Market Overview

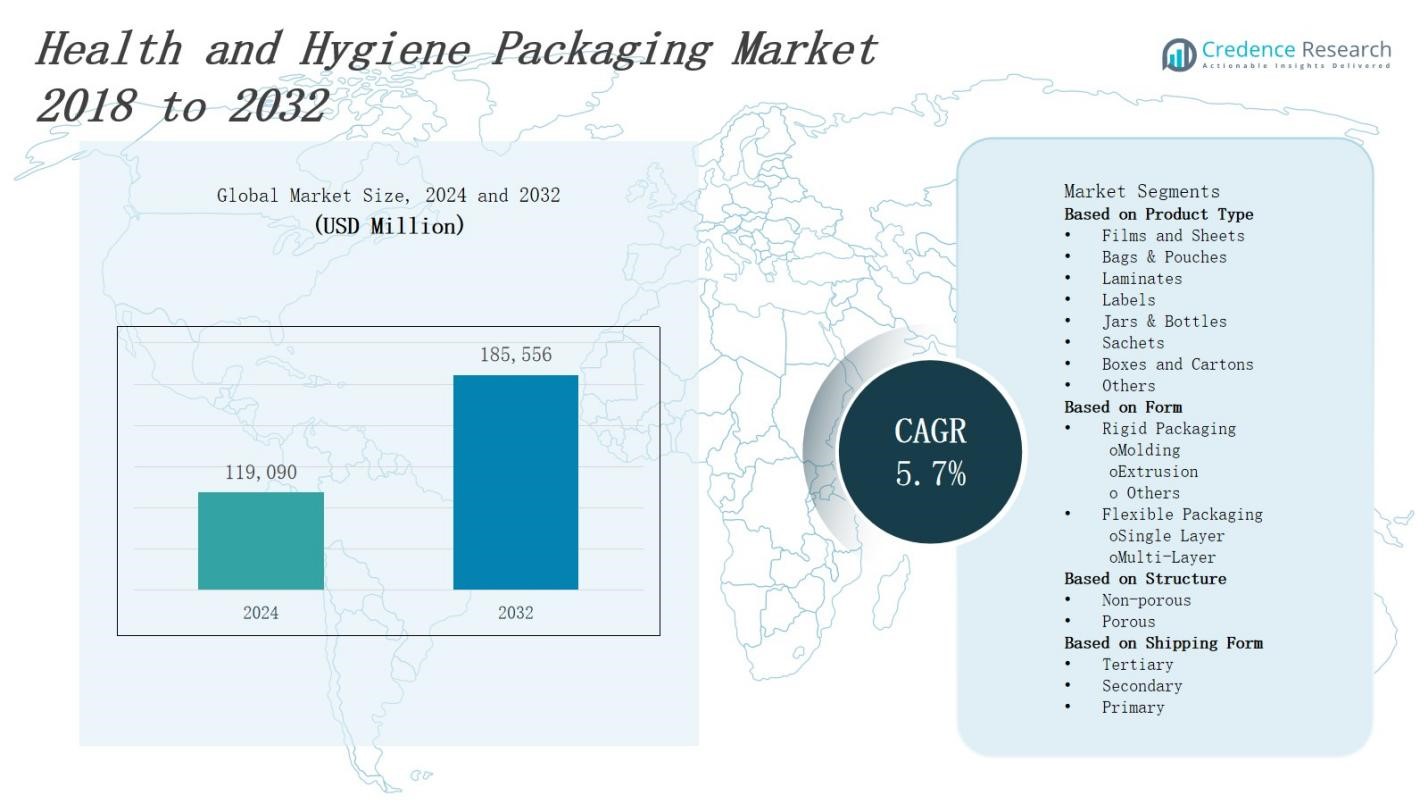

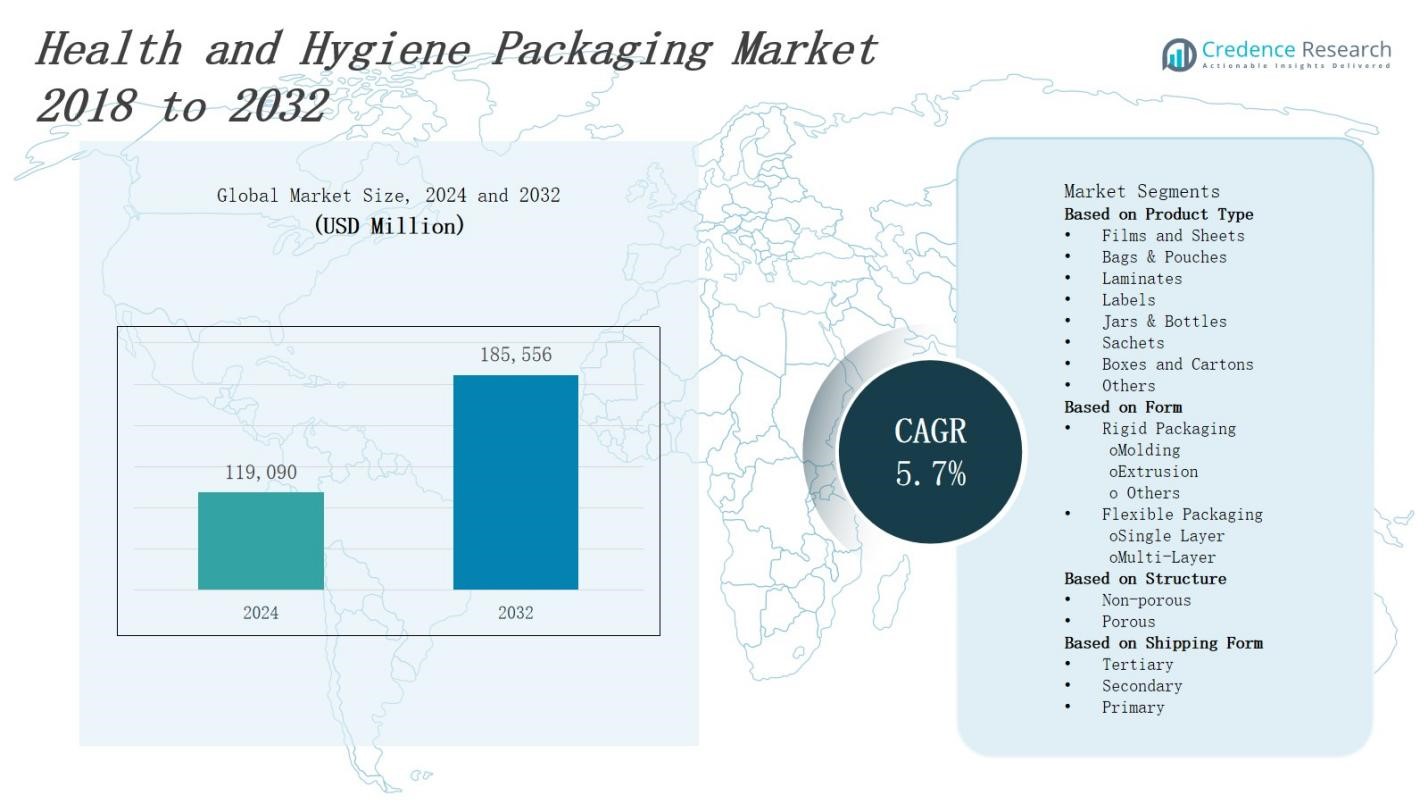

The health and hygiene packaging market is projected to grow from USD 119,090 million in 2024 to USD 185,556 million by 2032, expanding at a CAGR of 5.7%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Health & Hygiene Packaging Market Size 2024 |

USD 119,090 Million |

| Health & Hygiene Packaging Market, CAGR |

5.7% |

| Health & Hygiene Packaging Market Size 2032 |

USD 185,556 Million |

Rising consumer awareness of personal hygiene and increasing demand for convenient, safe, and sustainable packaging drive growth in the health and hygiene packaging market. Manufacturers actively adopt eco-friendly materials and innovative designs to meet regulatory requirements and consumer preferences. The expansion of healthcare infrastructure and growing e-commerce sales further boost packaging demand. Advances in smart packaging technologies enhance product safety, traceability, and user experience. Additionally, the market benefits from rising urbanization and increasing disposable incomes, which stimulate consumption of hygiene products. These factors collectively accelerate innovation and adoption within the health and hygiene packaging sector.

