| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Agave Nectar Market Size 2024 |

USD 199.90 million |

| Agave Nectar Market, CAGR |

5.62% |

| Agave Nectar Market Size 2032 |

USD 319.49 million |

Market Overview:

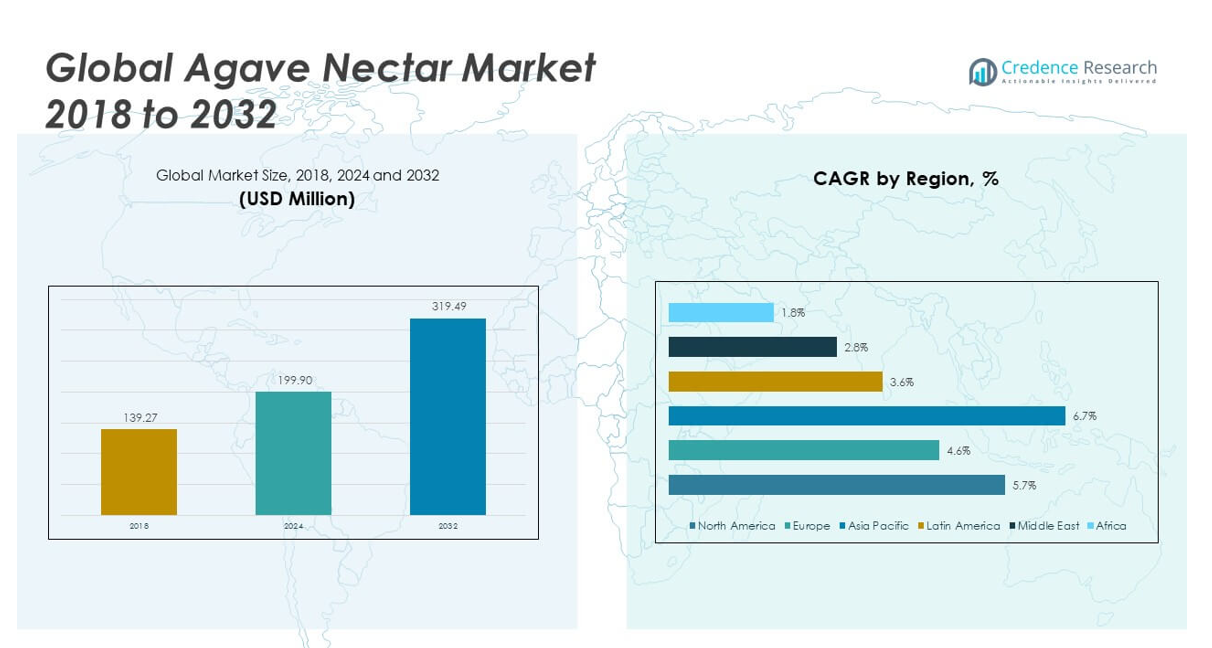

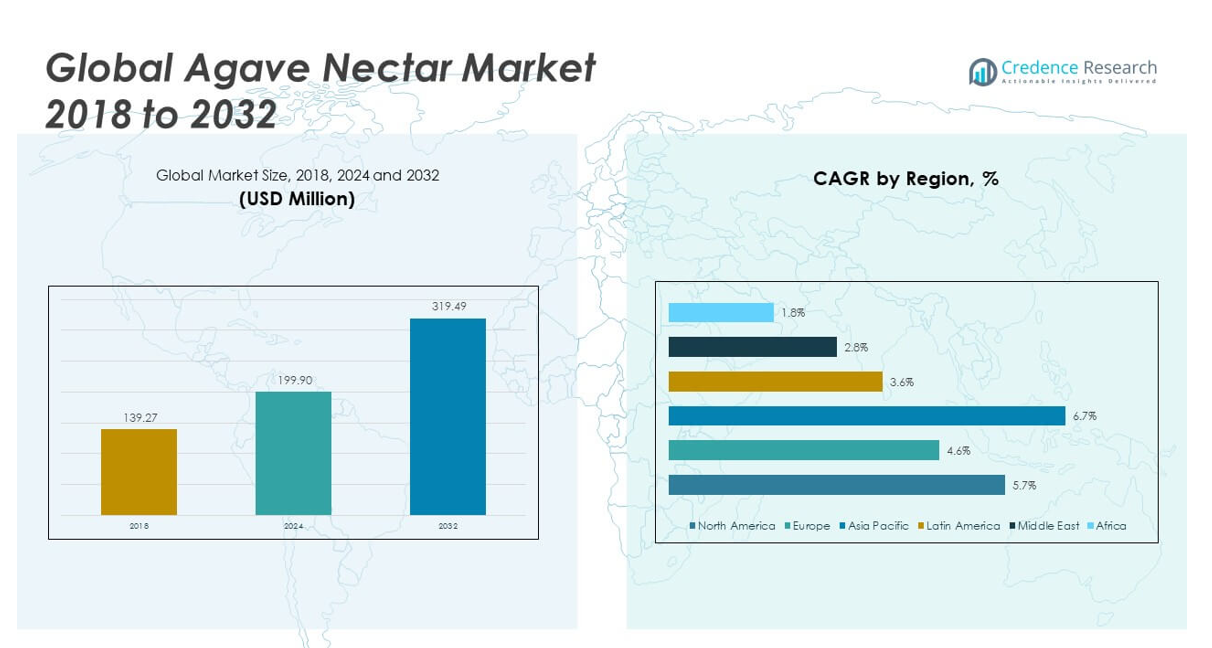

The Global Agave Nectar Market size was valued at USD 139.27 million in 2018 to USD 199.90 million in 2024 and is anticipated to reach USD 319.49 million by 2032, at a CAGR of 5.62% during the forecast period.

The growth of the global agave nectar market is primarily driven by increasing consumer awareness of the health risks associated with refined sugar and artificial sweeteners. Agave nectar, known for its low glycemic index and natural origin, appeals to health-conscious consumers, particularly those managing diabetes or seeking weight control. The rising popularity of plant-based and vegan diets has further enhanced its adoption across a wide range of food and beverage applications, including organic snacks, cereals, dairy alternatives, and beverages. Clean-label trends and growing demand for organic, non-GMO, and gluten-free products have prompted food manufacturers to integrate agave nectar into their formulations. Additionally, its mild flavor, high solubility, and ability to blend with other natural ingredients make it a preferred sweetener in both industrial and home settings. The market is also benefiting from advancements in sustainable farming and improved agave processing technologies, supporting consistent supply and quality.

