Market Overview

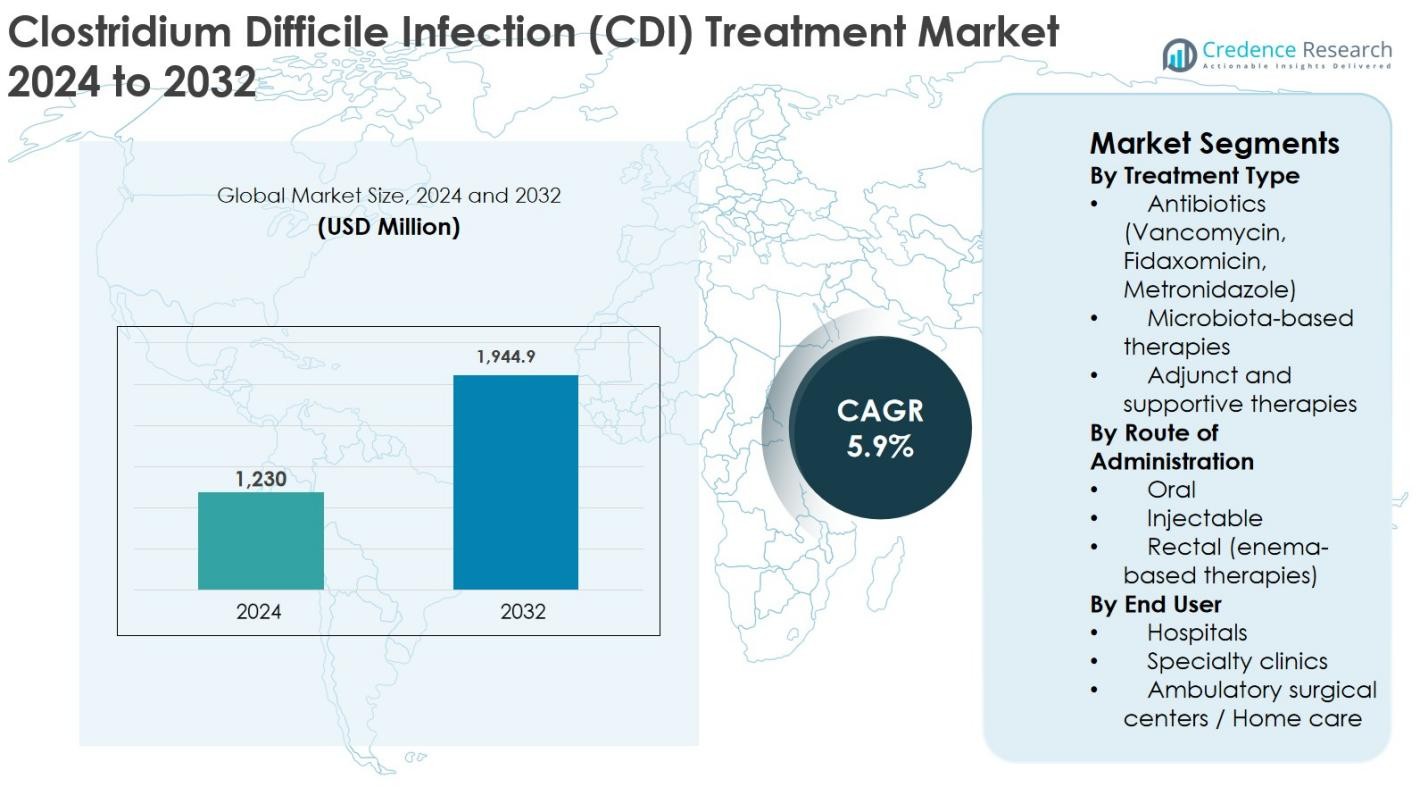

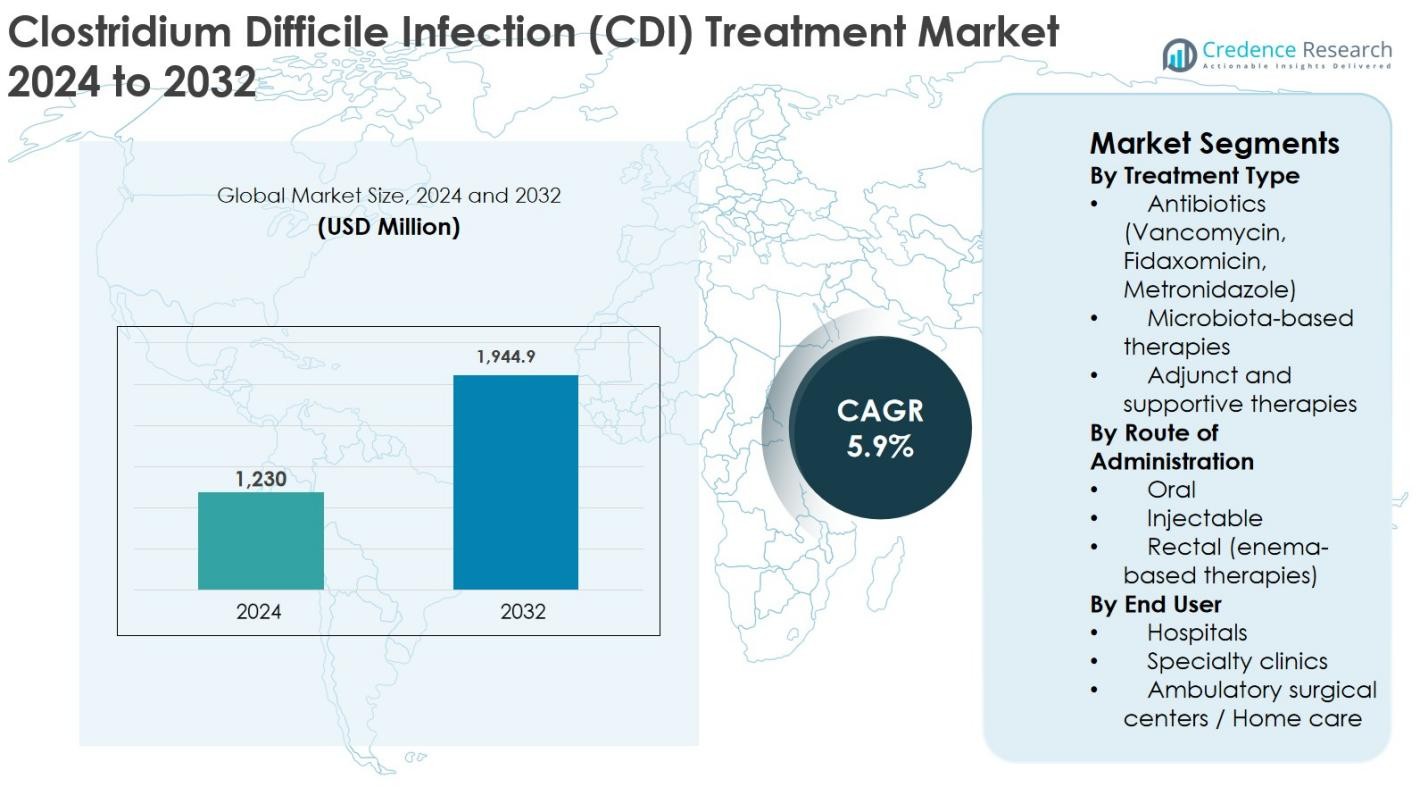

Clostridium Difficile Infection (CDI) Treatment market size was valued at USD 1,230 million in 2024 and is anticipated to reach USD 1,944.9 million by 2032, expanding at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Clostridium Difficile Infection (CDI) Treatment Market Size 2024 |

