Market Overview

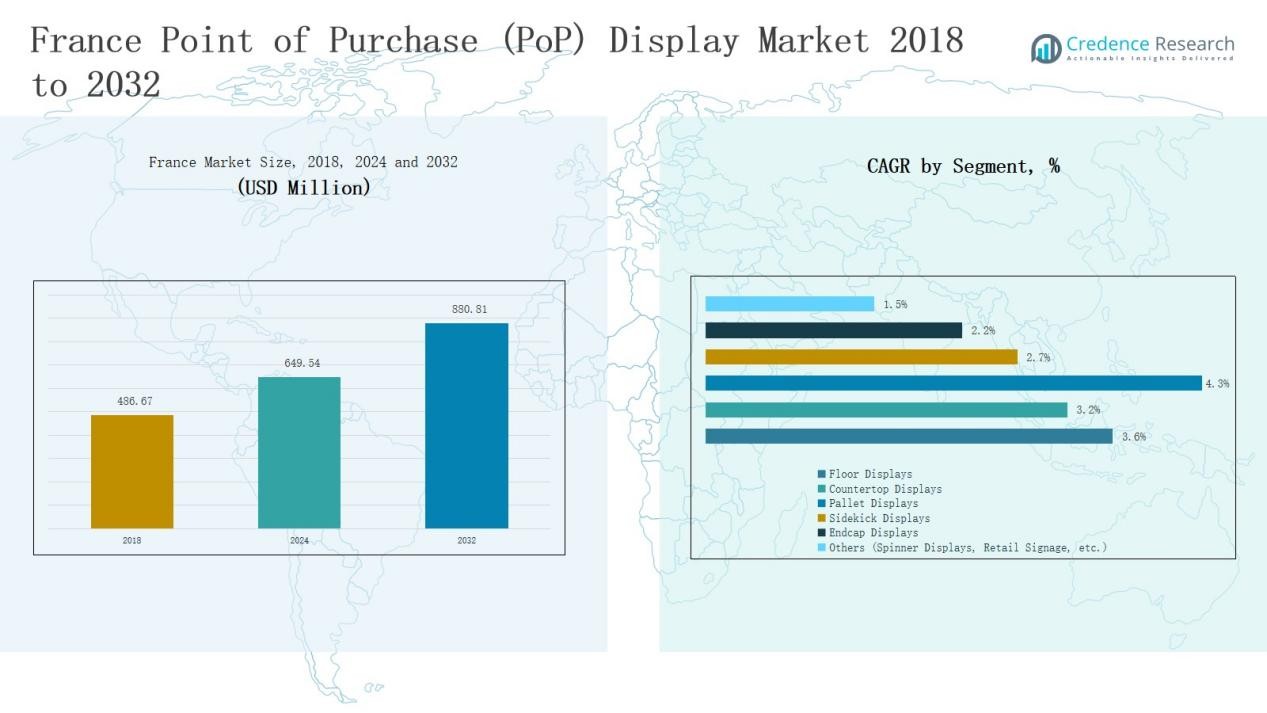

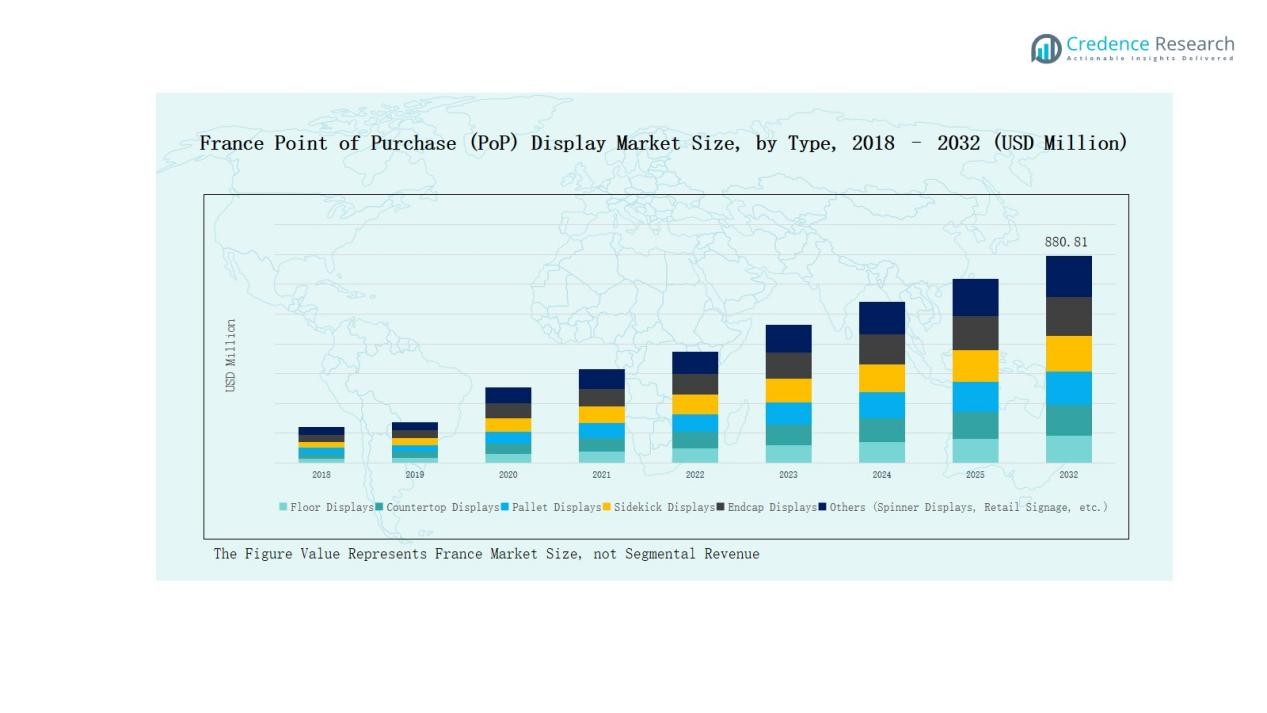

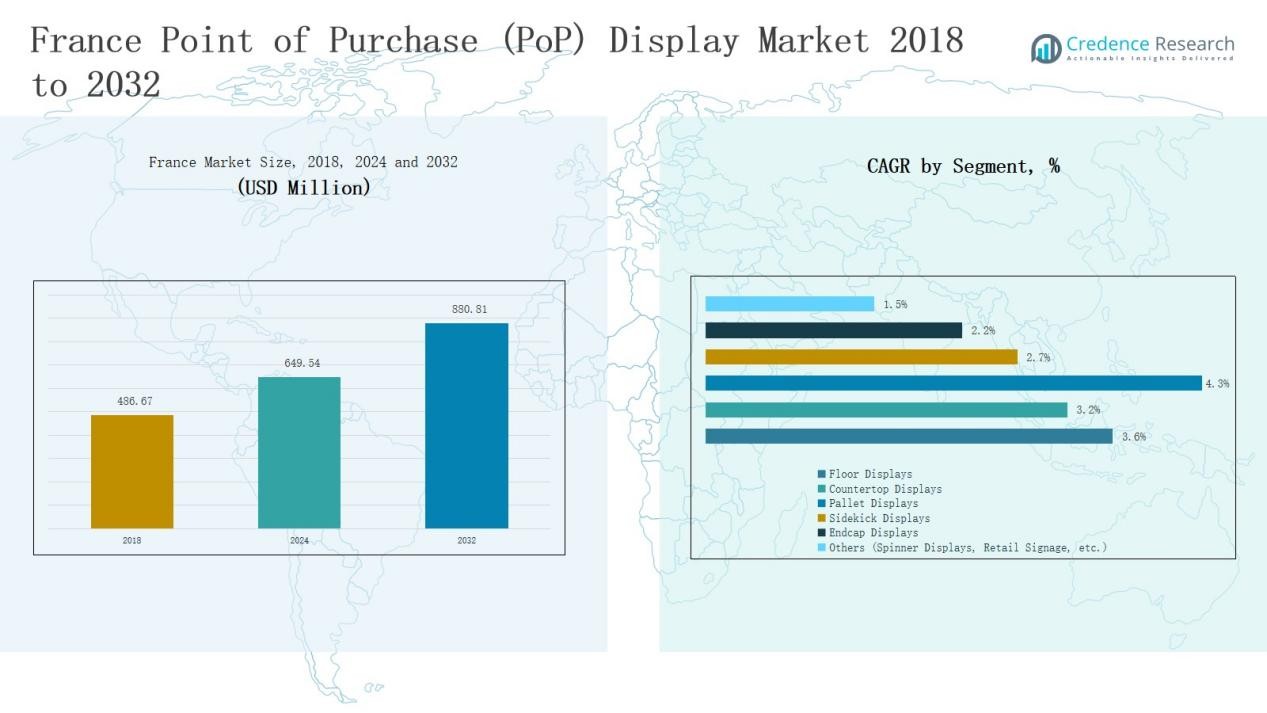