The health and hygiene packaging market spans key regions including North America, Europe, Asia Pacific, and the Rest of the World, each contributing significantly to global growth. North America and Europe lead with advanced healthcare infrastructure and strong sustainability initiatives. Asia Pacific holds the largest share due to rapid urbanization and rising disposable incomes. The Rest of the World, including Latin America, the Middle East, and Africa, shows growing demand fueled by expanding healthcare sectors. Leading players like Alpla Group, Amcor Plc, Berry Global, Kimberly Clark, and Mondi Group drive innovation and market expansion across these regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The health and hygiene packaging market will grow from USD 119,090 million in 2024 to USD 185,556 million by 2032, at a CAGR of 5.7%.

- Rising consumer focus on personal hygiene and demand for convenient, safe, and sustainable packaging propel market expansion.

- Manufacturers increasingly adopt eco-friendly materials and innovative designs to comply with regulations and satisfy consumer preferences.

- Healthcare infrastructure growth and e-commerce sales surge boost demand for hygienic packaging solutions globally.

- Smart packaging technologies improve product safety, traceability, and enhance the overall user experience.

- Asia Pacific leads the market with a 35% share, driven by rapid urbanization and increasing disposable incomes, while North America and Europe hold 30% and 25%, respectively.

- The Rest of the World accounts for 10%, showing growth opportunities in emerging regions despite supply chain challenges and increasing healthcare investments.

Market Drivers

Increasing Consumer Awareness and Demand for Hygiene Products

The health and hygiene packaging market experiences strong growth driven by rising consumer awareness of personal hygiene and safety. Consumers increasingly prioritize products that ensure protection against germs and contaminants. This demand encourages manufacturers to develop packaging that offers tamper-evident and hygienic features. Growing concerns about health crises and pandemics further push consumers toward hygienic packaging solutions. It motivates brands to enhance product safety and maintain consumer trust through innovative packaging designs. This shift significantly fuels market expansion globally.

For instance, startups like Notpla have introduced seaweed-based, biodegradable packaging solutions that replace plastics, addressing both hygiene and environmental concerns within the sector.

Adoption of Sustainable and Eco-Friendly Packaging Solutions

Sustainability plays a critical role in shaping the health and hygiene packaging market. Governments and consumers demand reduced environmental impact, prompting manufacturers to adopt recyclable, biodegradable, and renewable materials. It drives innovation toward eco-friendly packaging that meets strict regulatory standards without compromising product safety. Companies invest in developing sustainable designs that reduce waste and carbon footprint. This focus on green packaging aligns with growing corporate social responsibility commitments and appeals to environmentally conscious consumers.

For instance, Kraft Heinz, partnering with Berry Global, developed a 100% recyclable ketchup cap made entirely from a single type of recyclable plastic. This innovation replaces the unrecyclable silicone valve, enabling better recycling and potentially keeping 300 million plastic lids out of landfill annually.

Expansion of Healthcare Infrastructure and E-commerce Growth

Rapid development of healthcare facilities globally creates increased demand for hygiene products and their packaging. The health and hygiene packaging market benefits from investments in hospitals, clinics, and pharmaceutical sectors requiring sterile and secure packaging solutions. Simultaneously, the rise in e-commerce sales accelerates demand for durable, tamper-proof, and convenient packaging formats suitable for online distribution. It enhances accessibility and availability of hygiene products across diverse markets, driving further market growth.

Technological Advancements and Innovation in Packaging

Advances in smart packaging technology influence the health and hygiene packaging market significantly. Integration of features like RFID tags, QR codes, and anti-counterfeiting measures enhances product traceability and consumer safety. It enables brands to provide interactive and personalized experiences while protecting product integrity. Manufacturers focus on lightweight, ergonomic, and user-friendly packaging designs that improve convenience and reduce material usage. These innovations support market competitiveness and address evolving consumer needs effectively.

