Market Overview:

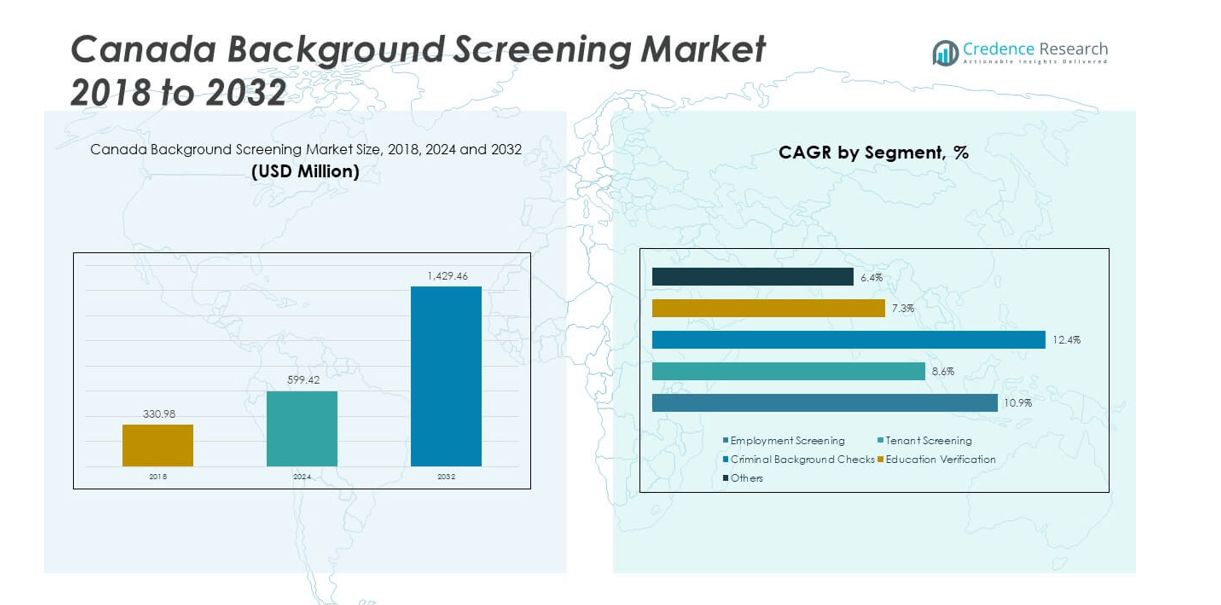

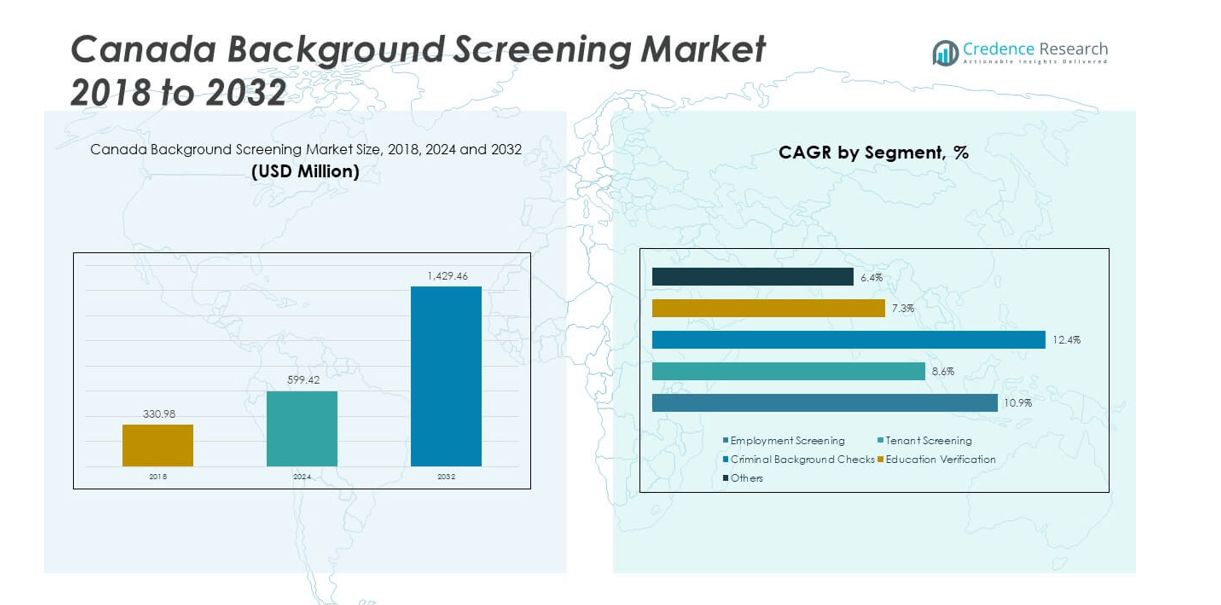

The Canada Background Screening Market size was valued at USD 330.98 million in 2018 to USD 599.42 million in 2024 and is anticipated to reach USD 1,429.46 million by 2032, at a CAGR of 10.69% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Canada Background Screening Market Size 2024 |

USD 599.42 million |

| Canada Background Screening Market, CAGR |

10.69% |

| Canada Background Screening Market Size 2032 |

USD 1,429.46 million |

Market drivers include the increasing emphasis on secure hiring due to regulatory mandates and rising fraud cases. Organizations are adopting advanced screening solutions to verify identities, education, and employment history. The market benefits from heightened awareness among businesses about reputational risks linked to poor hiring decisions. Technology integration, such as AI-powered verification systems and cloud-based platforms, is making processes faster, more reliable, and cost-efficient. These factors, combined with workforce expansion, continue to fuel industry growth across Canada.

Regionally, major metropolitan areas such as Ontario, Quebec, and British Columbia lead the Canada Background Screening Market due to their large corporate hubs and higher employment rates. These regions experience strong adoption across finance, healthcare, and IT sectors, where regulatory compliance is critical. Emerging provinces such as Alberta and Manitoba are catching up, driven by expanding energy and industrial sectors. This regional spread highlights a broader nationwide adoption trend, with both established and developing areas contributing to growth.

Market Insights:

- The Canada Background Screening Market was valued at USD 330.98 million in 2018, reached USD 599.42 million in 2024, and is projected to hit USD 1,429.46 million by 2032, growing at a CAGR of 10.69%.

- Ontario led with 38% share in 2024, followed by Quebec at 22% and British Columbia at 18%, driven by corporate hubs, regulated industries, and strong adoption in technology and education.

- Alberta, holding 12% share, is the fastest-growing region, supported by energy sector demand and industrial workforce expansion.

- Employment screening accounted for the largest segment share at 41% in 2024, reflecting its importance in corporate hiring and compliance.