North America holds the dominant share of the global agave nectar market, led by the United States, where rising health awareness and strong demand for organic and natural products support widespread consumption. The proximity to Mexico, the world’s largest agave producer, ensures a steady supply of raw materials and cost-effective production. Europe ranks as the second-largest market, driven by increasing adoption of clean-label sweeteners and regulatory support for organic food labeling. Countries such as Germany, the UK, and France are key markets due to their well-established organic food sectors. The Asia-Pacific region is poised for the fastest growth, fueled by rising disposable incomes, urbanization, and a shift toward Western dietary patterns in countries like China, India, and Japan. Growing retail penetration and consumer interest in low-sugar alternatives also support market expansion. Meanwhile, Latin America and the Middle East & Africa show emerging potential, supported by growing health awareness and gradual modernization of retail and foodservice infrastructure.

Market Insights:

- The Global Agave Nectar Market reached USD 199.90 million in 2024 and is projected to hit USD 319.49 million by 2032, registering a CAGR of 5.62%.

- Health-conscious consumers are shifting from refined sugars to natural sweeteners like agave nectar due to its low glycemic index and natural composition.

- The rising popularity of vegan, organic, and clean-label diets is driving strong demand across plant-based food and beverage applications.

- Agave nectar’s versatility in baking, beverages, sauces, and functional nutrition makes it a preferred ingredient for health-focused product developers.

- Technological improvements in agave processing and sustainable farming practices are enhancing supply chain efficiency and product quality.

- Long cultivation cycles and supply volatility pose challenges to scalability, especially with increasing diversion of agave for tequila production.

