Market Overview

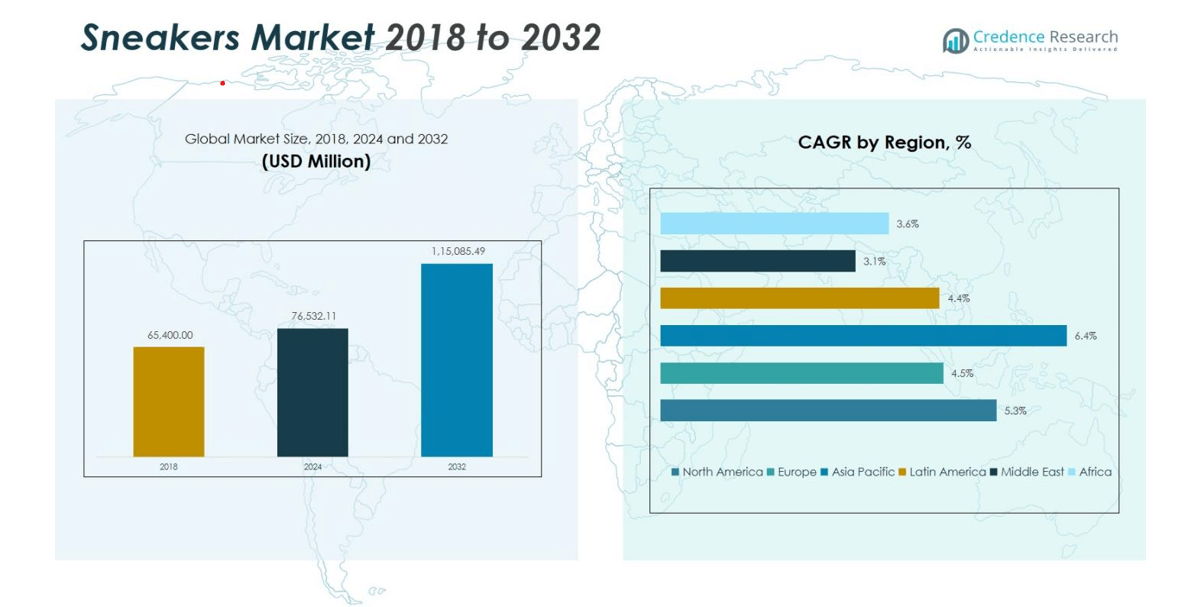

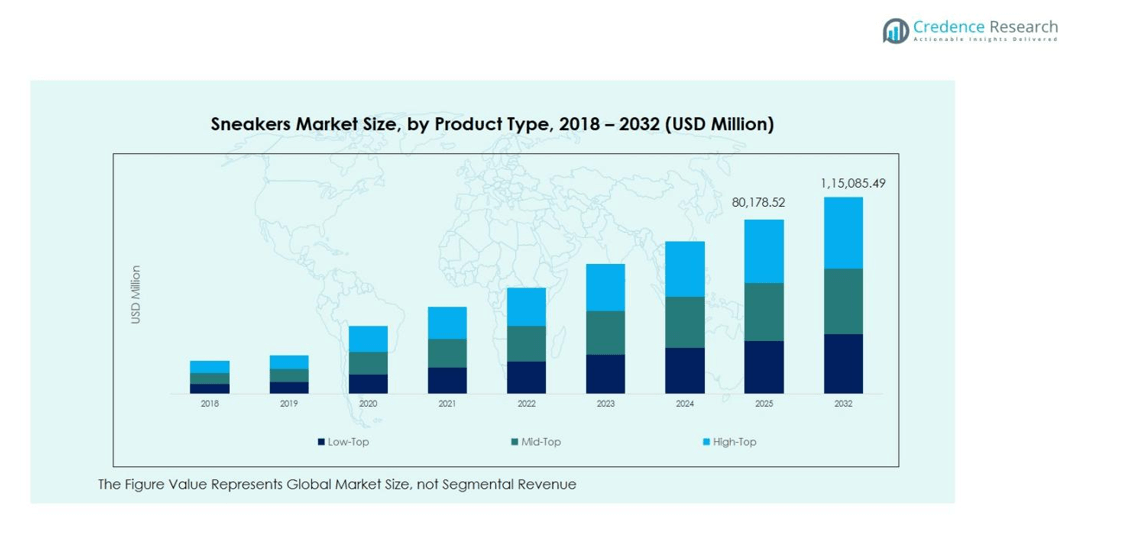

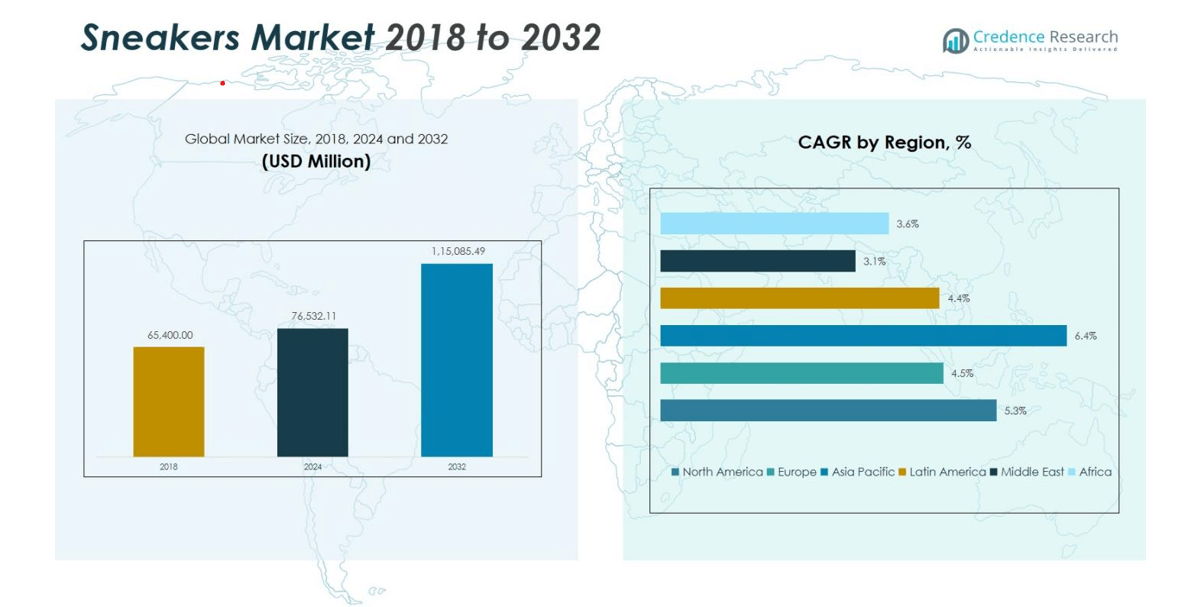

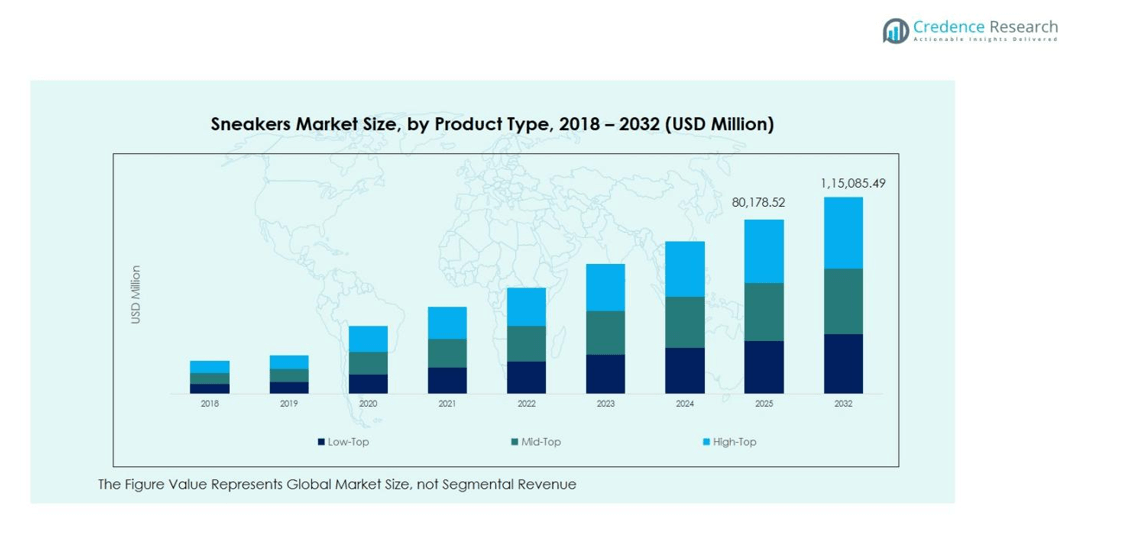

The Sneakers Market size was valued at USD 65,400.00 million in 2018 and increased to USD 76,532.11 million in 2024. It is anticipated to reach USD 115,085.49 million by 2032, growing at a CAGR of 5.30% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sneakers Market Size 2024 |

USD 76,532.11 million |

| Sneakers Market, CAGR |

5.30% |

| Sneakers Market Size 2032 |

USD 115,085.49 million |

The Sneakers Market is highly competitive, with leading players such as Nike, Inc., Adidas AG, Puma SE, New Balance Athletics, Inc., ASICS Corporation, Skechers USA, Inc., Under Armour, Inc., VF Corporation, Kering SA, and Relaxo Footwears Ltd. dominating global sales. These companies focus on innovation, sustainability, and strategic collaborations to strengthen market presence. North America leads the global sneakers market, accounting for approximately 35% of total market