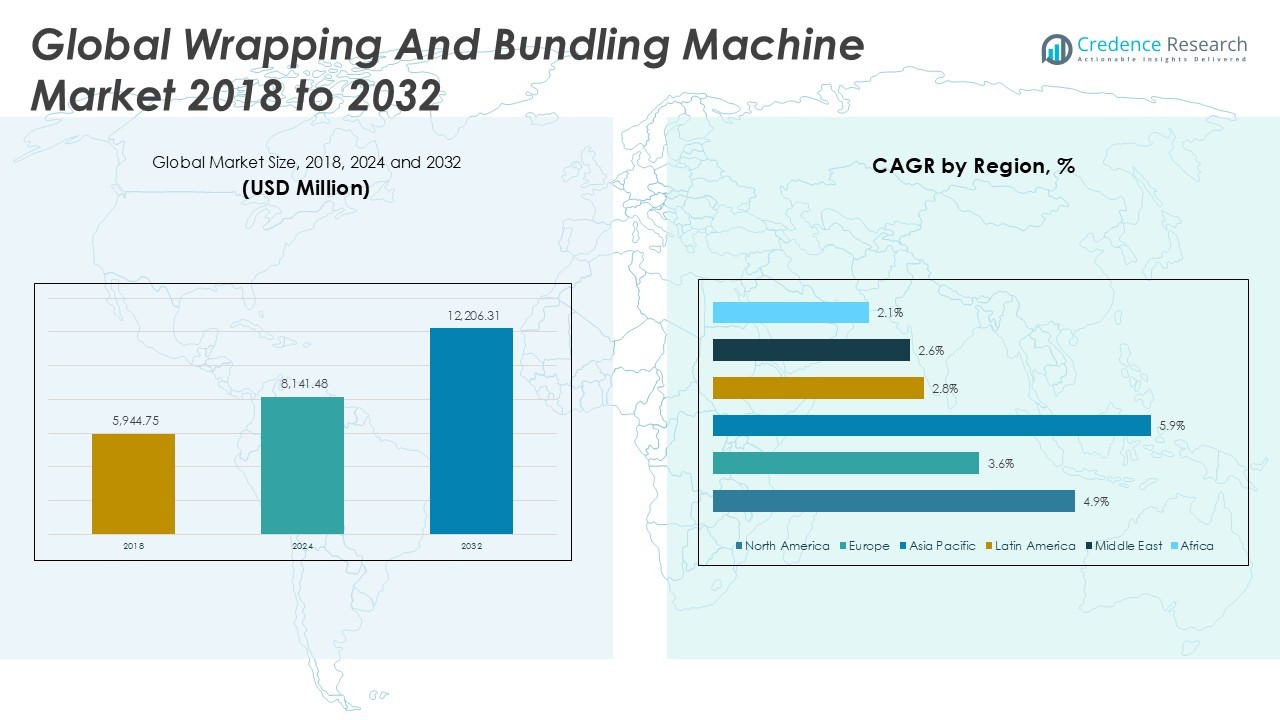

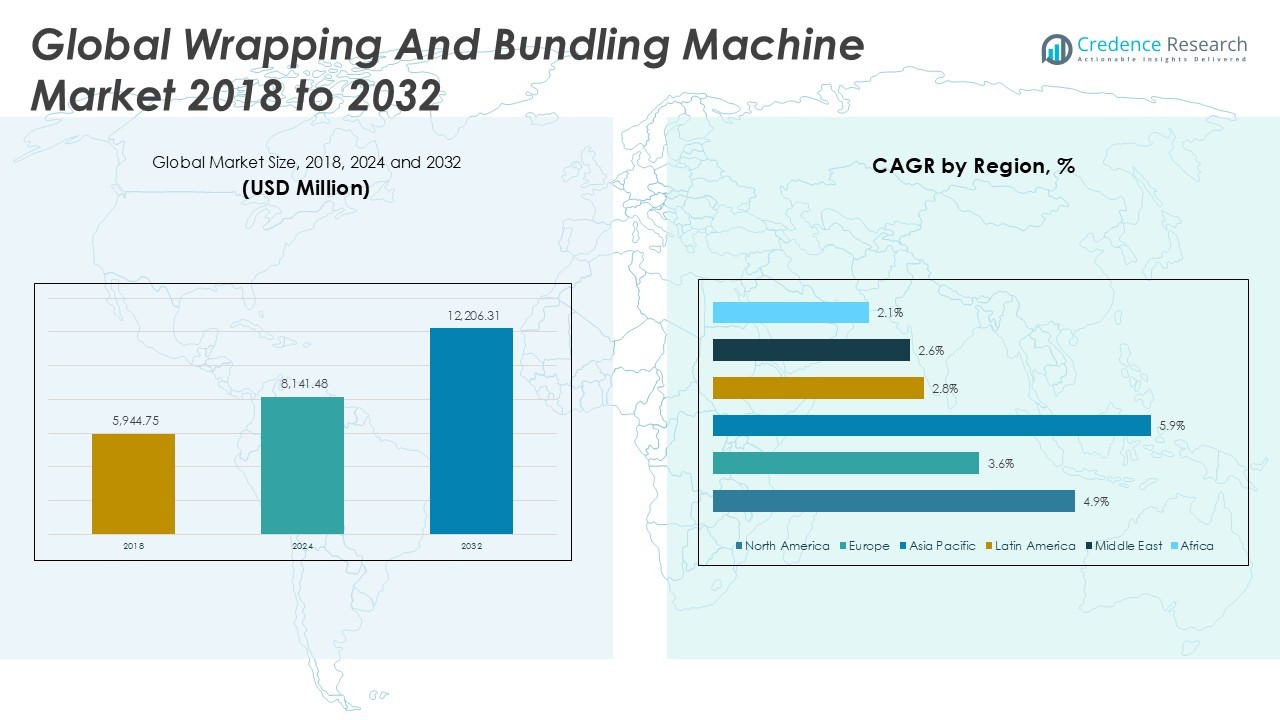

The Wrapping and Bundling Machine Market was valued at USD 5,944.75 million in 2018, reached USD 8,141.48 million in 2024, and is anticipated to reach USD 12,206.31 million by 2032, at a compound annual growth rate (CAGR) of 4.83% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wrapping and Bundling Machine Market Size 2024 |

USD 8,141.48 Million |

| Wrapping and Bundling Machine Market, CAGR |

4.83% |

| Wrapping and Bundling Machine Market Size 2032 |

USD 12,206.31 Million |

The Wrapping and Bundling Machine Market is experiencing steady growth, fueled by the expanding packaging sector across food and beverage, pharmaceuticals, and consumer goods industries. Rising demand for automation and efficiency in production lines drives adoption of advanced wrapping and bundling solutions that enhance throughput and minimize operational costs. Increasing focus on product safety, hygiene, and shelf life further supports market expansion, as companies seek to meet stringent regulatory and quality standards. Technological advancements, including the integration of IoT and smart sensors, are streamlining operations and enabling predictive maintenance. At the same time, sustainability trends are prompting manufacturers to develop energy-efficient and eco-friendly machinery. The rise of e-commerce and the need for secure, tamper-proof packaging solutions also contribute to heightened market demand. While initial investment costs and complex maintenance requirements remain challenges, ongoing innovation and shifting consumer preferences toward convenient packaging formats continue to shape the market’s positive outlook.

The geographical analysis of the Wrapping and Bundling Machine Market highlights strong demand across North America, Europe, and Asia Pacific, with each region exhibiting distinct growth drivers. North America and Europe benefit from advanced manufacturing capabilities, robust regulatory frameworks, and a strong focus on automation and sustainability in packaging solutions. Asia Pacific shows rapid expansion fueled by industrialization, a burgeoning e-commerce sector, and rising investments in modern production technologies. Emerging markets in Latin America, the Middle East, and Africa are witnessing steady growth due to increased adoption of packaged consumer goods and ongoing modernization of supply chains. Key players shaping the competitive landscape include Omori Machinery, known for its innovative wrapping solutions; Optima Packaging Group, recognized for its wide product portfolio; and Krones, a global leader in packaging technology. Lantech also holds a significant presence with its emphasis on automation and efficient machine designs tailored to diverse industry needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Wrapping and Bundling Machine Market was valued at USD 5,944.75 million in 2018, reached USD 8,141.48 million in 2024, and is projected to reach USD 12,206.31 million by 2032, reflecting a CAGR of 4.83%.

- Strong demand for automated and efficient packaging solutions in food, beverage, pharmaceuticals, and consumer goods sectors continues to drive market growth.

