Market Overview

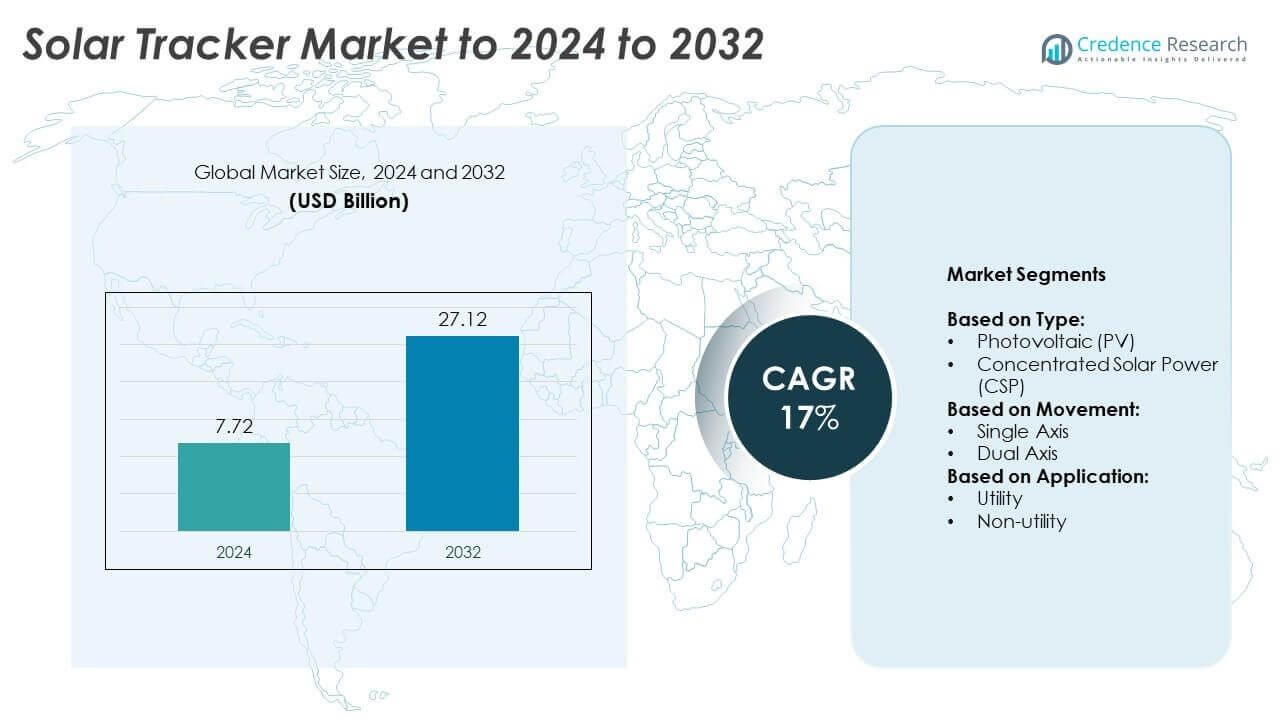

The Solar Tracker Market size was valued at USD 7.72 billion in 2024 and is anticipated to reach USD 27.12 billion by 2032, at a CAGR of 17% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Solar Tracker Market Size 2024 |

USD 7.72 Billion |

| Solar Tracker Market, CAGR |

17% |

| Solar Tracker Market Size 2032 |

USD 27.12 Billion |

The solar tracker market is led by major players such as NEXTracker, Array Technologies, Trina Solar, Soltec, Arctech Solar, and SunPower, alongside regional specialists including PV Hardware, Ideematec, and Scorpius Trackers. These companies focus on expanding utility-scale projects, improving efficiency with single-axis and dual-axis systems, and integrating digital solutions like IoT-based monitoring to strengthen competitiveness. In 2024, Asia-Pacific emerged as the leading region with a 36% share, driven by large-scale installations in China, India, and Australia. North America followed with 33%, supported by strong policy incentives, while Europe accounted for 22%, boosted by ambitious renewable targets and supportive frameworks.

Market Insights

Market Insights

- The solar tracker market was valued at USD 7.72 billion in 2024 and is projected to reach USD 27.12 billion by 2032, growing at a CAGR of 17%.