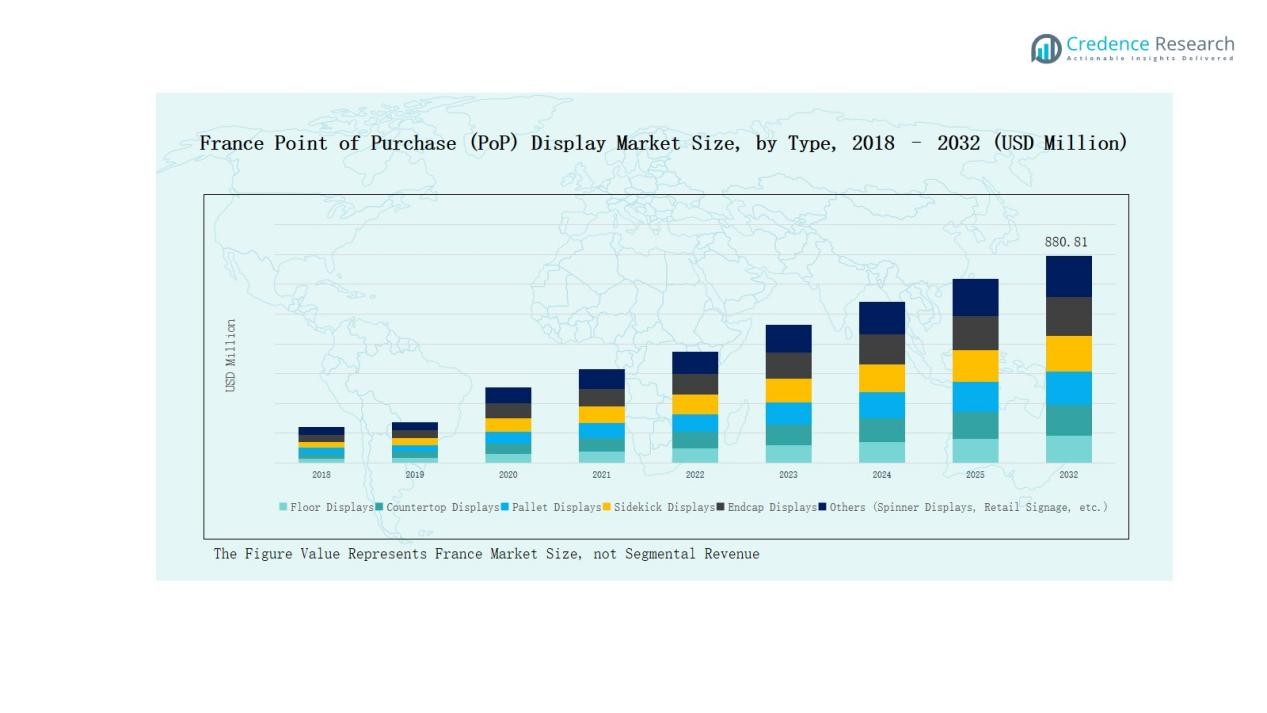

France Point of Purchase (PoP) Display Market size was valued at USD 486.67 million in 2018 to USD 649.54 million in 2024 and is anticipated to reach USD 880.81 million by 2032, at a CAGR of 3.61% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Point of Purchase (PoP) Display Market Size 2024 |