- North America dominates the market, while Asia Pacific is expected to grow the fastest, supported by urbanization, income growth, and expanding retail access.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Preference for Low Glycemic and Natural Sweeteners among Health-Conscious Consumers

Consumer demand is shifting rapidly toward healthier sugar alternatives, driven by growing awareness of metabolic disorders, diabetes, and obesity. Agave nectar is gaining prominence due to its low glycemic index, which helps regulate blood sugar levels more effectively than refined sugar. The product appeals to individuals following ketogenic, diabetic-friendly, and calorie-restricted diets. Its natural origin and perceived health benefits position it as a preferred sweetener in wellness-oriented food and beverage formulations. The Global Agave Nectar Market benefits from these evolving dietary habits, especially in regions with rising chronic health conditions. It continues to gain traction as consumers seek products with fewer artificial ingredients and minimal processing.

- For example, Nectavé offers a GI of approximately 28, confirmed by their lab analysis, significantly lower than table sugar (~65). Their 32.5 oz glass bottle features an exclusive no‑drip pump cap, designed to dispense exactly 1 mL per pump, improving user convenience and hygiene. The syrup contains 25% more sweetness than sugar and offers naturally occurring inulin fiber, adding functional benefits beyond sweetness.

Expansion of Organic, Vegan, and Clean-Label Food Segments Fuels Adoption

Demand for clean-label, plant-based, and organic foods is driving new opportunities for natural sweeteners like agave nectar. Food and beverage manufacturers are reformulating products to replace refined sugars with recognizable, wholesome alternatives. Agave nectar’s compatibility with vegan and allergen-free diets enhances its suitability in product portfolios targeting health-conscious demographics. It is widely used in organic snacks, cereals, beverages, and dairy substitutes due to its mild flavor and ease of blending. The market is responding with a wider range of organic and non-GMO certified agave syrups to align with consumer expectations. The push toward transparency in food labeling continues to support its long-term growth.

Wider Application Across Multiple Food and Beverage Categories Enhances Demand

Agave nectar’s neutral to caramel-like taste makes it suitable for diverse applications, ranging from bakery and confectionery to sauces, dressings, and functional beverages. Its liquid form and solubility give it a functional edge over granulated sugar in recipes requiring uniform consistency. It is increasingly used in health drinks, granola bars, yogurts, and meal replacements that aim to deliver both flavor and nutritional balance. Product developers value its natural profile and stability under heat, which supports innovation in shelf-stable and refrigerated products. The Global Agave Nectar Market is expanding its reach as new food trends, such as plant-based nutrition and artisanal beverages, continue to evolve. Manufacturers are capitalizing on its versatility to develop new product lines catering to emerging dietary trends.

- For example, Dialce (The iidea Company) supplies agave nectar for use in protein bars, herbal tonics, and wellness drinks, leveraging its natural sweetness and functional benefits to support clean-label health drinks and meal replacements.

Technological Advancements and Sustainable Sourcing Drive Market Efficiency

The agave nectar industry is undergoing significant improvements in extraction and processing technologies that enhance product quality and consistency. Enzyme-based processing methods reduce production time and increase yield, making operations more efficient. Sustainable sourcing practices, including responsible agave farming and fair-trade certification, are gaining importance among environmentally aware consumers. It is supported by producers focusing on reducing environmental impact while maintaining high purity standards. These advancements help ensure a stable supply chain, especially amid rising demand from global markets. Continued investment in sustainable and scalable production methods is reinforcing the market’s resilience and competitiveness.

Market Trends:

Rising Interest in Agave-Based Alcoholic Beverages Expands Upstream Demand

The growing popularity of agave-based alcoholic drinks, especially tequila and mezcal, is significantly impacting upstream dynamics of agave cultivation. Producers are allocating more agave crops toward spirits production, which indirectly affects the availability and pricing of agave nectar. This trend is influencing procurement strategies across the sweetener segment, prompting manufacturers to secure long-term supply contracts. The Global Agave Nectar Market is adapting to these shifts by diversifying sourcing and collaborating with local growers to stabilize inputs. Increased global recognition of tequila and other agave spirits is indirectly driving awareness of agave derivatives, including nectar. It is creating upstream competition, which can trigger supply chain innovations and foster alternative sourcing models.

