| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chiplet-based ASIC Market Size 2024 |

USD 4,215.72 million |

| Chiplet-based ASIC Market, CAGR |

19.73% |

| Chiplet-based ASIC Market Size 2032 |

USD 19,575.24 million |

Market Overview:

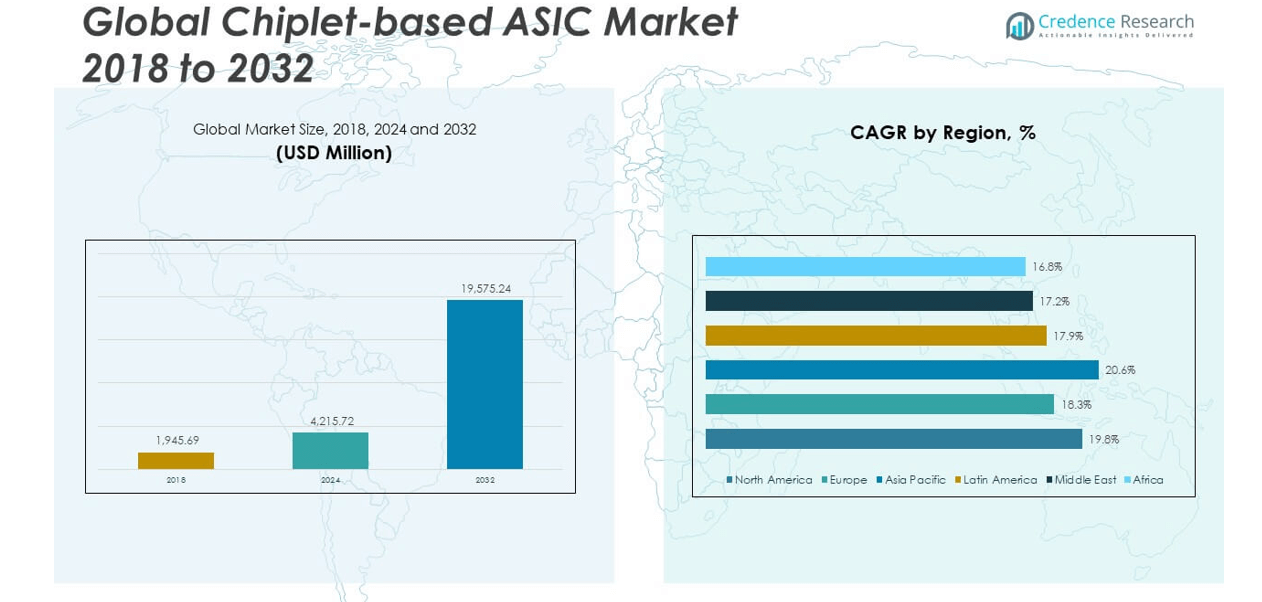

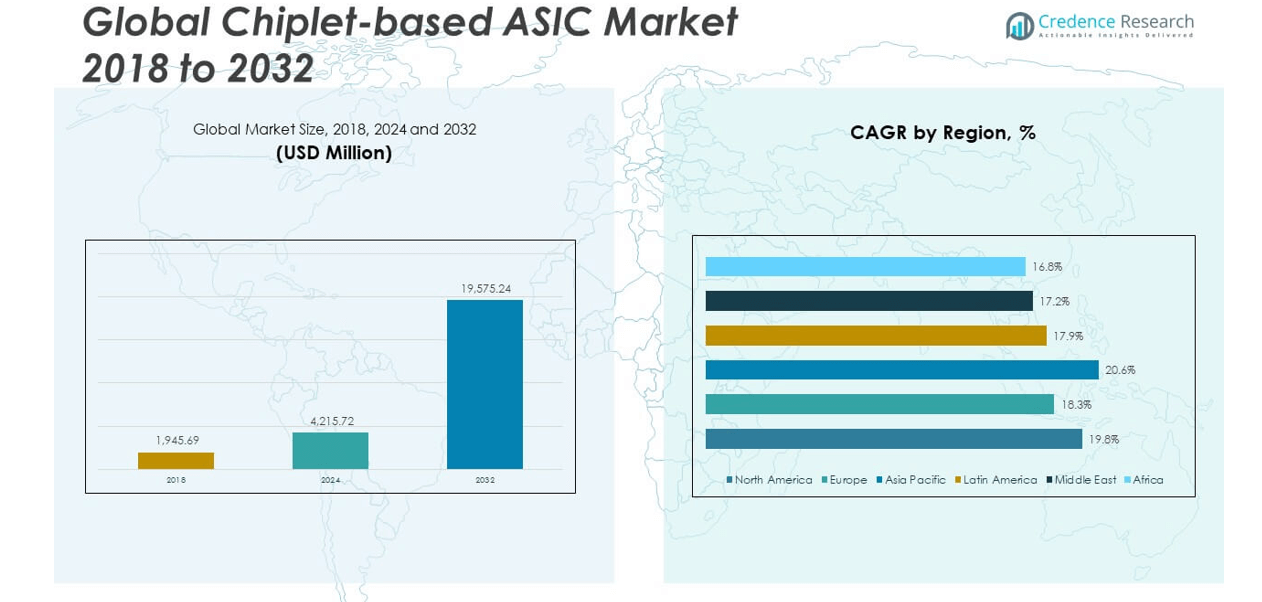

The Global Chiplet-based ASIC Market size was valued at USD 1,945.69 million in 2018 to USD 4,215.72 million in 2024 and is anticipated to reach USD 19,575.24 million by 2032, at a CAGR of 19.73% during the forecast period.

The key drivers fueling the growth of the chiplet-based ASIC market include the surging demand for high-performance and energy-efficient chips across AI, 5G, and edge computing domains. As semiconductor nodes continue to shrink, traditional monolithic chips face escalating challenges related to yield, cost, and power efficiency. Chiplets offer a compelling alternative by allowing the assembly of pre-tested functional blocks, enabling rapid customization and reducing time-to-market. Additionally, increasing investments from governments and tech giants in semiconductor R&D and manufacturing—particularly under initiatives like the U.S. CHIPS and Science Act—are further accelerating innovation in chiplet integration. The adoption of universal interconnect standards like UCIe is also facilitating seamless interoperability between chiplets from different vendors, opening up new avenues for collaboration and ecosystem development.

Regionally, Asia-Pacific dominates the global chiplet-based ASIC market, accounting for the largest revenue share due to the presence of leading semiconductor foundries and packaging facilities in countries such as Taiwan, South Korea, China, and Japan. The region benefits from a well-established