USD 649.54 Million |

| France Point of Purchase (PoP) Display Market, CAGR |

3.61% |

| France Point of Purchase (PoP) Display Market Size 2032 |

USD 880.81 Million |

The France Point of Purchase (PoP) Display Market is shaped by the presence of both global leaders and regional specialists that drive innovation and competitiveness. Key players include JCDecaux, Clear Channel Outdoor, Valassis Communications, International Paper, Diam International, POP Solutions Group, Micro Sheet Crafts, Quad Group, S2i Evolution, and Marquer Thermique. These companies focus on delivering tailored solutions, ranging from cost-effective temporary displays for FMCG products to premium permanent formats for cosmetics and luxury goods. Competition centers on sustainability, digital integration, and design differentiation. Regionally, Northern France led the market in 2024 with a 28% share, supported by its robust retail infrastructure, hypermarkets, and cross-border trade with Belgium and Germany, reinforcing its dominant role in the national market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The France Point of Purchase (PoP) Display Market grew from USD 486.67 million in 2018 to USD 649.54 million in 2024, projected at USD 880.81 million by 2032.

- Food and Beverage led applications with 38% share in 2024, while pharmaceuticals, cosmetics, and electronics followed, supported by retail penetration and promotional campaigns.

- Temporary PoP displays dominated with 62% share, driven by FMCG and seasonal promotions, while permanent displays held 38% share, used in luxury and electronics retail.

- Corrugated board accounted for 44% share, favored for affordability and flexibility, while plastic, metal, wood, glass, and foam boards supported niche and premium formats.

- Northern France led regionally with 28% share, followed by Southern France at 26%, Central France at 25%, and Western France at 21%, each shaped by distinct retail dynamics.

Market Segment Insights

By Application

Food & Beverage accounted for the largest share of 38% in the France PoP display market. The segment benefits from strong supermarket penetration and the high frequency of promotional campaigns in the retail sector. Demand for visually impactful displays in beverage promotions further strengthens its position. Pharmaceuticals followed with 15%, supported by rising consumer health awareness and pharmacy retail expansion. Cosmetics & Personal Care held 13%, driven by luxury brands and strong fashion retail presence. Electronics captured 12%, reflecting rising gadget sales, while Automotive and Home Furnishings represented 8% and 7%, respectively. Others, including sports and wine & spirits, accounted for 7%, benefiting from premium product placements in lifestyle and specialty outlets.

- For instance, in June 2024, Carrefour partnered with Coca‑Cola in France to roll out large-scale beverage PoP displays during the UEFA Euro promotional campaign, boosting in-store consumer engagement.

By Style

Temporary PoP displays dominated with a 62% share in the French market. Retailers prefer cost-effective and adaptable designs for short-term promotions and seasonal campaigns. This segment is further driven by FMCG and beverage industries that rely heavily on frequent product launches and discounts. Permanent PoP displays accounted for the remaining 38%, finding strong usage in cosmetics, luxury retail, and electronics, where long-term brand presence and durable aesthetics are prioritized. The balance reflects France’s mix of fast-moving consumer goods alongside high-end retail segments.

- For instance, Mondelez International used temporary PoP displays in French hypermarkets to highlight a new Oreo flavor launch, integrating promotional QR codes for customer engagement.

By Material

Corrugated board led the material segment with a 44% share, favored for its affordability, flexibility, and ease of customization in promotional displays. Plastic followed at 22%, driven by its durability and sleek finish, particularly in electronics and cosmetics. Metal accounted for 13%, primarily used in premium and permanent displays. Wood held 9%, gaining traction in luxury and eco-friendly retail formats. Glass contributed 6%, valued for its aesthetic appeal in high-end displays. Others, including foam boards, represented 6%, catering to niche retail signage and lightweight promotional structures.

