| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| ASIC Intellectual Property (IP) Market Size 2024 |

USD 8,499.11 million |

| ASIC Intellectual Property (IP) Market, CAGR |

7.75% |

| ASIC Intellectual Property (IP) Market Size 2032 |

USD 16,112.34 million |

Market Overview:

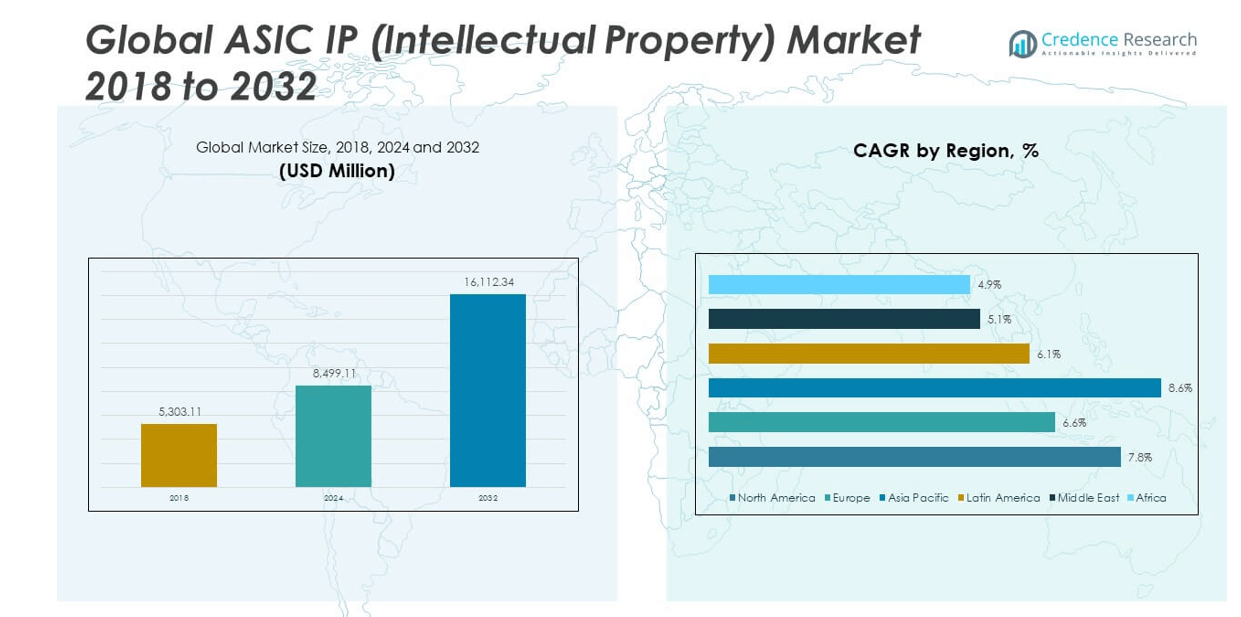

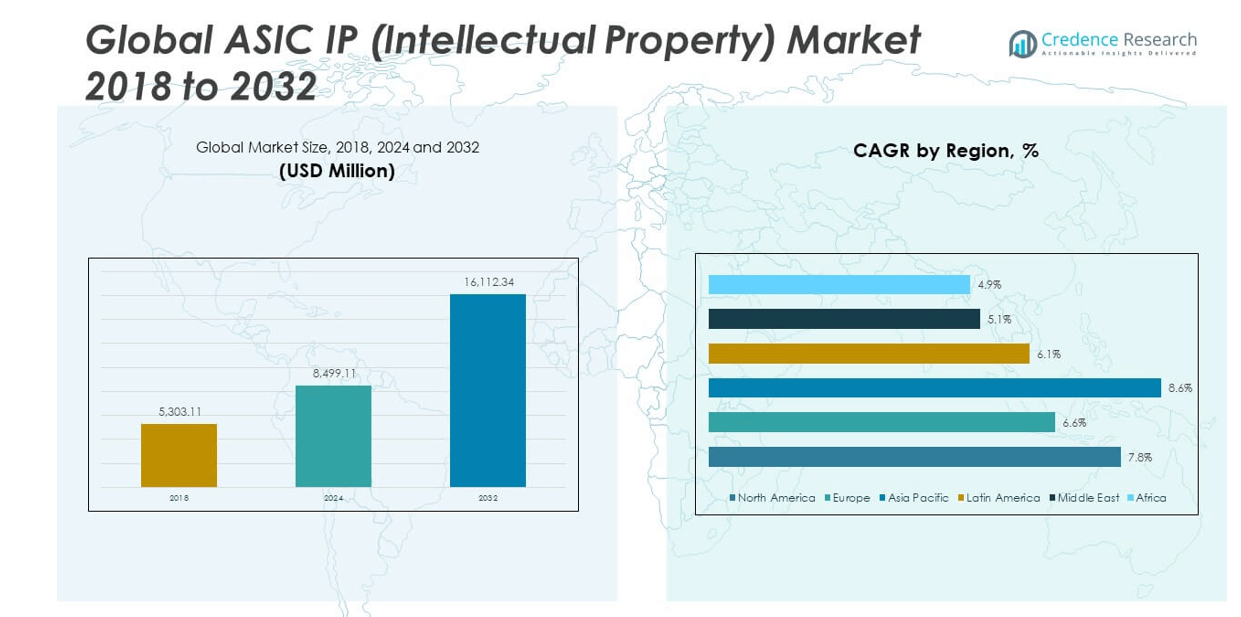

The Global ASIC Intellectual Property (IP) Market size was valued at USD 5,303.11 million in 2018 to USD 8,499.11 million in 2024 and is anticipated to reach USD 16,112.34 million by 2032, at a CAGR of 7.75% during the forecast period.

The Global ASIC IP Market is propelled by the surging demand for custom silicon solutions across emerging technologies such as AI, IoT, 5G, and automotive electronics. As organizations seek greater processing efficiency, reduced latency, and lower power consumption, ASICs integrated with tailored IP cores are becoming essential. The rise of AI and machine learning applications has heightened the need for domain-specific architectures, where ASICs offer both high performance and energy efficiency. Additionally, the rapid expansion of connected devices in consumer electronics and smart home systems is increasing the need for scalable and reusable IP cores. In the automotive sector, the transition to electric and autonomous vehicles has created a strong appetite for ASICs that enable sensor fusion, real-time data processing, and secure communications. Furthermore, the growing emphasis on design flexibility, faster time-to-market, and cost optimization continues to reinforce the adoption of pre-verified IP blocks in ASIC development workflows.

Asia Pacific holds the largest share of the ASIC IP market, driven by its dominant position in semiconductor manufacturing and electronics production. Countries such as China, Taiwan, South Korea, and Japan are major contributors, owing to the presence of leading foundries, fabless semiconductor companies, and robust consumer electronics sectors. The region benefits from extensive government support, skilled labor, and substantial investments in 5G infrastructure and automotive innovation. North America is witnessing rapid growth, supported by strong R&D capabilities and the presence of major IP vendors and chip designers. The U.S. leads in AI development, data center expansion, and the design of advanced application-specific processors. Europe maintains a stable market presence, with significant contributions from the automotive and industrial automation sectors. Countries like Germany and France are investing in semiconductor autonomy to reduce external dependencies. Meanwhile, Latin America, the Middle East, and Africa are emerging markets, showing gradual adoption of ASIC IP as digital transformation initiatives and industrial modernization efforts gain momentum.

Market Insights:

- The market was valued at USD 8,499.11 million in 2024 and is expected to reach USD 16,112.34 million by 2032, growing at a CAGR of 7.75%.

- Demand for custom silicon solutions in AI, IoT, and 5G is accelerating the adoption of ASIC IP cores across high-performance and edge applications.

- The market benefits from increasing 5G deployments, where IP cores enable low-latency communication and scalable network infrastructure.

- Growing focus on power efficiency and thermal optimization is driving integration of energy-efficient IP blocks in mobile, wearables, and compact systems.

- IP-based ASICs are enabling enhanced security and automation in design workflows, crucial for sectors like automotive, industrial, and defense.

- Key challenges include complex IP integration and verification, requiring advanced emulation tools and robust design frameworks.

- Asia Pacific leads the market with strong semiconductor manufacturing, while North America and Europe show growth through R&D strength and industrial innovation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Custom Silicon in AI, IoT, and High-Performance Applications

The Global ASIC IP (Intellectual Property) Market is expanding due to increasing demand for custom silicon solutions that enhance performance and efficiency. Enterprises across sectors are shifting toward application-specific designs to meet stringent computing, speed, and power requirements. AI-driven workloads, IoT device proliferation, and real-time data processing are fueling the adoption of ASICs embedded with optimized IP cores. These cores help reduce power consumption while improving computational throughput, making them ideal for edge devices and data-intensive environments. ASIC IP also enables companies to retain control over design features and intellectual property. It continues to gain preference in markets where generic processors fail to meet niche operational needs.

- For example, leading semiconductor companies like Marvell emphasize their advanced custom ASIC designs optimized for AI and cloud data centers using cutting-edge 5nm and 3nm process nodes. Marvell’s portfolio includes industry-leading IP cores such as 112G XSR SerDes and PCIe Gen 6 / CXL 3.0 SerDes, which enable high throughput and low power consumption critical for AI workloads and edge computing devices.

Rising Adoption of 5G and Connected Infrastructure Globally

The rollout of 5G networks is reinforcing demand for low-latency and high-speed ASIC architectures. Telecommunication equipment manufacturers rely on reusable IP cores to accelerate chip development and ensure consistent performance across infrastructure components. ASIC IP helps streamline the integration of hardware modules supporting baseband processing, signal filtering, and secure communication protocols. It plays a vital role in achieving the bandwidth and reliability targets set by next-generation mobile networks. The widespread deployment of 5G is pushing design teams to invest in IP portfolios that offer scalability, flexibility, and future-ready interfaces. This shift is positioning ASIC IP as a cornerstone in telecom and network equipment innovation.

- For instance, companies like AccelerComm provide specialized 5G NR physical layer IP accelerators that improve block error rates (BLER) by 0.7dB and offer Polar decoding cores that are 40% smaller than competing solutions, directly enhancing spectral efficiency and reducing power consumption in 5G base stations. Their IP solutions support full 3GPP compliance and provide configurable parallelism delivering up to 16x latency improvement, critical for meeting the stringent latency and bandwidth requirements of next-generation mobile networks.

Growing Emphasis on Power Efficiency and Thermal Management

Design efficiency and thermal control are driving IP demand within ASIC design cycles. Companies are increasingly focusing on reducing heat dissipation and improving battery performance in compact devices. ASIC IP enables the inclusion of specialized modules that optimize signal flow, clock gating, and data handling with minimal energy use. It proves essential in consumer electronics, wearables, and medical devices where space and battery life are critical. IP-based ASICs also contribute to extending product lifespan and reducing operational costs across the hardware ecosystem. The market continues to benefit from sustained investment in low-power design methodologies.

Expanding Role of Automation and Security in ASIC Design

The need for secure and automated design environments is enhancing the value of IP-based ASIC development. Pre-verified IP blocks accelerate prototyping and reduce risks associated with functional errors in complex systems. It supports faster time-to-market, allowing semiconductor firms to remain competitive in a dynamic landscape. ASIC IP also enables the integration of advanced security features, including cryptographic engines and trusted execution environments. This capability is essential in automotive, industrial, and defense sectors where data integrity and system protection are critical. Growing regulatory scrutiny and cybersecurity risks further elevate the importance of trusted ASIC IP solutions.

Market Trends:

Shift Toward Heterogeneous Integration and Advanced Packaging Technologies

The Global ASIC IP (Intellectual Property) Market is witnessing a structural transformation through the adoption of heterogeneous integration and advanced packaging. Designers are moving beyond traditional monolithic designs by incorporating multiple IP blocks within a single package or chiplet-based architecture. This evolution allows integration of analog, digital, memory, and RF IP into compact, high-performance systems. It enhances design flexibility while maintaining physical and functional separation of critical components. The trend supports the development of domain-specific architectures in edge devices and high-end computing. It also aligns with the industry’s push toward maximizing silicon area utilization and reducing interconnect complexity.

