| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| BRIC Organic Baby Food Market Size 2024 |

USD 7,372.29 million |

| BRIC Organic Baby Food Market , CAGR |

12.18% |

| BRIC Organic Baby Food Market Size 2032 |

USD 19,702.50 million |

Market Overview

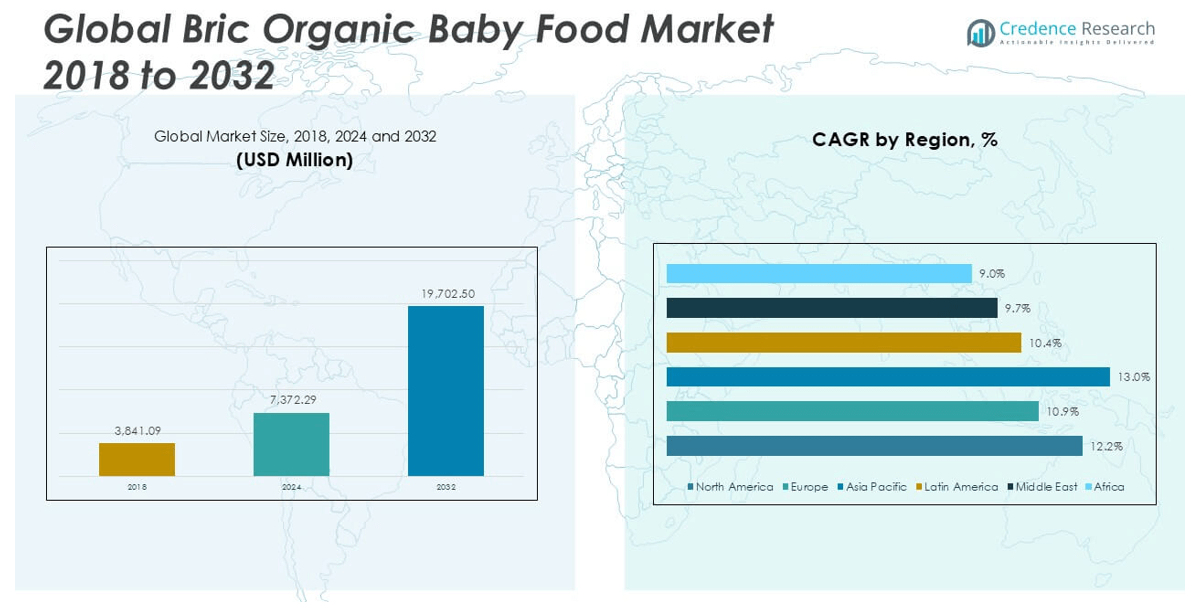

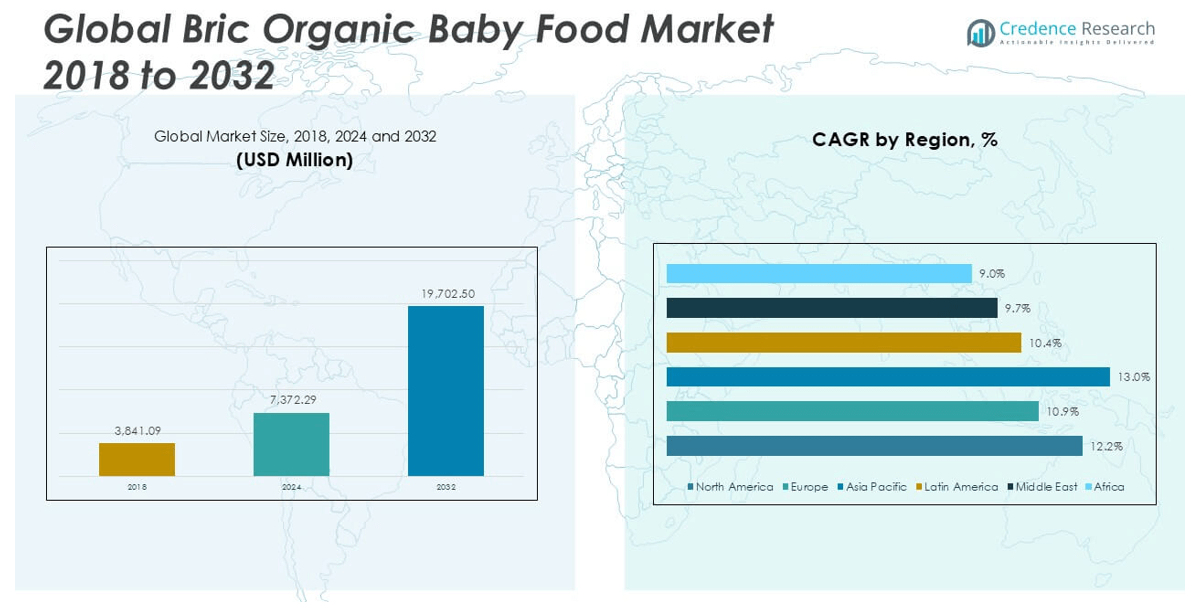

The BRIC Organic Baby Food market size was valued at USD 3,841.09 million in 2018, increased to USD 7,372.29 million in 2024, and is anticipated to reach USD 19,702.50 million by 2032, at a CAGR of 12.18% during the forecast period.

The BRIC Organic Baby Food market is led by prominent players such as Nestlé, Danone, Abbott Laboratories, The Hain Celestial Group, and Kraft Heinz, all of which maintain a strong presence through product innovation, wide distribution, and strategic brand positioning. Regional firms like Beingmate and Hindustan Unilever further enhance market competitiveness by catering to local preferences and price sensitivities. Asia Pacific emerged as the leading region in 2024, accounting for 44.1% of the total market share, driven by high birth rates, rising disposable incomes, and growing awareness of organic nutrition in countries like China and India.

Market Insights

- The BRIC Organic Baby Food market was valued at USD 7,372.29 million in 2024 and is projected to reach USD 19,702.50 million by 2032, growing at a CAGR of 12.18%.

- Rising health awareness among parents and growing demand for chemical-free, nutrient-rich baby food are key drivers fueling market growth across BRIC nations.

- Increasing adoption of e-commerce, demand for convenient packaging, and innovation in organic formulations are shaping emerging trends in the market.

- The market is highly competitive with major players like Nestlé, Danone, Abbott Laboratories, and regional brands such as Beingmate and Hindustan Unilever focusing on product innovation and distribution expansion.

- Asia Pacific dominated the market with a 44.1% share in 2024, followed by North America at 28.3%, while the Milk Formula segment led the product category due to its high demand and nutritional value.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

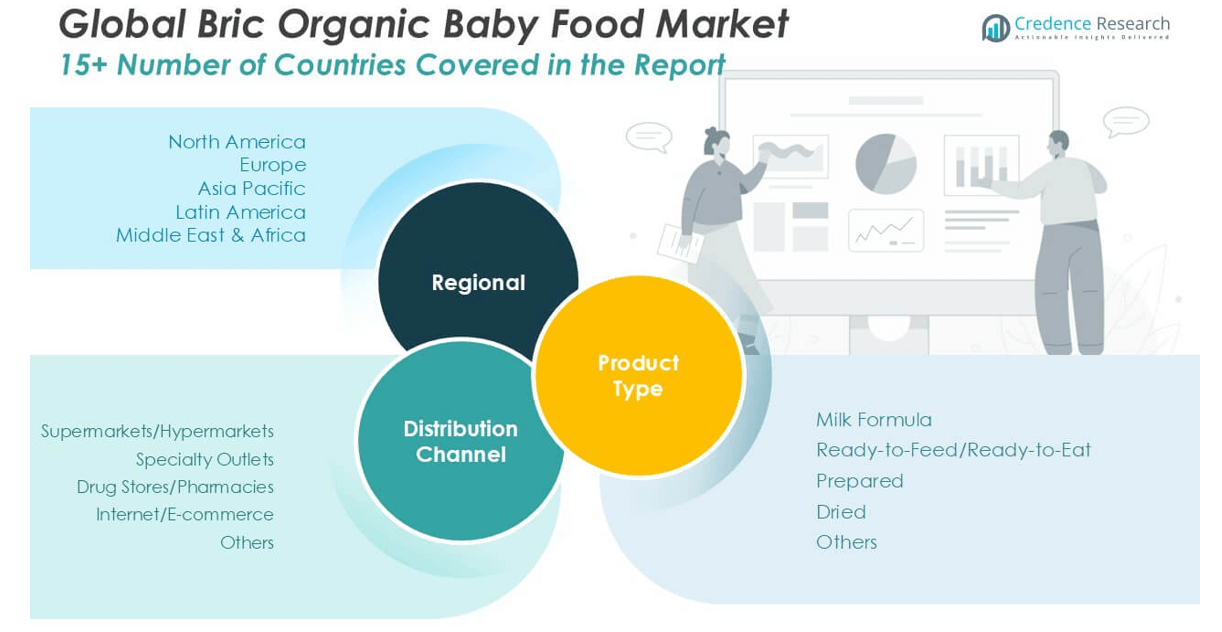

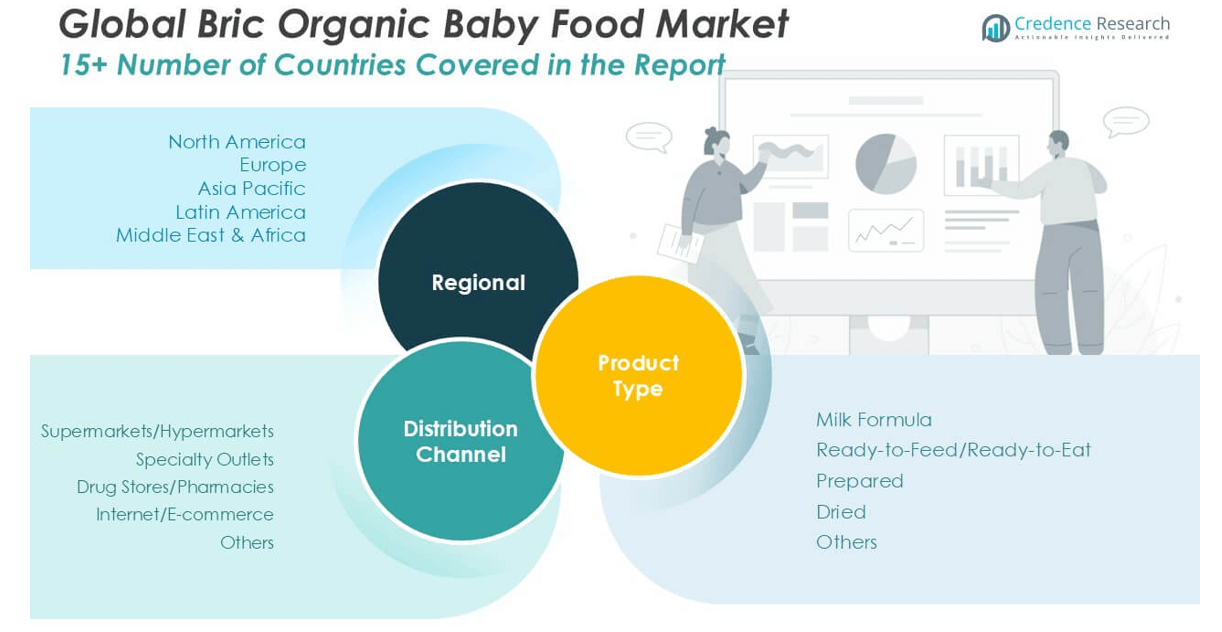

Market Segmentation Analysis:

By Product Type

In the BRIC Organic Baby Food market, the Milk Formula segment holds the dominant market share due to its high nutritional value and convenience for working parents. It accounted for the largest portion of the market in 2024, driven by increasing awareness about infant nutrition and a growing preference for organic ingredients. The Ready-to-Feed/Ready-to-Eat and Prepared segments are also witnessing steady growth, supported by urban lifestyle shifts and rising disposable incomes. The Dried segment remains popular in rural and semi-urban areas due to longer shelf life and affordability, while the others category captures niche products catering to specific dietary needs.

- For instance, Danone’s Aptamil Profutura formula incorporates 35 optimized nutrients and a patented blend of prebiotics GOS/FOS in a 9:1 ratio, which supports digestive health and immunity in infants.

By Distribution Channel

Supermarkets/Hypermarkets emerged as the leading distribution channel in the BRIC Organic Baby Food market, holding the highest revenue share in 2024. Their dominance is driven by wide product availability, strong brand visibility, and consumer trust in established retail chains. Specialty Outlets are gaining traction, particularly in urban centers where demand for premium organic products is rising. Internet/E-commerce has recorded significant growth, supported by digital penetration and increasing demand for doorstep delivery. Drug Stores/Pharmacies play a key role in promoting medically recommended products, while the others segment includes local stores and alternative retail channels catering to regional consumer bases.

- For instance, Nestlé reported that over 60 million units of its organic baby food SKUs were sold through Walmart and Carrefour stores across emerging markets in 2023, reflecting the power of offline hypermarket retail.

Market Overview

Rising Awareness of Infant Nutrition and Organic Products

Increasing parental awareness regarding the benefits of organic nutrition is a primary growth driver in the BRIC Organic Baby Food market. Consumers are actively shifting away from conventional baby foods due to concerns about pesticide residues, preservatives, and artificial additives. This shift is especially strong among health-conscious urban parents who prioritize clean-label, certified organic products. Government health campaigns and pediatric recommendations have further supported the market expansion, reinforcing the demand for safe, high-quality, and nutritionally balanced organic baby food options.

- For instance, The Hain Celestial Group’s Earth’s Best Organic baby food line is USDA-certified and tested for over 125 pesticides and heavy metals per batch before release to retail.

Urbanization and Changing Lifestyles

Rapid urbanization across BRIC nations has significantly influenced consumer behavior, leading to greater demand for convenient and ready-to-use baby food solutions. As more parents, especially mothers, enter the workforce, the need for time-saving, nutritious feeding alternatives has grown. This lifestyle transition supports the uptake of prepared and ready-to-feed organic baby foods, especially in metro areas. The availability of these products in modern retail and online platforms makes them easily accessible to busy, urban consumers, further propelling market growth.

- For instance, Hero Group’s organic baby food pouches, designed for single-hand use and portability, recorded over 8 million units sold in metropolitan regions of Brazil and India in 2023.

Rising Disposable Incomes and Expanding Middle Class

The expanding middle-class population and rising disposable incomes in BRIC countries have enhanced consumers’ capacity to invest in premium organic baby food products. This trend is especially evident in China and India, where economic growth is enabling families to prioritize health and wellness. Parents are increasingly willing to pay a premium for trustworthy, organic-certified brands, especially those offering added nutritional benefits. This shift toward premiumization continues to open up lucrative opportunities for both domestic and international market players.

Key Trends & Opportunities

Growth of E-Commerce and Digital Retail Channels

The rapid expansion of internet access and smartphone usage has led to a significant surge in online purchases of organic baby food across BRIC countries. E-commerce platforms offer convenience, variety, and detailed product information, which appeal to modern consumers. Digital marketing by organic brands, subscription models, and targeted promotions have further boosted online sales. This channel presents a strong growth opportunity for brands aiming to reach tech-savvy and time-constrained parents, particularly in urban and semi-urban regions.

- For instance, Abbott Laboratories reported that its Similac Organic infant formula achieved 1.4 million direct-to-consumer shipments through its e-commerce portal and Amazon storefronts across BRIC markets in 2023.

Innovation in Product Formulation and Packaging

Product innovation is emerging as a vital trend in the BRIC Organic Baby Food market. Companies are developing new formulations enriched with superfoods, probiotics, and allergen-free ingredients to cater to diverse consumer needs. Sustainable, user-friendly packaging is also gaining importance as eco-conscious parenting becomes more prevalent. Brands that focus on both nutritional value and environmental responsibility are gaining a competitive edge, thereby driving product differentiation and customer loyalty in a fast-evolving market.

- For instance, Hindustan Unilever’s organic baby food sub-brand introduced 100% recyclable aluminum-laminate pouches in 2023, reducing plastic content by 6.8 metric tons annually.

Key Challenges

High Product Pricing and Affordability Issues

One of the major challenges in the BRIC Organic Baby Food market is the high price point of organic products, which limits accessibility for price-sensitive consumers. Despite growing interest in health-oriented food, many families, particularly in rural and lower-income segments, find organic baby food unaffordable. This pricing disparity creates a barrier to wider market penetration and restricts growth to affluent urban areas, highlighting the need for cost-effective solutions and subsidies to expand consumer reach.

Lack of Consumer Trust and Mislabeling Concerns

Concerns regarding the authenticity and certification of organic products persist among consumers in the BRIC region. Mislabeling, insufficient regulatory enforcement, and the prevalence of counterfeit goods have eroded trust in some markets. This skepticism undermines consumer confidence and poses a challenge for legitimate brands. Building transparency through third-party certifications, clear labeling, and educational campaigns is essential for companies to gain credibility and foster long-term customer relationships.

Limited Supply Chain Infrastructure

Inadequate supply chain infrastructure, especially in remote and rural areas, continues to impede the distribution of organic baby food across the BRIC nations. Cold chain logistics, storage facilities, and efficient transportation are critical for maintaining product quality and shelf life. However, many regions still face logistical gaps, resulting in delayed deliveries and reduced product availability. Addressing these infrastructure challenges is crucial to ensure widespread accessibility and to support sustained market expansion.

Regional Analysis

North America

North America held a significant share of the BRIC Organic Baby Food market in 2024, reaching USD 2,084.96 million, up from USD 1,103.72 million in 2018. The region is projected to grow at a CAGR of 12.2%, attaining USD 5,595.71 million by 2032. In 2024, it accounted for approximately 28.3% of the global market. Growth is driven by increasing consumer preference for premium organic nutrition, strong retail infrastructure, and high awareness of infant health. The U.S. leads the regional demand, supported by regulatory clarity and innovation in product offerings.

Europe

Europe captured around 18.9% of the BRIC Organic Baby Food market share in 2024, recording a value of USD 1,387.63 million, compared to USD 762.26 million in 2018. With a projected CAGR of 10.9%, the market is expected to reach USD 3,393.22 million by 2032. Key factors driving growth include rising demand for clean-label products, increasing birth rates in parts of Eastern Europe, and supportive government regulations around organic certifications. Germany, France, and the UK remain the dominant contributors to regional market growth due to strong consumer awareness and availability.

Asia Pacific

Asia Pacific dominates the BRIC Organic Baby Food market with a commanding 44.1% market share in 2024, valued at USD 3,253.87 million, up from USD 1,633.35 million in 2018. It is forecasted to reach USD 9,240.57 million by 2032, growing at the fastest CAGR of 13.0%. The region’s rapid expansion is fueled by rising disposable incomes, urbanization, and growing parental concern for child health. China and India lead market growth, backed by a large population base, government promotion of organic farming, and the emergence of local organic baby food brands.

Latin America

Latin America accounted for approximately 4.6% of the BRIC Organic Baby Food market in 2024, with a valuation of USD 336.49 million, rising from USD 177.57 million in 2018. The region is set to grow at a CAGR of 10.4%, reaching USD 793.67 million by 2032. Market expansion is supported by a gradual shift toward health-conscious parenting, growth of modern retail formats, and rising urban middle-class populations in countries like Brazil and Mexico. However, affordability and limited awareness continue to challenge broader adoption across the region.

Middle East

The Middle East represented around 2.5% of the market share in 2024, with revenue rising to USD 183.85 million from USD 105.03 million in 2018. Forecasted to grow at a CAGR of 9.7%, the market is projected to reach USD 412.54 million by 2032. Increased focus on child nutrition, expanding healthcare awareness, and a growing expatriate population contribute to demand. The UAE and Saudi Arabia are the leading markets, with increasing availability of imported organic baby food through pharmacies, supermarkets, and online channels.

Africa

Africa held the smallest share in the BRIC Organic Baby Food market in 2024, contributing 1.7% of the global revenue, valued at USD 125.48 million, up from USD 59.15 million in 2018. With a CAGR of 9.0%, the region is expected to reach USD 266.79 million by 2032. Market growth is gradually progressing, supported by improving income levels, increased focus on child nutrition, and NGO-led awareness programs. However, challenges such as affordability, low product availability, and limited infrastructure continue to restrict wider market penetration across most African countries.

Market Segmentations:

By Product Type

- Milk Formula

- Ready-to-Feed/Ready-to-Eat

- Prepared

- Dried

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Outlets

- Drug Stores/Pharmacies

- Internet/E-commerce

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the BRIC Organic Baby Food market is characterized by the presence of both global and regional players striving to capture growing consumer demand for organic infant nutrition. Key market leaders such as Nestlé, Danone, Abbott Laboratories, and The Hain Celestial Group maintain a strong foothold through diversified product portfolios, extensive distribution networks, and significant investment in R&D and marketing. These companies focus on innovation, including the development of allergen-free, fortified, and sustainably packaged products. Regional brands like Beingmate and Hindustan Unilever also play a vital role, especially in price-sensitive and culturally specific markets. Strategic collaborations, acquisitions, and expansion into digital retail channels are common growth tactics. Increasing brand competition is driving improvements in product transparency, quality certifications, and customer engagement strategies. As the demand for organic baby food rises across BRIC nations, companies are intensifying efforts to enhance market share while navigating regulatory frameworks and regional consumer preferences.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nestlé

- Danone

- Abbott Laboratories

- The Hain Celestial Group

- Hero Group

- Kraft Heinz

- Beingmate

- Hindustan Unilever

- Otsuka Holdings

Recent Developments

- In April 2025, Nestlé reported continued organic sales growth in its baby food segment within the BRIC (Brazil, Russia, India, and China) markets. This growth was fueled by the company’s focus on product innovation and tailored offerings to specific regional consumer preferences. Nestlé highlighted its commitment to expanding its certified organic product lines and adapting to the unique demands of markets like India and China, where the demand for organic milk formula and cereals is on the rise.

- In May 2025, Danone expanded its presence in the plant-based baby food market by acquiring Kate Farms, a U.S. manufacturer of organic plant-based formulas. This strategic move allows Danone to diversify its portfolio in infant nutrition and cater to the rising demand for plant-based options, particularly in BRIC countries. The acquisition will integrate Kate Farms’ specialized nutrition products into Danone’s offerings, potentially enhancing their reach and impact.

- In April 2025, Hain Celestial reiterated its dedication to high safety standards in baby food production. The company emphasized its focus on minimizing trace heavy metals and ensuring the use of high-quality, USDA-organic ingredients, demonstrating a commitment to transparency and rigorous testing.

- In 2025, Abbott expanded its Pure Bliss™ by Similac® line to include USDA-certified organic and European-made infant formulas, catering to the growing demand for organic options, especially in BRIC markets. The expanded line now features products made with A2 milk, known for its digestibility.

- In 2025, Abbott’s Similac® 360 Total Care® formula, featuring a unique blend of five human milk oligosaccharides (HMOs), continues to be a popular choice for parents seeking a formula that closely mimics breast milk. This formula is designed to support the developing immune system, digestive health, and brain development in infants.

Market Concentration & Characteristics

The BRIC Organic Baby Food Market exhibits a moderately concentrated structure, with a few multinational corporations holding significant market share alongside several emerging regional players. It is characterized by high brand loyalty, stringent quality expectations, and increasing consumer preference for certified organic ingredients. The market is driven by rapid urbanization, rising disposable incomes, and heightened awareness of infant nutrition across BRIC countries. Companies such as Nestlé, Danone, and Abbott Laboratories dominate in terms of product innovation, distribution scale, and marketing strength, while regional brands compete by offering localized products at competitive prices. E-commerce growth has widened product access, especially in urban centers. The market favors companies that can align with clean-label demands, maintain supply chain transparency, and ensure regulatory compliance. Product differentiation through value-added nutrition and eco-friendly packaging remains critical. It continues to evolve through innovation and strategic expansion, particularly in Asia Pacific, where rising demand is reshaping competition and influencing product development.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow steadily due to rising awareness about organic nutrition among young parents.

- Asia Pacific will remain the dominant region driven by expanding middle-class population and increasing birth rates.

- Demand for plant-based and allergen-free baby food products will gain more traction.

- E-commerce sales will increase further with improved digital infrastructure and consumer convenience.

- Product innovation will focus on functional ingredients like probiotics, vitamins, and superfoods.

- Eco-friendly and sustainable packaging will become a key brand differentiator.

- Regional players will expand their footprint by targeting tier 2 and tier 3 cities.

- Companies will invest more in transparent sourcing and organic certifications to build consumer trust.

- Strategic partnerships and acquisitions will shape market competitiveness and expansion.

- Regulatory support and government initiatives promoting organic farming will enhance supply chain stability.