Market Overview:

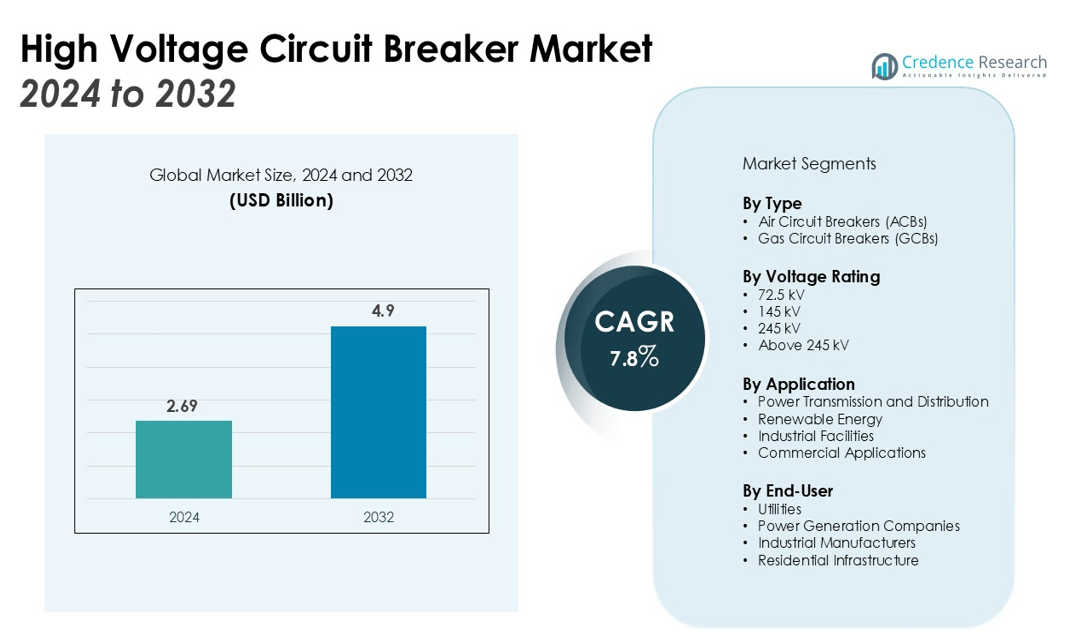

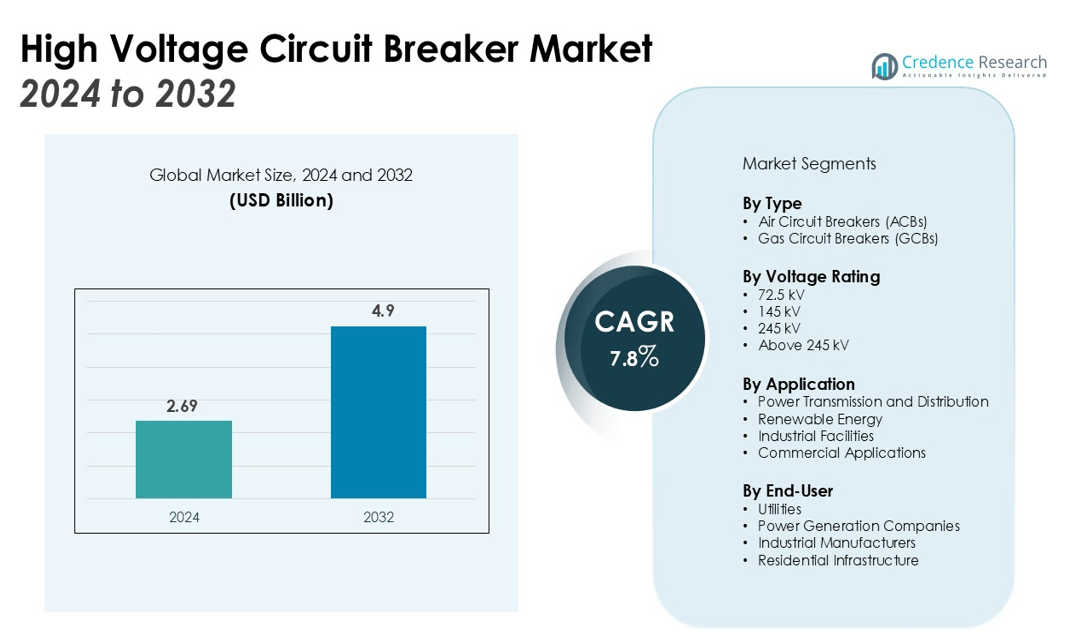

The High Voltage Circuit Breaker Market size was valued at USD 2.69 billion in 2024 and is anticipated to reach USD 4.9 billion by 2032, at a CAGR of 7.8% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Voltage Circuit Breaker Market Size 2024 |

USD 2.69 billion |

| High Voltage Circuit Breaker Market, CAGR |

7.8% |

| High Voltage Circuit Breaker Market Size 2032 |

USD 4.9 billion b |

Key drivers of the market include the rising need for stable and secure electricity distribution systems, particularly in emerging economies. The global shift towards renewable energy sources and the need for reliable grid infrastructure to handle variable energy inputs further fuels the demand for high voltage circuit breakers. Additionally, advancements in smart grid technologies and automation drive the adoption of innovative circuit breakers that enhance grid reliability, safety, and operational efficiency. The increasing focus on reducing carbon footprints and enhancing energy efficiency also plays a significant role in market expansion.

Regionally, Asia Pacific holds the largest share of the High Voltage Circuit Breaker market, driven by rapid industrialization, urbanization, and infrastructure expansion, particularly in China and India. North America and Europe follow closely, where strong investments in grid modernization and adherence to stringent safety regulations bolster market growth. The Middle East and Africa, along with Latin America, represent emerging markets with significant potential due to ongoing power infrastructure development and urbanization trends. The growing demand for resilient electrical infrastructure in these regions is expected to further drive market growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The High Voltage Circuit Breaker market was valued at USD 2.69 billion in 2024 and is expected to reach USD 4.9 billion by 2032, growing at a CAGR of 7.8%.

- The demand for reliable circuit breakers increases with the shift to renewable energy sources like wind and solar.