USD 1,230 Million |

| Clostridium Difficile Infection (CDI) Treatment Market, CAGR |

5.9% |

| Clostridium Difficile Infection (CDI) Treatment Market Size 2032 |

USD 1,944.9 Million |

Clostridium Difficile Infection (CDI) Treatment market is driven by the strong presence of established pharmaceutical companies and emerging biotechnology players focused on both antibiotic and microbiota-based therapies. Key companies such as Pfizer Inc., Merck & Co., Inc., Astellas Pharma Inc., Sanofi S.A., and Ferring Pharmaceuticals lead the market through robust product portfolios, extensive clinical experience, and global commercialization capabilities. Innovative players including Seres Therapeutics, Summit Therapeutics, Vedanta Biosciences, and Finch Therapeutics are strengthening competition by addressing recurrent CDI with advanced microbiome-based solutions. Regionally, North America dominates the CDI Treatment market with an exact market share of 41.6% in 2024, supported by high disease prevalence, advanced healthcare infrastructure, and rapid adoption of novel therapies, followed by Europe with 27.3% market share driven by strong hospital-based treatment demand and regulatory support.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Clostridium Difficile Infection (CDI) Treatment market was valued at USD 1,230 million in 2024 and is projected to reach USD 1,944.9 million by 2032, expanding at a CAGR of 5.9% during the forecast period.

- Market growth is primarily driven by the rising incidence of hospital-acquired infections, increasing elderly and immunocompromised populations, and higher recurrence rates of CDI, which significantly boost demand for effective antibiotic and microbiota-based therapies.

- Key market trends include the growing adoption of microbiota-based therapies for recurrent CDI and increasing preference for oral treatment options, with the antibiotics segment holding a dominant 68.5% market share in 2024, supported by widespread use of vancomycin and fidaxomicin.

- The competitive landscape is shaped by established players such as Pfizer Inc., Merck & Co., Inc., Astellas Pharma Inc., Sanofi S.A., and Ferring Pharmaceuticals, alongside emerging biotechnology companies focusing on microbiome innovation and targeted therapies.

- Regionally, North America led the market with 41.6% share in 2024, followed by Europe at 27.3%, Asia Pacific at 19.2%, Latin America at 7.1%, and Middle East & Africa accounting for 4.8%, reflecting differences in healthcare infrastructure and treatment access.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Treatment Type

The Clostridium Difficile Infection (CDI) Treatment market, by treatment type, is led by antibiotics, which accounted for 68.5% market share in 2024. Antibiotics such as vancomycin, fidaxomicin, and metronidazole remain the first-line therapy due to their proven clinical efficacy, rapid symptom control, and widespread physician familiarity. Fidaxomicin adoption continues to rise owing to its lower recurrence rates. Microbiota-based therapies are gaining traction in recurrent CDI cases, supported by regulatory approvals and microbiome research, while adjunct and supportive therapies maintain a smaller share focused on symptom management and recurrence prevention.

- For instance, the 2021 IDSA/SHEA focused update prefers fidaxomicin over vancomycin for an initial CDI episode because additional randomized trial data confirmed significantly lower recurrence risk with fidaxomicin while maintaining similar initial cure rates.

By Route of Administration

Based on route of administration, the oral segment dominated the Clostridium Difficile Infection (CDI) Treatment market with 72.1% share in 2024, driven by ease of administration, high patient compliance, and suitability for both inpatient and outpatient care. Oral formulations of vancomycin and fidaxomicin are widely prescribed and remain the preferred option for mild to severe CDI cases. Injectable therapies are primarily used in hospitalized patients with complications, while rectal enema-based therapies serve niche use cases for severe or refractory infections, supporting market diversity but limiting their overall share.

- For instance, oral vancomycin capsules and oral solutions are widely utilized as standard of care in both community and hospital settings for initial and recurrent CDI because they achieve high intraluminal concentrations in the colon without requiring intravenous access.

By End User

By end user, hospitals held the dominant position with 61.4% market share in 2024 in the Clostridium Difficile Infection (CDI) Treatment market. High hospitalization rates, increased incidence of healthcare-associated CDI, and access to advanced diagnostic and treatment protocols drive hospital dominance. Hospitals manage severe and recurrent CDI cases, supporting higher antibiotic and microbiota-therapy utilization. Specialty clinics are expanding their role in follow-up and recurrent infection management, while ambulatory surgical centers and home care settings are growing steadily due to early diagnosis, oral therapies, and cost-effective outpatient treatment models.

Key Growth Drivers

Rising Incidence of Healthcare-Associated Infections (HAIs)

The increasing prevalence of healthcare-associated infections, particularly Clostridium Difficile Infection (CDI), is a major growth driver for the CDI Treatment market. CDI remains one of the most common hospital-acquired infections globally, driven by prolonged hospital stays, extensive antibiotic usage, aging populations, and rising comorbidities. Elderly patients and immunocompromised individuals are at higher risk, significantly increasing treatment demand. Recurrent CDI cases further intensify the need for effective therapies, including advanced antibiotics and microbiota-based treatments. Hospitals are investing in early diagnosis and targeted treatment protocols to reduce infection burden and mortality rates. As healthcare systems prioritize infection control and patient safety, sustained demand for CDI treatments continues to accelerate market expansion.

- For instance, a tertiary-care hospital ICU cohort showed that broad‑spectrum antibiotic exposure and stays longer than one week were associated with markedly higher CDI incidence, leading the institution to implement stricter antimicrobial stewardship and CDI screening bundles.

Advancements in Antibiotic and Microbiome-Based Therapies

Continuous innovation in CDI therapeutics is significantly driving market growth. The shift from conventional broad-spectrum antibiotics toward targeted therapies such as fidaxomicin has improved clinical outcomes and reduced recurrence rates. Additionally, the emergence of microbiota-based therapies marks a paradigm shift in CDI management by restoring gut microbial balance rather than solely eliminating pathogens. Regulatory approvals for microbiome therapeutics have strengthened physician confidence and expanded treatment adoption, particularly for recurrent CDI. Ongoing clinical trials, increased R&D investments, and strategic collaborations between pharmaceutical and biotechnology companies further support innovation. These advancements address unmet clinical needs, improve long-term patient outcomes, and position novel therapies as key growth catalysts within the CDI Treatment market.

- For instance, randomized trials have shown that fidaxomicin achieves similar initial cure to oral vancomycin while significantly reducing recurrence risk, leading expert societies to endorse it as a first-line therapy for CDI in many patients.

Growing Awareness, Diagnosis Rates, and Treatment Accessibility

Improved awareness among healthcare professionals and advancements in diagnostic technologies are driving earlier and more accurate detection of CDI. Rapid molecular diagnostic tests and hospital screening programs have increased confirmed CDI cases, directly supporting treatment demand. Additionally, updated clinical guidelines emphasize early intervention and appropriate antibiotic stewardship, boosting therapy utilization. Expanding healthcare infrastructure in emerging markets and improved access to hospital care further contribute to market growth. Governments and healthcare organizations are implementing infection surveillance programs and reimbursement policies that encourage timely treatment. As diagnosis rates rise and access to effective therapies improves, the CDI Treatment market benefits from consistent and long-term demand growth.

Key Trends & Opportunities

Shift Toward Microbiota-Based and Recurrence-Focused Therapies

A key trend shaping the CDI Treatment market is the growing adoption of microbiota-based therapies aimed at preventing disease recurrence. Recurrent CDI remains a significant clinical challenge, creating opportunities for innovative treatments that restore gut microbiome balance. Regulatory approvals and positive clinical outcomes have accelerated physician acceptance of these therapies. Pharmaceutical companies are increasingly focusing on microbiome research, live biotherapeutic products, and combination approaches. This shift represents a long-term opportunity as healthcare providers seek durable solutions beyond antibiotics. The trend also supports premium pricing and differentiation, enabling manufacturers to capture higher-value segments within the evolving CDI treatment landscape.

- For instance, an FDA-approved fecal microbiota product is indicated specifically to prevent recurrent CDI in adults after completion of standard-of-care antibiotics, giving clinicians a regulated tool to lower relapse risk in high‑risk patients.

Expansion of Outpatient and Home-Based Treatment Models

The growing preference for outpatient and home-based CDI management represents a major opportunity for market expansion. Increased availability of oral therapies with strong safety profiles enables treatment outside hospital settings, reducing healthcare costs and improving patient convenience. Early diagnosis and improved disease monitoring support this transition, particularly for mild to moderate CDI cases. Home care adoption is further encouraged by aging populations and healthcare system efforts to reduce hospital readmissions. This trend opens new distribution channels and supports market penetration in ambulatory surgical centers and home healthcare environments, creating growth opportunities for oral and supportive CDI therapies.

