Market Overview

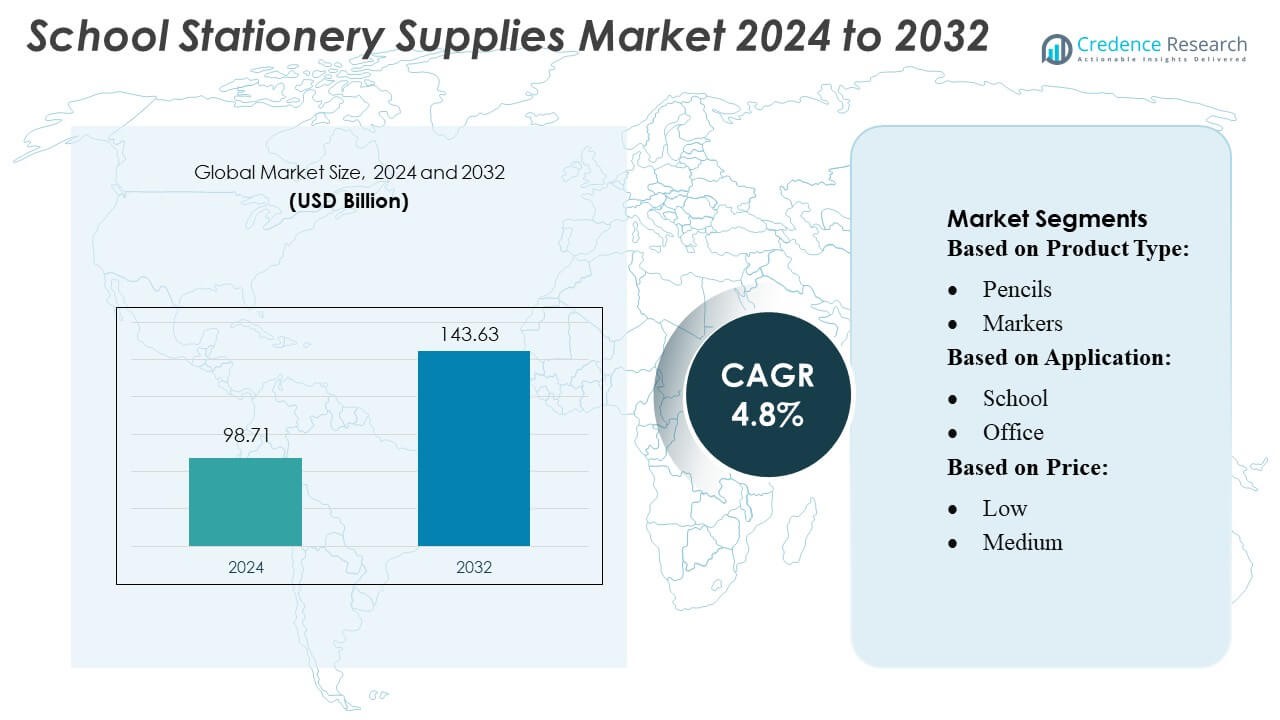

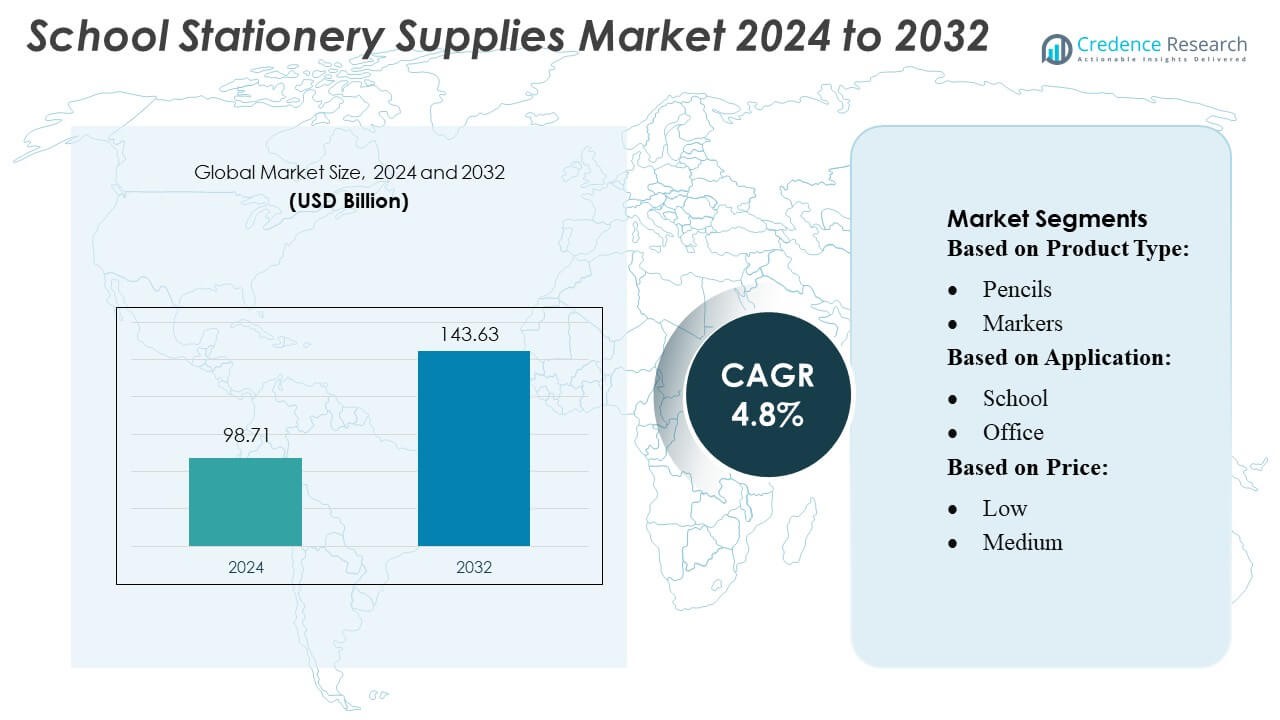

School Stationery Supplies Market size was valued USD 98.71 billion in 2024 and is anticipated to reach USD 143.63 billion by 2032, at a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| School Stationery Supplies Market Size 2024 |

USD 98.71 Billion |

| School Stationery Supplies Market, CAGR |

4.8% |

| School Stationery Supplies Market Size 2032 |

USD 143.63 Billion |

The global school stationery supplies market is led by major players such as Pilot, Kokuyo, Camlin, Newell Rubbermaid, Societe BIC, ACCO Brands, Adveo, Kaut-Bullinger, Lyreco, Ryman Group, and M&G, who together command a significant portion of the industry. These firms compete aggressively on product innovation, sustainability, and global distribution, leveraging strong R&D and regional networks. Regionally, the Asia-Pacific (APAC) market dominates, capturing approximately 45 % of the global market share, driven by growing student populations, rising educational investment, and strong demand for both traditional and eco-friendly stationery.

Market Insights

- The School Stationery Supplies Market reached USD 98.71 billion in 2024 and is projected to attain USD 143.63 billion by 2032 at a 4.8% CAGR, supported by rising student enrollment and consistent demand for essential learning materials.

- Increasing preference for eco-friendly stationery, digital-compatible writing tools, and ergonomic designs drives strong product innovation across writing instruments, office supplies, and accessory segments, boosting value growth.

- Competitive intensity remains high as leading players such as Pilot, Kokuyo, Camlin, Newell Rubbermaid, Societe BIC, ACCO Brands, Lyreco, Ryman Group, and M&G expand R&D capabilities and strengthen global distribution networks.

- Market restraints include growing digital adoption in classrooms, fluctuating raw material costs, and rising sustainability compliance requirements that increase production complexity for manufacturers.

- Regionally, Asia-Pacific holds around 45% of the global share, driven by large student populations, while writing instruments remain the largest segment, contributing a significant portion of total revenue due to their recurring demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The school stationery supplies market remains dominated by writing instruments, which account for an estimated 38–42% market share, driven by consistent demand for pens, pencils, markers, and highlighters in daily academic activities. Pens lead within this category as the preferred writing tool due to their low cost, broad availability, and continuous product innovation such as ergonomic grips and quick-dry ink. Office stationery, including staplers, scissors, rulers, and paper clips, holds a stable secondary position as schools increasingly adopt structured organizational tools. Art supplies are growing steadily, supported by expanding creative-learning curricula and rising participation in extracurricular art programs.

