Market Overview

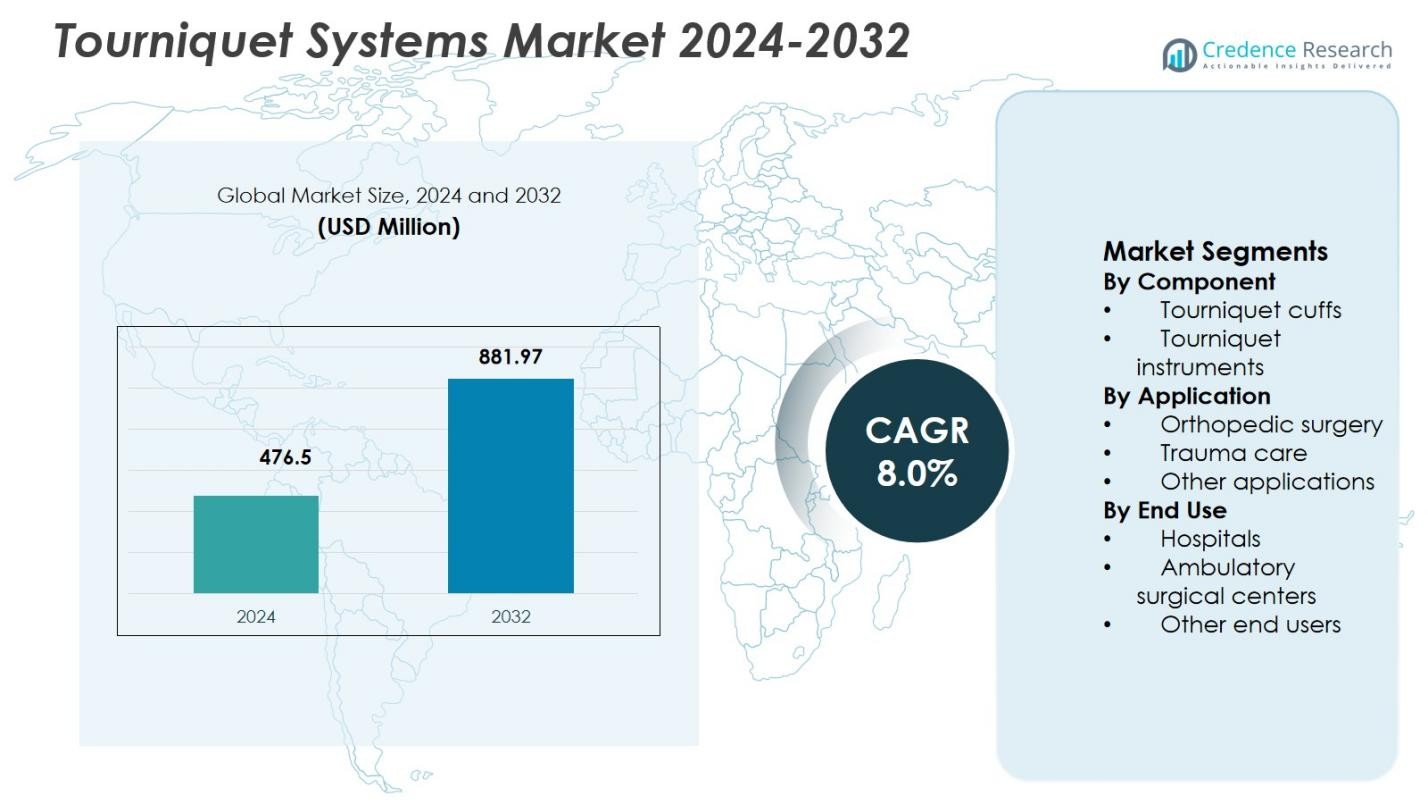

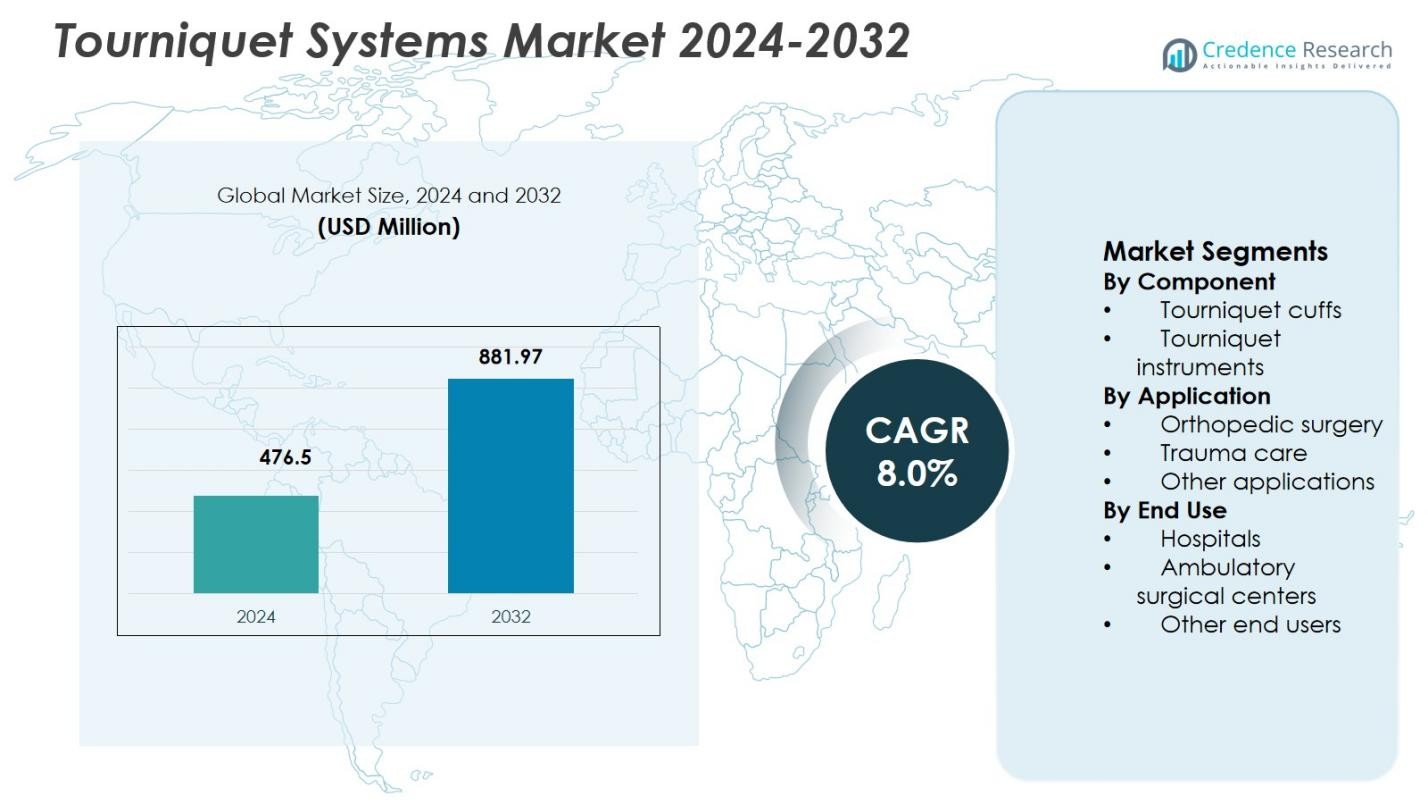

Tourniquet Systems Market size was valued at USD 476.5 Million in 2024 and is anticipated to reach USD 881.97 Million by 2032, expanding at a CAGR of 8.0% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tourniquet Systems Market Size 2024 |

USD 476.5 Million |

| Tourniquet Systems Market, CAGR |

8.0% |

| Tourniquet Systems Market Size 2032 |

USD 881.97 Million |

Tourniquet Systems Market is shaped by the presence of established medical device manufacturers and specialized trauma care providers, including Stryker, Delfi Medical Innovations, SAM Medical, Pyng Medical, Anetic Aid, C.A.T Resources, Hammarplast Medical, OHK Medical Devices, Huaxin, and Riester. These players focus on expanding automated and pneumatic tourniquet portfolios, enhancing safety features, and increasing adoption of disposable cuff solutions across surgical and emergency care settings. Strong relationships with hospitals, ambulatory surgical centers, and emergency medical services support sustained demand. North America leads the market with a 38.6% share, driven by high surgical volumes, advanced trauma care infrastructure, and strong uptake of technologically advanced tourniquet systems, followed by Europe and Asia-Pacific with expanding procedural volumes and healthcare investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Tourniquet Systems Market was valued at USD 476.5 Million in 2024 and is projected to grow at a CAGR of 8.0% through the forecast period, driven by rising surgical and trauma care demand globally.

