Market Overview

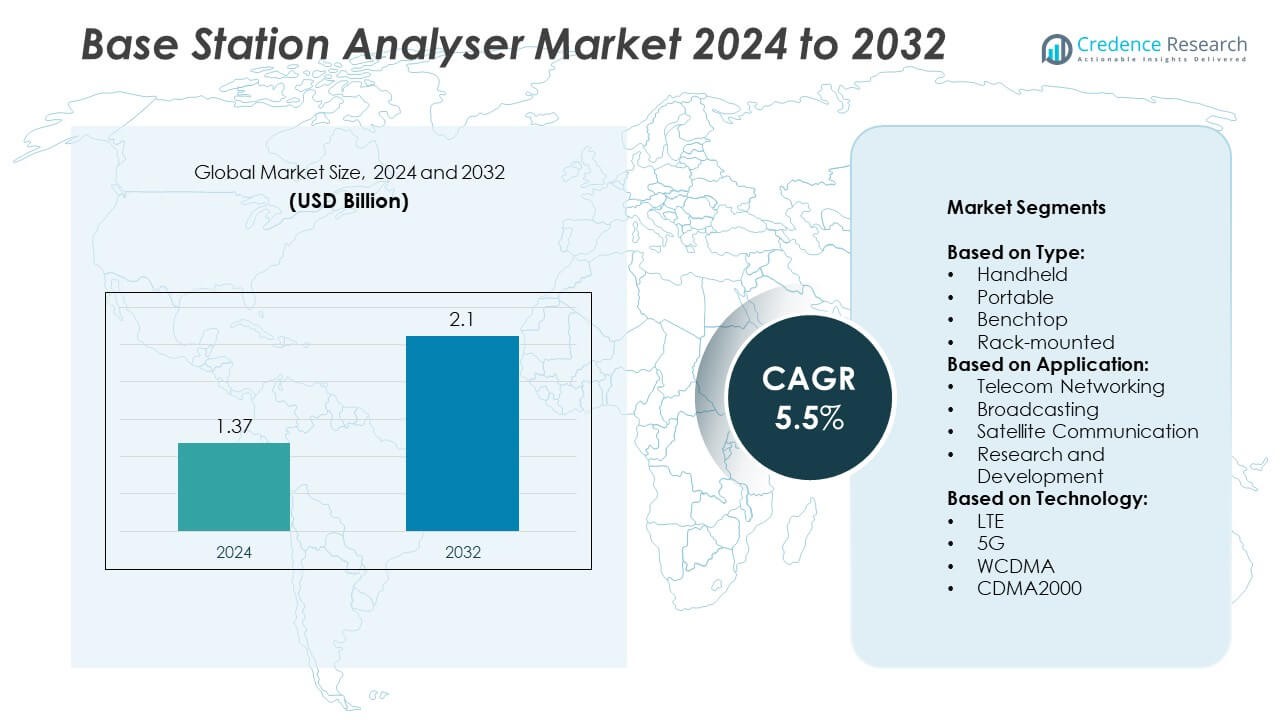

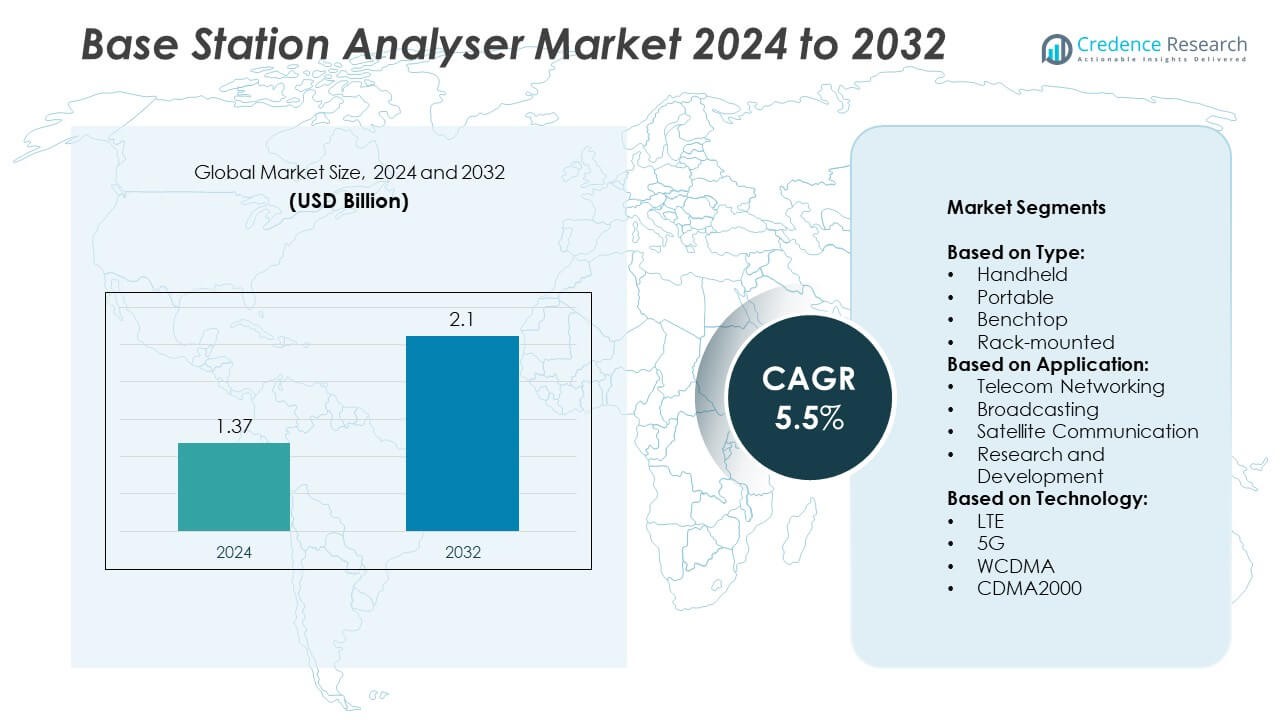

Base Station Analyser market size was valued at USD 1.37 billion in 2024 and is expected to reach USD 2.1 billion by 2032, growing at a CAGR of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Base Station Analyser Market Size 2024 |

USD 1.37 Billion |

| Base Station Analyser Market, CAGR |

5.5% |

| Base Station Analyser Market Size 2032 |

USD 2.1 Billion |

The base station analyser market is driven by leading players such as Rohde and Schwarz, Anritsu Corporation, Huawei, Fluke Networks, Keysight Technologies, and Spirent Communications, who focus on advanced 5G-ready solutions and multi-technology support. These companies emphasize portable, handheld, and software-upgradable analysers to meet rising field testing needs and evolving wireless standards. North America leads the market with approximately 35.6% share in 2024, supported by extensive 5G rollouts and strong R&D investments. Europe follows with around 29.8% share, driven by spectrum harmonization and quality compliance, while Asia Pacific holds 24.7% and emerges as the fastest-growing region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The base station analyser market was valued at USD 1.37 billion in 2024 and is projected to reach USD 2.1 billion by 2032, growing at a CAGR of 5.5% between 2025 and 2032.

- Rising 5G deployments, telecom network expansions, and demand for real-time network monitoring are driving adoption of advanced analysers, with handheld devices holding over 40% share in 2024.

- Multi-technology and software-upgradable analysers are trending, supporting LTE, 5G, and legacy networks to optimize operator investments and improve testing efficiency.

- The market is competitive, with global players focusing on innovation, partnerships, and rental solutions to reduce upfront costs and enhance customer access to high-end equipment.

- North America leads with 35.6% share, followed by Europe at 29.8% and Asia Pacific at 24.7%, where rapid network densification and growing 5G rollouts are making the region the fastest-growing market

Market Segmentation Analysis:

By Type

Handheld base station analysers dominate the market, accounting for over 40% share in 2024. Their compact size, portability, and ease of use make them ideal for field technicians conducting on-site network installation, troubleshooting, and maintenance. The growing need for quick fault detection in remote areas and the rise in outdoor base station deployments further drive adoption. Portable analysers follow closely, supported by their balance between mobility and performance. Benchtop and rack-mounted systems remain preferred in laboratories and production testing environments where precision, multi-function testing, and integration with automated systems are critical.

- For instance, Rohde & Schwarz introduced its R&S Spectrum Rider FPH handheld spectrum analyzer with frequency ranges up to 44 GHz in October 2021. The device features a typical measurement accuracy of 0.5 dB (for the 10 MHz–3 GHz range) and is used for outdoor applications like verifying 5G base stations. The analyzer is capable of measurements including occupied bandwidth and channel power for 5G signals.

By Application

Telecom networking is the leading application segment, holding over 55% of the market in 2024. The rapid expansion of mobile networks and rollout of 5G infrastructure create high demand for analysers capable of monitoring signal quality, latency, and coverage in real-time. Network operators rely on these devices to ensure compliance with service-level agreements and to optimize network performance. Broadcasting applications continue to grow steadily, driven by digital TV and radio transitions, while satellite communication and research and development segments see adoption for mission-critical connectivity and advanced testing scenarios.

- For instance, Keysight Technologies launched its FieldFox B-Series handheld analyzers, with models offering up to 120 MHz of real-time bandwidth, some of these models can detect pulsed signals with a duration as short as 5.52 µs with a 100% probability of intercept, and they can be equipped with various software options to perform lab-grade measurements in the field.

By Technology

5G technology leads the base station analyser market, capturing more than 50% share in 2024. Its dominance stems from global 5G rollouts, massive MIMO deployments, and network densification initiatives that require high-performance analysers to verify beamforming and spectrum efficiency. LTE remains relevant, supported by upgrades to 4G networks in developing regions and coexistence with 5G non-standalone architecture. WCDMA and CDMA2000 continue to serve legacy networks but represent a declining share as operators phase out older technologies in favor of faster, lower-latency standards that support IoT, AR/VR, and ultra-reliable communications.

Key Growth Drivers

Rising 5G Deployment

Global 5G rollouts are a major growth driver, boosting demand for advanced base station analysers. Network operators are expanding infrastructure to support enhanced mobile broadband and ultra-low latency services. These deployments require analysers that validate beamforming, spectrum usage, and carrier aggregation. Increasing adoption of small cells and massive MIMO antennas further drives equipment upgrades. Governments supporting 5G spectrum auctions and private network initiatives accelerate market penetration. The need for precise field measurements and network optimization ensures consistent investment in high-performance, portable analysers across telecom and enterprise networks worldwide.

- For instance, Anritsu has supplied numerous MT8000A Radio Communication Test Stations to various customers and partners, including mobile network operators, in the Asia-Pacific region and worldwide to support 5G testing.

Expansion of Telecom Networks

Rapid growth in mobile subscriptions and rural connectivity programs fuel demand for base station analysers. Operators are investing heavily in new macro and micro cell sites to enhance coverage and capacity. Emerging economies are witnessing large-scale 4G upgrades, while developed markets transition toward 5G standalone networks. This continuous network expansion requires analysers for commissioning, troubleshooting, and maintenance. Rising data consumption and IoT device integration further push network densification. Vendors offering multi-standard, field-friendly analysers benefit from consistent capital expenditure by telecom companies focused on quality-of-service improvements and competitive differentiation.

- For instance, ZTE is a major information and communication technology (ICT) provider known for its global network modernization efforts, which involve upgrading from legacy technologies like WCDMA (3G) to newer 4G and 5G networks. At Mobile World Congress (MWC) 2024, the company launched its Smart Cloud Platform (SCP) 2.0 to offer integrated, remote, and visual network management for home and small business users.

Emphasis on Network Quality and Compliance

Ensuring superior network performance and regulatory compliance drives analyser adoption. Operators face pressure to maintain stringent service-level agreements, requiring continuous monitoring of signal integrity, interference, and coverage. Base station analysers play a key role in meeting quality-of-service metrics set by national telecom authorities. The growing complexity of heterogeneous networks makes accurate testing essential. Businesses and public safety networks also demand uninterrupted connectivity, boosting periodic maintenance and verification activities. Manufacturers offering high-accuracy instruments with real-time analytics capabilities find strong opportunities in this compliance-driven market environment.

Key Trends & Opportunities

Transition to Multi-Technology Testing

The market is witnessing a shift toward analysers capable of supporting multiple technologies in a single platform. Telecom operators prefer versatile instruments that handle LTE, 5G, and legacy standards like WCDMA. This trend reduces equipment costs and simplifies field operations by eliminating the need for multiple devices. Vendors are integrating software-defined features, enabling upgrades through firmware to support future standards. The ability to switch between technologies during live network testing improves operational efficiency, making multi-technology analysers a strategic choice for large-scale network rollouts.

- For instance, the Tektronix RSA7100B offers a real-time spectrum analyser with 320 MHz bandwidth standard, optional 800 MHz acquisition bandwidth, and can detect events of 232 nanoseconds duration for full capture.

Growth of Private and Industrial Networks

The rise of private 5G and industrial networks presents a strong opportunity for analyser vendors. Enterprises in manufacturing, logistics, and energy sectors are deploying localized networks to enable automation and secure communications. These deployments require specialised analysers to verify coverage, optimize interference management, and ensure network reliability. The increasing focus on Industry 4.0 and mission-critical IoT applications strengthens demand. Vendors offering compact, cost-effective analysers with remote monitoring capabilities are well-positioned to capture this emerging enterprise segment, complementing the traditional telecom operator customer base.

- For instance, in a private 5G testbed deployed in Singapore’s FCT O-RAN, the indoor setup using 50 MHz bandwidth achieved 713 Mbps downlink throughput and 66 Mbps uplink; the outdoor setup with 40 MHz bandwidth achieved 371 Mbps downlink and 55 Mbps uplink.

Key Challenges

High Initial Cost of Advanced Analysers

The cost of high-performance base station analysers remains a major barrier, particularly for small network operators and contractors. Advanced instruments capable of 5G and multi-band testing involve significant capital expenditure. This high upfront investment limits adoption in cost-sensitive markets. Some users continue relying on older equipment, risking inaccurate results in modern networks. Vendors face pressure to deliver cost-effective solutions without compromising precision. Subscription-based and rental models are emerging as alternatives to mitigate the impact of high procurement costs and make advanced testing tools more accessible.

Complexity of Evolving Network Standards

Frequent updates to wireless communication standards pose a challenge for analyser manufacturers and users. Supporting new 5G releases, frequency bands, and carrier aggregation combinations requires constant hardware and software upgrades. This adds complexity for field technicians, who must stay trained on the latest protocols. Delays in updating instruments may lead to compatibility issues during testing. Vendors must invest in R&D to keep pace with evolving requirements. The need for continuous innovation raises costs and may slow deployment cycles for some operators, affecting market growth.

Regional Analysis

North America

North America holds around 35.6% share of the base station analyser market in 2024, supported by large-scale 5G deployments across the U.S. and Canada. Network operators are rapidly installing small cells and upgrading to standalone 5G, creating strong demand for advanced handheld and portable analysers. High R&D spending and the presence of leading telecom equipment manufacturers accelerate technology adoption. Regulatory pressure to ensure service quality drives continuous testing. Rural broadband expansion programs and spectrum auctions further boost demand, making North America the most mature and stable regional market for base station analysers.

Europe

Europe accounts for approximately 29.8% of the global market in 2024, led by Germany, the U.K., and France. The region’s focus on 5G spectrum harmonization and energy-efficient network deployment drives adoption of multi-technology analysers. EU regulations require precise quality-of-service testing, stimulating steady demand. Portable and benchtop models are widely used in both field operations and R&D labs. Europe’s strong broadcasting sector and satellite communication programs add to market opportunities. Government-backed digital initiatives and private investment support continued infrastructure upgrades, keeping Europe a major contributor to global base station analyser revenues.

Asia Pacific

Asia Pacific commands about 24.7% market share in 2024 and is the fastest-growing region. China leads with aggressive 5G rollouts, while Japan and South Korea are expanding ultra-dense network infrastructure. India’s ongoing 4G coverage expansion and early-stage 5G adoption are major growth contributors. Rising population density and high mobile data consumption drive network densification projects. Cost-effective local manufacturing supports affordable analyser availability. Vendors providing scalable and software-upgradable solutions gain traction in this price-sensitive but high-volume market, positioning Asia Pacific as a key growth engine over the forecast period.

Latin America

Latin America represents around 6.3% of the global market in 2024, with Brazil and Mexico as key revenue contributors. The region is upgrading existing 4G networks and conducting initial 5G trials, increasing demand for cost-effective portable analysers. Government initiatives to improve rural connectivity and bridge digital divides support steady infrastructure investments. Urbanization and rising mobile penetration rates push telecom operators to modernize networks. Despite budget constraints, demand for multi-functional, rugged analysers is growing, allowing operators to optimize coverage and reduce downtime while controlling operational costs in developing telecom markets.

Middle East and Africa

Middle East and Africa hold nearly 3.6% market share in 2024, showing steady growth potential. Gulf Cooperation Council countries such as UAE and Saudi Arabia lead with early 5G adoption and smart city initiatives, driving demand for high-performance analysers. In Africa, 4G network expansion remains the focus, with 5G adoption expected gradually over the next few years. The need for affordable and durable handheld analysers is high in price-sensitive markets. Continued investment in telecom infrastructure and regional digitalization programs will support market expansion in both Middle Eastern and African nations.

Market Segmentations:

By Type:

- Handheld

- Portable

- Benchtop

- Rack-mounted

By Application:

- Telecom Networking

- Broadcasting

- Satellite Communication

- Research and Development

By Technology:

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the base station analyser market features leading players such as Rohde and Schwarz, Anritsu Corporation, Huawei, Fluke Networks, Keysight Technologies, Spirent Communications, Nokia, Advanced Test Equipment Rentals, Infovista, Ericsson, Agilent Technologies, Tektronix, Viavi Solutions, ZTE Corporation, and Qualcomm. The market is characterized by continuous innovation, with manufacturers focusing on advanced 5G-ready analysers, multi-technology support, and software-defined upgrades to enhance versatility. Companies are investing in portable and handheld solutions to meet field testing requirements and reduce downtime for operators. Strategic partnerships with telecom providers and rental service offerings are gaining traction to lower capital expenditure barriers. Emphasis on real-time analytics, automation, and cloud integration helps operators optimize network performance and comply with regulatory standards. Competitive differentiation is driven by accuracy, ease of use, and the ability to support evolving wireless communication protocols, positioning these companies to capture demand from both telecom and enterprise customers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Rohde and Schwarz

- Anritsu Corporation

- Huawei

- Fluke Networks

- Keysight Technologies

- Spirent Communications

- Nokia

- Advanced Test Equipment Rentals

- Infovista

- Ericsson

- Agilent Technologies

- Tektronix

- Viavi Solutions

- ZTE Corporation

- Qualcomm

Recent Developments

- In 2025, Rohde & Schwarz developed an integrated test solution for the Taiwan Space Agency that combines EMC and antenna measurement capabilities into a single test chamber.

- In 2025, Anritsu Corporation teamed up with Bluetest AB to develop an Over-The-Air (OTA) measurement solution for evaluating 5G IoT performance.

- In 2025, Keysight introduced a 1.6T platform named INPT-1600GE with its associated software to automate network interconnect performance validation, especially for high-speed Ethernet and AI data center networks

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see strong growth driven by global 5G network rollouts and densification projects.

- Handheld and portable analysers will gain higher adoption due to field testing requirements.

- Multi-technology analysers supporting 5G, LTE, and legacy networks will become standard.

- Cloud-enabled and software-upgradable solutions will dominate to ensure long-term usability.

- Private 5G and industrial networks will create new opportunities for analyser manufacturers.

- Demand will rise from R&D labs for testing emerging wireless standards and protocols.

- Integration of AI and analytics will enhance fault detection and predictive maintenance.

- Asia Pacific will emerge as the fastest-growing region due to large-scale network expansion.

- Rental and subscription-based models will grow to address high equipment cost barriers.

- Focus on energy-efficient and compact designs will shape future product development.