Market Trends

Shift Toward Sustainable and Biodegradable Packaging Materials

The health and hygiene packaging market increasingly adopts sustainable materials to meet environmental regulations and consumer expectations. Manufacturers prioritize biodegradable, compostable, and recyclable substrates to reduce plastic waste and carbon emissions. It drives development of innovative bio-based polymers and fiber-based packaging solutions. Companies implement lightweight designs that minimize material usage without compromising protection. This trend reflects growing consumer demand for eco-friendly products and supports brand reputations focused on sustainability.

For instance, UK-based Pulpex produces bottles from sustainably sourced wood pulp that are FSC-certified, biodegradable, and have a lower carbon footprint than traditional glass or PET bottles.

Rising Integration of Smart and Digital Packaging Technologies

Smart packaging gains prominence within the health and hygiene packaging market due to its ability to enhance safety and traceability. It incorporates features like QR codes, NFC tags, and RFID chips that enable real-time product tracking and authentication. This technology combats counterfeiting and ensures compliance with regulatory standards. Brands leverage smart packaging to engage consumers through interactive content and personalized experiences. The adoption of these technologies improves supply chain transparency and builds consumer trust.

For instance, Pfizer uses NFC (Near Field Communication) tags on its packaging for product authentication and to enable patients to access important information and verify authenticity quickly. This improves trust and patient interaction.

Growth of Convenience-Focused and User-Friendly Packaging Designs

Consumers demand health and hygiene products packaged in formats that offer ease of use and portability. The health and hygiene packaging market responds with designs such as resealable pouches, pump dispensers, and single-use sachets. It supports on-the-go lifestyles and enhances product accessibility. Manufacturers emphasize ergonomic shapes and intuitive opening mechanisms that improve user experience. This trend also helps reduce product wastage and encourages repeat purchases through better functionality.

Expansion of E-commerce and Omnichannel Distribution Channels

The health and hygiene packaging market benefits from the rapid rise of e-commerce and omnichannel retailing. It demands packaging solutions that ensure product integrity during shipping and handling across multiple platforms. Packaging formats evolve to provide durability, tamper evidence, and visual appeal suited for online displays. Manufacturers collaborate with logistics providers to optimize packaging dimensions and materials for cost-efficient transportation. This trend accelerates market penetration in both developed and emerging regions.

Market Challenges Analysis

Stringent Regulatory Compliance and Material Restrictions

The health and hygiene packaging market faces challenges due to strict regulatory frameworks governing material safety and environmental impact. It must comply with multiple regional and international standards, which often vary significantly, complicating product development and approval processes. Manufacturers encounter difficulties sourcing materials that meet safety requirements while also supporting sustainability goals. Frequent changes in regulations require continuous monitoring and adaptation, increasing operational costs. These constraints limit flexibility in packaging design and material selection, potentially delaying market entry and innovation.

Balancing Cost Efficiency with Sustainability and Performance

Maintaining cost competitiveness while adopting sustainable and high-performance packaging materials presents a major challenge in the health and hygiene packaging market. It requires investments in advanced materials and technologies that may increase production expenses. Manufacturers must optimize supply chains and manufacturing processes to reduce costs without compromising product safety or functionality. Consumer expectations for environmentally friendly packaging intensify pressure on companies to innovate affordably. Failure to balance these factors risks loss of market share to competitors offering cost-effective solutions. This challenge demands strategic planning and efficient resource management.

Market Opportunities

Expansion into Emerging Markets and Rising Healthcare Investments

The health and hygiene packaging market holds significant opportunities in emerging economies where healthcare infrastructure rapidly develops. Growing awareness of hygiene and increasing disposable incomes drive demand for packaged hygiene products in these regions. It enables manufacturers to introduce innovative packaging solutions tailored to local consumer preferences and regulatory environments. Investments in public health initiatives and rising urbanization further boost market potential. Companies that strategically expand into these markets can capture new customer segments and increase global footprint.

