CHAPTER NO. 1 : INTRODUCTION………………………………. 23

1.1. Report Description ……………………………………………………. 23

Purpose of the Report…………………………………………..23

USP & Key Offerings……………………………………………..23

1.2. Key Benefits for Stakeholders……………………………………… 24

1.3. Target Audience ……………………………………………………….. 24

CHAPTER NO. 2 : EXECUTIVE SUMMARY……………………… 25

CHAPTER NO. 3 : U.S. SPINE DEGENERATIVE DISK DISEASE

TREATMENT MARKET FORCES & INDUSTRY

PULSE……………………………………………. 26

3.1. Foundations of Change – Market Overview……………………. 26

3.2. Rising Prevalence of Degenerative Disc Disease Among Aging

and Active Populations………………………………………………. 28

3.3. Shift Toward Motion-Preserving and Minimally Invasive

Treatments 29

3.4. Advancements in Biologics and Regenerative Therapies…… 30

3.5. Limited Long-Term Clinical Evidence for Biologic Therapies.. 31

3.6. Reimbursement and Regulatory Challenges …………………… 32

3.7. High R&D and Manufacturing Costs ……………………………… 33

3.8. Early Intervention in Younger Patients with Mild-to-Moderate

DDD 34

3.9. Integration of Digital Surgery and Robotic Assistance………. 35

3.10. Market Equilibrium – Porter’s Five Forces……………………… 36

3.11. Ecosystem Dynamics – Value Chain Analysis ………………….. 38

3.12. Macro Forces – PESTEL Breakdown………………………………. 40

CHAPTER NO. 4 : COMPETITION ANALYSIS ………………….. 42

4.1. Company Market Share Analysis………………………………….. 42

4.1.1. U.S. Spine Degenerative Disk Disease Treatment Market

Company Revenue Market Share, Key Devices Company….. 42

4.1.2. U.S. Spine Degenerative Disk Disease Treatment Market

Company Revenue Market Share, Key Drugs Companies….. 44

4.2. Strategic Developments …………………………………………….. 46

4.2.1. Expansion, Clinical Trial among Others………………………….. 46

4.2.2. New Product Type Launch and Spinoff………………………….. 49

4.2.3. FDA Approval and Funding …………………………………………. 51

4.3. Competitive Dashboard……………………………………………… 54

4.4. Company Assessment Metrics, 2024 …………………………….. 55

CHAPTER NO. 5 : U.S. MARKET ANALYSIS, INSIGHTS &

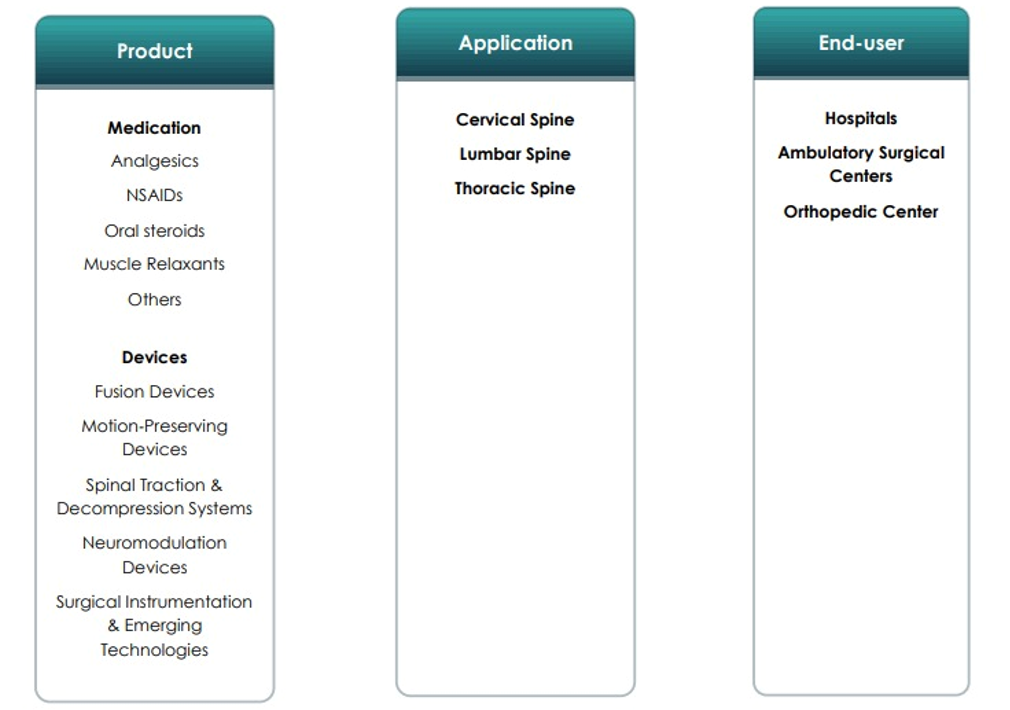

FORECAST, BY PRODUCT ………………….. 57

CHAPTER NO. 6 : U.S. MARKET ANALYSIS, INSIGHTS &

FORECAST, BY APPLICATION……………… 64

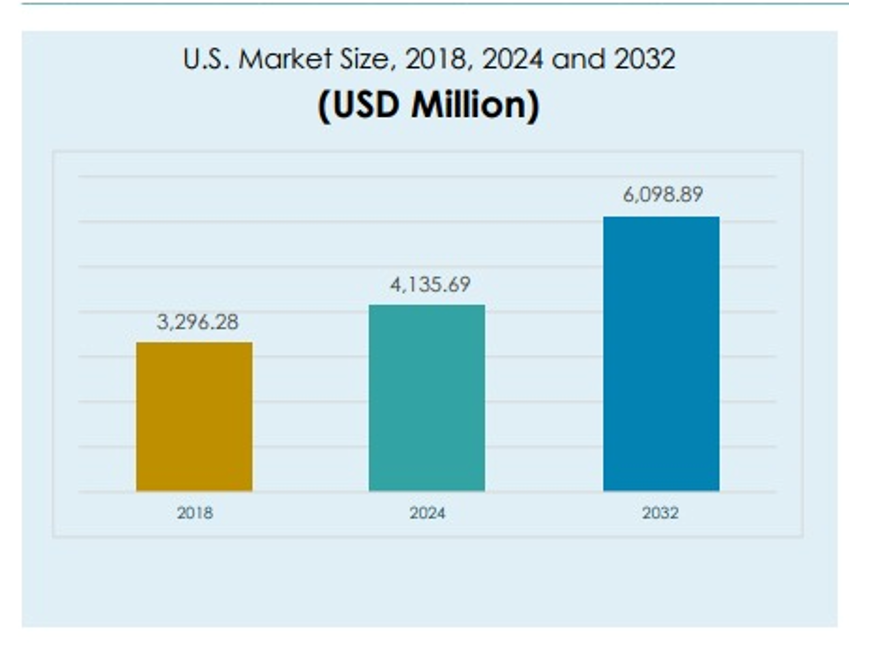

U.S. SPINE DEGENERATIVE DISK DISEASE TREATMENT MARKET, 2018 – 2032

CHAPTER NO. 7 : U.S. MARKET ANALYSIS, INSIGHTS &

FORECAST, BY END-USER………………….. 68

CHAPTER NO. 8 : U.S. SPINE DEGENERATIVE DISK DISEASE

TREATMENT MARKET PROCEDURAL

VOLUME, BY APPLICATION ……………….. 72

CHAPTER NO. 9 : COMPANY PROFILE …………………………. 73

9.1. DePuy Synthes …………………………………………………………. 73

9.2. B. Braun Medical Inc………………………………………………….. 77

