Market Overview

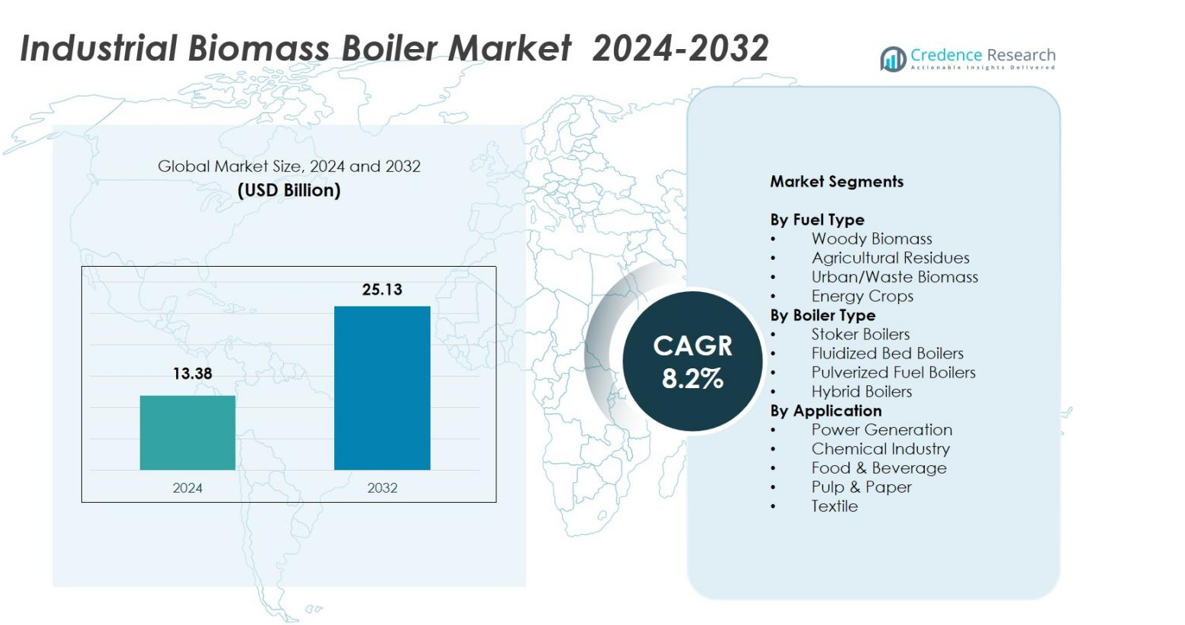

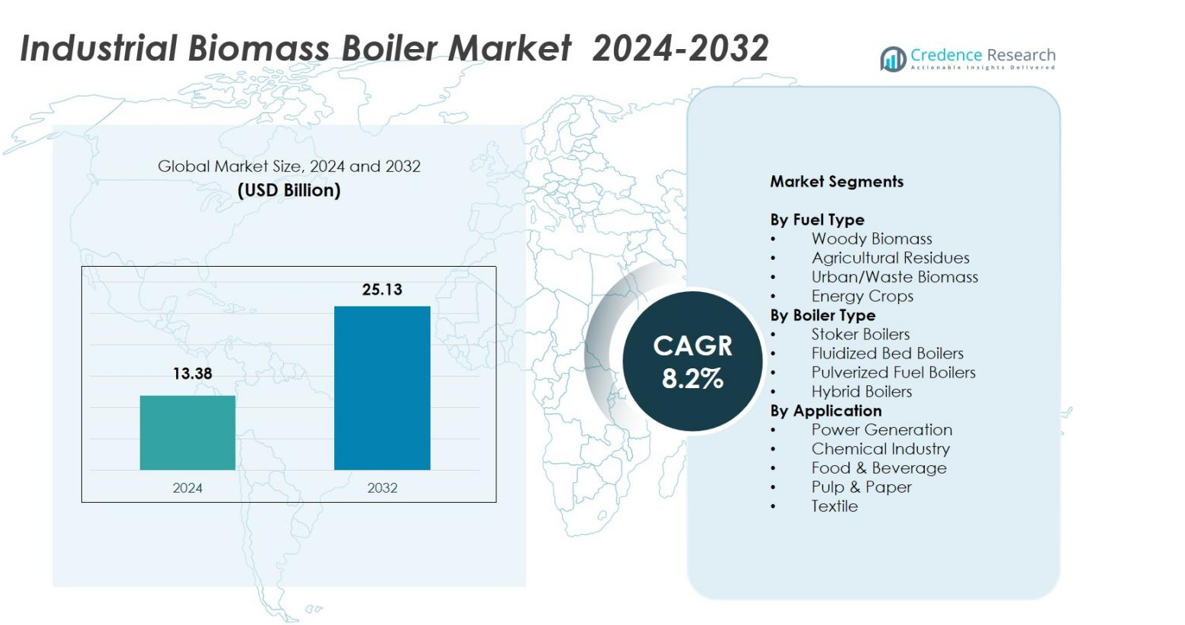

Industrial Biomass Boiler Market size was valued at USD 13.38 Billion in 2024 and is anticipated to reach USD 25.13 Billion by 2032, at a CAGR of 8.2% during the forecast period

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Biomass Boiler Market Size 2024 |

USD 13.38 Billion |

| Industrial Biomass Boiler Market, CAGR |

8.2% |

| Industrial Biomass Boiler Market Size 2032 |

USD 25.13 Billion |

Industrial Biomass Boiler Market is shaped by leading players such as Andritz AG, Valmet Oyj, Doosan Heavy Industries, Babcock & Wilcox, Thermax Ltd., General Electric Co., Isgec Heavy Engineering Ltd., and Bharat Heavy Electricals Ltd., all of which focus on advanced combustion technologies, high-efficiency systems, and multi-fuel boiler solutions. These companies strengthen their presence through technology upgrades, EPC capabilities, and strategic industrial partnerships. Europe remained the leading region in 2024 with a 36.8% market share, driven by stringent emission regulations, mature biomass supply chains, and large-scale adoption of bioenergy-based industrial heating systems.

Market Insights

- Industrial Biomass Boiler Market reached USD 13.38 Billion in 2024 and will grow at a CAGR of 8.2% through 2032, reaching USD 25.13 Billion.

- Market overview highlights strong adoption across industrial sectors as biomass systems replace fossil-fuel boilers, with woody biomass leading the fuel type segment at 44.6% share.