- Automation, IoT integration, and sustainability trends are shaping new product developments, with manufacturers focusing on energy-efficient and eco-friendly machines.

- Key players such as Omori Machinery, Optima Packaging Group, Krones, and Lantech maintain a competitive edge by investing in advanced technology and broad product portfolios.

- High initial capital investment and complex integration requirements act as primary restraints, especially for small and medium-sized enterprises considering market entry.

- North America leads the market, supported by advanced manufacturing infrastructure, while Asia Pacific shows the fastest growth due to industrialization and expanding e-commerce activities.

- Evolving regulatory standards and increasing emphasis on sustainable packaging materials encourage innovation and continuous upgrades across global markets.

Market Drivers

Expansion of Packaging Industry Across Key Sectors Drives Market Growth

The packaging industry’s ongoing expansion in food and beverage, pharmaceuticals, and consumer goods significantly drives the Wrapping and Bundling Machine Market. Companies across these sectors seek efficient packaging solutions to improve product safety and extend shelf life. Increased demand for packaged foods and medicines has pushed manufacturers to invest in reliable, high-speed wrapping and bundling systems. Globalization and urbanization trends support higher volumes of packaged goods, elevating demand for automated packaging lines. The market benefits from growing consumer preferences for convenient and hygienic products. It also aligns with the need to comply with evolving quality and regulatory standards. This broad industry adoption creates a steady base of customers and ongoing investment in advanced machinery.

- For instance, Krones AG delivered over 15,000 packaging lines worldwide to food and beverage producers, supporting large-scale packaging efficiency and meeting international standards for safety and hygiene.

Automation and Integration of Smart Technologies Boost Operational Efficiency

The drive for operational efficiency compels manufacturers to automate packaging processes with advanced wrapping and bundling equipment. Automation reduces manual labor, lowers operational costs, and minimizes human error. Smart features such as programmable logic controllers (PLCs), IoT connectivity, and real-time data analytics enhance machine performance and enable predictive maintenance. The integration of robotics and AI-driven control systems increases speed, accuracy, and adaptability on production lines. This technological progress empowers companies to scale operations and respond rapidly to market fluctuations. The market responds favorably to solutions that deliver higher throughput and flexibility for diverse packaging needs. Automation also improves workplace safety by reducing worker exposure to repetitive and hazardous tasks.

- For instance, Ishida’s advanced robotics solutions can perform up to 120 packs per minute, improving packaging speeds and reducing manual labor in high-output manufacturing plants.

Rising Regulatory Standards and Focus on Product Integrity Fuel Market Demand

Tighter regulations and industry standards around product safety, tamper resistance, and traceability shape investment decisions in the Wrapping and Bundling Machine Market. Governments and industry bodies impose strict guidelines on packaging to ensure hygiene, prevent contamination, and secure supply chains. Manufacturers must adopt equipment that guarantees consistent, high-quality packaging to meet these requirements. Demand grows for machines that support track-and-trace features, serial coding, and integration with quality management systems. Heightened consumer awareness around product authenticity and security further accelerates adoption of advanced wrapping and bundling technology. The need for compliance drives ongoing upgrades and replacement of older, less capable systems.

Sustainability Initiatives and the E-Commerce Boom Stimulate Technological Advancements

Sustainability pressures encourage manufacturers to design energy-efficient and environmentally friendly Wrapping and Bundling Machinery. Companies increasingly select equipment compatible with recyclable or biodegradable materials, supporting corporate sustainability goals and aligning with shifting consumer expectations. At the same time, the rapid growth of e-commerce fuels demand for secure, damage-resistant packaging that can withstand shipping and handling. The market sees a surge in solutions offering customization and adaptability for a variety of package shapes and sizes. The convergence of sustainability mandates and e-commerce requirements prompts continued research and development in this sector. Ongoing innovation ensures that the market remains responsive to dynamic supply chain needs and environmental responsibilities.

Market Trends

Automation and Digitalization Accelerate Adoption of Advanced Machinery

Automation and digitalization have become dominant trends in the Wrapping and Bundling Machine Market. Manufacturers increasingly invest in machines equipped with IoT sensors, cloud connectivity, and remote monitoring capabilities to improve efficiency and reduce downtime. These technologies enable predictive maintenance and data-driven decision-making, helping companies streamline production workflows. Robotics and machine vision integration further enhance speed, accuracy, and quality control on packaging lines. It empowers producers to handle complex packaging requirements and frequent product changeovers without significant disruption. The demand for fully automated and flexible systems continues to grow as companies pursue cost-effective solutions.

- For instance, Optima Packaging Group has deployed digital twins and remote service solutions, enabling over 1,000 customers worldwide to monitor and optimize packaging performance in real time.

Sustainable Packaging and Eco-Friendly Materials Reshape Machine Development

The shift toward sustainable packaging drives innovation in machine design and functionality. The Wrapping and Bundling Machine Market now emphasizes compatibility with recyclable, biodegradable, and compostable packaging materials. Manufacturers introduce equipment capable of handling thinner films and alternative substrates without compromising performance. Companies prioritize energy efficiency and reduced waste in machinery operation to align with environmental goals and regulatory expectations. Sustainability considerations extend to the entire lifecycle of machines, prompting the use of eco-friendly components and improved recyclability. This trend leads to the rapid adoption of advanced, green technologies across diverse packaging environments.

- For instance, Multivac’s latest flow packers reduce film consumption by 30 grams per meter, enabling users to significantly lower material waste while processing up to 120 packs per minute.

Customization and Modular Designs Meet Diverse Industry Demands

Customization emerges as a vital trend, with manufacturers seeking equipment tailored to their unique product formats and packaging requirements. The Wrapping and Bundling Machine Market supports this demand through modular designs and easily configurable systems. Companies can adjust or expand their machines to accommodate new products, package sizes, or formats with minimal downtime. Quick-change features and tool-free adjustments enable seamless transitions between product lines, supporting flexible and agile manufacturing environments. This adaptability proves essential for brands launching limited-edition products or responding to seasonal demand shifts. Customizable machinery delivers a competitive edge by ensuring efficient and scalable operations.

E-Commerce Expansion Drives Demand for Robust and Smart Packaging Solutions

The rapid growth of e-commerce reshapes packaging requirements, influencing trends in the Wrapping and Bundling Machine Market. The market prioritizes equipment that delivers strong, tamper-proof packaging suitable for shipping and last-mile delivery. Machines capable of variable packaging, secure wrapping, and precise bundling cater to a wide array of product types and shipment sizes. The integration of track-and-trace features supports transparency and supply chain visibility, which remain critical for e-commerce logistics. Market participants develop machines that deliver reliable performance under high-volume, fast-paced environments. The e-commerce boom reinforces the need for advanced packaging solutions, driving continuous upgrades in machine capability and efficiency.

Market Challenges Analysis

High Initial Capital Investment and Complex Integration Limit Market Penetration

High initial capital investment presents a significant challenge for companies considering advanced Wrapping and Bundling Machines. Small and medium-sized enterprises often face budget constraints, which can delay or prevent adoption of modern equipment. The Wrapping and Bundling Machine Market requires customers to justify the return on investment, especially when existing manual or semi-automated systems are still operational. Complex integration with existing production lines and digital infrastructure can also slow implementation. Companies must invest in skilled personnel and technical support to ensure smooth installation and operation. The risk of production downtime during the transition phase further complicates decision-making for manufacturers.

Maintenance Demands and Evolving Regulations Create Operational Hurdles

Regular maintenance and the need for technical expertise increase operational costs and present ongoing challenges for end users. Machines with advanced automation and smart technologies require specialized support, making it difficult for companies without dedicated maintenance teams. The Wrapping and Bundling Machine Market must also address evolving regulatory standards related to packaging safety, hygiene, and environmental sustainability. Frequent updates in compliance requirements demand continuous investment in equipment upgrades and documentation. Variations in regional standards add another layer of complexity for multinational companies. Meeting these challenges requires strategic planning, ongoing training, and flexible adaptation to changing industry demands.

Market Opportunities

Expansion in Emerging Markets and Growth of E-Commerce Open New Revenue Streams

Emerging markets present significant growth opportunities for the Wrapping and Bundling Machine Market, driven by rapid industrialization and expanding consumer goods sectors. Rising disposable incomes and urbanization in Asia-Pacific, Latin America, and Africa support increased demand for packaged products, prompting manufacturers to invest in advanced machinery. The market benefits from government initiatives promoting manufacturing and infrastructure development in these regions. Growth of e-commerce accelerates the need for secure and efficient packaging solutions, creating strong demand for machines capable of handling diverse package formats. Companies that tailor equipment to local market requirements can establish a competitive advantage and expand their global footprint. This expansion unlocks new revenue streams and long-term customer relationships.