share in 2024, driven by high consumer purchasing power and a strong culture of athletic and lifestyle footwear adoption. The Asia Pacific region follows closely with rapid growth fueled by expanding middle-class populations, increasing urbanization, and strong brand penetration across emerging economies such as China and India.

Market Insights

- The Sneakers Market was valued at USD 76,532.11 million in 2024 and is projected to reach USD 115,085.49 million by 2032, expanding at a CAGR of 5.30% during the forecast period.

- Growing consumer inclination toward comfort-driven, athleisure, and lifestyle footwear is driving global demand, with high adoption among younger demographics and sports enthusiasts.

- Sustainability and product innovation trends, including eco-friendly materials, 3D printing, and limited-edition collaborations, are reshaping market dynamics and boosting brand differentiation.

- The market remains competitive, dominated by key players such as Nike, Adidas, Puma, and Skechers, focusing on digital retail expansion and strategic partnerships to capture evolving consumer demand.

- North America leads with a 35% share, followed by Asia Pacific with 32%, driven by rising urbanization and fashion awareness, while Defensive Sneakers remain the dominant segment, accounting for 58% of global market share in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type:

The Sneakers Market is segmented into Defensive and Offensive sneakers. The Defensive sneakers segment dominated the market in 2024, accounting for around 58% of the total share, driven by rising adoption in basketball, training, and fitness activities that demand enhanced ankle support and cushioning. The Offensive sneakers segment, with a 42% share, is witnessing steady growth due to increasing preference among athletes and fashion-conscious consumers for lightweight designs and advanced traction technologies that improve agility and performance in sports and casual use.

- For instance, Nike launched the “Girl Dad” Nike Kobe 4 in June 2024, a sneaker that pays tribute to Kobe Bryant and his daughter Gianna.

By Distribution Channel:

The market is divided into Department Stores, Specialty Stores, Online, and Others. The Specialty Stores segment held the leading position with over 40% market share in 2024, supported by consumers’ preference for personalized fitting and expert guidance on premium sneaker models. The Online segment, with a 35% share, is rapidly expanding, fueled by e-commerce penetration, exclusive brand collaborations, and digital marketing initiatives. Department stores and other channels continue to cater to value-conscious consumers and maintain stable demand in regional and emerging markets.

- For instance, Adidas hosts exclusive releases and limited-edition models in specialty stores, attracting sneaker enthusiasts and collectors.

By End-User:

Based on end-user, the market includes Men, Women, and Kids. The Men’s segment led the market in 2024, contributing to around 52% of the global share, owing to strong demand for sports and lifestyle sneakers, brand-driven preferences, and frequent product launches targeting male consumers. The Women’s segment is growing at a notable pace, supported by the surge in athleisure fashion and fitness participation. The Kids’ segment, though smaller with a 12% share, is gaining traction due to rising awareness of comfort, durability, and style in children’s footwear.

Key Growth Drivers

Rising Demand for Athleisure and Lifestyle Footwear

The growing popularity of athleisure culture has significantly boosted demand for sneakers that combine style and comfort. Consumers are increasingly opting for versatile footwear suitable for both casual and athletic use, driving major brands to expand their lifestyle-oriented collections. This shift is reinforced by fashion collaborations, influencer marketing, and social media trends that highlight sneakers as essential style statements, propelling sustained market growth across diverse demographics and income segments.

- For instance, Puma’s collaboration with fitness influencer Pamela Reif in 2024 introduced an athleisure collection using advanced materials like Cloudspun and Shapeluxe, combining performance technology with fashionable aesthetics to meet diverse consumer needs.

Technological Advancements in Sneaker Design

Innovations in materials, cushioning systems, and sustainable manufacturing processes are transforming the sneakers market. Leading companies are investing in lightweight fabrics, 3D printing, and performance-enhancing midsoles to improve comfort, durability, and functionality. Sustainable design practices, such as recycled materials and bio-based fabrics, are also gaining traction as eco-conscious consumers favor environmentally friendly products. These technological developments are not only enhancing user experience but also helping brands differentiate themselves in an increasingly competitive market.

- For instance, Adidas has advanced cushioning technology through its collaboration with Carbon, utilizing a bio-based elastomer material in its 4DFWD running shoes that offers superior resilience and sustainability.

Expansion of E-Commerce and Direct-to-Consumer Channels

The rapid expansion of online retail and brand-owned digital platforms is a major driver of sneaker sales globally. Direct-to-consumer (D2C) models enable brands to control pricing, enhance customer engagement, and deliver personalized experiences. E-commerce platforms provide convenience, wider product accessibility, and exclusive launches, especially appealing to younger, tech-savvy consumers. The integration of virtual try-ons, AI-based recommendations, and limited-edition drops has further boosted online sneaker demand, making digital channels a critical growth avenue for both established and emerging brands.

Key Trends & Opportunities

Sustainability and Eco-Friendly Footwear Innovation

Sustainability has become a defining trend in the sneakers market as consumers increasingly demand ethical and environmentally conscious products. Brands are adopting recycled polyester, natural rubber, and biodegradable materials to reduce their carbon footprint. Companies like Adidas and Nike are leading initiatives with “green” collections, integrating closed-loop manufacturing and waste-reduction technologies. This shift toward eco-conscious production not only supports environmental goals but also opens up new opportunities for market differentiation and consumer loyalty among environmentally aware buyers.

- For instance, Nike launched its Space Hippie collection, using recycled polyester yarn, foam, and plastic waste to create sneakers with minimal environmental impact.

Customization and Limited-Edition Collaborations

Personalization and exclusive collaborations are shaping the modern sneaker landscape. Consumers are drawn to unique designs that reflect individuality, fueling growth in customizable sneaker platforms. Collaborations between sportswear giants and fashion houses, musicians, or artists generate hype and limited-edition demand, enhancing brand prestige. These partnerships create scarcity-driven value and strengthen direct engagement with target audiences. As digital design tools advance, the customization trend is expected to remain a strong growth catalyst across both online and offline channels.

- For instance, Adidas has successfully elevated brand prestige through collaborations like the Prada for Adidas limited edition, which combined Adidas’ iconic Superstar sneaker with Prada’s luxury craftsmanship, creating a highly sought-after exclusive drop.

Key Challenges

High Market Competition and Price Sensitivity

The sneakers market faces intense competition from global brands and emerging local players, all vying for consumer attention through innovation and marketing. Price-sensitive consumers in developing regions further pressure manufacturers to balance affordability with quality and design. This dynamic often results in margin compression and increased promotional spending. The challenge intensifies as counterfeit products and fast-fashion imitations flood the market, undermining brand equity and impacting overall profitability across both premium and mid-range segments.

Supply Chain Disruptions and Raw Material Volatility

Fluctuating raw material prices and global supply chain disruptions continue to challenge sneaker manufacturers. Dependence on imported materials and overseas production exposes companies to risks such as shipping delays, labor shortages, and regulatory changes. The rising cost of sustainable materials also affects pricing strategies. To mitigate these issues, brands are increasingly investing in regional manufacturing hubs, automation, and digital supply chain management, yet volatility in logistics and production costs remains a significant obstacle to consistent market growth.

Regional Analysis

North America:

The North America Sneakers Market was valued at USD 23,151.60 million in 2018 and reached USD 26,755.17 million in 2024. It is projected to attain USD 40,176.55 million by 2032, expanding at a CAGR of 5.3%. The region held a 35% market share in 2024, driven by high consumer spending on premium sportswear and the presence of major brands such as Nike, Adidas, and Under Armour. Growing demand for athleisure footwear, coupled with the surge in e-commerce sales and sustainable product launches, continues to strengthen North America’s dominance in the global sneakers market.

Europe:

Europe’s Sneakers Market was valued at USD 15,316.68 million in 2018 and increased to USD 17,141.10 million in 2024. It is expected to reach USD 24,162.51 million by 2032, registering a CAGR of 4.5%. With a market share of 22% in 2024, Europe remains a key region driven by strong fashion consciousness, the growth of luxury sneaker collaborations, and an emphasis on sustainable materials. Countries such as Germany, France, and the UK lead sales due to established retail networks and increasing consumer inclination toward eco-friendly and high-performance footwear.

Asia Pacific:

The Asia Pacific Sneakers Market stood at USD 18,769.80 million in 2018, rising to USD 22,794.77 million in 2024, and is forecast to reach USD 37,322.32 million by 2032, growing at the highest CAGR of 6.4%. Holding a 28% share in 2024, the region’s growth is fueled by rapid urbanization, rising disposable incomes, and increasing youth engagement in sports and streetwear culture. Major markets like China, Japan, and India drive production and consumption, while global brands continue expanding retail presence and digital sales strategies to cater to the booming middle-class population.

Latin America:

The Latin America Sneakers Market was valued at USD 4,447.20 million in 2018, reaching USD 5,157.50 million in 2024, and is anticipated to grow to USD 7,235.42 million by 2032 at a CAGR of 4.4%. Accounting for a 7% market share in 2024, regional growth is supported by rising sports participation, expanding online retail channels, and increasing brand penetration in Brazil and Mexico. The growing influence of global fashion trends and a shift toward comfortable, versatile footwear are also encouraging consumers to adopt premium sneaker brands across urban and emerging areas.

Middle East:

The Middle East Sneakers Market recorded USD 1,602.30 million in 2018, advancing to USD 1,690.86 million in 2024, and is estimated to reach USD 2,141.22 million by 2032, with a CAGR of 3.1%. The region captured a 4% market share in 2024, supported by growing youth interest in Western fashion and sports culture. Increasing retail development, the rise of luxury sneaker collections, and higher disposable incomes in GCC countries are driving gradual market expansion. However, moderate growth persists due to economic fluctuations and limited local manufacturing capabilities across parts of the region.

Africa:

The Africa Sneakers Market was valued at USD 2,112.42 million in 2018, increasing to USD 2,992.72 million in 2024, and projected to reach USD 4,047.47 million by 2032, registering a CAGR of 3.6%. The region accounted for a 4% market share in 2024, with growth primarily led by South Africa, Egypt, and Nigeria. Rising urbanization, youth population growth, and increased accessibility to affordable sneakers through online channels are driving demand. Although market penetration remains uneven, expanding retail infrastructure and the influence of global sports brands continue to shape the region’s emerging sneaker culture.

Market Segmentations:

By Product Type

- Defensive Sneakers

- Offensive Sneakers

By Distribution Channel

- Department Stores

- Specialty Stores

- Online

- Others

By End-User:

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Sneakers Market is characterized by strong brand positioning and continuous innovation from major players such as Nike, Inc., Adidas AG, Puma SE, New Balance Athletics, Inc., ASICS Corporation, Skechers USA, Inc., Under Armour, Inc., VF Corporation, Kering SA, and Relaxo Footwears Ltd. These companies compete through product innovation, sustainability initiatives, and strategic collaborations with fashion houses, athletes, and influencers. The market is witnessing an increased focus on eco-friendly materials, 3D printing, and digital customization to meet evolving consumer preferences. Leading brands are also expanding their direct-to-consumer and e-commerce channels to strengthen brand loyalty and improve profit margins. Meanwhile, emerging regional players are leveraging affordability and localized designs to capture niche markets. Mergers, acquisitions, and limited-edition launches remain key strategies, as brands aim to enhance their global footprint and cater to diverse lifestyle and performance-oriented consumer segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nike, Inc.

- Adidas AG

- New Balance Athletics, Inc.

- ASICS Corporation

- Kering SA (includes brands like Gucci and Balenciaga)

- Skechers USA, Inc.

- Under Armour, Inc.

- VF Corporation (owns Vans and The North Face)

- Puma SE

- Relaxo Footwears Ltd.

Recent Developments

- In October 2025, Nike introduced Project Amplify, the world’s first powered footwear system for running and walking, featuring an integrated motor, drive belt, and rechargeable cuff battery within a carbon-fiber-plated design.

- In July 2025, Under Armour launched its new lifestyle sneaker line, UA SOLA, blending athletic performance with contemporary streetwear appeal.

- In October 2025, Puma collaborated with the gaming franchise Sonic the Hedgehog to release a limited-edition sneaker and apparel collection tied to the game Sonic Racing: CrossWorlds.

- in October 2025, Reebok partnered with PlayStation to unveil a nostalgic sneaker collection celebrating the console’s 30th anniversary across Japan, the US, and the UK

Report Coverage

The research report offers an in-depth analysis based on Product Type, Distribution Channel, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The sneakers market is expected to witness steady growth driven by rising adoption of athleisure and casual fashion trends.

- Leading brands will continue investing in sustainable and recyclable materials to meet environmental goals.

- Expansion of e-commerce and direct-to-consumer platforms will enhance brand accessibility and customer engagement.

- Increasing collaborations between sportswear and luxury fashion brands will boost premium sneaker sales.

- Technological advancements such as 3D printing and smart materials will improve performance and comfort.

- Emerging markets in Asia Pacific and Latin America will offer significant growth opportunities.

- Customization and limited-edition releases will continue to attract younger and style-conscious consumers.

- Digital marketing and influencer partnerships will strengthen brand presence and consumer loyalty.

- The demand for gender-neutral and inclusive designs will shape future product portfolios.

- Sustainable supply chain practices and local manufacturing expansion will become strategic priorities for global brands.