- Rising utility-scale solar installations and supportive government policies are the primary drivers boosting adoption worldwide.

- Integration of IoT, AI, and predictive maintenance technologies is a growing trend, enhancing system efficiency and reducing downtime.

- Competition is intense with players focusing on cost optimization, digital innovation, and terrain-adaptive designs to expand market reach.

- Asia-Pacific led with 36% share in 2024, followed by North America at 33% and Europe at 22%, while the photovoltaic (PV) segment dominated by holding over 85% market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The photovoltaic (PV) segment dominated the solar tracker market in 2024, accounting for over 85% of the market share. PV trackers are widely adopted due to their cost-effectiveness, scalability, and ability to maximize energy yield across large solar farms. Rapid declines in PV module prices and the availability of government subsidies further strengthen adoption. In contrast, concentrated solar power (CSP) holds a smaller share, primarily used in niche applications requiring thermal energy storage. However, PV continues to lead as utilities and developers favor efficient, low-cost solar power generation.

- For instance, Nextracker shipped 28.5 GW in 2024, as global tracker shipments hit 111 GW.

By Movement

Single-axis trackers held the dominant position in 2024 with nearly 70% of the market share. Their popularity stems from their lower installation cost, simpler design, and strong ability to deliver significant efficiency gains compared to fixed-tilt systems. They are particularly well-suited for large-scale utility projects in regions with high solar irradiance. Dual-axis trackers, although providing higher efficiency by following the sun both horizontally and vertically, face limitations due to higher costs and maintenance needs. As a result, single-axis systems remain the most preferred choice globally.

- For instance, Array’s SmarTrack increased production by up to 5% in DNV-validated results.

By Application

The utility segment led the solar tracker market in 2024, securing more than 80% of the overall market share. Large-scale solar power plants drive this dominance, as trackers significantly improve output and reduce the levelized cost of electricity (LCOE). Rising investments in renewable energy infrastructure, coupled with favorable government policies, further accelerate deployment in the utility sector. The non-utility segment, covering commercial and industrial installations, holds a smaller share but shows growth potential with rising adoption of distributed solar solutions for cost savings and energy independence.

Key Growth Drivers

Rising Utility-Scale Solar Installations

The expansion of utility-scale solar projects remains the key growth driver in the solar tracker market. Large solar farms increasingly adopt single-axis and dual-axis trackers to maximize energy yield, reduce LCOE, and improve project economics. Governments worldwide are supporting renewable expansion through subsidies, tax incentives, and clean energy mandates. These measures make solar trackers a preferred choice in large-scale power generation. With rising demand for cost-efficient and sustainable energy, the surge in utility-scale projects continues to drive solar tracker adoption globally.

- For instance, in May 2024, Nextracker announced that it had surpassed 100 GW in lifetime shipments globally since the company was founded. The company noted its annual supply capacity had reached over 50 GW globally, including more than 30 GW within the US, reflecting a significant expansion of its manufacturing capabilities.

Declining Solar Module Costs

Falling photovoltaic module prices significantly support the adoption of solar trackers. Lower module costs make solar energy more competitive compared to conventional power sources, encouraging developers to invest in tracker-based systems that enhance efficiency. This cost reduction boosts ROI, especially for utility projects aiming to achieve higher output with minimal investment. In turn, trackers improve the value proposition by optimizing the performance of these low-cost modules. The combined effect of cheaper PV modules and higher energy gains fuels strong market penetration.

- For instance, Soltec’s SFOne tracker with 4×4 functionality can be installed on non-constant slopes up to 20%, or on constant north-south and east-west slopes up to 15%, reducing grading needs.

Favorable Government Policies and Incentives

Supportive government frameworks play a crucial role in advancing solar tracker deployment. Policies such as renewable portfolio standards, clean energy auctions, and tax credits encourage large-scale investments in solar power. Several countries also provide incentives for technology adoption to reduce carbon emissions and enhance energy security. Such programs not only increase demand for solar power but also accelerate the shift from fixed-tilt to advanced tracker systems. This regulatory push remains one of the most influential factors driving the market forward.