Key Growth Drivers

Expansion of Retail Infrastructure

The France Point of Purchase (PoP) Display Market benefits from the country’s dense retail network and hypermarket chains. Strong presence of Carrefour, Auchan, and Leclerc boosts demand for promotional displays across categories. Food and beverage retailers in particular use PoP systems to increase in-store conversions. Seasonal promotions, bundled offers, and frequent product launches ensure consistent adoption. The expansion of urban convenience stores also contributes, as compact PoP displays suit limited retail space. Together, these factors establish retail infrastructure as a key growth driver.

Rising Consumer Demand for Premium and Branded Products

Growing preference for premium goods across cosmetics, personal care, and wine segments supports PoP display growth. French consumers value brand-driven experiences, encouraging retailers to invest in attractive, high-quality displays. Luxury brands rely heavily on permanent displays to reinforce brand identity and visibility in-store. Increasing competition within premium categories further amplifies the need for differentiated point-of-sale strategies. This trend drives consistent adoption of visually appealing displays that highlight brand prestige and influence purchasing behavior in the French retail environment.

- For instance, Phoebe Philo opened its first physical store at Galeries Lafayette Haussmann, Paris, featuring exclusive, permanent point-of-purchase displays to enhance brand visibility and premium customer experience.

Growing Focus on Sustainability and Eco-Friendly Materials

Sustainability plays a major role in the France PoP display market, driven by strict European regulations and consumer expectations. Brands are shifting toward recyclable materials like corrugated board and reusable wood-based designs. Retailers view eco-friendly displays as a way to align with customer values and enhance corporate responsibility. Demand for lightweight, biodegradable, and low-carbon materials is accelerating. This focus on sustainability not only reduces environmental impact but also creates long-term cost savings through reusability. It positions green materials as a major driver of market expansion.

- For instance, DS Smith introduced its Fibre-based Circular Design Principles to French retailers, aiming to replace single-use PoP displays with fully recyclable corrugated and cardboard alternatives.

Key Trends & Opportunities

Digital Integration in PoP Displays

Retailers in France are increasingly adopting digital and interactive PoP solutions to attract attention. Integration of LED screens, QR codes, and augmented reality enhances customer engagement. Electronics and luxury goods brands lead this trend, as they rely on immersive displays to differentiate products. Interactive elements also provide opportunities for data collection, enabling brands to analyze consumer preferences. This trend creates opportunities for suppliers to deliver hybrid solutions that combine traditional display structures with technology-driven customer experiences in retail environments.

- For instance, Samsung Electronics France introduced interactive AR kiosks in flagship Fnac stores, enabling consumers to visualize home appliances in 3D before purchase.

Growth of Cosmetics and Personal Care Displays

The cosmetics and personal care segment presents significant opportunities due to France’s strong beauty and fashion culture. Global and local brands invest in permanent PoP displays to build consistent visibility in retail stores. Displays that highlight product samples, limited editions, and premium packaging resonate well with French shoppers. This trend is supported by luxury malls and duty-free retail, which prioritize elegant displays. As the demand for branded experiences grows, cosmetics-focused PoP solutions are expected to capture rising investments and long-term growth.

- For instance, L’Oréal partnered with Lagardère Travel Retail to roll out luxury PoP counters at Paris airports, showcasing Lancôme and Yves Saint Laurent products with interactive sampling features.

Key Challenges

High Competition and Price Pressure

The France PoP display market faces intense competition among manufacturers and design agencies. Retailers often prioritize cost over innovation, pushing suppliers to deliver at lower margins. Small and mid-sized producers struggle to compete with larger global firms offering economies of scale. Price sensitivity in temporary displays adds further pressure, limiting profitability. This challenge forces players to focus on value-added services, such as design consultation and customization, to differentiate from competitors while managing production costs effectively.

