Market Overview:

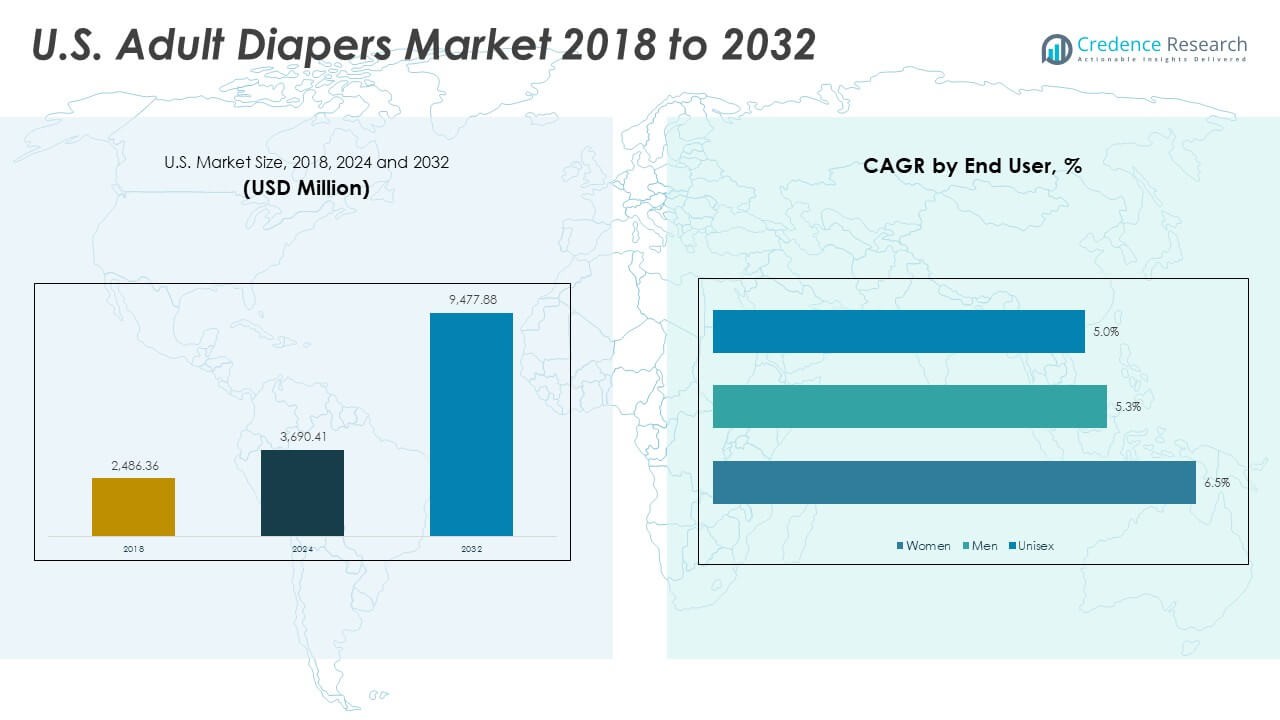

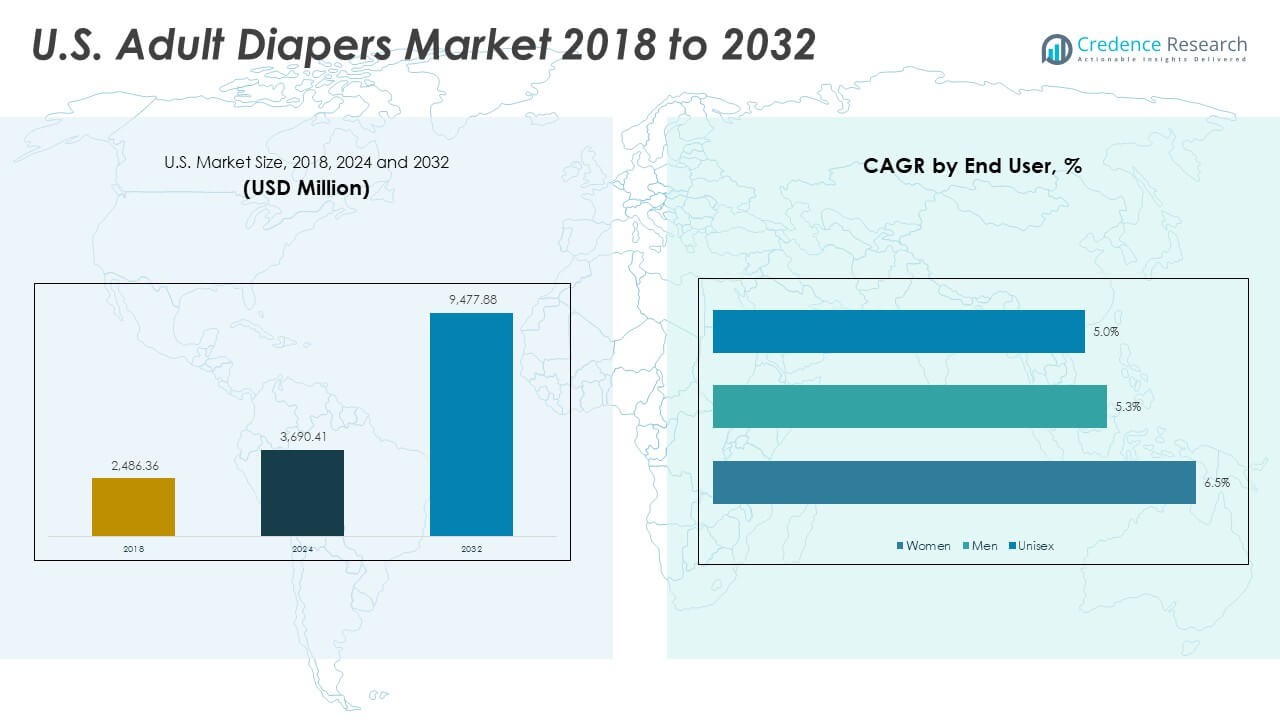

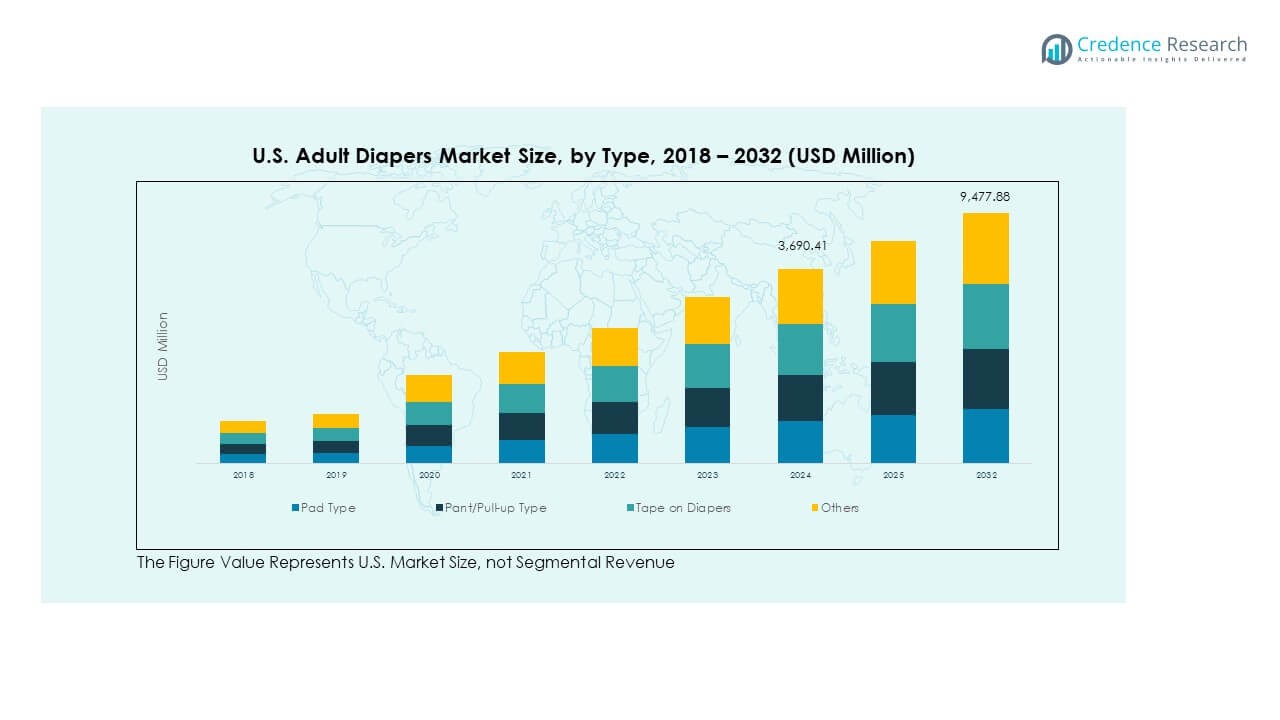

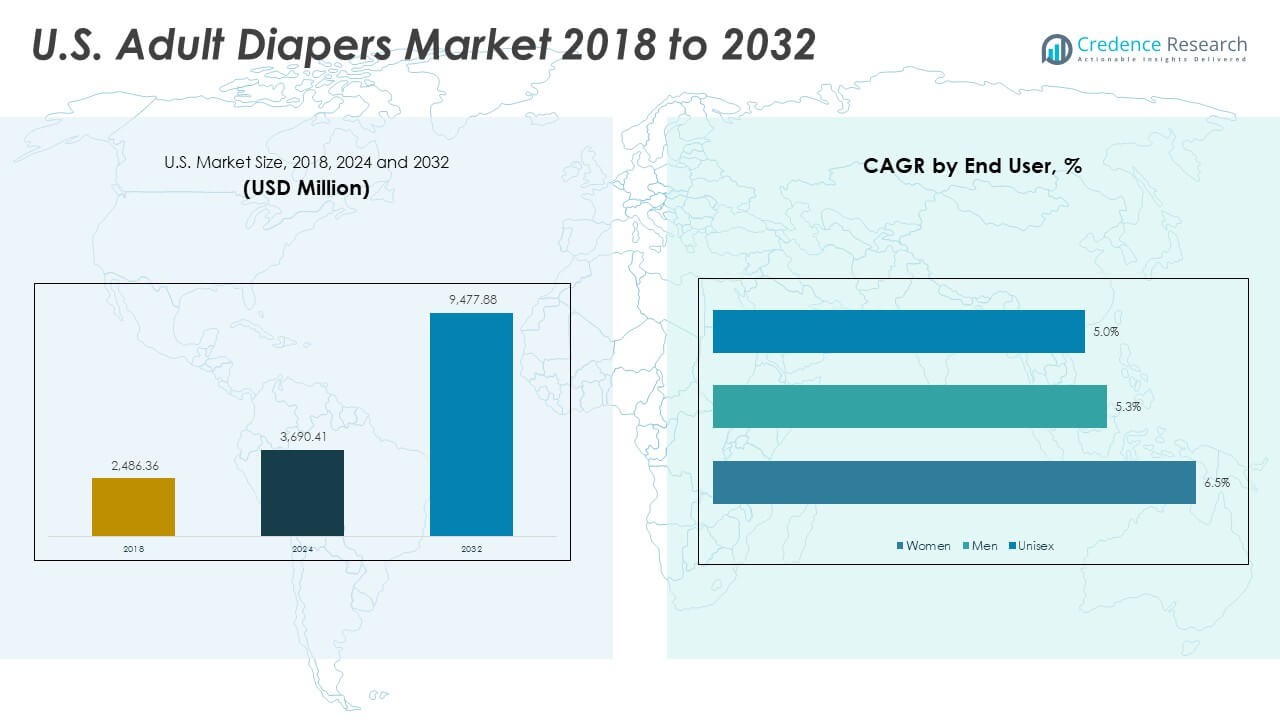

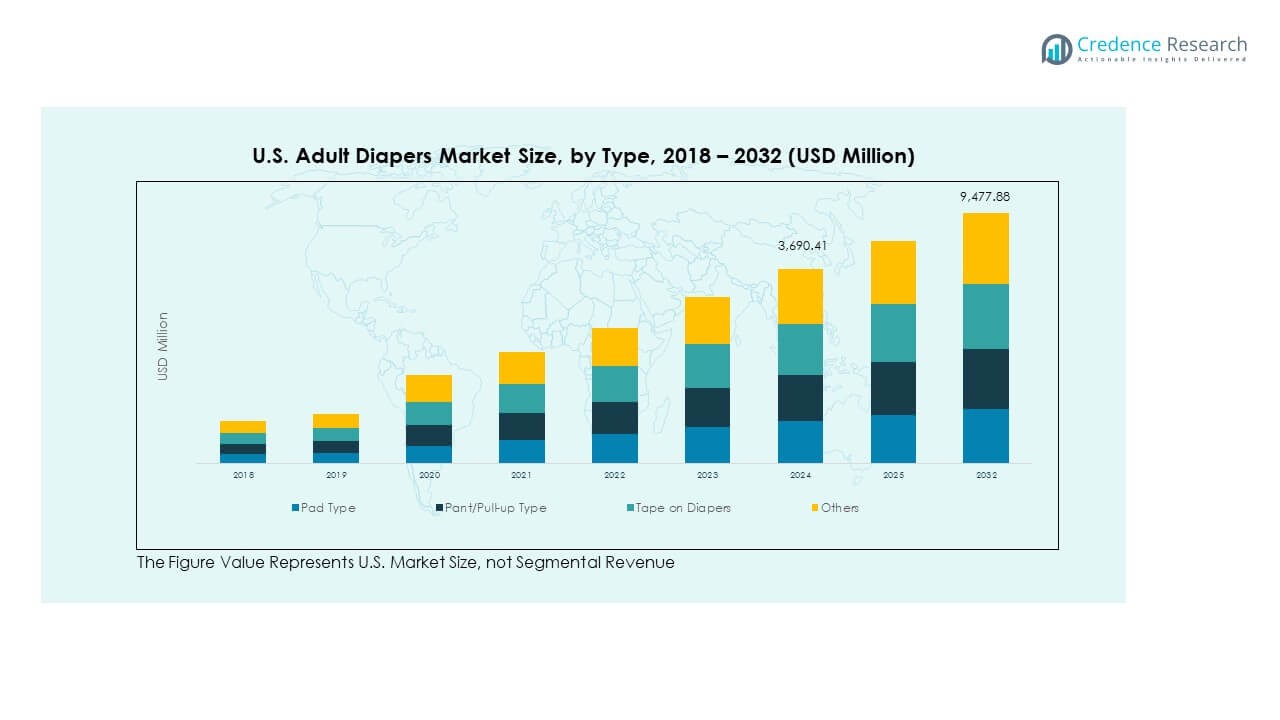

The U.S. Adult Diapers Market size was valued at USD 2,486.36 million in 2018 to USD 3,690.41 million in 2024 and is anticipated to reach USD 9,477.88 million by 2032, at a CAGR of 12.51% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Adult Diapers Market Size 2024 |

USD 3,690.41 Million |

| U.S. Adult Diapers Market, CAGR |

12.51% |

| U.S. Adult Diapers Market Size 2032 |

USD 9,477.88 Million |

The U.S. Adult Diapers Market is expanding due to an aging population, rising cases of incontinence, and growing health awareness. Consumers are increasingly seeking comfort, skin-friendly materials, and discreet designs. Advancements in absorbent technology, odor control, and eco-friendly products are improving adoption rates. The market also benefits from better healthcare infrastructure, higher spending on personal care, and reduced social stigma surrounding adult incontinence solutions. E-commerce growth further supports accessibility, enabling wider distribution and offering consumers convenience and variety.

Regionally, demand for adult diapers is most concentrated in urban and developed areas of the United States, where higher healthcare awareness and access drive sales. States with larger elderly populations, such as Florida and California, dominate due to strong demand from long-term care facilities and homecare users. Emerging markets include rural and semi-urban areas, where awareness is rising, and retail penetration is improving. These regions are seeing growth as product availability expands and consumers adopt modern incontinence care solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The U.S. Adult Diapers Market size was USD 2,486.36 million in 2018, USD 3,690.41 million in 2024, and is projected to reach USD 9,477.88 million by 2032, growing at a CAGR of 12.51% during the forecast period.

- The South leads with around 31% share due to its large elderly base and higher chronic condition prevalence, followed by the Northeast at 28% supported by advanced healthcare infrastructure, and the Midwest at 23% where affordability and insurance coverage expansion drive demand.

- The West, with 18% share, is the fastest-growing region, supported by innovative retail models, strong e-commerce penetration, and lifestyle-driven demand for premium and eco-friendly incontinence products.

- Pant/Pull-up type holds the largest share at about 38%, driven by convenience, discreet daily use, and comfort, making it the most preferred option among active users.

- Pad type follows with nearly 30% share, supported by affordability and extensive adoption across hospitals, nursing homes, and long-term care facilities.

Market Drivers:

Rising Aging Population and Increasing Incontinence Cases:

The U.S. Adult Diapers Market is strongly driven by the rising elderly population. An aging society creates higher demand for effective incontinence solutions. It benefits from increasing cases of bladder-related issues among both men and women. Healthcare professionals actively recommend adult diapers for managing conditions such as dementia and mobility challenges. Growing acceptance of incontinence care products reduces social stigma and drives product adoption. Extended life expectancy adds further pressure on long-term care needs. Homecare settings also contribute to steady growth. The market responds with improved designs tailored to elderly needs.

- For instance, First Quality Products, Inc. introduced the MaxSorb™+ Zone technology in April 2022, which accelerates absorption by up to 50% compared to previous products, ensuring a drier skin sensation throughout the day and enhancing skin health for elderly users.

Healthcare Infrastructure Strengthening and Higher Consumer Spending:

Healthcare advancements and spending trends strengthen the U.S. Adult Diapers Market. Hospitals, nursing homes, and assisted living centers purchase adult diapers in bulk. It also benefits from government-supported elderly care initiatives. Rising personal care expenditure across urban households supports steady adoption. Insurance coverage in certain states creates affordability for patients. Rising per capita income allows consumers to prioritize comfort and hygiene. Retail and pharmacy outlets make these products widely available. Higher consumer trust in hygiene products further accelerates long-term use.

- For instance, Kimberly-Clark Corporation, a key market player, supplies adult diapers with advanced leakage protection and skin-friendly materials, backed by large-scale contracts with healthcare institutions, supporting millions of units distributed annually across the U.S.

Technological Improvements in Absorbency and Skin Protection Features:

Innovation in materials significantly drives the U.S. Adult Diapers Market. Manufacturers integrate advanced absorbent layers that reduce leakage. It benefits from breathable fabrics that enhance skin comfort and prevent irritation. Products now feature odor-control systems to improve confidence in users. Anti-bacterial and skin-friendly materials gain preference among healthcare providers. Smart diaper solutions with moisture sensors are also emerging. These improvements provide higher convenience to patients and caregivers. Technological enhancements directly raise adoption across both institutional and personal care settings.

Growing Distribution Networks and Retail Expansion Across the Nation:

The U.S. Adult Diapers Market grows through expanded distribution channels. Retail chains and supermarkets increase their product ranges to attract consumers. It gains further support from online platforms offering wider accessibility. E-commerce channels promote discreet purchasing, which reduces hesitation among buyers. Pharmacies remain vital channels due to direct healthcare recommendations. Direct-to-consumer brands focus on building subscription-based models. Logistics improvements ensure timely delivery across both urban and semi-urban markets. Wide distribution strengthens penetration and fosters long-term consumer trust.

Market Trends:

Rising Demand for Eco-Friendly and Biodegradable Adult Diapers:

The U.S. Adult Diapers Market is witnessing a shift toward eco-friendly products. Consumers increasingly prefer biodegradable materials to reduce environmental impact. It drives manufacturers to adopt sustainable sourcing for raw materials. Plant-based fabrics and biodegradable polymers replace conventional plastic-based components. Retailers highlight green certifications to attract eco-conscious buyers. The market aligns with broader sustainability movements across the personal care industry. Younger caregivers prioritize brands that showcase eco-responsibility. This trend encourages large players to expand their green product portfolios.

- For instance, Ontex Group, in July 2025, began introducing bio-based superabsorbent polymers (bioSAP) into selected diapers, starting with its Moltex Pure and Nature baby diaper brand. This material is intended to reduce the product’s carbon footprint compared to conventional fossil-based SAP.

Premiumization of Adult Diaper Products With Comfort and Style Features:

Growing consumer expectations push premiumization in the U.S. Adult Diapers Market. Buyers now prioritize products that combine comfort with style. It leads to the development of slimmer designs and improved fitting. Brands highlight discreet packaging and fashionable elements to reduce stigma. Absorbent performance is paired with softer fabrics to enhance comfort. The trend reflects rising willingness to spend more on quality. Healthcare providers also support the shift by recommending advanced products. Premiumization sets new benchmarks for innovation and brand differentiation.

Adoption of Smart Diapers and Technology-Integrated Solutions:

The U.S. Adult Diapers Market shows increasing use of smart technology. Diapers embedded with sensors track moisture levels in real time. It allows caregivers to monitor patients more effectively and reduce discomfort. Digital alerts streamline diaper changing schedules in healthcare institutions. Elderly care homes adopt these solutions to reduce staff workload. Growing use of IoT and connected devices enhances product appeal. The market benefits from collaborations between tech firms and diaper manufacturers. Smart diapers gain momentum as personalized healthcare adoption expands.

Expanding Direct-to-Consumer Channels and Subscription Services:

The U.S. Adult Diapers Market expands through direct-to-consumer sales models. Subscription services ensure recurring orders for households and care facilities. It reduces purchasing effort and provides cost benefits for long-term users. Online platforms highlight value packs and customization options. Younger caregivers rely on digital platforms for convenient buying. Brands utilize social media marketing to raise awareness and engagement. Loyalty programs build stronger consumer relationships. This trend strengthens online presence and provides a reliable revenue stream for companies.

Market Challenges Analysis:

High Costs of Premium Products and Limited Affordability for Low-Income Groups:

The U.S. Adult Diapers Market faces cost-related challenges. Premium products with advanced features remain expensive for low-income buyers. It creates a barrier to adoption despite growing demand. Healthcare coverage does not always include adult diapers, raising out-of-pocket expenses. The cost factor restricts frequent purchases in economically weaker groups. Institutional buyers also face budgetary constraints when adopting premium products. Price sensitivity remains high among uninsured or underinsured populations. Manufacturers struggle to balance innovation with affordability. This challenge slows down overall adoption in certain segments.

Social Stigma, Awareness Gaps, and Environmental Concerns Limiting Adoption:

The U.S. Adult Diapers Market encounters challenges tied to social acceptance. Many adults remain reluctant to purchase products openly due to embarrassment. It limits retail growth despite strong awareness campaigns. In rural and semi-urban areas, awareness about product benefits is still low. Environmental concerns around non-biodegradable materials also create resistance. Waste management issues reduce acceptance among eco-conscious consumers. Retailers face difficulty in marketing these products without triggering sensitivity. Overcoming stigma and improving education remain essential for broader adoption.

Market Opportunities:

Innovation in Biodegradable Materials and Sustainable Packaging Solutions:

The U.S. Adult Diapers Market offers opportunities through sustainability-focused innovation. Biodegradable raw materials help address growing environmental concerns. It opens avenues for manufacturers to tap into eco-conscious consumers. Sustainable packaging enhances brand image and attracts premium buyers. Partnerships with green technology companies can accelerate product development. Brands investing in eco-friendly lines may gain a competitive edge. Marketing eco-benefits strengthens consumer loyalty. Demand for green alternatives will keep rising in future.

Expansion in Home Healthcare and Digital Direct-to-Consumer Sales:

The U.S. Adult Diapers Market benefits from rising home healthcare adoption. Patients prefer in-home care over institutional facilities for comfort. It creates a growing need for reliable incontinence solutions. Direct-to-consumer online sales meet this demand efficiently. Subscription models ensure steady revenue for companies. Personalized packs allow users to customize orders. Digital platforms increase convenience and reduce stigma. Growth in home healthcare directly supports long-term market opportunities.

Market Segmentation Analysis:

By Type

The U.S. Adult Diapers Market is divided into pad type, pant/pull-up type, tape-on diapers, and others. Pant/pull-up type dominates due to comfort and discretion, making it the most preferred option. Tape-on diapers remain vital for patients with mobility challenges, while pad type serves lighter incontinence needs.

- For instance, Attindas Hygiene Partners, which acquired Domtar’s former business, launched a new line of adult disposable incontinence underwear featuring elasticized waistbands, breathable materials, and ultrasonic bonding technology for a more comfortable fit. Attindas is one of many companies, along with Kimberly-Clark and Procter & Gamble, that collectively manufacture millions of high-performance units annually to meet market demand.

By End-User

The market caters to women, men, and unisex categories. Women account for a larger share due to higher incontinence prevalence, particularly in post-pregnancy and elderly segments. Unisex products support broader adoption in hospitals and care facilities where flexibility is needed.

- For instance, Essity AB produces unisex adult diapers distributed extensively in hospital settings, featuring advanced absorption cores that manage moderate to heavy incontinence, servicing millions of patients yearly in North America.

By Distribution Channel

It is segmented into e-commerce and offline channels. E-commerce is expanding quickly, driven by discreet purchasing, subscription models, and wide availability. Offline sales through pharmacies, supermarkets, and specialty stores maintain strong demand due to immediate product access and brand familiarity.

Segmentation:

By Type

- Pad Type

- Pant/Pull-up Type

- Tape-on Diapers

- Others

By End-User

By Distribution Channel

- E-Commerce

- Offline Channel

Regional Analysis:

Northeast

The U.S. Adult Diapers Market in the Northeast holds around 28% share, supported by its aging population and advanced healthcare infrastructure. States like New York, Pennsylvania, and Massachusetts show strong adoption, driven by higher awareness and strong distribution networks. Hospitals, long-term care facilities, and retail pharmacies play a key role in product penetration. E-commerce growth also boosts discreet purchases, particularly in urban centers. Premium product demand is rising, supported by higher disposable incomes and preference for comfort and convenience. It continues to benefit from early adoption of advanced incontinence care solutions.

Midwest

The Midwest accounts for nearly 23% of the U.S. Adult Diapers Market, influenced by its large elderly population and insurance coverage expansion. States such as Ohio, Michigan, and Illinois report steady growth through both online and offline channels. Regional healthcare providers are expanding product access through hospitals and elderly care centers. Offline sales remain dominant, but e-commerce penetration is accelerating. Cost-effective product demand is higher here compared to premium segments. It reflects a market that values affordability without compromising on quality standards.

South and West

The South leads with around 31% share of the U.S. Adult Diapers Market, driven by its large and diverse population base. States like Florida and Texas contribute significantly due to high elderly demographics and rising chronic conditions. The West follows with approximately 18% share, with California and Washington leading demand growth through innovative retail models and strong e-commerce adoption. Lifestyle-driven preferences in the West support demand for eco-friendly and premium-quality products. The South shows strong offline sales through supermarkets and drugstores, while the West emphasizes online retail growth. It benefits from a balanced mix of affordability and premium product expansion across diverse consumer groups.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The U.S. Adult Diapers Market is highly competitive, shaped by multinational corporations and regional players. Key companies include Procter & Gamble, Kimberly-Clark, Essity AB, and Cardinal Health, each leveraging brand reputation and wide distribution networks. Private label offerings from large retailers strengthen competition by targeting cost-sensitive consumers. Innovation in comfort, absorbency, and eco-friendly materials remains central to differentiation strategies. Marketing campaigns focus on reducing stigma and promoting discreet usage, further expanding consumer acceptance. It continues to attract investments from global healthcare and hygiene brands seeking long-term growth in a stable demand environment.

Recent Developments:

- In 2024, First Quality Enterprises, Inc. announced a significant expansion in its production capacity for baby care and adult incontinence products across multiple North American manufacturing facilities.

- In May 2024, Principle Business Enterprises, Inc. initiated a strategic investment to double its production capacity for plus-size adult incontinence products at its Dunbridge, Ohio facility. This move, set to finish in 2025, honors PBE’s 20th anniversary of launching Tranquility 3XL to 5XL disposable briefs catering to plus-size individuals. Along with capacity expansion, PBE introduced its first 3XL disposable pull-on underwear, focusing on unmatched comfort, absorbency, and fit for heavy incontinence users

- Essity Aktiebolag invested €24 million by late 2024 to expand its incontinence product capacity at its Puigpelat plant in Spain, producing adult diapers under Tena and Orly’s brands for Spain and European markets. The expansion plans to add two more production lines for feminine care and tissue paper products by 2025, responding to increased demand linked to aging populations.

- Medline Industries, Inc. introduced in September 2024 new wetness sensing technology for incontinence management, enabling real-time alerts to caregivers about incontinence episodes, improving patient care and management.

- Procter & Gamble launched a premium aloe-infused diaper brand called “bumbum” made in China, sold through Target in the U.S. As of August 2025, this line complements the Pampers and Luvs brands facing stiff competition. P&G imports these products to manage rising costs of domestically produced goods while enhancing product offerings in the diaper segment.

Report Coverage:

The research report offers an in-depth analysis based on type, end-user, and distribution channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for discreet and comfortable products will accelerate across hospitals and care facilities.

- E-commerce will expand further, driven by subscription models and discreet delivery services.

- Innovation in sustainable materials will play a larger role in consumer preferences.

- Premiumization trends will strengthen, with higher adoption of advanced absorbent technologies.

- Private labels from major retailers will expand, putting price pressure on global brands.

- Aging demographics will remain the most critical driver for long-term demand growth.

- Strategic partnerships with healthcare providers will improve market penetration.

- Marketing campaigns will focus on normalizing product use and reducing social stigma.

- Technological advances such as smart diapers will enter niche segments of the market.

- Regional variations in demand will encourage tailored product strategies across the U.S.