- The market is driven by industrial decarbonization, stringent emission norms, and expanding biomass supply chains that enhance feedstock reliability and affordability.

- Key players such as Andritz AG, Valmet Oyj, Thermax Ltd., and Doosan Heavy Industries strengthen market presence through technology innovation, high-efficiency boiler solutions, and digital monitoring capabilities.

- Regional analysis shows Europe leading with 36.8% share, followed by North America at 27.4% and Asia-Pacific at 24.6%, while power generation remains the top application segment with 41.2% market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Fuel Type:

In the Industrial Biomass Boiler Market, the fuel type segment is dominated by woody biomass, which accounted for 44.6% market share in 2024. Its leadership stems from abundant global availability, higher calorific value, and strong adoption across large-scale industrial heating systems. Agricultural residues captured 27.8% share, supported by rising waste-to-energy initiatives, while urban/waste biomass held 18.5% due to growing municipal waste valorization. Energy crops represented 9.1%, driven by emerging bioenergy plantations. The dominance of woody biomass is further propelled by stable supply chains, consistent combustion efficiency, and favorable policies promoting renewable heat generation.

- For instance, Fonterra installed a 30 MWth bubbling fluidized bed boiler at its Waitoa site, firing woody biomass with high moisture and ash content for process heat in dairy operations.