Innovation in Sustainable Solutions and Smart Technologies Fuels Market Advancement

Development of sustainable wrapping and bundling solutions presents a promising opportunity for companies focused on environmental responsibility. The Wrapping and Bundling Machine Market responds to increasing regulations and consumer preferences by offering equipment compatible with eco-friendly materials and energy-efficient operations. Manufacturers integrating IoT, AI, and robotics into their machines deliver value through predictive maintenance, real-time monitoring, and process optimization. These smart technologies enhance productivity, reduce downtime, and improve product quality. Customization and modular machine designs further enable manufacturers to address specific industry challenges and support agile production. Continued investment in innovation strengthens market positioning and creates pathways for future growth.

Market Segmentation Analysis:

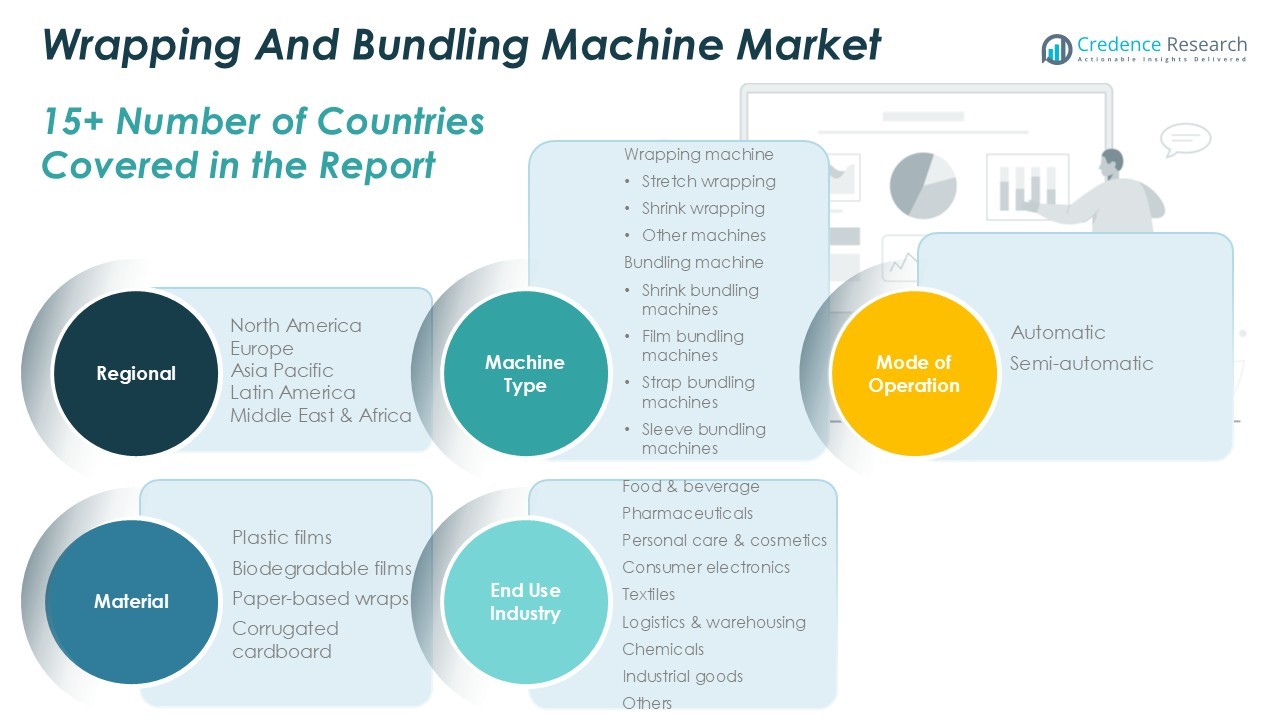

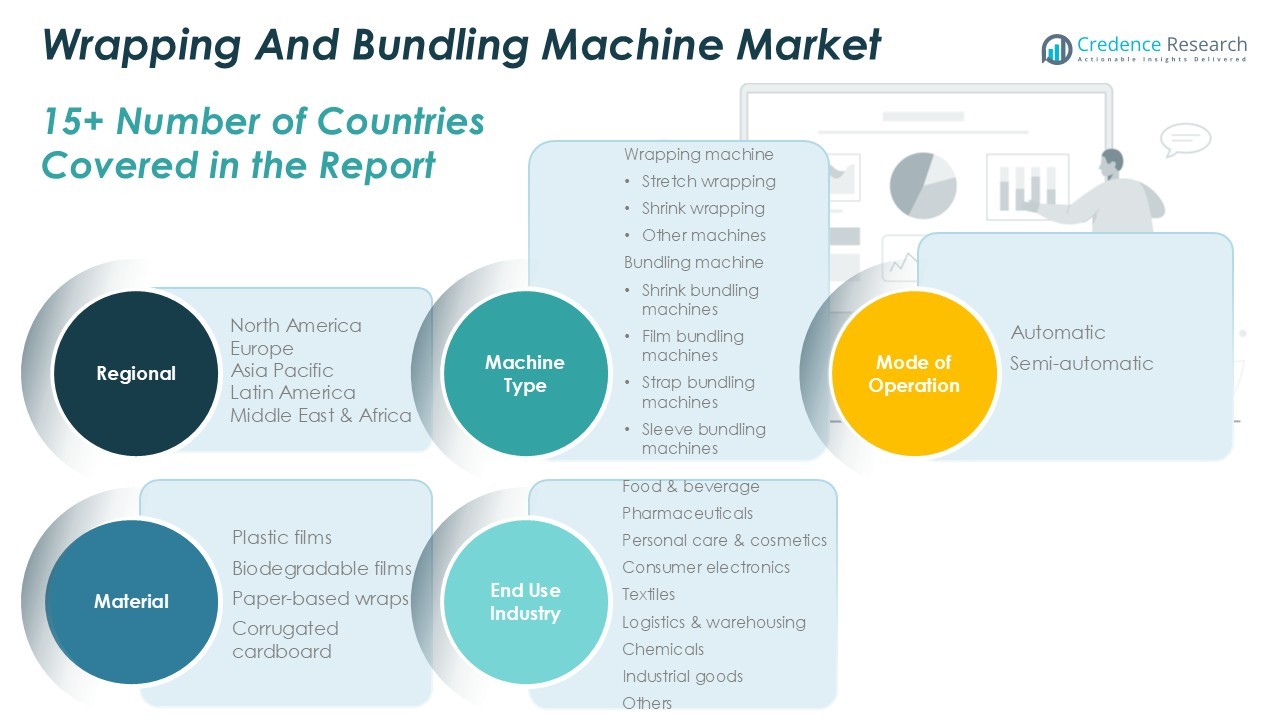

By Machine Type:

The market divides into wrapping machines and bundling machines. Wrapping machines feature prominent subtypes such as stretch wrapping, which dominates due to its extensive use in securing pallet loads and ensuring stable transit, and shrink wrapping, valued for its versatility in tightly sealing products for protection and tamper evidence. Other wrapping machines cater to niche applications requiring customized packaging solutions. Bundling machines further segment into shrink bundling, film bundling, strap bundling, and sleeve bundling machines. Shrink and film bundling machines hold significant shares within logistics, beverages, and consumer goods, offering high-speed packaging for multi-unit products. Strap and sleeve bundling machines serve specialized industrial needs, including heavy goods and irregular product shapes.

- For instance, Robopac’s stretch wrapping machines are installed in over 25,000 industrial facilities globally, with some models capable of processing up to 240 pallets per hour for high-throughput warehousing environments.

By Mode of Operation:

The market splits into automatic and semi-automatic systems. Automatic machines lead market growth due to the rising demand for higher throughput, minimal labor dependency, and consistent packaging quality. Manufacturers in high-volume sectors prefer automatic systems to optimize productivity and efficiency. Semi-automatic machines remain relevant for small to medium enterprises and production lines requiring flexibility and lower upfront investment. It caters to businesses managing moderate packaging volumes or needing adaptable operations for changing product lines.

- For instance, Lantech’s QL-400 semi-automatic stretch wrapper enables operators to wrap up to 35 loads per hour, making it a preferred solution for SMEs requiring speed and ease of use.