- Market growth is driven by increasing orthopedic and trauma procedures, expanding emergency medical services, and higher adoption of tourniquet systems for effective hemorrhage control in hospitals and pre-hospital settings.

- A key market trend is the shift toward automated and disposable tourniquet systems, with tourniquet cuffs leading the component segment at 62.4% share due to high replacement rates and infection control requirements.

- Market structure is influenced by innovation-led strategies, product safety enhancements, and wider adoption across hospitals, which dominate end use with a 1% share, while cost sensitivity remains a restraint in emerging markets.

- Regionally, North America leads with 38.6% share, followed by Europe at 4% and Asia-Pacific at 23.1%, supported by strong healthcare infrastructure, rising surgical volumes, and expanding access to advanced medical technologies.

Market Segmentation Analysis:

By Component:

The Tourniquet Systems Market by component is led by tourniquet cuffs, which accounted for 62.4% market share in 2024. Their dominance is driven by high replacement frequency, direct patient contact requirements, and continuous innovation in pneumatic, disposable, and limb-specific cuff designs. Hospitals and surgical centers prioritize advanced cuffs with improved pressure distribution, reduced nerve injury risk, and compatibility with automated tourniquet instruments. Growing adoption of single-use and latex-free cuffs to prevent cross-contamination further strengthens demand, while rising surgical volumes globally sustain consistent purchasing cycles for tourniquet cuffs.

- For instance, Zimmer Biomet’s A.T.S. tourniquet cuffs come in sterile, disposable single- and dual-port versions tailored for limb surgeries to minimize blood loss. These cuffs feature protective sleeves that shield soft tissue and keep hoses from the surgical field, supporting compatibility across A.T.S. regulators.

By Application:

By application, orthopedic surgery dominated the Tourniquet Systems Market with a 54.7% market share in 2024. The segment’s leadership is supported by the high volume of joint replacement, trauma fixation, and sports injury procedures that require controlled blood flow for improved surgical visibility. Increasing prevalence of osteoarthritis, road accidents, and age-related musculoskeletal disorders continues to drive orthopedic surgical volumes. Additionally, orthopedic surgeons increasingly rely on precise, automated tourniquet systems to minimize blood loss and reduce operative time, reinforcing the segment’s strong and sustained market position.

- For instance, Stryker’s SmartPump Tourniquet System uses EvenAIRe Technology stiffeners in Color Cuff Tourniquets to secure occlusion at the lowest effective pressure. This approach minimizes risks tied to high pressures during orthopedic limb surgeries like knee arthroplasty.

By End Use:

In terms of end use, hospitals held the largest share at 68.1% of the Tourniquet Systems Market in 2024. This dominance is driven by hospitals’ high surgical throughput, availability of specialized orthopedic and trauma departments, and greater capital budgets for advanced tourniquet instruments. Hospitals also manage a large share of emergency trauma cases, where rapid hemorrhage control is critical. The presence of trained surgical staff, strict patient safety protocols, and higher adoption of automated and pneumatic systems further supports hospitals as the primary end-use segment.

Key Growth Drivers

Increasing Surgical and Trauma Procedure Volumes

The Tourniquet Systems Market is primarily driven by the increasing number of surgical and trauma procedures performed globally. Rising orthopedic interventions, including joint replacements, fracture repairs, and sports injury treatments, require precise blood flow control to enhance surgical visibility and reduce blood loss. In addition, the growing incidence of road accidents and emergency trauma cases increases the use of tourniquets in acute care and pre-hospital settings. Hospitals and trauma centers increasingly integrate tourniquet systems into standard surgical protocols, reinforcing consistent demand across elective and emergency procedures.

- For instance, Delfi Medical Innovations’ Emergency & Military Tourniquet (EMT) employs a wide bladder pneumatic design to completely stop arterial blood flow in upper and lower limbs during pre-hospital trauma response.