9.3. Stryker – VB Spine …………………………………………………….. 83

9.4. ATEC Spine, Inc…………………………………………………………. 88

9.5. Spinal Elements, Inc…………………………………………………… 92

9.6. Novartis 96

9.7. Pfizer 99

9.8. Medtronic 102

9.9. Kenvue Brands LLC ………………………………………………….. 105

9.10. Bayer HealthCare LLC……………………………………………….. 108

List of Figures

FIG NO. 1. Spine Degenerative Disk Disease Treatment Market

Revenue Share, By Product, 2024 & 2032 ……………………..57

FIG NO. 2. Market Attractiveness Analysis, By Product …………………..58

FIG NO. 3. Incremental Revenue Growth Opportunity by Product,

2024 – 2032 ……………………………………………………………….59

FIG NO. 4. Spine Degenerative Disk Disease Treatment Market

Revenue Share, By Application 2024 & 2032………………….64

FIG NO. 5. Market Attractiveness Analysis, By Application………………65

FIG NO. 6. Incremental Revenue Growth Opportunity by Application,

2024 – 2032 ……………………………………………………………….66

FIG NO. 7. Spine Degenerative Disk Disease Treatment Market

Revenue Share, By End-user, 2024 & 2032…………………….68

FIG NO. 8. Market Attractiveness Analysis, By End-user………………….69

FIG NO. 9. Incremental Revenue Growth Opportunity by End-user,

2024 – 2032 ……………………………………………………………….70

U.S. SPINE DEGENERATIVE DISK DISEASE TREATMENT MARKET, 2018 – 2032

List of Tables

TABLE NO. 1. : U.S. Spine Degenerative Disk Disease Treatment Market

Revenue, By Product, 2018 – 2024 (USD Million)……………60

TABLE NO. 2. : U.S. Spine Degenerative Disk Disease Treatment Market

Revenue, By Product, 2025 – 2032 (USD Million)……………60

TABLE NO. 3. : U.S. Spine Degenerative Disk Disease Treatment Market

Revenue, By Medication, 2018 – 2024 (USD Million) ………61

TABLE NO. 4. : U.S. Spine Degenerative Disk Disease Treatment Market

Revenue, By Medication, 2025 – 2032 (USD Million) ………61

TABLE NO. 5. : U.S. Spine Degenerative Disk Disease Treatment Market

Revenue, By Devices, 2018 – 2024 (USD Million) ……………62

TABLE NO. 6. : U.S. Spine Degenerative Disk Disease Treatment Market

Revenue, By Devices, 2025 – 2032 (USD Million)…………… 63

TABLE NO. 7. : U.S. Spine Degenerative Disk Disease Treatment Market

Revenue, By Application, 2018 – 2024 (USD Million)……… 67

TABLE NO. 8. : U.S. Spine Degenerative Disk Disease Treatment Market

Revenue, By Application, 2025 – 2032 (USD Million)……… 67

TABLE NO. 9. : U.S. Spine Degenerative Disk Disease Treatment Market

Revenue, By End-user, 2018 – 2024 (USD Million)…………. 71

TABLE NO. 10. : U.S. Spine Degenerative Disk Disease Treatment Market

Revenue, By End-user, 2025 – 2032 (USD Million)…………. 71

TABLE NO. 11. : U.S. Spine Degenerative Disk Disease Treatment Market

Procedural Volume, By Application, 2020 – 2024 ………….. 72