Market Overview:

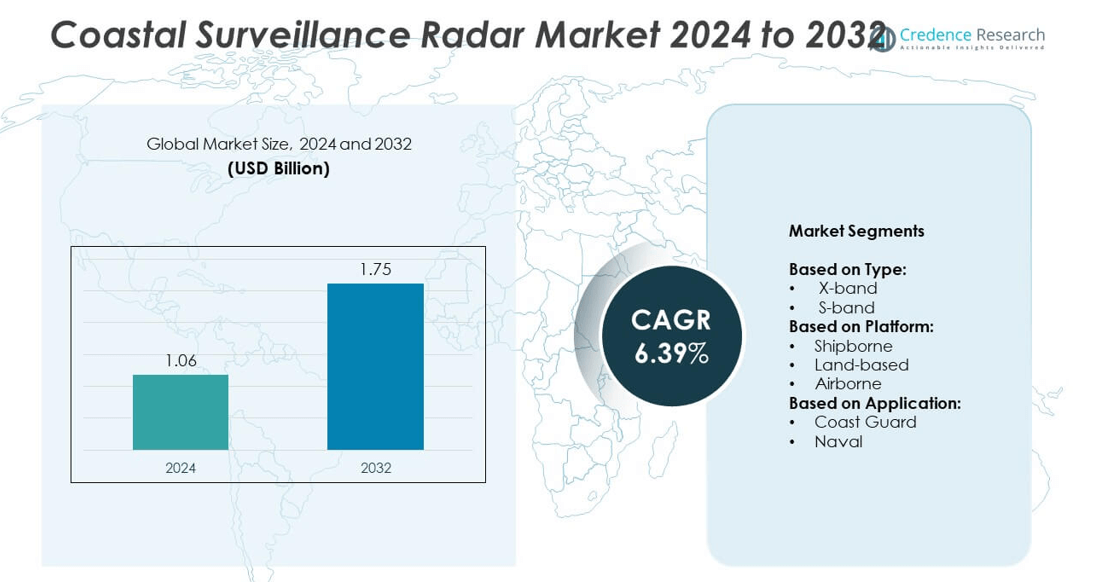

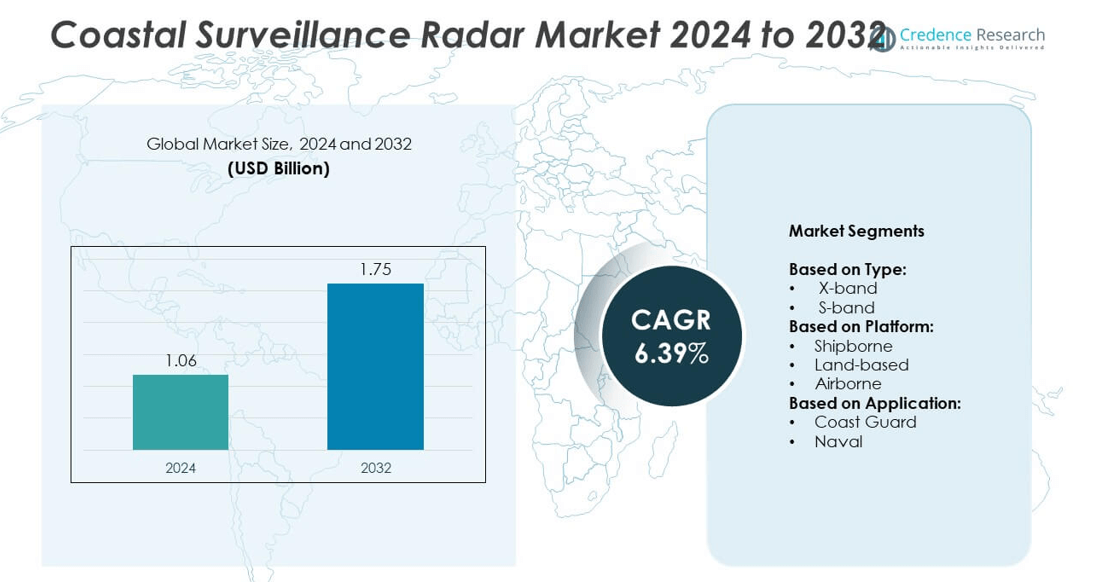

Coastal Surveillance Radar market size was valued USD 1.06 Billion in 2024 and is anticipated to reach USD 1.75 Billion by 2032, at a CAGR of 6.39% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Coastal Surveillance Radar Market Size 2024 |

USD 1.06 Billion |

| Coastal Surveillance Radar Market, CAGR |

6.39% |

| Coastal Surveillance Radar Market Size 2032 |

USD 1.75 Billion |

Key players in the coastal surveillance radar market include Leonardo, CETC, Furuno Electric, Raytheon, Airbus, IAI ELTA, Sperry Marine Northrop Grumman, Hensoldt, L3Harris Technologies, GEM Elettronica, Thales, Terma, Aselsan, Tokyo Keiki, and FLIR Systems. These companies focus on developing advanced radar systems with enhanced detection range, multi-sensor integration, and AI-driven analytics to improve maritime domain awareness. North America leads the global market with around 35% share in 2024, supported by strong U.S. investments in naval modernization and coastal security infrastructure. Europe follows with nearly 28% share, driven by NATO coastal surveillance programs and cross-border security initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The coastal surveillance radar market was valued at USD 1.06 billion in 2024 and is projected to reach USD 1.75 billion by 2032, growing at a CAGR of 6.39% during 2025–2032.

- Rising maritime security threats, illegal fishing, and smuggling incidents are driving strong demand for advanced radar systems with better detection and tracking capabilities.

- Adoption of X-band radar leads the market with over 55% share, supported by its superior resolution, while land-based systems dominate the platform segment with more than 50% share.

- The market is moderately competitive, with players focusing on AI-enabled detection, multi-sensor integration, and partnerships with naval and coast guard agencies to strengthen their positions.

- North America leads with 35% share, followed by Europe at 28% and Asia Pacific at over 25%, with Asia Pacific emerging as the fastest-growing region due to territorial security concerns and naval modernization programs.

Market Segmentation Analysis:

By Type

X-band radar dominates the type segment, accounting for over 55% of the market share in 2024. Its dominance is driven by superior resolution, ability to detect small and fast-moving targets, and suitability for short- to mid-range surveillance. X-band radars are widely adopted for port security, vessel traffic monitoring, and search-and-rescue operations where precision is critical. S-band radar holds a significant share due to its long-range coverage and resistance to rain clutter, making it ideal for wide-area maritime surveillance and early warning systems along expansive coastlines.

- For instance, Thales’s GM400 ground‑based 3D AESA radar provides a range of 470 km (or 515 km for the GM400α version) for long‑range air surveillance from land platforms.

By Platform

Land-based systems lead the platform segment with more than 50% share in 2024, supported by continuous demand for coastal command stations and border monitoring infrastructure. These installations provide round-the-clock surveillance, integrate with automatic identification systems (AIS), and support national security initiatives. Shipborne radars are gaining momentum as navies and coast guards modernize patrol fleets to monitor territorial waters. Airborne platforms, including manned aircraft and UAVs, are emerging as a complementary solution, offering rapid deployment and extended coverage for time-sensitive missions.

- For instance, the 3D‑CAR (ROHINI) radar by DRDO / BEL (India) is a land‑based mobile system with more than 150 km range and altitude coverage up to 18 km, deployed for long‑range early warning on land.

By Application

Naval applications dominate this segment, holding over 60% market share in 2024, driven by rising naval modernization programs and geopolitical tensions. These radars enable early detection of surface and low-flying threats, supporting mission planning and maritime domain awareness. Coast guard applications form the second-largest share, fueled by the need to curb smuggling, illegal fishing, and human trafficking. Investment in coastal radar networks for real-time vessel tracking and integration with national maritime security frameworks continues to strengthen this sub-segment’s growth globally.

Market Overview

Rising Maritime Security Concerns

Growing threats of piracy, smuggling, and illegal fishing are driving heavy investments in coastal surveillance radar systems. Governments worldwide are expanding coastal monitoring infrastructure to protect exclusive economic zones (EEZs) and secure maritime trade routes. Continuous upgrades in radar networks help improve early threat detection and enable faster response. This factor is the key growth driver for the market, especially in regions with high cross-border maritime traffic and geopolitical tensions.

- For instance, Bharat Electronics Limited secured an agreement with Terma to manufacture 38 SCANTER 2001 radars in Phase II of India’s coastal surveillance project.

Naval Modernization Programs

Defense budgets are increasingly allocated to modernizing naval fleets with advanced surveillance systems. Coastal radars are critical components in integrated coastal defense strategies, offering real-time situational awareness and target tracking. Countries such as India, China, and the U.S. are expanding radar coverage to enhance operational readiness. These modernization efforts ensure consistent demand for radar systems with improved resolution and integration capabilities across military operations.

- For instance, Thales delivered its Ground Master 200 Multi Mission (GM200 MM/C) radar to the Royal Netherlands Army on 14 February 2024, underlining rapid deployability and multi‑mission use of airborne & ground platforms.

Technological Advancements in Radar Systems

Emerging radar technologies, including solid-state transmitters, AESA radars, and AI-enabled analytics, are transforming coastal surveillance capabilities. These innovations enhance detection range, reduce false alarms, and enable better classification of small vessels. Integration with satellite data and unmanned platforms expands coverage and reduces operational costs. This technological shift drives adoption among both defense and civilian agencies seeking cost-efficient, scalable, and future-ready surveillance solutions.

Key Trends & Opportunities

Integration with Unmanned Systems

Unmanned aerial vehicles (UAVs) and unmanned surface vessels (USVs) are increasingly deployed for coastal monitoring. When integrated with radar networks, they extend surveillance coverage and allow rapid response to threats. This trend opens opportunities for radar manufacturers to develop lightweight, mobile radar solutions that seamlessly interface with autonomous platforms. The rising use of drones for surveillance is one of the key trends & opportunities reshaping the market.

- For instance, Navielektro (Finland) was involved in the development of a meteorological and marine research facility at the Utö observatory, in partnership with the Finnish Meteorological Institute. The setup included an X-band coastal radar to study atmospheric ducting over coastal and marine waters of the Baltic Sea. During specific ducting events, the radar demonstrated an extended over-the-horizon capability, with a maximum composite range of 150 km.

Shift Toward Network-Centric Surveillance

Coastal surveillance is moving toward networked and interoperable systems that link multiple radars, sensors, and command centers. This shift enables real-time information sharing across agencies and enhances maritime domain awareness. Opportunities exist for providers offering advanced software, data fusion solutions, and cybersecurity-enhanced systems. Growing demand for integrated, multi-sensor solutions will continue to create a competitive advantage for vendors focused on interoperability and scalability.

- For instance, NRTC & Blue Surge (Pakistan) co‑developed the AM‑350S, a GaN‑based AESA 3D S‑band radar that offers 350 km maximum range and 360° azimuth, built with modern digital beamforming and frequency hopping to support data sharing and resilience across networks.

Key Challenges

High Installation and Maintenance Costs

Deploying coastal surveillance radar infrastructure requires significant capital expenditure and ongoing maintenance costs. Remote coastal areas often need additional infrastructure, such as power supply and communication links, further raising expenses. Budget constraints in developing nations limit procurement and delay modernization projects. This cost burden remains one of the key challenges restricting wider market penetration, particularly for small-scale coast guard agencies.

Environmental and Operational Limitations

Harsh coastal weather conditions, sea clutter, and electromagnetic interference can reduce radar performance and lead to false alarms. Maintaining reliable coverage in tropical storms, high humidity, or extreme cold requires advanced radar calibration and regular system upgrades. These environmental constraints add to operational complexity and increase lifecycle costs, challenging agencies to maintain uninterrupted monitoring and high detection accuracy.

Regional Analysis

North America

North America holds the largest share of the coastal surveillance radar market, accounting for around 35% in 2024. Growth is driven by strong investments from the U.S. and Canada in maritime security and border protection. Modernization of radar systems by the U.S. Navy and Coast Guard ensures continuous demand. The presence of leading radar manufacturers and integration with advanced command-and-control systems further strengthens the region’s dominance. Rising emphasis on protecting trade routes, ports, and exclusive economic zones supports steady adoption of advanced radar technologies across both defense and commercial applications.

Europe

Europe represents nearly 28% of the market share in 2024, supported by extensive coastline monitoring programs across NATO countries. Demand is driven by modernization of naval fleets, cross-border security initiatives, and anti-smuggling operations in the Mediterranean. Countries such as the UK, France, and Italy are upgrading radar networks with multi-sensor integration to strengthen maritime domain awareness. EU funding for collaborative defense projects and emphasis on interoperability among member states drive consistent growth. Increasing focus on monitoring migrant routes and environmental protection along coastlines also boosts adoption of coastal surveillance radar solutions.

Asia Pacific

Asia Pacific accounts for over 25% of the coastal surveillance radar market in 2024, making it the fastest-growing region. Rising territorial disputes, illegal fishing, and piracy in the South China Sea drive significant investment in radar systems. China, India, Japan, and South Korea are expanding coastal radar networks under naval modernization programs. Regional governments are also deploying shipborne and airborne radar solutions to protect trade lanes and exclusive economic zones. Rapid adoption of new radar technologies and expansion of indigenous manufacturing capabilities continue to position Asia Pacific as a major growth hub in the forecast period.

Middle East & Africa

Middle East & Africa hold approximately 7% of the market share in 2024, driven by investments in protecting critical offshore infrastructure and trade routes. Gulf countries are deploying advanced radar systems to secure oil shipping lanes and ports. African nations with piracy-prone coastlines are gradually adopting coastal radar networks with international support programs. Harsh climatic conditions and budget constraints slow adoption rates in some regions. However, growing defense spending and collaborative maritime security initiatives are expected to drive steady growth over the forecast period, particularly in the Gulf and North African coastal areas.

Latin America

Latin America accounts for about 5% of the global market share in 2024, with Brazil and Mexico leading adoption. Regional demand is fueled by efforts to curb smuggling, monitor illegal fishing, and secure offshore oil and gas infrastructure. Governments are investing in land-based radar systems and upgrading surveillance networks to improve maritime domain awareness. Limited defense budgets in several countries slow the pace of large-scale deployments. However, joint security initiatives, rising naval modernization programs, and collaboration with international technology providers are gradually improving coastal monitoring capabilities across the region.

Market Segmentations:

By Type:

By Platform:

- Shipborne

- Land-based

- Airborne

By Application:

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

Key players in the coastal surveillance radar market include Leonardo (Italy), CETC (China), Furuno Electric (Japan), Raytheon (U.S.), Airbus (Netherlands), IAI ELTA (Israel), Sperry Marine Northrop Grumman (U.S.), Hensoldt (Germany), L3Harris Technologies (U.S.), GEM Elettronica (Italy), Thales (France), Terma (Denmark), Aselsan (Turkey), Tokyo Keiki (Japan), and FLIR Systems (U.S.). The market is characterized by intense competition, with companies focusing on technology upgrades, solid-state radar systems, and AI-based detection features to enhance surveillance performance. Strategic collaborations with naval forces, coast guards, and government agencies are common, supporting large-scale coastal monitoring projects. Continuous investment in R&D enables development of radars with improved resolution, longer detection range, and integration with command-and-control systems. Vendors are also emphasizing cost-efficient solutions, modular designs, and cybersecurity features to address evolving maritime security threats and meet global demand for scalable, network-centric surveillance infrastructure.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Leonardo (Italy)

- CETC (China)

- Furuno Electric (Japan)

- Raytheon (U.S.)

- Airbus (Netherlands)

- IAI ELTA (Israel)

- Sperry Marine Northrop Grumman (U.S.)

- Hensoldt (Germany)

- L3Harris Technologies (U.S.)

- GEM Elettronica (Italy)

- Thales (France)

- Terma (Denmark)

- Aselsan (Turkey)

- Tokyo Keiki (Japan)

- FLIR Systems (U.S.)

Recent Developments

- In 2025, Raytheon successfully completed the first live maritime environment test of its AN/SPY-6(V)4 radar, validating tracking performance of air and surface targets under varied conditions.

- In 2024, Thales introduced its CoastShield system, which includes the long-range CoastWatcher radar, AIS receiver, electro-optical sensors, radio systems, and command-and-control integration.

- In 2023, Leonardo demonstrated the increased scalability and adaptability of its radar platforms, emphasizing their suitability for multi-domain operations and their integrated data processing capabilities for maritime and coastal surveillance.

Report Coverage

The research report offers an in-depth analysis based on Type, Platform, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for advanced coastal surveillance radar will rise with growing maritime security concerns.

- Adoption of solid-state and AESA radar technology will increase for better detection accuracy.

- Integration with AI and machine learning will enhance target recognition and reduce false alarms.

- Network-centric systems will gain popularity, enabling seamless data sharing across agencies.

- Investments in radar-equipped unmanned systems will expand coverage in remote coastal areas.

- Governments will focus on upgrading aging radar infrastructure with modern digital solutions.

- Multi-band radar systems will see higher demand to handle diverse weather conditions effectively.

- Partnerships between defense contractors and regional governments will boost system deployments.

- Cybersecurity features will become a key requirement to protect radar networks from threats.

- Emerging economies will increase procurement, driving steady market growth across Asia and Africa.