- Smart grid solutions and automation are enhancing grid stability, boosting the adoption of advanced circuit breakers.

- Stricter regulatory standards for safety and sustainability are driving the demand for high voltage circuit breakers in North America and Europe.

- High capital investment and maintenance costs hinder the widespread adoption of high voltage circuit breakers in smaller utilities and developing regions.

- Integrating modern circuit breakers with existing grid systems presents technical and cost challenges.

- Asia Pacific holds 40% of the market share, with North America and Europe at 25% and 20%, respectively, driven by infrastructure investments and grid modernization.

Market Drivers:

Increasing Demand for Reliable and Secure Electricity Distribution

The High Voltage Circuit Breaker market is driven by the growing need for stable and secure electricity distribution systems, particularly in emerging economies. Rapid urbanization and industrialization in regions such as Asia Pacific and Africa are leading to higher demand for reliable power infrastructure. The increasing number of high-power electrical networks requires robust circuit breakers to ensure safety and minimize power outages. This demand is expected to escalate as more countries modernize their power grids.

- For instance, Siemens’ HB3 Generator Circuit-Breaker Switchgear is designed for power generation units up to 450 MW, providing enhanced system reliability with a vacuum interrupter capable of handling up to 110 kA.

Shift Towards Renewable Energy and Grid Modernization

The transition to renewable energy sources is a significant driver for the High Voltage Circuit Breaker market. Renewable power generation often relies on variable sources like wind and solar, requiring advanced grid systems to ensure stability. High voltage circuit breakers play a vital role in integrating renewable energy into the grid by providing essential protection and ensuring safe operation. Investments in grid modernization further boost the market, with new technologies designed to handle renewable energy fluctuations.

- For instance, ABB’s innovative hybrid HVDC breaker can interrupt power flows equivalent to a large power station in just 5 milliseconds, enabling the efficient integration of renewable energy sources into the grid.

Technological Advancements in Smart Grids and Automation

Technological advancements in smart grid solutions and automation significantly impact the High Voltage Circuit Breaker market. Automation enables faster fault detection and recovery, improving system reliability and operational efficiency. Circuit breakers integrated with smart grid technologies enhance real-time monitoring and control, reducing downtime and improving overall grid stability. The growing adoption of these advanced systems is propelling the market forward as industries prioritize grid reliability and efficiency.

Rising Regulatory and Safety Standards

The increasing regulatory focus on electrical grid safety and environmental sustainability is another key factor driving the High Voltage Circuit Breaker market. Stringent safety standards in North America and Europe require the use of high-quality circuit breakers to prevent accidents and ensure compliance. These regulations push for the adoption of advanced solutions that can offer better performance, greater safety, and reduced environmental impact. This trend is expected to continue as global infrastructure projects grow.

Market Trends:

Growing Adoption of Digital and Smart Circuit Breakers

One of the key trends in the High Voltage Circuit Breaker market is the increasing adoption of digital and smart circuit breakers. These devices integrate advanced monitoring and control systems that enhance grid performance and reliability. The introduction of real-time data analytics allows for quicker fault detection and system recovery, minimizing downtime and operational losses. Smart circuit breakers also offer predictive maintenance capabilities, which help in reducing maintenance costs and improving the efficiency of power systems. The trend toward digitalization and automation is closely linked to the rise of smart grid technologies, which continue to evolve as utilities seek to optimize their infrastructure and ensure uninterrupted service.

- For instance, in April 2024, Schaltbau launched a smart circuit breaker line capable of interrupting currents 10 to 100 times faster than conventional devices, significantly improving protection for energy storage systems.

Shift Toward Environmentally Friendly and SF6-Free Breakers

Another significant trend in the High Voltage Circuit Breaker market is the shift toward environmentally friendly alternatives to traditional sulfur hexafluoride (SF6)-based breakers. SF6, a potent greenhouse gas, has faced increasing scrutiny due to its environmental impact. In response, manufacturers are developing SF6-free circuit breakers that use alternative gases like vacuum or air. These environmentally conscious solutions are gaining traction, particularly in regions with stringent environmental regulations. The transition to SF6-free circuit breakers aligns with the global push toward sustainability, providing safer and more eco-friendly options for power systems. This trend is expected to gain momentum as governments and utilities continue to prioritize green technologies and carbon footprint reduction.

- For instance, in May 2025, Hitachi Energy announced its delivery of the world’s first SF6-free 550 kV gas-insulated switchgear.

Market Challenges Analysis:

High Capital Investment and Maintenance Costs

One of the major challenges facing the High Voltage Circuit Breaker market is the high capital investment and maintenance costs associated with these systems. The advanced technology required for high voltage breakers comes at a significant price, which can deter smaller utilities and regions with limited budgets from adopting them. Moreover, the long-term maintenance costs for these systems can be substantial, as they require regular inspections, repairs, and replacements of parts to ensure optimal performance. These expenses can create barriers to widespread adoption, particularly in developing regions or for small-scale infrastructure projects.

Complexity in Integration with Existing Grid Systems

The integration of new high voltage circuit breakers with existing grid systems presents another challenge. Older grid infrastructure may not be compatible with the advanced features of modern circuit breakers, such as smart grid functionalities or SF6-free technologies. Retrofitting these systems to work together can be technically complex and costly. Utilities must also ensure that these new systems do not disrupt current operations, which may require significant downtime and a careful management of grid stability. Such challenges can delay the adoption of more efficient, advanced circuit breakers, hindering market growth.

Market Opportunities:

Expansion in Emerging Markets and Infrastructure Development

The High Voltage Circuit Breaker market presents significant opportunities in emerging markets where rapid infrastructure development is underway. Countries in Asia Pacific, Africa, and Latin America are investing heavily in upgrading their power grids to meet the growing energy demands of urbanization and industrialization. These regions offer a large potential customer base for advanced circuit breakers that ensure reliable power distribution. As governments push for electrification and grid modernization, the demand for high voltage circuit breakers is expected to rise. Utilities in these regions seek to enhance grid stability, making this a key growth opportunity for market players.

Growth in Renewable Energy Integration and Smart Grid Solutions

The ongoing shift towards renewable energy and the growth of smart grid solutions present substantial opportunities for the High Voltage Circuit Breaker market. As the global energy mix increasingly includes solar, wind, and other renewable sources, there is a growing need for robust circuit protection technologies. High voltage circuit breakers play a crucial role in managing the variable nature of renewable energy, ensuring smooth integration into existing grids. The adoption of smart grid technologies, which require advanced breakers for real-time monitoring and fault detection, further drives this market. This shift opens new avenues for companies to innovate and develop next-generation circuit breakers tailored to the needs of modern energy systems.

Market Segmentation Analysis:

By Type

The market is primarily divided into two types: air circuit breakers (ACBs) and gas circuit breakers (GCBs). Gas circuit breakers dominate the market due to their higher efficiency in interrupting high-voltage currents and their ability to perform in diverse environmental conditions. Air circuit breakers, while less common, are used in specific applications requiring lower voltage levels.

By Voltage Rating

High voltage circuit breakers are classified based on their voltage rating, with the most common categories being 72.5 kV, 145 kV, and 245 kV. Breakers in the 72.5 kV to 145 kV range are widely used in electrical grids and power substations for medium to high-voltage systems. Those rated above 245 kV are employed in large-scale power generation plants and transmission networks, providing reliable protection against faults.

- For instance, GE Vernova’s DT1-245P 63 is a dead tank circuit breaker designed for 245 kV applications that offers high performance with an interrupting capability of up to 63 kA.

By Application

The High Voltage Circuit Breaker market serves a wide range of applications, including power transmission and distribution, renewable energy, and industrial facilities. The power transmission segment holds the largest market share due to the increasing need for efficient grid management and reliable protection of high-voltage lines. The renewable energy sector, particularly in wind and solar power generation, also contributes to market growth as these sources require efficient circuit breakers to integrate seamlessly into the grid.

- For instance, ABB’s solid-state circuit breaker enhances the reliability of renewable energy solutions by detecting and responding to a short circuit fault 100 times faster than a conventional mechanical circuit breaker.

Segmentations:

By Type

- Air Circuit Breakers (ACBs)

- Gas Circuit Breakers (GCBs)

By Voltage Rating

- 5 kV

- 145 kV

- 245 kV

- Above 245 kV

By Application

- Power Transmission and Distribution

- Renewable Energy

- Industrial Facilities

- Commercial Applications

By End-User

- Utilities

- Power Generation Companies

- Industrial Manufacturers

- Residential Infrastructure

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

Asia Pacific: Dominating the High Voltage Circuit Breaker Market

Asia Pacific holds the largest market share of 40% in the High Voltage Circuit Breaker market. Driven by rapid urbanization, industrialization, and substantial investments in infrastructure, the region continues to show significant growth. Countries like China and India are expanding their power grids to meet growing energy demands, presenting substantial opportunities for market expansion. The region’s push toward renewable energy and grid modernization further accelerates the demand for advanced circuit breakers. Government policies focusing on infrastructure development and smart grid adoption contribute to the rising market potential. The growing power distribution networks across this region ensure continued market growth.

North America: Strong Demand for Grid Modernization and Safety Standards

North America holds a market share of 25%, with high investments in grid modernization and stringent safety regulations. The United States and Canada have robust electrical infrastructure, requiring continuous upgrades to support advanced technologies and ensure grid reliability. The integration of renewable energy sources into the grid is fueling demand for circuit breakers capable of handling fluctuating energy loads. The region also emphasizes environmental sustainability, driving the adoption of eco-friendly circuit breakers, such as SF6-free technologies. These factors collectively create a favorable market landscape for high voltage circuit breakers in North America.

Europe: Focus on Regulatory Compliance and Sustainability

Europe captures a market share of 20% in the High Voltage Circuit Breaker market. Countries such as Germany, the UK, and France focus on stringent regulatory standards and sustainability. The European Union’s commitment to reducing carbon emissions and increasing renewable energy capacity has prompted investments in modernizing electrical grids, which increases the demand for advanced circuit protection systems. The region’s emphasis on environmental impact and the transition to SF6-free circuit breakers supports market growth. Europe’s well-established power infrastructure, coupled with its commitment to innovation and sustainability, provides a strong foundation for the adoption of high voltage circuit breakers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- ABB Ltd.

- Siemens AG

- Schneider Electric SE

- General Electric Company

- Mitsubishi Electric Corporation

- Hitachi Ltd.

- Eaton Corporation

- Toshiba Corporation

- Alstom SA

- Hyundai Heavy Industries Co., Ltd.

- Fuji Electric Co., Ltd.

- CG Power and Industrial Solutions Limited

- Meidensha Corporation

- Hyosung Corporation

- Larsen & Toubro Limited

Competitive Analysis:

The High Voltage Circuit Breaker market is highly competitive, with several key players dominating the landscape. Major companies include ABB Ltd., Schneider Electric, Siemens AG, and Mitsubishi Electric, all of which have a strong global presence and extensive product portfolios. These companies focus on continuous innovation, particularly in gas and SF6-free circuit breakers, to address environmental concerns and regulatory demands. They also emphasize the development of smart grid technologies, which enhance the performance and efficiency of circuit breakers in modern electrical networks. Market players are adopting strategies such as mergers, acquisitions, and partnerships to strengthen their market position and expand their geographical reach. Companies are also investing in R&D to enhance product reliability, reduce operational costs, and improve energy efficiency. With strong competition, companies are also exploring emerging markets, particularly in Asia Pacific and Africa, where significant infrastructure development is underway.

Recent Developments:

- In July 2025, ABB launched three new families of factory robots and partnered with German energy company E.ON to supply its environmentally friendly SF6-free switchgear.

- In May 2025, ABB announced its agreement to acquire BrightLoop, a French specialist in power electronics, and expanded its partnership with Tallarna to offer Battery Energy Storage Systems-as-a-Service.

- In September 2025, Siemens announced a collaboration with Snowflake to improve the integration of IT and operational technology (OT) for industrial clients.

Report Coverage:

The research report offers an in-depth analysis based on Type, Voltage Rating, Application, End-User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The High Voltage Circuit Breaker market will see increased demand as grid modernization and renewable energy integration accelerate.

- The adoption of SF6-free circuit breakers will rise due to stringent environmental regulations and a global focus on sustainability.

- Technological advancements, including smart grid solutions, will enhance the performance and efficiency of high voltage circuit breakers.

- Automation and real-time monitoring systems will continue to drive the market, improving grid reliability and minimizing downtime.

- The shift toward renewable energy sources, such as wind and solar, will create a growing need for advanced circuit protection technologies.

- Expanding power infrastructure in emerging markets like Asia Pacific and Africa will present significant opportunities for market growth.

- The increasing focus on reducing carbon footprints will influence the development of more eco-friendly and energy-efficient circuit breakers.

- Industrial and commercial sectors will demand higher voltage capacity circuit breakers to support growing power needs.

- Partnerships and collaborations between leading players in the market will intensify as companies strive to strengthen their positions and broaden their product offerings.

- The increasing frequency of power outages and grid failures will highlight the need for enhanced circuit protection systems, further driving market expansion.