- For instance, integrated delivery networks have introduced outpatient CDI pathways where newly diagnosed mild cases start oral therapy in the emergency department or clinic and then complete the full course at home under pharmacist- or nurse-led phone monitoring.

Key Challenges

High Recurrence Rates and Treatment Limitations

Despite therapeutic advancements, high recurrence rates remain a significant challenge in the Clostridium Difficile Infection (CDI) Treatment market. Standard antibiotic therapies often disrupt gut microbiota, increasing the likelihood of reinfection and repeated treatment cycles. Recurrent CDI cases require prolonged or combination therapies, increasing treatment complexity and cost. While microbiota-based therapies show promise, their adoption remains limited by clinical familiarity and availability. Managing recurrent infections continues to strain healthcare resources and highlights unmet clinical needs. These limitations challenge treatment effectiveness and underscore the need for durable, long-term solutions, potentially slowing optimal market expansion.

Cost Constraints and Limited Access in Emerging Markets

High treatment costs pose a major challenge, particularly for advanced antibiotics and microbiota-based therapies. Premium pricing limits accessibility in cost-sensitive healthcare systems, especially across emerging economies. Limited reimbursement coverage and budget constraints further restrict adoption of newer therapies. Inadequate diagnostic infrastructure and uneven healthcare access exacerbate underdiagnosis and undertreatment in developing regions. These economic and structural barriers hinder market penetration and widen treatment gaps. Addressing affordability, expanding reimbursement frameworks, and improving healthcare infrastructure remain critical challenges for sustained global growth in the CDI Treatment market.

Regional Analysis

North America

North America dominated the Clostridium Difficile Infection (CDI) Treatment market with 41.6% market share in 2024, driven by high CDI prevalence, advanced healthcare infrastructure, and strong adoption of innovative therapies. The United States accounts for the majority of regional revenue due to higher hospitalization rates, extensive antibiotic use, and widespread availability of fidaxomicin and microbiota-based treatments. Strong reimbursement frameworks, rapid regulatory approvals, and high awareness among healthcare professionals further support market leadership. Ongoing investments in microbiome research and infection control programs continue to strengthen North America’s position in the global CDI Treatment market.

Europe

Europe held 27.3% market share in 2024 in the Clostridium Difficile Infection (CDI) Treatment market, supported by a growing elderly population and rising incidence of hospital-acquired infections. Countries such as Germany, the UK, and France contribute significantly due to robust healthcare systems and adherence to updated clinical guidelines. Increasing adoption of advanced antibiotics and improving access to microbiota-based therapies drive regional growth. Government-led infection surveillance programs and antibiotic stewardship initiatives further enhance treatment utilization. Expanding diagnostic capabilities and favorable public healthcare coverage continue to support steady market expansion across Europe.

Asia Pacific

Asia Pacific accounted for 19.2% market share in 2024 and represents the fastest-growing region in the Clostridium Difficile Infection (CDI) Treatment market. Growth is fueled by expanding healthcare infrastructure, rising hospitalization rates, and improving awareness of CDI diagnosis and management. Countries such as China, Japan, and India are witnessing increased antibiotic consumption and better access to hospital care, driving treatment demand. Government investments in healthcare modernization and growing availability of oral CDI therapies support regional expansion. However, limited access to advanced microbiota-based treatments still constrains full market potential.

Latin America

Latin America captured 7.1% market share in 2024 in the Clostridium Difficile Infection (CDI) Treatment market, supported by improving healthcare access and rising awareness of hospital-acquired infections. Brazil and Mexico lead regional demand due to higher patient volumes and expanding hospital networks. Increased adoption of standard antibiotic therapies and gradual improvements in diagnostic infrastructure contribute to market growth. However, limited reimbursement coverage and cost sensitivity restrict penetration of premium treatments. Ongoing healthcare reforms and public health initiatives aimed at infection control are expected to support gradual market expansion across the region.

