Market Overview

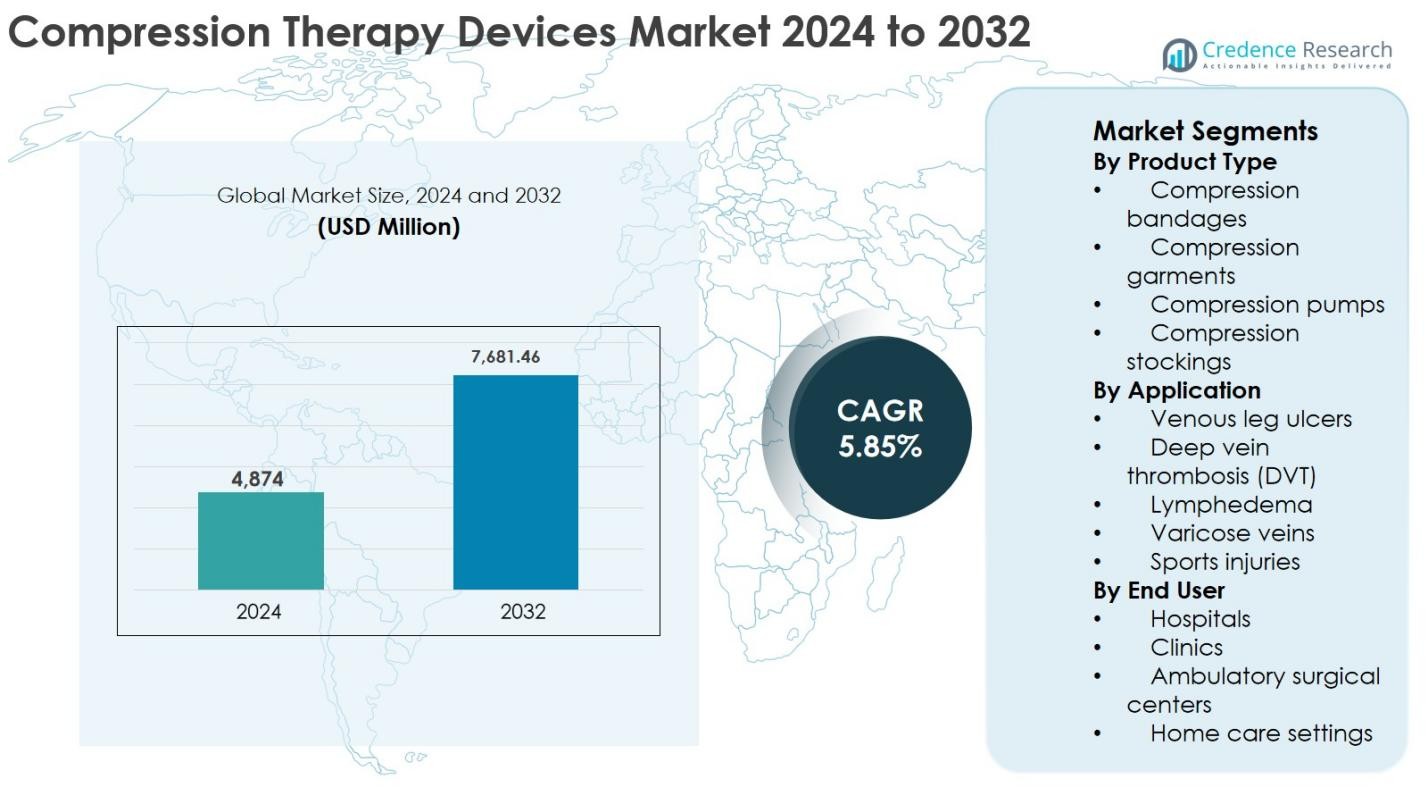

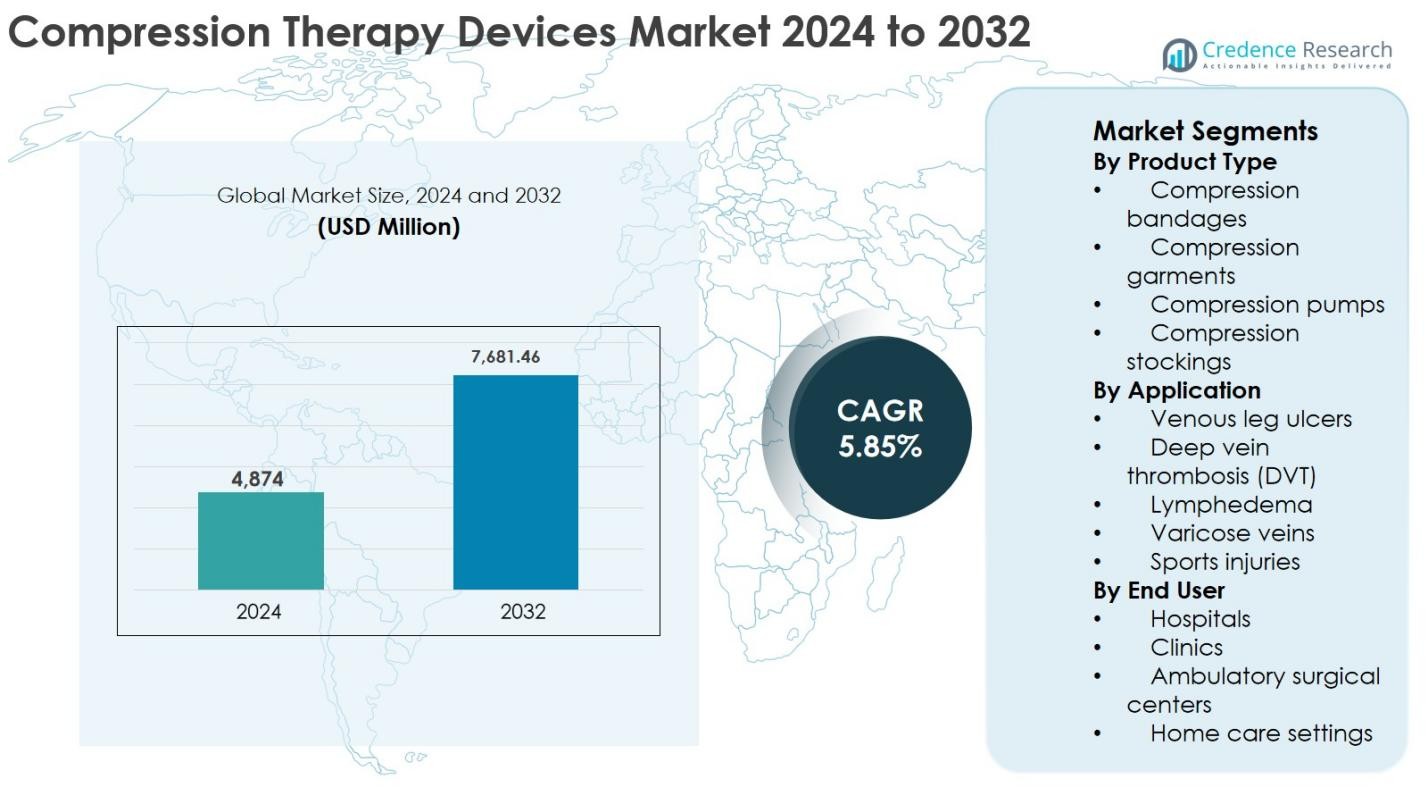

The Compression Therapy Devices Market size was valued at USD 4,874 million in 2024 and is anticipated to reach USD 7,681.46 million by 2032, growing at a CAGR of 5.85% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Compression Therapy Devices Market Size 2024 |