Expansion of Emergency Medical Services and Military Healthcare

The expanding role of emergency medical services and military healthcare systems significantly contributes to market growth. Rapid hemorrhage control has become a critical component of trauma response guidelines, driving widespread deployment of tourniquets in ambulances, battlefield medical kits, and disaster response units. Government investments in emergency preparedness and combat casualty care programs support procurement of reliable tourniquet systems. Proven clinical effectiveness in reducing preventable deaths from blood loss further accelerates adoption across both civilian and defense healthcare environments.

- For instance, the Combat Application Tourniquet (CAT) from North American Rescue, introduced by the U.S. Army in 2005, achieved 100% effectiveness in occluding distal arterial flow per U.S. Army Institute of Surgical Research evaluations.

Advancements in Tourniquet Technology and Safety Features

Technological advancements in tourniquet systems continue to strengthen market growth. Manufacturers focus on automated and pneumatic systems equipped with real-time pressure monitoring, alarms, and limb-specific control to improve patient safety. These innovations reduce the risk of nerve injury and ischemic complications while improving procedural efficiency. Enhanced materials, ergonomic designs, and compatibility with modern surgical workflows increase clinician confidence, supporting broader adoption in hospitals and ambulatory surgical centers.

Key Trends & Opportunities

Growing Adoption of Single-Use and Disposable Tourniquet Cuffs

A key trend in the Tourniquet Systems Market is the increasing adoption of single-use and disposable tourniquet cuffs. Healthcare providers emphasize infection control, reduced cross-contamination, and compliance with strict sterilization standards. Disposable cuffs eliminate reprocessing time and ensure consistent performance across procedures. This trend creates opportunities for manufacturers offering cost-efficient, latex-free, and environmentally responsible disposable solutions that align with evolving hospital safety protocols.

- For instance, VBM Medical’s Tourniquet Dispo Cuff serves as a sterile, single-use option ideal for contaminated procedures to prevent hospital-acquired infections. The cuff comes in straight shape for small or midsize upper extremities and contour shape for lower conical extremities, with color-coded sizes for easy selection.

Rising Demand from Ambulatory Surgical Centers

Ambulatory surgical centers represent a strong growth opportunity as outpatient and minimally invasive procedures expand worldwide. These facilities prefer compact, portable, and easy-to-use tourniquet systems that support high patient turnover. The shift toward same-day surgeries increases demand for automated and efficient tourniquet instruments. Manufacturers that design solutions specifically for ambulatory settings, focusing on reliability and workflow optimization, are well positioned to capture incremental market growth.

- For instance, Stryker’s SmartPump Tourniquet System includes built-in safety checks and intuitive controls tailored for efficient use in outpatient environments. It enables precise pressure regulation to support minimally invasive limb procedures with minimal workflow disruption.

Key Challenges

Risk of Tourniquet-Related Clinical Complications

Tourniquet-related clinical complications pose a significant challenge to market growth. Improper application or prolonged use can cause nerve damage, muscle injury, ischemia, and postoperative discomfort. These risks require strict adherence to usage guidelines and increased staff training, which may limit adoption in certain clinical scenarios. Healthcare providers remain cautious, driving demand for advanced safety features and continuous monitoring technologies.

Cost Constraints and Budget Limitations

Cost constraints among healthcare providers present another major challenge for the Tourniquet Systems Market. Advanced automated tourniquet systems involve higher capital investment, which can restrict adoption in smaller hospitals and emerging economies. Budget pressures often favor basic or reusable solutions over premium technologies. Additionally, reimbursement limitations for surgical consumables influence purchasing decisions, requiring manufacturers to balance innovation with affordability to ensure wider market penetration.

Regional Analysis

North America

North America accounted for 38.6% market share in 2024, leading the Tourniquet Systems Market due to high surgical volumes, advanced trauma care infrastructure, and strong adoption of automated tourniquet technologies. The region benefits from a high incidence of orthopedic surgeries, including joint replacements and sports injury procedures, alongside a well-established emergency medical services network. Widespread use of tourniquets in hospitals, ambulatory surgical centers, and pre-hospital trauma care supports sustained demand. Strong reimbursement frameworks, presence of major manufacturers, and continuous product innovation further reinforce North America’s leadership position.