Premiumization and Artisanal Positioning Create New Marketing Angles

Brands are increasingly positioning agave nectar as a premium, artisanal product to attract niche consumer segments seeking gourmet or specialty ingredients. Packaging innovations, such as glass bottles, eco-friendly labels, and detailed sourcing information, are reinforcing this premium image. Agave nectar is being promoted not only as a healthier option but also as a craft sweetener with origins rooted in traditional Mexican farming. The market is witnessing a shift in branding strategies, with emphasis on authenticity, regional sourcing, and cultural heritage. The Global Agave Nectar Market is responding to consumer interest in traceability and brand storytelling. It is opening doors for smaller producers and specialty food retailers who differentiate through unique positioning.

- For example, the introduction of eco-friendly glass bottles, detailed origin labeling, and QR codes for digital storytelling are now standard among leading brands, allowing consumers to trace nectar back to specific agave fields and production lots.

Integration of Agave Nectar into Nutraceutical and Supplement Formulations

Manufacturers are incorporating agave nectar into functional foods, nutraceuticals, and dietary supplements to enhance palatability without relying on synthetic sweeteners. It supports the formulation of protein bars, herbal tonics, and wellness drinks that require a natural and functional sugar source. The prebiotic properties of agave inulin, often extracted alongside nectar, contribute additional digestive health benefits, further supporting its inclusion in wellness-focused products. The Global Agave Nectar Market is expanding into adjacent health categories through strategic product development and ingredient blending. It is helping brands meet consumer demand for products that combine flavor, health, and convenience. This crossover trend is driving collaboration between sweetener producers and supplement manufacturers.

- For example, companies such as Dialce (The iidea Company) are leading this segment by focusing on high-solubility, GMO-free, and organic agave ingredients, catering to the growing demand for clean-label, health-focused products.

Growth of Private Label and Store Brands in Natural Sweetener Segment

Retailers are launching private label agave nectar products to compete with established brands and offer cost-effective alternatives to consumers. Supermarkets and e-commerce platforms are expanding their natural sweetener assortments, including multiple varieties and formats of agave nectar. These private labels often target budget-conscious consumers who seek healthier products at lower price points. The Global Agave Nectar Market is experiencing increased competition through this retail-driven trend. It is pressuring branded manufacturers to enhance differentiation through innovation and quality assurance. Retail consolidation and direct sourcing are also influencing pricing structures and consumer loyalty in the sweetener category.

Market Challenges Analysis:

Long Cultivation Cycle and Supply Volatility Limit Scalability

One of the primary challenges facing agave nectar producers is the long maturation period of agave plants, which can take up to seven years to reach harvest readiness. This extended growth cycle restricts the ability to quickly scale production in response to sudden increases in demand. Periodic supply shortages have been observed when more agave is diverted to tequila production, further straining nectar availability. The Global Agave Nectar Market remains highly dependent on agricultural conditions, which exposes it to risks from pests, disease outbreaks, and climate variability. It must navigate these challenges by improving cultivation practices and developing more resilient supply chains. Without intervention, supply bottlenecks may hinder the market’s ability to meet projected demand over the forecast period.

High Cost of Production and Competition from Alternative Sweeteners

Agave nectar typically carries a higher price tag compared to conventional sweeteners like corn syrup, cane sugar, or even newer entrants like monk fruit and stevia. Its cost structure is impacted by labor-intensive harvesting, specialized extraction processes, and international logistics. Consumers seeking affordable natural sweeteners often choose lower-cost alternatives, which limits agave nectar’s mass-market penetration. The Global Agave Nectar Market must compete on both price and value, especially in regions where income-sensitive buyers dominate purchasing decisions. It faces the added challenge of consumer skepticism, with some health experts questioning its fructose content despite its low glycemic index. It will need to strengthen consumer education and continue product innovation to maintain a competitive edge in a crowded sweetener landscape.