USD 4,874 Million |

| Compression Therapy Devices Market, CAGR |

5.85% |

| Compression Therapy Devices Market Size 2032 |

USD 7,681.46 Million |

The Compression Therapy Devices market is led by established manufacturers such as Mölnlycke Health Care AB, 3M, Essity Aktiebolag (BSN Medical), Cardinal Health, Arjo, Enovis (DJO Global), medi GmbH & Co. KG, Lohmann & Rauscher, Avanos Medical, and AIROS Medical, which collectively drive innovation across garments, stockings, and pneumatic compression systems. North America remains the leading region, accounting for 39% of the global market share in 2024, supported by strong reimbursement frameworks, high disease awareness, and advanced healthcare infrastructure. Europe follows with a 31% share, driven by an aging population and widespread adoption of compression therapy for chronic venous disorders. Asia Pacific holds a 21% share and demonstrates the fastest growth, supported by expanding healthcare access and rising vascular disease prevalence.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Compression Therapy Devices market was valued at USD 4,874 million in 2024 and is projected to reach USD 7,681.46 million by 2032, growing at a CAGR of 5.85% during the forecast period.

- Market growth is driven by the rising prevalence of chronic venous insufficiency, lymphedema, and deep vein thrombosis, along with increasing adoption of home-based compression therapy solutions for long-term disease management.

- Compression stockings dominated the product segment with a 38% market share in 2024, supported by ease of use, wide availability, and strong clinical recommendations, while smart and portable compression pumps represent a key emerging trend.

- Leading players such as Mölnlycke Health Care AB, 3M, Essity (BSN Medical), Cardinal Health, and Enovis focus on product innovation, portfolio expansion, and distribution partnerships to strengthen market presence.

- North America led the market with a 39% share in 2024, followed by Europe at 31% and Asia Pacific at 21%, with growth constrained by compliance challenges and reimbursement variability in emerging regions.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product Type

The By Product Type segment in the Compression Therapy Devices market is led by compression stockings, which accounted for 38% of the market share in 2024. Their dominance is driven by widespread adoption in chronic venous disorders, ease of use, availability across multiple pressure classes, and strong suitability for long-term and home-based therapy. Compression pumps follow, supported by rising use in lymphedema management and post-surgical recovery. Growth across this segment is further fueled by increasing awareness of preventive vascular care, expanding geriatric population, and continuous product innovation focused on comfort and compliance.

- For instance, Sigvaris Group offers graduated medical compression stockings in multiple compression levels (15–20 mmHg up to 40–50 mmHg) that are widely prescribed for chronic venous insufficiency and post-thrombotic syndrome.

By Application

Within the By Application segment, venous leg ulcers emerged as the dominant sub-segment, holding 34% of the Compression Therapy Devices market share in 2024. This leadership is attributed to the high global prevalence of chronic venous insufficiency and the proven clinical effectiveness of compression therapy in improving healing outcomes and reducing recurrence rates. Lymphedema and DVT also contribute significantly, supported by rising post-surgical complications and cancer-related lymphatic disorders. Market growth is driven by increasing diagnosis rates, improved clinical guidelines, and broader reimbursement coverage for compression-based treatments.

- For instance, clinical studies cited in 3M’s guidance on Coban 2 Layer Compression System report improved venous leg ulcer healing when sustained compression is applied compared to inactive dressings.

By End User

The By End User segment is primarily dominated by hospitals, which accounted for 41% of the market share in 2024. Hospitals lead due to high patient inflow for vascular disorders, availability of advanced compression systems, and greater physician preference for supervised therapy initiation. However, home care settings are witnessing accelerated growth, driven by the shift toward outpatient care, rising adoption of wearable compression products, and cost advantages. Expansion of ambulatory surgical centers and clinics further supports demand, as minimally invasive procedures increasingly require post-treatment compression management.