By Boiler Type:

The boiler type segment is led by fluidized bed boilers, holding a 39.7% market share in 2024 due to their superior fuel flexibility, high combustion efficiency, and lower emissions. Stoker boilers followed with 31.4% share, supported by cost-effective deployment in small and medium industries. Pulverized fuel boilers accounted for 17.6%, mainly used in high-capacity power and process applications. Hybrid boilers captured 11.3% with increasing adoption for multi-fuel operations. The leadership of fluidized bed boilers is driven by stringent emission regulations and industries’ shift toward efficient large-scale renewable heat systems.

- For instance, Valmet delivered a CFB boiler to Shanying Huazhong Paper’s thermal power plant, utilizing 260,000 tons of annual mill waste including paper rejects, pulp rejects, and pulp sludge to generate electricity and steam for mill operations.

By Application:

Among applications, power generation dominated the Industrial Biomass Boiler Market with a 41.2% market share in 2024, supported by the accelerating transition toward renewable baseload energy and biomass co-firing in thermal plants. The chemical industry accounted for 21.7% as companies integrate biomass boilers to reduce carbon footprints and energy expenses. Food & beverage held 16.8% driven by process steam requirements, while pulp & paper captured 13.4% due to the sector’s strong use of biomass-derived fuels. Textile applications comprised 6.9%. The leadership of power generation is fueled by supportive renewable energy mandates and improved biomass supply infrastructure.

Key Growth Drivers

Rising Industrial Decarbonization Targets

Industrial decarbonization remains a primary driver for the Industrial Biomass Boiler Market as manufacturers actively transition from fossil-fuel-based heat systems to renewable, low-carbon alternatives. Biomass boilers enable substantial CO₂ reductions while supporting high-temperature industrial processes, making them a strategic fit for sectors such as chemicals, pulp & paper, and food processing. Growing policy mandates, carbon taxation, and net-zero commitments further accelerate adoption. Companies increasingly invest in biomass solutions to meet ESG requirements, stabilize long-term energy costs, and reduce dependency on volatile fossil fuel markets.

- For instance, Bulleh Shah Packaging installed a biomass-fired energy plant at its Pakistan paper factory, using wheat straw, cotton stalks, corn, rice, and river grass residues to produce 150 t/h steam at 530°C and 98 bara, replacing fossil fuels for reliable mill operations.

Expansion of Biomass Supply Chains and Feedstock Availability

The rapid improvement in biomass collection, processing, and distribution networks significantly boosts market growth by ensuring reliable and cost-effective feedstock availability. Enhanced logistics for woody biomass, structured procurement of agricultural residues, and increased production of dedicated energy crops strengthen the fuel ecosystem for industrial boilers. Government incentives for biomass cultivation and waste-to-energy initiatives also widen the feedstock base. This expanded supply chain ecosystem reduces operational bottlenecks and encourages industries to adopt large-scale biomass boiler systems with confidence.

- For instance, PRESPL in India aggregates and processes agricultural residues like those from Punjab and Haryana into biomass briquettes and pellets, partnering with firms such as PepsiCo and Cipla to supply renewable energy inputs across over 100 districts.

Supportive Regulatory Frameworks and Renewable Heat Incentives

Government-backed renewable heat programs, emissions regulations, and incentive schemes strongly support biomass boiler installations across industrial facilities. Policies promoting clean energy adoption, such as renewable heat incentives, bioenergy subsidies, and carbon credit eligibility, make biomass systems financially attractive. Stricter emission norms push industries to replace coal-fired boilers with cleaner biomass alternatives. Public–private partnerships and funding for green infrastructure projects further stimulate market expansion, creating a favorable regulatory environment that accelerates the shift toward sustainable industrial heat generation.

Key Trends & Opportunities

Technological Advancements in High-Efficiency Boiler Systems

A major trend in the Industrial Biomass Boiler Market is the rapid development of advanced combustion technologies, including next-generation fluidized bed systems, automated feedstock handling, and improved emission control units. These innovations enhance combustion efficiency, reduce particulate emissions, and support multi-fuel operations. Opportunities arise from the integration of digital monitoring and predictive maintenance tools, enabling industries to optimize performance and reduce downtime. As efficiency improves, biomass boilers become more economically attractive, expanding their adoption across diverse industrial applications.