Market Opportunities:

Expansion into Emerging Markets with Growing Health-Conscious Consumer Base

Emerging economies in Asia-Pacific, Latin America, and parts of the Middle East offer strong growth potential for agave nectar producers. Rising disposable incomes, urbanization, and increased awareness of diet-related health issues are shifting consumer preferences toward natural and low-sugar alternatives. The Global Agave Nectar Market can leverage these trends by expanding distribution networks and forming partnerships with local food manufacturers and retailers. It can also benefit from targeted marketing strategies that highlight agave nectar’s health credentials in regional languages and formats. E-commerce platforms and health-focused specialty stores are opening new retail channels in previously underpenetrated markets. These regions represent valuable opportunities for building brand loyalty and capturing long-term demand.

Product Innovation Across Formats and Flavors to Attract New Segments

Brands can differentiate by developing agave nectar products in unique formats such as flavored syrups, portable sachets, and baking-specific blends. Innovation in flavor profiles, such as vanilla or cinnamon-infused varieties, can help attract younger demographics and gourmet food enthusiasts. The Global Agave Nectar Market can extend its reach into categories like ready-to-drink beverages, condiments, and frozen desserts. It also holds potential in hybrid sweeteners that combine agave with stevia or monk fruit to balance taste and caloric content. Customization and premium positioning can increase brand appeal in both mature and emerging markets. Product innovation will be critical to capturing evolving consumer interests and expanding usage occasions.

Market Segmentation Analysis:

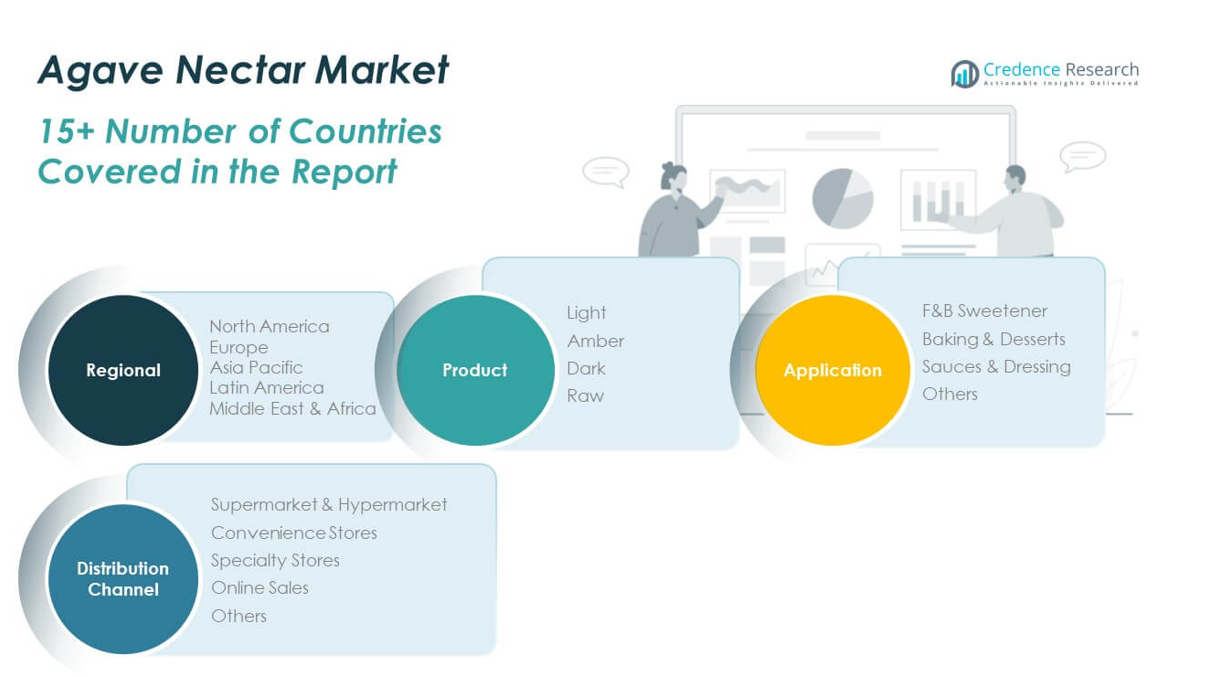

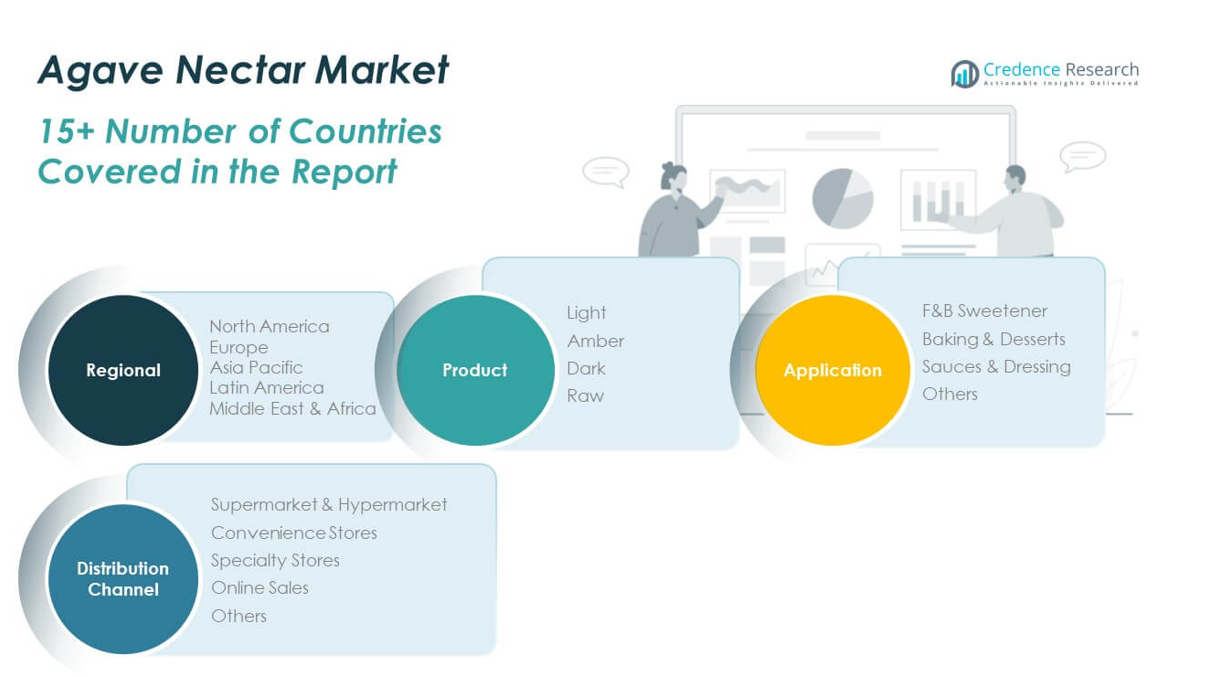

The Global Agave Nectar Market is segmented by product, application, and distribution channel.

By product, light agave nectar holds the largest share due to its mild flavor and versatility in beverages and packaged foods. Amber and dark variants cater to consumers seeking richer taste profiles for baking and specialty recipes, while raw agave nectar is gaining attention for its minimal processing and organic appeal.

- For example, Wholesome Sweeteners’ Organic Blue Agave Light is the company’s best-selling variant, specifically promoted for its mild, neutral flavor and high solubility. According to Wholesome’s official product sheet, this light agave nectar is used by leading beverage brands and food manufacturers for sweetening teas, lemonades, and ready-to-drink beverages. The product is certified organic, non-GMO, and is available in bulk (up to 1,300 kg totes) for industrial clients.

By application, F&B sweeteners lead the segment, driven by growing demand for natural sugar alternatives in beverages, cereals, and dairy substitutes. Baking and desserts follow, supported by agave nectar’s thermal stability and moisture-retaining properties. Sauces and dressings represent a niche yet growing category, where manufacturers use it to improve taste without artificial additives. The “others” segment includes nutritional products, meal replacements, and emerging functional foods.

- For example, The Coca-Cola Company uses light agave nectar in its Honest® Organic Lemonade line, as confirmed in their ingredient disclosures and supplier partnerships. The product is chosen for its low glycemic index and clean-label appeal, supporting the beverage’s positioning as a natural, healthier alternative.