Key Growth Drivers

Rising Prevalence of Chronic Venous and Lymphatic Disorders

The Compression Therapy Devices market is strongly driven by the increasing global burden of chronic venous insufficiency, venous leg ulcers, lymphedema, and deep vein thrombosis. Aging populations, sedentary lifestyles, obesity, and prolonged standing or sitting associated with modern occupations have significantly increased vascular disorder incidence. Compression therapy remains a clinically recommended first-line treatment due to its proven effectiveness in improving venous return, reducing edema, and accelerating wound healing. The growing number of surgical procedures and cancer treatments has further increased the risk of post-operative and secondary lymphedema, expanding demand for compression devices across hospitals and home care settings. Increased disease awareness and earlier diagnosis, supported by improved screening protocols, continue to strengthen long-term demand for compression-based therapeutic solutions.

- For instance, Essity’s JOBST portfolio includes medical compression stockings and garments specifically designed for chronic venous disease and lymphedema, with product information emphasizing edema reduction, symptom relief, and support for long-term ulcer prevention.

Shift Toward Home-Based and Preventive Healthcare

The growing emphasis on home-based healthcare is a major growth driver for the Compression Therapy Devices market. Healthcare systems worldwide are prioritizing cost-effective treatment models that reduce hospital stays and enable patient self-management. Compression stockings, garments, and portable compression pumps are increasingly prescribed for long-term use at home, particularly for elderly patients and those with chronic vascular conditions. Technological advancements have enhanced device portability, ease of use, and comfort, improving patient compliance. Rising healthcare expenditures, combined with favorable reimbursement for home care in developed markets, are accelerating adoption. Preventive use of compression therapy among high-risk populations, including pregnant women, athletes, and individuals with sedentary lifestyles, further supports sustained market expansion.

- For instance, Tactile Medical’s Flexitouch Plus system is designed specifically for home-based treatment of lymphedema and chronic venous insufficiency, with the company citing real‑world data showing reduced limb volume and fewer episodes of cellulitis under regular home use.

Technological Advancements and Product Innovation

Continuous innovation in compression therapy technologies is a key driver of market growth. Manufacturers are introducing advanced materials that improve breathability, durability, and pressure accuracy, enhancing therapeutic outcomes and user comfort. Smart compression devices integrated with sensors, digital controls, and mobile applications are gaining traction by enabling personalized therapy and remote monitoring. Innovations in intermittent pneumatic compression systems have improved treatment efficiency for lymphedema and post-surgical recovery. Additionally, expanding product customization options, including adjustable pressure levels and anatomically tailored designs, are increasing adoption across diverse patient populations. These advancements support wider clinical acceptance and help manufacturers differentiate products in a competitive market environment.

Key Trends & Opportunities

Integration of Smart and Connected Compression Devices

The integration of smart technologies presents a significant trend and growth opportunity in the Compression Therapy Devices market. Connected compression pumps and garments equipped with sensors, Bluetooth connectivity, and mobile applications enable real-time monitoring of pressure levels and patient adherence. These features support personalized treatment plans and allow healthcare providers to track therapy effectiveness remotely. The rise of telehealth platforms has accelerated demand for digitally enabled devices that align with remote patient management models. Manufacturers investing in data-driven solutions are gaining a competitive advantage by improving clinical outcomes and reducing therapy non-compliance. This trend opens opportunities for partnerships between medical device companies and digital health providers.

- For instance, Breg’s VPulse system includes compliance monitoring and data capture features that allow clinicians to review patient usage data and support adherence in post-surgical compression therapy.

Expansion in Emerging Markets and Untapped Patient Pools

Emerging economies represent a strong growth opportunity for the Compression Therapy Devices market due to improving healthcare infrastructure and rising awareness of vascular disorders. Increasing prevalence of diabetes, obesity, and post-surgical complications in Asia-Pacific, Latin America, and the Middle East is driving demand for compression-based treatments. Government investments in healthcare modernization and expansion of private hospitals are improving access to advanced medical devices. Additionally, growing middle-class populations and rising disposable incomes are increasing affordability of compression garments and pumps. Market players focusing on cost-effective product lines and localized distribution strategies can significantly expand their presence in these high-growth regions.

- For instance, companies like Tactile Medical and AIROS Medical have highlighted international expansion strategies, including distribution partnerships outside North America, to reach lymphedema and chronic venous insufficiency patients in underserved regions.

Key Challenges

Patient Compliance and Comfort-Related Limitations

Patient compliance remains a major challenge in the Compression Therapy Devices market, particularly for long-term treatment regimens. Many patients experience discomfort, heat retention, difficulty in wearing garments, or improper fitting, which can reduce adherence to prescribed therapy. Incorrect usage or inconsistent wear significantly impacts treatment effectiveness, leading to suboptimal clinical outcomes. Elderly patients and individuals with limited mobility often struggle with donning and doffing compression garments without assistance. Despite advancements in material technology, balancing therapeutic pressure with comfort remains complex. Addressing these issues requires continuous design improvements, patient education initiatives, and clinician involvement to ensure proper device selection and usage.

Cost Constraints and Reimbursement Variability

High device costs and inconsistent reimbursement policies pose a significant challenge for the Compression Therapy Devices market. Advanced compression pumps and smart devices can be expensive, limiting adoption in cost-sensitive markets and among uninsured patient populations. Reimbursement coverage varies widely across regions and healthcare systems, often restricting access to premium products. In developing economies, out-of-pocket healthcare spending remains high, reducing affordability for long-term compression therapy. Additionally, limited reimbursement for preventive use further constrains market penetration. Manufacturers must focus on pricing strategies, evidence-based clinical validation, and engagement with payers to overcome financial barriers and improve market accessibility.

Regional Analysis

North America

North America dominated the Compression Therapy Devices market with a market share of 39% in 2024, supported by a high prevalence of chronic venous disorders, advanced healthcare infrastructure, and strong reimbursement frameworks. The United States drives regional growth due to widespread adoption of compression stockings and pneumatic pumps across hospitals and home care settings. Rising awareness of preventive vascular care, increasing surgical volumes, and rapid uptake of technologically advanced and smart compression devices further strengthen demand. Presence of leading manufacturers, strong clinical guidelines, and favorable insurance coverage continue to support sustained market leadership across the region.

Europe

Europe accounted for 31% of the Compression Therapy Devices market share in 2024, driven by an aging population and a high incidence of venous leg ulcers and lymphedema. Countries such as Germany, the United Kingdom, and France are key contributors due to well-established healthcare systems and strong physician preference for compression-based therapies. Widespread reimbursement support, growing home care adoption, and increased emphasis on chronic wound management underpin market growth. Additionally, the presence of major compression garment manufacturers and rising awareness programs across public healthcare systems continue to fuel regional demand.

Asia Pacific

Asia Pacific held 21% of the Compression Therapy Devices market share in 2024 and represents the fastest-growing regional market. Growth is driven by rising healthcare expenditure, expanding hospital infrastructure, and increasing prevalence of diabetes and vascular disorders. Countries such as China, Japan, and India are witnessing growing adoption of compression therapy due to improved diagnosis rates and expanding medical tourism. Increasing awareness of lymphedema management, coupled with a growing geriatric population, is accelerating demand. Expanding private healthcare facilities and improved access to affordable compression products further support strong regional growth.

Latin America

Latin America captured 6% of the Compression Therapy Devices market share in 2024, supported by improving healthcare infrastructure and rising awareness of venous and lymphatic disorders. Brazil and Mexico are the primary markets, driven by increasing hospital investments and expanding access to specialized vascular treatments. Growth is further supported by rising surgical procedures and gradual adoption of home care-based compression therapies. However, cost sensitivity and reimbursement limitations moderate market expansion. Ongoing healthcare reforms and increasing penetration of private healthcare providers are expected to gradually improve access and drive future growth.