Regulatory and Sustainability Compliance Costs

Strict environmental and packaging regulations in France increase compliance costs for PoP display manufacturers. The transition to recyclable and eco-friendly materials requires redesigning processes and sourcing alternatives, raising expenses. While sustainability is a growth driver, smaller companies often find compliance financially challenging. Continuous updates to EU-level regulations further complicate operations. These rising costs create barriers to entry for new players and require established companies to balance compliance with maintaining competitive pricing in the French retail display market.

Shifts Toward E-commerce and Online Shopping

France’s growing e-commerce adoption challenges the PoP display market, as in-store foot traffic declines. Online platforms reduce the effectiveness of physical retail promotions, impacting demand for traditional displays. Retailers must re-evaluate investments, directing more resources to digital marketing rather than in-store experiences. Hybrid strategies are emerging, but balancing offline and online promotional budgets creates uncertainty. This shift compels PoP suppliers to innovate with omnichannel solutions that integrate digital presence, or risk losing relevance as consumer shopping behavior continues to evolve.

Regional Analysis

Northern France

Northern France held 28% share of the France Point of Purchase (PoP) Display Market, supported by its strong retail infrastructure and logistics hubs. The region benefits from proximity to Belgium and Germany, enhancing cross-border retail trade. Large hypermarkets and supermarkets dominate, creating consistent demand for temporary displays in food and beverage. Cosmetics and personal care brands also find growth opportunities in luxury malls across Lille and surrounding cities. Retailers here prioritize cost-effective corrugated board displays, which strengthen the dominance of short-term promotional formats.

Western France

Western France accounted for 21% share, driven by growing retail activities in cities such as Nantes and Rennes. The region has a strong food and beverage presence, with promotional displays widely used in supermarkets and regional chains. Wine and spirits also support demand, as western France has significant vineyard zones that rely on branded displays. Permanent displays are gradually increasing due to higher investments by local consumer goods companies. It remains a vital market segment due to its balance of FMCG and premium retail offerings.

Southern France

Southern France commanded 26% share, supported by tourism-driven retail hubs in Marseille, Nice, and Montpellier. The cosmetics and personal care segment dominates, influenced by the presence of luxury outlets and beauty brands. Home furnishings also see traction due to lifestyle-driven shopping behavior in urban centers. Retailers favor a mix of permanent and temporary displays to capture both tourist and resident shoppers. It remains a high-growth area within the France PoP display market due to its mix of domestic consumption and tourism-led sales.

Central France

Central France held 25% share, anchored by Paris and its surrounding metropolitan region. The capital city represents the largest retail and luxury hub, making it critical for high-end permanent PoP displays. Luxury brands in cosmetics, fashion, and wine segments prioritize premium materials like glass and metal. Food and beverage chains also dominate, sustaining the need for temporary formats in hypermarkets. It stands as the most competitive region where both multinational brands and local retailers use PoP solutions to differentiate offerings and increase footfall.