Key Trends & Opportunities

Integration of Digital and Smart Technologies

A key trend shaping the solar tracker market is the integration of digital solutions such as IoT sensors, AI-based monitoring, and predictive maintenance. These technologies improve system efficiency, minimize downtime, and extend equipment lifespan. Developers are increasingly adopting smart trackers with real-time monitoring capabilities to optimize performance under variable conditions. The growing demand for intelligent energy infrastructure creates strong opportunities for manufacturers to differentiate products and deliver added value, aligning with the broader trend of smart energy transformation.

- For instance, Arctech Solar shipped 17.41 GW of trackers in 2024, strengthening its position in Asia-Pacific markets. According to Wood Mackenzie’s “Global Solar PV Tracker Market Share Report 2025,” this represented a year-on-year increase of 127.93% and secured Arctech the number one ranking for two consecutive years in both India and the broader Asia-Pacific region.

Expansion in Emerging Markets

Another opportunity lies in the expansion of solar tracker adoption across emerging economies. Countries in Asia-Pacific, Latin America, and Africa are witnessing rapid growth in renewable capacity, supported by rising energy demand and favorable climate conditions. Governments in these regions are investing heavily in solar infrastructure, providing fertile ground for tracker suppliers. With large untapped potential and increasing international funding for clean energy, these markets present significant opportunities for companies to establish a strong presence and capture future demand.

- For instance, GameChange Solar surpassed 3.6 GW of tracker projects (installed and under deployment) across the Middle East & North Africa (MENA) and Central Asia as of May 2025. This includes a 3 GW project in Egypt, and it makes the company one of the fastest-growing suppliers in the region based on this reported activity and capacity expansion plans, which include doubling its manufacturing capacity in Saudi Arabia to 6 GW by September 2025.

Key Challenges

High Initial Costs and Maintenance

One of the key challenges in the solar tracker market is the relatively high upfront investment. Trackers require more complex structures and moving components compared to fixed-tilt systems, raising installation and maintenance expenses. In cost-sensitive markets, this can limit adoption despite long-term efficiency gains. Additionally, higher operational and maintenance requirements in harsh environments often discourage developers. While improving ROI offsets some concerns, the initial capital intensity continues to act as a restraint for small and medium-scale projects.

Land and Design Limitations

Land availability and design challenges present another obstacle in solar tracker deployment. Trackers demand larger space due to moving rows and wider layouts, which restricts use in land-constrained areas. Uneven terrain further complicates installation, increasing project costs and engineering requirements. In regions with limited land for large-scale projects, fixed-tilt systems often remain the preferred choice. Overcoming these constraints requires advancements in compact and terrain-adaptive designs, but until then, land and site limitations will continue to hinder wider tracker adoption.

Regional Analysis

North America

North America accounted for 33% of the solar tracker market share in 2024, driven by strong investments in large-scale solar projects across the United States and Mexico. Supportive policies, including tax credits, renewable energy mandates, and carbon reduction goals, continue to drive adoption. The region also benefits from advanced manufacturing capabilities and early adoption of smart technologies such as IoT-enabled monitoring systems. High solar irradiance in southern states and Mexico further boosts efficiency gains, making trackers a preferred option. Continuous government backing and utility-scale expansions ensure sustained growth throughout the forecast period.

Europe

Europe held 22% of the global solar tracker market share in 2024, supported by ambitious decarbonization targets under the European Green Deal. Countries such as Spain, Italy, and France lead adoption due to favorable climatic conditions and strong policy frameworks. The region’s focus on reducing reliance on fossil fuels and expanding renewable capacity drives the integration of advanced tracker technologies. Additionally, growing demand for distributed solar installations in Germany and the UK is contributing to market penetration. Investments in innovative dual-axis systems further strengthen Europe’s role in shaping the industry’s technology advancements.

Asia-Pacific

Asia-Pacific dominated the solar tracker market with a 36% share in 2024, emerging as the largest regional market. Rapid growth in solar capacity across China, India, Japan, and Australia underpins this leadership. Government initiatives supporting renewable energy transition, along with declining solar equipment costs, have made trackers increasingly viable. The region also benefits from abundant solar resources and large-scale utility projects. India’s ambitious solar targets and China’s continuous investments in grid integration further boost demand. With rising energy needs and favorable economics, Asia-Pacific is expected to remain the fastest-growing region through 2032.