- For instance, Valmet’s CFB Boiler employs circulating fluidized bed technology that circulates bed material with flue gas through the furnace for even combustion temperatures, handling varied fuel properties like moisture and ash content while ensuring low primary emissions.

Growing Adoption of Circular Bioeconomy and Waste-to-Energy Models

Expanding circular bioeconomy initiatives create strong opportunities as industries increasingly convert agricultural residues, organic waste, and by-products into usable biomass fuel. Waste-to-energy facilities strengthen local fuel security while helping companies achieve waste reduction goals. This trend is especially prominent in food processing, pulp & paper, and municipal operations. Industries benefit from lower fuel expenses, reduced landfill burden, and enhanced sustainability performance. The shift toward circular operations positions biomass boilers as a central technology supporting resource efficiency and renewable heat production.

- For instance, McCain’s Timaru plant converted its 14 MWth traveling grate boiler to burn biomass woodchips, replacing lignite coal for potato processing steam.

Key Challenges

Feedstock Supply Variability and Quality Inconsistencies

Despite expanding biomass supply chains, fluctuations in feedstock quality and seasonal availability remain a major challenge for market expansion. Variability in moisture content, calorific value, and contamination affects combustion performance and increases maintenance requirements. Agricultural residues and urban waste streams often face inconsistent supply volumes, complicating long-term procurement planning. These challenges drive up operational costs and limit adoption among industries requiring stable, high-efficiency heat generation. Developing standardized feedstock processing systems remains essential for overcoming these limitations.

High Capital Cost and Complex Installation Requirements

The high upfront investment associated with industrial biomass boiler installation poses a significant challenge, especially for small and mid-sized enterprises. Costs involve not only the boiler system but also fuel storage, handling equipment, emission control units, and retrofitting infrastructure. Complex site preparation and permitting regulations further extend project timelines. While operational savings may offset these expenses over time, the initial financial burden often delays adoption. Access to financing solutions and government subsidies is crucial to reducing these barriers and encouraging broader market penetration.

Regional Analysis

North America

North America accounted for 27.4% market share in 2024, driven by strong decarbonization initiatives across industrial sectors and the rising adoption of biomass-based heat systems to reduce reliance on natural gas and coal. The U.S. leads the region due to supportive renewable heat policies, tax credits, and expansion of woody biomass supply chains. Canada contributes significantly with its robust forest residue resources and sustainability-focused industrial operations. Increasing investments in renewable heat infrastructure and emission-compliance strategies continue to fuel market expansion across power generation, food processing, and chemicals industries.

Europe

Europe dominated the Industrial Biomass Boiler Market with 36.8% market share in 2024, supported by stringent emissions regulations and long-term climate neutrality targets. Countries such as Germany, Sweden, Finland, and the U.K. show strong adoption due to mature biomass supply chains and established district heating networks. The region benefits from extensive government incentives promoting bioenergy deployment and the replacement of coal-fired systems. Industrial users adopt biomass boilers to comply with carbon reduction frameworks and leverage abundant forestry residues. Ongoing investments in waste-to-energy facilities and advanced boiler technologies further reinforce Europe’s leadership.

Asia-Pacific

Asia-Pacific held 24.6% market share in 2024, driven by rapid industrialization, rising energy demand, and strong government focus on renewable heat solutions. China leads the region with expanding biomass power capacity and large-scale utilization of agricultural residues. India shows accelerating growth due to supportive waste-to-energy policies and rising adoption of biomass boilers in textiles, food processing, and manufacturing. Southeast Asian countries leverage abundant palm, rice husk, and coconut waste as feedstock. The region’s growing industrial base and increasing pressure to curb industrial emissions position Asia-Pacific as a major high-growth market.

Latin America

Latin America captured 6.4% market share in 2024, primarily fueled by extensive agricultural activity and abundant availability of biomass residues such as sugarcane bagasse and forestry by-products. Brazil dominates due to its strong bioenergy ecosystem and industrial transition toward renewable heat. Chile, Argentina, and Colombia also show growing adoption as industries seek cost-efficient alternatives to fossil fuels. Supportive government programs for energy diversification and sustainable industrial practices further accelerate market penetration. Expansion of biomass-based cogeneration plants in the food & beverage and paper industries enhances the region’s long-term growth outlook.