electronics manufacturing ecosystem and rising demand from consumer electronics, automotive, and telecom sectors. North America follows closely, driven by robust R&D activity, government-backed initiatives, and strong participation from key players like AMD, Intel, and NVIDIA. The U.S. is rapidly becoming a hub for chiplet innovation, particularly in HPC and AI accelerator markets. Meanwhile, Europe is steadily advancing in this space through strategic investments in heterogeneous integration and sustainable semiconductor manufacturing. Other regions, including Latin America and the Middle East, are gradually adopting chiplet-based technologies through imports and global partnerships, contributing to a broadening of the market’s geographic footprint.

Market Insights:

- The market was valued at USD 4,215.72 million in 2024 and is projected to reach USD 19,575.24 million by 2032, growing at a CAGR of 19.73% during the forecast period.

- Increasing demand for high-performance, energy-efficient chips across AI, 5G, and edge computing is accelerating the shift from monolithic to modular chiplet-based designs.

- Modular chiplet architecture supports faster time-to-market by allowing the reuse of pre-tested IP blocks, reducing development cycles and lowering costs.

- Government initiatives like the U.S. CHIPS and Science Act and large-scale private R&D investments are fueling domestic semiconductor manufacturing and chiplet innovation.

- Adoption of UCIe (Universal Chiplet Interconnect Express) is enabling interoperability between chiplets from multiple vendors, fostering ecosystem growth and design flexibility.

- Challenges such as design complexity, verification bottlenecks, and shortage of skilled talent hinder rapid deployment, especially for smaller firms.