Europe

Europe held 27.4% market share in 2024, supported by a well-developed healthcare system and rising focus on surgical safety and blood loss management. Increasing orthopedic procedures driven by aging populations and growing prevalence of musculoskeletal disorders contribute significantly to demand. European hospitals emphasize compliance with strict clinical guidelines, boosting adoption of high-quality pneumatic and disposable tourniquet systems. Government-funded healthcare infrastructure, strong trauma response capabilities, and increasing outpatient surgical procedures further support steady market growth across major countries in the region.

Asia-Pacific

Asia-Pacific captured 23.1% market share in 2024, emerging as the fastest-expanding regional market for tourniquet systems. Rapid growth in surgical volumes, expanding hospital infrastructure, and rising healthcare expenditure drive demand across China, India, and Southeast Asia. Increasing road accidents and trauma cases further accelerate adoption in emergency and pre-hospital settings. Growing awareness of advanced surgical tools, improving access to healthcare services, and expanding medical tourism support market expansion. Local manufacturing and cost-effective product offerings also contribute to wider penetration across public and private healthcare facilities.

Latin America

Latin America accounted for 6.5% market share in 2024, supported by gradual improvements in healthcare infrastructure and expanding access to surgical care. Rising orthopedic and trauma procedures, particularly in urban hospitals, drive adoption of tourniquet systems. Government investments in emergency care services and increasing private healthcare participation support market growth. However, cost sensitivity influences purchasing decisions, leading to higher use of basic and reusable tourniquet solutions. Growing awareness of surgical safety and blood loss control continues to strengthen demand across key countries in the region.

Middle East & Africa

The Middle East & Africa region represented 4.4% market share in 2024, driven by expanding hospital capacity and increasing focus on trauma and emergency care. Rising investments in healthcare infrastructure across the Gulf countries support adoption of advanced tourniquet systems. In Africa, demand is driven by emergency trauma care needs and improving access to surgical services. Although budget constraints limit penetration of premium technologies, growing awareness of hemorrhage control and government-led healthcare initiatives contribute to gradual market growth across the region.

Market Segmentations:

By Component

- Tourniquet cuffs

- Tourniquet instruments

By Application

- Orthopedic surgery

- Trauma care

- Other applications

By End Use

- Hospitals

- Ambulatory surgical centers

- Other end users

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Tourniquet Systems Market features a mix of established medical device manufacturers and specialized trauma care companies, with key players including Stryker, Delfi Medical Innovations, SAM Medical, Pyng Medical, Anetic Aid, C.A.T Resources, Hammarplast Medical, OHK Medical Devices, Huaxin, and Riester. These companies compete through product innovation, portfolio breadth, and strong clinical validation. Market participants focus on advancing automated and pneumatic tourniquet systems with enhanced pressure control, safety alarms, and disposable cuff options to meet evolving surgical and emergency care requirements. Strategic partnerships with hospitals, military agencies, and emergency medical service providers strengthen distribution reach and long-term contracts. Continuous investment in research and development, regulatory compliance, and clinician training programs enables players to differentiate offerings while maintaining high safety standards. Competitive positioning increasingly depends on balancing technological sophistication with cost efficiency to address both premium healthcare facilities and price-sensitive markets globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, SAM Medical expanded its product portfolio by acquiring TyTek Medical, a leading provider of chest decompression needles, strengthening its emergency medical offerings and enhancing its trauma care capabilities.

- In May 2024, Tri-Tech Forensics Inc. acquired SAM Medical, broadening its emergency medical device portfolio and strengthening its position in the tourniquet cuffs market.

Report Coverage

The research report offers an in-depth analysis based on Component, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of automated and digitally monitored tourniquet systems will increase across surgical and trauma care settings.

- Demand for single-use and disposable tourniquet cuffs will grow due to stricter infection control protocols.

- Hospitals will continue to lead usage, supported by rising orthopedic and trauma procedure volumes.

- Ambulatory surgical centers will expand adoption of compact and easy-to-use tourniquet solutions.

- Integration of safety features such as pressure sensors and alarm systems will become standard practice.

- Emergency medical services will increase tourniquet deployment for pre-hospital hemorrhage control.

- Military and disaster response applications will remain a stable source of long-term demand.

- Manufacturers will focus on improving patient comfort and reducing tourniquet-related complications.

- Cost-optimized product offerings will support wider penetration in emerging healthcare markets.

- Regulatory emphasis on patient safety and clinical effectiveness will shape product development strategies.