Advancements in Sustainable and Smart Packaging Technologies

Innovation in sustainable materials and smart packaging creates substantial growth prospects within the health and hygiene packaging market. It allows companies to differentiate products through enhanced functionality, such as tamper evidence, real-time tracking, and consumer engagement features. Sustainable packaging options attract environmentally conscious consumers and support compliance with evolving regulations. Collaboration between material scientists and packaging designers can accelerate development of cost-effective, eco-friendly solutions. These technological advancements offer pathways to strengthen brand loyalty and improve supply chain efficiency.

Market Segmentation Analysis:

By Product Type

The health and hygiene packaging market segments into various product types that cater to diverse packaging needs. Films and sheets lead due to their versatility in wrapping and barrier properties. Bags and pouches offer convenience and portability, favored for single-use hygiene products. Laminates provide enhanced protection through multi-layer structures, while labels ensure brand visibility and regulatory compliance. Jars and bottles serve liquid and cream-based products, maintaining product integrity. Sachets, boxes, cartons, and other formats support specialized packaging requirements, collectively driving market growth by meeting varied consumer demands.

For instance, Amcor Plc produces the AmLite recyclable films and sheets, which combine metal-free composition with strong barrier properties to maintain product freshness while supporting polyolefin recycling streams.

By Form

Rigid and flexible packaging forms dominate the health and hygiene packaging market, addressing different functional requirements. Rigid packaging utilizes molding and extrusion techniques to produce durable containers that protect products from contamination and damage. Flexible packaging offers lightweight, adaptable solutions through single-layer and multi-layer structures, optimizing material usage and extending shelf life. It supports ease of transportation and storage, improving user convenience. The combination of these forms allows manufacturers to target specific applications effectively and expand their product portfolios.

For instance, PakTech launched the TwinKlip Applicator, an innovative device applying recyclable injection-molded handles automatically to bottles for body wash, shampoo, and conditioner, enhancing efficiency while supporting flexible packaging needs.

By Structure

Packaging structures within the health and hygiene packaging market classify into non-porous and porous types based on permeability characteristics. Non-porous packaging provides superior barrier properties, preventing moisture, air, and contaminants from compromising product quality. It suits products requiring extended shelf life and strict hygiene standards. Porous packaging allows controlled breathability, useful for items needing ventilation or moisture regulation. This segmentation enables tailored packaging solutions that align with product specifications and consumer expectations, enhancing overall market adaptability and performance.

Segments:

Based on Product Type

- Films and Sheets

- Bags & Pouches

- Laminates

- Labels

- Jars & Bottles

- Sachets

- Boxes and Cartons

- Others

Based on Form

Based on Structure

Based on Shipping Form

- Tertiary

- Secondary

- Primary

Based on Distribution Channel

- Hypermarkets/Supermarkets

- Direct Sales

- Online Retailers

- Others

Based on End-Use Industry

- Home Care & Toiletries

- Pharmaceutical and OTC Formulations

- Nutraceuticals and Food Supplements

- Personal Care & Cosmetics

- Functional/Health Beverage

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds a significant share of 30% in the health and hygiene packaging market, driven by advanced healthcare infrastructure and high consumer awareness regarding hygiene products. It benefits from stringent regulatory standards that promote innovative and sustainable packaging solutions. Major players focus on product differentiation through smart packaging and eco-friendly materials. The region’s mature e-commerce sector boosts demand for convenient and tamper-evident packaging. Rising investments in public health and hygiene awareness campaigns further support market expansion. It remains a key hub for research and development activities within the packaging industry.

Europe

Europe captures 25% of the health and hygiene packaging market, supported by strong sustainability initiatives and comprehensive regulatory frameworks. It encourages adoption of recyclable and biodegradable packaging materials to reduce environmental impact. The market sees considerable innovation in packaging technologies that enhance product safety and user convenience. Consumer preference for premium and eco-conscious hygiene products drives demand. It also benefits from well-established supply chains and advanced manufacturing capabilities. European countries actively invest in circular economy models, influencing packaging design and material choices.

Asia Pacific

Asia Pacific commands the largest share at 35% in the health and hygiene packaging market due to rapid urbanization, rising disposable incomes, and expanding healthcare infrastructure. It experiences growing demand for hygiene products fueled by increased health awareness and lifestyle changes. Manufacturers focus on cost-effective, scalable packaging solutions to serve diverse consumer bases. The region attracts substantial foreign investments and benefits from expanding e-commerce penetration. Regulatory bodies increasingly enforce packaging standards, stimulating innovation. It represents a high-growth market with significant opportunities for new entrants and established companies.

Rest of the World

The Rest of the World accounts for 10% of the health and hygiene packaging market, encompassing regions with emerging healthcare sectors and growing hygiene awareness. It includes Latin America, Middle East, and Africa, where expanding urban populations and rising health concerns drive market demand. Companies target this segment by offering affordable and adaptable packaging formats. Market growth benefits from government initiatives to improve public health infrastructure. It faces challenges related to supply chain limitations but shows potential through increasing investments and partnerships. This region offers opportunities for customized packaging solutions aligned with local needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Glenroy

- Kimberly Clark

- Diversey

- Napco National

- Alpla Group

- JohnsByrne

- Amcor Plc

- Berry Global

- Comar

- Mondi Group

- Sidel

- Amerplast Ltd.

Competitive Analysis

The health and hygiene packaging market features intense competition among global and regional players focused on innovation, quality, and sustainability. Leading companies invest heavily in research and development to introduce advanced materials and smart packaging solutions that enhance product safety and consumer convenience. It experiences frequent product launches and strategic partnerships to expand market reach and meet evolving regulatory standards. Companies differentiate through eco-friendly packaging, tamper-evident designs, and digital traceability features. Price competitiveness and supply chain efficiency remain critical factors influencing market share. The market also sees consolidation trends, with mergers and acquisitions enabling firms to strengthen their product portfolios and geographic presence. It demands continuous adaptation to shifting consumer preferences and environmental mandates to maintain a competitive edge.

Recent Developments

- In November 2024, Amcor PLC announced an $8.4 billion stock deal to acquire Berry Global Group Inc., aiming to enhance its capabilities in consumer and health packaging.

- On October 11, 2023, UMF|PerfectCLEAN introduced new compostable packaging to reduce landfill waste and align with sustainability goals.

- In December 2024, Japan-based TOPPAN Holdings acquired the thermoformed and flexibles packaging business of Sonoco Products for $1.8 billion, signaling strategic consolidation in flexible packaging segments.

- In 2025, Novolex acquired Pactiv Evergreen for $6.7 billion, substantially expanding their footprint and product portfolio in flexible and sustainable packaging solutions

Market Concentration & Characteristics

The health and hygiene packaging market demonstrates a moderately concentrated competitive landscape dominated by a mix of global and regional players. Leading companies invest heavily in research and development to introduce innovative, sustainable, and smart packaging solutions that meet evolving regulatory standards and consumer demands. It experiences ongoing product differentiation through eco-friendly materials, tamper-evident features, and digital traceability technologies. The market balances large multinational corporations with agile local firms that cater to specific regional needs. Supply chain efficiency and cost optimization remain critical for maintaining market share. Companies pursue strategic partnerships, mergers, and acquisitions to expand their product portfolios and geographic reach. It demands continuous innovation to address challenges such as regulatory compliance and shifting consumer preferences, fostering dynamic competition and sustained growth.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form, Structure Shipping Form, Distribution Channel, End-User Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see increased adoption of sustainable and biodegradable packaging materials.

- Companies will invest more in smart packaging technologies to enhance product safety and traceability.

- Demand for tamper-evident and hygienic packaging designs will continue to rise globally.

- Expansion of healthcare infrastructure will drive higher consumption of hygiene packaging.

- E-commerce growth will push the development of durable and convenient packaging formats.

- Regulatory pressures will encourage innovation in eco-friendly and compliant packaging solutions.

- Manufacturers will focus on lightweight and ergonomic packaging to improve user experience.

- Emerging markets will offer significant opportunities for new product introductions and growth.

- Collaboration between material scientists and packaging companies will accelerate technological advancements.

- Consumer preference for premium and environmentally conscious products will shape future packaging trends.