- Asia-Pacific dominates the market due to the strong presence of foundries and packaging hubs in China, Taiwan, South Korea, and Japan, followed by North America and Europe with growing investments in heterogeneous integration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Surging Demand for High-Performance Computing and AI Accelerators Drives Adoption

The Global Chiplet-based ASIC Market is witnessing rapid growth driven by escalating requirements in high-performance computing (HPC) and artificial intelligence (AI) workloads. Enterprises and data centers are under pressure to deliver faster computation and lower latency for AI inference and training. Chiplet-based architectures enable integration of specialized accelerators, memory blocks, and compute cores within compact, energy-efficient packages. This modular approach increases compute density and allows better thermal and power management. The flexibility to upgrade or scale specific functions without redesigning the entire chip further strengthens its position. It supports scalable system design for complex computing environments, fueling widespread adoption across cloud, edge, and supercomputing infrastructures.

- For example, AMD’s Instinct MI300 series integrates up to 146 billion transistors within a single package, using chiplet technology to combine CPU, GPU, and memory dies. This configuration delivers over 5.2 teraflops of FP64 computing performance for HPC and AI workloads at data centers, reducing AI inference times by up to 40% compared to prior monolithic architectures.

Modular Design Approach Enables Faster Time-to-Market and Lower Development Costs

One of the primary drivers of the Global Chiplet-based ASIC Market is the cost-effective and time-efficient nature of modular chiplet integration. Traditional monolithic ASICs require complete redesigns for every upgrade or function enhancement, significantly extending development cycles and increasing risks. In contrast, chiplet-based ASICs allow manufacturers to reuse proven IP blocks, reducing validation efforts and accelerating deployment timelines. This approach helps companies lower their R&D investments while achieving greater design flexibility. It also mitigates the complexity associated with shrinking process nodes, where cost and defect rates rise. The ability to assemble tailored solutions from standardized chiplets positions it as a preferred architecture for next-generation electronics.

Industry and Government Investments Accelerate Technological Advancements

Strong support from both private industry and government bodies continues to strengthen the Global Chiplet-based ASIC Market. Major technology companies are investing heavily in chiplet-enabled platforms to meet growing demands for advanced applications. Concurrently, governments are funding initiatives to localize semiconductor production and promote chiplet research. Programs such as the U.S. CHIPS and Science Act are channeling billions of dollars into domestic fabrication and advanced packaging facilities. These investments are improving manufacturing capabilities and encouraging ecosystem partnerships. The influx of capital is helping scale chiplet development while reducing dependency on global supply chains.

- For example, Samsung Electronics announced a $230 billion, decade-long initiative to build advanced packaging facilities for chiplet manufacturing in Korea the world’s largest single private sector investment in chiplet and advanced packaging capacity, targeting sub-10nm process nodes and next-generation TSV (through-silicon via) technology.

Standardization of Interconnects Enhances Interoperability and Ecosystem Growth

Wider adoption of open interconnect standards such as Universal Chiplet Interconnect Express (UCIe) is unlocking new growth opportunities in the Global Chiplet-based ASIC Market. Standardization enables interoperability between chiplets from different vendors, allowing designers to build multi-vendor systems without compatibility issues. This promotes a vibrant ecosystem where innovation is shared across the value chain, encouraging third-party development of specialized chiplets. It simplifies system integration, reduces design risk, and increases commercial viability of chiplet-based platforms. Industry-wide collaboration on interface protocols, testing, and co-packaging methods is enhancing supply chain resilience. As interoperability improves, it creates new avenues for product differentiation and modular scalability.

Market Trends:

Rising Adoption of Advanced Packaging Technologies for Heterogeneous Integration

Advanced packaging is emerging as a key trend in the Global Chiplet-based ASIC Market, supporting the integration of diverse functional blocks into a single package. Techniques such as 2.5D interposers, 3D stacking, and fan-out wafer-level packaging are gaining traction among semiconductor manufacturers. These methods allow dense interconnects, efficient heat dissipation, and minimal signal loss across chiplets. Companies are prioritizing heterogeneous integration to combine logic, memory, RF, and analog functions within compact footprints. This trend supports miniaturization while improving performance and bandwidth. It positions the market to cater to increasingly complex applications in edge computing, automotive systems, and high-speed networking.