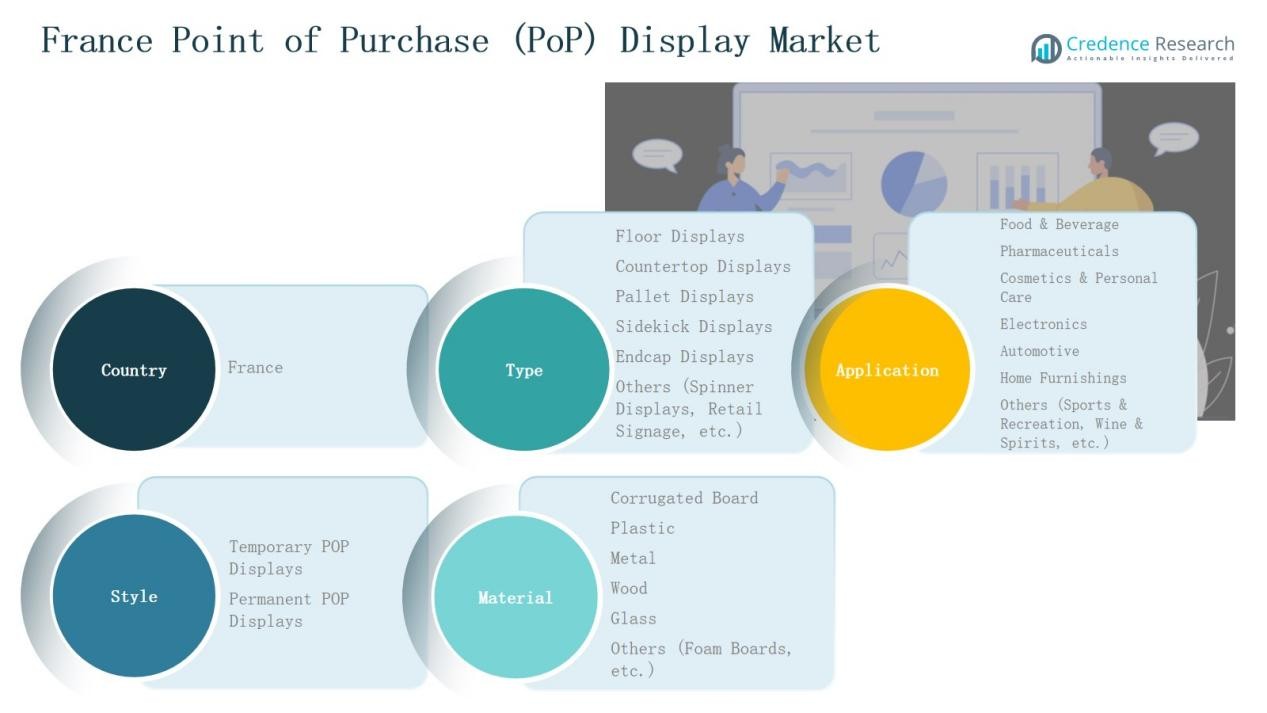

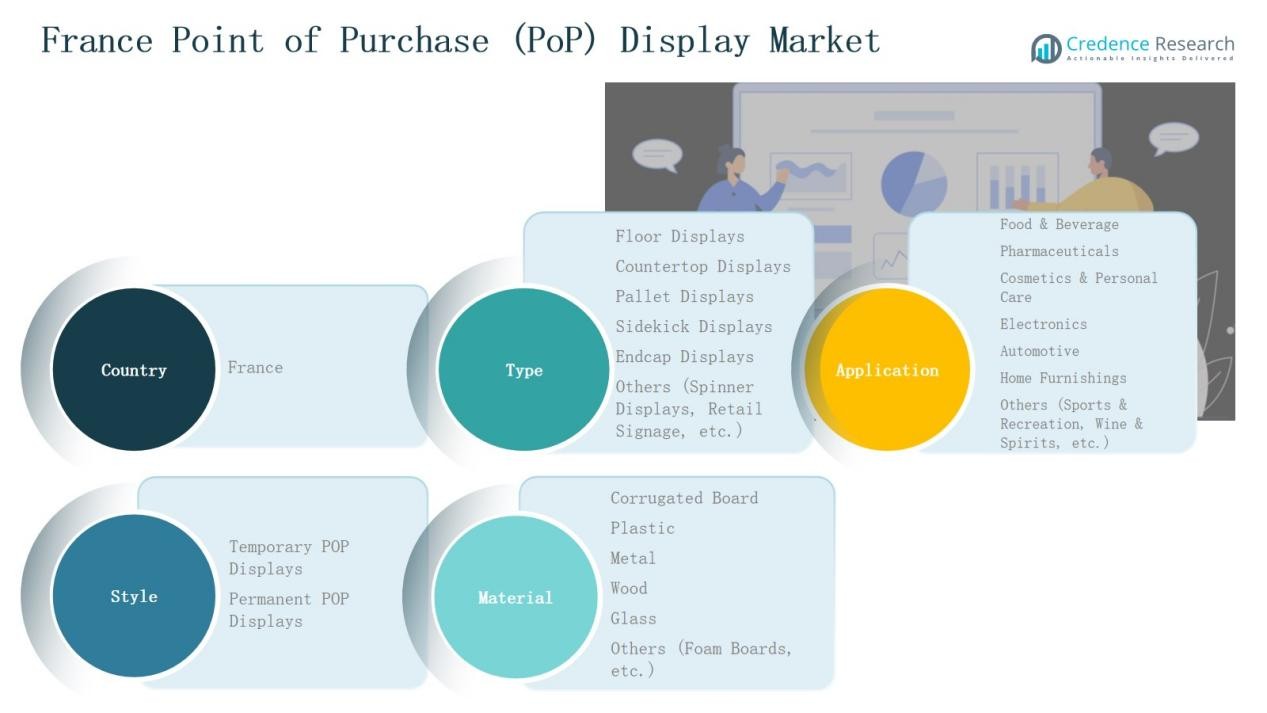

Market Segmentations:

By Type

- Floor Displays

- Countertop Displays

- Pallet Displays

- Sidekick Displays

- Endcap Displays

- Others (Spinner Displays, Retail Signage, etc.)

By Application

- Food & Beverage

- Pharmaceuticals

- Cosmetics & Personal Care

- Electronics

- Automotive

- Home Furnishings

- Others (Sports & Recreation, Wine & Spirits, etc.

By Style

- Temporary POP Displays

- Permanent POP Displays

By Material

- Corrugated Board

- Plastic

- Metal

- Wood

- Glass

- Others (Foam Boards, etc.)

By Region

- Northern France

- Western France

- Southern France

- Central France

Competitive Landscape

The France Point of Purchase (PoP) Display Market is characterized by strong competition among global leaders, regional suppliers, and specialized design firms. Key players such as JCDecaux, Clear Channel Outdoor, Valassis Communications, International Paper, and Diam International dominate through extensive networks, innovative design capabilities, and partnerships with major retailers. Local companies like Micro Sheet Crafts, POP Solutions Group, and S2i Evolution strengthen the market by offering customized and cost-effective solutions tailored to French retail environments. Competition is fueled by demand for temporary displays in FMCG sectors and premium permanent displays in cosmetics and luxury retail. Sustainability is a central factor, with many players investing in recyclable corrugated board and eco-friendly materials to comply with European regulations. Companies differentiate themselves by integrating digital elements, offering design consultation, and ensuring flexible production capabilities. This competitive environment encourages innovation while maintaining pressure on pricing, shaping the market’s growth trajectory in France.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- JCDecaux

- Clear Channel Outdoor