- For example, ASE Technology Holding Co., Ltd.has pioneered advanced heterogeneous integration by deploying its VIPack platform, which enables system-in-package (SiP) solutions with ultra-compact, high-capacity, and low-power modules.

Increasing Role of RISC-V and Open-Source IP Ecosystems

Open-source hardware models are creating new dynamics in the Global ASIC IP (Intellectual Property) Market. The adoption of RISC-V architecture is enabling organizations to reduce reliance on proprietary IP cores and licensing constraints. It promotes greater design freedom, cost control, and collaborative development across academic and commercial sectors. IP vendors are expanding support for RISC-V-based peripherals, accelerators, and SoC platforms. This openness is fostering innovation and allowing small and mid-sized players to compete with established semiconductor firms. It continues to reshape the competitive landscape by lowering entry barriers and encouraging modular, interoperable design frameworks.

Emphasis on Silicon-Proven IP for AI and Edge Inference Workloads

IP vendors are focusing on delivering silicon-proven cores tailored to AI inference, machine vision, and real-time processing at the edge. These IP blocks must meet strict latency, throughput, and memory constraints while ensuring compatibility with AI toolchains. The Global ASIC IP (Intellectual Property) Market is responding by offering configurable neural network engines, low-power DSP cores, and hardware accelerators pre-validated on silicon. It reduces risk for design teams and accelerates deployment in smart sensors, industrial automation, and wearable devices. The demand for ready-to-integrate solutions is growing across sectors seeking to avoid long validation cycles. This trend is pushing IP providers to invest heavily in hardware-software co-design and pre-silicon verification.

- For instance, BrainChip Holdings Ltd.has demonstrated the value of silicon-proven AI inference IP through its Akida neural processor. In industry benchmarks, Akida achieved relative performance efficiency scores up to 482x higher than conventional microcontrollers (e.g., Renesas RA6M4, ST STM32H7A3) in anomaly detection tasks, while maintaining energy consumption in the milliwatt range per inference.

Evolution of Licensing Models and IP Monetization Strategies

Licensing models in the ASIC IP ecosystem are undergoing notable changes to meet diverse business needs. Companies are shifting from traditional upfront royalty structures toward flexible models such as subscription-based licensing, usage metering, and pay-per-function access. This change supports design houses with shorter product cycles and smaller production volumes. The Global ASIC IP (Intellectual Property) Market is adapting by offering tiered licensing packages that accommodate startups, OEMs, and fabless firms with varied development scopes. It creates new monetization pathways and promotes recurring revenue streams for IP vendors. The evolving models also encourage deeper collaboration between IP providers and system integrators.

Market Challenges Analysis:

Rising Complexity of IP Integration and Design Verification

The Global ASIC IP (Intellectual Property) Market faces significant challenges stemming from the growing complexity of IP integration and verification processes. As SoCs incorporate multiple third-party IP cores, ensuring seamless interoperability across components becomes increasingly difficult. Each IP block must align with system-level design constraints, interface protocols, and performance targets, often leading to prolonged debugging and validation cycles. It places pressure on engineering teams to implement advanced verification methods such as formal verification and emulation, which can be time-consuming and costly. The risk of functional failures increases when IP lacks adequate documentation or is not silicon-proven. Ensuring design compliance across various foundries and process nodes also adds another layer of complexity.

Intellectual Property Protection and Regulatory Compliance Risks

The need for stronger IP protection and regulatory compliance presents another core challenge in the Global ASIC IP (Intellectual Property) Market. Unauthorized use, reverse engineering, and IP theft can undermine competitiveness and erode market trust. It forces IP vendors to adopt encryption techniques, watermarking, and secure licensing protocols, which may increase development time and operational overhead. Regulatory standards related to export controls, data privacy, and national security also restrict how and where IP can be licensed or deployed. Meeting the diverse legal requirements across global markets requires ongoing monitoring and adaptation. Failure to comply with these mandates can lead to legal liabilities and revenue losses for stakeholders involved in the IP supply chain.