- For example, TSMC has advanced its Chip-on-Wafer-on-Substrate (CoWoS) and System-on-Integrated-Chips (SoIC) technologies, which allow over 1,000 die-to-die interconnects per mm², with shipping volumes scheduled to surpass 1.2 million wafers per year by 2028.

Emergence of AI-Driven Design Automation in Chiplet Integration Workflows

Design automation tools powered by artificial intelligence are transforming development workflows in the Global Chiplet-based ASIC Market. Traditional design and verification processes involve extensive manual effort and iteration. AI-based design platforms are now streamlining architectural planning, floorplanning, and verification by predicting performance bottlenecks and optimizing chiplet placement. These platforms reduce the complexity of multi-chip integration and accelerate production timelines. It enables design teams to simulate multiple configurations before fabrication, minimizing errors and cost. The trend toward AI-driven design is shaping more intelligent, agile, and scalable development strategies in semiconductor design houses.

Growing Focus on Thermal and Power Optimization in Chiplet-Based Architectures

Thermal management and power optimization are gaining importance in the Global Chiplet-based ASIC Market due to increased integration density. Multi-chiplet packages create complex heat dissipation patterns that require advanced thermal solutions. Companies are investing in simulation tools, novel materials, and advanced cooling techniques to address these challenges. Innovations include thermal-aware floorplanning, integrated heat spreaders, and liquid-cooled packaging solutions. It enables high-performance chiplet designs to operate reliably under continuous load. The market is seeing more collaboration between chip designers and packaging engineers to co-optimize electrical and thermal characteristics.

Expanding Ecosystem of Third-Party Chiplet Providers and IP Vendors

A growing network of specialized chiplet and IP vendors is contributing to diversification in the Global Chiplet-based ASIC Market. This expanding ecosystem enables semiconductor companies to source chiplets for specific functions such as security, connectivity, AI, or memory from external suppliers. It supports modularity, reduces development burdens, and encourages innovation through ecosystem collaboration. The availability of pre-verified, interoperable chiplets from trusted vendors accelerates product development cycles. It is encouraging a shift toward platform-based ASIC development, where companies assemble solutions from a catalog of chiplets. This trend reflects a maturing market structure that prioritizes flexibility, customization, and supply chain scalability.

- For example, companies like Eliyan have presented 5 nm chiplet interconnect PHYs operating at 64 Gbps without interposers, lowering cost and complexity for partners.

Market Challenges Analysis:

Complexity in Design, Verification, and Integration Limits Widespread Adoption

Designing and integrating chiplet-based systems introduces significant architectural and verification complexity in the Global Chiplet-based ASIC Market. Engineers must manage intricate inter-chip communication protocols, signal integrity, and power delivery across heterogeneous components. Ensuring seamless interoperability among chiplets from different vendors adds further technical burden. Verification requires robust simulation environments and co-design tools that are still evolving. It increases development time and demands specialized talent, which is in short supply. These challenges make adoption difficult for smaller firms lacking advanced EDA tools and deep packaging expertise.

Supply Chain Fragmentation and Standardization Gaps Create Operational Risks

Supply chain fragmentation remains a persistent challenge in the Global Chiplet-based ASIC Market, particularly due to the involvement of multiple vendors in the assembly of a single product. Limited availability of standardized chiplet interfaces leads to compatibility issues and integration delays. The lack of mature, universally accepted interconnect protocols often forces companies to invest in proprietary solutions. It increases cost, slows scalability, and constrains ecosystem development. Regulatory trade barriers and geopolitical tensions also affect the flow of semiconductor components across borders. These factors collectively introduce uncertainty and operational risks for chiplet-based ASIC production.

Market Opportunities:

Rising Demand in Edge AI and IoT Devices Expands Commercial Potential

The Global Chiplet-based ASIC Market presents strong opportunities in edge AI and IoT applications, where compact, power-efficient, and high-performance solutions are essential. Chiplet-based architectures support customization, enabling designers to tailor compute, memory, and connectivity to specific use cases. It meets the growing need for localized intelligence in smart sensors, wearable electronics, and industrial automation systems. The ability to scale functionality without redesigning full systems offers a cost advantage for rapid product cycles. Market participants can capitalize on this trend by offering chiplet libraries optimized for low-power and real-time processing tasks. The integration of AI accelerators in edge devices is expected to further boost demand.