Middle East & Africa

The Middle East & Africa region accounted for 3% of the Compression Therapy Devices market share in 2024. Market growth is driven by rising incidence of obesity, diabetes, and post-surgical complications, particularly in Gulf Cooperation Council countries. Expanding healthcare infrastructure, increasing government investments, and growing adoption of advanced medical devices support regional demand. However, limited awareness, uneven access to healthcare, and reimbursement constraints in parts of Africa restrict broader adoption. Continued healthcare modernization initiatives and rising focus on chronic disease management are expected to support steady long-term market growth.

Market Segmentations:

By Product Type

- Compression bandages

- Compression garments

- Compression pumps

- Compression stockings

By Application

- Venous leg ulcers

- Deep vein thrombosis (DVT)

- Lymphedema

- Varicose veins

- Sports injuries

By End User

- Hospitals

- Clinics

- Ambulatory surgical centers

- Home care settings

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Compression Therapy Devices market features a well-established landscape characterized by the presence of global medical device manufacturers and specialized compression therapy providers competing through product innovation, portfolio expansion, and geographic reach. Key players such as Mölnlycke Health Care AB, 3M, Essity Aktiebolag (BSN Medical), Cardinal Health, Arjo, Lohmann & Rauscher, medi GmbH & Co. KG, Enovis (DJO Global), Avanos Medical, and AIROS Medical focus on offering comprehensive product ranges spanning compression stockings, bandages, garments, and advanced pneumatic compression systems. Companies increasingly invest in smart and portable compression technologies to improve patient compliance and enable home-based care. Strategic initiatives including new product launches, acquisitions, and partnerships with hospitals and distributors strengthen market positioning. Strong brand recognition, clinical validation, and established distribution networks continue to play a critical role in maintaining competitive advantage across both developed and emerging markets.

Key Player Analysis

- medi GmbH & Co. KG

- Mölnlycke Health Care AB

- Enovis (DJO Global, Inc.)

- Lohmann & Rauscher GmbH & Co. KG

- AIROS Medical, Inc. (Devon Medical Products)

- Cardinal Health

- Julius Zorn, Inc.

- Essity Aktiebolag (publ) (BSN Medical Inc.)

- Arjo (Huntleigh Healthcare Limited)

- Avanos Medical, Inc. (Game Ready)

Recent Developments

- In November 2025, AIROS Medical, Inc. launched a new AIROS Medical Travel Case designed to allow patients to safely and conveniently transport their compression therapy devices while traveling.

- In October 2025, WRS Group, LLC announced an agreement to acquire Avanos Medical’s US Game Ready® orthopedic rental business, expanding its portfolio in therapeutic device solutions that include compression and recovery technologies.

- In February 2025, Tactile Medical expanded its U.S. rollout of the next-generation Nimbl pneumatic compression platform to include treatment for lower extremity conditions following its initial launch for upper extremity lymphedema

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Compression Therapy Devices market will continue to expand steadily, supported by rising prevalence of chronic venous and lymphatic disorders worldwide.

- Growing adoption of home-based care will increase demand for user-friendly, wearable, and portable compression solutions.

- Technological advancements will drive development of smart compression devices with digital monitoring and personalized therapy capabilities.

- Aging populations across developed and emerging economies will sustain long-term demand for compression therapy products.

- Hospitals will remain key end users, while home care settings will register faster adoption due to outpatient care trends.

- Increasing awareness of preventive vascular care will support wider use of compression therapy beyond clinical treatment.

- Expansion into emerging markets will accelerate as healthcare infrastructure and access to vascular treatments improve.

- Manufacturers will focus on product comfort, ease of application, and compliance-enhancing designs to improve outcomes.

- Strategic collaborations, acquisitions, and portfolio diversification will strengthen market positioning of key players.

- Regulatory support and improved reimbursement frameworks will gradually enhance market penetration and adoption rates.

Market Segmentation Analysis:

Market Segmentation Analysis: