Market Overview

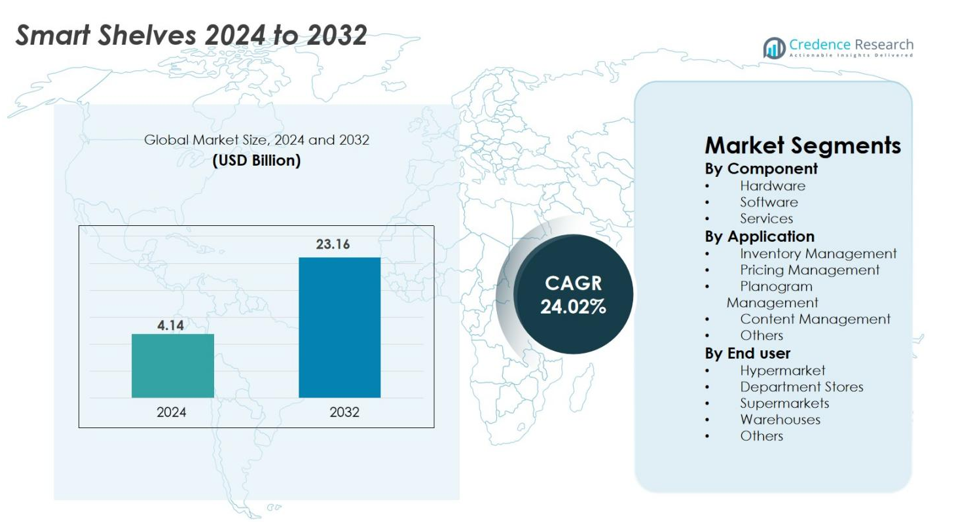

Smart Shelves Market size was valued at USD 4.14 Billion in 2024 and is anticipated to reach USD 23.16 Billion by 2032, at a CAGR of 24.02% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Shelves Market Size 2024 |

USD 4.14 Billion |

| Smart Shelves Market, CAGR |

24.02% |

| Smart Shelves Market Size 2032 |

USD 23.16 Billion |

Smart Shelves Market is shaped by leading players such as Avery Dennison Corporation, Huawei Technologies Co. Ltd, Intel Corporation, Samsung Electronics Co. Ltd, Honeywell International Inc., Lenovo PCCW Solutions Limited, Trax Retail, E Ink Holdings Inc., AWM Smart Shelf, and Happiest Minds Technologies Limited, all of which actively enhance retail automation through RFID platforms, ESL technologies, and AI-driven shelf intelligence. North America leads the market with a 37.4% share in 2024, supported by advanced digital infrastructure and strong adoption of real-time retail automation. Europe follows with 29.6% share, driven by widespread ESL deployment, while Asia-Pacific accounts for 22.1% due to rapid retail modernization across emerging economies.

Market Insights

- Smart Shelves Market reached USD 4.14 Billion in 2024 and will rise to USD 23.16 Billion by 2032, growing at a CAGR of 24.02%.

- Demand accelerates as retailers adopt RFID-enabled hardware, which held the dominant 62.7% segment share, driven by real-time inventory tracking and automated shelf monitoring across large-format stores.

- A key trend is the rapid expansion of electronic shelf labels and AI-powered shelf analytics, enabling dynamic pricing, automated planogram compliance, and enhanced customer engagement.

- Major players including Avery Dennison, Huawei, Intel, Samsung, Honeywell, and Trax Retail focus on AI, IoT, and ESL innovation to strengthen system accuracy, integration, and reliability while addressing high deployment costs.

- Regionally, North America leads with a 37.4% share, followed by Europe at 29.6% and Asia-Pacific at 22.1%, as hypermarkets remain the top adopters, holding 41.3% share due to high SKU volumes and modernization initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Component

The Smart Shelves Market is led by the hardware segment, accounting for 62.7% share in 2024, driven by strong adoption of RFID tags, IoT sensors, electronic shelf labels (ESLs), and smart cameras that enable real-time shelf monitoring. Retailers increasingly rely on hardware to automate stock visibility and reduce manual labor. Software follows with rising demand for AI-based analytics, while services grow steadily as retailers integrate advanced systems into existing infrastructure. The acceleration of automation in large-format retail and the need for accurate inventory control continue to reinforce hardware’s dominant position.

- For instance, Huawei partnered with SOLUM to launch a built-in IoT retail solution in 2025 that platform integrates Wi-Fi, IoT and ESL networks enabling retailers to deploy electronic shelf labels quickly and cost-efficiently across stores.

By Application

Inventory management dominates the Smart Shelves Market with a 48.6% share in 2024, supported by retailers’ need for real-time product tracking, automated replenishment, and shrinkage reduction. Smart shelves equipped with weight sensors, RFID, and vision systems enhance stock accuracy and cut operational delays. Pricing management grows as electronic shelf label adoption accelerates, while planogram and content management segments benefit from digital merchandising strategies. The shift toward data-driven store operations and omnichannel integration strengthens the role of inventory management as the core application.

- For instance, in a pilot store in France, Carrefour teamed with VusionGroup to deploy 70,000 electronic shelf labels (ESLs), 500 cameras and 7,000 smart-rails enabling automatic detection of stock-outs and real-time shelf monitoring.

By End-use

The hypermarket segment holds the largest share at 41.3% in 2024, driven by high product volumes, wide SKU assortments, and the need for automated shelf intelligence to streamline operations. Hypermarkets rapidly adopt smart shelves to reduce out-of-stock incidents and improve dynamic pricing. Supermarkets and department stores follow as they modernize store formats, while warehouses increasingly deploy smart shelf systems to support automated picking and logistics accuracy. Growing pressure for operational efficiency, labor optimization, and real-time product visibility ensures hypermarkets remain the primary adopters of smart shelf solutions.

Key Growth Drivers

Rising Adoption of IoT, RFID, and Real-Time Retail Automation

The Smart Shelves Market grows significantly as retailers accelerate the adoption of IoT-enabled automation, RFID tracking, and real-time data systems to improve store operations. Smart shelves equipped with weight sensors, computer vision, and RFID chips enable continuous visibility of product movement, reducing manual audits and eliminating stock discrepancies. Retailers prioritize automation to control labor costs while improving accuracy in replenishment cycles, thereby reducing out-of-stock incidents and enhancing customer satisfaction. Integration with inventory management platforms supports predictive analytics, allowing retailers to automate ordering and maintain optimal shelf conditions. As omnichannel models expand, smart shelves help physical stores match the accuracy and responsiveness of e-commerce fulfillment centers. The growing need for operational efficiency, shrinkage reduction, and data-driven decision-making firmly positions IoT-backed smart shelving as a mission-critical retail infrastructure upgrade worldwide.

- For instance, Amazon Go stores use integrated weight sensors and computer-vision “Just Walk Out” technology to monitor inventory automatically, eliminating checkout lines while ensuring precise shelf-level updates.

Expansion of Electronic Shelf Labels (ESLs) and Dynamic Pricing Strategies

Electronic Shelf Labels (ESLs) emerge as a major growth driver as retailers increasingly deploy digital pricing systems to support real-time price changes, reduce manual errors, and improve merchandising agility. Smart shelves integrated with ESLs allow retailers to synchronize shelf prices with central databases, enabling instant updates during promotions, market fluctuations, or inventory changes. This capability aligns physical stores with the responsiveness of e-commerce platforms, strengthening market execution capabilities. ESL adoption also reduces labor dependency, minimizes compliance issues, and enables advanced pricing models such as surge pricing, personalized offers, and automated markdowns. With energy-efficient displays and improved wireless communication, ESLs offer long-term cost benefits across hypermarkets, supermarkets, and specialty stores. Retailers also leverage ESL-based analytics to study shopper behavior, optimize product placement, and enhance category performance. As digital transformation accelerates, ESL-enabled smart shelves become an essential foundation for next-generation retail operations.

- For instance, Metro AG implemented Pricer’s optical wireless ESL platform in European hypermarkets, improving pricing accuracy while enabling advanced capabilities like automated markdowns and dynamic promotions.

Increasing Demand for Loss Prevention and Shrinkage Reduction

Rising retail shrinkage caused by theft, misplacement, and operational inefficiencies drives strong adoption of smart shelf technologies capable of real-time product monitoring. Smart shelves integrated with vision analytics, weight sensors, and RFID provide instant alerts for suspicious activity, enabling proactive loss prevention and reducing revenue leakage. Retailers utilize shelf-level tracking to accurately distinguish between legitimate product handling and potential theft, improving store security and minimizing false alarms. Enhanced visibility also prevents internal shrinkage due to stocking errors, misplaced items, and inaccurate counts. Integration with AI-enabled surveillance systems further strengthens asset protection strategies, offering predictive insights into high-risk zones and vulnerable categories. As organized retail crime grows globally, smart shelves help retailers mitigate losses while improving customer experience by maintaining correctly stocked shelves. This dual role of operational accuracy and security enhancement makes smart shelves a strategic investment in modern retail environments.

Key Trends & Opportunities

AI-Driven Shelf Analytics and Predictive Retail Intelligence

Artificial intelligence becomes a transformative trend in the Smart Shelves Market as retailers adopt AI-powered analytics to interpret shelf activity, predict demand patterns, and enhance merchandising efficiency. Smart shelves equipped with computer vision and machine learning algorithms identify stockouts, misplaced items, and customer engagement patterns with high accuracy, enabling retailers to optimize product availability and improve conversion rates. AI-driven insights support dynamic assortment planning, allowing retailers to adjust product layouts based on real-time shopper behavior. Predictive analytics further enhances replenishment precision by forecasting demand fluctuations at SKU level. Retailers integrate AI with point-of-sale systems to analyze promotional performance and optimize pricing. The convergence of AI and smart shelf technologies opens opportunities for automated compliance, localized merchandising, and hyper-personalized retail experiences, fundamentally transforming physical store intelligence.

- For instance, Trax Retail’s computer-vision platform is used by global retailers like Walgreens and Carrefour to automatically detect stockouts and misplaced items, achieving shelf-audit accuracy rates above 95% and reducing manual store checks.

Growth of Omnichannel Retailing and In-Store Digital Transformation

The expansion of omnichannel retailing presents substantial opportunities for smart shelf deployment as retailers strive to unify online and offline operations. Smart shelves enable real-time inventory synchronization across store networks, improving click-and-collect speed, same-day fulfillment accuracy, and in-store picking efficiency. As customers expect seamless shopping journeys, retailers invest in digital shelf technologies to increase product visibility, streamline replenishment, and support automated operations. Smart shelves also enhance in-store navigation, helping shoppers locate items faster while integrating digital signage for targeted promotions. The rise of frictionless retail experiences including cashierless checkout, mobile-led interactions, and sensor-driven automation accelerates adoption across hypermarkets, supermarkets, and convenience stores. Smart shelves act as a central pillar of the digitized store ecosystem, enabling physical retail to operate with the precision and intelligence of online platforms.

- For instance, Kroger’s partnership with Microsoft Azure connects smart shelves with digital signage and mobile navigation, helping shoppers locate products quickly while enabling targeted, data-driven promotions.

Key Challenges

High Initial Investment and Integration Complexity

Despite strong market potential, high upfront installation costs and integration complexities hinder rapid adoption of smart shelf solutions. Deploying sensors, RFID infrastructure, cloud connectivity, AI engines, and digital pricing systems demands significant capital, making it difficult for smaller retailers to justify the expenditure. Legacy store systems often lack compatibility with modern smart shelf platforms, requiring extensive customization and increasing implementation timelines. Retailers also face challenges in scaling deployments across multiple store formats with diverse layouts and network capabilities. The need for specialized IT support and ongoing maintenance increases operational costs, particularly in regions with limited digital maturity. These financial and technical constraints slow market penetration despite strong long-term benefits.

Data Security, Connectivity Issues, and System Reliability Risks

Smart shelves rely on continuous connectivity, cloud computing, and sensor-driven data flows, raising critical concerns around cybersecurity and operational reliability. Network disruptions can lead to inaccurate inventory data, failed dynamic pricing updates, or false alerts, directly affecting store performance. IoT ecosystems face heightened cyber risks, where compromised sensors or communication channels may expose sensitive pricing, product, or customer information. Ensuring secure data encryption, device authentication, and constant system monitoring becomes essential but adds complexity and cost. Additionally, maintaining consistent performance across thousands of sensors in high-traffic environments presents operational challenges. These vulnerabilities create hesitation among retailers evaluating long-term smart shelf adoption, emphasizing the need for robust, secure, and resilient system architecture.

Regional Analysis

North America

North America leads the Smart Shelves Market with a 37.4% share in 2024, driven by strong adoption of RFID, electronic shelf labels, and AI-enabled shelf monitoring across large retail chains. The region’s mature retail ecosystem, high labor costs, and focus on automation accelerate deployment in supermarkets, hypermarkets, and big-box stores. U.S. retailers increasingly implement smart shelves to streamline replenishment, improve planogram compliance, and support omnichannel fulfillment. Growing investments in IoT infrastructure and analytics strengthen market expansion, positioning North America as a key innovator in retail automation technologies.

Europe

Europe accounts for 29.6% of the Smart Shelves Market in 2024, supported by rapid retail modernization and widespread adoption of electronic shelf labels. Germany, France, and the U.K. lead adoption as retailers prioritize dynamic pricing, operational efficiency, and sustainability. Regulatory emphasis on price transparency further accelerates ESL deployment. Retailers use smart shelf technologies to improve supply chain efficiency, enhance customer engagement, and reduce shrinkage. Strong digital infrastructure and rising investments in AI-driven shelf analytics reinforce Europe’s position as a major center for retail technology advancement.

Asia-Pacific

Asia-Pacific holds a 22.1% share in 2024 and exhibits the fastest growth, driven by expanding retail networks, rapid urbanization, and ongoing digital transformation across China, Japan, South Korea, and India. Retailers deploy smart shelves to manage high SKU density, enable cashierless formats, and enhance real-time inventory accuracy. Government support for smart retail initiatives and robust IoT expansion accelerate adoption. Influences from e-commerce push physical retailers to adopt shelf intelligence solutions to remain competitive. The region’s price-sensitive yet technology-forward landscape creates substantial opportunities for scalable smart shelf implementations.

Latin America

Latin America represents 6.8% of the Smart Shelves Market in 2024, with growth concentrated in Brazil, Mexico, and Colombia as retailers modernize operations to improve stock accuracy and reduce shrinkage. Expanding supermarket chains and rising interest in automation support adoption of ESLs, RFID-enabled shelves, and AI-driven monitoring. Economic variability limits rapid deployment, yet pilot programs and collaborations with global technology providers strengthen adoption. Retailers focus on improving supply chain reliability and reducing labor-driven inefficiencies, positioning Latin America for steady and progressive market expansion.

Middle East & Africa

The Middle East & Africa region holds a 4.1% share in 2024, supported by growing modernization of retail formats in the UAE, Saudi Arabia, and South Africa. Retailers adopt smart shelves to elevate customer experience, support digital store concepts, and optimize merchandising strategies. Smart city initiatives and strong IT infrastructure in GCC countries accelerate adoption, while lower digital readiness in parts of Africa moderates growth. Increasing interest in dynamic pricing, automation, and real-time shelf intelligence continues to drive gradual uptake, positioning MEA as an emerging opportunity area for smart shelf technologies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations

By Component

- Hardware

- Software

- Services

By Application

- Inventory Management

- Pricing Management

- Planogram Management

- Content Management

- Others

By End user

- Hypermarket

- Department Stores

- Supermarkets

- Warehouses

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Smart Shelves Market features a dynamic competitive landscape shaped by global technology providers, retail automation specialists, and IoT solution developers. Key players such as Avery Dennison Corporation, Huawei Technologies Co. Ltd, Intel Corporation, Samsung Electronics Co. Ltd, Lenovo PCCW Solutions Limited, Honeywell International Inc., Trax Retail, E Ink Holdings Inc., AWM Smart Shelf, and Happiest Minds Technologies Limited actively expand their portfolios with advanced RFID systems, AI-driven shelf analytics, ESL technologies, and integrated retail automation platforms. Companies strengthen their market position through strategic partnerships, product innovations, and retail-chain deployments that enhance inventory visibility, planogram compliance, and dynamic pricing. Many vendors focus on developing scalable, cloud-connected smart shelf ecosystems to support omnichannel retailing. Increasing emphasis on AI, edge computing, and real-time data processing further intensifies competition, driving continuous innovation across hardware, software, and analytics segments. As retailers accelerate digital transformation, leading companies compete based on accuracy, integration capabilities, and system reliability.

Key Player Analysis

Recent Developments

- In 2025, a new academic/industry application of smart shelves using IoT + machine-learning for near-real-time shelf replenishment (with 99.35% product-distinction accuracy and ~8.66 s alert response) was published by Umm Al‑Qura University researchers.

- In August 2024, Scandit acquired shelf-audit automation technology from MarketLab a move to expand its smart-shelf and retail data-capture capabilities.

- In June 2025, Carrefour partnered with VusionGroup to roll out smart-shelves with IoT devices and cameras aimed at improving stock management, pricing and enabling in-store retail media

Report Coverage

The research report offers an in-depth analysis based on Component, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will accelerate as retailers integrate AI, computer vision, and predictive analytics to enhance real-time shelf intelligence.

- Adoption of electronic shelf labels will rise as retailers shift toward dynamic pricing and automated promotion execution.

- RFID adoption will expand across supermarkets and hypermarkets to improve stock accuracy and reduce shrinkage.

- Smart shelves will increasingly support cashierless store formats and frictionless checkout systems.

- Cloud-connected shelf ecosystems will become standard as retailers unify omnichannel inventory management.

- Integration with robotics and autonomous store assistants will enhance in-store operational efficiency.

- Energy-efficient ESLs and sustainable smart shelf materials will gain traction in eco-focused retail environments.

- Vision-based analytics will improve product placement decisions and optimize planogram compliance.

- Emerging markets will adopt smart shelves rapidly as retail digitization accelerates.

- Cybersecurity and IoT governance will become critical priorities as deployments scale across global retail networks.