Expansion into Automotive and Aerospace Systems Creates Long-Term Growth Paths

The automotive and aerospace sectors offer emerging growth avenues for the Global Chiplet-based ASIC Market due to rising demand for advanced driver assistance systems (ADAS), autonomous navigation, and avionics. These applications require high-reliability semiconductors capable of handling large datasets in real time under strict thermal and safety constraints. It allows modular design with targeted integration of safety-critical and performance-critical components. Chiplets also support design redundancy and functional isolation, which are essential in mission-critical environments. Vendors focusing on automotive-grade and radiation-hardened chiplet solutions can secure a competitive edge. Regulatory shifts toward smarter mobility infrastructure are expected to support long-term adoption.

Market Segmentation Analysis:

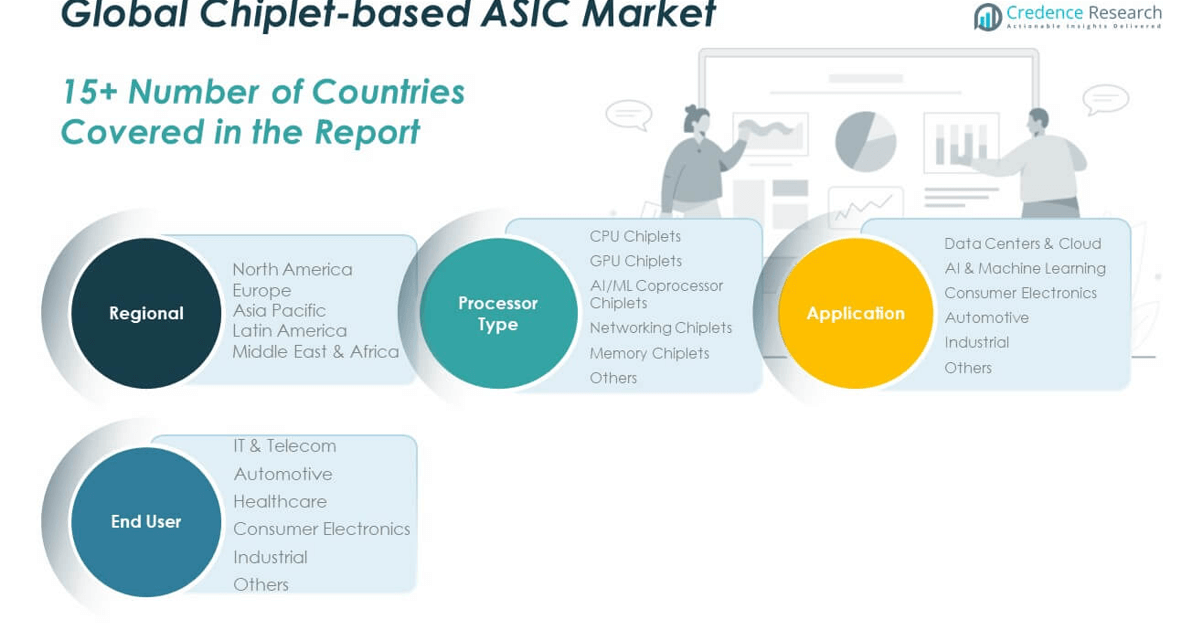

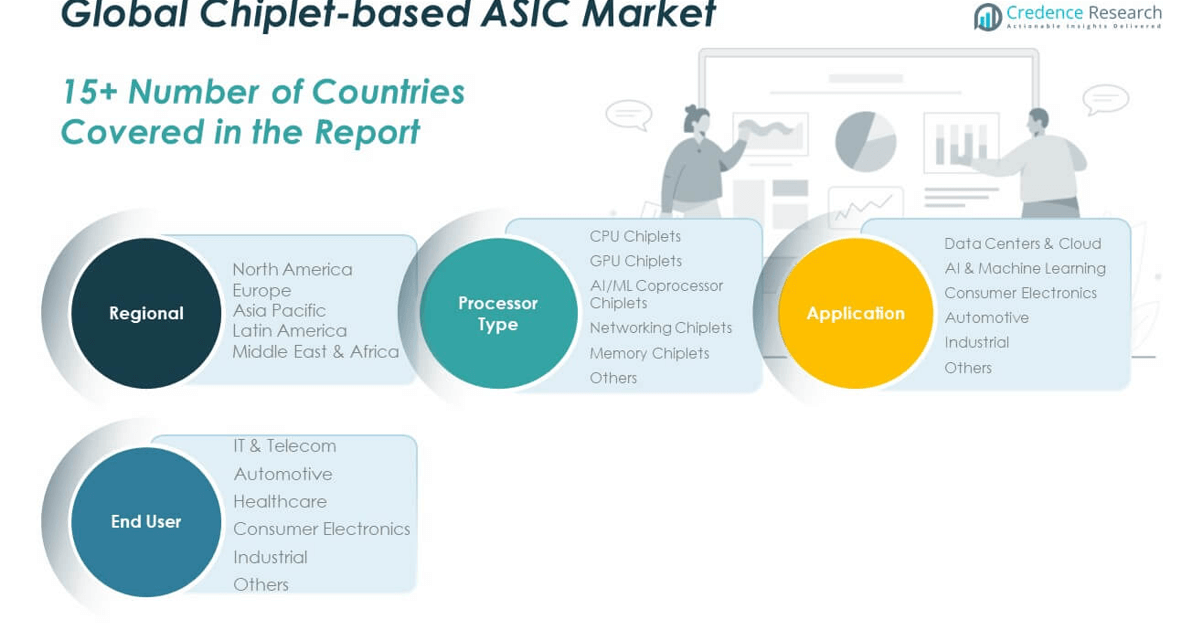

The Global Chiplet-based ASIC Market is segmented by processor type, application, and end user, each contributing uniquely to its growth trajectory.

By processor type, CPU chiplets dominate due to their critical role in general-purpose computing, followed by GPU chiplets, which power high-performance graphics and parallel workloads. AI/ML coprocessor chiplets are gaining momentum with rising demand for edge inference and data center training. Networking chiplets support high-bandwidth, low-latency communication in data-intensive environments, while memory chiplets enhance integration in advanced packaging solutions. The others segment includes custom accelerators and security-focused components.

- For example, AMD’s EPYC Genoa and Bergamo processors utilize a chiplet architecture with discrete CPU “core complex dies” (CCDs) on a single package. The EPYC 9654, for example, features 12 CCD chiplets and one I/O die, supporting up to 96 CPU cores and 12 memory channels per socket enabling top-tier general-purpose compute for cloud and enterprise deployments.

