Market Overview

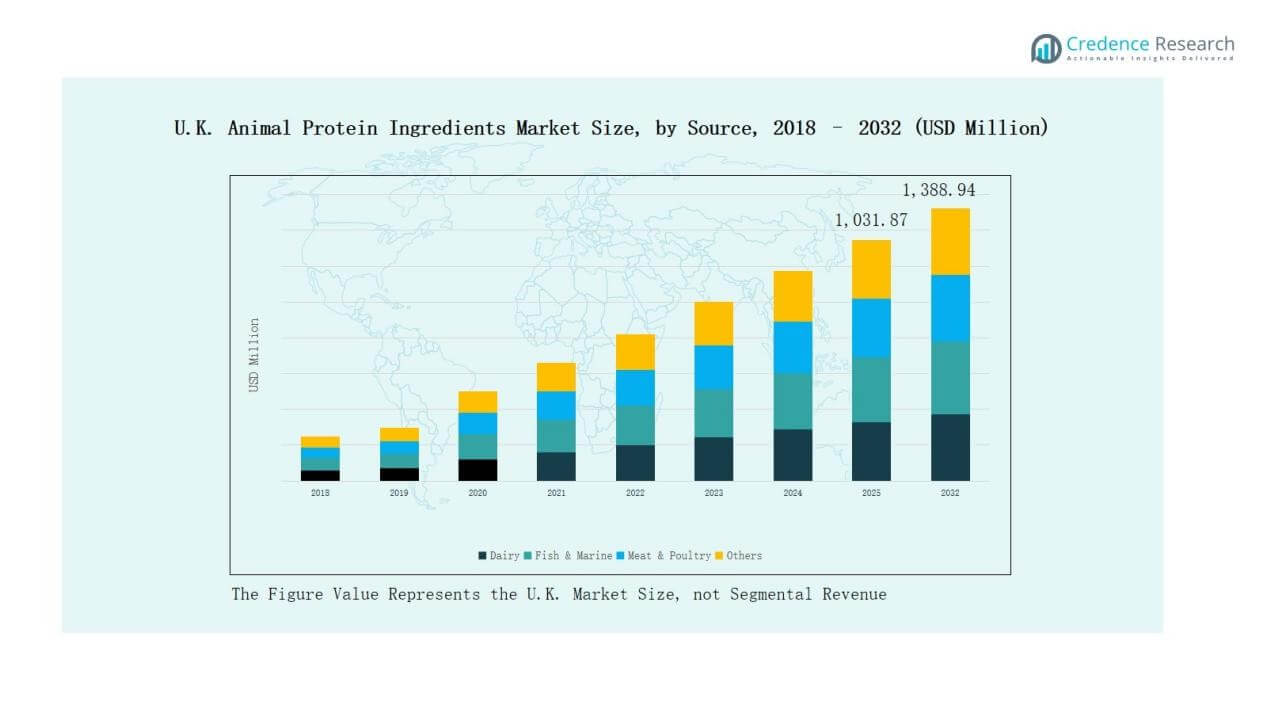

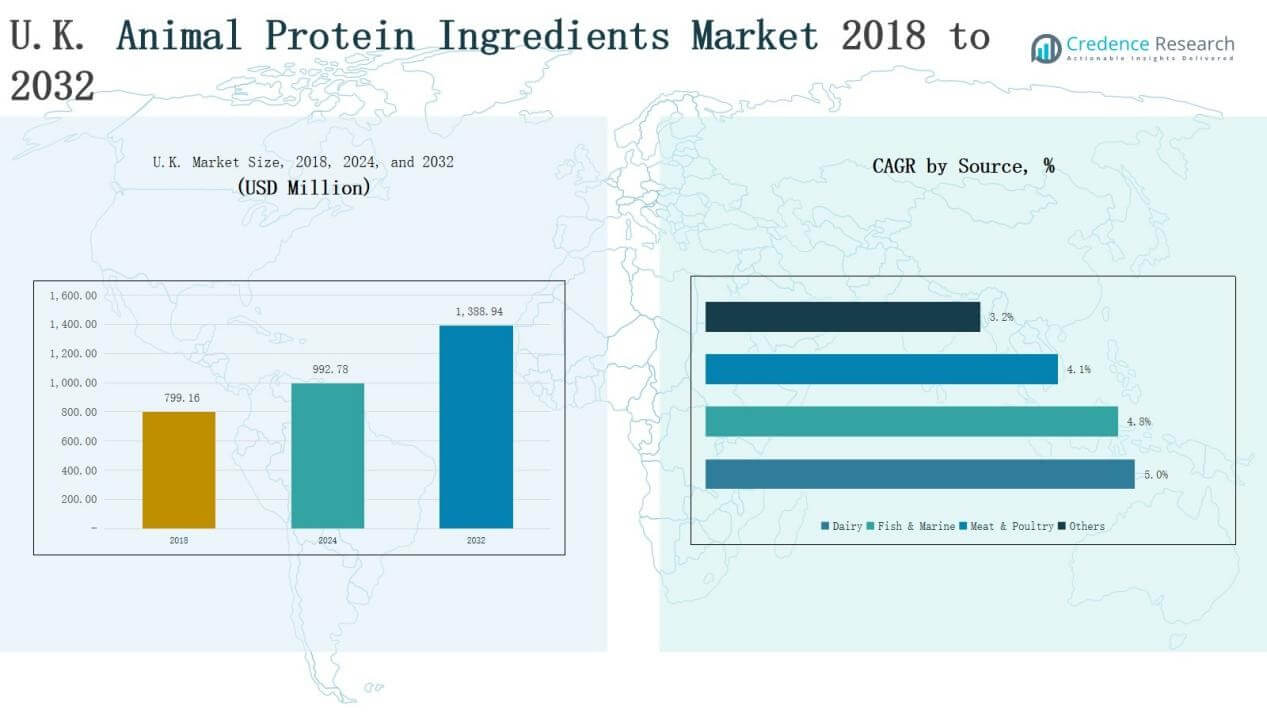

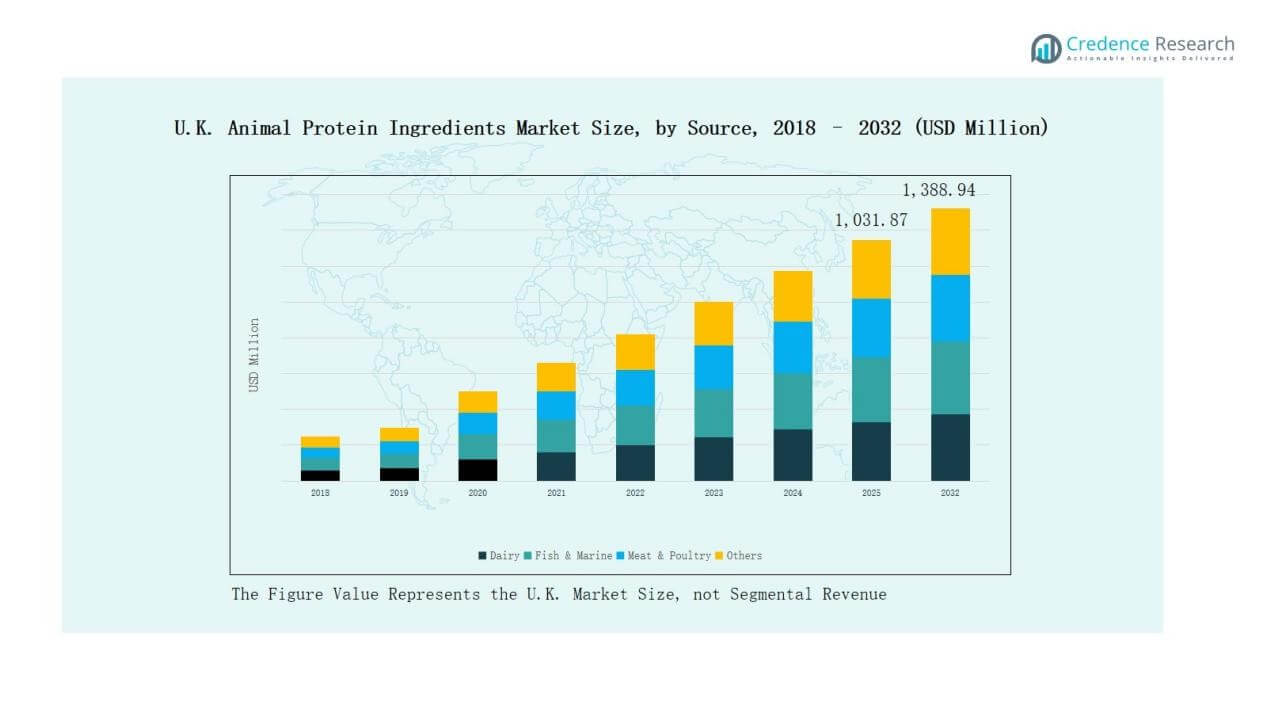

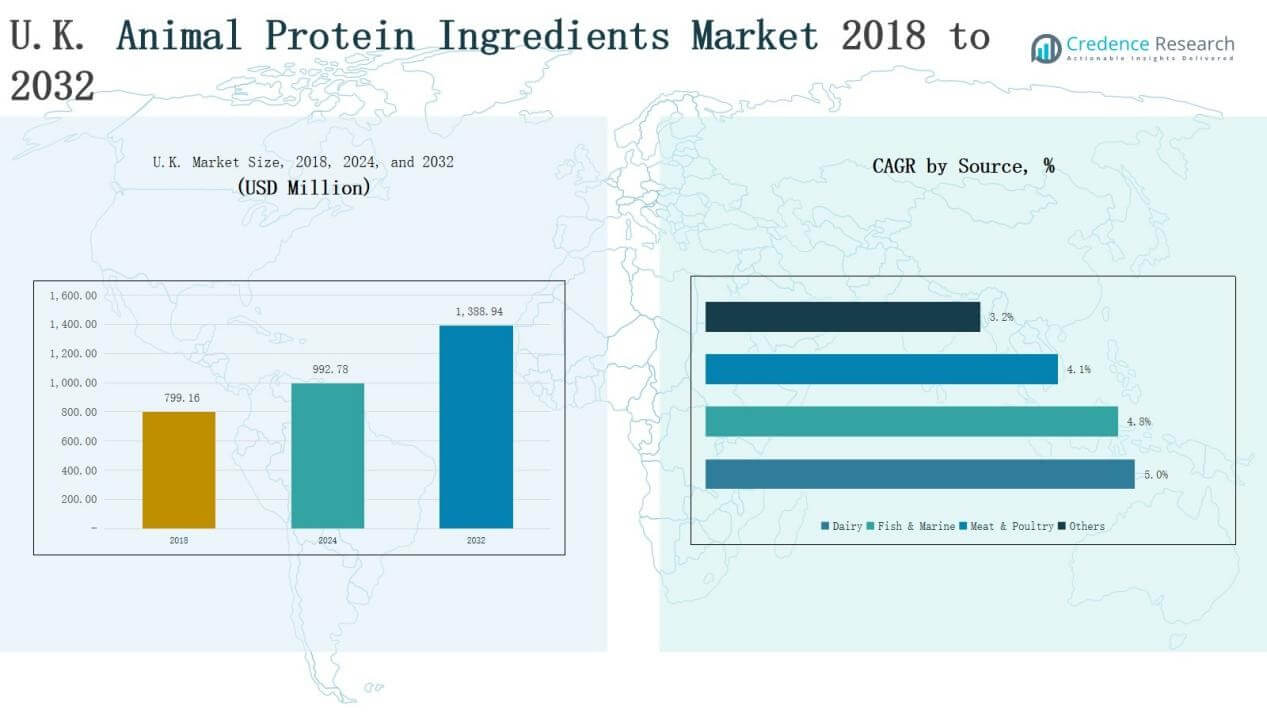

U.K. Animal Protein Ingredients Market size was valued at USD 799.16 million in 2018, rising to USD 992.78 million in 2024, and is anticipated to reach USD 1,388.94 million by 2032, at a CAGR of 4.21% during the forecast period (2024–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.K. Animal Protein Ingredients Market Size 2024 |

USD 992.78 Million |

| U.K. Animal Protein Ingredients Market, CAGR |

4.21% |

| U.K. Animal Protein Ingredients Market Size 2032 |

USD 1,388.94 Million |

The U.K. Animal Protein Ingredients Market is shaped by a mix of global leaders and regional specialists focusing on product innovation, diversified portfolios, and sustainability. Key players include Cargill, Tyson Foods, Kemin Industries, ADM Animal Nutrition, Prinova, Saria Ltd, BHJ UK Ltd, Nutraferma LLC, Kookaburra Limited, and NCC Food Ingredients. These companies strengthen competitiveness through advanced processing technologies, clinical and sports nutrition offerings, and premium pet food applications. England emerged as the leading region in 2024 with 58% market share, supported by its robust consumer base, advanced food processing infrastructure, and strong demand for functional and clinical nutrition products.

Market Insights

Market Insights

- The U.K. Animal Protein Ingredients Market was valued at USD 799.16 million in 2018, reaching USD 992.78 million in 2024, and projected at USD 1,388.94 million by 2032, growing at 4.21%.

- Dairy dominated the source segment with 41% share in 2024, driven by strong demand in clinical and sports nutrition, while fish & marine proteins grew through aquafeed and supplements.

- Powders led the form segment with 52% share in 2024, supported by stability, transport convenience, and integration in supplements and medical formulations, followed by granules and flakes.

- Sports & active nutrition was the largest application with 34% share in 2024, fueled by rising consumption of protein powders and beverages, with clinical nutrition and pet food following closely.

- England led regionally with 58% share in 2024, supported by advanced food processing, strong retail networks, and robust demand for functional and clinical protein products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Source

Dairy dominates the U.K. animal protein ingredients market, holding 41% share in 2024. Its leadership stems from strong demand in clinical and sports nutrition, driven by high protein diets and functional formulations. Fish & marine proteins follow, supported by rising use in aquafeed and supplements, while meat & poultry proteins gain traction in pet food. Other sources, though smaller, serve niche applications in specialty products.

For instance, BioMar Group incorporated marine protein hydrolysates into its SmartCare feed health concept to enhance fish growth and immune support in aquaculture.

By Form

Powders lead the market with 52% share in 2024, reflecting their stability, ease of transport, and wide integration in dietary supplements, sports powders, and medical formulations. Granules and flakes account for a moderate share, driven by their application in livestock feed and pet nutrition. Liquids and pastes, holding a smaller portion, remain essential for ready-to-use formulations and food processing applications.

For instance, FrieslandCampina Ingredients introduced a Biotis® protein blend in powder format for maternal and active nutrition, highlighting convenience and transport stability.

By Application

Sports & active nutrition represents the largest application segment, capturing 34% share in 2024, driven by growing consumer adoption of protein powders and functional beverages. Clinical & medical nutrition follows, supported by demand for specialized diets in hospitals and elderly care. Pet food also shows strong growth, as premium and protein-rich diets become mainstream. Aquafeed and livestock feed retain steady demand, while other applications contribute through niche uses across food innovation.

Key Growth Drivers

Rising Demand for High-Protein Diets

The growing consumer focus on health and wellness fuels strong demand for high-protein food and supplements in the U.K. Dairy-based ingredients, particularly whey and casein, remain popular in sports and clinical nutrition. Expanding gym culture and awareness of protein’s role in weight management and muscle development strengthen consumption. Food companies increasingly integrate protein-enriched ingredients into mainstream products, creating additional growth momentum across retail and online channels.

For instance, Quest Nutrition introduced Quest Protein Milkshakes with a leading 45 grams of protein per bottle, targeting consumers seeking convenient, high-protein ready-to-drink products.

Expanding Pet Food and Animal Nutrition Sector

The U.K. pet food industry significantly contributes to protein ingredient demand, with protein-rich diets becoming a standard preference among pet owners. Rising adoption of premium formulations, especially those emphasizing natural and functional protein sources, accelerates the use of meat and marine proteins. Livestock and aquafeed sectors also rely on animal protein ingredients for improving animal health and productivity. This dual growth in companion animal nutrition and feed applications provides consistent revenue streams.

For instance, in 2025, the U.K. became the first European country to approve lab-grown meat for pet food, reflecting innovation and rising demand for sustainable protein ingredients.

Strong Focus on Clinical and Medical Nutrition

The U.K.’s aging population and rising prevalence of chronic diseases strengthen the role of animal protein ingredients in medical applications. Clinical nutrition products, including protein-based supplements and therapeutic diets, see increased adoption across hospitals, elderly care facilities, and homecare. Dairy proteins, with their digestibility and amino acid profile, dominate this space. Government support for healthcare quality and nutrition programs further enhances demand, creating long-term opportunities in specialized nutrition categories.

Key Trends & Opportunities

Key Trends & Opportunities

Sustainability and Ethical Sourcing

Sustainability has become a central trend in the U.K. animal protein ingredients market. Companies are investing in eco-friendly sourcing methods, waste reduction, and circular processing solutions. Ethical considerations, including traceability and responsible animal farming practices, influence consumer choices. This creates opportunities for firms that can demonstrate low-carbon production and compliance with U.K. and EU sustainability frameworks while meeting rising demand for ethically produced protein ingredients.

For instance, Roquette unveiled a new plant-based protein ingredient derived from peas and rice with full traceability and sustainable certification aligned with U.K. and EU environmental standards, responding to growing demand for ethically sourced proteins.

Innovation in Functional and Specialty Applications

Expanding use of animal protein ingredients in functional foods and beverages presents strong opportunities. Beyond sports and clinical nutrition, proteins are now used in fortified snacks, ready-to-drink products, and meal replacements. Innovations in protein blends and formulations enhance taste, solubility, and functionality, broadening consumer appeal. Companies investing in R&D for tailored applications, such as collagen-based supplements or marine-derived proteins, are positioned to capture emerging growth niches.

For instance, Gelita expanded collagen peptide formulations for functional supplements, focusing on skin health and joint support, with tailored hydrolyzed proteins enabling improved solubility and bioavailability in liquid and powdered formats.

Key Challenges

Rising Competition from Plant-Based Alternatives

The accelerating popularity of plant-based proteins poses a direct challenge to animal protein ingredient producers in the U.K. Growing vegan and flexitarian populations reduce dependency on traditional animal-derived proteins. Food manufacturers increasingly diversify into pea, soy, and other plant-based options, which are marketed as sustainable and ethical. This trend pressures animal protein suppliers to differentiate through innovation, nutritional advantages, and sustainable sourcing practices.

Strict Regulatory and Food Safety Standards

The U.K. animal protein ingredients market operates under stringent food safety and regulatory frameworks. Compliance with labeling, traceability, and sustainability requirements increases operational costs. Companies face additional scrutiny regarding sourcing practices, antibiotic use, and environmental impact. Failure to comply can lead to restricted market access and reputational damage, making continuous investment in certifications and audits a necessity for maintaining competitiveness.

Volatility in Raw Material Supply and Prices

Supply chain challenges and fluctuating prices of dairy, meat, and marine raw materials create uncertainty for manufacturers. Factors such as global trade disruptions, feed cost inflation, and climate-driven changes in livestock productivity influence input availability and pricing. These fluctuations affect profit margins and complicate long-term planning. Companies must adopt hedging strategies, diversified sourcing, and technological efficiency to mitigate supply risks.

Regional Analysis

England

England held the largest share of the U.K. Animal Protein Ingredients Market in 2024 with 58%. It benefits from a strong consumer base, advanced food processing facilities, and a well-developed retail sector. Demand for sports nutrition and clinical protein products is especially strong, supported by fitness culture and aging demographics. Leading manufacturers focus on dairy and meat proteins, aligning with evolving consumer preferences. Innovation in sustainable sourcing strengthens market positioning. It remains the central hub for distribution and exports within the U.K.

Scotland

Scotland accounted for 18% of the market share in 2024. The region relies heavily on fish and marine proteins, supported by its strong aquaculture sector. Demand for aquafeed ingredients and marine-derived proteins drives growth. Scotland also shows increasing uptake of dairy proteins for health and wellness applications. Companies emphasize traceability and sustainability to meet regulatory and consumer expectations. It serves as a key supplier of marine-based ingredients to both domestic and export markets.

Wales

Wales represented 13% of the U.K. market share in 2024. The region’s dairy industry provides a solid base for protein ingredient production. Small and medium-scale manufacturers contribute to steady supply for food, clinical, and pet nutrition applications. Growing interest in functional proteins supports adoption across retail and healthcare channels. Meat and poultry proteins also find strong demand in pet food formulations. It continues to attract investment in processing infrastructure to enhance competitiveness.

Northern Ireland

Northern Ireland held 11% of the market share in 2024. Its strong livestock base underpins steady production of meat and poultry proteins. Dairy proteins also contribute significantly, supported by well-established farming practices. Export-oriented supply chains connect Northern Ireland’s production with European markets. Companies focus on quality and regulatory compliance to ensure competitiveness. It is building stronger integration of animal protein ingredients in livestock feed and functional food segments.

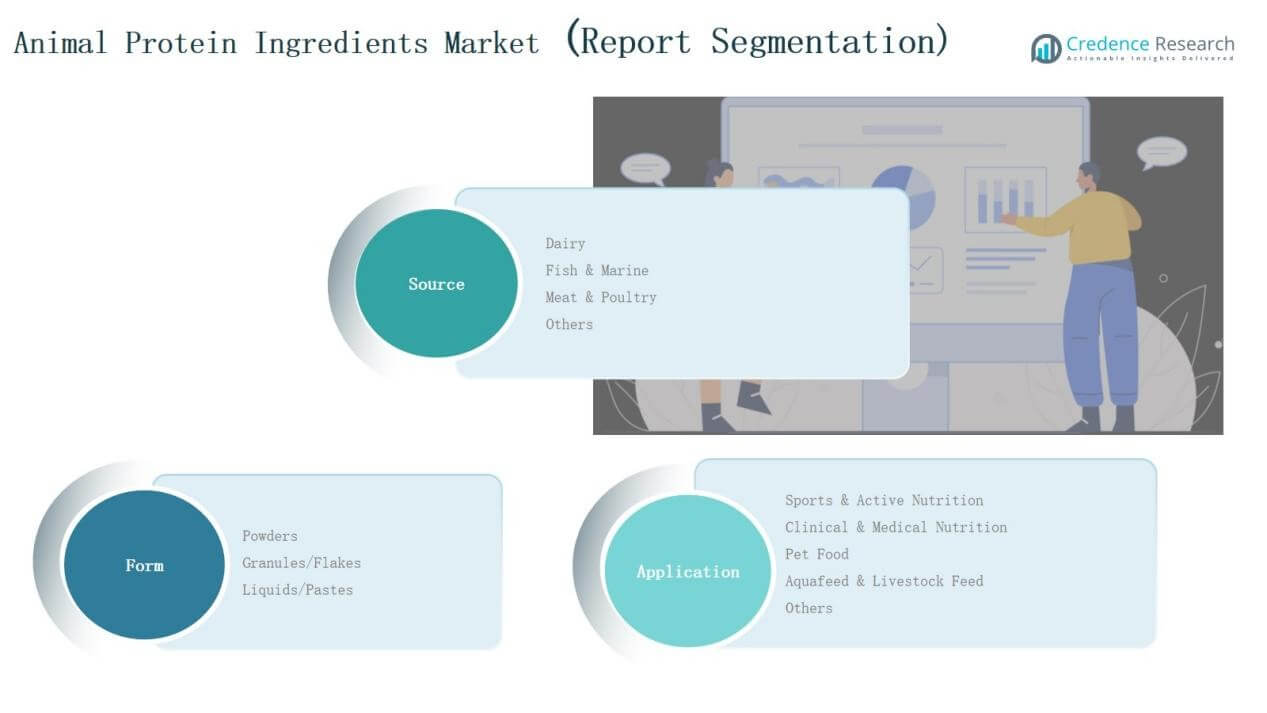

Market Segmentations:

By Source

- Dairy

- Fish & Marine

- Meat & Poultry

- Others

By Form

- Powders

- Granules/Flakes

- Liquids/Pastes

By Application

- Sports & Active Nutrition

- Clinical & Medical Nutrition

- Pet Food

- Aquafeed & Livestock Feed

- Others

By Region

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

The U.K. Animal Protein Ingredients Market is characterized by strong competition among global and regional players, each leveraging product innovation, strategic partnerships, and distribution expansion to strengthen their positions. Leading companies such as Cargill, Tyson Foods, Kemin Industries, ADM Animal Nutrition, and Prinova focus on advanced processing technologies and diversified portfolios spanning dairy, marine, and meat-based proteins. Regional firms including Saria Ltd, BHJ UK Ltd, and Kookaburra Limited add depth by targeting niche applications and emphasizing traceability and sustainable sourcing. Multinationals dominate clinical and sports nutrition, while local producers cater to pet food and aquafeed demand. The market rewards companies that can balance efficiency, sustainability, and compliance with evolving U.K. and EU food safety standards. Rising competition from plant-based alternatives further intensifies the need for differentiation through functional ingredients, premium formulations, and eco-friendly practices. Continuous R&D and alignment with consumer health trends remain central to long-term competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Nutraferma LLC

- Saria Ltd

- BHJ UK Ltd

- Kookaburra Limited

- Cargill

- Kemin Industries

- Prinova

- ADM Animal Nutrition

- NCC Food Ingredients

- Tyson Foods

- Other Key Players

Recent Developments

- In February 2025, Meatly partnered with Pets at Home to launch “Chick Bites,” a cultivated chicken and plant-based dog treat, marking the U.K.’s first lab-grown pet food.

- In April 2024, Arla Foods Ingredients acquired Volac’s Whey Nutrition division to strengthen its position in performance and sports nutrition within the U.K. protein ingredients market.

- In May 2025, Prefera Petfood acquired British alt-protein startup The Pack, strengthening its sustainable and premium pet food offerings in the U.K. market.

- In April 2025, German brand More Nutrition entered the U.K. market, introducing its high-protein snacks, collagen, whey & casein blends, clear whey isolate and other functional food items.

Report Coverage

The research report offers an in-depth analysis based on Type, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for dairy proteins will continue to lead due to strong use in clinical and sports nutrition.

- Fish and marine proteins will see rising uptake with growth in aquafeed and health supplements.

- Meat and poultry proteins will expand further in premium pet food and functional diets.

- Powders will remain the most preferred form, supported by convenience and product stability.

- Liquids and pastes will gain niche adoption in ready-to-use food and beverage formulations.

- Sports and active nutrition will drive the largest application share with lifestyle-focused consumption.

- Clinical nutrition will advance as hospitals and elderly care centers adopt protein-based therapies.

- Pet food will witness strong demand as owners prioritize protein-rich and premium formulations.

- Sustainability and ethical sourcing will shape purchasing decisions and company strategies.

- Innovation in specialty proteins and blended formulations will open new growth opportunities.

Market Insights

Market Insights Key Trends & Opportunities

Key Trends & Opportunities