Market Opportunities:

Expansion of Edge Computing and Industry-Specific Applications

The Global ASIC IP (Intellectual Property) Market holds strong opportunities in the rising demand for edge computing and domain-specific hardware. Edge devices in sectors like healthcare, automotive, and industrial automation require efficient, compact, and secure processing units. ASIC IP tailored for sensor fusion, AI inference, and real-time control can address these needs effectively. It enables rapid development of smart devices that meet power and performance constraints. IP vendors can capitalize on this trend by offering configurable cores optimized for vertical markets. The shift toward decentralized processing is opening new design pathways for high-value, purpose-built silicon.

Growing Adoption of Chiplet-Based Architectures and 3D ICs

Emerging chiplet-based designs and 3D integration technologies offer new growth avenues for IP providers. These architectures rely heavily on reusable IP blocks that can be integrated across dies or stacked vertically. The Global ASIC IP (Intellectual Property) Market can benefit by developing standardized interfaces and modular IP cores that align with these advanced packaging methods. It allows design teams to scale performance while controlling cost and yield risks. IP suppliers that support interoperability and ecosystem integration stand to gain competitive advantage. This shift is expected to drive long-term demand for flexible and scalable IP solutions.

Market Segmentation Analysis:

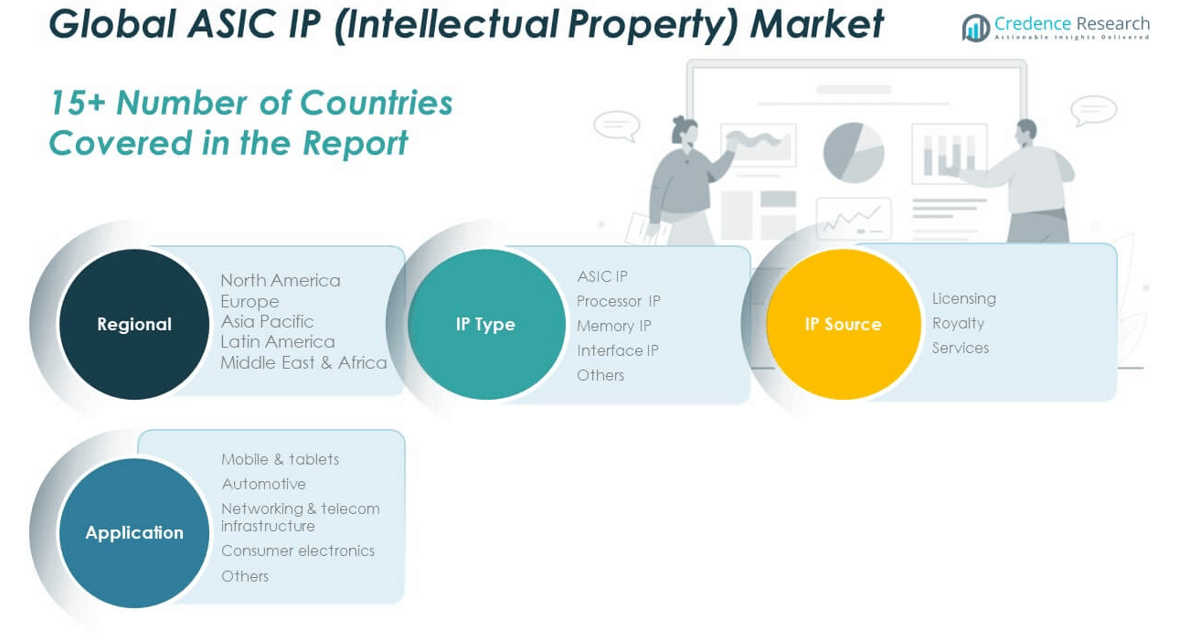

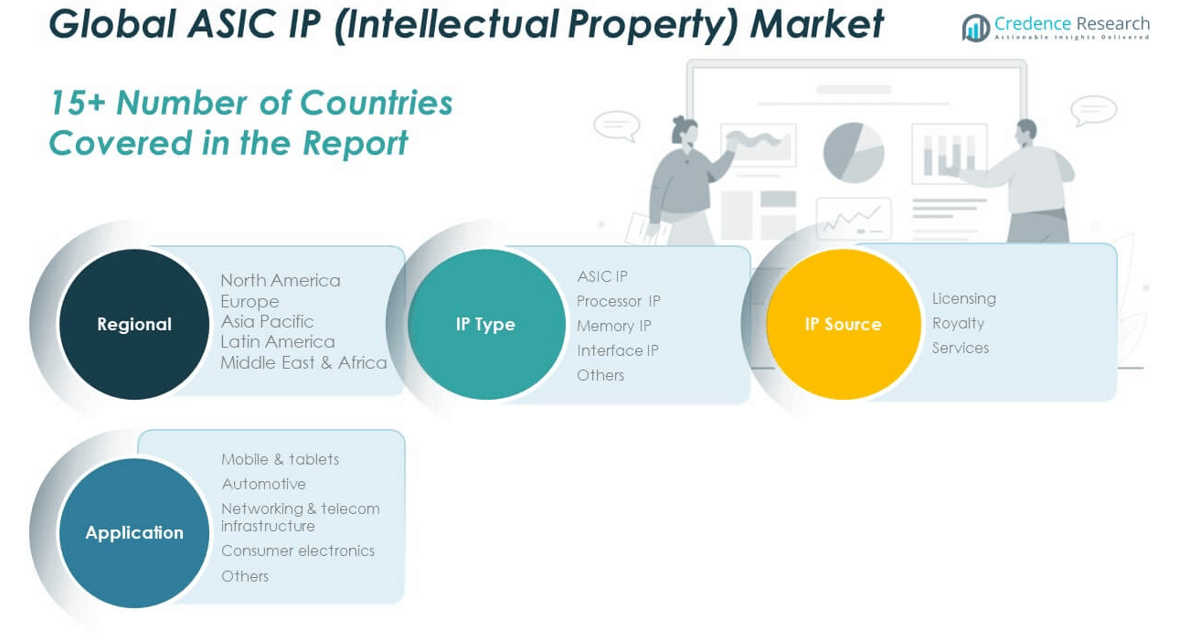

The Global ASIC IP (Intellectual Property) Market is segmented by IP type, IP source, and application, reflecting its diverse demand base across end-use industries.

By IP type, the market includes ASIC IP, Processor IP, Memory IP, Interface IP, and Others. Processor IP dominates this segment due to its critical role in AI accelerators, embedded systems, and SoCs. Memory IP is gaining traction in data-centric applications requiring low-power, high-speed access. Interface IP is essential for enabling connectivity across devices and contributes steadily to market growth.

By IP source, the market divides into Licensing, Royalty, and Services. Licensing holds the largest share, driven by pre-verified core adoption and reduced design cycles. Royalty-based models support recurring revenue streams for vendors, especially in high-volume production environments. Service-based IP, though smaller, supports custom integration, validation, and design consultancy.

- For example, companies like EnSilica and Fidus offer ASIC verification, integration, and design consultancy services, helping customers achieve first-time-right silicon and manage complex verification challenges for mixed IP designs.

By application, the market spans Mobile & Tablets, Automotive, Networking & Telecom Infrastructure, Consumer Electronics, and Others. Mobile & Tablets lead in IP consumption due to volume production and rapid innovation cycles. Automotive is a fast-growing segment, driven by electric vehicles and autonomous system demands. Networking and consumer electronics continue to adopt specialized IP cores to enhance performance and functionality.

- For instance, ASICs are critical for electric vehicles (EVs) and autonomous driving, integrating neural processing units (NPUs) and CPUs for real-time image processing and ADAS.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentation:

By IP Type

- ASIC IP

- Processor IP

- Memory IP

- Interface IP

- Others

By IP Source

- Licensing

- Royalty

- Services

By Application

- Mobile & Tablets

- Automotive

- Networking & Telecom Infrastructure

- Consumer Electronics

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America ASIC IP (Intellectual Property) Market size was valued at USD 1,519.08 million in 2018, reached USD 2,396.03 million in 2024, and is anticipated to reach USD 4,561.65 million by 2032, at a CAGR of 7.8% during the forecast period. North America holds a market share of 21.4% in the Global ASIC IP (Intellectual Property) Market. It leads in R&D investment and IP innovation, driven by strong presence of major semiconductor companies and advanced design houses. High demand for ASICs in datacenters, AI accelerators, automotive electronics, and defense systems supports continued market expansion. The U.S. remains the regional hub due to extensive government funding, a strong patent ecosystem, and collaboration between academia and private industry. Leading IP providers such as ARM, Synopsys, and Cadence operate extensively in this region. North America maintains technological leadership through early adoption of AI, cloud, and edge applications.

Europe

The Europe ASIC IP (Intellectual Property) Market size was valued at USD 1,055.95 million in 2018, reached USD 1,605.42 million in 2024, and is anticipated to reach USD 2,785.71 million by 2032, at a CAGR of 6.6% during the forecast period. Europe accounts for 14.3% of the Global ASIC IP (Intellectual Property) Market. It benefits from a mature industrial base and a strong focus on automotive and industrial electronics. Countries like Germany and France lead in adopting ASIC solutions for autonomous driving, robotics, and smart infrastructure. The European Union supports the semiconductor value chain through investment frameworks like the Chips Act. It is gradually increasing its self-sufficiency to reduce reliance on external chip suppliers. Regional players are also expanding their IP portfolios to align with sustainability goals and data security regulations.

Asia Pacific

The Asia Pacific ASIC IP (Intellectual Property) Market size was valued at USD 2,260.93 million in 2018, reached USD 3,760.64 million in 2024, and is anticipated to reach USD 7,574.65 million by 2032, at a CAGR of 8.6% during the forecast period. Asia Pacific holds the largest market share at 35.4% in the Global ASIC IP (Intellectual Property) Market. It leads in semiconductor manufacturing, supported by strong ecosystems in China, Taiwan, South Korea, and Japan. Rapid growth in consumer electronics, 5G infrastructure, and smart devices accelerates demand for high-performance ASIC IP. Regional foundries like TSMC and Samsung offer close integration between design and fabrication, enhancing IP reuse and customization. Government incentives in India and Southeast Asia further support local design talent and fabless startups. Asia Pacific is expected to retain its dominant position through aggressive investments in chip design and export capacity.

Latin America

The Latin America ASIC IP (Intellectual Property) Market size was valued at USD 244.60 million in 2018, reached USD 387.01 million in 2024, and is anticipated to reach USD 647.33 million by 2032, at a CAGR of 6.1% during the forecast period. Latin America holds a 3% market share in the Global ASIC IP (Intellectual Property) Market. The region is gradually expanding its electronics manufacturing and embedded system capabilities. Countries such as Brazil and Mexico are promoting domestic chip design and R&D through tech parks and university partnerships. Demand for ASIC IP is increasing in automotive components, telecommunications, and medical electronics. It still relies heavily on imports for IP cores and design software. Strengthening regional supply chains and fostering collaboration with global IP providers remain key growth opportunities.

Middle East

The Middle East ASIC IP (Intellectual Property) Market size was valued at USD 133.23 million in 2018, reached USD 193.07 million in 2024, and is anticipated to reach USD 301.57 million by 2032, at a CAGR of 5.1% during the forecast period. The region accounts for 1.4% of the Global ASIC IP (Intellectual Property) Market. Governments are supporting digital transformation through smart city programs, defense modernization, and renewable energy projects. These initiatives create a foundation for demand in custom ASIC designs. The region remains in early development stages for IP innovation but shows growing interest in partnerships with global vendors. Startups and universities in the UAE and Saudi Arabia are initiating semiconductor research clusters. It continues to focus on attracting investment to develop a knowledge-driven economy.

Africa

The Africa ASIC IP (Intellectual Property) Market size was valued at USD 89.33 million in 2018, reached USD 156.94 million in 2024, and is anticipated to reach USD 241.44 million by 2032, at a CAGR of 4.9% during the forecast period. Africa contributes 1.1% to the Global ASIC IP (Intellectual Property) Market. It is an emerging region with limited semiconductor design capacity and infrastructure. Most ASIC IP usage is linked to telecommunications, education technology, and basic automation. Countries like South Africa, Kenya, and Nigeria are increasing efforts to build digital capabilities. The market depends on imported IP solutions and lacks significant domestic IP development. Growing interest in smart agriculture and low-cost electronics could create future opportunities for custom ASIC adoption.

Key Player Analysis:

- Synopsys

- Arm Holdings

- Cadence Design Systems

- Imagination Technologies

- CEVA Inc.

- Lattice Semiconductor

- Faraday Technology

- Silicon Laboratories

- Marvell Technology

- Rambus

Competitive Analysis:

The Global ASIC IP (Intellectual Property) Market features a competitive landscape led by key players such as Synopsys, Cadence Design Systems, ARM (a subsidiary of SoftBank), CEVA Inc., and Imagination Technologies. It is shaped by constant innovation, portfolio expansion, and strategic alliances. Companies compete on the basis of IP breadth, silicon-proven reliability, design tool integration, and customer support. Leading firms invest heavily in R&D to develop IP cores tailored for AI, 5G, and edge computing applications. Emerging players focus on niche IP blocks and open-source frameworks like RISC-V to capture specific market segments. The market also sees increasing collaboration between IP vendors and foundries to ensure process compatibility and faster time-to-market. It remains highly dynamic, with mergers and acquisitions playing a key role in expanding IP libraries and global reach. Successful players differentiate through flexibility, design efficiency, and strong technical partnerships across the semiconductor value chain.

Recent Developments:

- In June 2025, Astera Labs and Alchip Technologies announced a strategic partnership to enhance connectivity for AI rack‑scale infrastructure. The collaboration integrates Astera Labs’ high‑speed PHY and controller IP with Alchip’s custom ASIC design capabilities. It aims to deliver validated, interoperable solutions for hyperscalers, accelerating time‑to‑market for advanced AI cluster networks.

- In March 2025, SEALSQ and IC’ALPS formed a partnership to integrate SEALSQ’s post‑quantum secure IP into IC’ALPS’ automotive ASIC designs. The alliance aims to deliver quantum‑resistant cryptographic features and functional‑safety compliance for vehicles. Initial QVault TPM samples are expected in Q1 2025.

- In February 2025, Siemens Digital Industries Software signed an exclusive OEM agreement with Alphawave Semi on February 12. The deal grants Siemens distribution rights to Alphawave’s high‑speed interconnect silicon IP including Ethernet, PCIe, CXL, HBM, and UCIe through its global EDA channels. It supports advanced SoC connectivity and chiplet‑based designs.

Market Concentration & Characteristics:

The Global ASIC IP (Intellectual Property) Market exhibits moderate to high market concentration, with a few dominant players controlling a significant share of global revenue. It is characterized by strong barriers to entry, including high R&D costs, extensive design expertise, and long client validation cycles. Leading firms maintain competitive advantage through proprietary IP portfolios, integration with design automation tools, and silicon-proven performance. The market favors vendors that offer scalable, reusable, and power-efficient cores across diverse applications. It shows a growing shift toward modular, configurable IP to support rapid prototyping and system customization. Standardization, interoperability, and foundry compatibility also define its competitive characteristics. It continues to evolve with advancements in chiplet integration, open-source IP frameworks, and domain-specific designs.

Report Coverage:

The research report offers an in-depth analysis based on IP type, IP source, and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for domain-specific accelerators will drive innovation in AI and edge device IP cores.

- Open-source architectures like RISC-V will gain traction, enabling broader access to customizable IP solutions.

- Growth in chiplet-based designs will increase the need for modular and interoperable IP cores.

- Expansion of 5G and IoT networks will push telecom and industrial sectors to adopt specialized IP.

- Automotive electronics and autonomous systems will create new opportunities for safety and security IP blocks.

- Cloud service providers will invest in custom ASICs, boosting demand for high-performance IP portfolios.

- Strategic collaborations between IP vendors and foundries will optimize design-to-silicon workflows.

- Emerging markets will gradually increase IP consumption through government-led digital infrastructure projects.

- Flexible licensing and subscription-based models will support broader adoption among startups and SMEs.

- Advancements in EDA tools will streamline IP integration, reducing design cycles and accelerating time-to-market.