By application, the market is led by data centers and cloud, driven by increasing compute demand and modular server design. AI and machine learning continue to expand due to growing deployment of AI workloads across industries. Consumer electronics benefit from the integration of chiplets in compact, power-efficient devices. Automotive applications are rising with the adoption of ADAS and autonomous systems. Industrial segments leverage chiplets for automation and robotics. The others category includes aerospace, defense, and specialized embedded systems.

- For example, Microsoft’s Azure Cobalt CPU is built on Arm Neoverse CSS chiplet IP within server processors custom-developed for cloud scale, improving power efficiency by 30% compared to previous Azure server generations.

By end user, IT and telecom lead with widespread use in infrastructure and services. Automotive and consumer electronics follow due to rapid digitization and connectivity requirements. Healthcare is adopting chiplet-based solutions in diagnostic and wearable technologies. Industrial sectors rely on modular chiplets for robust, scalable hardware platforms. The others segment includes academic, defense, and R&D institutions.

Segmentation:

By Processor Type

- CPU Chiplets

- GPU Chiplets

- AI/ML Coprocessor Chiplets

- Networking Chiplets

- Memory Chiplets

- Others

By Application

- Data Centers & Cloud

- AI & Machine Learning

- Consumer Electronics

- Automotive

- Industrial

- Others

By End User

- IT & Telecom

- Automotive

- Healthcare

- Consumer Electronics

- Industrial

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Chiplet-based ASIC Market size was valued at USD 568.59 million in 2018 to USD 1,212.84 million in 2024 and is anticipated to reach USD 5,655.19 million by 2032, at a CAGR of 19.8% during the forecast period. North America holds a market share of around 21.7% and remains a key region due to the presence of major semiconductor firms such as Intel, AMD, and NVIDIA. The region benefits from strong investments in R&D, robust demand for high-performance computing, and government-backed initiatives like the CHIPS and Science Act. It continues to lead in the development of advanced chiplet packaging technologies and open standards such as UCIe. High deployment rates of AI, edge computing, and data center infrastructure further drive growth. The U.S. dominates the regional market due to its advanced design ecosystem and access to capital for scaling chiplet-based innovations.

Europe

The Europe Chiplet-based ASIC Market size was valued at USD 364.29 million in 2018 to USD 746.19 million in 2024 and is anticipated to reach USD 3,151.67 million by 2032, at a CAGR of 18.3% during the forecast period. Europe accounts for a market share of approximately 12.1% and is expanding steadily due to increasing government support for semiconductor autonomy. The European Chips Act and associated funding mechanisms aim to enhance local manufacturing and design capabilities. It focuses on automotive, aerospace, and industrial automation sectors where chiplet-based systems provide modular and scalable solutions. Germany, France, and the Netherlands are leading the region’s adoption of advanced semiconductor packaging and integration. Strong collaboration between research institutes and industry accelerates innovation in heterogeneous design.

Asia Pacific

The Asia Pacific Chiplet-based ASIC Market size was valued at USD 831.47 million in 2018 to USD 1,869.57 million in 2024 and is anticipated to reach USD 9,222.19 million by 2032, at a CAGR of 20.6% during the forecast period. Asia Pacific dominates the Global Chiplet-based ASIC Market with a market share of around 35.4%. It leads due to strong manufacturing capabilities and the presence of key foundries like TSMC, Samsung, and UMC. Rapid growth in consumer electronics, 5G infrastructure, and AI-enabled devices fuels demand for chiplet-based architectures. Countries such as China, South Korea, Taiwan, and Japan are investing in domestic semiconductor production to reduce dependency on imports. It benefits from an efficient supply chain and high-volume chiplet deployment across sectors.

Latin America

The Latin America Chiplet-based ASIC Market size was valued at USD 91.69 million in 2018 to USD 196.18 million in 2024 and is anticipated to reach USD 806.03 million by 2032, at a CAGR of 17.9% during the forecast period. Latin America represents a smaller market share of 3.1% but offers opportunities for long-term growth. Countries like Brazil and Mexico are increasing their focus on digital transformation and semiconductor adoption. It is slowly incorporating chiplet-based solutions in industrial IoT, telecom, and smart city infrastructure. The region imports most of its semiconductor components but is forming technology partnerships with global vendors. Government initiatives to attract foreign direct investment in electronics manufacturing may enhance market participation.

Middle East

The Middle East Chiplet-based ASIC Market size was valued at USD 54.72 million in 2018 to USD 108.41 million in 2024 and is anticipated to reach USD 425.11 million by 2032, at a CAGR of 17.2% during the forecast period. The region holds a market share of around 1.6%, supported by its efforts to diversify economies beyond oil through digital initiatives. The UAE and Saudi Arabia are investing in AI, smart infrastructure, and cloud data centers, creating demand for advanced semiconductors. It is exploring chiplet-based systems to meet performance needs in surveillance, energy, and autonomous mobility. Regional growth is driven by technology partnerships and import of high-performance computing hardware. Efforts to establish local research hubs may accelerate future adoption.

Africa

The Africa Chiplet-based ASIC Market size was valued at USD 34.93 million in 2018 to USD 82.52 million in 2024 and is anticipated to reach USD 315.06 million by 2032, at a CAGR of 16.8% during the forecast period. Africa contributes approximately 1.2% of the global market and remains in the early stages of semiconductor adoption. Growth is fueled by expanding internet access, digital infrastructure, and industrial automation across regions like South Africa, Nigeria, and Kenya. It relies on imports for chiplet-based technologies but is engaging in international collaborations for knowledge transfer. Education and R&D investments are increasing to build future semiconductor capacity. The market holds untapped potential for deploying compact, cost-effective chiplet-based systems in telecommunications, healthcare, and energy sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Intel Corporation

- AMD (Advanced Micro Devices)

- NVIDIA Corporation

- Marvell Technology

- Broadcom Inc.

- Samsung Electronics

- Tenstorrent Inc.

- Amazon Web Services (AWS)

- Alibaba Group (T-Head)

- Microsoft Corporation

Competitive Analysis:

The Global Chiplet-based ASIC Market features a competitive landscape shaped by leading semiconductor firms and innovative start-ups focused on modular chip design. Key players include Intel, AMD, TSMC, Samsung Electronics, Broadcom, and NVIDIA, all of which are advancing chiplet architectures through proprietary technologies and collaborative ecosystems. It is characterized by aggressive investment in packaging innovations, interconnect standards like UCIe, and vertical integration strategies. Companies are differentiating through performance optimization, low-power design, and scalable chiplet libraries. Strategic partnerships and acquisitions play a crucial role in expanding technical capabilities and accelerating time-to-market. The presence of specialized IP vendors and third-party chiplet providers enhances modularity and ecosystem diversity. The market encourages open innovation, where collaboration between foundries, EDA tool providers, and fabless design firms defines long-term leadership. Competitive intensity continues to rise as players seek to address growing demand from AI, HPC, automotive, and 5G segments with flexible, high-performance solutions.

Recent Developments:

- In May 29, 2025, Marvell Technology introduced an advanced multi-die packaging platform for AI accelerators. Marvell’s modular RDL interposer enables larger custom AI accelerator designs up to 2.8× bigger while reducing power consumption, improving die-to-die interconnect efficiency, and lowering overall costs. It has entered production in collaboration with a leading hyperscaler, positioning Marvell to meet growing demands in data center AI infrastructure

- In March 2025, Zero ASIC unveiled the world’s first open-standard embedded FPGA (eFPGA) product for chiplet-based systems. This marked a significant milestone as the architecture is 100% open and standardized, allowing the industry more flexibility and accessibility for custom silicon solutions. This new launch aims to accelerate development timelines and reduce the entry barrier for chiplet-based ASIC customers seeking reconfigurable logic in their SoC designs.

- In March 2024, Intel researchers revealed a novel approach to optimizing power efficiency and reliability in chiplet-based systems through the UCIe (Universal Chiplet Interconnect Express) architecture. Their advancement aims to support modern System-in-Package (SiP) designs by reducing circuit frequencies while still delivering high performance, directly addressing increasing demands for more efficient chiplet-based ASICs in computing applications.

Market Concentration & Characteristics:

The Global Chiplet-based ASIC Market exhibits moderate to high market concentration, with a few dominant players driving technological advancements and setting design standards. It features a blend of established semiconductor companies and niche vendors specializing in chiplet IP and interconnect solutions. The market operates with high entry barriers due to complex design requirements, significant R&D costs, and reliance on advanced packaging capabilities. It is characterized by rapid innovation cycles, increasing standardization efforts, and growing ecosystem collaboration. Demand for customization, power efficiency, and modular scalability shapes product development. The presence of strong vertical integration and strategic alliances enhances supply chain control and accelerates deployment. Market dynamics are influenced by geopolitical factors, regulatory policies, and global investment in semiconductor infrastructure.

Report Coverage:

The research report offers an in-depth analysis based on processor type, application, and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market is expected to witness exponential growth driven by rising demand for modular, high-performance computing architectures.

- Advancements in 2.5D and 3D packaging technologies will enhance chiplet integration and signal efficiency.

- Adoption of open interconnect standards like UCIe will boost cross-vendor compatibility and ecosystem development.

- Increased deployment of chiplet-based designs in AI, 5G, and automotive sectors will expand application diversity.

- Strategic investments from governments and private players will strengthen domestic manufacturing and R&D capabilities.

- Growth of edge computing and IoT devices will drive demand for compact, energy-efficient chiplet solutions.

- Expanded availability of third-party chiplet IPs will accelerate design cycles and lower development costs.

- Emerging markets in Latin America, the Middle East, and Africa will gradually increase adoption through imports and partnerships.

- Rising need for thermal optimization and system reliability will spur innovation in co-design methodologies.

- Competitive intensity will increase as fabless companies and foundries adopt chiplet architectures to differentiate offerings.