- Valassis Communications

- International Paper

- POP Solutions Group

- Diam International

- Micro Sheet Crafts

- Quad Group

- S2i Evolution

- Marquer Thermique

Recent Developments

- In 2024, POP Solutions, a leading point-of-sale provider, announced the acquisition of a majority stake in MHK Displays GmbH in Germany. This strategic move strengthens POP Solutions’ presence across Europe and expands its portfolio with advanced capabilities in metal, wood, plastic, and cardboard display solutions.

- On March 13, 2023, POP Solutions and In Store Display (ISD) Group formalized a strategic and commercial alliance to provide a comprehensive offering in the French POS market.

- In 2025, VusionGroup entered a strategic partnership with NielsenIQ to integrate point-of-sales data, shelf insights, and consumer analytics into retail display solutions. This alliance enhances data-driven PoP effectiveness in physical commerce environments across France.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Style, Material and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Retailers will continue to adopt temporary displays to support frequent promotional campaigns.

- Permanent displays will expand in cosmetics, fashion, and luxury retail segments.

- Demand for eco-friendly materials such as corrugated board and wood will increase.

- Digital integration with interactive and LED-enabled displays will grow steadily.

- Food and beverage promotions will remain the leading driver of display adoption.

- Cosmetics and personal care brands will invest more in premium, design-focused solutions.

- Evolving consumer preferences will push suppliers to offer more customized display formats.

- Retail chains will seek flexible suppliers capable of balancing cost and design quality.

- Regional diversity will shape demand, with Paris leading luxury-driven innovations.

- Sustainability regulations will accelerate the shift toward recyclable and reusable materials.