By Material:

Plastic films continue to dominate market share because of their durability, cost-effectiveness, and compatibility with various machine types. The market witnesses a growing preference for biodegradable films, driven by environmental regulations and rising consumer awareness around sustainability. Paper-based wraps are increasingly selected in segments prioritizing recyclable and compostable packaging, such as food, personal care, and specialty goods. Corrugated cardboard holds an essential role for bulk packaging and transit protection, especially in logistics and industrial goods. The Wrapping and Bundling Machine Market remains highly responsive to shifts in packaging material preferences, integrating innovative features to accommodate new substrates and sustainability requirements across segments.

Segments:

Based on Machine Type:

- Wrapping machine

- Stretch wrapping

- Shrink wrapping

- Other machines

- Bundling machine

- Shrink bundling machines

- Film bundling machines

- Strap bundling machines

- Sleeve bundling machines

Based on Mode of Operation:

Based on Material:

- Plastic films

- Biodegradable films

- Paper-based wraps

- Corrugated cardboard

Based on End Use Industry:

- Food & beverage

- Pharmaceuticals

- Personal care & cosmetics

- Consumer electronics

- Textiles

- Logistics & warehousing

- Chemicals

- Industrial goods

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Wrapping and Bundling Machine Market

North America Wrapping and Bundling Machine Market grew from USD 2,481.64 million in 2018 to USD 3,361.74 million in 2024 and is projected to reach USD 5,054.81 million by 2032, reflecting a compound annual growth rate (CAGR) of 4.9%. North America is holding a 41% market share. The United States and Canada represent the primary markets, driven by strong demand in the food and beverage, pharmaceuticals, and consumer goods sectors. The region benefits from advanced manufacturing infrastructure and high adoption rates for automation technologies. The need for efficient and sustainable packaging, coupled with regulatory standards, fuels continuous investment in upgraded machinery.

Europe Wrapping and Bundling Machine Market

Europe Wrapping and Bundling Machine Market grew from USD 1,107.75 million in 2018 to USD 1,433.82 million in 2024 and is forecast to reach USD 1,954.38 million by 2032, with a CAGR of 3.6%. Europe accounts for a 16% market share. Key countries such as Germany, France, Italy, and the United Kingdom anchor the region’s market, supported by established packaging and logistics industries. Demand for eco-friendly packaging solutions and strict EU packaging regulations encourage manufacturers to invest in advanced wrapping and bundling technologies. The shift towards biodegradable and recyclable materials remains a significant driver.

Asia Pacific Wrapping and Bundling Machine Market

Asia Pacific Wrapping and Bundling Machine Market grew from USD 1,857.44 million in 2018 to USD 2,675.17 million in 2024 and is anticipated to reach USD 4,348.19 million by 2032, posting a CAGR of 5.9%. Asia Pacific holds a 36% market share. China, Japan, India, and South Korea dominate the market landscape, fueled by rapid industrialization, a growing middle class, and expanding e-commerce. The region’s robust manufacturing sector drives investments in automated packaging equipment to meet rising consumer demand. Government initiatives to modernize manufacturing further strengthen market growth.

Latin America Wrapping and Bundling Machine Market

Latin America Wrapping and Bundling Machine Market grew from USD 228.58 million in 2018 to USD 308.26 million in 2024 and is projected to reach USD 396.74 million by 2032, with a CAGR of 2.8%. Latin America holds a 3% market share. Brazil and Mexico lead the regional market, underpinned by a growing food processing industry and increased adoption of packaged consumer goods. Market growth is tempered by economic fluctuations but remains positive due to ongoing investment in modernization.

Middle East Wrapping and Bundling Machine Market

Middle East Wrapping and Bundling Machine Market grew from USD 169.13 million in 2018 to USD 212.03 million in 2024 and is expected to reach USD 269.07 million by 2032, reflecting a CAGR of 2.6%. The Middle East holds a 2% market share. The United Arab Emirates and Saudi Arabia are the main contributors, with rising investments in logistics, retail, and food packaging. The region is witnessing a gradual shift toward automation, though growth is moderated by economic and regulatory factors.

Africa Wrapping and Bundling Machine Market

Africa Wrapping and Bundling Machine Market grew from USD 100.23 million in 2018 to USD 150.46 million in 2024 and is anticipated to reach USD 183.11 million by 2032, at a CAGR of 2.1%. Africa accounts for a 2% market share. South Africa and Egypt represent the leading markets, where the adoption of modern packaging technology is rising alongside urbanization and growth in consumer goods sectors. The region faces challenges related to infrastructure and investment but presents opportunities for market entry as demand for packaged products increases.