Latin America

Latin America secured 6% of the solar tracker market share in 2024, driven by expanding solar capacity in Brazil, Chile, and Mexico. Favorable government policies, coupled with high solar irradiance, make trackers highly effective in boosting energy output across large projects. Brazil remains a major growth hub, supported by auctions and private investments. Chile’s desert regions also provide ideal conditions for solar power deployment. Despite challenges in financing and infrastructure, increasing international investments and demand for cost-effective renewable solutions are strengthening tracker adoption, positioning Latin America as a promising market for long-term growth.

Middle East and Africa

The Middle East and Africa region accounted for 3% of the solar tracker market share in 2024, reflecting its emerging status. Countries such as Saudi Arabia, the UAE, and South Africa are leading adoption with large-scale solar projects aimed at diversifying energy sources. Abundant sunlight and vast land availability make the region highly suitable for solar trackers. However, adoption is still limited by high initial investment costs and financing challenges. With ongoing renewable energy strategies and international partnerships, the region is expected to gradually expand its role, creating future opportunities for tracker suppliers.

Market Segmentations:

By Type:

- Photovoltaic (PV)

- Concentrated Solar Power (CSP)

By Movement:

By Application:

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The solar tracker market is characterized by strong competition among leading players such as PV Hardware, Sun Action Trackers, Soltec, Ideematec, Arctech Solar, Scorpius Trackers, ArcelorMittal Projects, SunPower Corporation, Convert Italia, NEXTracker, Solar Steel, Array Technologies, Trina Solar, Arctech, and SunPower. Companies compete through advanced product portfolios, global project pipelines, and innovation in single-axis and dual-axis designs. Strategic moves such as joint ventures, supply agreements, and regional expansions enhance their market presence. Firms also invest in digital integration, including IoT and AI-based monitoring, to improve system performance and reduce operational costs. The competitive environment is further shaped by a focus on cost optimization and terrain-adaptive solutions, meeting demand in diverse geographies. Partnerships with utility developers and governments strengthen growth prospects, while sustainability commitments align with global renewable energy goals. This dynamic landscape drives continuous innovation, ensuring long-term opportunities across both established and emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- PV Hardware (Spain)

- Sun Action Trackers (U.S.)

- Soltec (Spain)

- Ideematec (Germany)

- Arctech Solar (U.S.)

- Scorpius Trackers (India)

- ArcelorMittal Projects (Luxembourg)

- SunPower Corporation (U.S.)

- Convert Italia (Italy)

- NEXTracker (U.S.)

- Solar Steel (Spain)

- Array Technologies (U.S.)

- Trina Solar (China)

- Arctech

- SunPower (U.S.)

Recent Developments

- In 2025, Nextracker Inc. announced it had surpassed 10 GW of solar tracker deployments in India, a significant milestone reflecting the country’s accelerating solar adoption.

- In 2025, Array Technologies launched the DuraTrack Hail XP tracker, designed for regions prone to high winds and hail. This launch reinforced its focus on developing resilient products for extreme weather conditions.

- In 2024, Arctech unveiled SkyLight, a 1P linked dual-row tracking system specifically designed for low wind speed regions like Latin America.

Report Coverage

The research report offers an in-depth analysis based on Type, Movement, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The solar tracker market will continue expanding with strong demand from utility-scale projects.

- Single-axis trackers will remain the preferred choice due to lower costs and reliability.

- Dual-axis trackers will gain traction in niche projects requiring maximum efficiency.

- Asia-Pacific will sustain its dominance with rapid solar capacity additions.

- North America will see steady growth supported by tax incentives and renewable mandates.

- Digital integration with IoT and AI will enhance tracker performance and efficiency.

- Emerging markets in Latin America and Africa will present new growth opportunities.

- Declining solar module costs will strengthen the case for tracker adoption.

- Innovation in terrain-adaptive designs will address land and site constraints.

- Long-term growth will align with global carbon neutrality and renewable energy targets.