Middle East & Africa

Middle East & Africa accounted for 4.8% market share in 2024, with growth driven by emerging industrial diversification efforts and increasing emphasis on sustainable energy solutions. South Africa leads adoption due to strong agro-processing industries and rising investments in biomass-based heating systems. Gulf countries are gradually exploring biomass solutions as part of long-term renewable energy strategies, particularly for industrial clusters seeking carbon reduction. Limited feedstock availability and infrastructural gaps currently restrict large-scale deployment, but expanding waste-to-energy projects and policy shifts toward decarbonization present emerging opportunities in the region.

Market Segmentations

By Fuel Type

- Woody Biomass

- Agricultural Residues

- Urban/Waste Biomass

- Energy Crops

By Boiler Type

- Stoker Boilers

- Fluidized Bed Boilers

- Pulverized Fuel Boilers

- Hybrid Boilers

By Application

- Power Generation

- Chemical Industry

- Food & Beverage

- Pulp & Paper

- Textile

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Industrial Biomass Boiler Market features prominent players such as Andritz AG, Babcock & Wilcox Enterprises Inc., Bharat Heavy Electricals Ltd., Dongfang Electric Corp., Doosan Heavy Industries & Construction Co. Ltd., General Electric Co., Isgec Heavy Engineering Ltd., Thermax Ltd., Valmet Oyj, and Xizi United Holdings Ltd. The market is characterized by strong emphasis on technological innovation, energy efficiency, and emission reduction capabilities. Leading manufacturers focus on expanding their portfolios of fluidized bed and hybrid biomass boilers to meet evolving industrial decarbonization requirements. Companies increasingly invest in R&D to develop advanced combustion systems, automation-integrated operations, and multi-fuel flexibility. Strategic collaborations, EPC contracts, and long-term service agreements strengthen market positioning, particularly in Europe and Asia-Pacific. Additionally, players compete on performance reliability, lifecycle cost optimization, and integration of digital monitoring solutions, enabling industrial users to enhance operational efficiency while shifting toward renewable heat systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, Saica Group inaugurated a new biomass boiler at its Champblain-Laveyron containerboard mill in France, replacing a natural gas unit and enabling recovery of 105,000 tonnes of end-of-life wood annually.

- In 2024, Miura Co. from Japan acquired Cleaver-Brooks, a major U.S. boiler manufacturer, to integrate modular high-efficiency technologies across steam and hot water systems.

- In September 2024, Boccard acquired Leroux & Lotz Technologies (LLT), a French industrial boiler manufacturer specializing in biomass systems, to lead in renewable thermal energy.

Report Coverage

The research report offers an in-depth analysis based on Fuel Type, Boiler Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as industries intensify decarbonization efforts and transition from fossil-fuel boilers to renewable heat systems.

- Advancements in fluidized bed and hybrid boiler technologies will enhance efficiency, emissions control, and multi-fuel flexibility.

- Biomass supply chains will expand with improved collection, processing, and logistics infrastructure, strengthening long-term fuel security.

- Adoption will rise in emerging economies as governments promote waste-to-energy and bioenergy-based industrial heating.

- Digitalization through automation, remote monitoring, and predictive maintenance will optimize boiler performance and reduce downtime.

- Circular bioeconomy initiatives will increase the use of agricultural residues, organic waste, and by-products as reliable biomass feedstock.

- Industrial sectors such as chemicals, food processing, and pulp & paper will accelerate investment in biomass boilers to reduce carbon footprints.

- Policy support through incentives, renewable heat programs, and carbon compliance regulations will continue to drive installations.

- Integration of biomass boilers into cogeneration and district heating systems will expand operational efficiency and energy diversification.

- Global collaborations and EPC partnerships will grow as manufacturers expand their presence in high-growth regions.