- For instance, Faber-Castell reports producing more than 2.3 billion graphite and color pencils annually, and its Polychromos range features a precisely engineered 3.8-millimeter oil-based lead core.

By Application

The school segment dominates the market with an estimated 55–60% share, driven by mandatory academic requirements, large student populations, and recurring yearly purchases across grades. Demand is reinforced by rising school enrollments, increasing emphasis on project-based learning, and national education reforms that expand the use of art and writing products. The office segment contributes a modest but consistent share as administrative functions within schools require stationery for documentation and communication. The home segment gains traction due to the growth of home tutoring, digital-hybrid learning models, and parental spending on supplemental educational materials.

- For instance, Reynolds Pens documents that its widely used Reynolds 045 Fine Carbure ballpoint pen is engineered with a 0.7-millimeter fine-point tip designed for high durability and smooth writing, utilizing the company’s “laser tip technology.

By Price

The low-price segment leads the market with an estimated 60–65% share, supported by its affordability and mass adoption across public schools, budget-conscious households, and bulk procurement programs. Manufacturers in this category focus on cost efficiency and high-volume production of essential items such as pencils, pens, erasers, rulers, and sharpeners. The medium-price segment grows moderately as students and parents increasingly opt for better quality, durable, and aesthetically appealing products, particularly in writing instruments and art supplies. This shift is influenced by rising disposable incomes, brand awareness, and preference for long-lasting materials.

Key Growth Drivers

- Rising Enrollment Rates and Expanding K–12 Infrastructure

The School Stationery Supplies Market continues to grow as global K–12 enrollment increases and governments invest heavily in new educational infrastructure. Expanding public and private schools, improved access to education in developing economies, and national literacy initiatives are accelerating demand for essential stationery products. Increased classroom strength directly boosts recurring consumption of writing instruments, notebooks, art supplies, and organizational tools. Additionally, the rise of early childhood education and standardized learning kits fuels year-round procurement cycles, supporting steady market expansion.

- For instance, Mead’s Five-Star Wirebound 5-Subject Notebook features 200 perforated sheets of ink-bleed-resistant paper and a Spiral Lock wire binding engineered to prevent coil snagging.

- Increasing Consumer Preference for Premium and Ergonomic Products

The market benefits from a shift toward premium stationery that enhances writing comfort, durability, and user experience. Parents and schools increasingly prioritize high-quality pens, pencils, markers, and eco-friendly materials that offer better grip, smoother writing, and longer life cycles. Branded and design-centric stationery is gaining traction among students, creating higher-margin product opportunities. Manufacturers actively innovate in ink technology, anti-smudge formulations, and break-resistant leads, strengthening product differentiation. This demand for ergonomic and aesthetically enhanced stationery strengthens revenue growth across global markets.

- For instance, Linc Pens & Plastics Ltd. confirms that its flagship Linc Pentonic pen series uses a precision-cut 0.7-millimeter SS tip and an advanced low-viscosity ink system engineered for high-smoothness output.

- Growth of E-Commerce and Multi-Channel Retailing

E-commerce platforms play a critical role in driving stationery sales, offering broader product visibility, competitive pricing, and convenience for bulk and customized purchases. Online marketplaces and brand-specific portals allow suppliers to reach diverse customer groups, including schools, parents, and students. Digital payment adoption and faster delivery strengthen online buying behavior, particularly during peak back-to-school seasons. Multi-channel retailing, combining offline stores with online catalogs, enhances accessibility and helps brands introduce personalized bundles, subscription-based kits, and promotional offers that stimulate continuous demand.

Key Trends & Opportunities

1. Rapid Adoption of Sustainable and Eco-Friendly Materials

The industry is witnessing a strong trend toward sustainability as consumers and institutions prefer recyclable, biodegradable, and non-toxic stationery. Manufacturers increasingly use recycled paper, plant-based plastics, and natural inks to reduce carbon footprints. Regulatory pressure on single-use plastics further accelerates the shift toward greener alternatives. This creates opportunities for brands to launch certified eco-friendly product lines and integrate sustainability labels that appeal to environmentally conscious buyers. Companies offering transparent material sourcing and circular packaging models gain a competitive advantage.

- For instance, STAEDTLER SE has scaled production of its sustainable Lumocolor pens, whose barrels, caps, and end caps now consist of 97 %recycled plastic, as confirmed in sustainability progress report.

2. Rising Demand for Personalized and Themed Stationery

Customization is becoming a major opportunity as students increasingly prefer stationery reflecting personal style, characters, hobbies, or branding themes. Schools also adopt customized notebooks, planners, and writing kits featuring institutional logos. Advances in digital printing and on-demand production allow manufacturers to offer personalized designs at competitive costs. Seasonal collections, influencer-led designs, and limited-edition products further strengthen engagement. This trend supports higher pricing flexibility and helps brands differentiate in a competitive market while meeting evolving aesthetic expectations of young consumers.

- For instance, Artline India’s Softline Gel Pen is available in 12 vibrant ink colours, each built around a 0.7 mm or 1.0 mm ball diameter, enabling finely tailored sets for themed collections.

3. Increasing Integration of Digital-Aided Stationery Products

Hybrid learning environments are driving demand for digital-compatible stationery such as smart notebooks, erasable pens, stylus pens, and app-connected planning tools. These products bridge traditional writing with digital workflows, enhancing note-taking efficiency and organization. Growth in edtech adoption—especially in urban regions—creates opportunities for companies offering multifunctional products aligned with tablet-based learning. The trend is further supported by interest in productivity tools among older students. This segment, though niche, is expanding rapidly and expected to become a key differentiator for innovative brands.

Key Challenges

1. Rising Raw Material Costs and Price Volatility

Fluctuations in the cost of paper, plastics, ink, and packaging materials present ongoing challenges, particularly for budget-sensitive markets. Supply chain disruptions and global inflation increase production expenses, pressuring manufacturers to adjust pricing or absorb reduced margins. Smaller players struggle to maintain profitability while competing with established brands offering value-priced items. High logistics costs and import duties in several regions further strain operations. These challenges compel companies to optimize sourcing strategies, adopt cost-efficient materials, and streamline manufacturing processes.

2. Growing Competition from Digital Learning Tools

The expansion of digital classrooms and e-learning platforms reduces long-term dependence on traditional stationery items, especially notebooks, writing instruments, and art supplies. Tablets, e-notes, and stylus-based devices increasingly replace conventional writing tools in higher grades. Schools adopting digital curriculum models limit annual stationery procurement volumes. This shift pressures manufacturers to diversify into hybrid tools or specialized creative supplies that retain relevance in digital-centric environments. Companies unable to adapt risk losing market share to technology-driven alternatives that continue to reshape learning behavior.

Regional Analysis

North America

North America holds around 23% of the School Stationery Supplies Market, driven by high educational expenditure, widespread K–12 enrollment, and strong adoption of premium stationery products. The region benefits from established retail networks, including hypermarkets, bookstores, and expanding e-commerce platforms that support multi-channel distribution. Demand for eco-friendly and specialty stationery continues to rise as schools implement sustainability guidelines. The U.S. leads the region with significant consumption of writing instruments, art materials, and organizational tools. Growth remains stable due to consistent back-to-school spending and higher per-student expenditure compared with other global markets.

Europe

Europe accounts for approximately 28% of the global market, supported by a highly regulated education system, strong focus on sustainable stationery, and mature retail channels across the EU. Countries such as Germany, France, and the UK demonstrate steady demand for eco-certified notebooks, premium pens, and advanced writing tools. Government-backed literacy programs and expansion of early education continue to boost annual stationery consumption. The region sees rising adoption of recyclable materials and plastic-free products, creating opportunities for innovation. Despite market maturity, consistent replacement cycles and strong brand loyalty sustain Europe’s overall market dominance.

Asia-Pacific

Asia-Pacific dominates the School Stationery Supplies Market with approximately 34% share, driven by large student populations, rapid urbanization, and expanding education infrastructure in China, India, Indonesia, and Southeast Asia. The region benefits from strong domestic manufacturing capabilities, enabling cost-effective production of pens, notebooks, art supplies, and classroom essentials. Growing income levels and increased emphasis on academic performance boost purchasing of premium and innovative stationery. E-commerce adoption accelerates sales across urban and rural markets. APAC remains the fastest-growing region due to rising enrollment rates and government investment in universal education initiatives.

Latin America

Latin America holds around 8% of the market, supported by steady improvements in education access and increasing demand for affordable stationery solutions. Countries such as Brazil, Mexico, and Argentina drive consumption, with demand influenced by public school procurement programs and seasonal back-to-school campaigns. Economic volatility affects pricing sensitivity, prompting strong growth in low-cost writing instruments, notebooks, and basic school supplies. Expansion of retail chains and online marketplaces improves product availability across metropolitan areas. Despite modest growth rates, rising literacy programs and government investments continue to support stationery consumption across the region.

Middle East & Africa

The Middle East & Africa region accounts for approximately 7% of the global market, driven by expanding educational infrastructure in Gulf countries and increasing government focus on improving primary education access in Africa. The UAE and Saudi Arabia lead regional demand with high per-student spending and adoption of premium stationery. In contrast, African markets prioritize cost-efficient supplies due to budget constraints. Rising urbanization, growing youth populations, and expansion of private schools contribute to market growth. However, import dependence and economic disparities across countries create varied demand patterns and moderate overall growth.

Market Segmentations:

By Product Type:

By Application:

By Price:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The School Stationery Supplies Market features a diverse competitive ecosystem led by companies such as MUJI INDIA, Faber-Castell, Reynolds Pens, Maped, Mead, Linc Pens & Plastics Ltd., STAEDTLER SE, Artline India, 3M, and Fullmark Pte Ltd. The School Stationery Supplies Market remains highly competitive, characterized by a mix of global brands, regional manufacturers, and emerging private-label suppliers. Companies focus heavily on product quality, affordability, and design innovation to differentiate themselves in a largely commoditized segment. The market sees continuous investment in advanced writing technologies, sustainable materials, and premium stationery categories that appeal to students and institutions with rising quality expectations. E-commerce expansion intensifies competition as brands leverage digital platforms for broader reach, dynamic pricing, and customized product bundles. Retailers increasingly offer exclusive collections and back-to-school campaigns to attract volume sales, while manufacturers prioritize efficient supply chains and cost optimization to maintain margins. Growing demand for eco-friendly and digital-compatible stationery further drives innovation, pushing competitors to diversify portfolios and strengthen their presence across both mass-market and premium segments.

Key Player Analysis

Recent Developments

- In January 2025, Dynarex Corporation, a leading medical supply company, proudly announces the launch of LabChoice, a dynamic new line of laboratory products created for addressing changing priorities across various industries, including education, healthcare, food & beverage, research and other fields requiring precision tools.

- In November 2024, Grubhub announced today that it is adding office supplies to its marketplace in partnership with Office Depot, an operating company of The ODP Corporation. The platform will now feature items like paper supplies, writing tools, ink, and more, all available for on-demand delivery across over 800 locations.

- In September 2024, Labcon North America, a globally leading manufacturer of Earth Friendly laboratory disposables, formed a strategic collaboration with Polycarbin, an innovator in sustainable laboratory solutions for advancing a data-driven circular economy for pharma and life science companies.

- In May 2024, bioQ launched the world’s first 100% biodegradable pen in India. It features a non-toxic ink, recycled paper refill, and options for a metal, paper, or bamboo exterior to reduce plastic waste.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, Price and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily as global student enrollment increases and education access expands across developing regions.

- Demand for sustainable and recyclable stationery products will continue rising as schools and consumers prioritize environmentally responsible choices.

- Digital-compatible stationery, including smart notebooks and hybrid writing tools, will gain traction as blended learning models become more common.

- E-commerce will strengthen its role as a major distribution channel, driven by convenience, wider assortments, and competitive pricing.

- Premium and ergonomically designed stationery will experience higher adoption as parents seek quality and durability.

- Personalization and themed stationery will see strong demand, supported by customization technologies and seasonal product launches.

- Manufacturers will invest more in lightweight, non-toxic, and innovative materials to comply with evolving safety and sustainability standards.

- Private-label brands from retailers will expand their presence, increasing price competition in mass-market categories.

- Partnerships between suppliers, schools, and online marketplaces will streamline procurement and improve product accessibility.

- Rising urbanization and changing student lifestyles will boost demand for stylish, multifunctional, and trend-driven stationery items.