- Cloud-based deployment captured 62% share in 2024, driven by scalability, remote accessibility, and integration with HR management systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Compliance and Risk Mitigation Across Canadian Industries:

The Canada Background Screening Market is experiencing strong growth due to regulatory compliance requirements across sectors. Organizations in healthcare, finance, education, and IT prioritize thorough checks to meet industry standards. Risk mitigation is now central to hiring strategies for businesses of all sizes. Employers focus on safeguarding their reputation by ensuring reliable verification practices. Growing concern over identity theft and document fraud has strengthened the need for strict background checks. Companies now treat screening services as an essential component of workforce management. It continues to expand due to the rising pressure from regulators and stakeholders.

- For instance, Sterling Backcheck, a leading background screening provider in Canada, supports clients with compliance through dedicated privacy and legal teams that ensure consistent adherence to Canadian regulations, aiding healthcare and finance sectors in meeting stringent verification rules, including handling complex criminal record checks with seamless process oversight across hundreds of clients monthly.

Expansion of Workforce in Urban and Regional Job Markets:

Increasing employment opportunities across major provinces has fueled demand for screening services. Ontario, Quebec, and British Columbia host large corporate hubs with rising recruitment needs. Employers in energy-driven provinces such as Alberta are also adopting these solutions. With a higher volume of new hires, businesses emphasize faster and accurate verification. This expansion has created opportunities for service providers to scale operations. Large organizations demand advanced platforms that can process bulk verifications quickly. It reinforces the importance of screening as part of business continuity. The Canada Background Screening Market benefits directly from this growing employment landscape.

- For instance, in Ontario, large organizations partnering with background check providers have leveraged automated solutions that process thousands of verifications monthly to meet the bulk screening demands of regional job markets. The expansion of these platforms has created opportunities for service providers to scale their operations, as large organizations increasingly demand advanced systems that can process bulk verifications efficiently.

Integration of Technology in Screening Solutions for Enhanced Efficiency:

Adoption of AI, automation, and cloud-based platforms is reshaping background verification processes. Employers prefer real-time systems that offer faster turnaround and reliable outcomes. Technology reduces manual errors and strengthens the accuracy of information collected. Companies now integrate digital solutions with HR systems for seamless workflows. Advanced platforms improve data security, which is vital in sensitive industries. With automation, organizations save time and streamline candidate onboarding. These innovations strengthen trust among recruiters and employees. It enhances the competitiveness of service providers in the Canada Background Screening Market.

Growing Awareness About Workplace Safety and Reputational Protection:

Organizations now view screening as a tool to create safer workplaces. Employers recognize the value of checking candidates’ past records to prevent misconduct. Businesses also aim to protect their brand reputation through reliable hiring practices. The increasing emphasis on workplace safety has expanded the scope of services. From criminal record checks to reference verification, demand continues to diversify. This broader adoption has fueled steady revenue growth for the industry. Companies prefer screening providers that offer comprehensive service packages. It has positioned background verification as a key element in workforce strategies.

Market Trends:

Adoption of Continuous and Post-Hire Background Checks Across Organizations:

Employers now demand continuous monitoring beyond pre-hire checks to ensure compliance. Organizations are adopting post-hire verification to mitigate risks from current employees. This trend highlights a shift from one-time checks to ongoing assessments. Continuous screening helps companies detect emerging risks linked to employees’ activities. Service providers are innovating platforms that can deliver such features efficiently. Employers in sensitive sectors, including healthcare and finance, adopt these practices quickly. It enhances the overall trust and security of organizational processes. The Canada Background Screening Market benefits from this growing demand for advanced solutions.

Shift Toward Cloud-Based and Mobile-Friendly Screening Platforms:

Service providers are investing in digital-first platforms that simplify candidate verification. Cloud-based solutions ensure scalability for companies with large recruitment volumes. Employers prefer mobile-friendly systems that allow candidates to upload data remotely. This shift improves user convenience and reduces operational delays for businesses. Digital adoption is also driven by the need for better data security standards. Mobile integration enhances engagement and transparency throughout the screening process. Companies with dispersed operations gain flexibility from cloud platforms. It has strengthened the appeal of digital services in the Canada Background Screening Market.

- For instance: Modern background screening companies, including Backgrounds Online, have adopted mobile-friendly technology that allows candidates to complete background checks on smartphones. This digital integration is a key industry trend that has been shown to improve candidate engagement, enhance data security, and help streamline the overall hiring process. The move to cloud-based platforms also offers increased flexibility for companies with dispersed operations.

Increasing Preference for Industry-Specific Screening Solutions and Customization:

Industries such as education, construction, and IT now demand tailored screening services. Employers seek packages that align with their unique regulatory and operational needs. This trend has led to specialization among providers offering sector-focused checks. Customization enhances the relevance and effectiveness of background verification processes. Businesses prefer service providers with expertise in their respective domains. Tailored solutions support compliance and improve hiring efficiency for specific industries. The move toward sector-based offerings has intensified market competition. It fosters innovation in the Canada Background Screening Market and expands service diversity.

Collaboration Between Screening Providers and Recruitment Platforms:

Partnerships between background check firms and recruitment agencies are gaining momentum. Integration of verification services with applicant tracking systems simplifies hiring. Employers value unified solutions that reduce delays during onboarding processes. These collaborations enhance the speed and reliability of candidate evaluation. Service providers benefit by expanding access to broader client bases. Recruitment platforms also gain by offering bundled verification solutions to users. This synergy supports long-term adoption across industries with high hiring volumes. It strengthens the growth potential of the Canada Background Screening Market.

Market Challenges Analysis:

Data Privacy Concerns and Compliance With Canadian Regulations:

The Canada Background Screening Market faces challenges from stringent data privacy laws. Employers and service providers must comply with federal and provincial legislation. Non-compliance exposes organizations to fines and reputational risks. Providers often struggle to balance efficiency with strict regulatory frameworks. Sensitive information requires advanced security measures, which increase operational costs. Mismanagement of personal data can erode trust between employees and employers. These factors create barriers for smaller providers entering the market. It underscores the importance of compliance-driven operations in the industry.

High Costs and Operational Complexities in Service Delivery:

The industry struggles with rising costs of advanced screening solutions. Small and medium-sized businesses find it difficult to adopt comprehensive checks. High expenses limit adoption in sectors with tight budgets and high turnover. Operational complexities also create delays during large-scale recruitment drives. Integration with HR systems requires technical expertise and resources. These barriers often discourage smaller organizations from leveraging screening solutions. Competitive pressure adds further strain on providers offering affordable services. It makes c ost optimization a critical challenge for the Canada Background Screening Market.

Market Opportunities:

Rising Demand for AI-Driven Platforms to Improve Accuracy and Speed:

Service providers can expand by offering AI-driven platforms for real-time verification. Employers now demand systems that deliver faster results without compromising accuracy. Artificial intelligence reduces manual intervention and ensures consistent data analysis. Automated systems also minimize human error, which is vital for sensitive industries. This growing need for intelligent tools creates space for innovation. It enhances user confidence in verification processes across organizations. The Canada Background Screening Market gains potential through these advanced platforms.

Expanding Opportunities in Emerging Sectors and Regional Markets:

Industries such as gig economy, retail, and e-commerce are embracing background checks. Growth in Alberta, Manitoba, and other provinces creates demand for localized services. Providers can design solutions catering to temporary, part-time, and seasonal workers. This flexibility supports businesses with dynamic workforce requirements. Expansion into underserved regions broadens service adoption significantly. Companies that focus on scalable, sector-specific solutions gain a competitive edge. It strengthens the role of the Canada Background Screening Market in nationwide workforce management.

Market Segmentation Analysis:

By Type

Employment screening dominates the Canada Background Screening Market, driven by corporate demand for accurate verification of candidates’ work history. Tenant screening is expanding as property managers adopt tools to reduce rental risks. Criminal background checks hold steady demand across sensitive industries such as banking and healthcare. Education verification is rising with employers emphasizing degree and certification authenticity. Other checks, including reference and credit history, add further value to the screening portfolio. It reflects the market’s broad role in supporting secure hiring and compliance.

- For example, Sterling Backcheck reported processing criminal record checks that use three-tiered searches (RCMP, local police, sex offender databases) across various industries, highlighting that financial institutions in Canada have implemented stringent criminal and employment verifications to mitigate fraud risks. Other checks, including reference and credit history, add further value to the screening portfolio.

By Deployment

Cloud-based deployment leads due to scalability, faster processing, and remote accessibility. Employers prefer integrated systems that align with modern HR management software. On-premises deployment retains significance in organizations with stricter data control policies. It addresses requirements in government agencies and highly regulated sectors. Service providers are tailoring hybrid solutions to balance compliance and efficiency. This mix allows businesses to adopt platforms that match their operational priorities. It ensures the market caters to diverse organizational needs.

- For instance, government agencies and highly regulated sectors in Canada frequently utilize on-premises or hybrid solutions to fulfill strict internal compliance and data residency requirements for secure data management. These sectors often have specific rules, governed by legislation like PIPEDA, that limit data transfers outside of Canada and necessitate robust security controls for sensitive information. Background screening in these sectors must align with these regulations, often making hybrid or on-premises deployment models a necessary choice.

By End User

IT and telecom sectors are major adopters, driven by large-scale hiring and data-sensitive operations. Healthcare follows closely, with compliance and patient safety fueling demand. Education institutions implement checks to safeguard students and staff. Government agencies emphasize rigorous screening to uphold regulatory integrity. Other sectors such as retail and financial services adopt tailored verification processes. It shows the Canada Background Screening Market is embedded across industries. This diversity in adoption underlines its growing role in workforce management.

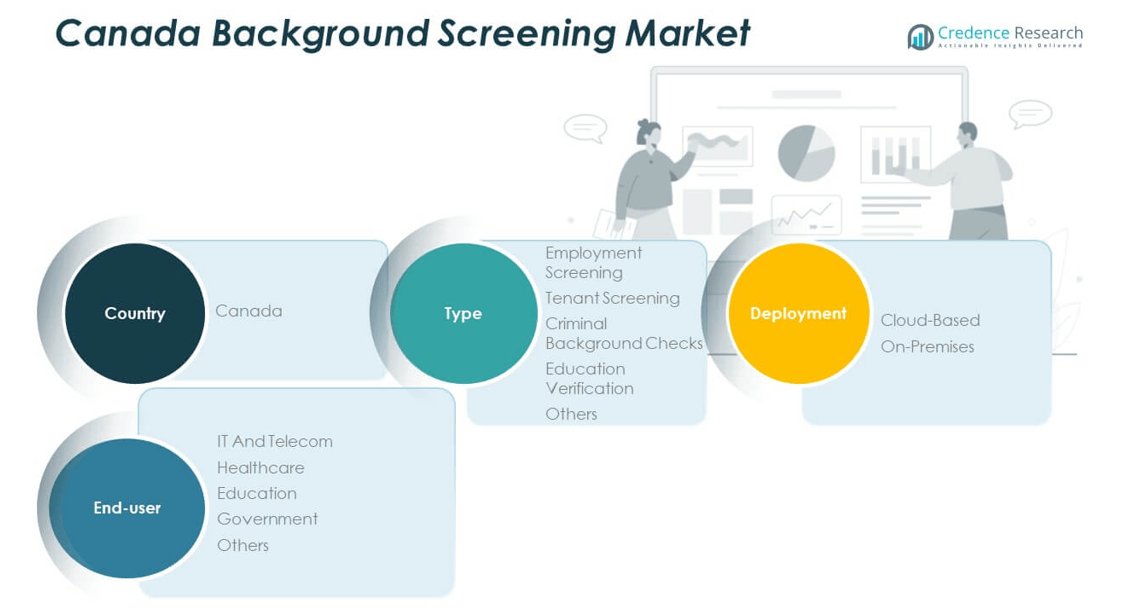

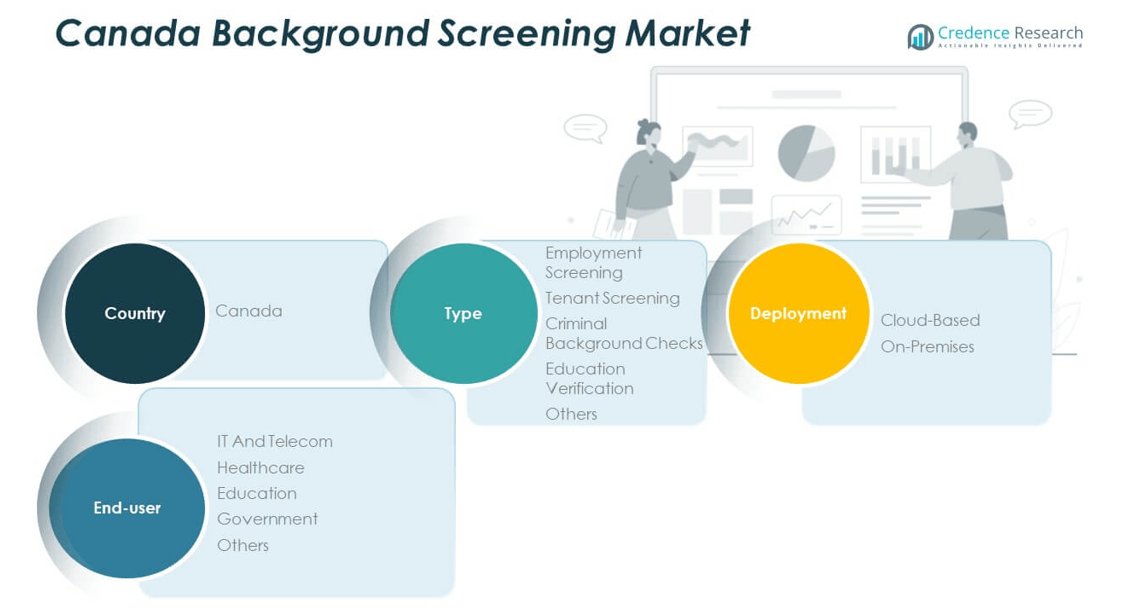

Segmentation:

By Type

- Employment Screening

- Tenant Screening

- Criminal Background Checks

- Education Verification

- Others

By Deployment

By End User

- IT and Telecom

- Healthcare

- Education

- Government

- Others

Regional Analysis:

Ontario and Quebec

Ontario leads the Canada Background Screening Market with nearly 38% share, supported by its position as the country’s economic hub. The province hosts major corporate headquarters, financial institutions, and technology firms that rely heavily on advanced screening solutions. Quebec follows with 22% share, driven by strong adoption in healthcare, education, and government sectors. Both regions emphasize compliance with provincial regulations, which accelerates service demand. Organizations focus on background checks to reduce hiring risks and strengthen workforce reliability. It highlights the importance of regulatory alignment and advanced technology adoption in these provinces.

British Columbia and Alberta

British Columbia commands around 18% share of the Canada Background Screening Market, supported by its expanding technology, film, and education sectors. Employers in this region adopt screening to ensure secure hiring in high-turnover industries. Alberta holds 12% share, largely influenced by the energy and industrial sectors. Demand for screening is strong in oil and gas companies that prioritize workforce safety and compliance. Both provinces are adopting digital platforms and cloud-based solutions to streamline verification. It reflects a growing emphasis on efficiency and integration with HR processes across western Canada.

Emerging Provinces and Territories

Other provinces, including Manitoba, Saskatchewan, and Atlantic Canada, collectively represent about 10% share of the Canada Background Screening Market. These regions are experiencing gradual adoption, particularly in government, retail, and education sectors. Employers focus on tenant and employment screening to minimize risks in expanding job markets. Service providers target these provinces with scalable, cost-effective solutions to penetrate smaller markets. The territories, while representing a minor share, are witnessing initial demand from public sector agencies. It indicates a broader nationwide adoption trajectory as background verification becomes integral to workforce management.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- HireRight

- First Advantage Corporation

- Certn

- Triton

- Accurate Background

- AuthBridge Research Services

- Mintz Global Screening

- Company 8 (to be finalized)

- Company 9 (to be finalized)

- Company 10 (to be finalized)

Competitive Analysis:

The Canada Background Screening Market is highly competitive, shaped by global providers and regional specialists. Major players such as HireRight, First Advantage, Certn, Triton, and Accurate Background hold significant presence through wide service portfolios and strong client relationships. Local companies like Mintz Global Screening strengthen their positions with tailored solutions for Canadian employers. Competition is fueled by technology integration, sector-specific offerings, and compliance-driven services. Firms focus on partnerships, digital platforms, and cloud-based solutions to enhance scalability and efficiency. It continues to evolve as companies differentiate through innovation, accuracy, and customer trust in delivering secure verification.

Recent Developments:

- In August 2025, AuthBridge released its “Workforce Fraud Files 2025” report highlighting significant discrepancy and fraud rates in workforce hiring based on data from October 2024 to March 2025. AuthBridge emphasizes the need for instant and ongoing verification powered by AI technology, continuing to serve clients globally across over 140 countries including Canada.

- In June 2025, HireRight released its 18th annual Global Benchmark Report, offering valuable insights into background screening, talent acquisition, and workforce management trends globally, including Canada. The report highlights key topics such as identity fraud and contingent workforce screening, helping companies compare their practices to regional and global trends.

- In April 2025, Triton announced a strategic long-term partnership with Sumitomo Mitsui Finance and Leasing Company to strengthen its business, supporting its growth and marketing efforts in Canada as well as globally.

- In February 2024, First Advantage Corporation announced its plan to acquire Sterling Check Corp. for approximately $2.2 billion in cash and stock. This transaction, expected to close in Q3 2024 pending regulatory approvals, will expand First Advantage’s capabilities and market presence in Canada and beyond.

- In December 2024, Accurate Background announced a partnership with Konfir to integrate instant employment verification technology into its screening solutions. This collaboration aims to provide faster and more comprehensive verification services for Accurate’s clients, including those in Canada.

- Mintz Global Screening, with over 100 years of experience, remains a leading background screening provider in Canada, recently participating in the Professional Background Screening Association (PBSA) Canada Conference 2025 to discuss industry trends and compliance challenges.

Report Coverage:

The research report offers an in-depth analysis based on type, deployment, and end-user segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Employment screening will remain the dominant type, supported by corporate hiring practices.

- Tenant screening adoption will rise with increasing demand in real estate and rental markets.

- Cloud-based deployment will strengthen as companies prioritize scalability and accessibility.

- AI-driven platforms will enhance accuracy, speed, and compliance of verification processes.

- Healthcare and IT sectors will continue driving strong adoption due to data sensitivity.

- Government agencies will expand usage to reinforce regulatory and security measures.

- Regional adoption in Alberta and Manitoba will grow with energy and industrial expansion.

- Partnerships between screening providers and recruitment platforms will intensify.

- Continuous background checks will gain traction for post-hire workforce monitoring.

- Technology innovation will shape competitive differentiation across the Canada Background Screening Market.