By distribution channel, supermarkets and hypermarkets dominate due to wide product availability and consumer trust. Online sales are expanding rapidly, supported by convenience and brand variety. Specialty stores cater to organic and health-focused buyers, while convenience stores serve impulse and local purchases. The market continues to evolve across all channels, driven by changing consumer buying behavior and digital retail growth.

Segmentation:

By Product:

By Application:

- F&B Sweetener

- Baking & Desserts

- Sauces & Dressing

- Others

By Distribution Channel:

- Supermarket & Hypermarket

- Convenience Stores

- Specialty Stores

- Online Sales

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

The North America Agave Nectar Market size was valued at USD 54.65 million in 2018 to USD 77.53 million in 2024 and is anticipated to reach USD 124.30 million by 2032, at a CAGR of 5.7% during the forecast period. North America holds the largest share of the Global Agave Nectar Market, accounting for 38% of the global revenue in 2024. The United States is the dominant consumer, driven by strong health awareness, demand for natural alternatives, and easy access to Mexican agave supplies. It benefits from robust retail distribution, including supermarkets, health food chains, and e-commerce platforms. Product visibility is high, and consumers are actively seeking organic and low-glycemic sweeteners. Manufacturers in the region continue to invest in product innovation and packaging to attract health-conscious buyers. The market remains competitive, with private labels and premium brands vying for shelf space.

The Europe Agave Nectar Market size was valued at USD 30.13 million in 2018 to USD 41.20 million in 2024 and is anticipated to reach USD 60.74 million by 2032, at a CAGR of 4.6% during the forecast period. Europe contributes 20% to the Global Agave Nectar Market and demonstrates steady demand for organic, plant-based products. Countries such as Germany, the UK, and France are leading in adoption, driven by regulatory support for clean-label foods and high consumer interest in ethical sourcing. It benefits from well-established health food markets and rising awareness of sugar reduction strategies. Retailers are expanding natural sweetener assortments to meet evolving dietary preferences. The market favors products with organic certification, non-GMO claims, and sustainable packaging. European buyers are brand-conscious and place strong emphasis on product transparency and origin.

The Asia Pacific Agave Nectar Market size was valued at USD 44.20 million in 2018 to USD 66.66 million in 2024 and is anticipated to reach USD 115.37 million by 2032, at a CAGR of 6.7% during the forecast period. Asia Pacific holds 33% of the Global Agave Nectar Market, making it the second-largest regional segment and the fastest growing. Rapid urbanization, rising disposable incomes, and increasing health awareness in countries such as China, India, Japan, and South Korea drive demand. It benefits from the adoption of Western dietary patterns and expanding modern retail infrastructure. Product availability is improving through both physical and digital retail platforms. Local food manufacturers are incorporating agave nectar in snacks, beverages, and health supplements. It is gaining consumer acceptance as a natural and versatile sweetener aligned with evolving dietary needs.

The Latin America Agave Nectar Market size was valued at USD 5.35 million in 2018 to USD 7.57 million in 2024 and is anticipated to reach USD 10.38 million by 2032, at a CAGR of 3.6% during the forecast period. Latin America accounts for 4% of the Global Agave Nectar Market, supported primarily by Mexico’s role as a major producer. It has a well-established agave cultivation ecosystem that serves both domestic and export markets. Consumption within the region remains modest but is gradually rising due to increased awareness of natural sweeteners. Local brands are promoting agave nectar through health campaigns and supermarket chains. It benefits from cultural familiarity with agave-based products, although affordability remains a constraint in broader market adoption. Export-oriented production continues to dominate overall output.

The Middle East Agave Nectar Market size was valued at USD 3.25 million in 2018 to USD 4.19 million in 2024 and is anticipated to reach USD 5.41 million by 2032, at a CAGR of 2.8% during the forecast period. The Middle East holds a 2% share of the Global Agave Nectar Market, with emerging demand driven by a small but growing segment of health-conscious consumers. Premium grocery chains and specialty health stores in countries such as the UAE and Saudi Arabia are beginning to stock agave-based products. It benefits from rising interest in diabetic-friendly diets and imported organic food items. Product awareness remains low, limiting widespread consumption across lower-income demographics. The market is still in its early stages but offers potential through targeted marketing and retail expansion. Future growth depends on increasing product visibility and competitive pricing.

The Africa Agave Nectar Market size was valued at USD 1.69 million in 2018 to USD 2.75 million in 2024 and is anticipated to reach USD 3.28 million by 2032, at a CAGR of 1.8% during the forecast period. Africa represents just under 2% of the Global Agave Nectar Market and remains a nascent market with limited penetration. South Africa leads regional demand, supported by a small base of health-conscious urban consumers. Product availability is low, and high import costs pose challenges for affordability and accessibility. It is primarily found in upscale supermarkets and online health food platforms. Lack of consumer education and limited awareness of agave nectar’s benefits constrain growth. Long-term opportunities exist through awareness campaigns and improved distribution partnerships across urban centers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Wholesome Sweeteners Inc.

- Now Foods

- Ciranda Inc.

- Global Goods Inc. (Agave In The Raw)

- Malt Products Corporation

- Sisana Sweeteners

- The Groovy Food Company

- Domino Foods, Inc.

- Tierra Group

- Arizona Beverages USA LLC

Competitive Analysis:

The Global Agave Nectar Market features a moderately fragmented competitive landscape with a mix of multinational players and regional producers. Key companies such as The IIDEA Company, Wholesome Sweeteners Inc., Madhava Ltd., and Nature’s Agave dominate through diversified product portfolios, organic certifications, and extensive retail networks. It is witnessing increased competition from private labels and emerging brands targeting niche segments with flavored, raw, or sustainably sourced variants. Strategic partnerships with local farmers, investment in sustainable sourcing, and product innovation are critical success factors. E-commerce platforms are enabling smaller players to access global markets and enhance brand visibility. It is also seeing consolidation trends, where established companies acquire or collaborate with artisanal producers to expand their reach. Quality assurance, supply chain stability, and transparent labeling remain essential for maintaining competitive advantage in this evolving market.

Recent Developments:

- In April 5, 2024, Backyard Nectar unveiled its new organic agave nectar brand, sourcing 100% blue agave from a local Mexican farm owned by founder Ryan Huntley.

- In July 2023, In The Raw® (parent company Cumberland Packaging Corp.) launched Organic Hot Agave In The Raw®, featuring a bold twist on traditional agave nectar. The new product blends raw blue agave nectar with jalapeño and chili heat in a 10-ounce bottle. It caters to consumers seeking novel sweet-and-spicy flavor profiles for beverages and culinary drizzles without sacrificing natural or vegan credentials.

Market Concentration & Characteristics:

The Global Agave Nectar Market exhibits moderate concentration, with a few established players controlling a significant share while numerous smaller firms cater to niche and regional demands. It is characterized by strong ties to agave cultivation in Mexico, which centralizes raw material sourcing and influences pricing dynamics. The market favors companies with vertically integrated operations, enabling better control over quality, traceability, and supply consistency. It features high consumer sensitivity to certifications such as organic, non-GMO, and fair trade, which shape purchasing decisions. Brand differentiation often hinges on purity, flavor variants, packaging design, and sustainable sourcing. It continues to evolve with increased demand from health-conscious and vegan consumers, pushing companies to innovate while maintaining clean-label standards.

Report Coverage:

The research report offers an in-depth analysis based on product, application, and distribution channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising global health awareness will drive sustained demand for natural low-glycemic sweeteners.

- Product innovation in flavored and functional agave nectars will attract new consumer segments.

- Expansion in Asia-Pacific will accelerate, supported by growing retail infrastructure and health-conscious populations.

- Increased use in functional foods and nutraceuticals will broaden application scope.

- Sustainable farming and traceable sourcing will become essential for market credibility.

- E-commerce and direct-to-consumer channels will improve accessibility in emerging markets.

- Strategic partnerships between producers and retailers will enhance distribution efficiency.

- Competitive pricing pressures from alternative sweeteners may prompt value-added differentiation.

- Regulatory clarity around organic and health claims will influence product positioning.

- Technological improvements in agave processing will boost supply consistency and cost control.