Key Player Analysis

- Omori Machinery

- Optima Packaging Group

- Ishida

- Krones

- Lantech

- Adelphi Group

- Coesia

- Multivac

- Nichrome Packaging Solutions

- Robopac

Competitive Analysis

The Wrapping and Bundling Machine Market features a competitive landscape shaped by leading players such as Omori Machinery, Optima Packaging Group, Ishida, Krones, Lantech, Adelphi Group, Coesia, Multivac, Nichrome Packaging Solutions, and Robopac. These companies compete by leveraging technological innovation, extensive product portfolios, and strong global distribution networks. Continuous investment in automation, IoT-enabled features, and energy-efficient solutions enables market leaders to address evolving customer demands for productivity, sustainability, and flexibility in packaging operations. Global players maintain extensive distribution and service networks to ensure reliable customer support and enhance brand loyalty. Many companies focus on expanding their geographic presence, forming strategic alliances, and tailoring solutions to meet the specific requirements of different regions and end-use industries. Competitive strategies include offering modular machine designs, rapid customization capabilities, and comprehensive after-sales service. These efforts strengthen market positions and drive the ongoing transformation of the packaging industry toward more efficient, sustainable, and intelligent solutions.

Recent Developments

- In January 2025, HiFlow Solutions, a packaging industry software specialist, launched an advanced AI-driven module for the purchase order (PO) management process to improve handling workflows with added efficiency, accuracy, and scalability.

- In June 2024, the global brand of aseptic process solutions, Spain-based Telstar, announced plans to join Germany-based Syntegon. They announced the acquisition by Syntegon, as well as by the current owners of Telstar, Japan-based Azbil Corporation.

- In October 2023, Matco Tools, a leading provider of premium tools, announced the launch of its newest diagnostic scan tool – the Maximus Plus. Designed with automotive technicians in mind, the Maximus Plus is the ultimate diagnostic scan tool that provides complete coverage flexibility, OE-level functionality, and the power of Android™ at your fingertips.

- In 2023, Orion Packaging Systems launched its redesigned MA Series, a fully automatic rotary stretches wrapping machine, at PACK EXPO 2023. The updated machine is designed for high-volume end-of-line applications and can wrap any type of load. Key features include a four-leg base for stability, enhanced safety measures, and a user-friendly control system. The MA Series minimizes installation time and provides extra load protection during shipping.

Market Concentration & Characteristics

The Wrapping and Bundling Machine Market demonstrates moderate concentration, with several global leaders holding significant shares while a large number of regional and specialized manufacturers address niche demands. It features a competitive environment shaped by innovation, automation, and the integration of smart technologies, including IoT-enabled systems and advanced controls. Market participants focus on expanding product portfolios and offering tailored solutions for various industries, such as food, beverage, pharmaceuticals, and consumer goods. The market values energy efficiency, flexibility, and the ability to process multiple packaging materials, reflecting shifting sustainability requirements and changing consumer preferences. Large players leverage strong distribution networks and after-sales services to maintain their competitive advantage, while regional firms excel by meeting local regulatory standards and offering cost-effective solutions. The Wrapping and Bundling Machine Market remains dynamic, responsive to technological advances, and characterized by ongoing investment in research and development to support operational efficiency and compliance across global supply chains.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Machine Type, Mode of Operation, Material, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Wrapping and Bundling Machine market will continue to expand with growing demand for automated packaging solutions across industries.

- Rising e-commerce activities will drive the adoption of high-speed and reliable bundling machines to manage bulk packaging efficiently.

- Manufacturers are expected to invest in energy-efficient and sustainable machines to meet global environmental regulations.

- Integration of IoT and smart sensors in wrapping machines will enhance operational visibility and predictive maintenance capabilities.

- The food and beverage industry will remain a key consumer, pushing demand for hygienic and high-performance wrapping technologies.

- Technological innovations such as robotic arms and AI-based control systems will reshape machine capabilities and accuracy.

- Flexible packaging formats and customization needs will influence the development of adaptable and modular machines.

- The pharmaceutical and healthcare sectors will continue to boost demand due to the need for secure and tamper-evident packaging.

- Market growth will be supported by rising industrialization in emerging economies and increasing packaging automation in SMEs.

- Strategic partnerships and product innovation will remain central to maintaining competitiveness and expanding market reach.