Middle East & Africa

The Middle East & Africa region accounted for 4.8% market share in 2024 in the Clostridium Difficile Infection (CDI) Treatment market. Growth is driven by improving hospital infrastructure, rising awareness of infectious diseases, and increasing government healthcare spending in countries such as Saudi Arabia and the UAE. Adoption remains concentrated on conventional antibiotic therapies due to cost constraints and limited access to advanced treatments. In Africa, underdiagnosis and limited healthcare resources restrain market growth. Continued investments in healthcare capacity and infection surveillance programs are expected to gradually improve regional market prospects.

Market Segmentations:

By Treatment Type

- Antibiotics (Vancomycin, Fidaxomicin, Metronidazole)

- Microbiota-based therapies

- Adjunct and supportive therapies

By Route of Administration

- Oral

- Injectable

- Rectal (enema-based therapies)

By End User

- Hospitals

- Specialty clinics

- Ambulatory surgical centers / Home care

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Clostridium Difficile Infection (CDI) Treatment market features a moderately consolidated competitive landscape characterized by the presence of established pharmaceutical companies and emerging biotechnology firms. Key players such as Pfizer Inc., Merck & Co., Inc., Astellas Pharma Inc., Sanofi S.A., and Ferring Pharmaceuticals maintain strong market positions through well-established antibiotic portfolios and global distribution networks. Biopharmaceutical innovators including Seres Therapeutics, Summit Therapeutics, Vedanta Biosciences, and Finch Therapeutics are intensifying competition by advancing microbiota-based and novel targeted therapies, particularly for recurrent CDI. Companies are actively investing in research and development, clinical trials, and strategic partnerships to address high recurrence rates and unmet clinical needs. Product differentiation, regulatory approvals, and expansion into outpatient and home-care settings remain critical competitive strategies. As treatment paradigms shift toward microbiome restoration and recurrence prevention, innovation-driven players are expected to gain increasing influence in the evolving CDI Treatment market.

Key Player Analysis

- Pfizer Inc.

- Merck & Co., Inc.

- Astellas Pharma Inc.

- Sanofi S.A.

- Ferring Pharmaceuticals

- Seres Therapeutics, Inc.

- Summit Therapeutics plc

- Vedanta Biosciences, Inc.

- Finch Therapeutics Group, Inc.

- Johnson & Johnson (Actelion Pharmaceuticals)

Recent Developments

- In June 2025, Idorsia announced a significant advancement in the development of its first bacterial vaccine for Clostridioides difficile infection, showing promising immunogenicity and tolerability in Phase I clinical data.

- In April 2025, Lumen Bioscience reported a 100% clinical cure rate in the sentinel cohort (Part A) of its REPREVE clinical trial (LMN-201) for CDI, marking a key therapeutic milestone.

- In February 2025, Mikrobiomik received approval of its Paediatric Investigation Plan (PIP) from the European Medicines Agency (EMA) for its C. difficile infection treatment program, enabling pediatric development pathways

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Treatment Type, Route of Administration, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Clostridium Difficile Infection (CDI) Treatment market will increasingly shift toward therapies focused on reducing recurrence and restoring gut microbiome balance.

- Microbiota-based and live biotherapeutic products will gain stronger clinical adoption, particularly for recurrent and severe CDI cases.

- Antibiotics will remain the primary treatment option, with continued preference for targeted agents that minimize disruption of gut flora.

- Ongoing research and clinical trials will expand the treatment pipeline, improving therapeutic efficacy and long-term patient outcomes.

- Early diagnosis and rapid molecular testing will support timely treatment initiation and improved disease management.

- Outpatient and home-based treatment models will expand due to greater use of oral therapies and efforts to reduce hospital readmissions.

- Strategic collaborations between pharmaceutical and biotechnology companies will accelerate innovation and market penetration.

- Regulatory support for novel microbiome therapies will encourage faster approvals and broader market acceptance.

- Emerging markets will experience gradual growth as healthcare infrastructure and infection awareness improve.

- Focus on antibiotic stewardship and infection prevention programs will shape sustainable demand for advanced CDI treatments.

Market Segmentation Analysis:

Market Segmentation Analysis: